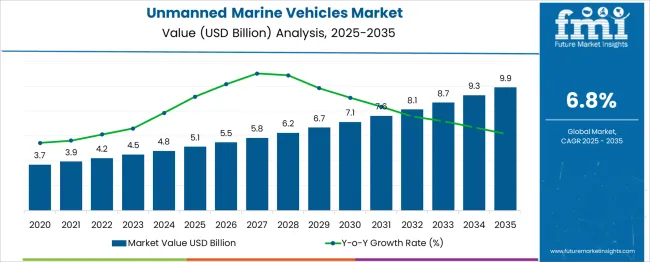

The Unmanned Marine Vehicles Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 9.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 5.1 billion to USD 7.1 billion, driven by increasing demand for autonomous vessels in defense, research, and commercial applications. Year-on-year analysis shows steady growth, with values reaching USD 5.5 billion in 2026 and USD 5.8 billion in 2027, supported by advancements in autonomous navigation technologies and cost-effective deployment of unmanned vehicles.

By 2028, the market is forecasted to reach USD 6.2 billion, advancing to USD 6.7 billion in 2029 and USD 7.1 billion by 2030. Growth will be further fueled by the expanding role of unmanned marine vehicles in environmental monitoring, offshore exploration, and logistics. These dynamics position unmanned marine vehicles as a vital component of modern maritime operations, offering significant opportunities for innovation in autonomous systems, energy efficiency, and data collection technologies in the coming decade.

| Metric | Value |

|---|---|

| Unmanned Marine Vehicles Market Estimated Value in (2025 E) | USD 5.1 billion |

| Unmanned Marine Vehicles Market Forecast Value in (2035 F) | USD 9.9 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The unmanned marine vehicles market is advancing rapidly due to growing interest in autonomous and remotely controlled maritime solutions across both defense and commercial sectors. Geopolitical tensions, increasing maritime surveillance needs, and investments in naval modernization programs have supported strong demand for technologically adaptive surface and sub-surface platforms.

The convergence of software-defined navigation, advanced sensor payloads, and real-time communication capabilities is redefining mission performance in offshore exploration, oceanographic research, and naval intelligence operations. As sustainability becomes critical in marine operations, electric propulsion systems and energy-efficient hull designs are also being integrated into these vehicles, further enhancing operational range and cost-effectiveness.

The market is additionally influenced by the expansion of underwater cable monitoring, subsea inspections, and anti-submarine warfare initiatives that require high-precision unmanned systems. With advancements in AI-based navigation, swarm coordination, and multi-platform interoperability, unmanned marine vehicles are poised to become essential components of future naval and commercial maritime architectures across global fleets.

The unmanned marine vehicles market is segmented by type, control, speed, endurance, solution, end use, application, and geographic regions. By type, the unmanned marine vehicles market is divided into Surface vehicles and underwater vehicles. In terms of control, the unmanned marine vehicles market is classified into remotely operated vehicles and autonomous vehicles. Based on speed, the unmanned marine vehicles market is segmented into 10−30 Knots, More than 30 Knots, and up to 10 Knots. By endurance of the unmanned marine vehicles market is segmented into 500−1,000 Hours, 100 Hours, 100−500 Hours>1,000 Hours.

By solution, the unmanned marine vehicles market is segmented into Propulsion system, Communication system, Payload, Chassis material, and Other solutions. By end-use application, the unmanned marine vehicles market is segmented into Defense, Research, Commercial, and others. Regionally, the unmanned marine vehicles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The surface vehicle segment is projected to account for 58.3% of the total revenue share in the unmanned marine vehicles market in 2025, establishing its dominant role across maritime operations. Growth in this segment is being driven by the demand for vessels capable of long-duration surface missions involving surveillance, reconnaissance, and environmental monitoring. Surface vehicles have proven advantageous due to their larger payload capacities, enhanced endurance, and ability to host multiple sensor arrays and communication systems.

The segment has benefited from increased utilization in defense coastal patrolling, anti-piracy missions, and offshore oil and gas inspections. Their compatibility with renewable energy modules, satellite navigation systems, and real-time data transmission has enhanced deployment efficiency across oceanic and littoral zones.

Software-defined capabilities allowing remote reconfiguration and mission planning have positioned surface vehicles as a flexible platform in dynamic marine environments. Additionally, reduced risks to human operators and lower operational costs compared to manned ships have supported widespread deployment in government and private fleets.

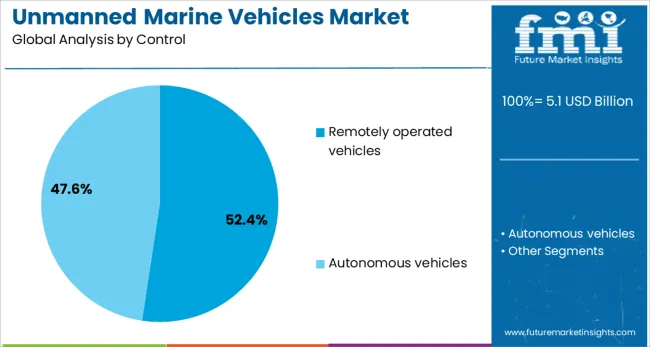

Remotely operated vehicles are anticipated to hold 52.4% of the revenue share in the unmanned marine vehicles market by 2025, driven by their indispensable role in deep-sea exploration and subsea infrastructure inspection. Their widespread adoption is supported by the ability to operate at extreme depths with precise maneuverability while transmitting high-definition data to surface operators. In industries such as offshore energy, subsea mining, and undersea cable maintenance, remotely operated vehicles are used for complex inspection and repair tasks that cannot be performed by manned divers.

Their integration with high-resolution sonar, robotic arms, and modular tools has significantly improved efficiency in underwater interventions. Enhanced tether management systems and fiber-optic communications have ensured low-latency command feedback even in harsh oceanographic conditions.

Remotely operated vehicles are also being deployed in defense sectors for mine countermeasures and port security tasks. Their continued evolution through real-time AI-assisted navigation and adaptive control interfaces is expected to sustain growth in both commercial and defense marine applications.

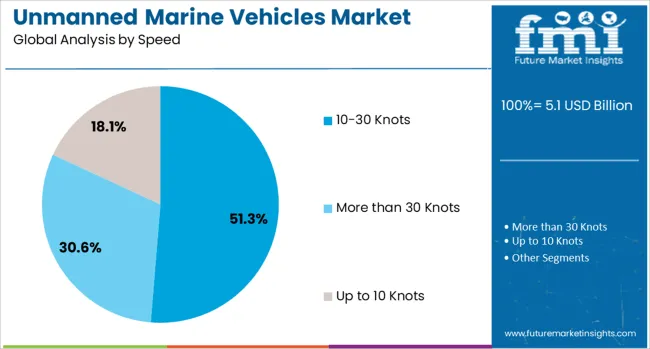

The 10–30 knots speed segment is expected to contribute 51.3% to the total revenue share of the unmanned marine vehicles market in 2025, making it the leading speed range across marine vehicle deployments. This segment’s dominance is attributed to its optimal balance between fuel efficiency, stability, and mission versatility. Unmanned marine vehicles operating within this speed range are favored for applications requiring consistent operational pacing such as seabed mapping, environmental data collection, and coastal surveillance.

Their ability to maintain reliable performance across varying sea states has made them suitable for both short- and mid-range missions. The speed range also supports efficient battery consumption in electric and hybrid propulsion systems, which are increasingly being adopted for sustainability goals.

Compatibility with precision control systems and stabilized imaging payloads has further boosted the deployment of vehicles in this category. As operational protocols prioritize endurance and mission flexibility, unmanned marine platforms within the 10–30 knots range are expected to remain central to multi-role maritime missions.

The unmanned marine vehicles market is driven by rising demand for autonomous solutions in both commercial and military applications. Opportunities are growing in offshore exploration, surveying, and defense, while trends toward hybrid and energy-efficient vehicles are reshaping the market. However, challenges such as regulatory barriers and high development costs may hinder growth. By 2025, overcoming these obstacles through streamlined regulations and cost-effective development processes will be essential for continued market expansion.

The unmanned marine vehicles (UMVs) market is growing due to the increasing demand for autonomous solutions in marine operations. UMVs are used for applications like environmental monitoring, oceanographic research, and military operations, offering advantages such as cost savings, efficiency, and reduced risk to human life. The rising need for accurate data collection in remote and hazardous marine environments is expected to continue driving demand. By 2025, the market will benefit from the growing adoption of unmanned vehicles for both commercial and defense applications.

Opportunities in the UMV market are expanding in both commercial and military sectors. In commercial applications, UMVs are increasingly used for tasks such as offshore oil exploration, underwater surveying, and logistics. The defense sector is also adopting these vehicles for surveillance, reconnaissance, and mine detection. By 2025, the growing need for cost-effective, autonomous vehicles in high-risk environments will fuel demand, offering substantial growth potential for manufacturers in both sectors.

Emerging trends in the unmanned marine vehicles market include the development of hybrid and energy-efficient UMVs. As the need for longer operational times and lower environmental impact grows, manufacturers are focusing on creating vehicles with reduced fuel consumption and lower emissions. Hybrid propulsion systems and renewable energy sources, such as solar and wind power, are gaining popularity. By 2025, these energy-efficient and environmentally friendly vehicles will dominate the market, providing more sustainable and cost-effective solutions.

Despite growth, challenges such as regulatory hurdles and high development costs persist in the unmanned marine vehicles market. Strict regulations related to maritime safety, navigation, and vehicle operation can slow down the deployment of UMVs. Additionally, the complex design and testing processes associated with developing reliable and functional autonomous marine vehicles lead to high upfront investment. By 2025, addressing these regulatory and cost-related challenges will be crucial for enabling wider adoption and expanding the market.

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

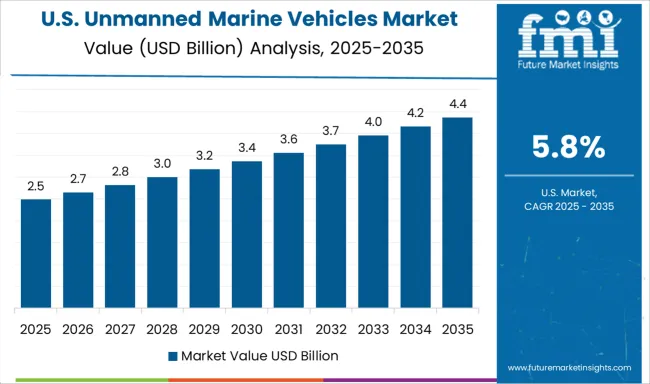

| USA | 5.8% |

| Brazil | 5.1% |

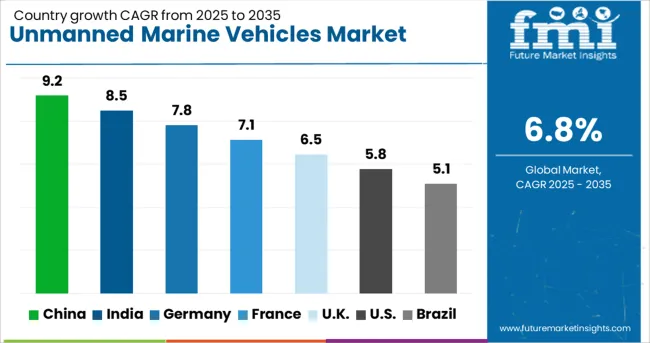

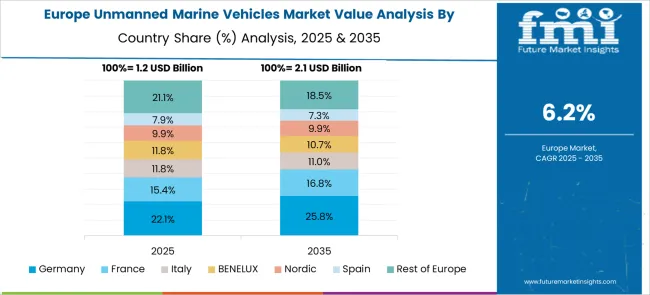

The global unmanned marine vehicles market is projected to grow at a 6.8% CAGR from 2025 to 2035. China leads with a growth rate of 9.2%, followed by India at 8.5%, and Germany at 7.8%. The United Kingdom records a growth rate of 6.5%, while the United States shows the slowest growth at 5.8%. These varying growth rates are driven by factors such as increasing investments in autonomous marine technology, the growing need for defense applications, and the expanding use of unmanned marine vehicles in research and logistics.

Emerging markets like China and India are witnessing higher growth due to rapid industrialization, advancements in maritime security, and increasing demand for autonomous technology, while more mature markets like the USA and the UK experience steady growth driven by technological advancements and established industries. This report includes insights on 40+ countries; the top markets are shown here for reference.

The unmanned marine vehicles market in China is growing at a robust pace, with a projected CAGR of 9.2%. China’s rapidly expanding maritime security needs and investments in autonomous technologies are driving the adoption of unmanned marine vehicles for defense, research, and logistics applications. The country’s increasing focus on improving naval capabilities, coupled with rising demand for unmanned vessels for scientific exploration and environmental monitoring, further supports market growth. Additionally, China’s commitment to advancing AI and robotics technologies in maritime systems continues to fuel the development and deployment of unmanned marine vehicles.

The unmanned marine vehicles market in India is projected to grow at a CAGR of 8.5%. India’s growing defense sector, coupled with the need for autonomous solutions in research, logistics, and marine security, is driving the demand for unmanned marine vehicles. The country’s emphasis on advancing maritime capabilities and enhancing border security, along with investments in smart ports and logistics solutions, is accelerating the adoption of unmanned vessels. Additionally, India’s focus on scientific research in its vast marine territories further drives the demand for unmanned marine vehicles for oceanographic studies and environmental monitoring.

The unmanned marine vehicles market in Germany is projected to grow at a CAGR of 7.8%. Germany’s strong maritime industry and its increasing investments in autonomous technologies are fueling the demand for unmanned marine vehicles, particularly in defense and research applications. The country’s commitment to developing green and sustainable maritime solutions, coupled with a rising focus on using unmanned vessels for environmental monitoring, is contributing to market growth. Additionally, Germany’s growing role in international maritime security and scientific collaboration further supports the adoption of unmanned marine vehicles.

The unmanned marine vehicles market in the United Kingdom is projected to grow at a CAGR of 6.5%. The UK ’s well-established defense and research sectors are key drivers of demand for unmanned marine vehicles. The country’s focus on enhancing maritime security, coupled with rising investments in AI and robotics technologies for autonomous systems, is contributing to market growth. Additionally, the UK government’s commitment to sustainable and green maritime practices, along with its growing focus on environmental research and oceanographic studies, further supports the demand for unmanned vessels.

The unmanned marine vehicles market in the United States is expected to grow at a CAGR of 5.8%. The USA remains a significant player in the global market, with steady demand for unmanned marine vehicles driven by military, defense, and scientific research needs. The growing use of autonomous vessels for oceanographic research, surveillance, and environmental monitoring is contributing to market growth. Additionally, the USA Navy’s increasing focus on developing autonomous technologies for maritime security and defense applications supports continued demand for unmanned marine vehicles, despite slower growth compared to emerging markets.

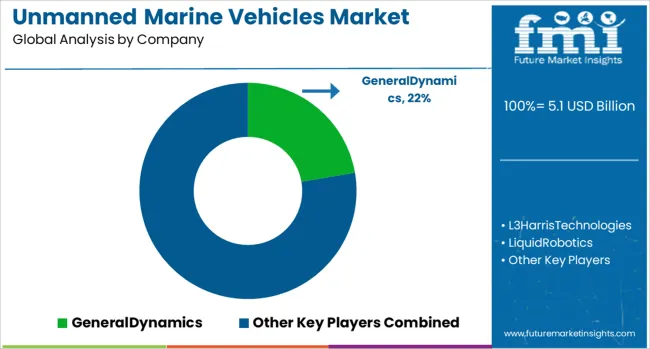

The unmanned marine vehicles market is dominated by General Dynamics, which leads with its innovative range of unmanned surface vehicles (USVs) and autonomous underwater vehicles (AUVs) used for defense, research, and commercial applications. General Dynamics’ dominance is supported by its advanced technology, extensive expertise in defense systems, and strong global presence. Key players such as L3 Harris Technologies, Northrop Grumman, and Teledyne Technologies Inc. maintain significant market shares by offering autonomous marine vehicles designed for surveillance, mapping, data collection, and military defense operations. These companies focus on enhancing vehicle autonomy, improving sensor integration, and ensuring operational reliability in challenging marine environments.

Emerging players like Liquid Robotics, Ocean Aero Inc., and Pelorus Naval Systems are expanding their market presence by offering specialized unmanned marine vehicles for niche applications such as environmental monitoring, offshore oil and gas exploration, and scientific research. Their strategies include focusing on cost-effective, sustainable solutions and improving vehicle endurance and energy efficiency. Market growth is driven by increasing demand for autonomous solutions in defense and marine research, the need for safer and more efficient maritime operations, and advancements in AI, robotics, and sensor technologies. Innovations in hybrid power systems, real-time data processing, and multi-vehicle coordination are expected to continue shaping competitive dynamics and drive further growth in the global unmanned marine vehicles market.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.1 Billion |

| Type | Surface vehicle and Underwater vehicle |

| Control | Remotely operated vehicles and Autonomous vehicles |

| Speed | 10−30 Knots, More than 30 Knots, and Up to 10 Knots |

| Endurance | 500−1,000 Hours, 100 Hours, 100−500 Hours, and >1,000 Hours |

| Solution | Propulsion system, Communication system, Payload, Chassis material, and Other solutions |

| End Use Application | Defense, Research, Commercial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GeneralDynamics, L3HarrisTechnologies, LiquidRobotics, NorthropGrumman, OceanAeroInc., PelorusNavalSystems, RafaelAdvancedDefenseSystems, SaabAB, SeaRoboticsInc., and TeledyneTechnologiesInc. |

| Additional Attributes | Dollar sales by vehicle type and application, demand dynamics across defense, offshore oil & gas, and environmental monitoring sectors, regional trends in unmanned marine vehicle adoption, innovation in autonomous navigation and energy-efficient technologies, impact of regulatory standards on safety and operations, and emerging use cases in search and rescue and marine research. |

The global unmanned marine vehicles market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the unmanned marine vehicles market is projected to reach USD 9.9 billion by 2035.

The unmanned marine vehicles market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in unmanned marine vehicles market are surface vehicle and underwater vehicle.

In terms of control, remotely operated vehicles segment to command 52.4% share in the unmanned marine vehicles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Unmanned Aerial Vehicles (UAV) Commercial Drone Market Size and Share Forecast Outlook 2025 to 2035

Marine Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Railway Vehicle Washing Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA