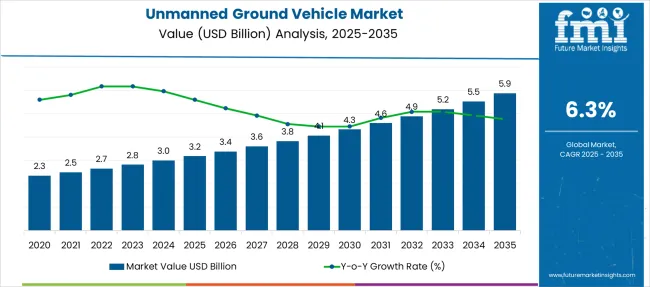

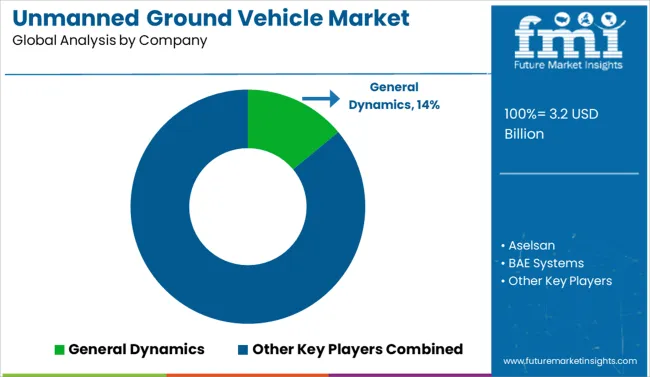

The Unmanned Ground Vehicle Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Unmanned Ground Vehicle Market Estimated Value in (2025 E) | USD 3.2 billion |

| Unmanned Ground Vehicle Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The unmanned ground vehicle market is advancing steadily as defense modernization, automation in hazardous environments, and demand for remote operations converge to drive adoption. The current landscape is shaped by increasing investments in robotics for military, security, and industrial applications where human presence is risky or inefficient.

Technological improvements in autonomy, energy efficiency, and sensor integration are enhancing vehicle performance and reliability, prompting wider deployment. Future growth is expected to be fueled by evolving battlefield doctrines, urban security challenges, and the need for scalable robotic platforms in civilian domains.

Enhanced mission flexibility, reduced personnel risk, and cost efficiency of unmanned systems are paving the way for broader market penetration and long term development across sectors.

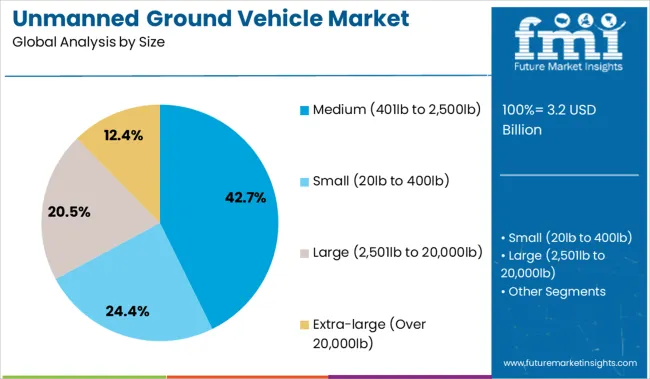

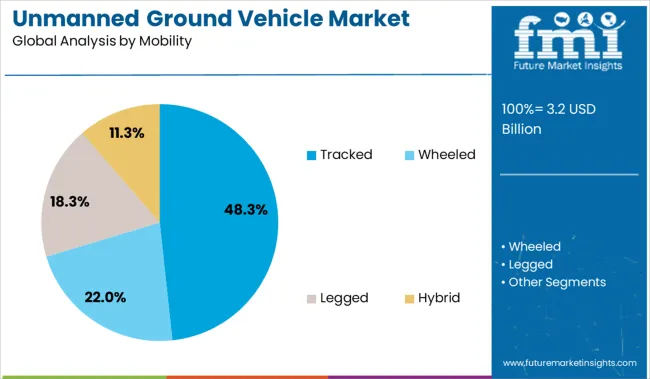

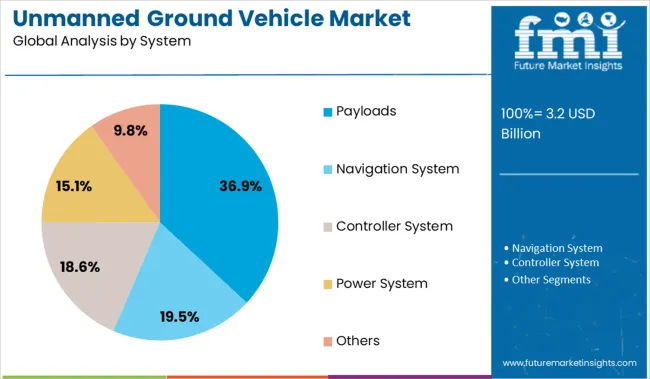

The unmanned ground vehicle market is segmented by size, mobility, system, mode of operation, and application and geographic regions. By size of the unmanned ground vehicle market is divided into Medium (401lb to 2,500lb), Small (20lb to 400lb), Large (2,501lb to 20,000lb), and Extra-large (Over 20,000lb). In terms of mobility of the unmanned ground vehicle market is classified into Tracked, Wheeled, Legged, and Hybrid. Based on system of the unmanned ground vehicle market is segmented into Payloads, Navigation System, Controller System, Power System, and Others. By mode of operation of the unmanned ground vehicle market is segmented into Autonomous, Teleoperated, and Tethered. By application of the unmanned ground vehicle market is segmented into Military & Defense and Commercial. Regionally, the unmanned ground vehicle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by size, the medium category ranging from 401lb to 2,500lb is anticipated to hold 42.7% of the total market revenue in 2025, marking it as the leading size segment. This dominance is attributed to its optimal balance between payload capacity and operational flexibility which meets diverse mission requirements effectively.

Medium unmanned ground vehicles are being adopted for both tactical and logistical roles where heavy platforms are impractical and smaller units lack capability. Their ability to carry advanced sensors, weapons, and supplies while maintaining mobility in confined or rugged terrains has strengthened their appeal.

Additionally, their compatibility with existing transport and deployment systems enhances operational readiness, reinforcing their leadership position in military and industrial settings where performance and adaptability are critical.

Segmented by mobility, the tracked configuration is projected to account for 48.3% of the market revenue in 2025, securing its position as the dominant mobility type. This leadership stems from superior stability and traction on uneven, soft, or debris-laden surfaces compared to wheeled or legged counterparts.

Tracked unmanned ground vehicles are favored for missions requiring high maneuverability over rough terrain, including urban rubble, snow, and loose soil. Their robust design enables greater payload carriage without compromising mobility, and their durability in harsh operating environments further enhances mission success rates.

The proven reliability of tracked systems in military and rescue operations has ensured sustained preference, making them the configuration of choice where terrain adaptability and load carrying capacity are paramount.

When segmented by system, the payloads category is expected to command 36.9% of the market revenue in 2025, establishing it as the leading system segment. This prominence is driven by the critical role of payloads in defining the functional capabilities of unmanned ground vehicles.

Modular payloads such as surveillance sensors, communication relays, ordnance, and detection equipment enhance mission versatility and value. The ability to customize vehicles for reconnaissance, logistics, explosive ordnance disposal, or combat roles by integrating appropriate payloads has made this segment central to operational planning.

Continuous innovation in sensor miniaturization, data processing, and multi-mission payload designs has expanded application possibilities, reinforcing the segment’s leadership as operators prioritize flexible and high-performing solutions for complex missions.

Surging demand stems from defense modernization, security automation, and industrial autonomy requirements. Future opportunity lies in role-specific payload modules, AI navigation systems, and service models targeting new civilian and commercial sectors.

Unmanned ground vehicles (UGVs) are increasingly adopted by defense and security sectors for missions including explosive ordnance disposal, reconnaissance, logistics support, and perimeter monitoring. Governments are investing in rugged UGV variants capable of traversing harsh terrain while carrying mission‑specific payloads such as sensors, manipulators, or drone launchers. Partnerships between military agencies and robotics firms have accelerated field deployments in conflict zones, border security, and remote patrolling use cases. At the same time, industrial facilities and large-scale infrastructure sites deploy UGVs for hazardous material handling, facility inspection, and automated logistics tasks. Beyond saving manpower, UGVs provide safer alternatives in dangerous environments, reducing risk exposure and enabling continuous operations under harsh conditions.

Growth opportunities in the UGV market revolve around modular platform architectures that support different mission payloads like remote tools, environmental sensors, and robotic chargers tailored for search and rescue, agriculture, mining, and utilities. Embedding AI-based navigation and obstacle avoidance enables autonomous route execution in dynamic environments without GPS reliance. On-demand UGV-as-a-service models where operators lease vehicles and support with training, field servicing, and software upgrades make deployment viable for commercial players. Collaboration with agriculture equipment firms, mining operators, and facility management companies can unlock new industry adoption. Additional value is created through simulation-based operator training, edge analytics for condition monitoring, and integration with command centers for coordinated operations.

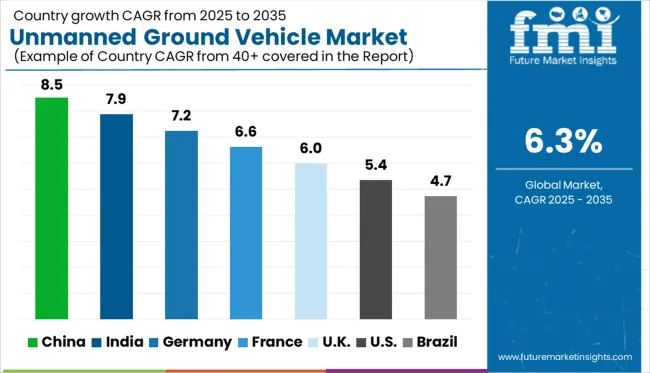

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

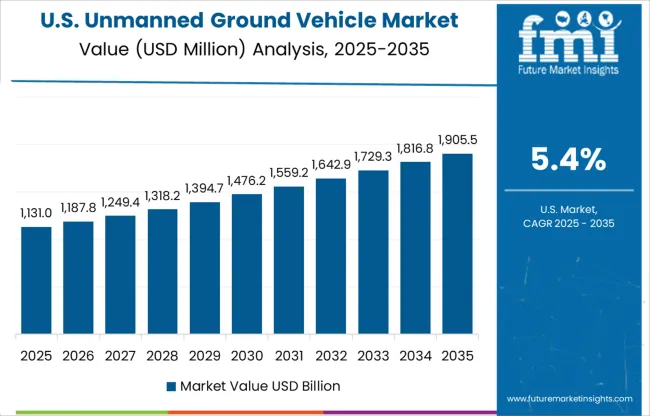

| USA | 5.4% |

| Brazil | 4.7% |

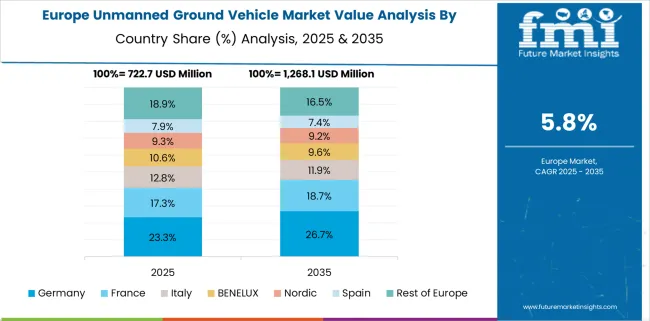

The global unmanned ground vehicle (UGV) market is projected to grow at a CAGR of 6.3% from 2025 to 2035, driven by rising defense modernization, industrial automation, and AI-enabled navigation systems. BRICS nations are leading the expansion, with China at 8.5% CAGR due to robust military R&D, logistics automation, and security robotics deployment. India follows closely at 7.9%, benefiting from Make-in-India defense programs and autonomous surveillance demand. Germany, representing the OECD bloc, is growing at 7.2% supported by dual-use robotics and industrial safety applications. In contrast, the United Kingdom (6.0%) and the United States (5.4%) are growing more moderately, reflecting mature defense systems and regulatory constraints on broader civilian UGV applications. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China leads the UGV market with a projected CAGR of 8.5%, setting a benchmark across Asia-Pacific. The surge is fueled by defense automation, industrial surveillance needs, and smart mining applications. Unlike the United States, where innovation is fragmented, China benefits from centralized R&D aligned with military modernization goals. Public–private partnerships accelerate field trials of AI enabled autonomous vehicles for both security and logistics. Comparatively, India’s growth remains reactive and logistics-focused, while China actively deploys UGVs in national infrastructure projects.

UGV market in India, is projected to expand at a CAGR of 7.9%, maintaining strong momentum behind China. Defense modernization is a key driver, but unlike Germany’s engineering-led market, India leans on agile and low-cost innovation. UGV adoption is rising within ordnance disposal, perimeter patrolling, and warehouse automation sectors. Compared to the UK’s focus on research-heavy platforms, India prioritizes field-tested, modular systems suited to rugged terrains. The ecosystem is further supported by domestic manufacturing programs like Make in India.

In Germany, UGV sector is advancing at a CAGR of 7.2%, slightly trailing India but clearly ahead of the UK and US. The market is heavily influenced by precision manufacturing and engineering-first prototypes. Unlike India’s speed-to-deploy mindset, Germany emphasizes durability, fail-safe navigation, and industrial-grade systems. UGVs are integrated into factory floor automation, environmental risk inspections, and airport perimeter security. This contrasts with China’s rapid deployment across multiple civilian sectors.

The UK’s UGV market is set to grow at a CAGR of 6.0%, reflecting moderate progress compared to Germany or India. Defense contracts and research-led initiatives continue to drive the sector, but commercialization is slower than in China. Academic institutions lead in AI and autonomy development, but integration into field-ready UGV systems lags. Compared to the US, where tactical systems are fielded by major contractors, the UK focuses more on technical capability demonstrations than wide-scale deployment.

The United States UGV market is forecast to grow at a CAGR of 5.4%, the lowest among major markets analyzed. While the US has long led in tactical UGV design, recent years have seen a lag in full-scale civilian integration. The contrast is stark when compared to China, which pushes both defense and industrial use cases simultaneously. Fragmented state-level procurement and long R&D cycles delay widespread commercialization. However, private defense contractors remain globally influential.

The Unmanned Ground Vehicle (UGV) market is moderately fragmented, with a competitive mix of defense contractors and advanced technology firms. General Dynamics leads with a significant share, leveraging its extensive military portfolio and autonomous navigation systems. BAE Systems, Rheinmetall, and Northrop Grumman follow, focusing on combat and reconnaissance UGVs integrated with AI and remote operation capabilities. Emerging players like Aselsan, QinetiQ, and Elbit Systems are investing in modular designs for multi-mission adaptability. The market is fueled by increasing defense modernization programs, border surveillance needs, and IED detection. Partnerships with robotics firms and advancements in autonomy, payload flexibility, and sensor fusion continue to shape competitive dynamics.

On February 5, 2025, Ukraine’s Ministry of Defence confirmed the deployment of robotic ground vehicle units at the front lines. These UGVs, tested since mid-2024, support missions like reconnaissance, logistics, and mine clearing, enhancing troop safety amid conflict.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Size | Medium (401lb to 2,500lb), Small (20lb to 400lb), Large (2,501lb to 20,000lb), and Extra-large (Over 20,000lb) |

| Mobility | Tracked, Wheeled, Legged, and Hybrid |

| System | Payloads, Navigation System, Controller System, Power System, and Others |

| Mode of Operation | Autonomous, Teleoperated, and Tethered |

| Application | Military & Defense and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Dynamics, Aselsan, BAE Systems, ECA Group, Elbit Systems, Hexagon, Israel Aerospace Industries, L3Harris, Lockheed Martin, Northrop Grumman, QinetiQ, Rheinmetall, ST Engineering, Teledyne, Textron, and Thales |

| Additional Attributes | Dollar sales by vehicle type, mobility system, and end-use application; regional demand driven by defense modernization, border security, and industrial automation; innovation in autonomous navigation, sensor integration, and AI-based mission planning; cost dynamics shaped by payload capacity, battery life, and terrain adaptability; environmental impact tied to energy sources and material use; and emerging use cases in disaster response, surveillance, logistics, and agriculture. |

The global unmanned ground vehicle market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the unmanned ground vehicle market is projected to reach USD 5.9 billion by 2035.

The unmanned ground vehicle market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in unmanned ground vehicle market are medium (401lb to 2,500lb), small (20lb to 400lb), large (2,501lb to 20,000lb) and extra-large (over 20,000lb).

In terms of mobility, tracked segment to command 48.3% share in the unmanned ground vehicle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Unmanned Aerial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Marine Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Aerial Vehicles (UAV) Commercial Drone Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Railway Vehicle Washing Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Surface Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Ground Grid Tester Market Size and Share Forecast Outlook 2025 to 2035

Ground and Precipitated Calcium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Ground Mounted Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Ground Mounted Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Ground Resistance Testers Market Growth - Trends & Forecast 2025 to 2035

Ground Fault Circuit Interrupter Market

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Hard Ground Tent Stake Hammer Market Size and Share Forecast Outlook 2025 to 2035

Underground Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Underground Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Aboveground Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Underground Coal Gasification Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Underground Cabling EPC Market Size and Share Forecast Outlook 2025 to 2035

Underground Mining Automation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA