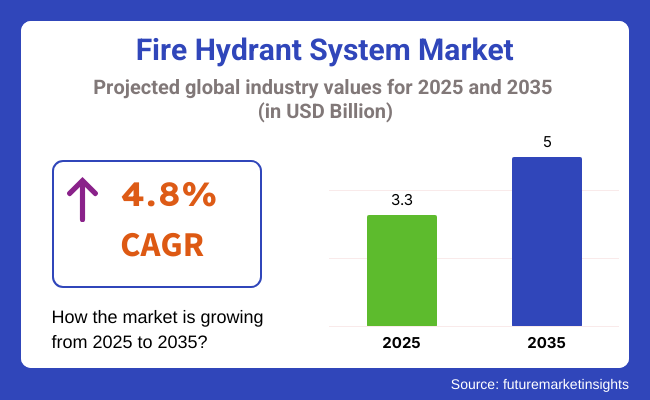

The fire hydrant system market is anticipated to expand gradually, with an estimated industry size of USD 3.3 billion in 2025, projected to reach approximately USD 5 billion by 2035, at a CAGR of 4.8%. One of the primary reasons for the industry's growth is the rise in urbanization and high-density development.

As cities continue to grow and high-rise developments become more prevalent, the demand for effective fire extinguishing systems is of utmost importance. Fire hydrants provide immediate access to high-pressure water, enabling emergency responders to fight fires efficiently throughout complex urban areas.

Industrial complexes, such as manufacturing factories, oil refineries, warehouses, and power plants, are also significant contributors to the need. Such areas with high hazard demand robust firefighting infrastructure to mitigate potential fire dangers involving combustible materials, large machines, and electrical devices. Hydrant systems form larger fire safety measures within such premises.

Technological progress is also increasing the efficiency and monitoring of hydrant networks. Intelligent hydrant systems with sensors and telemetry units are being adopted in smart cities. These systems provide real-time water pressure data, tamper alert, and maintenance alerts to fire departments and municipalities.

The optimistic outlook notwithstanding, the industry presents some challenges. There are aging water infrastructure systems across older cities, which can restrict hydrant system performance if not properly installed or maintained.

Failing installations, corrosion, and a lack of regular testing can also contribute to malfunctioning hydrants during emergencies. In order to mitigate these risks, facility managers and municipalities are investing more in automated test systems, inspection services, and fire hydrant mapping technology.

These technologies enhance response efficiency, guarantee system readiness, and enable proactive maintenance programs. The industry is dominated by Europe and North America, which have highly developed regulatory systems, established fire protection infrastructure, and a history of frequent retrofitting of aging hydrant networks. The Asia-Pacific region is set to record the highest growth, driven by urbanization, government expenditure on safety systems, and increasing awareness of fire safety.

The industry is growing rapidly, fueled by the growing demand for effective fire protection solutions in different industries. The growth is fueled by various factors like the growing need to enhance public safety, strict government regulations, and urban infrastructure expansion. The industry is dominated by a geographically dispersed and diverse range of product types, specific applications, end-user industries, and geographical landscape.

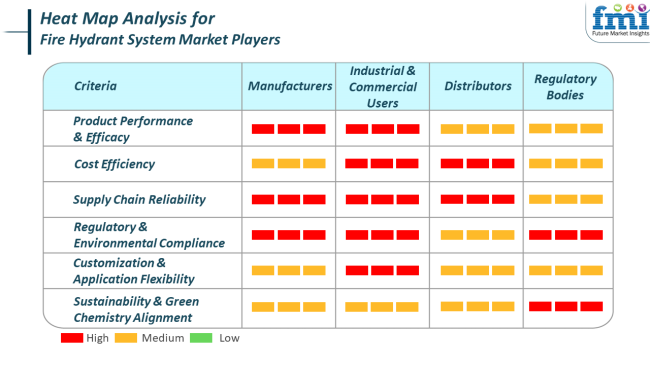

Manufacturers focus on producing high-performance fire hydrant systems that meet the stringent demands of commercial and industrial clients. They invest in environmentally friendly manufacturing practices and seek to ensure a secure supply chain to meet the growing global demand.

Industrial and commercial end users, including manufacturing industries, building construction, and public infrastructure, appreciate cost-effective and reliable fire hydrant system solutions that ensure maximum performance across various applications. The industry is characterized by a collaboration among stakeholders in developing and applying products that respond to performance requirements, are sustainable, and cater to evolving industry demands.

Between 2020 and 2024, the industry experienced steady growth, mainly driven by rapid urbanization, expansion of commercial infrastructure, and stricter fire safety regulations worldwide. Governments and municipalities across both developed and emerging economies emphasized the integration of modern hydrant networks in new construction projects, especially in high-density residential, industrial, and commercial zones.

The focus of this decade was primarily on developing water distribution networks, replacing ageing infrastructure, and encouraging code compliance in fire protection. Technology uptake was moderate with basic monitoring devices and mechanical hydrants being used for the lion's share of industry applications.

Between 2025 and 2035, the industry is expected to undergo a significant transformation, driven by the convergence of smart hydrant technologies with Internet of Things (IoT) and Geographic Information Systems (GIS) mapping technologies. These technologies will enable real-time monitoring of pressure, water flow, and operational readiness, significantly enhancing the effectiveness of emergency response.

Sustainability will also become a prominent issue, with cities employing eco-efficient hydrants that reduce water loss and aid leak detection. Tamper-resistant, modular hydrants with greater longevity will also become in vogue, particularly for smart city and industrial safety applications.

Growth will also be supported by stricter regulatory frameworks that mandate proactive fire preparedness, especially in rapidly urbanizing regions of the Asia-Pacific, Latin America, and Africa.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Urbanization, commercial development, and stricter building fire safety regulations. | Smart city growth, water conservation goals, and real-time emergency preparedness through IoT and AI technologies. |

| Basic mechanical hydrants with limited or no real-time monitoring capability. | Smart hydrants with inbuilt sensors, remote diagnostic functionality, and pressure/flow monitoring as part of built-in emergency systems. |

| Emphasis on the installation of new and modernized replacement systems and the networking of hydrants in urban settings. | Smart infrastructure with in-built emphasis on GIS-mapped location of hydrants, leak-detection systems, and leak-protection systems. |

| Compliance with national fire protection standards and safety audit requirements specified by insurance-providers. | Growing regulatory demands for smart infrastructure, data recorders, and real-time reporting of hydrant maintenance. |

| Low to mid-rise urban long-term cast-iron solutions. | Modular, corrosion-resistant, smart-capable hydrants for high-density cities and manufacturing zones. |

| North America and Europe demand leadership with modest growth in emerging economies. | The Asia-Pacific, Africa, and Latin America regions witness high growth, fueled by urbanization and stricter building codes. |

The industry, a critical component of urban security and emergency preparedness, faces existing and ongoing threats that may impact its growth trajectory. The most important among them is the high cost of installing and maintaining fire hydrant systems.

The cost of new hydrants is between USD 3,000 and USD 7,000 and annual maintenance of USD 5 to USD 25 per unit. The cost has the potential to deter adoption, especially in regions with budget constraints or aging infrastructure.

Another pressing issue is the aging of infrastructure in nearly all cities. Aging water supply systems may be unable to provide room for optimum performance of modern fire hydrant systems, which leads to loss of efficiency and increased exposure in times of need. Retrofitting or replacing the systems is a time-consuming and costly effort, which can become challenging for cities.

In the future, environmental issues are likely to pose even greater risks. Efforts to conserve water and laws regulating it may restrict supplies for firefighting needs, where the creation of more effective yet efficient hydrant systems that waste less water while remaining effective may be necessary.

As technological advancements provide greater functionality, they also provide complexity. Installing smart technologies into fire hydrant systems requires significant capital outlays and technical expertise. Moreover, employing digital systems opens the risk of cyberattack and system malfunction in high-pressure situations.

In general, while the industry has future growth potential, it must address threats related to excessive costs, outdated infrastructure, environmental regulations, and the integration of new technologies. Addressing these risks through proper planning, infrastructure investment, and the adoption of new technologies will be essential in ensuring the future reliability and performance of fire hydrant systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

| UK | 5.5% |

| France | 5.4% |

| Germany | 6.1% |

| Italy | 5.2% |

| South Korea | 5 % |

| Japan | 4.8% |

| China | 7.3% |

| Australia-NZ | 5.6% |

The USA industry is expected to grow at 6.3% CAGR during the analysis period. Increasing investment in commercial buildings, factory units, and municipal safety infrastructure is driving homogeneous demand in urban and suburban developments. Mandatory adherence to national fire protection codes and the need for robust fire suppression infrastructure have led to ubiquitous installation in new and existing buildings.

Technological advancements, such as intelligent hydrants equipped with pressure sensors and remote monitoring capabilities, are enhancing system performance and effectiveness. Increasing attention to climate-driven fire risk and an emphasis on emergency readiness are driving municipalities and private operators toward the modernization of fire protection equipment, fueling the growth of the industry.

The UK industry is expected to expand at a 5.5% compound annual growth rate (CAGR) during the study period. Urban renewal, accelerated infrastructure upgrades, and compliance with safety regulations in dense residential zones are driving the industry. Compliant fire safety regulations for newly constructed commercial and residential buildings promote steady demand for modern hydrant systems.

Installation of new materials to retrofit outdated hydrants for tamper and corrosion resistance is gaining momentum. Additionally, more focus on conserving water and detecting leaks is propelling the adoption of smart, metered hydrant systems. Municipal-utility cooperation offers long-term fire protection planning and supplements public investment in hydrant infrastructure development.

France's industry is expected to grow at a compound annual growth rate (CAGR) of 5.4% during the forecast period. Public security concerns and stringent regulatory imposition over civil and industrial zones are driving the demand for efficient fire suppression infrastructure, such as hydrant networks. Urban development and public facility growth, such as airports, hospitals, and school campuses, are driving the installation of comprehensive fire response systems.

Valve technology, anti-freeze systems, and pressure control are enhancing hydrant systems in colder climates. Involvement by the insurance community in assessing fire risk is motivating facility owners to invest in compliant hydrant infrastructure, fueling ongoing industry activity and modernization initiatives.

The German industry is expected to grow at a 6.1% compound annual growth rate (CAGR) throughout the study period. Germany remains committed to safety engineering and infrastructure resilience and continues to modernize its industrial and municipal fire protection systems. Large-scale infrastructure developments such as commercial complexes and energy plants are increasingly incorporating integrated fire hydrant systems.

Water utility organizations and urban planners are accorded top priority to hydrant performance monitoring, thereby necessitating demand for digitally enabled solutions. Fire risk management practices, especially in heritage precincts and chemical industrial clusters, necessitate highly efficient and accessible hydrant networks.

Public safety augmentation incentives offered by the government and conformance with EU-wide fire standards are further fueling system deployment.

The Italian industry is forecasted to grow at a 5.2% CAGR during the research period. Urbanization, the renovation of historical centers, and an increased interest in infrastructure for the tourism sector are all key factors contributing to the growing demand for reliable fire hydrant installations. The integration of fire protection systems into commercial real estate developments and industrial estates is becoming a priority in national safety codes.

Retrofit schemes aimed at upgrading aging hydrant installations are increasing, and the new installations feature higher flow rates and materials less prone to corrosion. Higher investment in more vulnerable coastal and hillside areas is also driving concentrated fire safety upgrading, providing consistent opportunities for suppliers of hydrant systems.

The South Korean industry will expand at a 5% CAGR during the period of the study. Continuous urbanization and infrastructure upgrades are creating a high demand for compact and efficient hydrant systems, which are best suited for high-density settings. Fire protection programs mandated by governments are driving upgrades in commercial and high-rise buildings.

Local resellers are developing system configurations for smooth interfacing with automated fire detection and control systems. Freeze-proofing technology and quick deployment valves are also influencing industry needs. Growing awareness of workplace safety and rising insurance incentives for being fire-ready are driving long-term investments in hydrant infrastructure across both the public and private sectors.

The Japanese industry is expected to grow at a 4.8% CAGR during the analysis period. Upgradation of fire protection in residential high-rise complexes, commercial buildings, and industries is fueling the industry growth step by step. Due to stringent space constraints and aging infrastructure in metropolises, compact, high-performance hydrant systems with low maintenance requirements are experiencing growing demand.

Japan's strong engineering and automation capabilities are allowing the development of systems with remote monitoring and auto-fault detection capabilities. Local governments in disaster resilience planning are focusing on replacing outdated systems and integrating fire hydrants into comprehensive urban emergency response systems, which supports steady industry growth.

The China industry is expected to expand at 7.3% CAGR during the forecast period. Rapid urbanization and industrialization are generating huge opportunities for fire safety infrastructure, particularly in secondary- and tertiary-tier cities. National fire safety upgrades and increased enforcement of building codes are compelling developers to install intelligent fire hydrant systems across commercial and residential properties.

The use of IoT-based hydrants with flow sensors and leakage alert capabilities is increasing, improving system reliability and efficiency. Transport terminals, airports, and industrial parks continue to be key drivers of infrastructure growth. Strong domestic production capacity and large project initiations are complementing China's leadership in system installation and innovation.

The Australia-New Zealand industry will expand at a 5.6% CAGR during the study period. Regulatory reforms and enhanced planning for safety from bushfire hazards and city fire threats are driving the adoption of sophisticated fire hydrant systems. City planning directives already mandate the provision of accessible hydrants for new housing estates and public works.

Australia's manufacturing and mining sectors also need robust, high-capacity hydrant installations for compliance and asset protection. New Zealand's redevelopment and modernization of earthquake-prone infrastructure has guaranteed fire preparedness as a top priority. Low-maintenance, climate-adapted systems are becoming more sought after, backed by an expanding base of certified suppliers and fire safety consultants.

In the industry, segmentation by product type is based on two basic categories: wet barrel and dry barrel fire hydrants. By 2025, the dry barrel fire hydrant industry is expected to hold a 60% share, while Wet Barrel fire hydrants will contribute the remaining 40% of the industry.

The dry barrel fire hydrants are expected to remain in use for the same reason: they are extensively used where the water in the barrel could freeze. Dry barrels are, therefore, designed in a manner that when the hydrant is closed, the water in the barrel is drained to avoid freezing in cold climates.

Dry barrels are primarily found in North America and Europe, where they are designed with functionality in mind during the cold winter months. Mueller Water Products and American Flow Control are prominent companies that supply dry barrel hydrants, primarily for municipalities and industries, to sustain fire protection systems during harsh winters.

On the contrary, wet barrel fire hydrants are meant for mild climate areas where freezing is not a major concern. The water in these hydrants remains in the barrel, whether the hydrant is in use or not. Wet barrel hydrants can, therefore, be found in places such as California or parts of Southern Europe.

Generally, they are cheaper to manufacture and maintain than dry barrel hydrants. Major suppliers of wet barrel hydrants include AVK and Clow Valve Company, which provide solutions for warmer climates where freezing is not a concern.

In summary, dry barrel hydrants lead the industry owing to their design for cold regions. In contrast, wet barrel hydrants continue to maintain water availability in areas where freezing is not a concern, thereby endangering fire safety infrastructure.

The industry is further subdivided based on Operation Type into two segments: diesel-operated and electric-operated fire hydrants. By 2025, projection indicates that electric-operated hydrants will account for 40% of the industry share, while diesel-operated hydrants will account for 30%.

The growing preference for electric-operated fire hydrants, thanks to their efficiency, ease of operation, and compatibility with modern infrastructure, suits well urban areas and large industrial facilities with ample electrical power for seamless operations.

Suppliers like Mueller Water Products and Pentair sell electric-operated hydrants with automated controls, thereby achieving greater performance and requiring less manual intervention. Furthermore, with the increasing trend of automation and smart cities, more developed countries with mature infrastructure will likely witness a greater uptake of electric-operated fire hydrants.

Diesel-operated fire hydrants operate, in general, in such places where electricity is less reliable or not available. Diesel hydrants are more likely used in settings such as remote locations, industrial zones, or underdeveloped regions where electric power supply is interrupted.

These hydrants are rugged, operate in different weather environments, and are typically favored for their high reliability. The diesel hydrants are offered by American Fire Hydrant and Clow Valve Co., specifically designed for critical infrastructure that requires backup power sources or where the electrical infrastructure is underdeveloped.

In summary, although electric-operated hydrants are projected to experience more growth due to automation trends, diesel-operated hydrants continue to be a reliable alternative for regions or industries with limited electrical infrastructure. They are essential for fire safety in any setting, geographic or industrial.

The industry features heavy competition among the major players, whose priorities focus on safety advances, compliance with regulations, and modernization of infrastructure. Companies such as Tyco Fire Products, Minimax, and Naffco are dominating the system by offering advanced fire suppression technologies integrated with smart monitoring innovation.

Furthermore, they emphasize large-scale installations for commercial, industrial, as well as municipal functions to ensure high operational efficiency and rapid response capabilities.

Regional players such as K.B. Building Solutions, ZedEx Fire Services and Fire Hydrant Systems Pty Ltd deliver localized needs through customized hydrant solutions specifically tailored to fire safety regulations. They offer competitive prices while providing quick-to-deploy products that comply with national fire safety codes, thereby maintaining a solid presence in the developing industries.

Differentiation occurs through technology, with companies such as Waterous and Kennedy Valve producing automated hydrant systems that include remote monitoring, real-time pressure adjustments, and self-diagnostic features. Additionally, firms such as Smith & Sharks and Rapidrop deal in components of high durability with corrosion-resistant hydrants and advanced valve formation to reach a longer operational life.

Mergers, partnerships, and investments are forming a continuous trend in the industry regarding smart fire safety solutions. An example of these partnerships is between Angus Fire and Akash Uni Safe Equipment, which collaborate to integrate their operations with emergency response agencies and urban developers in the construction of modern infrastructures featuring the Internet of Things (IoT) technology, such as hydrants. This integration advances preparedness and effectiveness in the response stage of confronting fire emergencies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Tyco Fire Products | 18-22% |

| Naffco | 14-18% |

| Minimax | 12-16% |

| Kennedy Valve | 10-14% |

| Waterous | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Tyco Fire Products | Provides integrated fire hydrant systems with smart pressure control and automation. |

| Naffco | Specializes in fire hydrants with IoT connectivity for real-time monitoring and safety compliance. |

| Minimax | Develops high-durability hydrants with corrosion-resistant materials for industrial applications. |

| Kennedy Valve | Focuses on remote-controlled hydrants and intelligent water flow regulation systems. |

| Waterous | Offers high-pressure fire hydrant systems with advanced water supply management. |

Key Company Insights

Tyco Fire Products (18-22%)

A global leader in fire safety, Tyco Fire Products integrates smart hydrant technology with automated pressure regulation for rapid emergency response.

Naffco(14-18%)

Naffco specializes in intelligent fire hydrant systems, leveraging IoT-enabled monitoring to ensure optimal fire safety performance in urban areas.

Minimax(12-16%)

Minimax develops durable fire hydrants featuring corrosion-resistant components that are widely used in heavy-duty industrial fire suppression.

Kennedy Valve(10-14%)

Kennedy Valve specializes in remote-controlled hydrants, enabling automated water pressure adjustments and enhanced firefighting capabilities.

Waterous(8-12%)

Waterous offers high-pressure hydrant systems designed for large-scale municipal and industrial applications, ensuring reliable water supply.

Other Key Players(30-40% Combined)

By product type, the industry is segmented into wet barrel and dry barrel.

By operation, the industry is segmented into diesel-operated, electric-operated, and hybrid-operated.

By end users, the industry is segmented into industrial use and commercial use.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The industry is estimated to reach USD 3.3 billion by 2025.

The industry is projected to grow to USD 5 billion by 2035.

China is anticipated to grow at a rate of 7.3%.

Dry barrel fire hydrants are leading the segment, particularly in colder climates where water supply needs to be isolated to prevent freezing.

Key companies include Tyco Fire Products, Naffco, Minimax, Kennedy Valve, Waterous, K.B. Building Solutions, ZedEx Fire Services, Fire Hydrant Systems Pty Ltd, Akash Uni Safe Equipment, Smith & Sharks, Angus Fire, and Rapidrop.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End Users, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Operation, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Users, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Operation, 2023 to 2033

Figure 23: Global Market Attractiveness by End Users, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Operation, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Users, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Operation, 2023 to 2033

Figure 47: North America Market Attractiveness by End Users, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Operation, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Users, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Operation, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Users, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Operation, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Users, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Operation, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Users, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Operation, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Users, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Operation, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Users, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Operation, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Users, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Operation, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Users, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Operation, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Users, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Operation, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Users, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Operation, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Users, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Operation, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Users, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Fire Collar Market Size and Share Forecast Outlook 2025 to 2035

Fire Protective Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire And Explosion Proof Lights Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA