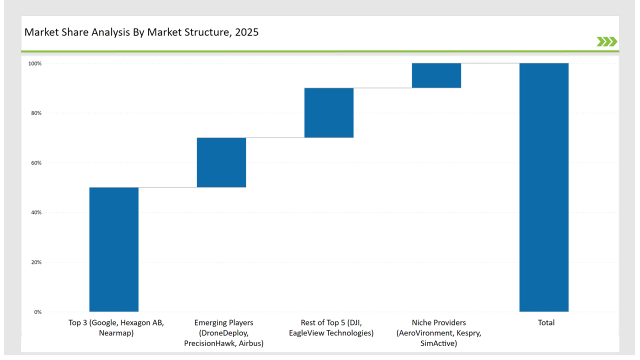

The Aerial Imaging market is expanding rapidly as industries adopt drone and satellite-based imaging for defense, urban planning, disaster response, and resource management. Google, Hexagon AB, and Nearmap lead the market, controlling 50%. They provide AI-powered image analytics, real-time mapping, and high-resolution aerial imagery solutions.

DJI and EagleView Technologies, holding 20%, focus on drone-based imaging solutions and cloud-based geospatial analytics. Emerging players like DroneDeploy, PrecisionHawk, and Airbus capture 20%, excelling in AI-driven aerial surveying and geospatial intelligence. Niche providers such as AeroVironment, Kespry, and SimActive account for 10%, catering to specialized imaging applications in agriculture, energy, and disaster management.

| Category | Industry Share (%) |

|---|---|

| Top 3 (Google, Hexagon AB, Nearmap) | 50% |

| Rest of Top 5 (DJI, EagleView Technologies) | 20% |

| Emerging Players (DroneDeploy, PrecisionHawk, Airbus) | 20% |

| Niche Providers (AeroVironment, Kespry, SimActive) | 10% |

| Market Concentration | Assessment |

|---|---|

| High (> 60% by top 10 players) | Medium |

| Medium (40-60%) | High |

| Low (< 40%) | Low |

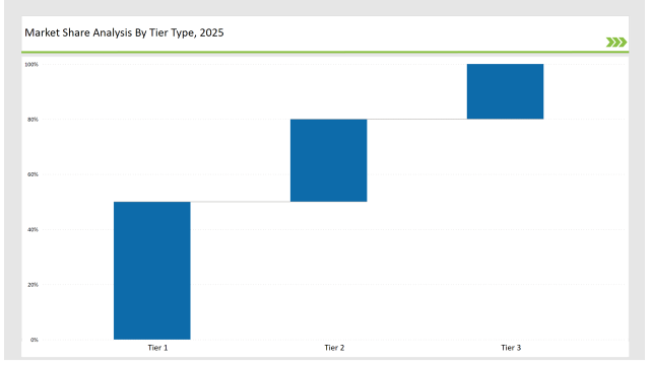

| Tier | Tier 1 |

|---|---|

| Vendors | Google, Hexagon AB, Nearmap, DJI |

| Consolidated Market Share (%) | 50% |

| Tier | Tier 2 |

|---|---|

| Vendors | EagleView Technologies, DroneDeploy, PrecisionHawk, Airbus |

| Consolidated Market Share (%) | 30% |

| Tier | Tier 3 |

|---|---|

| Vendors | AeroVironment, Kespry, SimActive |

| Consolidated Market Share (%) | 20% |

| Vendor | Key Focus |

|---|---|

| Expands AI-powered geospatial analytics and real-time mapping. | |

| Hexagon AB | Advances photogrammetry software and AI-driven land surveying tools. |

| Nearmap | Enhances real-time aerial imaging and urban planning solutions. |

| DJI | Develops next-gen UAV imaging technology with multispectral sensors. |

| EagleView Technologies | Strengthens cloud-based aerial property assessment solutions. |

| DroneDeploy | Innovates AI-driven drone surveying and mapping platforms. |

| PrecisionHawk | Expands satellite and UAV-based energy infrastructure monitoring. |

| Airbus | Strengthens high-resolution defense intelligence imaging. |

The aerial imaging industry is set for transformative growth with AI, cloud computing, and IoT integration. Vendors must refine AI models for automated aerial data analysis, enabling real-time decision-making. Predictive analytics and deep learning will enhance anomaly detection in defense, disaster response, and urban planning.

Blockchain-enabled aerial imaging will ensure transparency and data security. UAV-based aerial imaging will expand into commercial applications, requiring international regulatory compliance. Cloud-based platforms and strategic GIS/IoT collaborations will drive industry growth.

Leading vendors Google, Hexagon AB, Nearmap, and DJI hold 50% of the market.

Emerging players DroneDeploy, PrecisionHawk, and Airbus hold 20% of the market.

Niche providers AeroVironment, Kespry, and SimActive hold 10% of the market.

The top 5 vendors (Google, Hexagon AB, Nearmap, DJI, and EagleView Technologies) control 70% of the market.

Market concentration in 2025 is categorized as medium, with the top 10 players controlling 60-70% of the market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Aerial Firefighting Market Size and Share Forecast Outlook 2025 to 2035

Aerial Ladder Trucks Market Size and Share Forecast Outlook 2025 to 2035

Aerial Imaging Market Growth - Trends & Forecast 2025 to 2035

UK Aerial Work Platform Market Analysis – Size & Growth Forecast 2025-2035

UK Aerial Imaging Market Trends – Demand, Innovations & Forecast 2025-2035

USA Aerial Work Platform Market Insights – Demand, Size & Industry Trends 2025-2035

USA Aerial Imaging Market Analysis – Size & Industry Trends 2025-2035

BRICS Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Korea Aerial Work Platform MarketGrowth - Trends & Forecast 2025 to 2035

Japan Aerial Work Platform Market Growth – Innovations & Therapies 2025 to 2035

ASEAN Aerial Work Platform Market Insights – Size, Trends & Forecast 2025-2035

Japan Aerial Imaging Market Report – Trends & Innovations 2025-2035

Germany Aerial Work Platform Market Trends – Demand & Outlook 2025-2035

Germany Aerial Imaging Market Analysis – Growth, Applications & Outlook 2025-2035

Unmanned Aerial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Aerial Vehicles (UAV) Commercial Drone Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Aerial Robot Market Size and Share Forecast Outlook 2025 to 2035

GCC Countries Aerial Imaging Market Growth – Trends, Demand & Innovations 2025-2035

Western Europe aerial work platform market Analysis & Forecast by Product Type, End-use, Fuel Type, Platform Height, Sales Channel, and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA