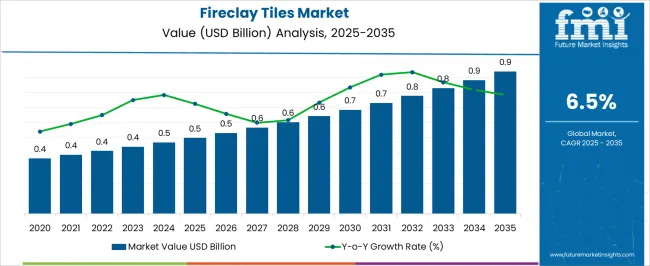

The fireclay tiles market is estimated to be valued at USD 0.5 billion in 2025 and is projected to reach USD 0.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

A rolling CAGR analysis over the forecast period highlights how growth accelerates and maintains momentum in successive years. From 2021 to 2025, the market expands from USD 0.4 billion to 0.5 billion, with incremental values of USD 0.4 billion in early years before reaching 0.5 billion. During this phase, rolling CAGR indicates modest yet steady gains driven by increasing adoption in residential, commercial, and industrial flooring applications, coupled with rising awareness of durable and aesthetic tiling options. Between 2026 and 2030, the market grows from USD 0.5 billion to 0.7 billion, passing through USD 0.5 billion, 0.6 billion, and 0.6 billion annually.

Rolling CAGR in this period reflects a slightly higher annualized growth as demand expands in emerging economies, new construction projects accelerate, and fireclay tiles gain preference for heat resistance, low maintenance, and environmental compliance. From 2031 to 2035, values advance from USD 0.7 billion to 0.9 billion, moving through USD 0.8 billion increments, showing consistent rolling CAGR that reinforces long-term growth potential. The cumulative rolling CAGR analysis demonstrates a progressive increase in annualized growth rates, highlighting a compounding effect where each consecutive period benefits from market expansion, technological improvements, and wider adoption in commercial and residential applications.

| Metric | Value |

|---|---|

| Fireclay Tiles Market Estimated Value in (2025 E) | USD 0.5 billion |

| Fireclay Tiles Market Forecast Value in (2035 F) | USD 0.9 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The fireclay tiles market is influenced by five parent markets that collectively drive its growth, product adoption, and applications across residential, commercial, and industrial sectors. The ceramics and tiles market contributes the largest share, about 28-32%, as fireclay tiles are valued for their durability, high-temperature resistance, and aesthetic appeal in flooring, wall cladding, and decorative applications. The construction and infrastructure market adds approximately 20-24%, with fireclay tiles widely used in commercial buildings, hotels, kitchens, and institutional projects where long-lasting, easy-to-clean surfaces are required.

The industrial refractory and high-temperature applications market contributes around 15-18%, as fireclay tiles serve in furnaces, kilns, chimneys, and fireplaces where heat resistance and thermal stability are critical. The interior design and home improvement market accounts for roughly 10-12%, where architects and designers use fireclay tiles for bespoke finishes, color customization, and premium surface solutions. Finally, the restoration and renovation market represents about 8-10%, as fireclay tiles are preferred for refurbishing heritage buildings, heritage kitchens, and traditional masonry structures to retain authenticity while improving durability.

The fireclay tiles market is experiencing steady growth, supported by rising consumer interest in durable, aesthetically distinctive, and eco-friendly building materials. Industry updates and architectural trend reports have noted the increasing use of fireclay tiles in both new construction and renovation projects due to their exceptional heat resistance, water absorption properties, and longevity. Growing awareness of sustainable building practices has amplified demand, as fireclay is a recyclable and non-toxic material, aligning with green construction standards.

Additionally, design-driven consumer preferences have led manufacturers to offer a wide array of handcrafted and customized styles, expanding market appeal. The premium positioning of handmade fireclay tiles has been further boosted by their use in high-end residential interiors, boutique commercial spaces, and restoration projects.

Looking ahead, the market is poised for continued expansion, with demand driven by design versatility, artisanal production methods, and rising investment in luxury home finishes.

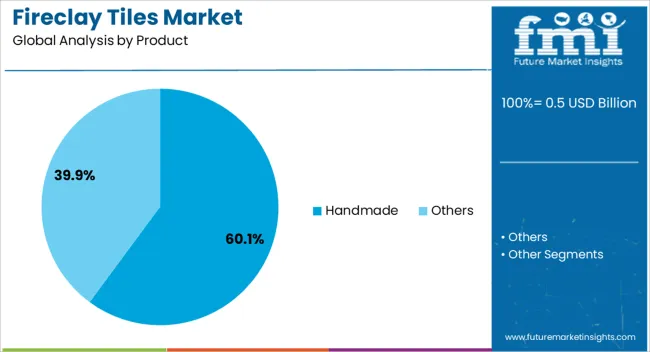

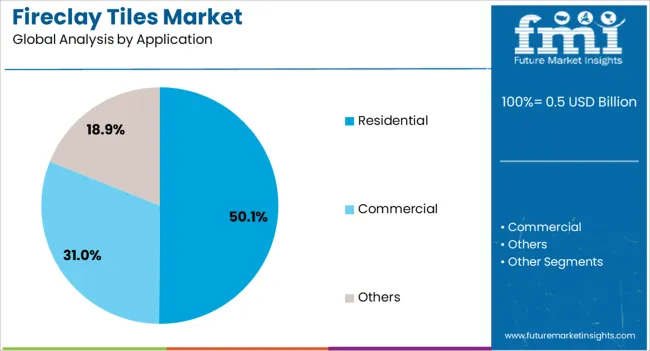

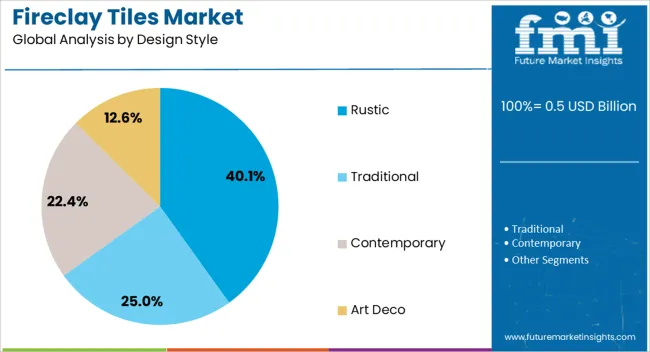

The fireclay tiles market is segmented by product, application, design style, end-use, and geographic regions. By product, fireclay tiles market is divided into handmade and others. In terms of application, fireclay tiles market is classified into residential, commercial, and others. Based on design style, fireclay tiles market is segmented into rustic, traditional, contemporary, and art deco. By end-use, fireclay tiles market is segmented into flooring, wall cladding, countertops, and backsplashes. Regionally, the fireclay tiles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The handmade segment is projected to account for 60.1% of the fireclay tiles market revenue in 2025, securing its position as the leading product type. Growth has been driven by the unique craftsmanship, intricate detailing, and individuality offered by handmade tiles, which appeal strongly to homeowners and designers seeking one-of-a-kind finishes. Artisanal manufacturing processes allow for customization in size, texture, and glaze, which mass-produced alternatives cannot match. Consumers have increasingly associated handmade fireclay tiles with superior quality and aesthetic value, making them a preferred choice for premium projects. Additionally, the ability to produce limited editions and bespoke designs has given manufacturers a competitive advantage in the luxury segment. As architectural and interior design trends continue to prioritize authenticity and craftsmanship, the Handmade segment is expected to sustain its leadership in the market.

The residential segment is expected to hold 50.1% of the fireclay tiles market revenue in 2025, establishing it as the primary application area. This dominance is linked to the rising use of fireclay tiles in kitchens, bathrooms, fireplaces, and outdoor patios, where both aesthetics and durability are crucial. The growing focus on home customization, coupled with the increasing popularity of artisanal finishes, has strengthened demand in the residential sector. Home renovation activity, particularly in developed markets, has contributed significantly to sales, as homeowners seek to enhance property value with premium finishes. Fireclay tiles’ resistance to heat, stains, and moisture makes them particularly suitable for high-traffic and functional areas. With lifestyle trends favoring personalized and long-lasting home materials, the Residential segment is expected to remain the strongest application area for fireclay tiles.

The rustic segment is projected to represent 40.1% of the fireclay tiles market revenue in 2025, reflecting a strong consumer preference for warm, natural, and textured finishes. This design style aligns with the growing popularity of traditional, farmhouse, and vintage-inspired interiors, as well as modern spaces that incorporate organic elements. Rustic fireclay tiles often feature earthy tones, handcrafted textures, and irregular edges, which add character and depth to interiors. The trend toward biophilic design and natural aesthetics in architecture has further fueled interest in rustic styles. Manufacturers have expanded offerings in this segment by combining rustic design appeal with modern performance features, ensuring broad market acceptance. As consumers increasingly seek design elements that evoke warmth and authenticity, the Rustic segment is expected to retain a prominent role in the fireclay tiles market.

The fireclay tiles market is growing due to rising demand for durable, heat-resistant, and decorative flooring and wall solutions. Adoption is driven by residential construction, hospitality projects, and industrial applications requiring premium, long-lasting tiles. Challenges include raw material price fluctuations, energy-intensive production, and compliance with fire and building regulations. Opportunities exist in customization, high-quality finishes, and integration with modern interior design trends. Manufacturers providing certified, aesthetically appealing, and robust tiles are best positioned to capture market growth. Asia-Pacific, North America, and Europe remain key regions due to urbanization, renovation projects, and increasing demand for high-end commercial and residential construction.

Fireclay tiles are valued for their robustness, chemical resistance, and ability to withstand high temperatures, making them ideal for kitchens, bathrooms, and industrial spaces. Growing urbanization, renovation of residential properties, and modern architectural trends support market growth in North America, Europe, and Asia-Pacific. Manufacturers focus on offering customized designs, vibrant colors, and textured finishes to appeal to consumer aesthetics. Adoption is further driven by the use of fireclay tiles in luxury hotels, commercial spaces, and high-end residential projects. Innovations in manufacturing techniques, including extrusion and high-temperature firing, enhance quality, durability, and visual appeal, creating opportunities for market expansion globally.

Despite rising adoption, the fireclay tiles market faces challenges from raw material costs, particularly clay, minerals, and pigments. Fluctuations in energy costs for kiln firing affect production expenses. Supply chain delays, especially in exporting finished tiles, impact project timelines. Technical constraints include achieving uniform color, strength, and water absorption rates across large-scale production. Compliance with building codes, fire-resistance standards, and environmental regulations further adds complexity for manufacturers. Buyers increasingly demand certified, high-quality, and defect-free tiles for residential and commercial projects. Companies investing in automated production, consistent quality control, and efficient logistics are better positioned to mitigate operational challenges. Overcoming production and supply challenges is essential to capture growth in global urban and industrial construction projects.

The fireclay tiles market offers opportunities driven by new construction and renovation activities in residential and commercial spaces. Luxury hotels, restaurants, and office complexes seek premium fireclay tiles for aesthetics, durability, and heat resistance. Industrial applications, including kitchens, laboratories, and manufacturing facilities, further broaden market scope. Asia-Pacific, particularly India and China, shows strong adoption due to rapid urbanization and rising disposable income. Manufacturers offering customized sizes, high-quality finishes, and eco-friendly packaging gain a competitive advantage. Collaborations with interior designers, architects, and construction contractors enhance market penetration. Expanding applications in decorative facades, flooring, and wall cladding, combined with innovative designs and functional attributes, support long-term growth prospects for fireclay tile producers globally.

Technological advancements in fireclay tile production focus on improving durability, surface finish, and color consistency. Manufacturers are adopting high-temperature firing, digital printing, and modular designs to cater to diverse consumer preferences. Customizable shapes, textures, and patterned finishes are increasing adoption in luxury and commercial projects. Integration with modern interior design trends, including minimalistic, industrial, and contemporary aesthetics, drives market growth. Digital platforms and e-commerce are enabling manufacturers to showcase products and provide technical support for installation. Suppliers offering certified, high-quality, and design-focused fireclay tiles are positioned to meet evolving market needs. Rising emphasis on durability, heat resistance, and visual appeal ensures fireclay tiles remain a preferred choice in global construction and interior design sectors.

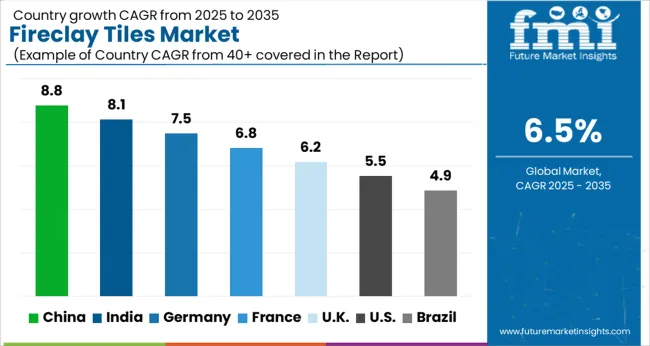

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

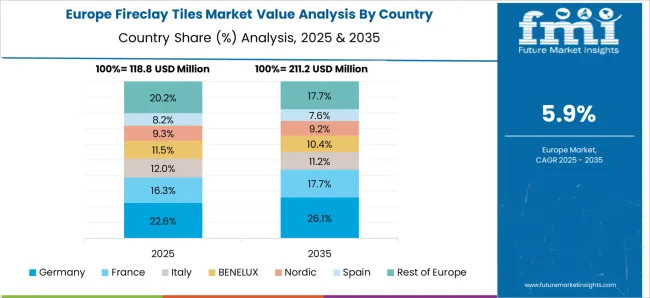

The global fireclay tiles market is projected to grow at a CAGR of 6.5% from 2025 to 2035. China (8.8%) and India (8.1%) are the fastest-growing markets, driven by rapid urbanization, residential and commercial construction, and rising demand for durable and decorative tiles. France (6.8%) emphasizes residential renovations, luxury housing, and high-quality finishes, while the UK (6.2%) benefits from remodeling projects, boutique hotels, and commercial developments. The USA (5.5%) shows moderate growth, supported by residential remodeling, corporate infrastructure, and premium interior design adoption. Key drivers include urban development, real estate expansion, interior design trends, customization, and the rise of e-commerce and retail channels. The analysis includes over 40+ countries, with the leading markets detailed below.

The fireclay tiles market in China is projected to grow at a CAGR of 8.8% from 2025 to 2035, driven by rapid urbanization, residential and commercial construction expansion, and growing interest in high-quality, durable flooring and wall solutions. Increasing investments in real estate, hospitality, and interior design projects are fueling demand for decorative and functional tiles. Manufacturers are focusing on product innovation, improved durability, aesthetic appeal, and cost-efficient production. The growing popularity of customized tile designs, eco-friendly manufacturing methods, and smart construction materials also contributes to adoption. E-commerce and modern retail channels are enhancing market accessibility, while architectural and interior design trends promote premium fireclay tile usage.

The fireclay tiles market in India is expected to grow at a CAGR of 8.1% from 2025 to 2035, supported by expanding residential, commercial, and hospitality sectors. Urbanization, infrastructure development, and increased disposable income are driving demand for decorative and functional tiles. Manufacturers are emphasizing innovative designs, high-quality production, and affordable premium options to attract middle- and high-income consumers. The real estate boom, combined with growth in hotels, restaurants, and corporate offices, is creating robust demand. Adoption of modern retail outlets and e-commerce platforms further facilitates market penetration, while interior design trends and renovation projects promote high-end fireclay tile usage.

The fireclay tiles market in France is projected to expand at a CAGR of 6.8% from 2025 to 2035, driven by residential renovations, luxury housing, and commercial projects. Consumers increasingly prefer durable, eco-friendly, and decorative tiles for kitchens, bathrooms, and living spaces. Manufacturers are focusing on high-quality fireclay production, innovative finishes, and customized designs to meet market demand. Growth is also supported by interior designers and architects incorporating fireclay tiles into modern and heritage projects. The market sees steady adoption in urban centers and luxury real estate developments.

The UK market is expected to grow at a CAGR of 6.2% from 2025 to 2035, with demand driven by residential construction, renovation projects, and commercial infrastructure development. Consumers seek high-quality, visually appealing, and functional tiles for modern living spaces. Manufacturers focus on premium finishes, customized designs, and enhanced durability. Growing interest in home remodeling, boutique hotels, and office spaces supports market expansion. E-commerce platforms and retail expansion improve accessibility, while interior design trends emphasize creative and personalized tile solutions.

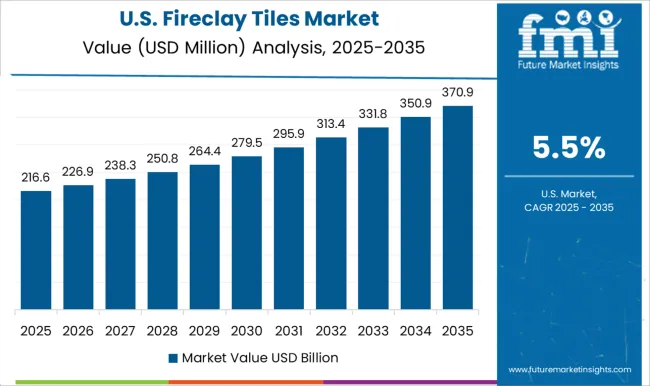

The USA fireclay tiles market is projected to grow at a CAGR of 5.5% from 2025 to 2035, supported by residential remodeling, commercial construction, and hospitality projects. Consumers increasingly adopt decorative and high-durability tiles for kitchens, bathrooms, and living spaces. Manufacturers are emphasizing innovative designs, premium finishes, and customization options. Demand is also driven by boutique hotels, luxury homes, and corporate offices seeking modern and aesthetically appealing interiors. E-commerce and retail expansion enhance product accessibility, while architectural and interior design trends continue to influence adoption.

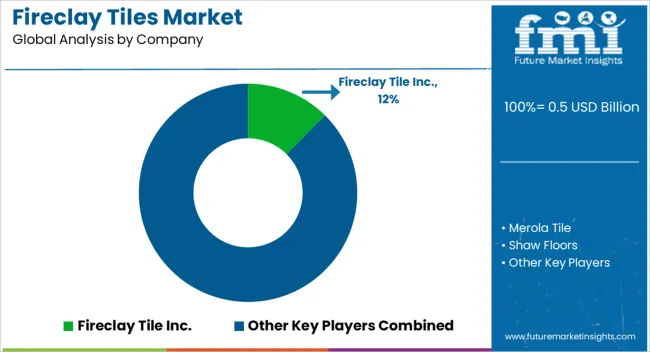

Competition in the fireclay tiles market is driven by design diversity, production quality, and the ability to serve both residential and commercial applications. Fireclay Tile Inc. maintains a strong position through handcrafted, customizable tiles emphasizing artisanal finishes and sustainability (observed industry pattern). Their offerings cater to designers and homeowners seeking unique wall and floor solutions with long-lasting durability. Merola Tile differentiates through patterned, decorative ceramic and fireclay tiles, targeting design-conscious buyers who value style and aesthetic customization. Shaw Floors leverages large-scale production, integrated flooring portfolios, and extensive distribution networks to provide fireclay tiles for both retail and commercial projects, emphasizing consistent quality and wide availability. Crossville Inc. focuses on technical expertise, blending porcelain and fireclay to offer durable, high-performance surfaces suitable for high-traffic areas, with uniform color, finish, and structural integrity. RAK Ceramics competes through large-scale manufacturing, export capabilities, and a wide variety of sizes, finishes, and textures for global markets. Mohawk Industries integrates fireclay tiles within its broader flooring solutions, emphasizing reliability, brand recognition, and a range of design options suitable for residential and commercial clients.

Porecelanosa Grupo targets premium segments with innovative textures, large-format tiles, and architectural designs appealing to luxury residential and hospitality projects. Atlas Concorde strengthens its position by offering technically superior tiles with versatile application, including interior and exterior spaces, commercial buildings, and decorative installations, emphasizing both design innovation and structural performance. Strategies across the sector focus on expanding color palettes, introducing large-format and modular tiles, and adopting digital printing technologies for intricate designs. Product brochures highlight glazed and unglazed fireclay tiles, mosaics, patterned and textured options, water-resistant and scratch-resistant finishes, and suitability for floors, walls, kitchens, and bathrooms. Collectively, these players demonstrate a market defined by a combination of design innovation, technical quality, and capacity to serve both premium and mass-market segments with consistent performance, aesthetic appeal, and reliable supply.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.5 billion |

| Product | Handmade and Others |

| Application | Residential, Commercial, and Others |

| Design Style | Rustic, Traditional, Contemporary, and Art Deco |

| End-Use | Flooring, Wall Cladding, Countertops, and Backsplashes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fireclay Tile Inc., Merola Tile, Shaw Floors, Crossville Inc., RAK Ceramics, Mohawk Industries, Porecelanosa Grupo, and Atlas Concorde |

| Additional Attributes | Dollar sales by tile type (wall, floor, decorative), material composition (clay, ceramic blends, glazed), and application (residential, commercial, hospitality). Demand is driven by architectural trends, interior design innovation, and sustainable construction practices. Regional trends show strong growth in North America, Europe, and Asia-Pacific, supported by increasing real estate development and renovation projects. |

The global fireclay tiles market is estimated to be valued at USD 0.5 billion in 2025.

The market size for the fireclay tiles market is projected to reach USD 0.9 billion by 2035.

The fireclay tiles market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in fireclay tiles market are handmade and others.

In terms of application, residential segment to command 50.1% share in the fireclay tiles market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Quarry Tiles Market Size and Share Forecast Outlook 2025 to 2035

Agri Textiles Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tiles Market Growth & Trends 2025 to 2035

Ceiling Tiles Market Growth - Trends & Forecast 2025 to 2035

Agro textiles Market

Technical Textiles Market Growth - Trends & Forecast 2025 to 2035

Market Share Insights of Leading Protective Textiles Providers

Non Lethal Projectiles Market Size and Share Forecast Outlook 2025 to 2035

Smart and Interactive Textiles Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Breathable Textiles WBT Size Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA