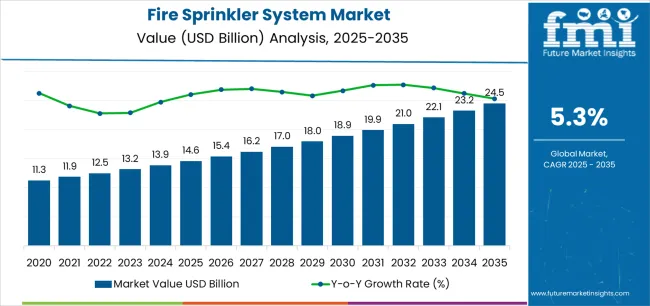

The fire sprinkler system market, valued at USD 14.6 billion in 2025, is projected to reach USD 24.4 billion by 2035, growing at a CAGR of 5.3%. The early growth phase of the market is expected to be steady but measured, driven primarily by increasing awareness of fire safety regulations and rising adoption in commercial and residential construction. Initial growth is influenced by regulatory compliance, especially in regions where building codes mandate fire suppression systems, and by retrofit projects in existing buildings seeking improved safety standards.

In the late growth phase, market expansion is anticipated to accelerate due to broader adoption across industrial facilities, educational institutions, and large-scale infrastructure projects. Technological advancements, including smart sprinkler systems, improved detection mechanisms, and integration with building management systems, will enhance system efficiency and reliability, encouraging wider deployment. Manufacturers focusing on product innovation and strategic regional expansion are likely to capture a greater share of the growing market.

Comparing early and late growth phases, the early curve reflects incremental adoption and cautious investment, while the late curve demonstrates faster accumulation of market value as infrastructure development intensifies and technological benefits become more widely recognized.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New system installations (commercial, industrial, residential) | 48% | Code-driven, new construction requirements |

| Retrofit & upgrade projects | 24% | Existing buildings, regulatory compliance | |

| Maintenance & inspection services | 14% | Periodic testing, code compliance verification | |

| Component replacement & repair | 10% | Sprinkler heads, valves, piping upgrades | |

| Design & engineering services | 4% | System specification, hydraulic calculations | |

| Future (3-5 yrs) | Connected & smart sprinkler systems | 28-32% | IoT integration, predictive maintenance |

| New construction installations | 24-28% | High-rise, warehouse automation, data centers | |

| Retrofit & code compliance | 18-22% | High-rise safety, social housing upgrades | |

| Service & lifecycle management | 12-16% | Subscription models, remote monitoring | |

| Specialized systems (ESFR, water-mist, clean agent) | 10-14% | High-value, high-performance applications | |

| Component & parts revenue | 6-8% | Replacement heads, valves, accessories |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 14.6 billion |

| Market Forecast (2035) | USD 24.4 billion |

| Growth Rate | 5.3% CAGR |

| Leading System Technology | Wet Pipe |

| Primary Application | Commercial Segment |

The market demonstrates strong fundamentals with wet pipe sprinkler systems capturing dominant share through proven reliability capabilities and commercial building optimization. Commercial applications drive primary demand, supported by increasing code enforcement requirements and high-rise construction development. Geographic expansion remains concentrated in developed markets with established fire safety infrastructure, while emerging economies show accelerating adoption rates driven by urbanization initiatives and rising life safety standards.

Design for compliance, not just water delivery

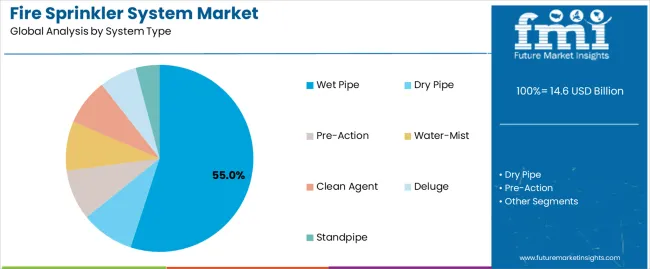

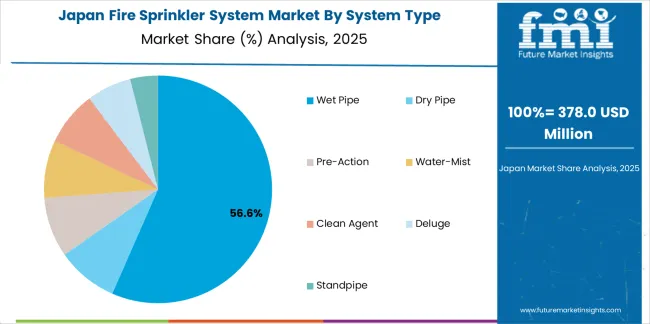

Primary Classification: The market segments by system type into wet pipe, dry pipe, pre-action, water-mist, clean agent, deluge, and standpipe systems, representing the evolution from basic water-based suppression to sophisticated fire protection solutions for comprehensive life safety optimization.

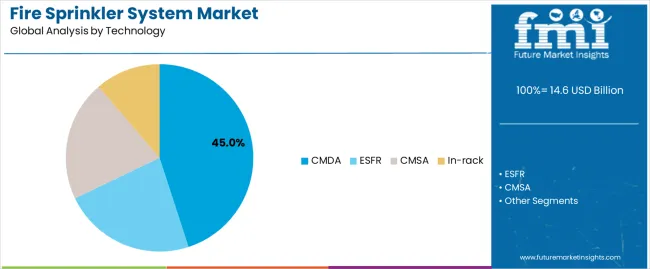

Secondary Classification: Technology segmentation divides the market into CMDA (Control Mode Density Area), ESFR (Early Suppression Fast Response), CMSA (Control Mode Specific Application), and in-rack sprinkler configurations, reflecting distinct requirements for fire control methodology, storage protection, and suppression effectiveness standards.

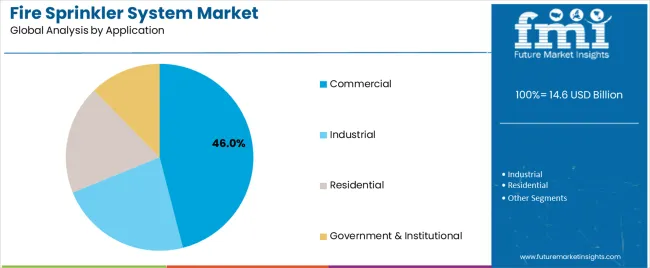

Tertiary Classification: Application segmentation covers commercial, industrial, residential, and government & institutional sectors, while response time spans quick response and standard response categories, and hazard class encompasses ordinary hazard, light hazard, and extra hazard classifications.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading installations while emerging economies show accelerating growth patterns driven by building code adoption programs.

The segmentation structure reveals technology progression from traditional water-based systems toward sophisticated suppression technologies with enhanced control and monitoring capabilities, while application diversity spans from commercial offices to industrial warehouses requiring comprehensive fire protection solutions.

Market Position: Wet pipe systems command the leading position in the fire sprinkler system market with 55.0% market share through proven reliability features, including simple operation, rapid response, and commercial building optimization that enable property owners to achieve effective fire protection across diverse office, retail, and hospitality environments.

Value Drivers: The segment benefits from building owner preference for straightforward suppression systems that provide immediate water discharge, lower installation costs, and operational simplicity without requiring complex controls or freeze protection. Advanced design features enable code compliance assurance, standard component availability, and integration with building fire alarm systems, where reliability and cost-effectiveness represent critical investment requirements.

Competitive Advantages: Wet pipe sprinkler systems differentiate through proven field reliability, lowest total cost of ownership, and compatibility with comprehensive fire protection strategies that enhance building safety while maintaining optimal economic value suitable for diverse commercial and residential applications.

Key market characteristics:

Dry pipe systems maintain a 16.0% market position in the fire sprinkler system market due to their freeze protection capabilities in unheated spaces. These systems appeal to facilities requiring fire protection in cold storage, parking structures, and outdoor loading areas. Market strength is driven by warehouse expansion and cold climate applications, emphasizing reliable freeze-proof solutions through pressurized pipe configurations.

Pre-action systems capture 9.0% market share through specialized requirements in data centers, museums, and archives requiring dual-interlock protection against accidental water discharge. Water-mist systems hold 6.0%, clean agent systems account for 5.0%, deluge systems represent 5.0%, while standpipe systems maintain 4.0% through specialized fire protection applications.

Market Context: Control Mode Density Area (CMDA) technology demonstrates the dominant market position in the fire sprinkler system market with 45.0% market share due to widespread adoption of conventional sprinkler protection and increasing focus on general fire control, building occupancy protection, and traditional hazard coverage that maximizes life safety while maintaining code compliance standards.

Appeal Factors: CMDA users prioritize proven protection methodology, broad applicability, and compatibility with standard building designs that enable effective fire control across multiple occupancy types. The segment benefits from substantial building code acceptance and established design standards that emphasize the deployment of density-based systems for general commercial and residential fire protection applications.

Growth Drivers: Commercial construction programs incorporate CMDA sprinklers as baseline fire protection for office buildings, while residential high-rise development increases demand for code-compliant systems that provide adequate occupant protection and property conservation.

Market Challenges: High-challenge storage and specialized industrial applications may require more advanced ESFR or specialized technologies beyond traditional CMDA capabilities.

Application dynamics include:

Early Suppression Fast Response (ESFR) technology captures 18.0% market share through superior performance in high-piling storage and warehouse applications requiring fire suppression rather than mere control. In-rack sprinklers hold 25.0% market share, while CMSA (Control Mode Specific Application) accounts for 12.0% through specialized protection scenarios.

Market Position: Commercial applications command dominant market position with 46.0% market share through extensive building code requirements and property protection mandates.

Value Drivers: This application segment provides the fundamental fire protection requirements for office buildings, retail centers, hotels, and healthcare facilities, meeting life safety needs, insurance requirements, and building code compliance without operational exceptions.

Growth Characteristics: The segment benefits from continuous commercial construction activity, retrofit mandate programs, and insurance incentive structures that support widespread sprinkler adoption and system upgrade cycles.

Industrial facilities capture 25.0% market share through manufacturing, warehouse, and logistics protection requiring high-challenge fire suppression and property conservation. Residential applications hold 24.0% share, while government & institutional sectors account for 5.0% through public buildings, schools, and infrastructure facilities.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Building code enforcement & high-rise regulations (residential tower mandates, commercial retrofit requirements, tragic fire incident responses) | ★★★★★ | Fatal building fires driving regulatory tightening; jurisdictions mandating sprinkler retrofits in existing high-rises and social housing creating substantial market expansion beyond new construction. |

| Driver | Warehouse automation & e-commerce logistics (fulfillment center construction, high-piling storage, automated retrieval systems) | ★★★★★ | E-commerce growth driving massive warehouse construction; automated high-bay facilities requiring sophisticated ESFR and in-rack sprinkler protection for property conservation and business continuity. |

| Driver | Insurance incentives & premium reduction (property loss prevention, business interruption mitigation, carrier requirements) | ★★★★☆ | Insurance carriers offering significant premium discounts for sprinklered buildings; loss prevention economics improving sprinkler ROI beyond code compliance for property owners and tenants. |

| Restraint | Installation cost & water infrastructure (upfront capital, water supply requirements, building disruption during retrofit) | ★★★★☆ | High retrofit costs deterring voluntary adoption; water supply adequacy and building disruption challenges in existing structures limiting penetration despite life safety benefits. |

| Restraint | Maintenance requirements & false activation concerns (testing obligations, freeze risks in dry pipe, water damage from accidental discharge) | ★★★☆☆ | Property owners concerned about ongoing inspection costs; rare but costly accidental discharge incidents and freeze-related failures creating adoption hesitancy despite statistical safety advantages. |

| Trend | Connected & smart sprinkler systems (IoT sensors, predictive maintenance, cloud monitoring, analytics-driven inspection) | ★★★★★ | Building automation driving sprinkler system digitization; connected devices enabling remote monitoring, predictive component replacement, and automated compliance documentation transforming service models. |

| Trend | Water-mist & clean agent alternatives (water-efficient technologies, sensitive equipment protection, heritage building applications) | ★★★★☆ | Water scarcity and data center growth driving alternative suppression; mist and gaseous systems protecting electronics and artifacts while reducing water consumption and environmental impact. |

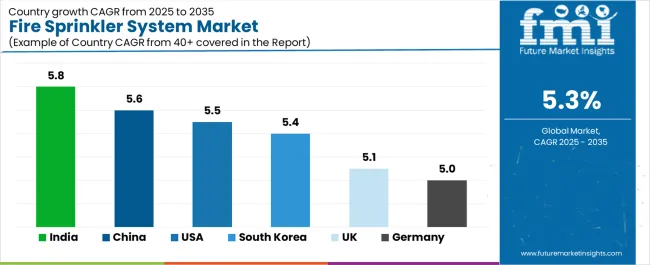

The market demonstrates varied regional dynamics with Growth Leaders including India (5.8% growth rate) and China (5.6% growth rate) driving expansion through urbanization initiatives and high-rise construction development. Steady Performers encompass United States (5.5% growth rate), South Korea (5.4% growth rate), and United Kingdom (5.1% growth rate), benefiting from established fire codes and retrofit mandate programs. Developed Markets feature Germany (5.0% growth rate) and Japan (4.4% growth rate), where industrial facility upgrades and building stock modernization support consistent growth patterns.

Regional synthesis reveals South Asian markets leading adoption through rapid urban construction and safety code tightening, while North American and East Asian countries maintain strong growth supported by warehouse automation and commercial real estate development. European markets show steady growth driven by retrofit programs and industrial safety directive compliance.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| India | 5.8% | Focus on high-rise expertise | Payment cycles; enforcement inconsistency |

| China | 5.6% | Lead with ESFR warehouse solutions | Local competition; margin pressure |

| United States | 5.5% | Push connected services | Contractor availability; code fragmentation |

| South Korea | 5.4% | Premium data center systems | Economic cycles; export dependency |

| United Kingdom | 5.1% | Retrofit program alignment | Skills shortage; supply chain Brexit impacts |

| Germany | 5.0% | Industrial upgrade focus | Conservative adoption; extended sales cycles |

| Japan | 4.4% | Compact system innovation | Shrinking construction; deflation pressures |

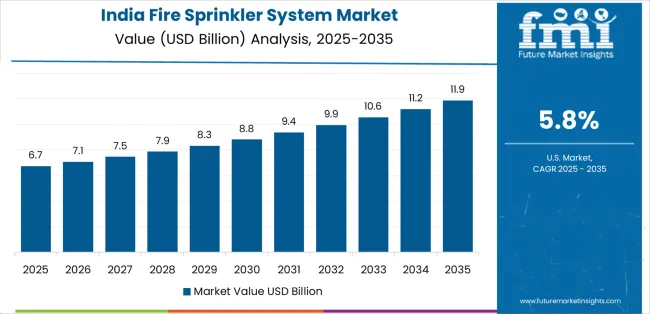

India establishes fastest market growth through aggressive urban development programs and comprehensive high-rise construction expansion, integrating fire sprinkler systems as mandatory components in residential towers and commercial complexes. The country's 5.8% growth rate reflects government initiatives promoting building safety and fire code enforcement that mandate the use of automatic suppression systems in high-rise and commercial facilities. Growth concentrates in major metropolitan regions, including Mumbai high-rise developments, Bengaluru IT parks, and NCR commercial construction, where building infrastructure showcases expanding sprinkler deployment that appeals to developers seeking code compliance and insurance approval.

Indian construction markets are adopting fire sprinkler technology through increasing code enforcement in metro cities and tragic fire incident responses driving regulatory tightening, including residential tower mandates and commercial building requirements. Installation channels through fire protection contractors and MEP system integrators expand market access, while growing fire safety awareness and insurance requirements support adoption across diverse commercial and residential segments.

Strategic Market Indicators:

In Shanghai logistics parks, Guangzhou commercial developments, and nationwide e-commerce fulfillment centers, property developers and warehouse operators are implementing fire sprinkler systems as mandatory infrastructure for building approval and operational insurance applications, driven by warehousing build-out and commercial construction scale that emphasize the importance of property protection. The market holds a 5.6% growth rate, supported by continued urbanization and automated logistics expansion that promote advanced sprinkler systems for warehouse and commercial building facilities. Chinese operators are deploying sprinkler systems that provide reliable fire suppression and code compliance, particularly appealing in high-bay warehouse regions where inventory protection and business continuity represent critical investment requirements.

Market expansion benefits from massive e-commerce logistics infrastructure development and commercial real estate construction that require comprehensive fire protection systems. Technology adoption follows patterns established in building systems, where code compliance and insurance requirements drive installation decisions and facility-scale deployment.

Market Intelligence Brief:

United States establishes market leadership through comprehensive building code enforcement and emerging connected sprinkler technology adoption, integrating fire protection systems across commercial retrofits and new construction. The country's 5.5% growth rate reflects strict code requirements and mature fire safety infrastructure that supports widespread sprinkler installation in commercial and residential high-rise facilities. Demand concentrates in commercial real estate markets, warehouse automation projects, and residential tower construction, where building development showcases mandatory sprinkler deployment that appeals to property owners seeking code compliance and liability protection.

American fire protection markets leverage established contractor networks and comprehensive code enforcement frameworks, including NFPA standards and local building requirements that mandate sprinkler installation. The market benefits from insurance premium incentives and retrofit mandate programs that support system installation in existing buildings and emerging smart sprinkler service models offering predictive maintenance.

Market Intelligence Brief:

In Seoul data center clusters, Gyeonggi manufacturing complexes, and nationwide semiconductor facilities, industrial operators are implementing advanced fire sprinkler systems as critical infrastructure for equipment protection and business continuity applications, driven by technology infrastructure investment and stringent fire codes that emphasize the importance of reliable suppression. The market holds a 5.4% growth rate, supported by advanced manufacturing expansion and data center construction that promote specialized sprinkler systems for high-value asset protection. Korean operators are deploying sprinkler systems that provide equipment-safe suppression and rapid response, particularly appealing in technology facilities where downtime prevention and asset protection represent paramount operational requirements.

Market expansion benefits from substantial technology infrastructure investment and comprehensive national fire code enforcement that require sophisticated fire protection. Technology adoption follows patterns established in facility systems, where asset value and business continuity drive specification decisions and premium system deployment.

Market Intelligence Brief:

United Kingdom's building safety reform demonstrates accelerated fire sprinkler deployment with emphasis on high-rise residential retrofits and social housing upgrades through regulatory response to building safety failures. The country maintains a 5.1% growth rate, driven by comprehensive retrofit mandates and warehouse automation expansion.

Market dynamics focus on residential tower sprinkler retrofits meeting new safety regulations and warehouse fire protection for e-commerce logistics expansion. Regulatory change and automation trends create sustained opportunities for sprinkler installation in existing buildings and new industrial facilities.

Strategic Market Considerations:

Germany's industrial safety standards demonstrate comprehensive fire sprinkler deployment with emphasis on manufacturing facility upgrades and compliance with EU safety directives through established regulatory frameworks. The country maintains a 5.0% growth rate, driven by industrial modernization and public building retrofit programs.

Market dynamics focus on industrial facility fire protection meeting stringent German and EU safety requirements combined with steady public building upgrade cycles. Safety culture and regulatory compliance create consistent demand for sprinkler systems in industrial and institutional applications.

Strategic Market Considerations:

Japan's aging building infrastructure demonstrates fire sprinkler deployment with focus on retrofit applications and healthcare facility protection through quality standards and disaster preparedness culture. The country maintains a 4.4% growth rate, driven by building stock modernization and specialized facility requirements.

Market dynamics focus on aging building retrofits addressing fire safety in older construction and healthcare facilities requiring life safety systems for vulnerable populations. Conservative but steady upgrade programs and disaster preparedness focus create sustained sprinkler demand in institutional applications.

Strategic Market Considerations:

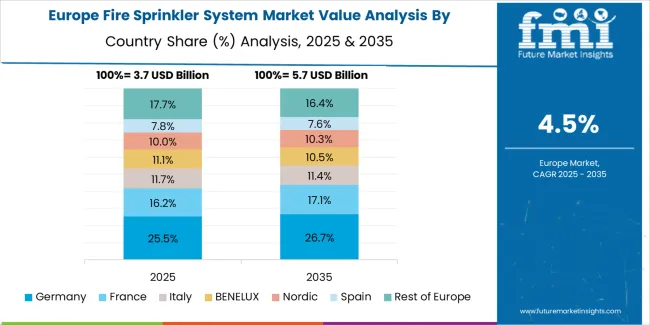

The fire sprinkler system market in Europe is projected to grow from USD 3.9 billion in 2025 to USD 6.3 billion by 2035, registering a CAGR of 5.0% over the forecast period. Germany is expected to maintain leadership with a 26.5% share in 2025, easing to 25.8% by 2035, supported by stringent industrial safety norms and steady retrofit activity.

France follows with an 18.7% share in 2025, edging to 19.0% by 2035 on hospital and public building upgrades. United Kingdom holds a 17.1% share in 2025, moving to 16.9% by 2035 amid strong warehouse automation demand. Italy accounts for a 14.0% share in 2025, while Spain represents 11.8% in 2025, both benefiting from tourism-related hospitality development and mixed-use construction projects. Rest of Europe collectively rises from 11.9% to 12.6% by 2035 as Nordic and Eastern European markets accelerate fire code adoption and building safety standard implementation.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Integrated fire protection OEMs | Product development, UL/FM testing, distribution networks | Technology innovation, code expertise, brand credibility | Installation execution; local market nuances |

| Regional/national contractors | Installation relationships, code authority connections, service networks | Customer intimacy, inspection business, permit knowledge | Product technology; global reach |

| Wholesale distributors | Inventory management, contractor credit, logistics networks | Volume aggregation, working capital, delivery speed | Manufacturing control; end-user relationships |

| Building services integrators | MEP coordination, general contractor relationships, project management | System integration, single-source convenience, schedule certainty | Sprinkler expertise depth; aftermarket service |

| Specialty technology providers | Water-mist systems, clean agent, digital platforms | Performance differentiation, niche applications | Market scale; distribution breadth |

| Item | Value |

|---|---|

| Quantitative Units | USD 14.6 billion |

| System Type | Wet Pipe, Dry Pipe, Pre-Action, Water-Mist, Clean Agent, Deluge, Standpipe |

| Technology | CMDA, ESFR, CMSA, In-rack |

| Application | Commercial, Industrial, Residential, Government & Institutional |

| Response Time | Quick, Standard |

| Hazard Class | Ordinary Hazard, Light Hazard, Extra Hazard |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, South Korea, Canada, Brazil, France, Australia, and 25+ additional countries |

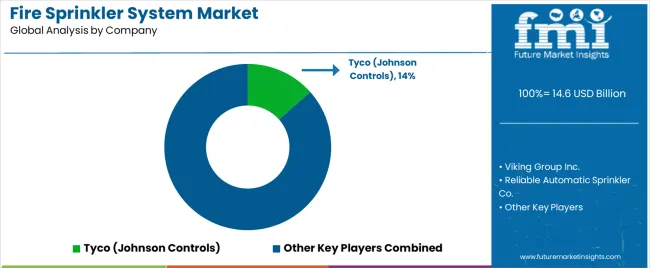

| Key Companies Profiled | Tyco (Johnson Controls), Viking Group Inc., Reliable Automatic Sprinkler Co., Globe Fire Sprinkler Corp., Victaulic Company, Minimax GmbH, Siemens AG (Building Technologies), Honeywell International Inc., APi Group Corporation, Hochiki Corporation |

| Additional Attributes | Dollar sales by system type and application categories, regional installation trends across South Asia Pacific, East Asia, and North America, competitive landscape with fire protection equipment manufacturers and building services contractors, building owner preferences for code compliance and life safety protection, integration with fire alarm systems and building management platforms, innovations in connected sprinkler technology and suppression performance, and development of specialized fire protection solutions with enhanced reliability and service optimization capabilities. |

The global fire sprinkler system market is estimated to be valued at USD 14.6 billion in 2025.

The market size for the fire sprinkler system market is projected to reach USD 24.5 billion by 2035.

The fire sprinkler system market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in fire sprinkler system market are wet pipe, dry pipe, pre-action, water-mist, clean agent, deluge and standpipe.

In terms of technology, cmda segment to command 45.0% share in the fire sprinkler system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Fire Collar Market Size and Share Forecast Outlook 2025 to 2035

Fire Protective Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire And Explosion Proof Lights Market Size and Share Forecast Outlook 2025 to 2035

Fire Retardant Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA