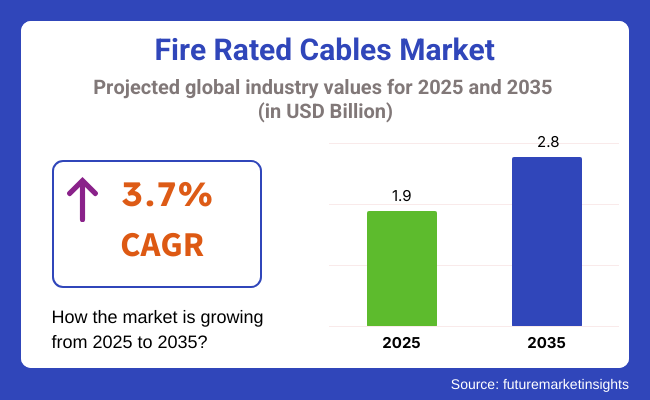

The fire rated cables market is expected to increase steadily, reaching an estimated value of USD 1.9 billion in 2025 and is anticipated to reach around USD 2.8 billion by 2035, growing at a CAGR of 3.7%. The increase is fueled by the stringent regulations on fire safety and rising infrastructure spending across the globe.

One of the primary industry drivers is growing enforcement of building codes for safety in commercial, residential, and industrial uses. Fire rated cables play an important role in passing safety standards such as BS 7629, IEC 60331, and NFPA 70. As regulation bodies close requirements, there is a growing demand for certified fire-resilient cabling of high performance.

Urbanization and the smart city boom, skyscraper construction, data centers, and public infrastructures are driving fire-rated system installations. In areas such as hospitals, airports, and subway systems, the continuous functioning of such critical circuits is a matter of life and death, reflecting further on the need for fire rated cabling solutions.

The industry is subject to some challenges, especially cost-sensitive industries. Fire rated cables cost more than standard power and communications cables, which can restrain demand in low-cost projects or in the informal construction industry. Awareness and enforcement differ markedly by regions.

Policy incentives and public-private partnerships are driving adoption, particularly in Europe and the Middle East, where fire safety is built into new building codes. Asia-Pacific is projected to be the most rapidly growing industry with increasing urban development and a transition to high-rise, code-based infrastructure.

Tunnel, oil and gas, renewable energy, transport industries demand also increases, as these applications require greater cable survivability, especially in fire or high-temperature environments. The fire rated cable provides the enhanced security required by such mission-critical applications.

The industry for fire rated cables is a critical part of the new worldwide focus on strong, secure, and code-compliant infrastructure. With regulatory momentum gaining steam and smart buildings the new norm, fire rated cabling will remain an essential part of future-proofed safety systems.

The fire rated cables industry is witnessing major expansion, influenced by the growing need for safety and compliance in different industries. This expansion is due to factors including the growing demand for fire-resistant materials in construction and building, energy, automotive, and manufacturing sectors.

The industry is dominated by diverse types of insulation material suited to specific applications like XLPE, PVC, EPR, and LSZH. Advancements in technology have enabled the production of cables with increased fire retardancy, toughness, and environmental advantages. The Asia-Pacific region is anticipated to experience significant growth due to urbanization and industrialization.

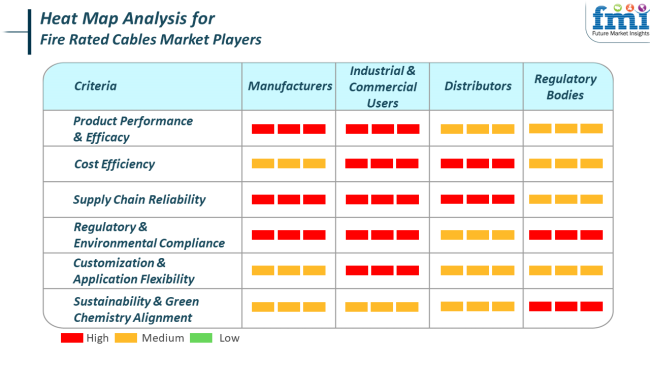

Distributors emphasize the necessity of an assured supply chain to serve industrial and commercial customers' needs. They excel at supplying a diverse range of products for different applications with timely and competitive delivery. The industry of fire rated cables is characterized by a collaborative effort of stakeholders to develop and utilize the products to guarantee performance, respect environmental policy, and adapt to evolving industry requirements.

Between 2020 and 2024, the industry was influenced by growing fire awareness in critical facilities. The timeframe witnessed a steady increase in the use of fire-rated cables across applications, including transport systems, healthcare facilities, power stations, and data centers. Demand was dominated by updates to fire safety standards and codes in key industries.

A number of global events added to the demand for products guaranteeing circuit integrity in case of fire. Consequently, there was increased application of low-smoke, zero-halogen (LSZH) cable types, although cost concerns in developing industries restricted widespread applications. Technological advancement was modest, with the main emphasis on conformity and reliability.

Heading towards 2025 to 2035, the industry will turn towards more intelligent, greener, and more converged solutions. Next-generation fire rated cables will provide better thermal reliability, environmental friendliness, and integration with digital infrastructure. Smart cities and green construction will turn into mainstream and call for more environmentally friendly and smart fire safety solutions.

Besides, stricter regulatory enforcement, paired with improving material science, will drive the creation of cables that not only can handle high temperatures but will also enable real-time monitoring and diagnostic capabilities. Development will be strongest in Asia-Pacific and the Middle East, where urbanization and infrastructure spending are gaining pace.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased fire safety consciousness and revisions in building codes in industrial and commercial applications. | Smart city construction, sustainability goals, and digital infrastructure integration. |

| Compliance cable designs based on LSZH materials. | Smart cable introduction featuring diagnostics and improved fire-resistance quality. |

| High-rise buildings, hospitals, metro stations, and data centers. | Smart buildings, IoT infrastructure, energy-efficient complexes, and industrial automation. |

| Moderate level of fire standards enforcement; uptake largely among developed economies. | Stricter global enforcement, especially in quickly developing regions; global code harmonization. |

| Usage of PVC, uncomplicated LSZH materials with limited innovation. | Growth of recyclable, green, halogen-free alloys with enhanced thermal and electrical properties. |

| Driven by North America and Europe with sluggish growth in Asia-Pacific. | Strong growth in Asia-Pacific, Middle East, and Latin America driven by infrastructure expansion. |

The industry which is responsible for maintaining the integrity of electrical circuits in case of fire incidents, is confronted with a mix of operational, economic, and regulatory risks in 2024. One of the most significant issues is the elevated manufacturing cost of fire-resistant materials like low-smoke zero-halogen (LSZH) compounds and advanced insulation.

These products increase the cost of production by a large margin when compared to ordinary cables, thus not being so desirable in cost-oriented construction work, particularly in developing economies. Secondly, the industry is under stress as a result of extensive distribution of low-quality or fake fire-rated cables, especially in price-sensitive areas.

In the future, the faster pace of technological innovation brings added risk. With increasingly advanced, increasingly effective flame-restricting products and standards available, earlier ones can quickly become disfavored. This puts pressure on firms to invest heavily in continuous R&D and testing to stay competitive and compliant with evolving rules.

In addition, increasing demand for smart buildings and integrated safety systems is driving the industry towards intelligent cabling solutions. Although this trend opens up new opportunities, it also brings cybersecurity threats and interoperability issues, especially when integrating with legacy infrastructure.

Supply chain disruptions across the world are another threat expected to occur, with geopolitical conflicts, logistics backlog, and shortage of materials that can slow manufacturing and increase cost.At a macro level, the fire rated cable industry is forced to navigate a perilous labyrinth of heavy regulatory demands, costly materials, fake competition, high-cycle technology, and risk exposure in the supply chain.

Its sustainability on a long-term basis will hinge on timely mitigation of risks, quality assurance, and technological responsiveness.

The industry is segmented by Construction Type, with two major categories: Single-core and Multicore fire-rated cables. By 2025, Multicore cables are expected to remain in the top position with a 65% share, leaving single-core cables with 35%.

Multicore fire-rated cables win the favor of many due to their flexibility in serving multiple electrical circuits through a single cable. They are thus deemed suitable for complex applications, including fire alarm systems, emergency lighting, and communication networks in commercial buildings, industrial setups, and large residential venues.

Due to the multiservice cable wiring system concept, less effort is spent on running and connecting the cables, which also reduces costs in short. Manufacturers like Prysmian Group and Nexans produce multicore fire-rated wires that meet the highest standards of safety to be used in applications like transportation and oil & gas that pose the highest risk concerning fire safety.

Conversely, Single-core fire-rated cables are generally used in simpler or more specific applications where only one electrical circuit is needed. They can be easily installed in a building that has many tight spots and is commonly used in smaller buildings or infrastructure projects.

Single-core cables are typically used to facilitate greater flexibility and ease of maneuvering in smaller residential buildings with electrical installations or power distribution networks. US-based companies such as General Cable and Southwire manufacture high-quality single-core fire-rated cables under different applications.

However, monocoque fire-rated cables remain significantly used in more special and simplified applications throughout the industry, even as multicore-rated cables tend to dominate generally because of versatile and cost-effective usage, especially in complex systems providing comprehensive safety and reliability throughout fire safety systems within various sectors.

The analysis of the industry extends towards another axis of categorization, which is considered the Cable Type, which mainly finds Unarmored and Armored cables. In 2025, Armed cables are forecasted to be the industry holder at 45%, while Unarmed cables account for 40% of the total in this regard.

Armored cables are built with an extra layer of protection, that is, the metal sheathing, to offer protection against mechanical forces. They are applied to sites with a high risk of physical impact or abrasion. Such applications include industrial, commercial, and risky scenarios where fire safety and durability are of utmost importance.

For instance, Armed fire-rated cables are extensively used in oil and gas refineries, chemical plants, and power stations. Manufacturers such as Prysmian Group and Nexans provide armored wires that comply with slightly varying international fire safety standards and protect them from fire and mechanical damage. The robustness of armored cables makes it possible for their installations in areas of open exposure, underground conduits, and crowded locations.

On the other hand, unarmored cables are lighter and, hence, more flexible, making them easier and quicker to install in less demanding environments. Such wires are generally used for residential buildings, commercial buildings, and light industrial jobs where there are lower risks for physical damage.

Unarmored fire-rated cables are preferred for installation in areas such as control panels, junction boxes, and office buildings wherever flexibility and easy handling are essential. Southwire and General Cable manufacture superior unarmored cables that are fire-resistant and are employed under very low mechanical exposure.

To summarize, armed cables find themselves in favored applications in demanding environments requiring protection. In contrast, Unarmed cables serve applications that are lighter and more flexible and, thus, need only a modicum of fire resistance for standard building infrastructure. Therefore, both types stand to fuse the growth of the cable industry, therefore solving different applications across several industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.7% |

| UK | 5.8% |

| France | 5.6% |

| Germany | 6.3% |

| Italy | 5.3% |

| South Korea | 5.1% |

| Japan | 4.9% |

| China | 7.6% |

| Australia-NZ | 5.5% |

The USA industry is expected to grow at a 6.7% CAGR during the study period. One of the primary drivers of industry growth is the increased enforcement of fire safety codes in the construction of commercial, industrial, and residential buildings. Fire-rated cable demand is highest in high-rise buildings, hospitals, and transportation infrastructure, where mission-critical systems require uninterrupted operation in the event of a fire.

The National Electric Code mandates the use of low-smoke, zero-halogen fire-resistant cables for sensitive applications. Furthermore, the modernization of power distribution networks and the integration of building automation systems are driving the increased use of advanced fire-rated cable technologies with enhanced thermal stability and circuit integrity.

The UK industry is expected to grow at 5.8% CAGR during the study period. The focus on retrofitting building fire protection systems after regulatory updates is creating a strong demand for certified fire-rated cables in new build and retrofit contracts. Adoption is strong across public transport infrastructure, including railway stations, tunnels, and hospitals, where smoke suppression and fire performance are essential requirements.

BS and EN compliance is influencing buying behavior. The country's emphasis on sustainability is also influencing the selection of halogen-free and recyclable cable materials. Investment in smart building and energy-efficient systems is also driving the adoption of intelligent, fire-rated cabling infrastructure.

The French industry is expected to register a 5.6% compound annual growth rate (CAGR) during the forecast period. Growth is driven by the extensive application of high-safety electrical systems in public infrastructure, industrial buildings, and data center development. The use of EU fire protection directives and national laws demanding flame-retardant and low-toxicity cable systems is driving demand.

Growing commercial applications of advanced security and building management systems are demanding uninterruptible power and signal delivery through fire-rated cables. Cable makers are focusing more on product development, offering products with better quality insulation material and higher resistance towards endurance under conditions of fire exposure, thus responding to compliance and performance needs.

Germany's industry can be expected to grow at a rate of 6.3% CAGR during the period of study. With its advanced engineering and high fire safety standards, Germany is experiencing high usage of fire-rated cables in energy, industrial automation, and intelligent infrastructure industries. Building developers are prioritizing fire safety as a key design element, and this has led to higher usage of low-smoke, flame-retardant cable systems.

Data centers, high-speed rail development, and manufacturing facilities require cables that offer circuit integrity during emergency conditions. The development of insulation compounds and cable design is enabling increased fire endurance and mechanical strength for extended periods, a feature desired in the country's highly regulated building sector.

Growth in the Italian industry is forecast to be at 5.3% CAGR during the study period. The rising demand for fire-resistant construction materials and the rehabilitation of existing electric infrastructure are driving the growth of the industry for fire-rated cables. Italy's efforts to achieve European Union safety regulations and increase urban fire resistance are encouraging the use of flame-retardant and smoke-suppressant cables in public and private building construction.

In seismically active and wildfire-prone regions, there is a growing demand for reliable, high-durability fire-rated cables. Smart city investment and renewable energy installations are also fueling the growing demand for cables that offer electrical performance as well as fire protection.

The South Korean industry will expand at a 5.1% CAGR during the study period. Residential and commercial high-rise building construction, coupled with rapid urbanization, is generating the demand for integrated fire protection systems supported by high-performance cables. Fire-rated cables are being used in large-scale infrastructure projects like subway lines, airports, and government buildings.

Insurance mandates and regulatory mandates are forcing builders to install certified fire-rated electrical components. Manufacturers are prioritizing cable designs that are tight and energy-efficient with good thermal insulation properties. Growing emphasis on minimizing fire losses in technologically dense environments like data centers is also fueling demand.

The industry for Japan will expand at 4.9% CAGR during the study period. Protection against fire in infrastructure works continues to be a priority, particularly in high-population urban areas and industrial parks. The aging infrastructure of Japan is being retrofitted, and thus, the old wiring is being replaced by fire-resistant cables, meeting new safety and seismic standards.

Low emission, small size, and heat resistance are the key features in demand. Increasing application of building automation, emergency lighting, and security systems is also fueling demand for fire-rated cables that maintain signal integrity in dangerous conditions. Safety certification and reliability remain the primary factors in cable selection.

China's industrial demand is projected to grow at a rate of 7.6% annually over the research period. As vast construction projects are occurring all over China's infrastructure, along with strict regulations for enforcing fire protection, the implementation of fire-rated cables in residential, commercial, and industrial constructions is growing at an exponential rate in China.

Urbanization and smart city projects have led to the construction of complex systems that require enhanced safety from fire in power and control cables. Metro systems, tunnels, and high-rise structures are the major consumers of flame-retardant, low-smoke cable solutions. Domestic manufacturers are stepping up production of superior cable systems through new fire-resistant sheathing and insulation materials to meet rising local and export industry demand.

The Australia-New Zealand industry is forecast to grow at a 5.5% CAGR during the study period. The regulatory framework in both countries emphasize safety and building resilience, particularly where natural hazards are prevalent, such as bushfires and earthquakes. Fire-rated cables are also being fitted in hospitals, schools, and industrial parks in order to support the uninterrupted operation of crucial systems in the event of a crisis.

Spending on public infrastructure modernization and expansion of urban networks is driving demand. Demand for low-halogen, flexible cables with good heat resistance is shaping product development among manufacturers. Compliance with international standards and an increase in insurance-driven safety audits are strengthening the industry's foundation.

The industryis characterized by strong competition among global and local players since the leaders of the industry focus on safety compliance, innovation of fire-resistant materials, and forming strategic partnerships. They distinguish themselves based on the offerings of cables that have enhanced heat resistance, halogen-free materials, and improved insulation properties.

Certification standards like UL, BS, and IEC form a competitive advantage in that only companies that comply stringently have a foothold in high-regulation markets.

Key manufacturers, including the Prysmian Group, Nexans S.A. as well as Elsewedy Electric, focus on R&D investments to develop enhanced fire-rated cables, ensuring better endurance in high-temperature environments. They are also integrating vertically to simplify supply chains and reduce production costs. Their partnerships with construction firms and infrastructure projects increase their industry visibility.

Regional players and niche manufacturers such as TPC Wire & Cable Corp. and Relemac Technologies focus on customization, providing cables made for industrial, commercial, and residential applications. A few companies manufacture fire-rated specialty cables for critical environments, such as hospitals, data centers, and metro rail systems. A competitive pricing strategy and a distribution partnership with electronics wholesalers help these companies grab market shares.

Mergers, acquisitions and collaborations are shaping the competitive landscape since companies acquire specialized manufacturers with an eye toward expanding their fire-rated product portfolio. More and more, the demand for green and low-smoke zero-halogen (LSZH) cables is affecting their offering. Using digital monitoring systems with fire-rated cables is increasingly being viewed as a competitive differentiator.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Prysmian Group | 18-22% |

| Nexans S.A | 15-18% |

| Elsewedy Electric | 12-15% |

| TPC Wire & Cable Corp. | 8-12% |

| RR Kabel | 6-10% |

| Other Companies (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Prysmian Group | Offers advanced fire-rated cables for critical applications with LSZH technology. |

| Nexans S.A | Focuses on heat-resistant and halogen-free cables for infrastructure projects. |

| Elsewedy Electric | Provides high-performance fire-rated solutions for commercial and industrial sectors. |

| TPC Wire & Cable Corp. | Specializes in heavy-duty fire-resistant cables for industrial applications. |

| RR Kabel | Develop cost-effective fire-rated cables with strong regional distribution. |

Key Company Insights

Prysmian Group (18-22%)

Prysmian leads the industry with cutting-edge LSZH fire-rated cables, securing contracts for metro rail, aviation, and high-rise construction projects.

Nexans S.A. (15-18%)

Nexans focuses on innovative insulation technologies, integrating AI-driven cable testing for enhanced fire safety assurance.

Elsewedy Electric (12-15%)

Elsewedy Electric expands its footprint in energy infrastructure, providing tailored fire-rated solutions to utilities and power grid networks.

TPC Wire & Cable Corp. (8-12%)

TPC Wire & Cable Corp. excels in industrial fire-resistant cabling, ensuring durability in high-temperature environments.

RR Kabel (6-10%)

RR Kabel strengthens its presence in emerging industries with cost-efficient, safety-certified fire-rated cables.

Other Key Players (25-35% Combined)

The industry is segmented into single core and multicore.

Industry is segmented into unarmored, armored, braided, and other.

The industry is segmented into residential applications, commercial applications, and industrial applications.

The industry is estimated to reach USD 1.9 billion by 2025.

The industry is projected to grow to USD 2.8 billion by 2035.

China is expected to expand at a rate of 7.6%.

Multicore cables are leading the industry due to their high efficiency in transmitting signals and power in critical fire-prone environments.

Major players include Prysmian Group, Nexans S.A, Elsewedy Electric, TPC Wire & Cable Corp., RR Kabel, Relemac Technologies Pvt. Ltd., RSCC Wire and Cable, FirstFlex, Cleveland Cable Company, and Universal Cable (M) Berhad.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Fire Collar Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA