Expanding at a positive CAGR, the global industrial cooking fire protection systems market is expected to witness steady growth from 2025 to 2035, thanks to evolving safety regulations, rising investments in food processing facilities and developing innovations in fire suppression technologies.

The scarcity of effective fire protection solutions ensuring worker safety, compliance, and minimal operational disruption has grown significantly as cooking equipment designed for the commercial restaurant industry and beyond gets bigger and more sophisticated.

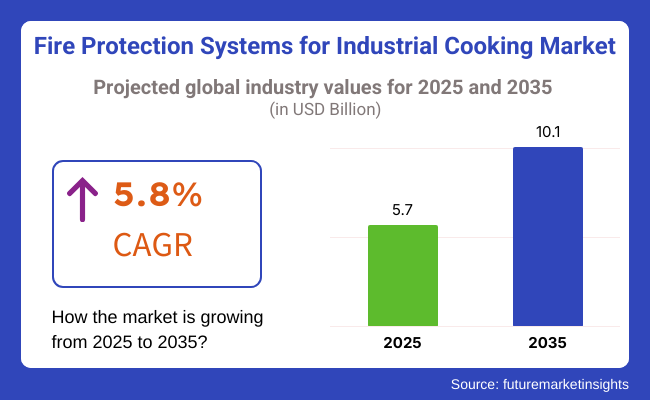

The market was valued at USD 5.7 Billion in 2025 and is expected to reach USD 10.1 Billion by 2035, witnessing a CAGR of 5.8%. “This growth is driven by increasing awareness of the risks of fire hazards in commercial kitchens and industrial food production lines, as well stricter enforcement of fire safety codes around the world. Advancements in detection systems, suppression agents, and integrated fire alarm technologies are spurring the adoption of comprehensive fire protection solutions.

Historically, traditional suppression types dominated this area, but the market is developing towards leading systems like water mist and clean agent suppression technologies, offering fast response, low residue and quick reoperation after a fire event. Moreover, the increasing adoption of connected fire protection systems with IoT-enabled sensors and real-time monitoring features provides timely responses and also helps provide operational efficiency.

The 5.8% CAGR highlights the increasing priority placed on fire safety in industrial cooking operations, especially as the global food processing industry continues to expand. The adoption of more sophisticated, compliant fire protection systems is expected to further drive the market.

The North America region holds the major share in terms of fire protection systems for industrial cooking owing to the lucrative food processing industry and regulation pertaining to safety. Increased adoption of advanced suppression technologies by the United States and Canada in large food production facilities and commercial kitchens Powerful regulatory bodies like NFPA (National Fire Protection Association) impose significant standards on manufacturers and operators to ensure top tier-levels fire protection measures are taken.

Furthermore, North America is also witnessing the growth of IoT-enabled smoke detection and fire suppression systems for real-time monitoring, predictive maintenance, and improved safety measures. With the continuous growth of the food processing and hospitality industries, requiring complete fire protection solution, the demand is expected to register steady growth.

Europe is a key fire protection systems market, propelled by a robust food manufacturing industry and stringent fire safety regulations in the EU. Some of the key nations in the innovative fire suppression systems market include Germany, France, and the UK, where technological advancements are quickly being integrated into the industrial kitchens and large-scale food production sectors.

In Europe the push towards energy-efficient and environmentally friendly suppression agents, as well as advanced detection technologies, drives the market growth. Moreover, the growing number of commercial kitchen and foodservice establishments in the region is driving the demand for dependable fire protection systems that keep operations safe, compliant, and running without failure.

The fastest growth in the fire protection systems for industrial cooking market is being witnessed in the Asia-Pacific region, thanks to rapid industrialization, urbanization, and growth of the food processing industry. Countries like China, India, Japan, and South Korea are gradually adopting fire suppression systems in the food production and commercial kitchen environments.

The region's market is developing on account of raising awareness about workplace safety, strict enforcement of fire safety regulations, and enormous investments in innovative food processing facilities. Furthermore, growing emphasis on operational efficiency and decreased downtime, along with the introduction of advanced fire detection and suppression technologies, along with increasing awareness of occupational safety are propelling the demand for fire protection solutions across the Asia-Pacific region.

Challenge

Stringent Safety Regulations and High Installation Costs

Challenges for the Fire Protection Systems for Industrial Cooking Market include stringent safety regulations, high installation costs, and complex integration requirements. Given all the grease and flammable materials in industrial kitchens - in restaurants, hotels and food processing facilities - there are strict fire safety standards they must follow: NFPA 96 and UL 300. However, compliance with such regulations often requires significant investment in fire suppression systems, ventilation systems, and check-out inspections.

Moreover, fire suppression systems are difficult to be integrated into existing kitchen plans without disturbing the kitchen operations. Many of these barriers can be overcome if manufacturers can produce cost-efficient, modular fire protection solutions that are easier to install, which automatically handle compliance reporting to reduce time stress on safety, compliance and maintenance auditing.

Opportunity

Growth in Smart Fire Detection and Automated Suppression Systems

The growing focus and enhancement of workplace safety and fire prevention create large prospects for the Fire Protection Systems for Industrial Cooking Market. AI-Powered Fire Safety for Commercial Kitchens Fire safety in commercial kitchens is being revolutionized by the adoption of AI-driven fire detection, real-time monitoring, and automated suppression technologies. Food service industries are increasingly turning to advanced fire suppression systems such as water mist, foam-based extinguishers, and gas-based fire suppression to provide a quick way to control fires without interrupting cooking operations.

Further, diagnostic suites with smart sensor and IoT enabled monitoring for remote diagnostics and predictive maintenance are being developed. Alternatively, firms that develop AI-powered fire detection systems, sustainable suppression agents, and cloud-based assets for safety management will logically dominate innovation in industrial fire safety.

From 2020 to 2024, the Fire Protection Systems for industrial cooking market experienced growth driven by a rise in the awareness of fire safety hazards and regulatory compliance standards. “Many commercial kitchens, food processing facilities have updated fire suppression systems to modern safety standards.” But market growth faced some challenges including high installation costs, supply chain disruptions, and concerns around system reliability.

This led to manufacturers developing more energy-efficient, self-contained fire suppression devices that used minimal water and chemicals while providing better fire containment ability. Likewise, enhanced wireless fire alarm systems and heat-resistant detection sensors have increased safety outcomes for high-risk environments.

The future of fire safety in the 2025 to 2035 era will be defined by transformational technologies in the areas of smart fire safety equipment, AI-based risk assessment tools, and eco-friendly fire suppression methods.

Additionally, adopting real-time fire risk analytics and remote-controlled suppression systems will contribute to enhancing safety and efficiency standards in industrial cooking environments. Over the next decade, the companies that will innovate within this market will be those that emphasize automation, predictive fire hazard detection, and the ability to keep up with evolving fire safety regulations.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with NFPA 96 and UL 300 fire safety standards |

| Technological Advancements | Growth in water mist and chemical suppression systems |

| Industry Adoption | Increased fire safety upgrades in restaurants and food processing |

| Supply Chain and Sourcing | Dependence on specialized fire suppression equipment |

| Market Competition | Presence of established fire safety system providers |

| Market Growth Drivers | Rising demand for kitchen fire prevention and safety compliance |

| Sustainability and Energy Efficiency | Early adoption of low-water and chemical fire suppression |

| Integration of Smart Monitoring | Limited remote fire suppression control |

| Advancements in Fire Suppression Technology | Use of traditional wet chemical and dry powder suppression |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of AI-driven compliance monitoring and stricter sustainability regulations. |

| Technological Advancements | Widespread adoption of AI-powered fire detection, automated suppression, and smart IoT monitoring. |

| Industry Adoption | Expansion into cloud-integrated fire safety systems and predictive hazard assessment. |

| Supply Chain and Sourcing | Shift towards localized production and eco-friendly suppression agents. |

| Market Competition | Rise of AI-driven fire safety start-ups and next-generation automated suppression firms. |

| Market Growth Drivers | Increased investment in real-time risk analytics, predictive maintenance, and cloud-based monitoring. |

| Sustainability and Energy Efficiency | Full-scale deployment of biodegradable, non-toxic fire suppression agents with minimal environmental impact. |

| Integration of Smart Monitoring | AI-powered fire risk detection, automated maintenance scheduling, and IoT-based real-time monitoring. |

| Advancements in Fire Suppression Technology | Development of advanced water mist, gas-based, and eco-friendly suppression methods. |

United States Fire Protection Systems for Industrial Cooking Market is growing because of the stringent fire safety regulations, increasing adoption for automated suppression systems, and rising investment in the foodservice industry. Demand for the market over the forecast period is primarily driven by the commercial kitchens market that is governed by NFPA 96 (National Fire Protection Association) standard that enforces the use of fire suppression systems.

The restaurant sector and food processing industry are significant consumers, utilizing wet chemical fire suppression, high-performance malodour control in the food processing industry and IoT-based fire detection and monitoring solutions to meet compliance and to reduce the risk of fire. In addition, increasing investments in the cloud kitchen and fast food chain sectors are spurring the demand for compact and efficient fire protection systems.

The USA region will continue to grow steadily with the continuing evolution of technology in terms of AI-enabled fire detection and awareness of safety among the people.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

Various factors including strict fire safety regulations, growing penetration in the hospitality industry, and innovation in fire detection technologies are supporting the growth trajectory of industrial cooking fire protection systems in United Kingdom.

Industry expansion in sectors like catering, restaurants, and food delivery services is projected to bolster demand for high performing flame suppression systems such as wet chemical extinguishers and mist-based fire suppression solutions. Also, growing investment in smart fire detection, real-time monitoring, etc. is improving fire safety measures.

The UK marketplace is well-positioned for sustained growth, with strong regulatory enforcement coupled with an increased focus on fire safety in professional kitchens.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.5% |

The European Union fire protection systems for industrial cooking market is expected to witness considerable growth owing to stringent fire safety regulations, increasing demand from food processing industries, and rising adoption of sustainable fire suppression technologies. Commercial kitchen fire safety compliance put countries like Germany, France, and Italy in the lead.

The demand for non-toxic and environmentally friendly fire suppression agents is growing, propelling the market forward, which is predominantly driven by the EU’s environmental sustainability initiatives. Smart fire monitoring system with real-time alerting and automated shut off mechanisms are also rapidly becoming a trend in recent times in the food processing plants and commercial kitchens.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.7% |

The Japanese fire protection systems for industrial cooking market is driven by stringent fire safety regulations, growing adoption of smart fire detection technologies, and the increase in commercial kitchens. In Japan, the Building Standards Act and the Fire Service Act require high-performance fire suppression systems at restaurants and food processing factories.

Fast-food chains, sushi bars, large-scale catering operations, and the foodservice industry are also contributing to the demand for advanced wet chemical fire suppression systems, high-efficiency exhaust hoods, and Internet of Things (IoT)-based fire monitoring systems. Japan’s focus on automation and smart kitchens is further increasing the demand for AI-powered fire detection and suppression systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

South Korea Fire Protection Systems for Industrial Cooking Market is growing at a constant pace with the growth of safety regulations, adoption in commercial kitchens, and technological advancements in fire suppression systems. The Korean Fire Safety Act requires all commercial kitchens and food processing units to implement fire suppression systems, which is contributing to market growth.

With the growing hospitality and fast-food sector, and rising investments towards smart restaurant infrastructure, the companies in automatic fire suppression, fire safety system integrated exhaust hoods, and IoT-based fire monitoring solutions are witnessing increasing demand. Moreover, growing government initiatives for enhancing fire safety in commercial kitchens further drive the market growth.

The South Korean market is forecast to exhibit steady growth due to strong regulatory enforcement and growing adoption of smart fire protection technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

Fire detection system & fire protection system segments dominate the fire protection systems for industrial cooking market as adoption of advanced fire safety systems in several industries are high due to the need for risk mitigation, stringent regulatory requirements compliance, and workplace safety enhancements.

Fire protection systems (high performance) are more resistant compared to conventional fire safety systems and play an essential role in preventing fire threats, preventing damage to property and maintaining business continuity across industrial kitchens, food processing units and large-scale commercial cooking organizations.

Today, fire detection systems are considered as one of the most valuable fire safety solutions providing real-time monitoring, immediate identification of fire hazards, and systems to alert in the moment of need. Contrary to traditional fire safety practices, modern fire detection systems utilize sophisticated sensor technology to detect both smoke, heat, and flames instantaneously, which stops the fire from escalating in industrial cooking environments.

The increasing need for food processing units to have flame detectors due to usage in high-temperature processes requiring fast fire detection has led to adoption of optical and infrared flame detection systems, as fire protection and workplace safety take centre stage in food production facilities. It is known based on the studies that flame detectors help cut response time to a fire hazard by more than 60%, thereby ensuring that hazards are identified and taken care of quickly.

The market demand for smoke detectors is reinforced by the increased implementation of smoke detection systems in industrial food production plants and commercial kitchens equipped with advanced ionization and photoelectric smoke sensors for improved classification accuracy, leading to the appropriate adoption of systems in large cooking areas with a higher level of fire risk due to corn oil and cooking oils.

Also, use of intelligent sensor based fire detection with real time analytics and automated hazard classification has further propelled adoption by facilitating predictive fire safety measures and reduced false alarms on high heat industrial cooking zones.

These include interconnected fire detection systems featuring smart alarm integrations with emergency response teams, enhancing the efficiency of the market while increasing responsiveness in cooking environments with a higher risk of fire.

Smoke, gas, and temperature variations in fire can be detected by multi-sensing fire detectors including infrared and RF devices, thereby contributing to the adoption of smarter fire detection sensors reducing the size of the fire by ensuring lower-volume operation for better adaptability in industrial kitchens and automated food processing lines has acted as a market trend bolstering market expansion.

Cloud-based fire detection systems offer several benefits over traditional systems, including enhanced safety compliance, quicker fire alerts, and fewer fire-related losses, but calm experience higher initial setup costs, false alarm risks in high-temperature environments, and more intense sensor maintenance calibrations. However, although growing research is dedicated to AI-based fire prediction, real-time sensor diagnostics, and heat-resistant detection technologies to enhance efficiency, reliability, and cost-effectiveness, the market will persist with growth for fire detection solutions in industrial cooking environments.

Fire suppressing systems have had wide market acceptance in the industrial cooking neighbourhoods, large scale food manufacturing units and also commercial kitchen, business owners are investing heavily in fire controlling systems to reduce loss of property due to fire and adhere to the regulations. Fire suppression systems do far more than a standard fire extinguisher in that they provide automatic fire control and immediate hazard containment, minimizing reliance on human intervention.

In food processing industries, the drive to adopt high-performance water-based suppression systems has been fuelled by the need for fire suppression systems in one of the most dangerous areas: the areas where raw food is cooked and automated sprinkler systems are used as part of the systems in places that contain explosive ingredients that are used in the food preparation process. According to research, water-fire suppression systems control the propagation of fire by more than 70 percent, allowing for effective containment in a matter of moments in all industrial culinary settings.

Furthermore, the commercial kitchen segment of gaseous/clean agent fire suppression systems has gained greater market adoption owing to the increased adoption of environmentally friendly, residue-free suppression agents for applications in food processing plants, where chemical residue may be detrimental to food safety and quality.

Integration of AI-driven fire suppression activation with real-time hazard assessment and automated suppression deployment further accelerated adoption, providing better efficiency in reducing fire damage and downtime in cooking operations.

Market growth has been enhanced as foam fire suppressions systems have evolved with high-efficiency extinguishing agents for oil and grease fires, providing better fire prevention and fire escalations in intense heat commercial cooking environment.

Powder fire suppression systems with dry chemical agents to snuff the fire out instantly have increased in adoption, which are better suited in industrial kitchens and automated food processing assembly lines, thereby, further supplementing market growth.

Automation benefits fire suppression systems by enabling faster mitigation of fire hazards, deploying systems instantly should a fire hazard be introduced into the environment, and meets fire protection laws. Nevertheless, new developments like AI-based suppression control, environmentally safe fire suppression agents, and intelligent hazard assessment systems are enhancing efficiency, flexibility, and longer-term economic viability, and thus continue to fuel growth for fire suppression solutions in the domain of industrial cooking.

Two Largest Market Drivers The food processing units and industrial kitchens segments are the two major market drivers, with industries deploying advanced fire protection systems (such as smoke and heat detectors) to prevent accidents, protect assets, and ensure plant operation.

Food processing units are rapidly evolving into one of the prime users of fire protection systems as food manufacturers adopt high-performance solutions such as fire detection and suppression systems to avoid costly fire damage, meet industry regulations and ensure product safety.

Food processing facilities differ from small-scale commercial kitchens in that they involve high-volume production lines, cooking oils that are flammable by nature, and operations that are run at high temperatures - all of which can increase the likelihood of a fire incident.

Enhanced with early smoke and gas detection to prevent ignition of processing equipment, fire detection systems are also witnessing increasing adoption in food manufacturing plants and combustible dairy products, which has positively impacted the dairy product manufacturing fire detection system market.

The implementation of AI-based fire hazard detection with real-time fire risk analytics for high-heat production areas has further stimulated adoption and contributed to improve proactive fire safety planning.

These factors, including the development of multi-agent fire suppression systems with hybrid water and gas-based extinguishing systems for various food processing settings, have facilitated the growth of the industry; allowing an even greater adaptability to food production setups.

Fire protection in food processing units has advantages over fire risk reduction, improved compliance, and overall operational safety; however, it does face some challenges like the regulatory complexities and high equipment costs involved as well as the risk of potential food contamination by suppression agents. But new advancements in areas like AI-powered fire tracking, smart fire-fighting agents, and modular suppression system designs are increasing efficiency, cost-effectiveness, and sustainability,

The market has a strong adoption in industrial kitchens such as large-scale catering services, hotel kitchens, and quick-service restaurant chains, as the fire suppression and detection system is increasingly widely implemented by the business to protect personnel, equipment, and property. Whereas ovens, fryers, and grills of industrial cooking environments can hold much higher capacities than conventional household kitchens, so fire safety needs to be highest priority.

The growing adoption of dry chemical and CO₂ extinguishers for grease fire hazards has driven demand for fire extinguishers across commercial and institutional kitchens, as operators increasingly prioritize the safety of their employees and customers by implementing high-performance fire safety systems.

Growing demand for automated fire detection and alarm systems in restaurant chains with AI-enabled hazard detection, as well as direct emergency response notifications has enhanced market demand, catering to the high-traffic food service industry.

Conversely, while not only offering significant advantages for fire risk mitigation, compliance with regulation and overall operational safety, fire protection in Industrial kitchens present issues such as space restrictions for larger suppression systems, expensive compliance, and frequent inspections/repairs.

But advances in so-called compact fire-suppression designs, AI-based kitchen fire analytics, and smart automated extinguishing systems have improved effectiveness, affordability and adaptability, paving the way for sustained adoption of fire safety solutions in industrial kitchens.

The fire protection systems for industrial cooking market is growing due to the demand for fire safety compliance, automation systems for suppression and smart fire detection for commercial kitchens, food processing plants and industrial cooking applications. To enhance safety, compliance with regulations, and operational efficiency, companies focus on AI-powered fire detection, automated suppression systems, and eco-friendly fire retardants.

International fire safety equipment manufacturers and niche industrial fire suppression companies help this market thrive by driving technological innovation for wet chemical systems, foam-based suppression products, and fire-resistant ventilation solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Johnson Controls (Tyco Fire Protection) | 15-20% |

| Honeywell International Inc. | 12-16% |

| Siemens AG | 10-14% |

| Halma plc (Advanced Fire Suppression Systems) | 8-12% |

| Amerex Corporation | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Johnson Controls (Tyco Fire Protection) | Develops AI-driven fire suppression systems, kitchen hood fire suppression, and real-time fire detection technologies. |

| Honeywell International Inc. | Specializes in smart fire alarm systems, flame detection sensors, and industrial kitchen fire suppression solutions. |

| Siemens AG | Manufactures automated fire control systems, gas-based fire suppression, and thermal imaging fire detection. |

| Halma plc | Provides advanced fire suppression solutions with high-efficiency wet chemical and CO₂-based extinguishing systems. |

| Amerex Corporation | Offers commercial kitchen fire suppression systems, portable fire extinguishers, and UL-certified fire suppression technologies. |

Key Company Insights

Johnson Controls (Tyco Fire Protection) (15-20%)

Johnson Controls is at the forefront of the fire protection systems market with connected and AI-enabled fire suppression and advanced industrial fire safety technologies.

Honeywell International Inc. (12-16%)

Honeywell designs, develops and manufactures smart fire detection, automated alarm and suppression systems and integrated solutions for industrial cooking facilities.

Siemens AG (10-14%)

Siemens supplies fire suppression systems with low failure rates (FF), using AI-supported flame detection and real-time fire monitoring.

Halma plc (8-12%)

Create fast-acting, wet chemical and gas-based fire suppression technologies to provide rapid protection to your environment while meeting the required regulatory compliance.

Amerex Corporation (5-9%)

Amerex, the industry's leading manufacturer of commercial-grade fire suppression systems, incorporates both eco-friendly suppression agents and smart monitoring solutions.

Other Key Players (40-50% Combined)

Next generation fire suppression innovation, AI-driven fire safety systems, and sustainable suppression solutions these are all contributed to by several fire safety and industrial cooking protection companies. These include:

The overall market size for Fire Protection Systems for Industrial Cooking Market was USD 5.7 Billion in 2025.

The Fire Protection Systems for Industrial Cooking Market expected to reach USD 10.1 Billion in 2035.

The demand for fire protection systems in industrial cooking will be driven by factors such as stringent safety regulations, increasing fire hazards in commercial kitchens, growing awareness of worker safety, and the rising number of food service establishments. Technological advancements in fire suppression systems will further boost market growth.

The top 5 countries which drives the development of Fire Protection Systems for Industrial Cooking Market are USA, UK, Europe Union, Japan and South Korea.

Fire Detection and Fire Suppression Systems Drive Market Growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Fire Collar Market Size and Share Forecast Outlook 2025 to 2035

Fire Protective Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire And Explosion Proof Lights Market Size and Share Forecast Outlook 2025 to 2035

Fire Retardant Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA