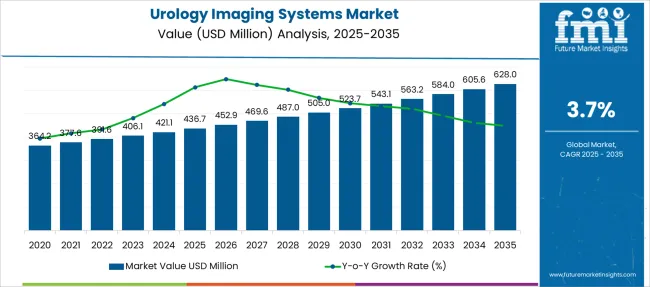

The Urology Imaging Systems Market is estimated to be valued at USD 436.7 million in 2025 and is projected to reach USD 628.0 million by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Urology Imaging Systems Market Estimated Value in (2025 E) | USD 436.7 million |

| Urology Imaging Systems Market Forecast Value in (2035 F) | USD 628.0 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

The urology imaging systems market is growing steadily, fueled by increased demand for advanced diagnostic tools in urological care. Rising incidences of urological disorders such as kidney stones, prostate abnormalities, and urinary tract infections have driven healthcare providers to adopt more precise imaging solutions.

Improvements in imaging technologies, including higher resolution and real-time visualization, have enhanced diagnostic accuracy and patient outcomes. Hospitals are expanding their diagnostic capabilities as part of broader efforts to improve early detection and minimally invasive treatment approaches.

Growing awareness among clinicians and patients regarding non-invasive diagnostic options has also contributed to market growth. Technological integration with electronic medical records and telemedicine has further expanded the usability of imaging systems. The market outlook remains positive as healthcare infrastructure improves globally and demand for efficient urological diagnostics continues to rise. Segmental growth is expected to be led by ultrasound systems as the primary product type and hospitals as the major end users.

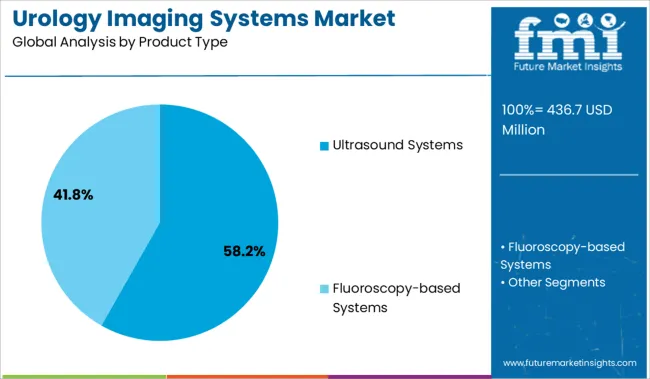

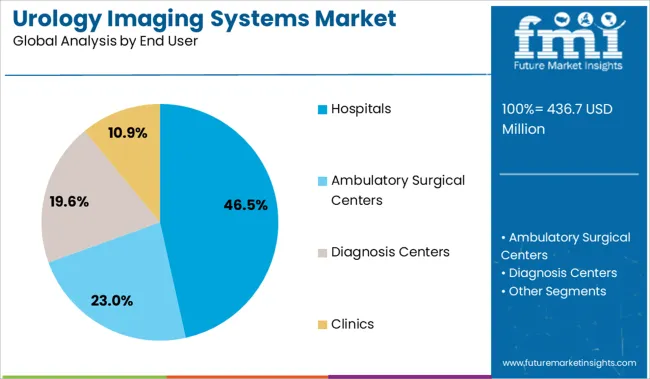

The market is segmented by Product Type and End User and region. By Product Type, the market is divided into Ultrasound Systems and Fluoroscopy-based Systems. In terms of End User, the market is classified into Hospitals, Ambulatory Surgical Centers, Diagnosis Centers, and Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ultrasound systems segment is projected to hold 58.2% of the urology imaging systems market revenue in 2025, maintaining its dominance in product type. This segment’s growth has been driven by the non-invasive nature of ultrasound, its cost-effectiveness, and its ability to provide real-time imaging critical for accurate diagnosis.

Ultrasound systems are widely used for evaluating kidney stones, bladder function, and prostate conditions, making them indispensable in urological practice. Technological advances have improved image clarity and portability, facilitating their use in diverse clinical settings including outpatient clinics and bedside diagnostics.

The safety profile of ultrasound, which does not involve ionizing radiation, has further increased its preference among healthcare professionals. As urological disease burden grows, the ultrasound systems segment is expected to retain its leading position in the market.

The hospitals segment is projected to account for 46.5% of the urology imaging systems market revenue in 2025, establishing itself as the primary end user. This segment’s growth is attributed to the widespread adoption of advanced imaging modalities within hospital settings where diagnostic precision is paramount.

Hospitals often serve as referral centers for complex urological cases requiring comprehensive imaging evaluations. Investments in upgrading diagnostic infrastructure and expanding urology departments have supported the integration of sophisticated imaging systems.

Additionally, hospitals provide multidisciplinary care involving urologists, radiologists, and nephrologists, which necessitates reliable imaging tools. The capacity to perform a high volume of imaging procedures and ongoing clinical research also positions hospitals as key users. With increasing patient inflow and demand for minimally invasive interventions, hospitals are expected to remain the dominant end user segment.

| Particulars | Details |

|---|---|

| H1, 2024 | 3.78% |

| H1, 2025 Projected | 3.68% |

| H1, 2025 Outlook | 3.48% |

| BPS Change - H1, 2025 (O) – H1, 2025 (P) | (+) 04 ↑ |

| BPS Change – H1, 2025 (O) – H1, 2024 | (-) 30 ↓ |

As per the Future Market Insights’ analysis, the H1-2025 outlook period in comparison to H1-2025 projected period showed a surge in growth rate in terms of Basis Point Share by 04 BPS.

The surge in the BPS values observed can be associated with the development of 3d printing for novel equipment, as well as translation of medical imaging into tangible replicas of patient-specific anatomy. With growing enhancements in medical imaging systems, the market is set to experience a positive growth outlook.

However, In H1-2025 when compared to H1-2024, the market growth rate of urology imaging systems is expected to fall by 30 basis point share (BPS), as per FMI analysis. The resultant drop in the BPS values in are associated with the high costs associated with the MRI compatible urology imaging systems, as well as long procedural time, thus resulting in a fall in the adoption rate.

The market is subject to changes as per the macro and industry dynamics which include disease prevalence and epidemiology, device regulations, technology adoption, and product licensing and distribution.

Key developments in the market include the collaboration of 3D printing and additive manufacturing for imaging.

The urology imaging systems market is expected to register 3.7% CAGR between 2025 and 2035, up from 3.8% CAGR recorded during 2013 to 2024, predicts Future Market Insights.

The increasing cases of kidney stones in various parts of the globe is one of the major factors bolstering the sales of urology imaging solutions. According to the National Kidney Foundation, from 2013 to 2014, the prevalence of kidney stones was 10% in the USA ., while in the late 2000s, it was 8.8%. It is likely to surge worldwide in the near future because of obesity, not drinking enough water, and consumption of sugar and protein-rich food and beverages.

Focus of various governments towards the expansion of their healthcare infrastructure also will fuel the demand for urology scanners. The market is slated to gain from the growing number of innovative diagnostic centers and the high prevalence of chronic diseases.

The increasing geriatric population is often linked to the surging prevalence of bladder outlet obstruction, urological cancer, and urinary incontinence. As per a report published by the World Health Organization (WHO) in 2020, the prevalence of urinary incontinence reported in population-based studies ranges from 9.9% to 36.1%. The rate is twice as high in older women as in older men. This trend is likely to continue in the near future, thereby propelling the growth in this market.

The surging adoption of cutting-edge urology imaging solutions by non-radiologists is projected to push the growth in this market. Innovations in PC-based designs, miniaturization of ultrasound urology imaging systems, development of the narrow band imaging cystoscopy technology, and the easy access to instant clinical information are estimated to fuel the market in the forthcoming years.

Stone formation and infections in the tract are the two common urological diseases that are expected to increase in the future backed by the high consumption of red meat and alcohol, drinking inadequate amount of water, and lack of knowledge about urological hygiene post sexual intercourse.

The WHO mentioned that an estimated 50% of women report having had an UTI at some point in their lives and more than 1 million hospitalizations take place every year because of this condition worldwide. Thus, governments around the world are taking initiatives to conduct awareness programs to educate the general public about UTI and its treatment options, which is set to bolster the demand for urology imaging solutions.

Rapid Adoption of Portable Urology Scanners to Drive the Market

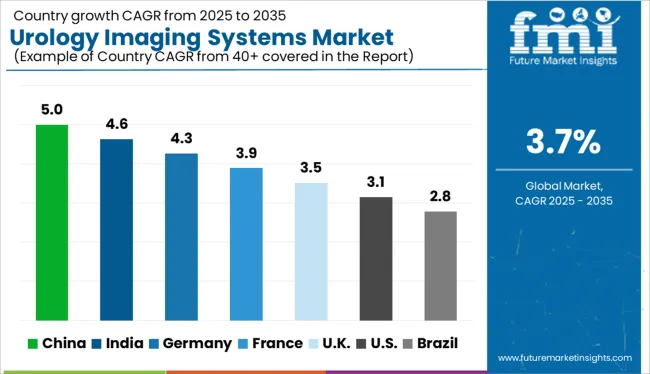

The rising adoption of portable urology scanners among non-radiology specialists in the USA. is anticipated to drive the urology imaging systems market in North America. Also, the presence of various reputed healthcare device manufacturers, such as GE, Stryker Corporation, Boston Scientific Corporation, and Intuitive Surgical in the USA. is projected to accelerate adoption of urology imaging systems.

In December 2024, for instance, Proton International, a leading provider of proton therapy to cancer patients based in Florida, signed a new contract with Belgium-based medical technology company, Ion Beam Applications S.A. As per this contract, Ion will install the former’s Proteus ONE proton therapy solution in its three-story Radiation Oncology Center.

The system will be equipped with a fully integrated Quality Assurance (QA) hardware and software package, Pencil Beam Scanning (PBS), hand pendant for easy patient positioning, and Cone Beam Computed Tomography (CBCT). Thus, the engagement of leading USA.-based players in signing contracts with healthcare institutions of other countries is anticipated to spur the demand for urology scanners.

Growing Incidence of Prostate Cancer to Boost Adoption of Narrow Band Imaging Cystoscopy

The rapid expansion of the medical devices industry in Japan is likely to bolster the urology imaging systems market in East Asia during the evaluation period. The country has the highest number of the elderly population in this region. According to the World Bank data, in 2024, about 28.39% percent of Japan's population were aged 65 years and above. This number is projected to surge in the forthcoming years, thereby propelling the need for urology MRI scans.

Furthermore, the higher incidence rate of colorectal cancer and prostate cancer among the aging population is set to spur the market in Japan. The American Association for Cancer Research states that the incidence of prostate cancer surged to 58.7 in 2014 from 7.1 per 100,000 in 1975 in Japan. Driven by the abovementioned factors, the adoption of narrow band imaging cystoscopy technology is likely to grow in this country.

Increasing Obese Population to Fuel the Demand for Urology MRI Scanners

The increasing demand for cloud-based solutions with higher magnified visualization and portable urology MRI scanners equipped with novel software solutions in the UK. is set to push the growth in Europe by 2035. Besides this, the presence of a well-established healthcare system in the UK. is estimated to propel the market in the near future.

The increasing cases of obesity owing to the surging consumption of junk food and adoption of unhealthy lifestyles is anticipated to spur the market in the UK. According to Cancer Research UK., 1 in 6 men will get prostate cancer at some point in their lives in this country. The organization also mentions that being obese will increase the risk of advanced prostate cancer. Thus, the prevalence of prostate cancer induced by obesity is set to rise in the UK., which would bolster the market.

High Accuracy Feature to Fuel Demand for Ultrasound Urology Imaging Solutions

In terms of product type, the ultrasound systems segment is estimated to account for approximately 54.6% of the urology imaging systems market share in 2025, predicts FMI. The high reliability and accuracy provided by ultrasound systems in terms of diagnosis is anticipated to propel their demand in the assessment period.

The fluoroscopy-based systems will remain the second-leading segment, contributing around 45.4% of the market share till 2025, finds FMI. Unlike standard radiographs, fluoroscopy-based systems deliver images in an inverted grayscale. The ongoing evolution in the field of urology imaging solutions is projected to aid the development of advanced fluoroscopy-based systems with 3-D capabilities. This is likely to spur the segment’s growth.

Hospitals are Preferring Narrow Band Imaging Cystoscopy Technology

Based on end user, the hospitals segment is anticipated to remain at the forefront in terms of the urology imaging systems market share. The surging demand for minimally invasive techniques owing to the need to shorten the length of hospital stay, reduce the infection rate, and lower the blood loss across the globe is likely to increase people’s preference for hospitals.

The increasing number of hospitals offering state-of-the-art medical services, such as narrow band imaging cystoscopy technology in both developed and emerging economies is expected to push the segment forward. Many renowned companies are tying up with hospitals worldwide to install their in-house solutions for providing better treatment options to patients. This will also emerge as a chief growth driver.

Some of the key players operating in the urology imaging systems market are focusing on the production of novel systems to cater to the high demand from patients across the globe. Other players are conducting extensive research and development activities to introduce technologically developed urology imaging solutions. A few of them are also participating in the acquisition strategy to expand their existing product portfolios and gain a competitive edge in the market.

For instance,

In January 2025, Olympus, a manufacturer of optics and reprography products headquartered in Japan, published the findings of independent clinical studies in the Journal of Urology. The study found that the treatment of kidney stones with SOLTIVE Premium SuperPulsed Laser System can provide the potential for lower procedures costs, better patient outcomes, and shorter procedure times, as compared to those performed with Holmium: YAG.

In January 2025, Promaxo, Inc., a medical imaging, robotics, and AI technology company based in California, sold its in-office MRI system to Kasraeian Urology. The USA. FDA recently approved the company’s single-sided MRI system equipped with AI-based imaging for in-office use. It would enable hospitals and practices to seamlessly and accurately guide prostate interventions, thereby overcoming the limitations of conventional MRI systems.

| Attribute | Details |

|---|---|

| Forecast Period | 2013 to 2024 |

| Historical Data Available for | 2025 to 2035 |

| Market Analysis | Units for Volume and USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; India; and the Middle East & Africa. |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Italy, Spain, Nordic, Russia, Poland, China, India, Thailand, Indonesia, Australia and New Zealand, Japan, GCC countries, North Africa, South Africa, others. |

| Key Market Segments Covered | Product Type, End Use, and Region |

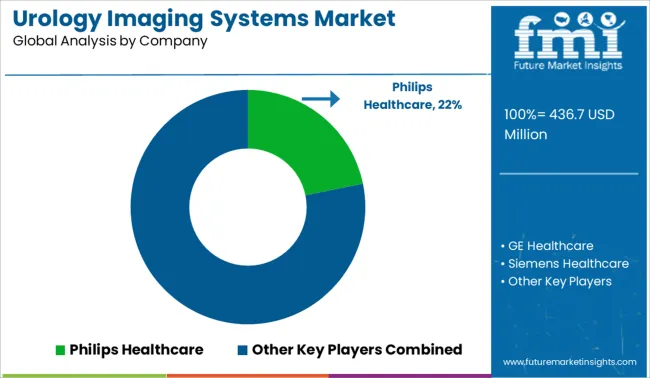

| Key Companies Profiled | Philips Healthcare; GE Healthcare; Siemens Healthcare; Analogic Corporation; Esaote S.p.A.; Samsung Medison Co. Ltd.; FUJIFILM Holdings Corporation; Hitachi Medical Corporation; Toshiba Corporation; Mindray Medical International Limited |

| Pricing | Available upon Request |

The global urology imaging systems market is estimated to be valued at USD 436.7 million in 2025.

The market size for the urology imaging systems market is projected to reach USD 628.0 million by 2035.

The urology imaging systems market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in urology imaging systems market are ultrasound systems and fluoroscopy-based systems.

In terms of end user, hospitals segment to command 46.5% share in the urology imaging systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Urology Lasers Market Size and Share Forecast Outlook 2025 to 2035

Urology Supplements Market Size and Share Forecast Outlook 2025 to 2035

Urology Disposables Market

Neurology Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

Neurology Services Market Overview - Growth & Forecast 2025 to 2035

Neurology Digital Therapeutics Market Growth – Trends & Forecast 2024-2034

Nephrology and Urology Incontinence Devices Market Growth – Trends & Forecast 2025 to 2035

Imaging Markers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

Gel Imaging Documentation Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Aerial Imaging Market Share

Aerial Imaging Market Growth - Trends & Forecast 2025 to 2035

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Spinal Imaging Market Trends – Growth, Demand & Forecast 2022-2032

Hybrid Imaging System Market

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA