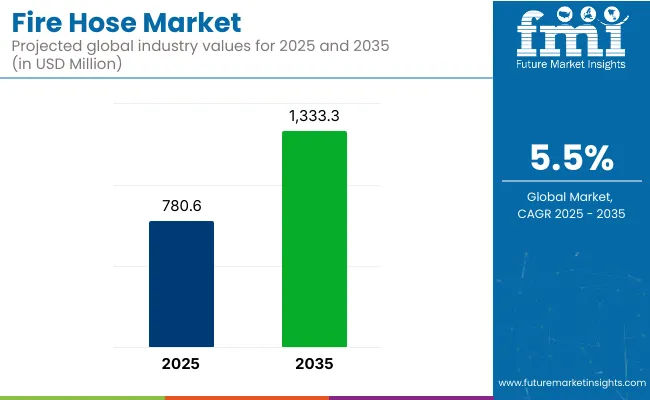

The global fire hose market is anticipated to expand at a CAGR of 5.5%. The market is valued at USD 780.6 million in 2025 and is poised to reach USD 1,333.3 million by 2035. This growth is supported by rising fire safety regulations, increasing industrialization, and urban development across emerging economies.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 780.6 million |

| Industry Value (2035F) | USD 1,333.3 million |

| CAGR (2025 to 2035) | 5.5% |

Demand has been driven by government mandates, insurance compliance requirements, and the expanding use of fire suppression systems in smart infrastructure.Rapid advancements in lightweight and eco-friendly fire hose materials, along with the integration of IoT-based smart firefighting systems, are also contributing to market expansion. These technologies are being adopted to reduce maintenance costs, extend product lifespan, and improve emergency response effectiveness.

Government regulations focus on ensuring safety, performance, and reliability in firefighting operations. In the USA, NFPA 1961 sets design, construction, and testing requirements for fire hoses, while NFPA 14 specifies installation and maintenance standards for standpipe and hose systems. NFPA 1962 covers care, use, and inspection of fire hoses and related equipment.

Additionally, OSHA 1910.158 mandates protection against mechanical damage for standpipes and outlines equipment requirements. In Europe, 46 CFR 108.425 applies to fire hoses on vessels, detailing nozzle specifications and maintenance standards.

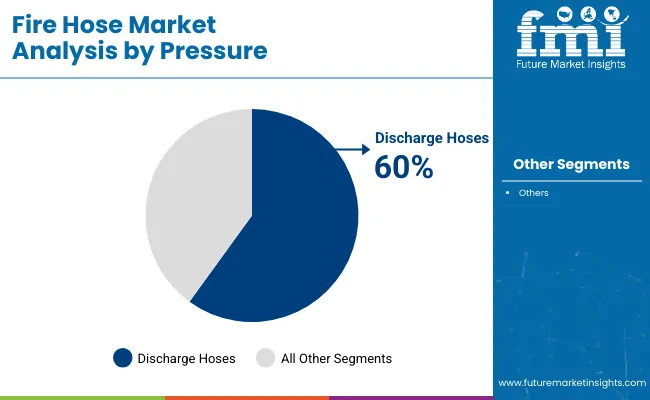

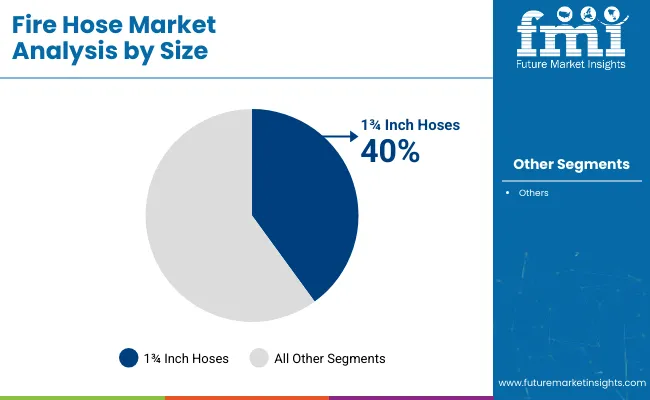

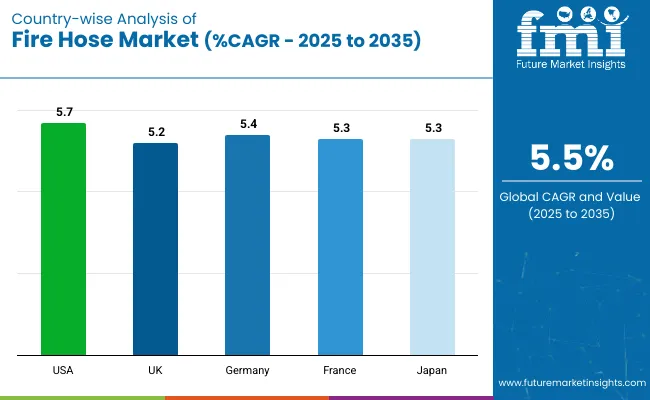

The USA fire hose market is projected to grow at a CAGR of 5.7%, driven by the modernization of fire departments and increased industrial fire risks. Discharge hoses will dominate the pressure segment, holding a 60% market share in 2025. The 1 ¾ inch hose size will lead the size segment with a 40% market share. Germany and France are also expected to experience strong growth, with projected CAGRs of 5.4% and 5.3%, respectively, fueled by increased industrial and municipal fire safety needs.

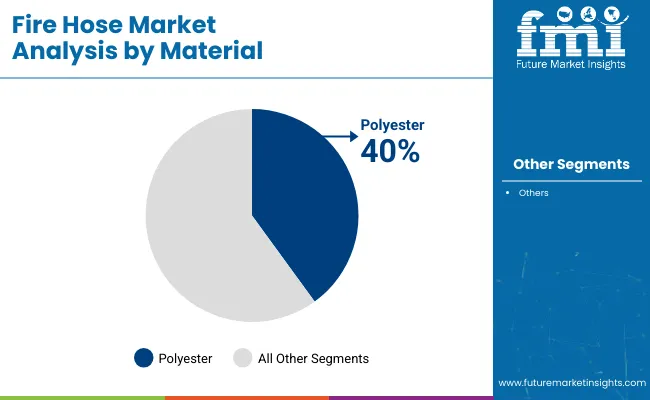

The market is segmented into pressure, material used, size, and region.By pressure, the market is bifurcated into discharge hoses and suction hoses.Based on material used, the market is categorized into cotton, polyester, and nylon filament.In terms of size, the market is segmented into 1 ½ inch, 1 ¾ inch, and 2 ½ inch hoses.Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa.

Discharge hoses are projected to lead the pressure segment, accounting for 60% of the global market share by 2025. These hoses have been recognized for their ability to handle high water pressure, making them essential in municipal firefighting, industrial plants, and emergency response operations.

The polyester segment is expected to lead the material category, securing 40% of the global market share by 2025. Known for its high tensile strength and abrasion resistance, polyester has been extensively used in the production of fire hoses designed for demanding environments.

The 1 ¾ inch hose size is anticipated to dominate the size segment, capturing 40% of the global market share in 2025. This size has been considered ideal for its balance between maneuverability and water flow, making it a standard choice for municipal fire services and industrial use.

The fire hose market is experiencing robust expansion, driven by rising fire safety mandates, increased industrial risk preparedness, and continuous innovation in fire hose material technologies. Growth is supported by advancements in IoT-enabled fire suppression systems and the increasing integration of smart safety infrastructure in urban environments.

Recent Trends in the Fire Hose Market

Challenges in the Fire Hose Market

The USA fire hose market is expected to grow at a CAGR of 5.7% from 2025 to 2035. This growth is being driven by the modernization of fire departments, increasing industrial fire risks, and strict enforcement of NFPA fire safety regulations across commercial and residential infrastructure.

The UK fire hose market is projected to expand at a CAGR of 5.2% during the forecast period. Regulatory reform and intensified fire safety mandates following high-profile incidents have strengthened the need for certified, durable hose systems across industries and public infrastructure.

Germany’s fire hose market is forecasted to grow at a CAGR of 5.4% from 2025 to 2035. As a central manufacturing and logistics hub, Germany has prioritized industrial-grade firefighting systems supported by robust EU safety standards and local enforcement policies.

France’s fire hose market are anticipated to grow at a CAGR of 5.3% during the forecast period. The country’s commitment to modernizing firefighting infrastructure and reducing emergency response times has stimulated demand for high-efficiency hose solutions.

Japan’s fire hose market is projected to expand at a CAGR of 5.3% through 2035. Owing to its earthquake-prone landscape and dense urban infrastructure, Japan has invested significantly in high-performance firefighting technologies, including pressure-sensitive and heat-durable hoses.

The fire hose market is moderately consolidated, with several established global manufacturers holding notable market shares, while regional and specialized suppliers continue to focus on innovation. Competitive strategies are being shaped by regulatory compliance, material science advancements, smart firefighting technologies, and strategic collaborations aimed at expanding production and geographic reach.

Tier-one companies such as Angus Fire Ltd., Dixon Valve & Coupling, National Fire Equipment Ltd., Armored Textiles Inc. (ATI), and All-American Hose LLC are competing through investments in R&D for heat-resistant and eco-friendly hose materials, digital integration into firefighting systems, and enhanced product customization. Manufacturing capabilities are being expanded globally, and long-term supply relationships with defense, municipal, and industrial clients are being established through strategic partnerships.

Recent Fire Hose Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 780.6 million |

| Projected Market Size (2035) | USD 1,333.3 million |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million / Volume in linear meters |

| By Pressure Type | Discharge Hoses and Suction Hoses |

| By Material Used | Cotton, Polyester, and Nylon Filament |

| By Size | 1 ½ Inch, 1 ¾ Inch, and 2 ½ Inch |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Mercedes Textiles Limited, Kuriyama of America, Niedner Inc., Snap- tite Hose, Superior Corp., Richards Hose Ltd., Key Hose LLC, Tipsa Group, SABRE Fire Hose, BullDog Hose Company, and other major players. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

In terms of Pressure, the industry is divided into Discharge Hoses, Suction Hoses

In terms of Size, the industry is divided into 1 ½ inch, 1 ¾ inch, 2 ½ inch

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The fire hose market is valued at USD 780.6 million in 2025.

The market is forecasted to reach USD 1,333.3 million by 2035, reflecting a CAGR of 5.5%.

Discharge hoses will lead the market by pressure type, holding a 60% market share in 2025.

The 1 ¾ inch hose segment will dominate the market with a 40% market share in 2025.

The USA is projected to grow at the fastest rate, with a CAGR of 5.7% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Fire Collar Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA