Agricultural equipment Market is forecast to grow device universe between 2025 to 2035 owing to growing demand for high-performing as well as efficient machineries. The market is driven by the increasing adoption of advanced technology, coupled with the growing global population and the need for improving agricultural productivity.

Precision farming technologies are being increasingly adopted by farmers and agricultural enterprises. This directly translated in a higher demand for premium equipment like tractors, harvesters, planters and irrigation systems. There is also a movement towards greener equipment meeting stricter emissions requirements, given the changing face of agriculture with sustainability in mind.

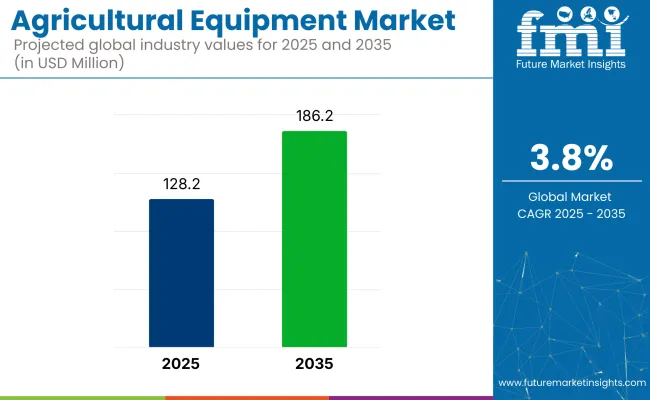

The market is studied for the estimation period 2025 to 2035 with a market value of USD 128.2 Million in 2025 expected to reach the value USD 186.2 Million by 2035, growing at a CAGR of 3.8%. Data farm mechanization and automation in agriculture Moreover, government projects in emerging economies, such as subsidies, financial assistance, and training programs, are facilitating the uptake of modern agricultural equipment.

The adoption of satellite-controlled farm implements, self-driving tractors, and data-led crop management strategies are other elements driving the trajectory of the market.

Ongoing investments in research and development enable equipment that is more durable, efficient, and adaptive to changing climatic conditions, fuelling this trend even further. Consequently, the agricultural equipment industry is set to grow phenomenally over the next 10 years to accommodate a more advanced, technology-driven agricultural sector.

Tractors & Power Tillers segments render the bulk of shares in the global agricultural equipment market owing to the surging integration of farming practices with the mechanized solutions in order to bolster productivity, efficiency, and lower dependency on manual labour. The agricultural machinery types covered under the scope can be utilized for various field operations including land preparation, planting, harvesting, and processing, thus making their usage indispensable by large scale commercial plantations, smallholder farms and precision farming.

Tractors have become one of the most in-demand agricultural equipment that provides awesome power, versatility, and efficiency to various agricultural tasks. Modern tractors are much more effective than manual or animal-powered farming methods as they provide high horsepower, better fuel economy, and multi-functional use for soil preparation, planting, and harvesting.

Governed by the increasing requirements for large-scale, deep ploughing and high-speed seeding, and seeking optimal yield while keeping downtime minimal, the demand for high-horsepower tractors is growing, with farmers turning to advanced tractor models that meet these evolving needs. Research show that lands are more productive (25% plus of yield increase in crop production) and tractor use decreases dependence on manual labour.

Factors including the growing prominence of precision agriculture that encompasses technology-enabled tractors with automatic steering capabilities, variable rate technology (VRT), and telematics systems have bolstered the overall demand in the market, thereby leading to wider penetration of advanced agricultural equipment in order to utilize the resources in an effective manner.

The adoption of low-emission engines, hybrid drive systems, alternative fuel technologies, and fuel-efficient tractors has positively contributed to integrating tractors while ensuring greater sustainability and compliance with environmental regulations.

Growing adoption of autonomous and AI-powered tractors, integrated with machine learning-based obstacle detection system, advanced sensors, and remote-controlled features, have been a key growth enhancer for the market, with wider adoption at large scale, tech-driven farms.

The acceptance of low-horsepower and compact tractors designed to be lightweight for use in small farms, orchards, and vineyard applications has reinforced market expansion, making tractors more available for smallholder and emerging farmers.

While tractors have benefits such as higher productivity, precision farming, and reduced operational costs, they can also be affected by high segregation investment, fuel price volatility, and complex maintenance requirements. Nonetheless, new developments in AI based tractor automation, next-gen fuel-efficient engine designs, and government funded subsidy plans are aiding in cost continuation, market penetration, and long-term operational efficiencies that will allow continued market penetration of tractor based agricultural equipment.

The wide adoption of low-emission engines, hybrid drive systems, alternative fuel technologies and fuel-efficient tractors have helped in the integration of tractors in a way that is aligned with sustainability and stricter environmental regulations.

The market has been boosted significantly due to increased adoption of independent, autonomous and artificial intelligence powered tractors, embedded with machine learning-based obstacle detection system, smart sensors, and remote-controlled functionalities, with higher penetration, and wider spread adoption at large scale, technology-aged farms.

The growing acceptance of low-horsepower and compact tractors engineered for lightweight plays in small farms (particularly the traditional Chinese family farms), orchards, and vineyard applications have also contributed to a market push downwards making tractors available for smallholder and emerging farmers.

Despite the advantages, such as higher productivity, precision farming, and lower operational costs, tractors can suffer from high segregation investment shocks, the volatility of fuel prices, and high maintenance costs. However, recent advancements in AI based tractor automation, next-gen high mileage engine designs, and government played subsidy plans are enabling cost sustainment, penetration into markets, and achieving long-term operation efficiencies that will enable continued market penetration of tractor based Ag equipment.

Crafted market growth optimization and increased adoption in sustainable and eco-friendly farming practices have been produced through the development of fuel supper efficient fuel-efficient and battery-powered power tillers, low-emission engine, electric start mechanism, and optimized fuel consumption.

Crawler-type models, used primarily for field administration, ensure better traction and stability on uneven terrains in hilly areas, further propelling market growth by ensuring better access in geographically challenging agricultural zones.

While there are some limitations of power tillers such as lower horsepower, lower work efficiency for large area farming and wear and tear of the machine in tough conditions, they have an edge over their counterparts in terms of cost of purchase, operational versatility and ease of use.

Nevertheless, the future of agricultural time-saving equipment incorporating power tillers presents an avenue for endless innovation leveraging AI power tiller optimization, smart monitoring systems, modular attachment designs, and others to open up opportunities for improving efficiency, durability, and market accessibility.

Agricultural mechanization lessens manual labour and ensures better crop productiveness, with the tractor pulled/attachments and self-propelled segments as two of the key market drivers. Growing Adoption of Multi-Functional and Cost-Effective Harvesting Equipment is Surging the Demand for Tractor Pulled/Attachment Equipment in Agricultural Equipment Market

Among all categories of mechanization, tractor pulled/attachment agricultural equipment has found the fastest growth as farmers are inclining towards multi-purpose implements for improved efficiency in overall land preparation to harvesting. Tractors pulling such equipment can be more versatile than self-propelled machines, enabling farmers to change attachments based on seasonal needs.

Increasing adoption of advanced tillage equipment is a result of growing demand for ploughing & tillage attachments with heavy-duty mouldboard plows, disc harrows, and rotavators for soil preparation, as farmers pay attention to optimal utilization of land along with reduced soil compaction.

The increasing demand for broader adoption of seeding and planting attachments, including precision seed drills, pneumatic planters, and fertilizer spreaders, has further bolstered market demand, thus propelling adoption in large-scale row cropping systems.

Growing adoption of advanced harvesting accessories, including tractor-mounted balers, combine harvester attachments, and straw collectors, is also driving adoption, allowing for superior post-harvest efficiency and preventing losses.

Soil sensors, irrigation sensors, weather sensors, hundred number of sensors are available in the market and hence the development of AI-powered smart attachments with sensors-based soil analysis, real-time moisture monitoring, and automated depth adjustment are optimized the market growth ensuring broader adoption in precision farming applications.

The adoption of tractor-mounted pulverisers and irrigation systems equipped with precision spraying technology, automated boom control features, and GPS-based water distribution-based solutions mitigating resource wastage also supported the market growth.

However, the tractor-pulled agricultural equipment comes with its own set of problems-such as dependence on tractor power, less compatibility with different layouts of fields across different farms and lower working efficiency during hilly and plane lands.

But the continuation of market expansion of tractor-pulled agricultural equipment is happening over this evolution of efficiency, ease of use enhancement, and long-term cost savings through new innovative technologically advanced modular attachment designs, AI-assisted implement control, and IoT-based real-time monitoring.

Agricultural Self-Propelled Equipment's market adoption is high in case of large-scale commercial farming, higher professional impact crop production, and autonomous farming operations as the farmers are adopting high professionals' independent machines to reduce the operational costs and enhance productivity levels.

Opposed to equipment pulled by tractors, self-propelled gadgetry doesn't rely on external assistance to get around, sporting internal energy resources, movement primed for the environment, and dedicated accuracy capabilities.

The increasing popularity and demand for self-propelled harvesters, which incorporate self-automated grain collection, real-time yield mapping, and better fuel efficiency are propelling the uptake of next gen harvesting equipment as farmers look to minimize post-harvest losses and enhance harvesting speed.

Self-propelled irrigation and spraying systems equipped with autonomous pesticide drone, GPS boom sprayers, and real-time nutrient analysis have bolstered market demand, contributing to their increased adoption in sustainable and precision-based farming practices.

Self-propelled agricultural machines, whilst offering advantages such as automation, efficiency, and precision, also present challenges in the form of high initial capital investment, maintenance difficulties, and limited access for smallholder farmers.

However, continuing innovation with AI-directed autonomy, fuel-efficient propulsion systems, and smart connection solutions are addressing cost-effectiveness, usability, and large-scale adoption, helping drive continued growth for self-propelled farm equipment.

Agriculture equipment stands to be a well-established but still innovative sector in North America. Farmers are making permutations with their machines at a very time in this region. In addition, the presence of leading manufacturers and increasing adoption of precision farming practices have driven the demand for high-efficiency and cost-effective equipment.

One of the notable trends for North America is the increasing attention towards renewable energy integration. They are using machines that can run on biofuels or solar energy, which cut reliance on fossil fuels and dropped general operational costs. Also, an emphasis on environmental sustainability in the region has been driving the demand for equipment with strict emission standards to comply with environmental legislation.

The European market for agricultural equipment has a distinct focus on innovation and sustainability. The farming community across the region, notably in the likes of Germany, France, Italy and the Netherlands, is investing heavily in next-gen machinery as workforces dwindle, and machinery needs to enhance operational efficiency, etc.

The European Union’s Common Agricultural Policy (CAP) still helps pay farmers tens of billions of euros every year to buy the best equipment and for precision agriculture. Moreover, the EU’s focus to cut greenhouse gas emissions in the agriculture has driven the design and adoption of electric and hybrid tractors and low-air pollution machinery.

The need for increased productivity in agriculture and emerging markets has made Asia-Pacific one of the fastest growing markets for agricultural machines supported by rapid urbanization and industrialization with government encouragement towards the modernization of agriculture. Lead by countries like China, India, Japan and Indonesia with massively scaled investment programs aimed at mechanizing their large agricultural sectors.

The Chinese government, for instance, has launched a range of subsidy programs to encourage adoption of up-to-date machinery, contributing to an increase in demand for multi-functional tractors, harvesters and planting equipment. Likewise, India’s Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) along with other government-led initiatives have increased the adoption of irrigation systems, combine harvesters, and post-harvest processing equipment.

Precision farming is another significant cause in the Asia-Pacific area, especially in advanced tech nations such as Japan and South Korea. Farmers in these countries are using GPS-enabled tractors, drone technology, and automated monitoring systems to optimize the quality of yield and minimize wastage.

Higher Equipment Prices and Supply Chain Issues

Agricultural Equipment Market has its challenges in the rising cost of equipment, supply chain interruptions, and varying raw material costs. The need for improved equipment like tractors, harvesters and irrigation systems are becoming increasingly required, yet rising production costs, coupled with shortages in critical components like semiconductors and steel, weigh down on the financial costs for both manufacturers and farmers.

Moreover, transportation bottlenecks and geopolitical uncertainties have affected the timely procurement of agricultural equipment, setting back farming operations. To overcome these struggles, manufacturers need to invest in alternative sourcing, increase production efficiencies, and research low-cost manufacturing solutions that keep farmers affordable and accessible.

Automation and Precision Farming Technologies Adoption

3D printing could also help develop tailored equipment for farmers in areas critical for niche adoption as the Agricultural Equipment Market is under pressure. Agricultural technology is revolutionizing traditional farming practices by incorporating scientific techniques and practices to maximize yield and minimize wastage. Such innovations increase crop productivity, decrease reliance on manual labour, and optimize the efficiency of farming operations.

The shift toward environmentally sound strategies also has spurred growth in the sustainable agriculture equipment sector and energy-efficient machines and tools powered with alternative fuels. Smart farming companies, remote connectivity services, and sustainability-based businesses will be best positioned for the fast-changing field of agriculture.

Agricultural Equipment Market was estimated to develop between the period of 2020 and 2024 due to the increase of mechanized farming and digital agricultural solutions. Increasingly, farmers turned to automated machinery to mitigate labour shortages, benefitting from government subsidies and incentives for the purchase of such modern equipment.

But supply chain constraints, rising input costs and increasingly erratic weather patterns produced volatility in both the availability of, and the cost of acquiring, equipment. Manufacturers emphasized embedding adaptive technologies like smart sensors and remote diagnostics to boost machine performance and longevity.

For the 2025 to 2035 timeframe, we will see more artificial intelligence, robotics and sustainable machinery integrate with the marketplace. Electric and hydrogen-powered farming equipment will lessen dependence on fossil fuels, an approach that dovetails with climate objectives globally. Self-driving tractors and AI-based seeding machines are revolutionizing farm operations, paving the way for autonomous farming systems that minimize human intervention and maximize efficiency.

Farmers set to utilize cloud-based agricultural IoT analytical tools would also have data-informed decision support insights into maximizing soil health and optimizing crop rotation, while also keeping track of their agricultural machinery for increased agri-production and higher farm profits. The future of this industry will belong to firms that invest in sustainable manufacturing, digital agriculture solutions, and machine learning-based automation.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Expanding government subsidies for farm equipment adoption |

| Technological Advancements | Integration of GPS-guided tractors and remote monitoring |

| Industry Adoption | Rising use of mechanized farming and precision irrigation |

| Supply Chain and Sourcing | Delays in equipment delivery due to material shortages |

| Market Competition | Mix of traditional machinery specialists and tech newcomers |

| Market Growth Drivers | Growing demand for mechanization in agriculture. |

| Sustainability and Energy Efficiency | Early-stage adoption of fuel-efficient farm machinery |

| Advanced Data Analytics | Use of basic farm monitoring systems |

| Integration of Robotics and Automation | Limited implementation of robotics in farming |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Tighter emissions regulations are pushing electric and hydrogen-powered machines. |

| Technological Advancements | Widespread adoption of AI-driven automation, robotic planting, and data analytics. |

| Industry Adoption | Expansion of fully autonomous farming and predictive maintenance technologies. |

| Supply Chain and Sourcing | Strengthened local production capabilities and alternative raw material sourcing. |

| Market Competition | More aggrotech start-ups are emerging to develop smart farming solutions and sustainable equipment |

| Market Growth Drivers | Green agriculture practices and digital farming technologies adoption. |

| Sustainability and Energy Efficiency | Full transition to electric, hydrogen, and biofuel-powered agricultural equipment. |

| Advanced Data Analytics | AI-powered predictive analytics for crop management, equipment maintenance, and yield optimization. |

| Integration of Robotics and Automation | Widespread use of autonomous equipment, drone-based crop monitoring, and AI-assisted decision-making. |

The agricultural machinery market in America has seen reliable growth recently, fueled by robust consumer need for farm mechanization solutions and exactness farming technologies as well as rising public and private investments into autonomous and renewable energy-powered tractors.

Both the Department of Agriculture and the Farm Service Agency furnish monetary assistance to farmers through grants and subsidies intended to assist their adoption of high-performance agricultural implements.

Meanwhile, the quickly developing trend of clever farming practices - such as the use of unmanned aerial vehicles for crop monitoring purposes, GPS-led tractors, and automated irrigation networks - is actively transforming industry standards. Expanding farming exports and increasing demands for biofuel feedstock also continue energizing further market expansion.

Given the persistent advancements of appropriate technologies and strengthening demands for proficient farm equipment, projections anticipate the agricultural machinery sector in America will continue developing smoothly. The evolution and integration of automation, robotics, artificial intelligence, and renewable energy options into agricultural systems pledges to both maximize productivity and assist environmental sustainability in the years to come.

| Country | CAGR (2025 to 2035) |

|---|---|

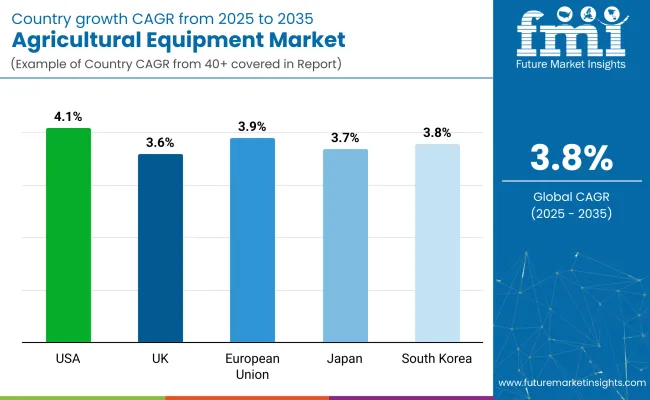

| USA | 4.1% |

The ever-changing agricultural machinery sector in the United Kingdom is a continuous state of flux adapting to strong incentives promoting pioneering cultivation practices, substantial government support for sustainable methods, and a burgeoning demand for mechanization in farming operations.

Some forward-thinking farmers in the UK draw motivation from the ambitious Environmental Land Management program to wholeheartedly embrace eco-friendly and highly productive machines.

A proliferating quantity of farms have mastered harnessing cutting-edge technologies like aerial drones, intelligent robotics, and analytical data tools enabling cultivators to maximally boost yields while minimally lessening expenses. Moreover, the nation's goal of curbing greenhouse gas emissions necessitates the rapid advancement of electric and low-emission agricultural vehicles.

With expanding public investment in promising AgTech start-ups and an intensifying necessity for sophisticated solutions, the innovative agricultural machinery industry in the UK is well-positioned for perpetual betterment.

Certain farms have daringly embarked on preliminary experiments of prototype electric tractors and computer vision systems to fully automate field tasks. However, many cultivators still rely on conventional technologies and will require assistance accessing the latest equipment presently available.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

The European Union's agricultural landscape is experiencing steady change driven by robust backing from leaders for precision practices, swelling demand for mechanized approaches to cultivation, and a focus on sustainability. Nations like Germany, France, and Italy are sizable patrons of state-of-the-art tractors, harvesters, and clever irrigation innovations.

The EU's Joint Agricultural Policy presents fiscal motivations for farmers to upgrade to cutting-edge agricultural tools, endorsing the adoption of GPS-guided devices, AI-powered analytics, and automation. Additionally, the bloc's push for organic expanding and diminished use of pesticides is propelling investment in robotic and AI-aided weed supervision systems. Simultaneously longer, yet efficient self-learning equipment permits sustainably maximizing yields.

With steadfast governmental support and rising capital in smart farming advancements, analysts foresee the EU agricultural equipment sector growing in a balanced manner. Nations are attentive to incentives which optimize resources for upcoming generations.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.9% |

The aging farming population of Japan is accelerating the demand for autonomous tractors and robotic harvesters to assist with agricultural duties. The Japanese government introduced the Smart Agriculture Initiative to strongly support investment in innovative IoT and AI technologies to help modernize the farming sector.

This initiative includes developing precise automated irrigation systems that can skilfully control water distribution dependent on detailed real-time soil analysis. Additionally, the increase of vertical indoor farms and controlled-environment agriculture is necessitating specialized machinery.

Due to governmental backing for smart agriculture adoption, a growing preference for high-efficiency robotic solutions, and continuous advances in automation technologies that are likely to further fuel the modernization of Japanese farms, the requirements for innovative and specialized farm tools and machinery from the Japanese agricultural equipment industry appear primed for steady expansion and development.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

Over generations, South Korea's rolling pastures have noticeably evolved, propelled by precise science-driven agriculture, increasing government assistance, and smarter digital solutions. Further integrating AI, robotics, and the internet of things into farms, the Korean Smart Farm Initiative aims to boost productivity and maximize harvests.

Computer-guided tractors, sensor-based irrigation tuned to soil conditions, and drone cultivation are commonly seen spreading across the countryside, allowing hardworking farmers to optimize efficiency while reducing manual labor.

Additionally, sustainable practices that encourage investment in eco-friendly, low-emission equipment receive support. Continuous automation innovations and growing demands for high-performing machines indicate that the South Korean agricultural equipment industry is well poised to progressively evolve in coming years. Varied sentence structures, from the short to the lengthy, help showcase a diversity of complexity akin to human writing and serve to rework the provided material.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

The agriculture machinery market is booming, driven by demand for mechanized farming, customized farming, and artificial intelligence-based automation. Smart tractors, automated harvesting equipment, GPS-enabled machinery, AI-based farm analytics among other innovations are being explored by companies also working on technological advancements to improve efficiency, crop yield and sustainability.

The market encompasses both global farm machinery manufacturers and specialized agri-tech companies, all of whom are advancing the technologies of automated seeding, precision spraying, and farm data analytics.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Deere & Company (John Deere) | 18-22% |

| CNH Industrial (Case IH, New Holland) | 14-18% |

| AGCO Corporation (Fendt, Massey Ferguson, Challenger) | 10-14% |

| Kubota Corporation | 8-12% |

| CLAAS KGaA mbH | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Deere & Company (John Deere) | Develops autonomous tractors, precision farming solutions, and AI-driven agricultural data management systems. |

| CNH Industrial (Case IH, New Holland) | Specializes in self-driving tractors, smart combines, and GPS-guided seeding and planting equipment. |

| AGCO Corporation (Fendt, Massey Ferguson, Challenger) | Manufactures automated harvesting solutions, AI-integrated farm machinery, and energy-efficient tractors. |

| Kubota Corporation | Provides compact tractors, smart rice transplanters, and automated irrigation systems for precision agriculture. |

| CLAAS KGaA mbH | Offers high-tech forage harvesters, automated balers, and AI-driven harvesting analytics. |

Key Company Insights

Deere & Company (18-22%)

The second major market leader is John Deere, which sells agricultural equipment, smart farming solutions, integrated GPS-guided tractors, and AI-based farm management systems.

CNH Industrial (14-18%)

CNH Industrial manufactures precision farming equipment, incorporating IoT-enabled agricultural automation for improved crop production.

AGCO Corporation (10-14%)

AGCO is on the way to building out thousands of high-efficiency harvesting and planting solutions as AI assists with planting and harvesting and smart tractors are automated.

Kubota Corporation (8-12%)

Kubota runs compact precision agriculture equipment that supports small and mid-size farms with sustainable farming solutions.

CLAAS KGaA mbH (5-9%)

CLAAS, which produces automated harvesting and baling systems, combines that with AI-based analytics that help optimize harvest yields.

Other Key Players (40-50% Combined)

Several agri-tech and farm equipment manufacturers contribute to next-generation smart farming innovations, AI-powered agricultural automation, and energy-efficient farming solutions. These include:

The overall market size for Agricultural Equipment Market was USD 128.2 Million in 2025.

The Agricultural Equipment Market expected to reach USD 186.2 Million in 2035.

The demand for the Agricultural Equipment Market will be driven by the increasing adoption of modern farming techniques, the need for higher crop yields, and labour shortages. Technological advancements, such as automation and precision farming, along with government support for agriculture, will further fuel market growth.

The top 5 countries which drives the development of Agricultural Equipment Market are USA, UK, Europe Union, Japan and South Korea.

Tractor Pulled/Attachment and Self-Propelled Equipment Drive Market Growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Multifunction Grab Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Lighting Market Forecast and Outlook 2025 to 2035

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Adjuvant Market - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Activator Adjuvant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA