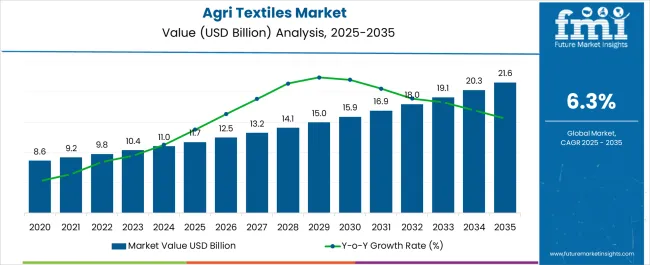

The Agri Textiles Market is estimated to be valued at USD 11.7 billion in 2025 and is projected to reach USD 21.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Agri Textiles Market Estimated Value in (2025 E) | USD 11.7 billion |

| Agri Textiles Market Forecast Value in (2035 F) | USD 21.6 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The agri textiles market is witnessing consistent growth, driven by increasing adoption of protective and yield-enhancing textile solutions in agriculture. Rising concerns about climate variability, crop losses, and soil degradation are encouraging farmers and agricultural enterprises to integrate specialized textile-based applications that improve productivity and sustainability. The ability of agri textiles to protect crops from excessive sunlight, wind, pests, and moisture fluctuations is reinforcing their use across both open-field farming and greenhouse systems.

Governments in emerging and developed economies are supporting the expansion of sustainable farming practices, which is further strengthening demand. Technological advancements in polymer processing, weaving, and coating are enhancing the durability and cost-effectiveness of agri textiles, making them more accessible to a wider base of growers.

The growing emphasis on water conservation and controlled cultivation is also accelerating adoption, as these solutions help reduce resource wastage while maintaining crop health With the rising global population and increasing pressure on food supply chains, agri textiles are expected to remain central to agricultural modernization and sustainable productivity initiatives worldwide.

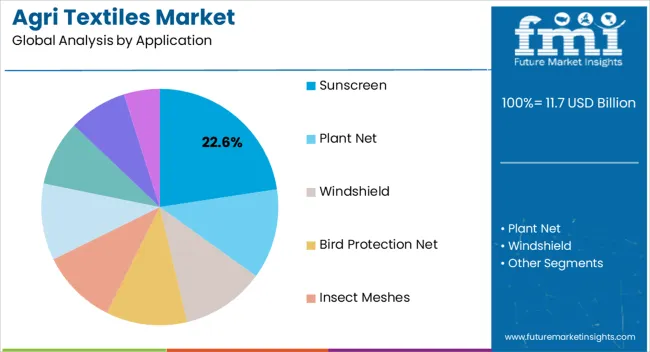

The agri textiles market is segmented by application, techniques, and geographic regions. By application, agri textiles market is divided into Sunscreen, Plant Net, Windshield, Bird Protection Net, Insect Meshes, Nets for pallet covering, Cherry Covers, Packaging Materials for Agriculture Products, and Others (Includes Ground Cover, Tape Nets, Turf Protection Net). In terms of techniques, agri textiles market is classified into Woven, Nonwoven, Stitch Bonded Nonwoven, Needle Punch Nonwoven, Spun Bonded Nonwoven, Hydro Entangled Nonwoven, Thermally Bonded Nonwoven, Wet Nonwoven, and Knitted. Regionally, the agri textiles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sunscreen application segment is projected to hold 22.6% of the agri textiles market revenue share in 2025, making it the leading application. This dominance is being supported by the growing need to protect crops from harmful ultraviolet radiation and excessive heat exposure, which can negatively impact growth cycles and yields. Sunscreen textiles offer effective shading, regulating light intensity and temperature in cultivation environments, ensuring optimal plant development and improved quality of produce.

The increasing use of these solutions in both horticulture and floriculture has reinforced their adoption, particularly in regions with high solar intensity. Farmers are prioritizing sunscreen applications for their ability to extend growing seasons and reduce crop damage from harsh weather conditions.

Rising focus on sustainable agricultural practices has further encouraged the deployment of protective textiles that enhance water efficiency and reduce reliance on chemical treatments As climate-related challenges intensify globally, sunscreen applications are expected to continue leading adoption within the agri textiles market due to their proven role in improving crop resilience and yield outcomes.

The woven techniques segment is anticipated to account for 26.9% of the agri textiles market revenue share in 2025, positioning it as the dominant technique. Its leadership is being driven by the durability, versatility, and cost-effectiveness of woven textiles, which make them suitable for a wide range of agricultural uses. Woven structures provide excellent strength and stability, ensuring long-term protection for crops, soil, and water resources.

The ability of woven textiles to resist tearing and withstand harsh environmental conditions has reinforced their demand in both large-scale farming and smallholder cultivation. These textiles are being widely adopted for applications such as shading, soil stabilization, wind protection, and water management. Manufacturers are also focusing on developing woven textiles with advanced UV stabilization and biodegradable materials, aligning with global sustainability goals.

The cost advantage of woven techniques compared to other textile methods, coupled with their proven field performance, is driving large-scale adoption As farmers and agricultural enterprises increasingly seek reliable and affordable protective solutions, woven textiles are expected to maintain their leadership in the market.

One of the main causes driving the demand for Agri textiles is the growing difficulties farmers in the agricultural sector face, such as crop protection and weed control, to improve the total yield. In addition, governments in many nations are encouraging the use of high-tech farming methods due to the shrinking arable land area and rising food insecurity. This, in turn, is assisting in the market's expansion. Agri textiles made from natural fibres are also becoming more popular globally as a result of rising environmental concerns, the trend toward sustainable farming, and the advent of landfill regulations.

These fabrics provide UV protection and mitigate the impacts of wind-induced evapotranspiration, which lowers the demand for water, weedkillers, and fertilisers while minimising desiccation and product degradation. This is expected to propel the market along with the increased focus on creating intelligent, high-performance materials employing contemporary technology.

Using agricultural textiles helps increase crop productivity in accordance with market demands. Rapid urbanisation has boosted peoples' disposable income, which has led to an increase in food expenditures. The COVID-19 epidemic, as well as fluctuations in the pricing of raw materials like nylon, wool, and polyester, added to the market's complexity. The pandemic caused numerous downturns in the worldwide economy due to supply chain disruptions brought on by lockdowns and restrictions. However, as a result of the relaxations offered, things are beginning to normalise, and businesses are recovering.

The demand for shade nets is mostly driven by an increase in building and construction activity. For safety and protection, these shade nets are often used. Technological developments help products flourish and offer huge potential to the main players. After a yield is achieved, growing consumer knowledge of crop protection is anticipated to spur market expansion.

The global rise in pollution levels, escalating temperatures, and expanding need to preserve crops are all contributing to the growth of the agricultural textile industry. The use of modern agricultural practices by farmers is growing, which is a further driver of market expansion. The market value is also being driven by ongoing attention to improvements in textile materials. Better crop quality and greater overall production are two of the key benefits of using these materials, which also help to increase market demand.

Textile industry has a long history of applications in agriculture sector. The term agri textiles is used to classify the knitted, woven and nonwoven fabrics which are used in horticulture and agriculture uses. The usage of textiles in agriculture has also expanded to safeguard the agriculture products such as fruits, vegetables and plants from birds, weed and weather.

Moreover, with continuous upsurge in population globally, the stress on the agriculture crops has increased. Henceforth, it is essential to increase the quality and yield of agriculture products. Nylon, polyolefin, polyethylene and polyester are some of the fiber materials that are used in different techniques in agri textiles.

The exceptional ecological resistance, mechanical properties, robustness and processability of agri textiles can improve the quality, quantity and safety of agriculture products.

This acts as a key driver for global agri textiles market. Agri textiles in the form of knitted textiles are also extensively used for many agricultural end uses mainly due to its ease of transport, performance ratio, favorable price and long service lifespan.

Also, the favorable policies is leading to growth in the global agri textiles market. Strengthen government regulations may act as a restraint for the global agri textiles market.

In the nonwoven techniques, the needle punch and spun bonded nonwoven techniques are majorly used for the production of nonwoven agri textiles. The spun bonded fabrics have constant and high tensile strength in every direction.

Furthermore, the nonwoven technique segment is anticipated to grow at a significant CAGR during the forecast period mainly due to its better suitability and economy for various applications.

Asia Pacific is expected to hold majority of the global agri textiles regional market share. Moreover, the demand for agri textiles in Asia Pacific is expected to rise in the coming years due to rapid agriculture industry development in countries such as China, India and South Korea.

In addition, as an emerging economic authority, China and India have remarkable potential for the production, export and consumption of agri textiles. This has further lead to more number of agri textiles manufactures owing to cheap labour and raw material availability and is in turn hampering the agri textiles markets in the regions of North America and Europe.

North America is currently expected to hold a significant regional share of the global agri textile market but is anticipated to lose its market share to the market in Asia Pacific and Latin America. Rest of the regions are expected to grow at a steady rate during the forecast period.

Some of the market participants in the global agri textilesmarket are 3M, Agru America, Inc., CTM Technical Textiles Ltd., DuPont, Johns Manville, Koninklijke Ten Cate nv., SGL Group and Milliken & Company among many others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types, technology and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

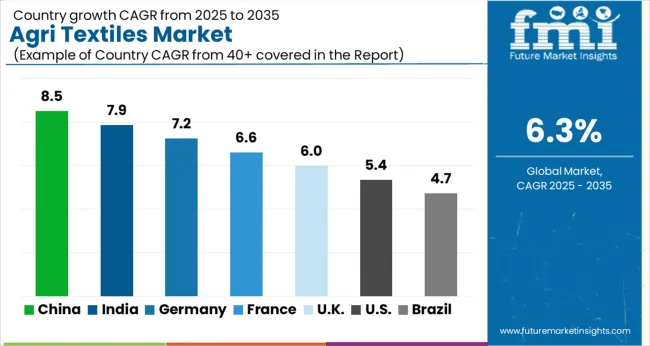

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The Agri Textiles Market is expected to register a CAGR of 6.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.5%, followed by India at 7.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.7%, yet still underscores a broadly positive trajectory for the global Agri Textiles Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.2%. The USA Agri Textiles Market is estimated to be valued at USD 4.3 billion in 2025 and is anticipated to reach a valuation of USD 7.2 billion by 2035. Sales are projected to rise at a CAGR of 5.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 569.3 million and USD 304.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.7 Billion |

| Application | Sunscreen, Plant Net, Windshield, Bird Protection Net, Insect Meshes, Nets for pallet covering, Cherry Covers, Packaging Materials for Agriculture Products, and Others (Includes Ground Cover, Tape Nets, Turf Protection Net) |

| Techniques | Woven, Nonwoven, Stitch Bonded Nonwoven, Needle Punch Nonwoven, Spun Bonded Nonwoven, Hydro Entangled Nonwoven, Thermally Bonded Nonwoven, Wet Nonwoven, and Knitted |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

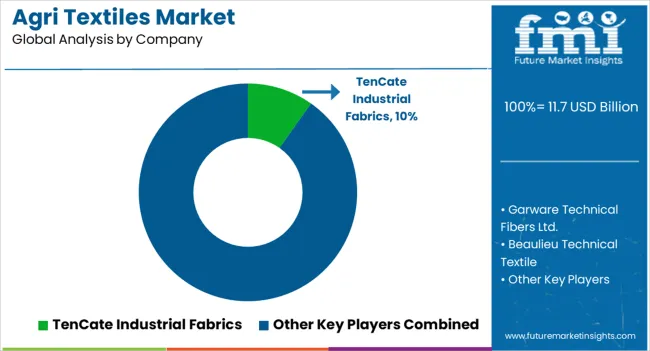

| Key Companies Profiled | TenCate Industrial Fabrics, Garware Technical Fibers Ltd., Beaulieu Technical Textile, Belton Industries, Inc., Meyabond Industry &Trading Co., Ltd., Diatex SAS, Mogul Co. Ltd., Karatzis Group of Companies, Zhongshan Hongjun Nonwovens Co., Ltd., ACE Geosynthetics, Freudenberg Performance Materials, Hy-Tex (UK) Ltd., Aduno SRL, Agro-Jumal Sp, Siang May Pte Ltd., AB Ludvig Svensson, Phormium, HELIOS GROUP S.r.l., Egersund Group AS, Tama CE, and Morenot |

The global agri textiles market is estimated to be valued at USD 11.7 billion in 2025.

The market size for the agri textiles market is projected to reach USD 21.6 billion by 2035.

The agri textiles market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in agri textiles market are sunscreen, plant net, windshield, bird protection net, insect meshes, nets for pallet covering, cherry covers, packaging materials for agriculture products and others (includes ground cover, tape nets, turf protection net).

In terms of techniques, woven segment to command 26.9% share in the agri textiles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Multifunction Grab Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agritourism Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Lighting Market Forecast and Outlook 2025 to 2035

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Gateway Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Solar Water Pumps Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Fertilizer Spreader Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Packaging Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Analytics Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Adjuvant Market - Size, Share, and Forecast Outlook 2025 to 2035

Agritech Platform Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA