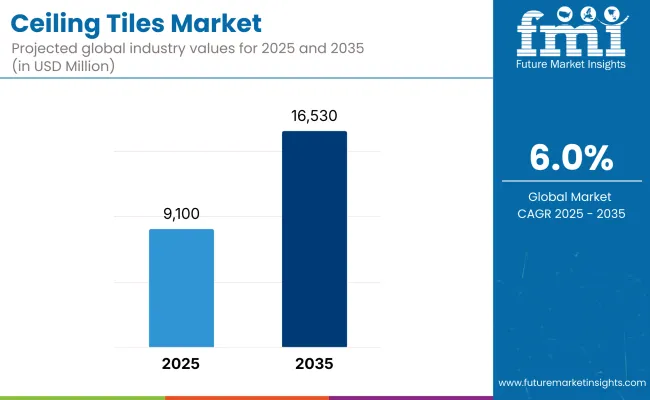

The global ceiling tiles market is positioned for steady growth, supported by an increasing demand for energy-efficient, acoustic-friendly, and visually appealing ceiling solutions across residential, commercial, and institutional sectors. The market is projected to reach USD 16,530 million by 2035, up from USD 9,100 million in 2025, expanding at a CAGR of 6.0% during the forecast period.

With ongoing urbanization and rising infrastructure spending across the globe, the demand for modern construction materials, such as ceiling tiles, is witnessing parabolic growth. Growing awareness about its importance for noise insulation, indoor comfort and sustainable design has compelled builders, architects and developers to make use of ceiling systems that serve function and aesthetic appeal.

Demand is especially strong in the commercial sector offices, retail spaces, hospitals and educational institutions-where ceiling tiles help achieve thermals efficiency, and noise control, while also adhering to modern design standards.

With the global goal of Sustainability, manufacturers are maintaining sustainability and focusing to offer innovative range of ceiling tiles made from; environmentally friendly, recyclable, and sustainable raw materials. Fire resistance, moisture resistance, ease of installation, etc. are no longer just features, they are growing expectations in the market.

Modular ceiling systems that allow for speedy replacement and low maintenance are growing in favour, particularly in retrofit or renovation projects. The trend is particularly pronounced in emerging markets in Asia and Latin America, where consumers and developers are prioritizing durability and visual impact, further propelling the uptake of high performance ceiling tile.

The future of the ceiling tiles market is expected to be on an upswing due to trends such as smart building development, integration of acoustic technologies, and green building certifications, including LEED. With a growing emphasis on energy conservation and sustainable design, ceiling tile innovations will only continue. A combination of factors including regulatory policies, customer preferences and advancements in technology will drive sustained growth in upcoming markets as ceiling tiles become a ubiquitous feature of the modern built environment.

North America holds a significant share in the global ceiling tiles market, owing to large investments in commercial infrastructure, institution renovation, and rising influence of acoustics and aesthetics in interiors. The United States commands the largest share within the region, driven by robust construction in corporate offices, educational facilities, and healthcare. Use of ceiling tiles is increasing for sound insulation and energy-efficient construction in LEED-certified green buildings.

Mineral fiber, metal and PVC ceiling tiles are likely to see increasing demand as they offer easy installation, fire resistance and low maintenance. Additionally, changes in the work environment, such as the adoption of open-plan office design, have created a demand for sound-absorbing products, making acoustic ceiling tiles one of the leading product segments.

Various ceiling tile manufacturers are experiencing a major shift to sustainable and recycled ceiling tile materials in this region due to stringent regulations and green building codes. This growth trajectory is complemented in Canada with increasing demand across commercial and mixed-use real estate developments, particularly in urban areas like Toronto and Vancouver.

Major North American manufacturers are pouring investments into modular tile systems, moisture-resistant varieties and antimicrobial coatings to address the emerging needs of schools, hospitals and airports. There’s also further developments in aesthetic designs for example, 3D textures and wood-finish tiles-find their way into hospitality and retail projects. With strong distribution networks and expanding construction activity, North America is projected to maintain a significant share in the ceiling tiles market throughout the next decade, its culture of early adoption of building technologies.

Europe is a well-developed and eco-friendly ceiling tiles market, which is distinguished by tough energy regulations of buildings (commercial and residential), updates of historical buildings, and a global concern on sustainability & eco-friendly design. Crème de la crème countries like Germany, the UK and France benefit from a strong renovation sector and massive investments in renovation.

A strong demand for energy-efficient and noise-mitigating buildings particularly at educational and governmental facilities remains a center of momentum behind the adoption of thermally and acoustically efficient ceiling systems. These are especially accompanied by lightweight, modular, and elegantly layered tile solutions in European design trends, with an emphasis on the use of bio-based materials and non-toxic additives under the principles of a circular economy.

The industrial expansion in Eastern Europe, along with government initiatives for public building restoration, gives traction to the market in countries like Poland and the Czech Republic. Integrated solutions such as ceiling tiles with lighting and HVAC are making their mark across North America, driven by demand in the smart building sector. The region often prefers suspended ceiling grids in commercial and institutional buildings for flexibility and accessibility in service maintenance.

Strong demand is coming from the rise of coworking spaces and the conversion of heritage structures to modern offices, which requires custom and fire-retardant tile solutions. European manufacturers, while grappling with cost pressures from raw material imports and energy costs, have maintained competitive strength through digital integration, durability, and compliance with eco-labelling to meet the high-performance standards expected of products in this mature market.

The fastest-increasing area in the ceiling tiles market is Asia-Pacific, which is due to rapid urban growth, infrastructure improvement, and the growth of the commercial property market. China will continue to be the largest market driven by a richly stocked construction pipeline, government driven urban redevelopment initiatives and increasing incorporation of modern acoustic and thermal control systems into new buildings.

Mineral fiber and PVC ceiling tiles find the highest demand in the office, hospital and transit infrastructure segments of the Chinese market, as these products are fairly affordable and easy to install. Japan and South Korea dominate the market with technologically innovated, compact, and aesthetic interior solutions, predominantly in urban residential and commercial spaces.

With exploding IT, metro rail and increasing investments in smart cities and new-age educational institutions, India is emerging as a high-growth market. Yet, affordability continues to be a key driver of product selection in emerging markets. National firms are occupying local space, not only expanding their ceiling capacity, but also diversifying their portfolio into gypsum and laminated ceiling tiles to meet increasing demand.

In addition, countries in Southeast Asia, including Vietnam, Indonesia, and the Philippines, also seem to be generating positive momentum primarily from their commercial real estate and tourism-related infrastructure investments, driving demand for ceiling tiles as new hotel and retail spaces spring up in these countries.

Although Asia-Pacific presents various challenges like a general lack of standardization and a disjointed supplier network, the region's heterogeneity and incredibly dynamic construction sector, increasing middle-class population, and supportive governmental policies are rendering Asia-Pacific one the most important driving forces behind the global ceiling tiles market.

Raw Material Volatility and Installation Complexity

The ceiling tiles market is revolving around this element most of the raw materials used in mineral fiber, metal and gypsum-based ceiling tiles face constant price volatility. Changes in the global supply of these materials as well as inflationary pressures determine the cost of manufacturing and profit margins.

Moreover, their difficult handling and complicated installs require skilled labour, driving up overhead costs for commercial and institutional work. Fire-resistance ratings, acoustic performance, and sustainability certifications all require stringent testing,complicating production cycles, as well.

Green Building Initiatives and Acoustic Innovations

As green construction practices and energy-efficient building designs become increasingly popular, ceiling tile manufacturers will have significant opportunities ahead. Modern office spaces, schools, and healthcare facilities are utilizing acoustic ceiling solutions that improve the quality of indoor sound.

And innovations, from antimicrobial tiles to recycled-content panels to modular designs,further support functionality and sustainability goals. Prospects of government subsidies for green buildings and surging demand for decorative ceiling treatment in the hospitality and residential sector are likely to fuel the market.

The global ceiling tiles market exhibited moderate growth from 2020 to 2024, as the construction industry experienced stagnation during the COVID-19 pandemic. Renovation projects in advanced economies and a bounce in commercial building activity kept demand from being pushed out. There was continued focus on solutions that were cost-effective and quick to install, particularly when it came to tiles, where mineral fiber tiles dominated the market, offering a good balance of price and performance.

The market is expected to move towards high-end multi-purpose systems in 2025 to 2035. The trend will involve high-performance tiles incorporating lighting, HVAC diffusers, and IoT-enabled sensors. As indoor air quality regulations tighten, expect further adoption of bio-based materials and low-VOC coatings. Emerging economies will see growth mainly in Asia and the Middle East due to ultra-urbanization, booming infrastructure spending, and growing commercial real estate sectors.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Construction Industry Influence | Focus on post-pandemic recovery and commercial renovations |

| Technology Integration | Basic suspension systems and standard panels |

| Sustainability Focus | Use of recycled content and low-VOC materials in niche segments |

| Material Usage | Mineral fiber tiles dominate |

| Design Preferences | Standardized white tiles for cost efficiency |

| Market Expansion Regions | North America and Europe led growth |

| End-User Demand | Office spaces and retail centers |

| Regulatory Landscape | Moderate compliance for fire and acoustics |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Construction Industry Influence | Strong growth from new urban development and smart city projects |

| Technology Integration | Multi-functional ceiling systems with embedded tech and smart sensors |

| Sustainability Focus | Mainstream adoption of eco-friendly and biodegradable materials |

| Material Usage | Rise of composite, wood wool, metal, and bio-based ceiling tiles |

| Design Preferences | Custom textures, colours , and 3D printed acoustic tile designs |

| Market Expansion Regions | Asia Pacific, Middle East, and Africa emerge as key demand centers |

| End-User Demand | Growth in healthcare, hospitality, education, and mixed-use buildings |

| Regulatory Landscape | Stringent norms for energy efficiency, air quality, and environmental impact |

The USA continues to be a big player in the ceiling tiles market, backed by strong spending in commercial build-out projects, renovation projects, and green building practices. As energy efficiency and acoustics in buildings become a bigger focus, the need for all-new ceiling systems has steadily increased.

Demand for ceiling tiles is expected to increase from commercial verticals such as schools, hospitals, offices, and retail space, which will be further supported by robust distributor networks and growing use of modular construction methods. Sales of recyclable and low-emission ceiling tiles are also getting a boost from LEED certification trends and government promotion of green buildings.

| Country | CAGR (2025 to 2035) |

|---|---|

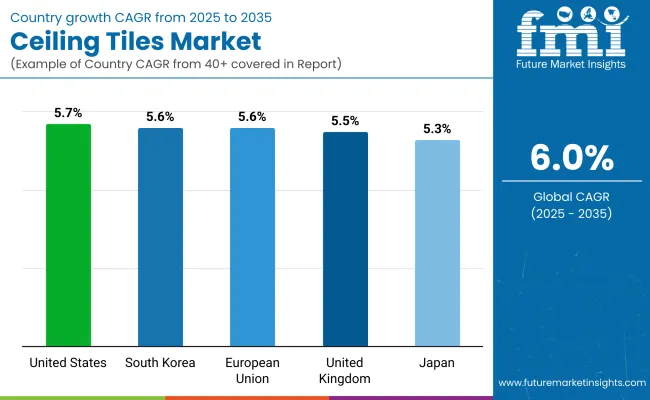

| United States | 5.7% |

The ceiling tiles market in the UK is growing steadily owing to the growing refurbishment activities in the education and healthcare sectors. The increasing prescriptive requirement of suspended ceiling systems to achieve better acoustical control and thermal insulation in vintage structures is one of the factors driving the adoption of ceiling tiles. Additionally, the demand for energy-efficient building envelopes and adherence to strict building codes is spurring the use of high-performance ceiling materials in commercial interiors.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.5% |

The demand for different types of tiles such as mineral fiber, metal, and gypsum-based tiles has been propelling the European Union ceiling tiles market owing to strict regulations with regard to energy and fire safety. Germany, France, and The Netherlands something like this is assisting increasing commercial construction, and awareness for green accreditations are pushing adoption.

Aging government and office building retrofitting, a significant component behind growth, is also amongst the factors driving, where sustainability initiatives are driving manufacturers to produce recyclable and low-VOC ceiling solutions.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.6% |

Seismic safety standards and space optimization requirements shape the ceiling tiles market in Japan. In seismic zones, modular and lightweight ceiling tiles are recommended for use. In addition, Japan's high expectations of aesthetic design and hygiene in indoor spaces are bolstering the demand for anti-microbial and easy-care ceiling tiles in its public buildings. Market expansion is also being aided through the renovation of older buildings to bring them in line with modern design trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

In South Korea, the demand for high-performance ceiling tiles is supported by the development of urban infrastructure and smart building initiatives. Also, the increasing commercial real estate sector such as office buildings, hotels and shopping complexes is propelling product demand.

The rise in demand for interior design, soundproofing, and HVAC integration is leading to the adoption of advanced ceiling solutions. South Korea’s wired population is also amenable to a digital ceiling tile system with lighting or air purification embedded in the surface.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

The global ceiling tiles market is receiving continuous growth as the commercial constructions, refurbishment of old structures, and an increasing demand for aesthetic and acoustic interior solutions. They are suitable for offices, healthcare, educational institutions, and retail spaces for their functional and decorative advantages such as sound absorption, insulation, and fire resistance.

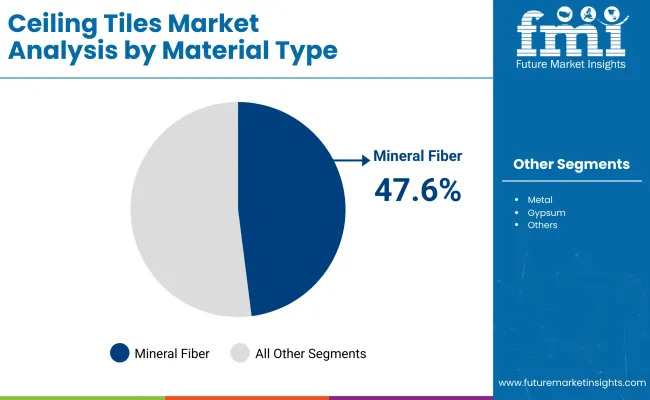

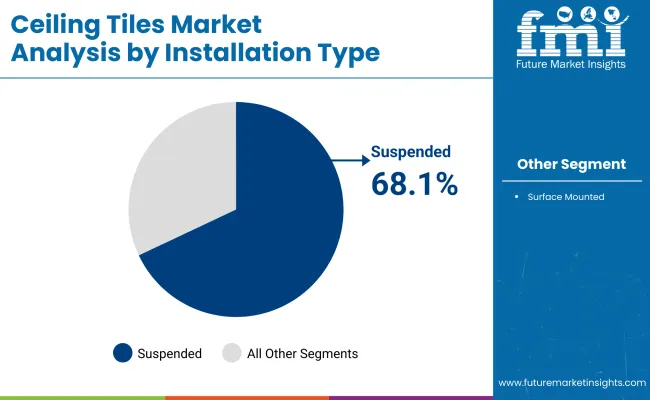

The market is segmented by material type into mineral fiber, metal, wood & engineered wood, gypsum, and others; and, by installation type into suspended and surface mounted. This includes mineral fiber tiles and suspended installations, which represent a high degree of preference for cost-effective, flexible, and high-performance solutions.

Mineral Fiber Tiles Dominate Due to Affordability and Acoustic Performance

Mineral fiber ceiling tiles were estimated to hold the market share of 47.6% in 2025 owing to their superior acoustic properties, cost-effectiveness, resistance to fire and ease of application. These types of tiles are more common in commercial and institutional buildings, where noise control and the appearance of the ceiling matter significantly.

Its lightweight structure, recycled material, and availability in various textures and finishing enhance its market-leading capabilities. Furthermore, growing green building activities and the demand for green building materials are also contributing to the growth of mineral fiber tiles.

Suspended Installation Leads as Modular Ceiling Systems Gain Popularity

In 2025, suspended ceiling was estimated to account for 68.1% of the ceiling tiles market share, On account of their versatility, ease of maintenance, and for hiding HVAC and wiring systems. Often used in commercial environments, these systems enable quick access to overhead utilities, and can accommodate a range of tile materials. Their modular style allows for easy swapping and additionalization, which is a boon in the corporate office, hospital, and retail settings where function needs to follow form.

Insulation - the original roof dowel is a store fixture used to hold a product to enhance visibility, thereby resulting in a sale. Trends like the refurbishment of ageing buildings, sustainability and modular construction are leading to increased adoption of innovative ceilings. The manufacturers are trying to remain in the race, and that's why in 2024 and 2025, they are concentrating on recyclable materials, smart acoustic integration, moisture-resistant technologies, etc.

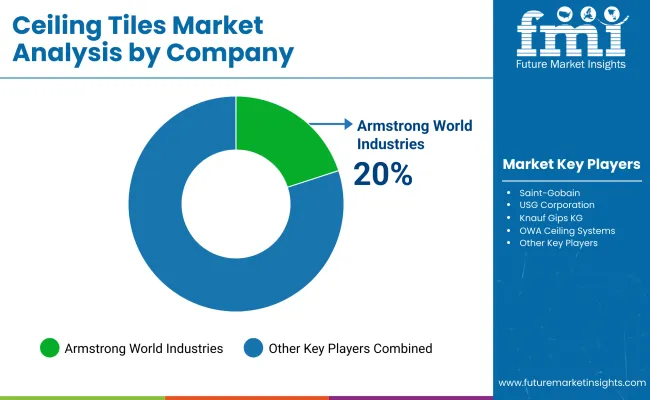

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Armstrong World Industries | Launched Total Acoustics ceiling systems with high NRC ratings in 2024. |

| Saint-Gobain (Ecophon) | Introduced Eco-friendly mineral wool ceiling panels for schools and hospitals in 2025. |

| USG Corporation | Rolled out moisture and mold-resistant ceiling tiles for high-humidity environments in 2024. |

| Knauf Gips KG | Unveiled sustainable gypsum-based ceiling solutions with low VOC emissions in 2025. |

Key Market Insights

Armstrong World Industries (20-24%)

Armstrong remains the global leader with a wide range of commercial ceiling tile systems. Its strong portfolio in acoustics and modular ceiling design-coupled with expansion into grid-integrated lighting systems-has helped solidify its position in 2024 and 2025.

Saint-Gobain (Ecophon) (14-17%)

Ecophon continues to lead in sustainable ceiling solutions with a focus on schools, hospitals, and offices. The firm’s emphasis on sound absorption and circular materials supports ESG initiatives and green certifications.

USG Corporation (13-16%)

With innovations targeting moisture-prone and healthcare environments, USG’s performance ceiling products remain in high demand. The company expanded its custom design options and antimicrobial tiles in 2024 to appeal to institutional clients.

Knauf Gips KG (9-12%)

Knauf’s integration of gypsum ceilings with thermal and acoustic insulation has gained traction across Europe and North America. Its 2025 offerings highlight lightweight, fire-rated ceiling tilesthat support modular construction needs.

Other Key Players (31-39% Combined)

These include

The overall market size was USD 9,100 million in 2025.

The market is expected to reach USD 16,530 million in 2035.

Demand will be driven by rising adoption of sustainable construction practices, increased focus on indoor aesthetics, and the need for better acoustic insulation.

The top 5 contributing countries are United States, China, Germany, United Kingdom, and India.

The mineral fiber and suspended installation segment is expected to lead, owing to increasing renovations and construction of offices, retail spaces, and hospitality establishments.

Table 01: Global Market Size (US$ million) and Volume (million Sq. Meter) Analysis and Forecast By Material Type, 2018 to 2033

Table 02: Global Market Size (US$ million) and Volume (million Sq. Meter) Analysis and Forecast By Installation Type, 2018 to 2033

Table 03: Global Market Size Volume (million Sq. Meter) Analysis and Forecast By End Use, 2018 to 2033

Table 04: Global Market Size Value (US$ million) Analysis and Forecast By End Use, 2018 to 2033

Table 05: Global Market Size Volume (million Sq. Meter) Analysis and Forecast By Region, 2018 to 2033

Table 06: Global Market Size Volume (million Sq. Meter) Analysis and Forecast By Region, 2018 to 2033

Table 07: North America Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Country, 2018 to 2033

Table 08: North America Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Material Type, 2018 to 2033

Table 09: North America Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Installation Type, 2018 to 2033

Table 10: North America Market Size Volume (Sq. Meter) Analysis and Forecast By End Use, 2018 to 2033

Table 11: North America Market Size Value (US$ million) Analysis and Forecast By End Use, 2018 to 2033

Table 12: Latin America Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Country, 2018 to 2033

Table 13: Latin America Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Material Type, 2018 to 2033

Table 14: Latin America Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Installation Type, 2018 to 2033

Table 15: Latin America Market Size Volume (Sq. Meter) Analysis and Forecast By End Use, 2018 to 2033

Table 16: Latin America Market Size Value (US$ million) Analysis and Forecast By End Use, 2018 to 2033

Table 17: Western Europe Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Country, 2018 to 2033

Table 18: Western Europe Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Material Type, 2018 to 2033

Table 19: Western Europe Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Installation Type, 2018 to 2033

Table 20: Western Europe Market Size Volume (Sq. Meter) Analysis and Forecast By End Use, 2018 to 2033

Table 21: Western Europe Market Size Value (US$ million) Analysis and Forecast By End Use, 2018 to 2033

Table 22: Eastern Europe Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Country, 2018 to 2033

Table 23: Eastern Europe Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Material Type, 2018 to 2033

Table 24: Eastern Europe Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Installation Type, 2018 to 2033

Table 25: Eastern Europe Market Size Volume (Sq. Meter) Analysis and Forecast By End Use, 2018 to 2033

Table 26: Eastern Europe Market Size Value (US$ million) Analysis and Forecast By End Use, 2018 to 2033

Table 27: Central Asia Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Material Type, 2018 to 2033

Table 28: Central Asia Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Installation Type, 2018 to 2033

Table 29: Central Asia Market Size Volume (Sq. Meter) Analysis and Forecast By End Use, 2018 to 2033

Table 30: Central Asia Market Size Value (US$ million) Analysis and Forecast By End Use, 2018 to 2033

Table 31: Balkan & Baltic Countries Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Material Type, 2018 to 2033

Table 32: Balkan & Baltic Countries Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Installation Type, 2018 to 2033

Table 33: Balkan & Baltic Countries Market Size Volume (Sq. Meter) Analysis and Forecast By End Use, 2018 to 2033

Table 34: Balkan & Baltic Countries Market Size Value (US$ million) Analysis and Forecast By End Use, 2018 to 2033

Table 35: Russia & Belarus Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Material Type, 2018 to 2033

Table 36: Russia & Belarus Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Installation Type, 2018 to 2033

Table 37: Russia & Belarus Market Size Volume (Sq. Meter) Analysis and Forecast By End Use, 2018 to 2033

Table 38: Russia & Belarus Market Size Value (US$ million) Analysis and Forecast By End Use, 2018 to 2033

Table 39: East Asia Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Country, 2018 to 2033

Table 40: East Asia Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Material Type, 2018 to 2033

Table 41: East Asia Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Installation Type, 2018 to 2033

Table 42: East Asia Market Size Volume (Sq. Meter) Analysis and Forecast By End Use, 2018 to 2033

Table 43: East Asia Market Size Value (US$ million) Analysis and Forecast By End Use, 2018 to 2033

Table 44: South Asia Pacific Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Country, 2018 to 2033

Table 45: South Asia Pacific Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Material Type, 2018 to 2033

Table 46: South Asia Pacific Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Installation Type, 2018 to 2033

Table 47: South Asia Pacific Market Size Volume (Sq. Meter) Analysis and Forecast By End Use, 2018 to 2033

Table 48: South Asia Pacific Market Size Value (US$ million) Analysis and Forecast By End Use, 2018 to 2033

Table 49: Middle East and Africa Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Country, 2018 to 2033

Table 50: Middle East & Africa Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Material Type, 2018 to 2033

Table 51: Middle East & Africa Market Size (US$ million) and Volume (Sq. Meter) Analysis and Forecast By Installation Type, 2018 to 2033

Table 52: Middle East & Africa Market Size Volume (Sq. Meter) Analysis and Forecast By End Use, 2018 to 2033

Table 53: Middle East & Africa Market Size Value (US$ million) Analysis and Forecast By End Use, 2018 to 2033

Figure 01: Global Historical Market Volume (million Sq. Meter) Analysis, 2018 to 2022

Figure 02: Global Current and Future Market Volume (million Sq. Meter) Analysis, 2023 to 2033

Figure 03: Global Historical Value (US$ million), 2018 to 2022

Figure 04: Global Value (US$ million) Forecast, 2023 to 2033

Figure 05: Global Absolute $ Opportunity, 2018 to 2023 and 2033

Figure 06: Global Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 07: Global Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 08: Global Market Attractiveness Analysis By Material Type, 2023 to 2033

Figure 09: Global Market Absolute $ Opportunity by Mineral Fiber Segment, 2018 to 2033

Figure 10: Global Market Absolute $ Opportunity by Metal Segment, 2018 to 2033

Figure 11: Global Market Absolute $ Opportunity by Wood & Engineered Wood Segment, 2018 to 2033

Figure 12: Global Market Absolute $ Opportunity by Gypsum Segment, 2018 to 2033

Figure 13: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 14: Global Market Share and BPS Analysis By Installation Type, 2023 & 2033

Figure 15: Global Market Y-o-Y Growth Projections By Installation Type, 2023 to 2033

Figure 16: Global Market Attractiveness Analysis By Installation Type, 2023 to 2033

Figure 17: Global Market Absolute $ Opportunity by Suspended Segment, 2018 to 2033

Figure 18: Global Market Absolute $ Opportunity by Surface Mounted Segment, 2018 to 2033

Figure 19: Global Market Share and BPS Analysis By End Use, 2023 & 2033

Figure 20: Global Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 21: Global Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 22: Global Market Absolute $ Opportunity by Residential Segment, 2018 to 2033

Figure 23: Global Market Absolute $ Opportunity by Commercial Segment, 2018 to 2033

Figure 24: Global Market Absolute $ Opportunity by Industrial Segment, 2018 to 2033

Figure 25: Global Market Share and BPS Analysis By Region, 2023 & 2033

Figure 26: Global Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 27: Global Market Attractiveness Analysis By Region, 2023 to 2033

Figure 28: Global Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 29: Global Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 30: Global Market Absolute $ Opportunity by Western Europe Segment, 2018 to 2033

Figure 31: Global Market Absolute $ Opportunity by Eastern Europe Segment, 2018 to 2033

Figure 32: Global Market Absolute $ Opportunity by Central Asia Segment, 2018 to 2033

Figure 33: Global Market Absolute $ Opportunity by Balkan & Baltic Countries Segment, 2018 to 2033

Figure 34: Global Market Absolute $ Opportunity by Russia & Belarus Segment, 2018 to 2033

Figure 35: Global Market Absolute $ Opportunity by East Asia Segment, 2018 to 2033

Figure 36: Global Market Absolute $ Opportunity by South Asia Pacific Segment, 2018 to 2033

Figure 37: Global Market Absolute $ Opportunity by Middle East & Africa Segment, 2018 to 2033

Figure 38: North America Market Share and BPS Analysis By Country, 2023 & 2033

Figure 39: North America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 40: North America Market Attractiveness Analysis By Country, 2023 to 2033

Figure 41: North America Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 42: North America Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 43: North America Market Attractiveness Analysis By Material Type, 2023 to 2033

Figure 44: North America Market Share and BPS Analysis By Installation Type, 2023 & 2033

Figure 45: North America Market Y-o-Y Growth Projections By Installation Type, 2023 to 2033

Figure 46: North America Market Attractiveness Analysis By Installation Type, 2023 to 2033

Figure 47: North America Market Share and BPS Analysis By End Use, 2023 & 2033

Figure 48: North America Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 49: North America Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 50: Latin America Market Share and BPS Analysis By Country– 2023 & 2033

Figure 51: Latin America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 52: Latin America Market Attractiveness Projections By Country, 2023 to 2033

Figure 53: Latin America Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 54: Latin America Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 55: Latin America Market Attractiveness Analysis By Material Type, 2023 to 2033

Figure 56: Latin America Market Share and BPS Analysis By Installation Type, 2023 & 2033

Figure 57: Latin America Market Y-o-Y Growth Projections By Installation Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness Analysis By Installation Type, 2023 to 2033

Figure 59: Latin America Market Share and BPS Analysis By End Use, 2023 & 2033

Figure 60: Latin America Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 61: Latin America Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 62: Western Europe Market Share and BPS Analysis By Country– 2023 & 2023

Figure 63: Western Europe Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 64: Western Europe Market Attractiveness Index By Country, 2023 to 2033

Figure 65: Western Europe Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 66: Western Europe Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 67: Western Europe Market Attractiveness Analysis By Material Type, 2023 to 2033

Figure 68: Western Europe Market Share and BPS Analysis By Installation Type, 2023 & 2033

Figure 69: Western Europe Market Y-o-Y Growth Projections By Installation Type, 2023 to 2033

Figure 70: Western Europe Market Attractiveness Analysis By Installation Type, 2023 to 2033

Figure 71: Western Europe Market Share and BPS Analysis By End Use, 2023 & 2033

Figure 72: Western Europe Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 73: Western Europe Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 74: Eastern Europe Market Share and BPS Analysis By Country– 2023 & 2023

Figure 75: Eastern Europe Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 76: Eastern Europe Market Attractiveness Index By Country, 2023 to 2033

Figure 77: Eastern Europe Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 78: Eastern Europe Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 79: Eastern Europe Market Attractiveness Analysis By Material Type, 2023 to 2033

Figure 80: Eastern Europe Market Share and BPS Analysis By Installation Type, 2023 & 2033

Figure 81: Eastern Europe Market Y-o-Y Growth Projections By Installation Type, 2023 to 2033

Figure 82: Eastern Europe Market Attractiveness Analysis By Installation Type, 2023 to 2033

Figure 83: Eastern Europe Market Share and BPS Analysis By End Use, 2023 & 2033

Figure 84: Eastern Europe Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 85: Eastern Europe Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 86: Central Asia Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 87: Central Asia Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 88: Central Asia Market Attractiveness Analysis By Material Type, 2023 to 2033

Figure 89: Central Asia Market Share and BPS Analysis By Installation Type, 2023 & 2033

Figure 90: Central Asia Market Y-o-Y Growth Projections By Installation Type, 2023 to 2033

Figure 91: Central Asia Market Attractiveness Analysis By Installation Type, 2023 to 2033

Figure 92: Central Asia Market Share and BPS Analysis By End Use, 2023 & 2033

Figure 93: Central Asia Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 94: Central Asia Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 95: Balkan & Baltic Countries Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 96: Balkan & Baltic Countries Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 97: Balkan & Baltic Countries Market Attractiveness Analysis By Material Type, 2023 to 2033

Figure 98: Balkan & Baltic Countries Market Share and BPS Analysis By Installation Type, 2023 & 2033

Figure 99: Balkan & Baltic Countries Market Y-o-Y Growth Projections By Installation Type, 2023 to 2033

Figure 100: Balkan & Baltic Countries Market Attractiveness Analysis By Installation Type, 2023 to 2033

Figure 101: Balkan & Baltic Countries Market Share and BPS Analysis By End Use, 2023 & 2033

Figure 102: Balkan & Baltic Countries Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 103: Balkan & Baltic Countries Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 104: Russia & Belarus Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 105: Russia & Belarus Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 106: Russia & Belarus Market Attractiveness Analysis By Material Type, 2023 to 2033

Figure 107: Russia & Belarus Market Share and BPS Analysis By Installation Type, 2023 & 2033

Figure 108: Russia & Belarus Market Y-o-Y Growth Projections By Installation Type, 2023 to 2033

Figure 109: Russia & Belarus Market Attractiveness Analysis By Installation Type, 2023 to 2033

Figure 110: Russia & Belarus Market Share and BPS Analysis By End Use, 2023 & 2033

Figure 111: Russia & Belarus Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 112: Russia & Belarus Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 113: East Asia Market Share and BPS Analysis By Country– 2023 & 2033

Figure 114: East Asia Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 115: East Asia Market Attractiveness Projections By Country, 2023 to 2033

Figure 116: East Asia Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 117: East Asia Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness Analysis By Material Type, 2023 to 2033

Figure 119: East Asia Market Share and BPS Analysis By Installation Type, 2023 & 2033

Figure 120: East Asia Market Y-o-Y Growth Projections By Installation Type, 2023 to 2033

Figure 121: East Asia Market Attractiveness Analysis By Installation Type, 2023 to 2033

Figure 122: East Asia Market Share and BPS Analysis By End Use, 2023 & 2033

Figure 123: East Asia Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 124: East Asia Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 125: South Asia & Pacific Market Share and BPS Analysis By Country– 2023 & 2023

Figure 126: South Asia & Pacific Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 127: South Asia & Pacific Market Attractiveness Index By Country, 2023 to 2033

Figure 128: South Asia Pacific Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 129: South Asia Pacific Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 130: South Asia Pacific Market Attractiveness Analysis By Material Type, 2023 to 2033

Figure 131: South Asia Pacific Market Share and BPS Analysis By Installation Type, 2023 & 2033

Figure 132: South Asia Pacific Market Y-o-Y Growth Projections By Installation Type, 2023 to 2033

Figure 133: South Asia Pacific Market Attractiveness Analysis By Installation Type, 2023 to 2033

Figure 134: South Asia Pacific Market Share and BPS Analysis By End Use, 2023 & 2033

Figure 135: South Asia Pacific Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 136: South Asia Pacific Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 137: Middle East & Africa Market Share and BPS Analysis By Country– 2023 & 2023

Figure 138: Middle East & Africa Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 139: Middle East & Africa Market Attractiveness Index By Country, 2023 to 2033

Figure 140: Middle East & Africa Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 141: Middle East & Africa Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 142: Middle East & Africa Market Attractiveness Analysis By Material Type, 2023 to 2033

Figure 143: Middle East & Africa Market Share and BPS Analysis By Installation Type, 2023 & 2033

Figure 144: Middle East & Africa Market Y-o-Y Growth Projections By Installation Type, 2023 to 2033

Figure 145: Middle East & Africa Market Attractiveness Analysis By Installation Type, 2023 to 2033

Figure 146: Middle East & Africa Market Share and BPS Analysis By End Use, 2023 & 2033

Figure 147: Middle East & Africa Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 148: Middle East & Africa Market Attractiveness Analysis By End Use, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ceiling Fan Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Ceiling Cassettes Market

Train Ceiling Modules Market

Suspended Ceiling System Market Growth - Trends & Forecast 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

Quarry Tiles Market Size and Share Forecast Outlook 2025 to 2035

Agri Textiles Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tiles Market Growth & Trends 2025 to 2035

Agro textiles Market

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Technical Textiles Market Growth - Trends & Forecast 2025 to 2035

Market Share Insights of Leading Protective Textiles Providers

Non Lethal Projectiles Market Size and Share Forecast Outlook 2025 to 2035

Smart and Interactive Textiles Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Breathable Textiles WBT Size Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA