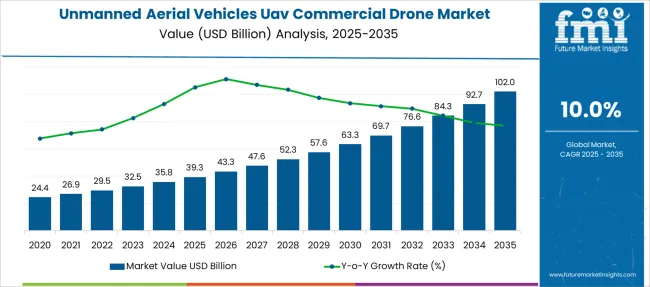

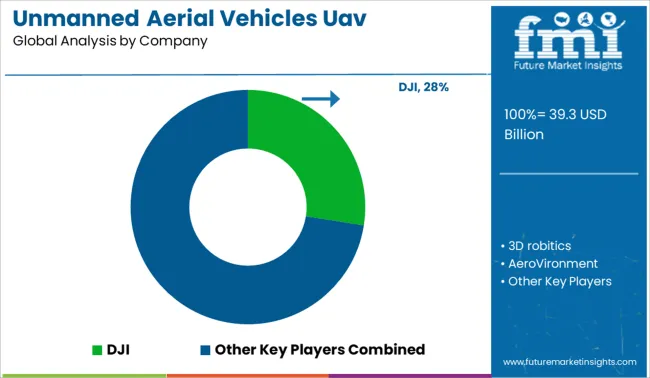

The Unmanned Aerial Vehicles (UAV) Commercial Drone Market is estimated to be valued at USD 39.3 billion in 2025 and is projected to reach USD 102.0 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

| Metric | Value |

|---|---|

| Unmanned Aerial Vehicles (UAV) Commercial Drone Market Estimated Value in (2025 E) | USD 39.3 billion |

| Unmanned Aerial Vehicles (UAV) Commercial Drone Market Forecast Value in (2035 F) | USD 102.0 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The UAV commercial drone market is experiencing significant growth due to expanding applications across various industries and advancements in drone technologies. Increased demand for efficient aerial data collection and real-time monitoring has driven adoption in sectors such as agriculture, construction, and media. Improvements in battery life, sensor accuracy, and navigation systems have enhanced drone performance and operational safety.

Additionally, regulatory developments have facilitated wider commercial drone deployment by establishing clearer operational guidelines. The rising need for cost-effective and flexible solutions in surveying and inspection tasks has boosted demand.

Future growth is expected to be driven by integration with AI and data analytics, expanding autonomous capabilities, and increasing adoption in emerging markets. Segmental growth is expected to be led by fixed wing drones in the offering category, remotely operated drones in mode of operation, and aerial photography as the primary application.

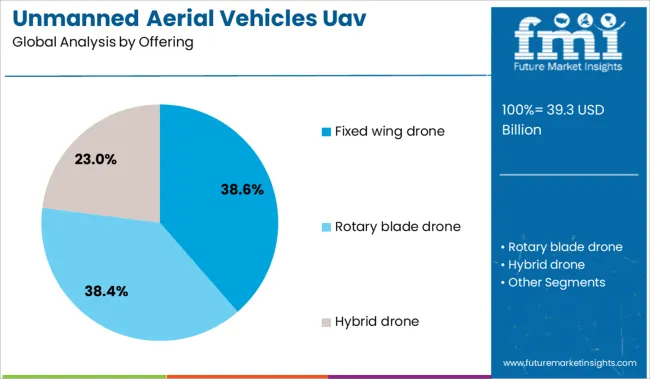

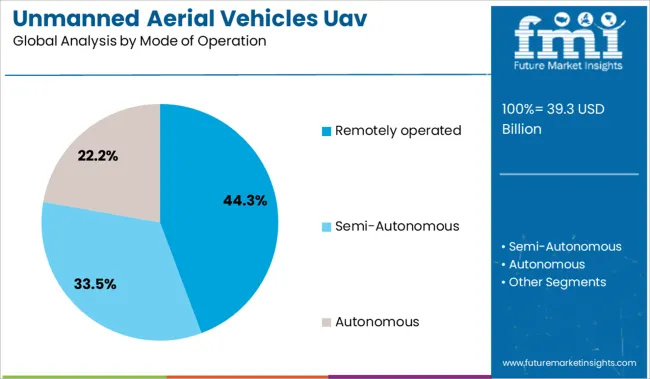

The market is segmented by Offering, Mode of Operation, Application, and Distribution Channel and region. By Offering, the market is divided into Fixed wing drone, Rotary blade drone, and Hybrid drone. In terms of Mode of Operation, the market is classified into Remotely operated, Semi-Autonomous, and Autonomous.

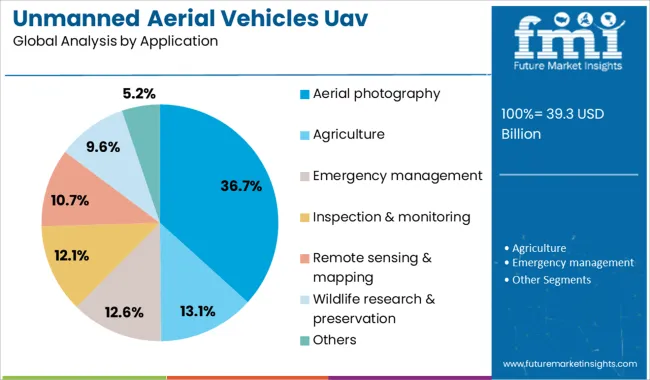

Based on Application, the market is segmented into Aerial photography, Agriculture, Emergency management, Inspection & monitoring, Remote sensing & mapping, Wildlife research & preservation, and Others. By Distribution Channel, the market is divided into Direct and Indirect. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed wing drone segment is projected to account for 38.6% of the UAV commercial drone market revenue in 2025. This growth is driven by the ability of fixed wing drones to cover large areas with higher endurance and longer flight times compared to rotary wing models. Their efficient aerodynamic design allows for extended operations in surveying, mapping, and agricultural monitoring.

The suitability of fixed wing drones for long-range applications where endurance is critical has made them preferred choices in sectors requiring wide area coverage. Operators benefit from reduced operational costs and improved data acquisition efficiency.

As industries seek to optimize large-scale data collection, the fixed wing drone segment is expected to sustain its market prominence.

The remotely operated drone segment is anticipated to hold 44.3% of the market revenue in 2025, reflecting its widespread adoption in commercial applications. Remotely operated drones provide operators with direct control and real-time response capabilities, which are essential for tasks requiring precise maneuvering and immediate decision-making.

This mode of operation is favored in industries such as construction, infrastructure inspection, and media production where operator oversight ensures safety and adaptability to changing conditions.

The continued reliance on skilled pilots and the development of intuitive control interfaces have supported this segment’s growth. While autonomous systems advance, remotely operated drones remain critical for applications demanding human judgment and intervention.

The aerial photography segment is projected to contribute 36.7% of the UAV commercial drone market revenue in 2025, positioning it as the leading application area. The demand for high-resolution imagery and video content in media, advertising, real estate, and event coverage has significantly increased. Drones offer unique vantage points and flexibility that traditional methods cannot match, making them indispensable tools for creative professionals.

Additionally, the ease of deployment and relatively low operational costs have made aerial photography accessible to a broader range of users. The growth of social media platforms and digital marketing strategies has further amplified the need for compelling visual content captured via drones. As technology improves and content demands rise, aerial photography will continue to be a dominant driver of the UAV commercial drone market.

The UAV commercial drone market is shaped by rising enterprise use in agriculture, logistics, and infrastructure inspection. Demand for AI-integrated drones with precision sensors is increasing, while regulatory support for BVLOS operations is enabling wider deployment. However, challenges remain around airspace integration, data privacy, and national security restrictions. Supply chain volatility and evolving compliance requirements also create entry barriers for new manufacturers and service operators across global markets.

Industrial sectors have begun deploying UAVs for tasks like precision agriculture, infrastructure inspection, mapping, and security monitoring. Automated intelligence functions such as AI-enabled imaging, analytics, and data capture—are now embedded in hardware platforms. Delivery operations are gaining pilot-scale momentum with real-world trials, supported by unmanned traffic management integration. These applications have encouraged heavy investments in purpose-built drones, registration frameworks, and operator certification. As enterprises require scalable drone fleets tailored to specific workflows, manufacturers are releasing specialized systems with payload flexibility, high‑precision sensors, and integrated analytics pipelines. The result is a transition from general-purpose platforms to workflow-optimized UAV systems that streamline operational ROI and accelerate industry penetration.

Recent regulatory developments, such as mandatory remote identification, streamlined Part‑107 licensing, and approval of beyond‑visual‑line‑of‑sight (BVLOS) operations, are laying the groundwork for large-scale commercial adoption. These advances allow for the safe integration of UAVs into shared airspace and public workflows. With remote monitoring and collision-avoidance systems now required under new rules, manufacturers can deliver systems that meet compliance out of the box. Opportunities exist for service providers to offer compliance-as-a-service, including operations planning, airspace authorization, and safety audits. Vendors that incorporate regulatory updates into upgradeable firmware and modular drone architecture are expected to gain accelerated acceptance among logistics, emergency response, and infrastructure sectors.

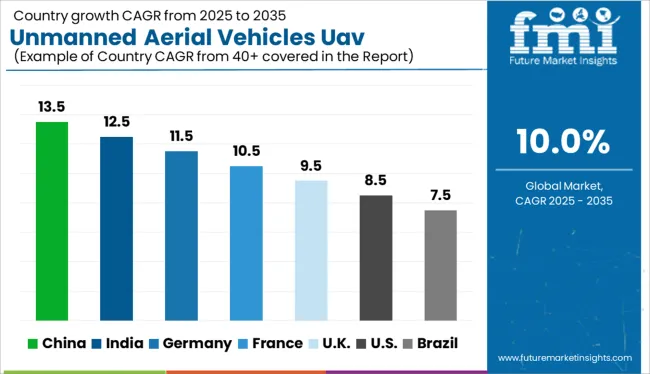

| Country | CAGR |

|---|---|

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

Global commercial UAV Drone market is forecast to grow at a CAGR of 10.0% between 2025 and 2035, though regional performance reflects disparities in regulatory frameworks, end-user integration, and domestic manufacturing depth. China leads at 13.5%, outperforming the global rate by 3.5 percentage points, underpinned by strong domestic OEMs, dual-use drone development, and exports of LiDAR-equipped UAVs across BRICS and ASEAN markets. India follows at 12.5%, driven by DGCA-backed licensing reforms, agri-drone subsidy programs, and growing use in infrastructure surveying and logistics delivery zones.Germany, posting 11.5%, benefits from high-tech collaborations in precision agriculture, autonomous inspection, and AI-based flight analytics. Industrial zones in Bavaria and Lower Saxony are scaling UAV testing corridors. France, at 10.5%, is expanding use cases across defense, public safety, and utilities, aided by corridor-based BVLOS (beyond visual line of sight) pilots. The United Kingdom lags at 9.5%, slightly under the global mark, limited by airspace coordination challenges and slower rollout of commercial drone corridors. The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Adoption of unmanned aerial vehicles (UAV) commercial drone in China is expanding at a 13.5% CAGR through 2035, led by widespread industrial adoption and dominant domestic manufacturing. Companies like DJI and XAG have enabled mass deployment of drones in precision agriculture, last-mile delivery, surveillance, and energy grid inspection. Government support for AI integration and 5G connectivity strengthens UAV communication capabilities. Provinces such as Heilongjiang and Guangdong show high UAV penetration across logistics and farmland management. Compared to European countries, China's ecosystem exhibits full-stack capabilities, from chipsets to autonomous flight software.

Deamand for unmanned aerial vehicles (UAV) commercial drone in India is advancing at a 12.5% CAGR through 2035, propelled by a blend of policy liberalization and agri-tech demand. The Drone Shakti initiative and Production-Linked Incentive (PLI) schemes have strengthened local assembly capabilities. Startups in Telangana and Maharashtra lead drone-as-a-service (DaaS) models in crop spraying and land mapping. Integration with GIS for mining and rail inspection has scaled rapidly. Compared to China, India focuses on affordability and scalable services rather than high-end automation.

The sale of unmanned aerial vehicles (UAV) commercial drone is expanding at an 11.5% CAGR, driven by precision inspection and infrastructure surveillance applications. Compliance with EASA guidelines has enabled safe airspace integration for drones in urban and rural zones. High-end enterprise applications in energy, real estate, and predictive maintenance dominate demand. Unlike India’s agri-led growth, Germany’s focus lies in AI-enabled solutions for large-scale inspection and autonomous asset tracking. Industrial clusters in Bavaria and North Rhine-Westphalia show strong uptake.

Demand for unmanned aerial vehicles (UAV) commercial drone is growing at a 10.5% CAGR, with increasing adoption in surveillance, agriculture, and industrial monitoring. Vineyards in Bordeaux and Rhône-Alpes utilize drones for crop health, while public agencies deploy UAVs for border and civil surveillance. Domestic firms like Parrot and Delair support indigenous innovation across dual-use drone segments. DGAC-enforced training and pilot certification have streamlined professional use. France’s market contrasts with China’s in terms of tighter regulation and more specialized applications.

Sales of unmanned aerial vehicles (UAV) commercial drones in United Kingdom are is witnessing a 9.5% CAGR, led by infrastructure, public safety, and medical logistics. UAV trials by the NHS for sample delivery, along with power grid inspections by major utilities, have broadened the application landscape. CAA regulation post-Brexit has helped stabilize certification norms. Compared to France and Germany, the UK market is more focused on pilot projects and government-backed implementations rather than commercial scaling. Drone integration into smart city projects remains early stage.

The commercial UAV market is led by DJI, which holds dominant global share due to its extensive product range, intuitive user interface, and strong distribution across both consumer and enterprise segments. Yuneec follows as a notable Chinese manufacturer offering long-endurance drones suited for inspection and surveillance applications. Autel Robotics, Parrot, and Skydio form the next layer of competition. Autel has gained attention with the EVO series and Dragonfish models, particularly in the USA enterprise and public sector. Parrot maintains relevance through its offerings in agriculture and mapping applications. Skydio has carved a niche in autonomous drones, primarily servicing defense, law enforcement, and infrastructure inspection industries. AeroVironment, Delair, 3D Robotics, and AgEagle target specific commercial and tactical use cases. AeroVironment remains strong in defense-related applications, while Delair is recognized for long-range fixed-wing platforms tailored for surveying. 3D Robotics has pivoted toward enterprise drone software. AgEagle, along with its acquired unit senseFly, focuses on precision agriculture and geospatial mapping

| Item | Value |

|---|---|

| Quantitative Units | USD 39.3 Billion |

| Offering | Fixed wing drone, Rotary blade drone, and Hybrid drone |

| Mode of Operation | Remotely operated, Semi-Autonomous, and Autonomous |

| Application | Aerial photography, Agriculture, Emergency management, Inspection & monitoring, Remote sensing & mapping, Wildlife research & preservation, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DJI, 3D robitics, AeroVironment, Ageagle, Autel, Delair, Parrot, Skydio, Wingtra, and Yuneec |

| Additional Attributes | Dollar sales by drone type and operational range, share by rotary-wing and fixed-wing platforms, surge in BVLOS approvals across logistics and surveillance use cases, integration with AI-based flight analytics and 3D mapping, growth in precision agriculture and infrastructure inspection deployments, demand for autonomous navigation and swarm coordination features |

The global unmanned aerial vehicles (UAV) commercial drone market is estimated to be valued at USD 39.3 billion in 2025.

The market size for the unmanned aerial vehicles (UAV) commercial drone market is projected to reach USD 102.0 billion by 2035.

The unmanned aerial vehicles (UAV) commercial drone market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in unmanned aerial vehicles (UAV) commercial drone market are fixed wing drone, rotary blade drone and hybrid drone.

In terms of mode of operation, remotely operated segment to command 44.3% share in the unmanned aerial vehicles (UAV) commercial drone market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Unmanned Railway Vehicle Washing Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Surface Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Ground Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Unmanned Marine Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Aerial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Aerial Firefighting Market Size and Share Forecast Outlook 2025 to 2035

Aerial Ladder Trucks Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Aerial Imaging Market Share

Aerial Imaging Market Growth - Trends & Forecast 2025 to 2035

UK Aerial Imaging Market Trends – Demand, Innovations & Forecast 2025-2035

UK Aerial Work Platform Market Analysis – Size & Growth Forecast 2025-2035

USA Aerial Work Platform Market Insights – Demand, Size & Industry Trends 2025-2035

USA Aerial Imaging Market Analysis – Size & Industry Trends 2025-2035

BRICS Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Korea Aerial Work Platform MarketGrowth - Trends & Forecast 2025 to 2035

Japan Aerial Work Platform Market Growth – Innovations & Therapies 2025 to 2035

Japan Aerial Imaging Market Report – Trends & Innovations 2025-2035

ASEAN Aerial Work Platform Market Insights – Size, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA