The Western Europe aerial work platform market is anticipated to be valued at USD 2637.8 million in 2025. It is expected to grow at a CAGR of 5.5% during the forecast period and reach a value of USD 4505.7 million in 2035.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Size in 2025 | USD 2637.8 Million |

| Projected Size in 2035 | USD 4505.7 Million |

| CAGR (2025 to 2035) | 5.5% |

The Western Europe aerial work platform market in 2024 witnessed advancements increased by technological integration as well as evolving industry demands. An emerging trend is the increasing use of drones combined with AWPs for inspection and survey activities, enhancing productivity and accuracy in construction, utilities, and facilities management.

For instance, the focus on safety and automation has led to the development of sensor-equipped and remotely operated platforms, which are increasingly being adopted by industry players. In turn, rentals were mostly characterized by cost-efficient service providers who modernize fleets as part of their operations.

Demand spiked in countries like Germany, France, and the UK due to infrastructure upgrades and stringent safety regulations. Electric-powered AWPs were favored due to sustainability momentum and emission regulations. The challenges presented by supply chain disruptions and the fluctuating cost of raw materials were countered by a strong end-user demand that, however, somewhat eased major setbacks.

Looking ahead beyond 2025, sustained growth is expected driven by factors such as urbanization, green building campaigns, and further automation. IoT and AI-powered maintenance solutions will possibly offer improved fleet connectivity in the industry. OEMs will concentrate on developing lightweight energy-efficient models in line with evolving regulations. By 2035, Western Europe’s AWP sector is expected to reach USD 4,505.7 million, with rental and electric AWPs driving expansion.

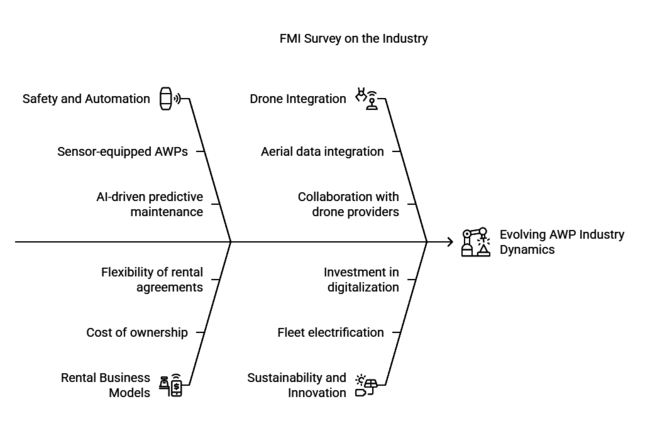

A recent FMI survey with key stakeholders in the Western Europe aerial work platform market revealed critical industry trends and investment priorities. Safety enhancements and automation emerged as the top concerns for equipment buyers, rental companies, and end-users. Respondents preferred sensor-equipped AWPs, remote monitoring systems, and AI-driven predictive maintenance to minimize operational risks and downtime. Additionally, fleet electrification is accelerating as businesses align with stringent EU emission norms and sustainability goals.

The survey also underscored a shift toward rental-based business models, with nearly 65% of industry participants favoring rental over outright purchases. This trend is driven by the rising cost of AWP ownership, maintenance challenges, and the flexibility offered by rental agreements. Rental providers are expanding their fleets with compact, electric-powered AWPs, catering to increasing demand from urban construction projects and indoor facility management. Stakeholders expect rental penetration to rise further, reshaping procurement strategies across industries.

Another key takeaway is the growing adoption of drone-assisted AWPs for inspection and survey applications. Utility firms and construction companies are particularly keen on integrating aerial data with ground-level operations to improve accuracy and efficiency. This trend is fueling collaborations between AWP manufacturers and drone technology providers, paving the way for more automated, data-driven site management solutions.

As the industry evolves, investment in digitalization, lightweight materials, and ergonomic designs is set to increase. Stakeholders believe that OEMs focusing on sustainability, connectivity, and safety innovations will strengthen their future position in the industry.To access the complete survey findings and gain deeper insights into industry opportunities, contact FMI today.

Government regulations and mandatory certifications play a crucial role in shaping the Western European aerial work platform market, ensuring safety, operational efficiency, and compliance with evolving industry standards.

| Country | Regulations & Mandatory Certifications |

|---|---|

| Germany |

|

| France |

|

| United Kingdom |

|

| Italy |

|

| Spain |

|

| Netherlands |

|

| 2020 to 2024 (Historical Performance) | 2025 to 2035 (Future Outlook) |

|---|---|

| The industry experienced steady growth, driven by increasing urbanization and infrastructure development. | The industry is expected to expand at a consistent CAGR, fueled by smart city initiatives, sustainability efforts, and stricter safety regulations. |

| Boom lifts are dominated by their extensive use in high-rise construction and maintenance projects. | Technologically advanced boom lifts with automation and telematics will gain traction, improving safety and operational efficiency. |

| Electric AWPs saw rising adoption, mainly in urban projects, due to stringent emission regulations and demand for sustainable solutions. | Electric AWPs will dominate the fuel type segment as advancements in battery technology and charging infrastructure drive wider adoption. |

| The construction sector remained the largest end-user, supported by government-funded infrastructure projects. | The construction sector will continue leading, but demand from warehousing, logistics, and facility management will rise significantly. |

| Rental services gained popularity as businesses prioritized cost efficiency over ownership. | The rental model will expand further, with short-term contracts and digital fleet management solutions making AWPs more accessible and cost-efficient for businesses. |

| COVID-19 caused temporary supply chain disruptions, but demand recovered as infrastructure projects resumed. | The industry will see stable growth with fewer disruptions, supported by automation, IoT-based fleet tracking, and predictive maintenance. |

Boom lifts are projected to maintain dominance within the product type category, securing 66.2% of the share in 2024. Among the various boom lift subtypes, articulating boom lifts stand out due to their superior flexibility in reaching confined and obstructed areas.

These lifts are widely adopted in urban construction, maintenance, and industrial applications where maneuverability is critical. The increasing emphasis on worker safety and regulatory compliance further accelerates demand for articulating boom lifts, making them a key contributor to industry expansion.

Electric aerial work platforms (AWPs) are set to capture 56.2% of the share in 2024, with battery-powered AWPs leading the fuel type segment. These machines are favored for their zero-emission capabilities and noise reduction benefits, making them ideal for indoor operations and urban projects.

The growing enforcement of stringent emission regulations across Western Europe drives the transition from diesel-powered models to electric alternatives. Continued advancements in battery technology and fast-charging capabilities are expected to enhance the operational efficiency of electric AWPs further.

The construction industry remains the largest end-use sector, heavily relying on AWPs for high-rise building projects, maintenance, and infrastructure development. Within this segment, residential and commercial construction accounts for a substantial portion of demand, driven by increasing urbanization. The necessity for safe and efficient elevation solutions in congested metropolitan areas fuels AWP adoption. Additionally, government investments in infrastructure modernization ensure continued growth in the construction sector’s reliance on aerial work platforms.

In the platform height segment, AWPs with a working height of 10 to 20 meters dominate usage due to their versatility across industrial, commercial, and municipal applications. These machines are commonly utilized for building maintenance, signage installation, and warehouse operations, where medium-height access is essential. The segment benefits from technological enhancements, including improved load capacity and operational stability, making 10 to 20M AWPs the preferred choice for a wide range of industries.

Rental service providers continue to be the primary sales channel as businesses seek cost-effective alternatives to direct equipment purchases. Within this category, short-term rental contracts are witnessing significant traction, particularly among construction firms and logistics providers needing temporary access solutions. The flexibility of rental agreements, coupled with reduced maintenance and ownership costs, makes this model highly attractive. The shift toward rental-based solutions is expected to accelerate, reinforcing the segment’s dominance through 2035.

The Western Europe aerial work platform market in 2024 has witnessed significant growth, driven by increased demand in construction, maintenance, and industrial applications. Key players such as JLG Industries holds 30% of the Western Europe AWP industry, followed by Terex Corporation (25%), Haulotte Group (18%), Skyjack (15%), and Manitou Group (12%). The remaining share is distributed among smaller regional and international players contributing to industry competition. These companies have focused on innovation, sustainability, and strategic partnerships to maintain their competitive edge.

In 2024, JLG Industries, a subsidiary of Oshkosh Corporation, has continued to dominate the Western Europe AWP sector with an estimated share of 30%. The company has focused on expanding its electric and hybrid product lines to meet the growing demand for eco-friendly equipment. JLG’s revenue share in Western Europe is approximately USD 790 million in 2024, based on its 30% share of the total industry valuation of USD 2.63 billion, driven by strong sales of boom lifts and scissor lifts. The company has also invested in digital solutions, such as telematics and fleet management software, to improve customer efficiency and equipment uptime.

Terex Corporation, another major player, holds a 25% share in Western Europe, with a revenue share of around USD 657.5 million. In 2024, Terex launched a new line of low-emission diesel-powered AWPs, targeting urban construction projects with strict environmental regulations.

The company has also strengthened its after-sales service network across the region, aiming to enhance customer loyalty and retention. Terex’s strategic focus on sustainability and operational efficiency has helped it maintain a strong position in the industry.

Haulotte Group, a leading European manufacturer, has an 18% share and a revenue share of approximately USD 650 million in 2024. The company has prioritized innovation, introducing a new range of compact and lightweight AWPs designed for indoor applications.

Haulotte has also expanded its distribution network in key regions such as Germany and France, leveraging its local manufacturing capabilities to reduce lead times and costs. Additionally, the company has partnered with renewable energy firms to provide AWPs for solar and wind farm maintenance, tapping into the growing green energy sector.

Skyjack, a Linamar Corporation subsidiary, holds a 15% share in Western Europe, with a revenue share of around USD 394.5 million. In 2024, Skyjack has focused on expanding its electric scissor lift portfolio, catering to the increasing demand for zero-emission equipment.

The company has also introduced advanced safety features, such as enhanced load sensing and stability control systems, to differentiate its products in a competitive landscape. Skyjack’s emphasis on affordability and reliability has made it a preferred choice for small and medium-sized contractors.

Manitou Group, with a 12% share and a revenue share of approximately USD 430 million, has been actively pursuing growth in the AWP segment. In 2024, Manitou launched a new line of hybrid AWPs, combining diesel and electric power for improved efficiency and reduced emissions.

The company has also invested in digitalization, offering remote diagnostics and predictive maintenance solutions to its customers. Manitou’s focus on innovation and customer-centric solutions has helped it gain traction in Western Europe.

Western Europe’s AWP industry in 2024 has also seen increased consolidation, with smaller players being acquired by larger firms to enhance their product portfolios and reach. For instance, in March 2024, Haulotte Group acquired a German AWP manufacturer specializing in low-height platforms, as reported by Access International. This acquisition has strengthened Haulotte’s position in the niche segment and expanded its customer base in Germany.

Overall, Western Europe’s AWP sector in 2024 is characterized by a strong focus on sustainability, innovation, and customer-centric strategies. Leading players are leveraging technological advancements and strategic partnerships to address the evolving needs of the construction and industrial sectors. With further growth expected, these companies are well-positioned to capitalize on emerging opportunities and maintain their competitive edge.

The Western Europe aerial work platform industry falls under the construction and industrial equipment sector, closely tied to infrastructure development, manufacturing, logistics, and maintenance industries. Macroeconomic factors, including GDP growth, urbanization trends, industrial automation, and regulatory policies, influence this industry.

Between 2020 and 2024, Western Europe experienced moderate economic recovery post-COVID-19, with governments prioritizing infrastructure investments and urban redevelopment projects. Rising labor costs and stricter workplace safety regulations accelerated automation in construction and maintenance, increasing reliance on AWPs for safe and efficient elevated work access. Additionally, green energy policies and carbon neutrality goals pushed the adoption of electric-powered AWPs over diesel models.

From 2025 to 2035, the industry is set to benefit from sustained infrastructure growth, automation in facility management, and the expansion of e-commerce-driven warehousing. The European Union’s Fit for 55 regulations and emission reduction targets will further incentivize electric and hybrid AWP adoption. The shift towards rental-based procurement models will drive growth, making AWPs more accessible to small and mid-sized businesses. However, challenges such as supply chain volatility, high raw material costs, and labor shortages may impact production and pricing. Despite these factors, strong industrial demand and technological advancements will sustain industry expansion across the region.

Expanding Rental Services with Digital Fleet Management

Rental demand is rising as businesses prefer flexible access to AWPs over direct ownership. Stakeholders should invest in telematics and IoT-based fleet management, enabling real-time monitoring of usage, maintenance needs, and location tracking. Subscription-based rental models can further attract cost-conscious customers, ensuring higher fleet utilization and profitability.

Capitalizing on the Transition to Electric AWPs

With 56.2% of new AWPs sold in 2024 being electric, stakeholders must expand battery-powered offerings. Investing in swappable battery technology and fast-charging solutions can address concerns around downtime. Partnerships with renewable energy providers for charging infrastructure can also enhance industry competitiveness while meeting sustainability goals.

Targeting Urban Infrastructure & Smart City Projects

As urbanization accelerates, demand for AWPs in high-rise construction, facility maintenance, and public infrastructure will surge. Manufacturers should develop compact, lightweight AWPs designed for narrow urban spaces and low-emission zones. Offering automated, remote-controlled AWPs for hard-to-reach locations can also create a competitive edge.

By product type, the industry is segmented into boom lift, push around and spider lift, scissor lift, and vertical mast lift.

In terms of end-use, the sector is segmented into aerospace and defense, construction, manufacturing, mining, transportation and logistics, and others.

By fuel type, the industry is segmented into electric, gas or diesel, and hybrid.

In terms of platform height, the sector is segmented into 10 to 20m, 20 to 30m, above 30m, and below 10m.

By sales channel, the industry is segmented into OEM and rental service providers.

Increasing urbanization, infrastructure development, and stringent safety regulations are major factors contributing to higher adoption. The shift toward electric models due to emission control policies is also playing a significant role.

Boom lifts hold the largest share, particularly articulating models, due to their flexibility in reaching difficult areas. Their demand is high in construction, maintenance, and industrial applications.

Regulations related to worker safety, emission control, and equipment certification are shaping adoption trends. Many countries require compliance with strict standards, which is pushing companies to invest in safer and more energy-efficient equipment.

Businesses prefer rentals over ownership due to lower upfront costs, maintenance-free access, and flexible contract options. The increasing integration of telematics in rental fleets is further driving this trend.

Innovations such as AI-powered safety controls, IoT-based fleet monitoring, and fast-charging battery systems are enhancing operational efficiency. Automation features and remote-control capabilities are also becoming more common.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Unit) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Unit) Forecast by End-Use, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Unit) Forecast by Fuel Type, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Platform Height, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Unit) Forecast by Platform Height, 2018 to 2033

Table 11: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 14: UK Industry Analysis and Outlook Volume (Unit) Forecast By Region, 2018 to 2033

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: UK Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2018 to 2033

Table 17: UK Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 18: UK Industry Analysis and Outlook Volume (Unit) Forecast by End-Use, 2018 to 2033

Table 19: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 20: UK Industry Analysis and Outlook Volume (Unit) Forecast by Fuel Type, 2018 to 2033

Table 21: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Platform Height, 2018 to 2033

Table 22: UK Industry Analysis and Outlook Volume (Unit) Forecast by Platform Height, 2018 to 2033

Table 23: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: UK Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 25: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 26: Germany Industry Analysis and Outlook Volume (Unit) Forecast By Region, 2018 to 2033

Table 27: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Germany Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2018 to 2033

Table 29: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: Germany Industry Analysis and Outlook Volume (Unit) Forecast by End-Use, 2018 to 2033

Table 31: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 32: Germany Industry Analysis and Outlook Volume (Unit) Forecast by Fuel Type, 2018 to 2033

Table 33: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Platform Height, 2018 to 2033

Table 34: Germany Industry Analysis and Outlook Volume (Unit) Forecast by Platform Height, 2018 to 2033

Table 35: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Germany Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 37: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 38: Italy Industry Analysis and Outlook Volume (Unit) Forecast By Region, 2018 to 2033

Table 39: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Italy Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2018 to 2033

Table 41: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 42: Italy Industry Analysis and Outlook Volume (Unit) Forecast by End-Use, 2018 to 2033

Table 43: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 44: Italy Industry Analysis and Outlook Volume (Unit) Forecast by Fuel Type, 2018 to 2033

Table 45: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Platform Height, 2018 to 2033

Table 46: Italy Industry Analysis and Outlook Volume (Unit) Forecast by Platform Height, 2018 to 2033

Table 47: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Italy Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 49: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 50: France Industry Analysis and Outlook Volume (Unit) Forecast By Region, 2018 to 2033

Table 51: France Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: France Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2018 to 2033

Table 53: France Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 54: France Industry Analysis and Outlook Volume (Unit) Forecast by End-Use, 2018 to 2033

Table 55: France Industry Analysis and Outlook Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 56: France Industry Analysis and Outlook Volume (Unit) Forecast by Fuel Type, 2018 to 2033

Table 57: France Industry Analysis and Outlook Value (US$ Million) Forecast by Platform Height, 2018 to 2033

Table 58: France Industry Analysis and Outlook Volume (Unit) Forecast by Platform Height, 2018 to 2033

Table 59: France Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: France Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 61: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 62: Spain Industry Analysis and Outlook Volume (Unit) Forecast By Region, 2018 to 2033

Table 63: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: Spain Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2018 to 2033

Table 65: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 66: Spain Industry Analysis and Outlook Volume (Unit) Forecast by End-Use, 2018 to 2033

Table 67: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 68: Spain Industry Analysis and Outlook Volume (Unit) Forecast by Fuel Type, 2018 to 2033

Table 69: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Platform Height, 2018 to 2033

Table 70: Spain Industry Analysis and Outlook Volume (Unit) Forecast by Platform Height, 2018 to 2033

Table 71: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: Spain Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 73: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Rest of Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2018 to 2033

Table 75: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 76: Rest of Industry Analysis and Outlook Volume (Unit) Forecast by End-Use, 2018 to 2033

Table 77: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 78: Rest of Industry Analysis and Outlook Volume (Unit) Forecast by Fuel Type, 2018 to 2033

Table 79: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Platform Height, 2018 to 2033

Table 80: Rest of Industry Analysis and Outlook Volume (Unit) Forecast by Platform Height, 2018 to 2033

Table 81: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 82: Rest of Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Platform Height, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 7: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 8: Industry Analysis and Outlook Volume (Unit) Analysis by Country, 2018 to 2033

Figure 9: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 10: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 11: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2018 to 2033

Figure 13: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 16: Industry Analysis and Outlook Volume (Unit) Analysis by End-Use, 2018 to 2033

Figure 17: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 18: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 19: Industry Analysis and Outlook Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 20: Industry Analysis and Outlook Volume (Unit) Analysis by Fuel Type, 2018 to 2033

Figure 21: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 22: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 23: Industry Analysis and Outlook Value (US$ Million) Analysis by Platform Height, 2018 to 2033

Figure 24: Industry Analysis and Outlook Volume (Unit) Analysis by Platform Height, 2018 to 2033

Figure 25: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Platform Height, 2023 to 2033

Figure 26: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Platform Height, 2023 to 2033

Figure 27: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 29: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 32: Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 33: Industry Analysis and Outlook Attractiveness by Fuel Type, 2023 to 2033

Figure 34: Industry Analysis and Outlook Attractiveness by Platform Height, 2023 to 2033

Figure 35: Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 37: UK Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: UK Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 39: UK Industry Analysis and Outlook Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 40: UK Industry Analysis and Outlook Value (US$ Million) by Platform Height, 2023 to 2033

Figure 41: UK Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 43: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 44: UK Industry Analysis and Outlook Volume (Unit) Analysis By Region, 2018 to 2033

Figure 45: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 46: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 47: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 48: UK Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2018 to 2033

Figure 49: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: UK Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 52: UK Industry Analysis and Outlook Volume (Unit) Analysis by End-Use, 2018 to 2033

Figure 53: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 54: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 55: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 56: UK Industry Analysis and Outlook Volume (Unit) Analysis by Fuel Type, 2018 to 2033

Figure 57: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 58: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 59: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Platform Height, 2018 to 2033

Figure 60: UK Industry Analysis and Outlook Volume (Unit) Analysis by Platform Height, 2018 to 2033

Figure 61: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Platform Height, 2023 to 2033

Figure 62: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Platform Height, 2023 to 2033

Figure 63: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: UK Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 65: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: UK Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 68: UK Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 69: UK Industry Analysis and Outlook Attractiveness by Fuel Type, 2023 to 2033

Figure 70: UK Industry Analysis and Outlook Attractiveness by Platform Height, 2023 to 2033

Figure 71: UK Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 72: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 73: Germany Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Germany Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 75: Germany Industry Analysis and Outlook Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 76: Germany Industry Analysis and Outlook Value (US$ Million) by Platform Height, 2023 to 2033

Figure 77: Germany Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 79: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 80: Germany Industry Analysis and Outlook Volume (Unit) Analysis By Region, 2018 to 2033

Figure 81: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 82: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 83: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 84: Germany Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2018 to 2033

Figure 85: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 88: Germany Industry Analysis and Outlook Volume (Unit) Analysis by End-Use, 2018 to 2033

Figure 89: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 90: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 91: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 92: Germany Industry Analysis and Outlook Volume (Unit) Analysis by Fuel Type, 2018 to 2033

Figure 93: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 94: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 95: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Platform Height, 2018 to 2033

Figure 96: Germany Industry Analysis and Outlook Volume (Unit) Analysis by Platform Height, 2018 to 2033

Figure 97: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Platform Height, 2023 to 2033

Figure 98: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Platform Height, 2023 to 2033

Figure 99: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Germany Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 101: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Germany Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 104: Germany Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 105: Germany Industry Analysis and Outlook Attractiveness by Fuel Type, 2023 to 2033

Figure 106: Germany Industry Analysis and Outlook Attractiveness by Platform Height, 2023 to 2033

Figure 107: Germany Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 109: Italy Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Italy Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 111: Italy Industry Analysis and Outlook Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 112: Italy Industry Analysis and Outlook Value (US$ Million) by Platform Height, 2023 to 2033

Figure 113: Italy Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 115: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 116: Italy Industry Analysis and Outlook Volume (Unit) Analysis By Region, 2018 to 2033

Figure 117: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 118: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 119: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 120: Italy Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2018 to 2033

Figure 121: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 123: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 124: Italy Industry Analysis and Outlook Volume (Unit) Analysis by End-Use, 2018 to 2033

Figure 125: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 126: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 127: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 128: Italy Industry Analysis and Outlook Volume (Unit) Analysis by Fuel Type, 2018 to 2033

Figure 129: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 130: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 131: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Platform Height, 2018 to 2033

Figure 132: Italy Industry Analysis and Outlook Volume (Unit) Analysis by Platform Height, 2018 to 2033

Figure 133: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Platform Height, 2023 to 2033

Figure 134: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Platform Height, 2023 to 2033

Figure 135: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Italy Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 137: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Italy Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 140: Italy Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 141: Italy Industry Analysis and Outlook Attractiveness by Fuel Type, 2023 to 2033

Figure 142: Italy Industry Analysis and Outlook Attractiveness by Platform Height, 2023 to 2033

Figure 143: Italy Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 145: France Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: France Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 147: France Industry Analysis and Outlook Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 148: France Industry Analysis and Outlook Value (US$ Million) by Platform Height, 2023 to 2033

Figure 149: France Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 151: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 152: France Industry Analysis and Outlook Volume (Unit) Analysis By Region, 2018 to 2033

Figure 153: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 154: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 155: France Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 156: France Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2018 to 2033

Figure 157: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 158: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 159: France Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 160: France Industry Analysis and Outlook Volume (Unit) Analysis by End-Use, 2018 to 2033

Figure 161: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 162: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 163: France Industry Analysis and Outlook Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 164: France Industry Analysis and Outlook Volume (Unit) Analysis by Fuel Type, 2018 to 2033

Figure 165: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 166: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 167: France Industry Analysis and Outlook Value (US$ Million) Analysis by Platform Height, 2018 to 2033

Figure 168: France Industry Analysis and Outlook Volume (Unit) Analysis by Platform Height, 2018 to 2033

Figure 169: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Platform Height, 2023 to 2033

Figure 170: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Platform Height, 2023 to 2033

Figure 171: France Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: France Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 173: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: France Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 176: France Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 177: France Industry Analysis and Outlook Attractiveness by Fuel Type, 2023 to 2033

Figure 178: France Industry Analysis and Outlook Attractiveness by Platform Height, 2023 to 2033

Figure 179: France Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 180: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 181: Spain Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: Spain Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 183: Spain Industry Analysis and Outlook Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 184: Spain Industry Analysis and Outlook Value (US$ Million) by Platform Height, 2023 to 2033

Figure 185: Spain Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 187: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 188: Spain Industry Analysis and Outlook Volume (Unit) Analysis By Region, 2018 to 2033

Figure 189: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 190: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 191: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 192: Spain Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2018 to 2033

Figure 193: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 194: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 195: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 196: Spain Industry Analysis and Outlook Volume (Unit) Analysis by End-Use, 2018 to 2033

Figure 197: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 198: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 199: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 200: Spain Industry Analysis and Outlook Volume (Unit) Analysis by Fuel Type, 2018 to 2033

Figure 201: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 202: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 203: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Platform Height, 2018 to 2033

Figure 204: Spain Industry Analysis and Outlook Volume (Unit) Analysis by Platform Height, 2018 to 2033

Figure 205: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Platform Height, 2023 to 2033

Figure 206: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Platform Height, 2023 to 2033

Figure 207: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: Spain Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 209: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: Spain Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 212: Spain Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 213: Spain Industry Analysis and Outlook Attractiveness by Fuel Type, 2023 to 2033

Figure 214: Spain Industry Analysis and Outlook Attractiveness by Platform Height, 2023 to 2033

Figure 215: Spain Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 216: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 217: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 218: Rest of Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 219: Rest of Industry Analysis and Outlook Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 220: Rest of Industry Analysis and Outlook Value (US$ Million) by Platform Height, 2023 to 2033

Figure 221: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 222: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 223: Rest of Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2018 to 2033

Figure 224: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 225: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 226: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 227: Rest of Industry Analysis and Outlook Volume (Unit) Analysis by End-Use, 2018 to 2033

Figure 228: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 229: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 230: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 231: Rest of Industry Analysis and Outlook Volume (Unit) Analysis by Fuel Type, 2018 to 2033

Figure 232: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 233: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 234: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Platform Height, 2018 to 2033

Figure 235: Rest of Industry Analysis and Outlook Volume (Unit) Analysis by Platform Height, 2018 to 2033

Figure 236: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Platform Height, 2023 to 2033

Figure 237: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Platform Height, 2023 to 2033

Figure 238: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 239: Rest of Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 240: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 241: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 242: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 243: Rest of Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 244: Rest of Industry Analysis and Outlook Attractiveness by Fuel Type, 2023 to 2033

Figure 245: Rest of Industry Analysis and Outlook Attractiveness by Platform Height, 2023 to 2033

Figure 246: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Western Europe Social Employee Recognition System Market - Trends & Forecast 2025 to 2035

The thermal printing Market in Western Europe is segmented by printer type, printing technology, industry and country from 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA