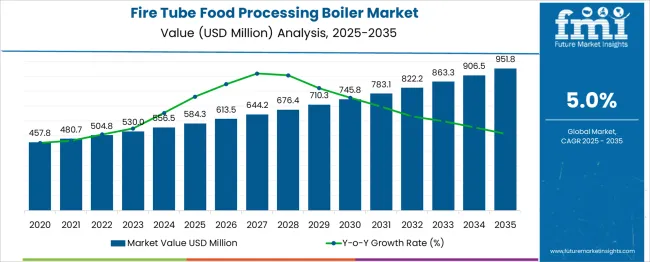

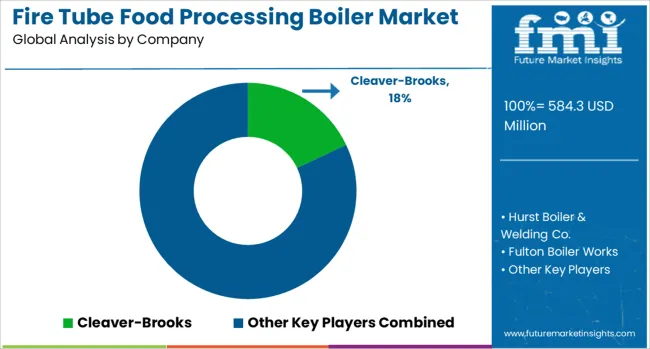

The Fire Tube Food Processing Boiler Market is estimated to be valued at USD 584.3 million in 2025 and is projected to reach USD 951.8 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The 5% CAGR reflects steady year-on-year growth, with annual value increases ranging from USD 29 million to USD 45 million. By 2030, the market is estimated to reach USD 745.8 million, moving past USD 800 million by 2031. These figures suggest ongoing demand supported by consistent replacement cycles, fuel-efficiency upgrades, and operational continuity within medium and high-capacity food production units. Value progression appears stable, without signs of erratic expansion or early saturation. From 2032 to 2035, the growth rate begins to flatten in response to maturing infrastructure and extended equipment lifespans. The increase from USD 906.5 million in 2034 to USD 951.8 million in 2035 signals the onset of volume stabilization, consistent with historical saturation behavior in similar industrial equipment markets. The 1.63x multiplier over ten years confirms expansion, though it also reflects a shift in purchasing patterns toward lifecycle management and system optimization. After 2035, demand is expected to depend on service contracts, automation integration, and compliance-driven retrofits rather than first-time installations.

| Metric | Value |

|---|---|

| Fire Tube Food Processing Boiler Market Estimated Value in (2025 E) | USD 584.3 million |

| Fire Tube Food Processing Boiler Market Forecast Value in (2035 F) | USD 951.8 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

Fire-tube boilers designed for food processing represent roughly 80–85% of the niche food processing boiler market, as this application is their primary use. These boilers account for around 40–50% of the broader industrial boiler market, prized for compact size and efficiency in low to mid scale steam generation. Within the steam generation equipment market, their share stands at about 30–35%, favored for batch processes and hygienic steam needs. In the broader industrial thermal equipment segment, they represent 25–30%, where energy-efficient, low emission systems are valued. Within the food and beverage processing machinery market, fire tube boilers account for approximately 15–20%, supporting critical cooking, sterilization, drying, and cleaning functions in bakeries, dairies, breweries, and canning plants. Demand for compact units is strong in small and medium food processing facilities due to lower installation and maintenance costs and minimal vibration impact. Innovations include smart combustion control systems real time monitoring predictive maintenance features and low NOx burners for emission compliance. Modular designs allow scalable capacity and fuel flexibility including natural gas oil and biomass. Major players such as Babcock Wanson Bosch Thermotechnology Cleaver Brooks Fulton Miura America Thermax and Hurst Boiler Welding expand through regional partnerships local service networks and acquisitions. Asia Pacific leads growth driven by urbanization industrialization and evolving food safety regulations while North America and Europe emphasize emissions control and efficiency in retrofit projects.

Adoption of fire tube boilers that offer robust thermal output and simplified maintenance is being supported by increasing focus on operational safety and cost control. Improvements in boiler design have enabled better heat transfer performance suitable for pasteurization, sterilization, and cooking applications in processing plants.

Investments in food production capacity in emerging economies are also contributing to sustained demand. Regulatory requirements around emissions efficiency and waste heat recovery have further encouraged the adoption of advanced boiler technologies. Over time further gains are expected as rising energy costs and sustainability targets push companies toward higher efficiency systems.

Integration with automation controls and digital monitoring solutions is enabling boiler systems to be optimized in real time amounting to lower fuel consumption and improved uptime. Overall forecast is positive supported by infrastructure growth in food manufacturing the need for scalable steam generation capacity and strategic emphasis on operational reliability and environmental compliance..

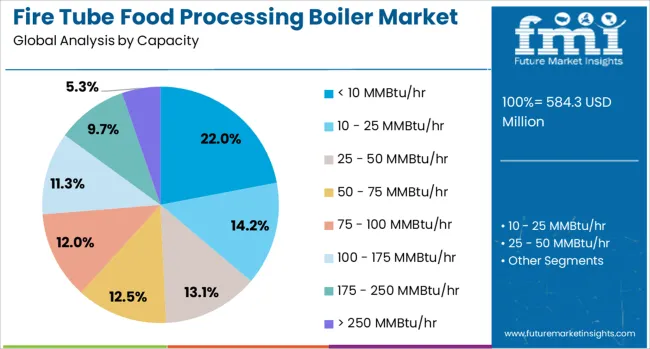

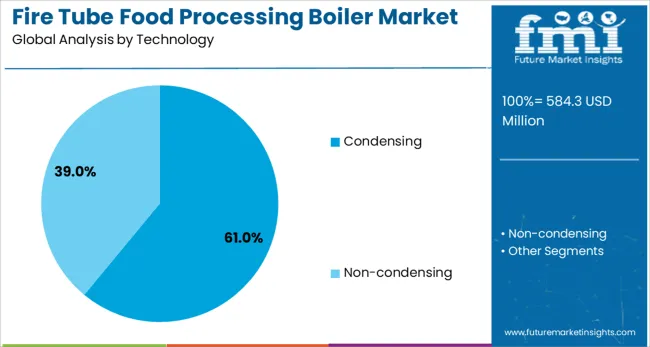

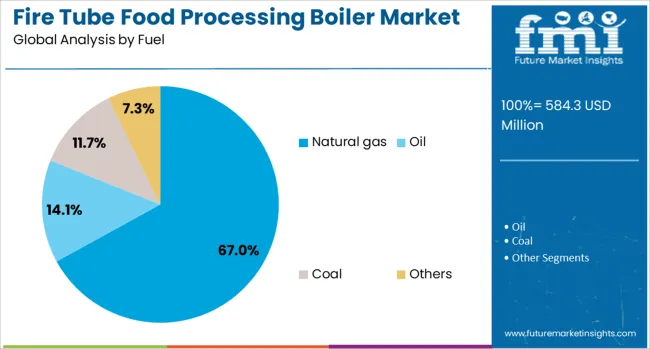

The fire tube food processing boiler market is segmented by capacity, technology, fuel and geographic regions. By capacity of the fire tube food processing boiler market is divided into < 10 MMBtu/hr, 10 - 25 MMBtu/hr, 25 - 50 MMBtu/hr, 50 - 75 MMBtu/hr, 75 - 100 MMBtu/hr, 100 - 175 MMBtu/hr, 175 - 250 MMBtu/hr, and > 250 MMBtu/hr. In terms of technology of the fire tube food processing boiler market is classified into Condensing and Non-condensing. Based on the fuel of the fire tube food processing boiler market, it is segmented into Natural gas, Oil, Coal, and Others. Regionally, the fire tube food processing boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The < 10 MMBtu/hr capacity segment is projected to hold 22% of the Fire Tube Food Processing Boiler market revenue share in 2025 and has been designated as a leading capacity subsegment. Growth has been supported by the preference for smaller capacity boilers in small and mid‑scale food processing facilities convenience in installation and shorter commissioning timelines. Cost efficiency has been achieved through lower upfront capital expenditure as well as simplified operational routines.

The modular sizing offered by this capacity range has allowed manufacturers to match steam generation precisely to process demands avoiding energy wastage. Boilers in the < 10 MMBtu/hr range have frequently been specified in pilot plants research kitchens and small production units that require flexibility in load profiles.

Energy regulations and sustainability goals have further encouraged adoption as these systems tend to deliver acceptable low emissions without complex control mechanisms. As energy management becomes more critical in smaller facilities the < 10 MMBtu/hr capacity subsegment has continued to secure a competitive position within the broader market..

The condensing technology segment is expected to account for 61% of the Fire Tube Food Processing Boiler market revenue share in 2025 making it the predominant technology subsegment. Growth has been driven by the ability of condensing boilers to recover latent heat from flue gases elevating overall thermal efficiency significantly compared to conventional models. Implementation of food processing facilities with high process steam demands has favored condensing systems for their capability to reduce fuel consumption and greenhouse gas emissions.

Integration of condensing technology has been facilitated by increasingly stringent environmental regulations and sustainability policies placed upon food processors. Software aided control systems and heat recovery loops have enhanced efficiency gains enabling real‑time monitoring performance optimization and predictive maintenance.

Operational cost advantages have been realised through lower energy bills reduced carbon taxes and improved return on investment over lifecycle. As pressure mounts on processing plants to demonstrate green credentials condensing boilers have retained their leadership within the technology segment..

The natural gas fuel segment is forecast to command 67% of the Fire Tube Food Processing Boiler market revenue share in 2025 highlighting its status as the leading fuel subsegment. Preference has been shown for natural gas due to its cleaner combustion characteristics lower carbon intensity and cost‑effectiveness in regions with developed pipeline infrastructure.

Natural gas fired fire tube boilers have been favoured in food processing plants that require consistent temperature steam quality and rapid response to varying load demands. Economic benefits have also been realised through reduced maintenance requirements and lower particulate emissions compared to alternative fuels.

Compatibility with emission control standards and existing onsite gas supply infrastructure has enabled widespread adoption. As sustainability and operational efficiency become more critical drivers in food production the natural gas fuel subsegment has continued to dominate through its balance of affordability reliability and regulatory alignment..

Fire tube boilers are being installed across food processing units due to low maintenance needs, consistent steam output, and compact design. More than 40 % of demand in 2024 came from mid-capacity applications such as beverage pasteurization and dairy sterilization. The installed base expanded in Asia Pacific and Latin America, where process steam under 40 psi suffices for over 55 % of plant use cases. Snack and frozen food producers adopted packaged boiler units to reduce startup times by 20 %.

Fire tube boilers are preferred by mid-size food processors requiring clean, saturated steam for tasks like blanching, sterilization, and mixing. Units under 5 tonnes per hour account for nearly 61 % of food-grade steam supply in developing regions. These boilers deliver faster pressure build-up and lower cycle fluctuation, improving energy balance. Built-in feedwater preheaters improved fuel efficiency by up to 18 % in retrofitted facilities. Design simplicity and horizontal layout reduce commissioning time by 32 % compared to water tube systems. Their consistent thermal profile makes them suitable for sensitive products such as milk concentrates and sauces. Compact fire tube variants are also installed in vertical configurations where floor area is constrained. Dual-fuel burners compatible with both LPG and light diesel have expanded use in off-grid processing facilities, especially in Southeast Asia.

Fire tube boiler systems are constrained by thermal capacity limits, usually capped at 4 to 6 tonnes per hour. This restricts their deployment in high-throughput food factories, where continuous processing demands exceed these thresholds. Thermal gradients across flue passages cause metal fatigue over long cycles, increasing lifecycle maintenance costs. Limited burner options restrict the use of biofuels, making them less viable in jurisdictions enforcing emission caps. Cleaning soot deposits in internal flue tubes requires shutdown, which impacts productivity. Plants operating on low-sulfur fuel oil experience combustion inefficiencies due to inadequate burner flame stabilization. Some regions reported up to 11 % downtime attributed to fouling and scale buildup. These units are also unable to operate efficiently above 150 psi, limiting their compatibility with processes requiring high-pressure direct injection, especially in freeze-drying and flash sterilization.

Modular skid-mounted fire tube boilers have opened new commercial opportunities in batch production and seasonal food processing units. Pre-engineered systems combining water softening, condensate return, and preheater coils are reducing installation time by 28 %. Craft breweries, fruit canners, and spice dehydrators are adopting plug-in boiler units for fast deployment. Dual-utility designs integrating electric preheating or solar-assisted hot water systems are being commercialized to reduce primary fuel dependency. In Chile and Vietnam, hybrid boiler systems accounted for nearly 12 % of new orders in 2024. Remote control modules using Wi-Fi and GSM are being introduced to allow cloud-based diagnostics. Government-backed programs for food MSMEs in Central Asia and Eastern Africa are expected to drive future demand for portable fire tube solutions. These offer savings in licensing time, civil works, and energy auditing compliance.

Energy efficiency is being improved through combustion optimization, better flue gas recovery, and dual-stage heating profiles. Burner modulation systems cut fuel consumption by up to 17 % in recent installations. Intelligent load management enabled fire tube boilers to operate in start-stop cycles aligned with food batching schedules. In India and South Korea, vertical cylindrical fire tube boilers captured 26 % of demand in bakeries and confectionery units. Digital pressure controls with flame-failure detection reduced manual interventions by 31 % year over year. Integration with SCADA and MES systems allowed predictive maintenance. Corrosion-resistant alloys such as Inconel are being used in tube bundles to withstand acidic condensates during CIP cycles. Low NOx burners are being retrofitted in compliance with stricter emission rules in the EU and North America. These advancements are reshaping performance expectations.

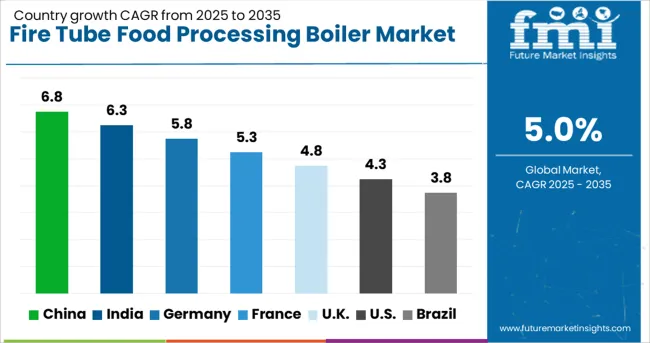

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

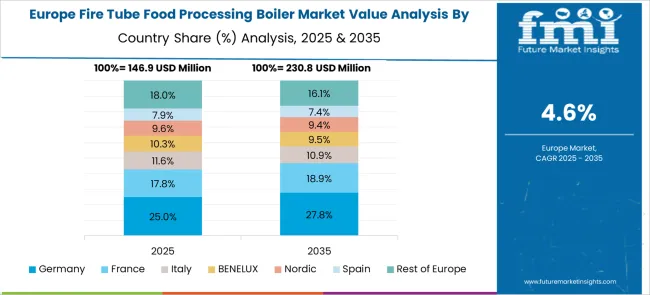

The global fire tube food processing boiler market is projected to expand at a CAGR of 5.0% from 2025 to 2035. China is growing at 6.8%, or 1.36x the global rate, supported by continuous upgrades in commercial-scale food production clusters. India follows at 6.3%, or 1.26x, due to demand from packaged food manufacturers shifting toward energy-efficient thermal systems. Germany (OECD) records 5.8%, equivalent to 1.16x growth, aided by stricter thermal process regulations in the EU food sector. The United Kingdom (OECD) posts a 4.8% CAGR, slightly below average at 0.96x, reflecting slower replacement cycles in SME facilities. The United States (OECD) lags at 4.3%, or 0.86x, amid subdued capital spending in legacy processing plants. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China accounted for 6.8% of global market share in 2025. Food processing facilities increasingly adopted fire tube boilers to handle large-scale sterilization, pasteurization, and drying operations. The manufacturing base expanded in Shandong and Jiangsu, where compliance with thermal efficiency benchmarks was enforced. Condensing boiler designs gained preference for lowering stack gas temperature and capturing latent heat.

India held a 6.3% share of global installations in 2025. The market was driven by demand from packaged food, biscuit manufacturing, and spice processing industries in Gujarat, Maharashtra, and Tamil Nadu. Fire tube boilers with capacity under 5 tph were selected for decentralized plants. Efficiency mandates by the Bureau of Energy Efficiency favored low-NOx burners and water treatment modules.

Germany represented 5.8% of the global market in 2025. Fire tube boilers were used for batch heating in chocolate, sauces, and cheese production. Retrofitting for exhaust heat recovery and flue gas recirculation was prioritized under EU thermal process directives. Adoption was strongest in Bavaria and North Rhine-Westphalia, where processing clusters operated continuous feed systems.

The United Kingdom accounted for 4.8% of global market activity in 2025. Older plants upgraded to fire tube systems with advanced safety interlocks, economizers, and feedwater preheaters. Preference was observed for gas-fired 3-pass units among beverage, cereal, and pet food producers. Regulatory audits accelerated compliance upgrades in Wales and Northern England.

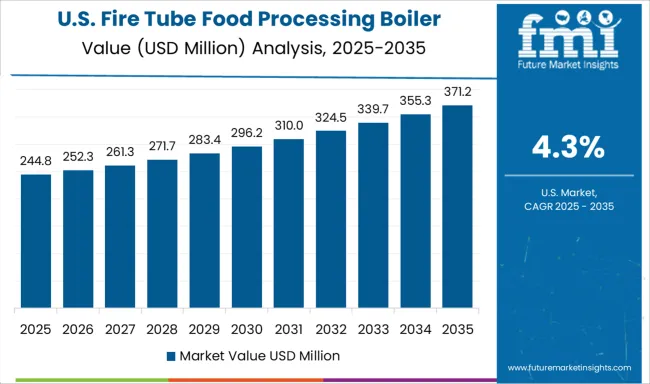

The United States held 4.3% of global demand in 2025. Modular fire tube boilers were selected for batch cooking, sterilizing, and CIP processes in small to mid-sized facilities. Hot-water fire tube units with rapid steam generation were favored in poultry and snack food production. Decentralized boiler rooms reduced transmission losses and improved load responsiveness.

The fire tube food processing boiler market includes manufacturers delivering steam generation systems tailored for operations such as blanching, pasteurization, sterilization, and cleaning-in-place (CIP). Cleaver-Brooks offers integrated fire tube boilers with low NOx burners and high-efficiency designs, often customized for food-grade steam requirements. Their modular skid systems allow for rapid installation in processing plants with limited floor space.

Hurst Boiler & Welding Co. supplies durable, fire tube steam boilers designed for continuous operation in high-moisture environments common to food facilities, with models supporting dual-fuel configurations for operational flexibility. Fulton Boiler Works provides compact fire tube units with vertical and horizontal designs suited to medium-capacity food operations, emphasizing consistent steam pressure and energy efficiency. Miura America Co., Ltd. delivers modular fire tube boilers engineered for quick start-up and load-following operation, supporting steam-on-demand processes and optimizing fuel consumption.

The Boiler Company supplies fire tube systems equipped for food and beverage applications, offering custom solutions for batch cooking, bottling, and sanitation processes. Across the market, competitive strength is shaped by steam purity control, recovery time, space-saving configurations, and service reliability—critical factors for maintaining uptime and regulatory compliance in food production environments.

Fulton Boiler Company unveiled a biomass-compatible fire-tube model suited to beverage and dairy processing. In May 2024, Miura completed its acquisition of Cleaver‑Brooks, extending its product reach in North American food‑grade steam systems. Miura also launched a proactive maintenance service program leveraging IoT for predictive care. Thermax secured a large boiler contract with a major Asian beverage producer. Hardware upgrades and modular control systems improved reliability and fuel flexibility across installations.

| Item | Value |

|---|---|

| Quantitative Units | USD 584.3 Million |

| Capacity | < 10 MMBtu/hr, 10 - 25 MMBtu/hr, 25 - 50 MMBtu/hr, 50 - 75 MMBtu/hr, 75 - 100 MMBtu/hr, 100 - 175 MMBtu/hr, 175 - 250 MMBtu/hr, and > 250 MMBtu/hr |

| Technology | Condensing and Non-condensing |

| Fuel | Natural gas, Oil, Coal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cleaver-Brooks, Hurst Boiler & Welding Co., Fulton Boiler Works, Miura America Co., Ltd., and The Boiler Company |

| Additional Attributes | Dollar sales by boiler type (single-pass, multi-pass fire‑tube) and application (food processing, beverage, dairy), demand from thermal processing operations, led by Asia‑Pacific with North America catching up, innovation in compact modular design and energy recovery systems. |

The global fire tube food processing boiler market is estimated to be valued at USD 584.3 million in 2025.

The market size for the fire tube food processing boiler market is projected to reach USD 951.8 million by 2035.

The fire tube food processing boiler market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in fire tube food processing boiler market are < 10 mmbtu/hr, 10 - 25 mmbtu/hr, 25 - 50 mmbtu/hr, 50 - 75 mmbtu/hr, 75 - 100 mmbtu/hr, 100 - 175 mmbtu/hr, 175 - 250 mmbtu/hr and > 250 mmbtu/hr.

In terms of technology, condensing segment to command 61.0% share in the fire tube food processing boiler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Fire-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Fire Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA