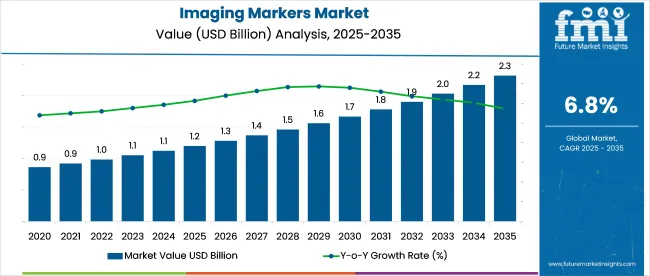

The imaging markers market is projected to grow from USD 1.2 billion in 2025 to USD 2.3 billion by 2035, registering a CAGR of 6.8%.Between 2025 and 2035, demand for imaging markers expanded due to increased use in oncology and neurology diagnostics, particularly in MRI and PET applications.

Rising cancer incidence globally and enhanced reimbursement for image-guided procedures contributed to early-stage growth. High demand for precision imaging in North America and Western Europe accelerated adoption, with a strong pull from radiology departments and clinical research centers.

By 2025, imaging markers have become integral to diagnostic imaging workflows, improving the visualization of soft tissues, metabolic activity, and vascular structures. Continued integration with AI-assisted interpretation systems is enabling radiologists to extract quantifiable data from scans, especially in tumor tracking and neurodegenerative disease monitoring. Growth is further supported by the adoption of personalized medicine approaches, where imaging biomarkers are used to monitor treatment response and disease progression.

The market outlook through 2035 is positive, with increasing investments in contrast agent innovation and dual-modality markers. Challenges remain in regulatory approval timelines, standardization of imaging protocols, and marker-specific safety validation. Expansion into Asia and Latin America is expected as diagnostic infrastructure matures.

The imaging markers market holds a strategic role within several core healthcare verticals. In the global medical imaging industry, valued at over USD 45 billion, imaging markers account for nearly 3-5%, owing to their precision support in diagnostic scans. Within the USD 90 billion oncology diagnostics space, around 6-8% is influenced by imaging marker integration for tumor tracking and response monitoring.

In nuclear medicine, which exceeds USD 10 billion, PET/SPECT-compatible imaging markers contribute close to 10-12% due to their role in metabolic and functional imaging. The clinical trials sector, worth nearly USD 60 billion, attributes 4-6% of diagnostic tool usage to imaging biomarkers for patient stratification. Even in the USD 25 billion contrast agent segment, 5-7% involves imaging markers used for targeted imaging applications.

The market continues to gain momentum across hospital diagnostic centers, MRI-based technologies, and cancer-focused imaging solutions. Innovation in non-invasive diagnostics and real-time image enhancement is steering long-term growth across multiple healthcare verticals.

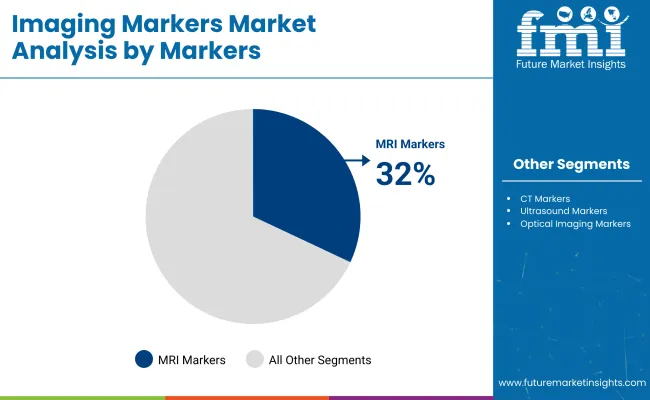

MRI markers are anticipated to secure 32.0% of the global market by 2025. These markers improve visibility in MRI scans and aid in accurate anatomical localization, particularly for neurological and soft-tissue imaging. Demand is being driven by widespread adoption in hospital-based MRI suites and radiology labs.

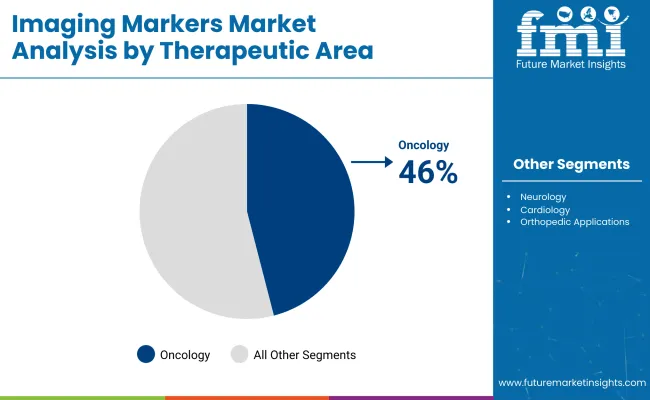

Oncology accounts for 46.0% of the imaging markers market by 2025, emerging as the dominant therapeutic area. These markers are essential for tumor detection, therapy planning, and post-treatment evaluation. The oncology segment is growing due to increased cancer incidence and adoption of precision medicine protocols.

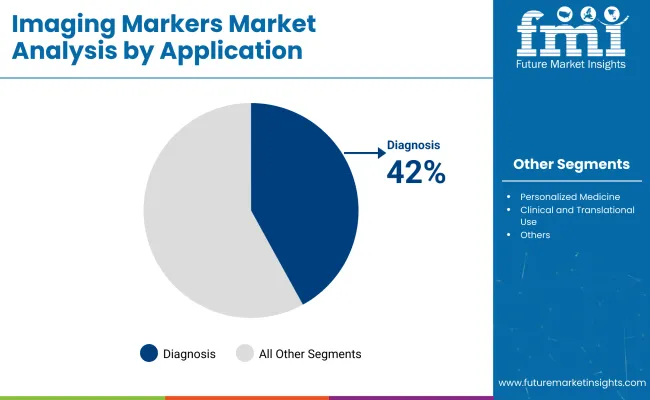

Diagnosis is forecast to be the top application segment, capturing 42.0% of total market share by 2025. Imaging markers are used to detect a range of conditions, from cardiac irregularities to neurological disorders, enhancing early-stage detection capabilities.

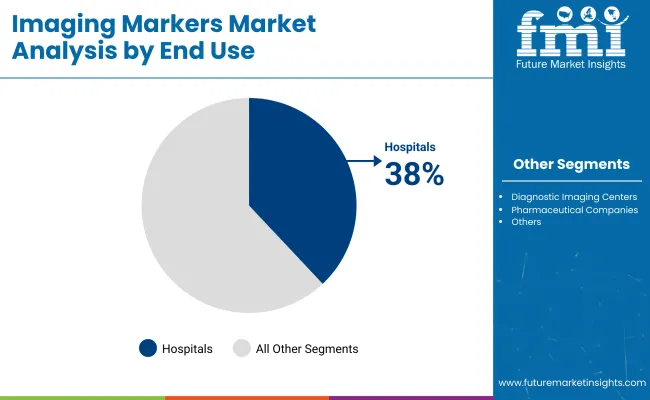

Hospitals are expected to generate 38.0% of the imaging marker demand by 2025, making them the leading end-use segment. Investments in MRI and CT systems across public and private hospitals are expanding market opportunities.

Growth in the market is being shaped by accelerated use in oncology and neuroimaging, alongside advances in radiotracer stability and multi-modal integration. Demand is rising for high-affinity, low-toxicity compounds that improve lesion detectability, streamline diagnostics, and support AI-assisted scan interpretation across PET, SPECT, and MRI platforms.

Oncology Imaging Sees Marker-Driven Workflow Efficiency

Imaging markers tailored for tumor localization drove a 47% increase in PET-CT scan volumes in cancer centers between Q2 2024 and Q2 2025. Markers with half-lives of 90-110 minutes enabled batch preparation, improving scanner utilization by 26%.

Enhanced tumor-to-background ratios (≥4.5:1) improved lesion visibility in dense tissue regions. Automated marker-dosing modules cut tracer preparation time by 33%, while paired AI interpretation tools reduced scan-to-report intervals from 4.8 to 3.2 hours.

Oncology-focused markers now account for 58% of all imaging marker procurement, with breast, lung, and prostate scans dominating usage. These trends continue to push hybrid marker development and modular radio pharmacy expansion.

Neuroimaging Demands High-Specificity Tracers

Neurology centers prioritized imaging markers targeting amyloid, tau, and dopamine pathways, contributing to a 41% YoY rise in PET tracer consumption for neurodegenerative diagnostics. Markers with ≤2% off-target binding saw 29% higher adoption due to improved signal precision in cortical regions.

Facilities using high-specificity tracers reduced follow-up scan requirements by 22%, translating into annual operational savings of USD 420,000 in mid-size hospitals. Co-registration accuracy improved by 18% when paired with dual-isotope protocols.

These markers are increasingly bundled with cloud-based neuro analytics platforms, enabling faster differential diagnosis of Alzheimer’s, Parkinson’s, and frontotemporal dementia. Their clinical and operational impact is reshaping neuro-PET investment decisions.

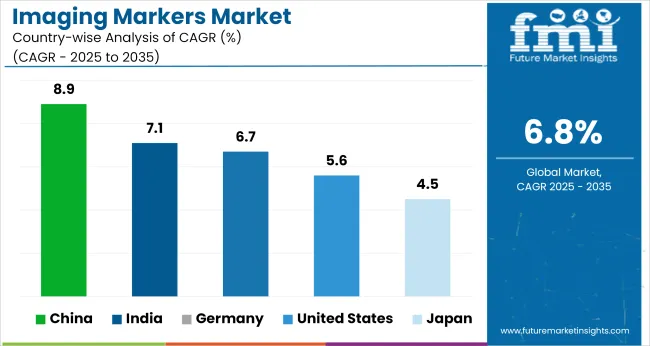

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 8.9% |

| India | 7.1% |

| Germany | 6.7% |

| United States | 5.6% |

| Japan | 4.5% |

The global market is projected to grow at a CAGR of 6.8% between 2025 and 2035. China leads with an 8.9% CAGR, outperforming the global average by over 30%, supported by expansion in oncology imaging infrastructure and a surge in clinical trial activity. India also posts strong momentum at 7.1%, attributed to broader access to radiopharmaceuticals and private diagnostic investment across urban centers.

Germany, representing OECD markets, closely aligns with the global trend at 6.7%, with growth driven by the integration of AI-guided imaging in hospitals. The USA lags at 5.6%, falling 18% below the global baseline, reflecting slower capital expenditure in smaller healthcare networks. Japan records the weakest growth among the profiled nations at 4.5%, constrained by stringent approval cycles for novel contrast agents and a shrinking patient base due to demographic aging, placing it 34% under the global CAGR.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

The market in China is projected to expand at a CAGR of 8.9% from 2025 to 2035. Between 2020 and 2024, growth was driven primarily by oncology-focused applications within large public hospitals. Looking ahead, the next decade will witness accelerated uptake in AI-assisted diagnostics, nuclear medicine centers, and high-resolution PET and MRI technologies. Nationwide deployment of tiered healthcare and a surge in imaging volumes is boosting demand for molecular imaging markers.

India is forecast to register a CAGR of 7.1% between 2025 and 2035. From 2020 to 2024, limited infrastructure and high cost constrained demand, but recent improvements in imaging facility density and insurance coverage are expanding the market base. Increasing usage of contrast markers in CT and MRI scans, particularly in cardiac and neurological diagnostics, is enhancing the role of markers in clinical imaging workflows.

Germany is anticipated to grow at a CAGR of 6.7% through 2035. During 2020 to 2024, usage was concentrated in diagnostic radiology and hospital oncology departments. Since 2025, clinical trial centers and CROs have increased their reliance on imaging biomarkers for endpoint assessment, particularly in neurodegenerative and autoimmune disease research. Imaging biomarker quantification is now standard in Phase II and III drug trials.

The US market is projected to grow at a CAGR of 5.6% between 2025 and 2035. From 2020 to 2024, demand centered around oncology diagnostics and hospital radiology departments. Recent trends show significant movement toward personalized medicine, where imaging markers are being used to monitor drug response, disease staging, and early detection. Integration of imaging data with genomics and EHR platforms is reshaping radiological workflows.

Japan is forecast to grow at a CAGR of 4.5% from 2025 to 2035. Between 2020 and 2024, usage was primarily limited to major university hospitals and cancer centers. The next phase will see broader use of imaging markers in regional diagnostic clinics, driven by new guidelines promoting early disease detection. Government investment in domestic radiopharmaceutical production is reducing reliance on imports and improving marker availability.

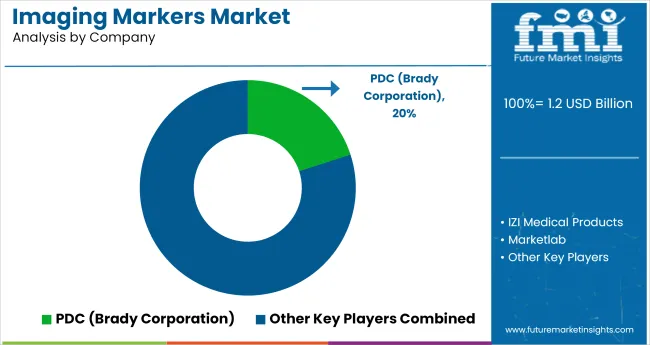

The market is moderately fragmented, with a mix of specialized medical imaging firms and diversified healthcare suppliers. PDC, a Brady Corporation brand, holds a leading position with over 20% market share, driven by its extensive hospital partnerships and FDA-cleared radiology skin markers. IZI Medical Products follows closely, offering a wide range of MRI-, CT-, and X-ray-compatible markers with a focus on disposable and precision-guided biopsy applications.

Medline Industries and Market lab leverage broad distribution networks to offer customizable markers in bulk, targeting outpatient and diagnostic imaging centers. AliMed and Solstice Corporation emphasize ergonomic and color-coded marker designs that enhance technician workflow. Maven Imaging has carved a niche in portable imaging accessories for urgent care and point-of-care ultrasound environments. Demand is rising for single-use, latex-free, and antimicrobial markers compatible with AI-enabled imaging systems.

Recent Imaging Markers Industry News

In March 2024, Brady Corporation entered exclusive talks to acquire Gravotech Holding for €123 million. The move enhances Brady’s precision marking capabilities across its imaging identification systems. This strategic acquisition strengthens PDC’s portfolio within the medical imaging markers segment and expands its European manufacturing and technological footprint.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.2 billion |

| Projected Market Size (2035) | USD 2.3 billion |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Markers Analyzed (Segment 1) | MRI Markers, CT Markers, PET and SPECT Markers, Ultrasound Markers, Optical Imaging Markers, Others |

| Therapeutic Areas Analyzed (Segment 2) | Oncology, Neurology, Cardiology, Infectious Disease/Inflammation, Hepatic Imaging, Orthopedics |

| Applications Analyzed (Segment 3) | Diagnosis, Treatment Planning & Monitoring, Drug Development & Research, Personalized Medicine |

| End Users Analyzed (Segment 4) | Hospitals, Diagnostic Imaging Centers, Research Institutes, Pharmaceutical Companies, CROs |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan & Baltic Countries, Russia & Belarus, Middle East & Africa |

| Key Players | PDC (Brady Corporation), IZI Medical Products, Marketlab, Medline Industries, AliMed, Maven Imaging, Solstice Corporation |

| Additional Attributes | Dollar sales by marker type and therapeutic focus, rising use in precision diagnostics, growing clinical research adoption, and integration of imaging markers in multimodal imaging workflows. |

The market is segmented into MRI markers, CT markers, PET and SPECT markers, ultrasound markers, optical imaging markers, and others, each enhancing imaging precision across modalities.

Key therapeutic areas include oncology, neurology, cardiology, infectious disease/inflammation, hepatic imaging, and orthopedic applications, reflecting broad clinical relevance.

Applications span diagnosis, treatment planning and monitoring, drug development and research, and personalized medicine, supporting both clinical and translational use.

End users include hospitals, diagnostic imaging centers, research institutes, pharmaceutical companies, and CROs, covering the full diagnostic and development ecosystem.

Geographic analysis covers North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The market is expected to reach USD 1.2 billion in 2025.

The market is forecasted to reach USD 2.3 billion by 2035.

The market is anticipated to grow at a CAGR of 6.8% during the forecast period.

MRI markers lead the market with a 32.0% share in 2025.

China is projected to grow at the fastest rate, with a CAGR of 8.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diagnostic Imaging Markers Market Size and Share Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

Gel Imaging Documentation Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Aerial Imaging Market Share

Aerial Imaging Market Growth - Trends & Forecast 2025 to 2035

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Dental Imaging Equipment Market Analysis – Growth & Forecast 2024-2034

Spinal Imaging Market Trends – Growth, Demand & Forecast 2022-2032

Hybrid Imaging System Market

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Quantum Imaging Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medical Imaging Software Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Imaging Devices Market Size and Share Forecast Outlook 2025 to 2035

Urology Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

In Vivo Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Global Nuclear Imaging Equipment Market Insights – Trends & Forecast 2024-2034

Medical Imaging Agent-Producing System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA