The Marine Electronics Tester Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Marine Electronics Tester Market Estimated Value in (2025 E) | USD 1.4 billion |

| Marine Electronics Tester Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The Marine Electronics Tester market is experiencing steady growth driven by increasing reliance on advanced navigational and communication systems across maritime operations. The market is being shaped by rising global trade, stricter maritime safety regulations, and the adoption of sophisticated electronics on both commercial and defense vessels. Testing solutions are being deployed to ensure operational reliability, compliance with safety standards, and performance optimization of onboard navigation and communication systems.

Growing complexity in marine electronic systems has necessitated specialized testing equipment capable of verifying GPS, RADAR, and radio systems under diverse environmental conditions. As shipping companies and maritime operators continue to prioritize system reliability and minimize downtime, investment in comprehensive testing solutions has increased.

Additionally, the expansion of smart shipping technologies and automated vessel monitoring systems has further driven the demand for robust and precise testing tools The future outlook is expected to be positive, with technological advancements and global fleet expansion continuing to stimulate market demand for marine electronics testers.

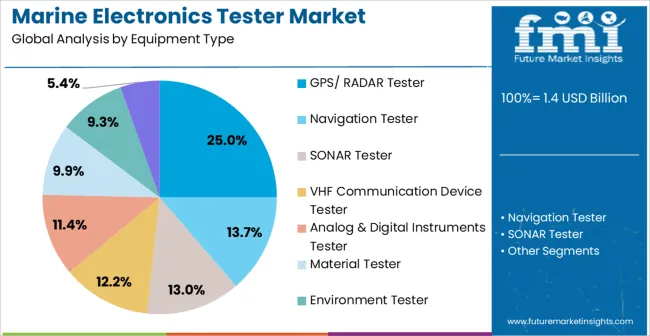

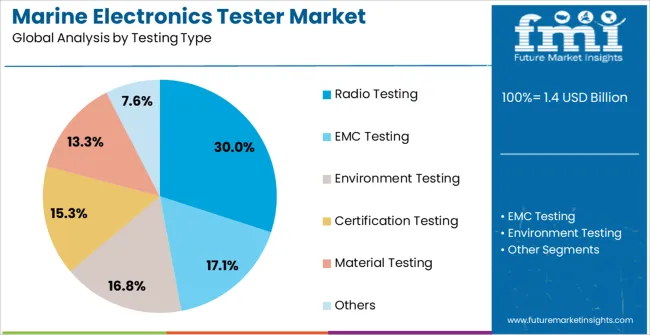

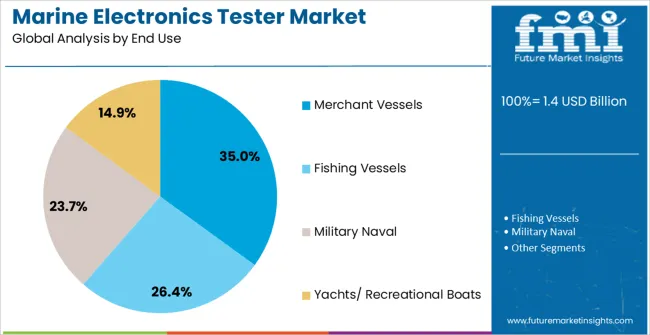

The marine electronics tester market is segmented by equipment type, testing type, end use, and geographic regions. By equipment type, marine electronics tester market is divided into GPS/ RADAR Tester, Navigation Tester, SONAR Tester, VHF Communication Device Tester, Analog & Digital Instruments Tester, Material Tester, Environment Tester, and Others. In terms of testing type, marine electronics tester market is classified into Radio Testing, EMC Testing, Environment Testing, Certification Testing, Material Testing, and Others. Based on end use, marine electronics tester market is segmented into Merchant Vessels, Fishing Vessels, Military Naval, and Yachts/ Recreational Boats. Regionally, the marine electronics tester industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The GPS/RADAR tester segment is projected to hold 25.00% of the Marine Electronics Tester market revenue in 2025, making it the leading equipment type. This dominance is being attributed to the critical role these systems play in maritime navigation, collision avoidance, and operational safety. Testing these systems is essential to ensure accurate positioning, effective radar signal processing, and adherence to international maritime standards.

The growth of this segment has been reinforced by increasing adoption of advanced radar and GPS systems across commercial and industrial fleets. Investment in software-defined navigation and automated collision alert systems has further amplified demand for GPS/RADAR testers.

As vessels become more reliant on precise navigational inputs, the segment has benefited from requirements for frequent calibration, maintenance, and performance validation Additionally, the reliability of these testing solutions reduces operational risks and enhances vessel safety, making them indispensable for maritime operators seeking to maintain compliance and optimize fleet performance.

The radio testing segment is expected to account for 30.00% of the Marine Electronics Tester market revenue in 2025, establishing it as the dominant testing type. This prominence has resulted from the necessity of ensuring uninterrupted and clear maritime communication across long distances and diverse sea conditions. Radio testing is crucial for compliance with safety and communication regulations, as well as for supporting emergency and distress signaling capabilities.

Increased deployment of digital communication networks and satellite-based marine radio systems has further accelerated the segment’s adoption. The ability of software-enhanced testers to simulate real-world signal conditions and detect anomalies has strengthened the segment’s position.

As vessels increasingly rely on integrated radio systems for navigation, fleet coordination, and operational monitoring, the demand for precise testing solutions continues to rise This segment is expected to maintain its leadership due to the growing complexity of onboard communication systems and the critical role of reliable radio connectivity in maritime safety and operational efficiency.

The merchant vessels end-use segment is projected to hold 35.00% of the Marine Electronics Tester market revenue in 2025, making it the largest contributor. This leadership has been driven by the growing global shipping industry and the increasing adoption of advanced marine electronics on cargo, tanker, and container vessels. Merchant vessels require continuous monitoring of navigation, communication, and radar systems to ensure operational safety and regulatory compliance.

The segment’s growth is being fueled by the need for regular testing to prevent navigational errors, communication failures, and operational disruptions, which can have significant financial and safety implications. Technological advancements in vessel automation, GPS-enabled navigation, and integrated radar systems have further supported the demand for dedicated testing solutions.

Additionally, rising safety standards and stricter maritime regulations have reinforced the requirement for reliable electronics testing across commercial fleets The segment’s dominance is expected to persist, as merchant operators continue to prioritize system reliability, risk reduction, and operational efficiency in increasingly complex maritime environments.

High usage of marine electronics in vessels is creating a huge demand for Marine Electronics Tester and are significantly driving the global Marine Electronics Tester market. Equipments and materials used in the vessel for construction and operation must be in compliance with standard regulations.

Marine Electronics Tester performs tests for propulsion engine components, welding consumables, lifting appliances, electrical & automation system, navigation & fire safety equipment, and others. The need for certified material and equipment for safety and security is driving the demand for Marine Electronics Tester.

The testing standards are approved by international maritime regulations. The operator must confirm that the material and equipment are as per the international safety standards and regulatory requirements. Many companies offer complete marine testing services as per the requirement and standards.

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| Brazil | 5.7% |

| USA | 5.1% |

| UK | 4.6% |

| Japan | 4.1% |

The Marine Electronics Tester Market is expected to register a CAGR of 5.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.3%, followed by India at 6.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Marine Electronics Tester Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.2%. The USA Marine Electronics Tester Market is estimated to be valued at USD 538.0 million in 2025 and is anticipated to reach a valuation of USD 538.0 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 78.7 million and USD 42.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Equipment Type | GPS/ RADAR Tester, Navigation Tester, SONAR Tester, VHF Communication Device Tester, Analog & Digital Instruments Tester, Material Tester, Environment Tester, and Others |

| Testing Type | Radio Testing, EMC Testing, Environment Testing, Certification Testing, Material Testing, and Others |

| End Use | Merchant Vessels, Fishing Vessels, Military Naval, and Yachts/ Recreational Boats |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

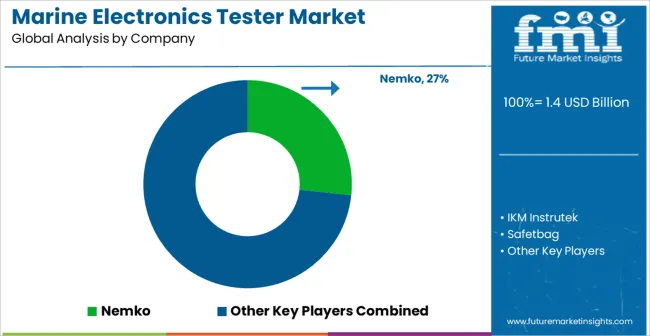

| Key Companies Profiled | Nemko, IKM Instrutek, Safetbag, Aeromarine, Elite Electronic Engineering, Parker Hannifin Manufacturing, FURUNO ELECTRIC, and CDI Electronics |

The global marine electronics tester market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the marine electronics tester market is projected to reach USD 2.4 billion by 2035.

The marine electronics tester market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in marine electronics tester market are gps/ radar tester, navigation tester, sonar tester, vhf communication device tester, analog & digital instruments tester, material tester, environment tester and others.

In terms of testing type, radio testing segment to command 30.0% share in the marine electronics tester market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA