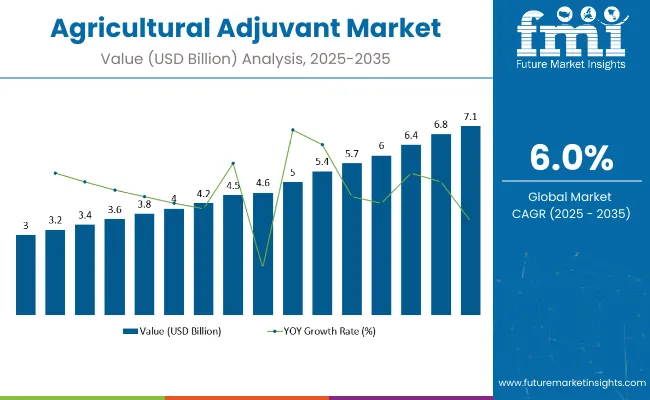

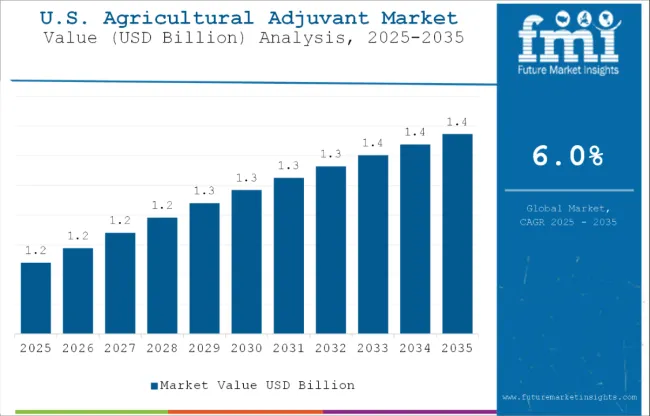

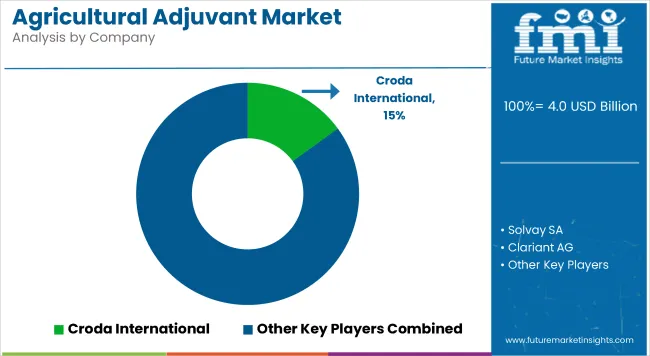

The global agricultural adjuvant market is valued at USD 4.0 billion in 2025 and is slated to reach USD 7.1 billion by 2035, reflecting a CAGR of 6%. This growth will be fueled by increasing demand for effective, sustainable agricultural inputs that enhance pesticide performance and reduce environmental impact.

Quick Stats for Agricultural Adjuvant Market

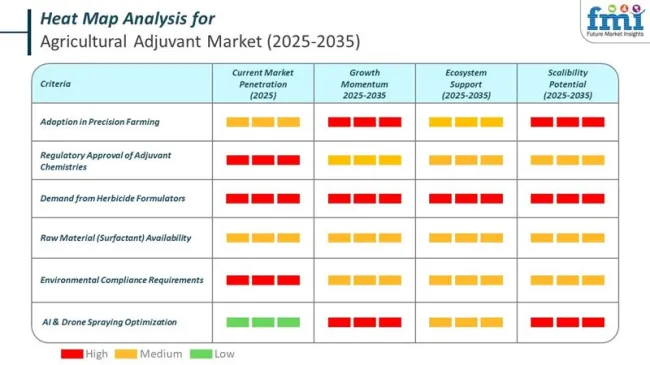

Greater adoption of organic and precision farming practices is expected to support the expansion of the adjuvant market, particularly in regions with rising food security concerns and eco-conscious farming regulations.

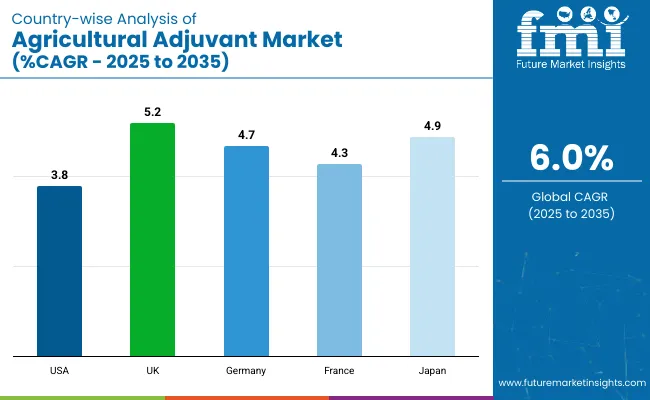

The UK is projected to grow at a 5.2% CAGR due to strong government initiatives promoting sustainable farming and subsidies for eco-friendly inputs. Germany, with a CAGR of 4.7%, is witnessing rising adoption of organic farming and demand for adjuvants compatible with environmentally friendly practices.

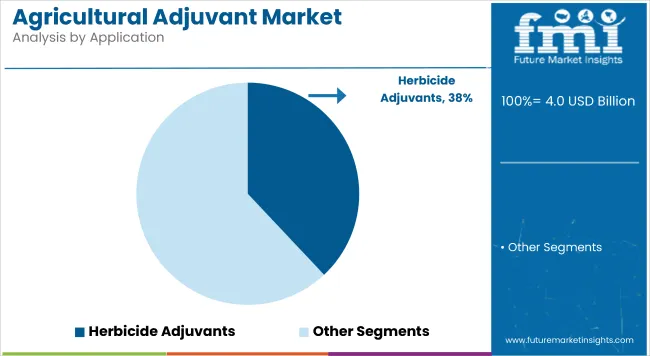

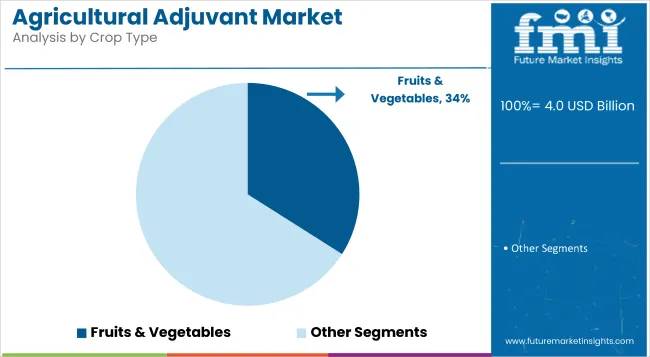

In the USA, growing interest in precision farming and technological innovations is driving a 3.8% CAGR. Across these markets, herbicide adjuvants are expected to lead the application segment with a 38% market share in 2025, while fruits and vegetables will dominate crop type with a 34% market share.

Recent innovations in the agricultural adjuvant market have focused on developing eco-friendly and high-efficiency formulations that enhance pesticide performance while reducing environmental impact. Companies are introducing bio-based and polymer-based adjuvants that improve rain fastness, absorption, and compatibility with sustainable farming practices. For instance, novel seed treatment and nano-adjuvant technologies are being commercialized to increase precision and reduce chemical runoff.

The market holds an estimated 8% share of the broader agrochemicals market, driven by its role in enhancing pesticide efficacy and application precision. Adjuvants contribute around 10% of the crop protection chemicals market and approximately 8% of the overall agrochemicals market.

This reflects their importance in improving herbicide, fungicide, and insecticide performance. In the overall agricultural inputs market, adjuvants account for approximately 3-4%, given the dominance of fertilizers and seeds. Their share in the precision farming and sustainable agriculture markets is smaller, at around 2-3%, but growing steadily due to rising demand for eco-friendly and efficient crop protection solutions aligned with modern farming practices.

In 2025, the agricultural adjuvant market is undergoing rapid change with Industry 4.0 technologies like AI, ML, IoT, and smart automation. These tools improve precision in input use, boost productivity, and influence consumption patterns. AI analytics assess crop stress for optimized adjuvant application, while IoT sensors track field conditions for real-time dosing.

IoT and sensors enable real-time, site-specific decisions, helping farmers replace generalized schedules with precision-based application strategies that lower chemical waste and improve efficiency.

The agricultural adjuvant market is experiencing a shift as companies integrate AI, ML, IoT, robotics, and smart automation into their product and service offerings. These technologies are helping optimize adjuvant usage, minimize chemical waste, and enhance per capita productivity in farming.

John Deere and Trimble are leading global players embedding AI and IoT into farm machinery. Their connected sprayers use real-time data to adjust adjuvant dosage per square meter, improving both efficiency and crop protection outcomes.

In India, KissanAI offers Hindi voice-based AI advisory, helping farmers understand when and how to apply adjuvants effectively. This democratizes access to precision farming and improves input outcomes in smallholder contexts. Click2Cloud’s Agripilot app, built on Microsoft’s FarmBeats, supports Indian farmers through IoT sensors and AI-powered dashboards, enabling accurate adjuvant recommendations based on real-time environmental data.

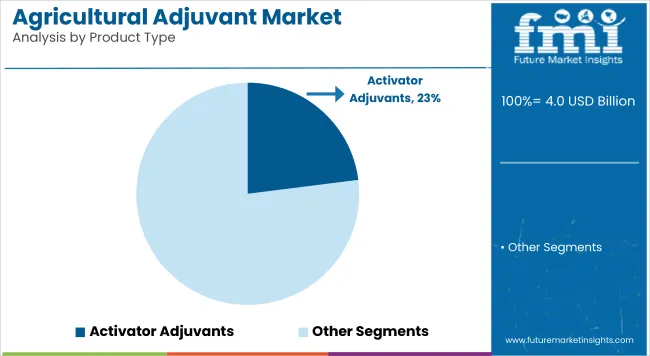

The market segments include product type, application, crop type, and region. The product type segment covers activator adjuvants, oil adjuvants, surfactants, and utility adjuvants (stickers, compatibility agents, buffering agents, anti-foamers). The application segment includes fungicide adjuvants, insecticide adjuvants, herbicide adjuvants, and others (plant growth regulators, desiccants, foliar nutrients).

The crop type segment comprises cereals, oilseeds, fruits & vegetables, and others (pulses, tubers, spices, plantation crops). The regional segment includes North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

Activator adjuvants are projected to be the most lucrative segment in the agricultural adjuvant market, holding a 23% share in 2025. These adjuvants enhance the effectiveness of pesticides by improving their absorption, penetration, and rain fastness, making them highly suitable for use in diverse climatic conditions.

Herbicide adjuvants are expected to be the most lucrative application segment in the agricultural adjuvant market holding over 38% share in 2025.

Fruits and vegetables are anticipated to be the most lucrative crop type segment in the agricultural adjuvant market, accounting for a dominant 34% share in 2025.

The market is expanding steadily, driven by the rising demand for sustainable crop protection solutions, increased adoption of precision farming techniques, and advancements in eco-friendly adjuvant formulations that enhance pesticide efficiency across diverse agricultural applications.

Recent Trends in the Agricultural Adjuvant Market

Key Challenges in the Agricultural Adjuvant Market

Among the top five countries in the market, the UK leads with a CAGR of 5.2% from 2025 to 2035, driven by strong sustainability mandates and advanced farming practices. Japan follows closely with a CAGR of 4.9%, supported by government-backed eco-friendly agriculture initiatives and precision farming adoption.

Germany is next with 4.7%, while France records 4.3%, both benefiting from regulatory support and innovation in organic inputs. The USA trails with a CAGR of 3.8%; although it has a large market size, its growth is moderate due to already high adoption levels, yet it continues to see steady innovation in precision agriculture and mechanized farming systems.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA agricultural adjuvant market is projected to expand at a CAGR of 3.8% from 2025 to 2035. Growth is being driven by the adoption of precision agriculture, the development of innovative crop protection technologies, and strong demand for sustainable farming inputs.

The UK agricultural adjuvant revenue is forecast to grow at a CAGR of 5.2% from 2025 to 2035. Growth is supported by rising emphasis on organic farming, sustainability regulations, and government-backed subsidies for eco-friendly agricultural practices.

Germany's agricultural adjuvant market is anticipated to expand at a CAGR of 4.7% between 2025 and 2035. The rise in organic farming, precision agriculture, and advanced agrochemical use has led to increased demand for effective and sustainable adjuvants.

Sales of agricultural adjuvants in France are expected to grow at a CAGR of 4.3% from 2025 to 2035 in the market. The market is driven by reforms in agricultural policy, a strong focus on food safety, and widespread adoption of integrated pest management (IPM) systems. French farmers are also transitioning toward greener crop inputs.

Japan's agricultural adjuvant demand is projected to grow at a CAGR of 4.9% from 2025 to 2035. The country’s aging farming population and shrinking arable land are pushing demand for high-efficiency solutions.

The market features a moderately fragmented competitive landscape, with a mix of tier-one global players and regional suppliers. Major companies such as Brandt Consolidated, Wilbur-Ellis, Lamberti S.p.A., WINFIELD Solutions LLC, and Clariant AG are actively competing through product innovation, geographic expansion, and strategic partnerships.

Top players are increasingly leveraging bio-based and polymer-enhanced adjuvant technologies to differentiate themselves. Collaborations with agricultural input companies and acquisitions of niche adjuvant firms are being pursued to strengthen the market position. Additionally, pricing competitiveness, product customization, and improved delivery systems are key areas of focus.

Recent Agricultural Adjuvant Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 4.0 billion |

| Projected Market Size (2035) | USD 7.1 billion |

| CAGR (2025 to 2035) | 6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume (Metric Tons) |

| By Product Type | Activator Adjuvants, Oil Adjuvants, Surfactants, and Utility Adjuvants |

| By Application | Fungicide Adjuvants, Insecticide Adjuvants, Herbicide Adjuvants, Others (Plant Growth Regulator Adjuvants, Desiccant Adjuvants, Fertilizer Adjuvants, Biopesticide Adjuvants) |

| By Crop Type | Cereals, Oilseeds, Fruits & Vegetables, Others (Pulses, Ornamental Crops, Forage Crops, and Nuts and Plantation Crops) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Brandt Consolidated, Inc., Lamberti S.p.A., WINFIELD SOLUTIONS LLC, Dow Corning, Wilbur-Ellis Holdings, Inc., Helena Chemical Company, Clariant AG, Croda International, Tanatex Chemicals, Momentive Performance Materials, Solvay SA, and Adjuvant Plus Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

Activator Adjuvants, Oil Adjuvants, Surfactants and Utility Adjuvants are key products analyzed under the product type segment.

Fungicide Adjuvants, Insecticide Adjuvants, Herbicide Adjuvants, and Other applications are reviewed under the applications segment title.

Different crop types, including Cereals, Oilseeds, Fruits & Vegetables, and Other Crops, are analyzed in the segment title.

The regional analysis includes the assessment of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and The Middle East and Africa.

The market is valued at USD 7.1 billion by 2035.

The market is projected to grow at a CAGR of 6% over the forecast period.

Activator adjuvants will lead with a 23% market share in 2025.

Fruits and vegetables will dominate with a 34% market share in 2025.

The UK is projected to hold the highest CAGR at 5.2% during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Activator Adjuvant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Agricultural Adjuvants in EU Size and Share Forecast Outlook 2025 to 2035

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Agricultural Food Grade Rubber Conveyor Belt Market Growth - Trends & Forecast 2025 to 2035

Agricultural Nets Market Growth - Trends & Forecast 2025 to 2035

Agricultural Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA