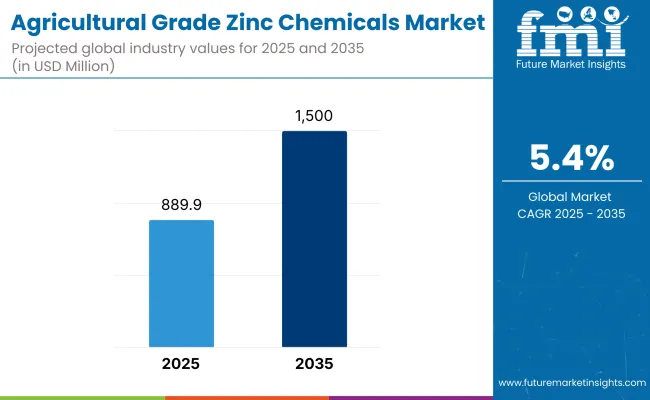

Sales of agricultural grade zinc chemicals reached USD 844.3 million in 2024. With a year-on-year growth rate of 4.9%, the market is expected at USD 889.9 million in 2025. Between 2025 and 2035, with a projected CAGR of 5.4%, the global demand is expected to achieve a value of USD 1500 million by 2035, driven by precise agronomic needs and micronutrient deficiency correction in major crop-producing regions.

Agricultural applications remain lucrative zinc-based chemical usage in 2025. A technical bulletin issued by Mosaic Company in March 2025 confirmed that nearly 50% of cultivated soils across Asia and Latin America suffer from zinc deficiency, reinforcing the agronomic need for targeted micronutrient interventions. Zinc sulfate monohydrate and chelated zinc solutions gained market share due to superior solubility and high compatibility with fertigation systems, especially in irrigated cropping systems.

According to Nutrien Ltd.'s Q1 2025 earnings statement, sales of agricultural micronutrients rose by 6.2% year-on-year, with the majority of growth originating from strong demand for zinc-enhanced fertilizers in India and Brazil. Field data published by the Indian Council of Agricultural Research in February 2025 demonstrated that maize yields improved by an average of 18% following the application of zinc sulfate-based formulations, validating their efficacy under varying agro-climatic conditions.

As a response to these findings, public-private collaborations intensified. In a press release dated March 2025, Yara International confirmed the launch of a regional partnership with agronomic institutes in Vietnam, Thailand, and the Philippines. The initiative focused on piloting bioavailable zinc fertilizers targeting nutrient-deficient and resource-constrained farming communities.

Foliar application demand also expanded, particularly among producers of high-value horticultural crops. The Syngenta 2024 Sustainability Report noted a 27% increase in foliar zinc blend inquiries across Latin America. During a 2024 investor call, Syngenta’s CEO affirmed that the company's micronutrient portfolio would continue evolving toward high-efficiency zinc solutions to meet sustainability and nutrient-use goals.

Advanced zinc delivery mechanisms gained momentum in controlled environments. In February 2025, Haifa Group launched an encapsulated zinc micronutrient designed specifically for greenhouse farming in Europe. The product was engineered to align with the EU’s Green Deal 2025 directives, which promote micronutrient precision in soil-sensitive production zones. The controlled-release formulation aimed to reduce leaching losses and improve uptake over longer crop cycles.

Despite progress, key technical limitations persisted. Zinc mobility in calcareous and high-pH soils remained a challenge. Early 2025 research led by the University of Queensland explored zinc-ligand complexes that enhance solubility and uptake efficiency under alkaline soil conditions.

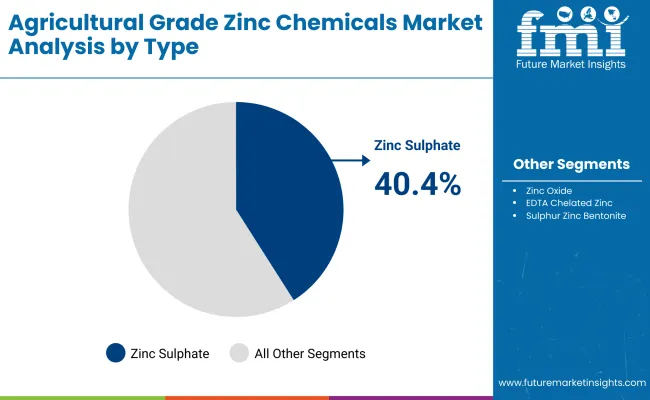

The section explains the market value of the leading segments in the industry. In terms of type, the zinc sulphate category will likely dominate and generate a share of around 40.4% in 2025.

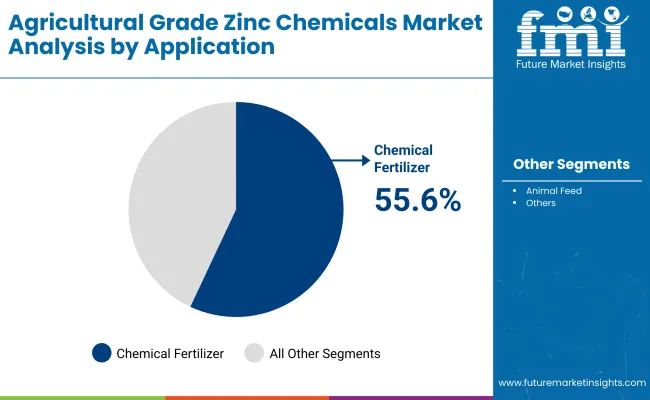

Based on application, the chemical fertilizer segment is projected to hold a share of 55.6% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Zinc Sulphate (Type) |

|---|---|

| Value Share (2025) | 40.4% |

The agricultural grade zinc chemicals segment holds a share of 40.4% owing to the wide application and efficiency of zinc sulphate as a factor of improving soil fertility. It is usually applied as a micronutrient fertilizer for correcting zinc deficiencies in crops to ensure better plant growth and higher yields.

Zinc sulphate is cost-effective and easy to apply, hence a preferred choice among the farming fraternity around the world. It is also applied to both the soil and in foliar application for grains, vegetables, and fruits. This makes it dominant in the market because of its versatility and efficiency.

| Segment | Chemical Fertilizer (Application) |

|---|---|

| Value Share (2025) | 55.6% |

Chemical fertilizers have the largest share of about 55.6% in agricultural grade zinc chemicals because of their extensive use in increasing yields of crops.

Zinc-based chemical fertilizers like Zinc Sulphate are vital for developing crops that require a sufficient amount of zinc in the soil, the deficiency of which severely restricts the growth and productivity of crops. They are normally applied in large-scale farming activities to enhance nutritional value, ensure healthy root growth, and promote general plant vigor.

Cost-effectiveness, ease of use, and the ability to provide the necessary nutrients to a wide variety of crops, ranging from grains, vegetables, and fruits, help them gain the dominant share in the market.

The table below presents the annual growth rates of the global Agricultural Grade Zinc Chemicals industry from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth trajectory evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half year, between the years 2024 and 2025. The industry is expected to grow at a CAGR of 5.3% in H1-2024. In H2, the growth rate increases.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.3% (2024 to 2034) |

| H2 2024 | 5.5% (2024 to 2034) |

| H1 2025 | 5.4% (2025 to 2035) |

| H2 2025 | 5.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 5.4% in the first half and relatively increase to 5.6% in the second half. In the first half (H1), the sector saw an increase of 10 BPS while in the second half (H2), there was a slight increase of 10 BPS.

Rising Global Food Demand Necessitates Zinc-Enriched Fertilizers for Higher Agricultural Productivity

The global population is growing rapidly, leading to higher food demand. To meet this demand, agricultural productivity must improve. Zinc-enriched fertilizers are very important for improving crop yield and quality, since zinc is an essential micronutrient for plant growth.

By addressing zinc deficiencies in the soil, these fertilizers help improve plant development, boosting crop productivity and ensuring a stable food supply.

Farmers, with limited arable land and growing concerns over sustainability, are increasingly using more efficient farming practices, including micronutrient fertilizers. Therefore, zinc-enriched fertilizers will be vital to maximize nutrient use in crops for higher productivity.

This, in turn, coupled with the rising demand for more food, is driving up the demand for such fertilizers and hence driving growth in the global agricultural grade zinc chemicals market.

Soil Zinc Deficiency and Depleting Crop Yields are Key Reasons Driving Demand for Zinc Chemicals

Zinc deficiency is widespread in the soils of most regions, especially with high soil pH or with intensive farming. This results in crop growth being retarded and their yield is lower in nutritional value.

Removal of these deficiencies with the help of zinc-enriched fertilizers restores the health to the soil, enhances plant development, and increases the yield and quality of the crops, thus making zinc fertilizers an important component of sustainable agriculture.

Zinc plays a very significant role in various physiological processes of the plant, which includes enzyme activity, protein synthesis, and chlorophyll production. The use of zinc-containing fertilizers increases nutrient uptake by the crop, thereby promoting root development and resistance to disease.

Improvement in qualitative and quantitative yield by overcoming zinc deficiency will increase demand for agricultural-grade zinc chemicals at farmers' level since such products provide concrete solutions to global challenges in food security.

Associated Soil Health Benefits and Crop Producers’ Awareness Boosting Demand for Zinc-Based Agricultural Products

Over the last years, there have been quite a number of programs targeting farmers on the importance of soil health and micronutrient management. As farmers increasingly become aware of the role that zinc plays in improving soil fertility and boosting crop yields, they are more willing to adopt zinc-based fertilizers.

Growing awareness promotes good farming practices, hence a greater demand for agricultural grade zinc chemicals to restore and maintain soil health.

Farmers are increasingly after farming practices that are sustainable, improving soil quality over time, reducing input costs, and increasing crop productivity. Zinc contributes to nutrient cycling and plant metabolism, hence playing a very important role in soil health and crop performance.

As more farmers realize the long-term benefits of integrating zinc into their farming practices, the demand for zinc-enhanced agricultural products increases, thereby fueling overall market growth.

High Cost of Zinc Fertilizers Limits Adoption in Price-Sensitive Markets, Hindering Widespread Use

Zinc fertilizers are relatively more expensive than conventional fertilizers, which is a challenge to the farmers, especially in developing regions with limited financial resources. The high cost discourages adoption, especially among smallholder farmers who cannot afford these premium inputs, slowing the widespread use of zinc-based products.

In price-sensitive markets, when farmers are already struggling with increasing input costs, the high price of zinc fertilizers acts as a barrier to adoption.

This cost is an impediment to the application of the necessary micronutrient fertilizers required to improve soil deficiencies among many farmers, thereby limiting market growth and hindering the full realization of the potential benefits of zinc-based agricultural products.

Lack of Awareness in Rural Areas Restricts Knowledge and Adoption of Zinc Supplementation in Agriculture

Many rural areas, especially within developing countries, are devoid of agricultural extension services or even modern farming education. Without proper information regarding the advantages of zinc supplementation, farmers are unaware of how much additional soil and crop yield improvement might benefit from supplements, which is deterring them from using the zinc-based fertilizers.

Farmers in rural areas normally stick to traditional farming practices and happen to be conservative in their approach toward adopting new technologies or new products like zinc fertilizers.

The general lack of awareness and education about the long-term benefits of zinc supplementation further restricts the acceptance, hindering growth for the agricultural grade zinc chemicals market in such regions.

The global agricultural grade zinc chemicals industry recorded a CAGR of 4.8% during the historical period between 2020 and 2024. The growth of agricultural grade zinc chemicals industry was positive as it reached a value of USD 844.3 million in 2024 from USD 688.8 million in 2020.

Several factors have contributed to the positive growth in the global Agricultural grade zinc chemicals market from 2020 to 2024. Increasing global food demand, driven by population growth and increasing agricultural productivity, favored the application of zinc-enriched fertilizers. Growing awareness of soil health and the role of zinc in improving crop yield further boosted the market adoption.

Furthermore, the cases of zinc deficiencies in the soils and the popularization of methods of sustainable farming also contributed to the demand for zinc-based products. Government support and educational initiatives helped farmers understand the need for micronutrients in agriculture, which drove the growth of the market.

Tier 1 companies include industry leaders with annual revenues exceeding USD 300 million. These companies are currently capturing a significant share of 40-45% globally. These frontrunners are characterized by high production capacity and a wide product portfolio.

They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. The firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include: UPL, Syngenta Crop Protection AG, IFFCO, Yara, and others.

Tier 2 companies encompass mid-sized participants with revenues ranging from USD 100-300 million, holding a presence in specific regions and exerting significant influence in local economies. These firms are distinguished by robust presence overseas and in-depth industry expertise.

They possess strong technology capabilities and adhere strictly to regulatory requirements. However, the firms may not wield cutting-edge technology or maintain an extensive global reach. Noteworthy entities in Tier 2 include Zochem Inc., EverZinc, Rubamin, Bionova, and few others.

Tier 3 encompasses most of the small-scale enterprises operating within the regional sphere and catering to specialized needs with revenues below USD 100 million. These businesses are notably focused on meeting local demand and are hence categorized within the Tier 3 segment.

They are small-scale participants with limited geographical presence. In this context, Tier 3 is acknowledged as an informal sector, indicating a segment distinguished by a lack of extensive organization and formal structure in comparison to the structured one. Tier 3 includes Sulphur Mills Limited, Aries Agro Limited, and many more small and local players.

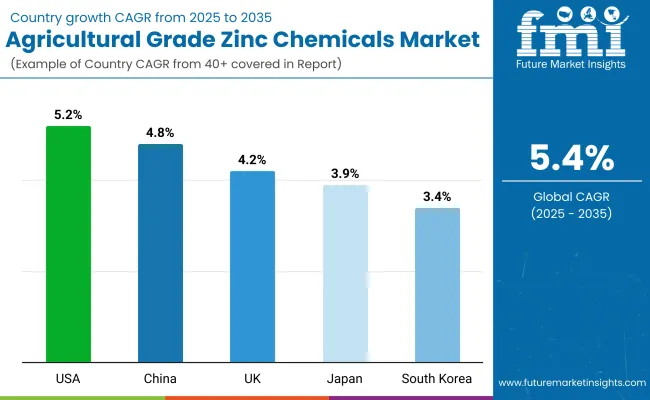

The section below highlights assessments of agricultural grade zinc chemicals market sale across key countries. China, Japan, and India are expected to showcase promising growth, with each exhibiting a strong CAGR through the forecast period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| UK | 4.2% |

| China | 4.8% |

| Japan | 3.9% |

| South Korea | 3.4% |

Precision farming techniques have improved immensely in the USA, where the effective use of fertilizers, including supplements of zinc, is an area of growing interest.

Generally, farmers are increasingly looking toward data-driven solutions to optimize crop yields while minimizing their environmental footprint. Focus on precision agriculture increases the requirement for zinc-enriched fertilizers to meet additional micronutrient needs of crops for better growth and productivity.

The USA has a very strong livestock industry, and for that, a great quantity of animal feed is required, especially high-quality animal feed. Zinc supplements contribute a lot to animal health and productivity, further encouraging agricultural grade zinc chemicals market growth.

With the increasing demand for animal-derived products, the demand for zinc-enriched animal feed also continues to rise and drives growth in the country's market.

The UK has been focusing on sustainability in agriculture, hence giving more attention to eco-friendly farming practices and reducing dependence on synthetic chemicals. More and more zinc-enriched fertilizers are being introduced to improve soil health while minimizing environmental impact.

Such a shift towards sustainability fuels the demand for agricultural-grade zinc chemicals since they support long-term soil fertility and enhance crop resilience to environmental stresses.

The increasing demand among consumers for quality and organic produces, therefore, is raising the use among UK farmers of micronutrient-rich fertilizers, which include zinc-based micronutrients.

These improved nutrient contents in crops also result in healthier and yield-improving plants. The development of organic farming methods, including soil care, is expected to further sustain the application of zinc-enhanced fertilizers and enhance market growth in the country.

Soil degradation and micronutrient deficiencies, particularly zinc, are concerns for agriculture productivity in China. In general, zinc fertilizers are vastly used to restore health to the soils and to increase crop yields in staple crops such as rice and wheat.

With zinc deficiencies addressed, farmers can ensure better quality of crops that translate into improved food security and increased agricultural production.

Corresponding to the growth in population, there has been an increased demand for high-value agricultural produce like vegetables, fruits, and grains.

Zinc fertilizers help to raise the nutritional value and quality of crops, which will be a must-meet factor from consumer expectations to export requirements. It is this increasing requirement for high-value produce that has been driving the adoption of zinc-based fertilizers in the country.

The section provides comprehensive assessments and insights that highlight current opportunities and emerging trends for companies in developed and developing countries. It analyzes advancements in manufacturing and identifies the latest trends poised to drive new applications in the market.

A few key players in the agricultural grade zinc chemicals industry are actively enhancing capabilities and resources to cater to the growing demand for the compound across diverse applications. Leading companies also leverage partnership and joint venture strategies to co-develop innovative products and bolster resource base.

Significant players are further introducing new products to address the increasing need for cutting-edge solutions in various end-use sectors. Geographic expansion is another important strategy that is being embraced by reputed companies. Start-ups are likely to emerge in the sector through 2035, thereby making it more competitive.

Industry Updates

In terms of type, the industry is divided into Zinc Oxide, Zinc Sulphate, EDTA Chelated Zinc, Sulphur Zinc Bentonite, Zinc Chloride, and Others.

In terms of application, the industry is divided into Animal Feed, Chemical Fertilizer, and Other.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East and Africa (MEA), have been covered in the report.

The global market was valued at USD 844.3 million in 2024.

The global market is set to reach USD 889.9 million in 2025.

Global demand is anticipated to rise at 5.4% CAGR.

The industry is projected to reach USD 1.5 Billion by 2035.

Table 1: Global Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Type, 2015 – 2021

Table 2: Global Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Type, 2022 – 2032

Table 3: Global Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Application, 2015 – 2021

Table 4: Global Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Application, 2022 – 2032

Table 5: Global Agricultural Grade Zinc Chemicals Market, By Region, 2015 – 2021

Table 6: Global Agricultural Grade Zinc Chemicals Market, By Region, 2022 – 2032

Table 7: North America Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Type, 2015 – 2021

Table 8: North America Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Type, 2022 – 2032

Table 9: North America Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Application, 2015 – 2021

Table 10: North America Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Application, 2022 – 2032

Table 11: North America Agricultural Grade Zinc Chemicals Market, By Country, 2015 – 2021

Table 12: North America Agricultural Grade Zinc Chemicals Market, By Country, 2022 – 2032

Table 13: Latin America Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Type, 2015 – 2021

Table 14: Latin America Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Type, 2022 – 2032

Table 15: Latin America Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Application, 2015 – 2021

Table 16: Latin America Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Application, 2022 – 2032

Table 17: Latin America Agricultural Grade Zinc Chemicals Market, By Country, 2015 – 2021

Table 18: Latin America Agricultural Grade Zinc Chemicals Market, By Country, 2022 – 2032

Table 19: Europe Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Type, 2015 – 2021

Table 20: Europe Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Type, 2022 – 2032

Table 21: Europe Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Application, 2015 – 2021

Table 22: Europe Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Application, 2022 – 2032

Table 23: Europe Agricultural Grade Zinc Chemicals Market, By Country, 2015 – 2021

Table 24: Europe Agricultural Grade Zinc Chemicals Market, By Country, 2022 – 2032

Table 25: Asia Pacific Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Type, 2015 – 2021

Table 26: Asia Pacific Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Type, 2022 – 2032

Table 27: Asia Pacific Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Application, 2015 – 2021

Table 28: Asia Pacific Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Application, 2022 – 2032

Table 29: Asia Pacific Agricultural Grade Zinc Chemicals Market, By Country, 2015 – 2021

Table 30: Asia Pacific Agricultural Grade Zinc Chemicals Market, By Country, 2022 – 2032

Table 31: MEA Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Type, 2015 – 2021

Table 32: MEA Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Type, 2022 – 2032

Table 33: MEA Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Application, 2015 – 2021

Table 34: MEA Agricultural Grade Zinc Chemicals Market Value (US$ Mn), By Application, 2022 – 2032

Table 35: MEA Agricultural Grade Zinc Chemicals Market, By Country, 2015 – 2021

Table 36: MEA Agricultural Grade Zinc Chemicals Market, By Country, 2022 – 2032

Table 37: Global Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Type, 2015 - 2021

Table 38: Global Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Application, 2022 – 2032

Table 39: Global Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Region, 2022 – 2032

Table 40: North America Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Type, 2015 - 2021

Table 41: North America Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Application, 2022 – 2032

Table 42: North America Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Country, 2022 – 2032

Table 43: Latin America Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Type, 2015 - 2021

Table 44: Latin America Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Application, 2022 – 2032

Table 45: Latin America Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Country, 2022 – 2032

Table 46: Europe Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Type, 2015 - 2021

Table 47: Europe Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Application, 2022 – 2032

Table 48: Europe Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Country, 2022 - 2032

Table 49: Asia Pacific Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Type, 2015 - 2021

Table 50: Asia Pacific Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Application, 2022 – 2032

Table 51: Asia Pacific Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Country, 2022 – 2032

Table 52: MEA Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Type, 2015 - 2021

Table 53: MEA Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Application, 2022 – 2032

Table 54: MEA Agricultural Grade Zinc Chemicals Market Incremental $ Opportunity, By Country, 2022 - 2032

Figure 1: Global Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Year-on-Year Growth, 2015-2032

Figure 2: Global Agricultural Grade Zinc Chemicals Market Absolute $ Historical Gain (2015 - 2021) and Opportunity (2022 – 2032), US$ Mn

Figure 3: Global Agricultural Grade Zinc Chemicals Market Share, By Type, 2022 & 2032

Figure 4: Global Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Type – 2022-2032

Figure 5: Global Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Type – 2022-2032

Figure 6: Global Agricultural Grade Zinc Chemicals Market Share, By Application, 2022 & 2032

Figure 7: Global Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Application – 2022-2032

Figure 8: Global Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Application – 2022-2032

Figure 9: Global Agricultural Grade Zinc Chemicals Market Share, By Region, 2022 & 2032

Figure 10: Global Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Region – 2022-2032

Figure 11: Global Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Region – 2022-2032

Figure 12: North America Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Year-on-Year Growth, 2015-2032

Figure 13: North America Agricultural Grade Zinc Chemicals Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Mn

Figure 14: North America Agricultural Grade Zinc Chemicals Market Share, By Type, 2022 & 2032

Figure 15: North America Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Type – 2022-2032

Figure 16: North America Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Type – 2022-2032

Figure 17: North America Agricultural Grade Zinc Chemicals Market Share, By Application, 2022 & 2032

Figure 18: North America Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Application – 2022-2032

Figure 19: North America Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Application – 2022-2032

Figure 20: North America Agricultural Grade Zinc Chemicals Market Share, By Country, 2022 & 2032

Figure 21: North America Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 22: North America Market Attractiveness Index, By Country – 2022-2032

Figure 23: Latin America Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Year-on-Year Growth, 2015-2032

Figure 24: Latin America Agricultural Grade Zinc Chemicals Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Mn

Figure 25: Latin America Agricultural Grade Zinc Chemicals Market Share, By Type, 2022 & 2032

Figure 26: Latin America Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Type – 2022-2032

Figure 27: Latin America Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Type – 2022-2032

Figure 28: Latin America Agricultural Grade Zinc Chemicals Market Share, By Application, 2022 & 2032

Figure 29: Latin America Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Application – 2022-2032

Figure 30: Latin America Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Application – 2022-2032

Figure 31: Latin America Agricultural Grade Zinc Chemicals Market Share, By Country, 2022 & 2032

Figure 32: Latin America Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 33: Latin America Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Country – 2022-2032

Figure 34: Europe Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Year-on-Year Growth, 2015-2032

Figure 35: Europe Agricultural Grade Zinc Chemicals Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Mn

Figure 36: Europe Agricultural Grade Zinc Chemicals Market Share, By Type, 2022 & 2032

Figure 37: Europe Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Type – 2022-2032

Figure 38: Europe Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Type – 2022-2032

Figure 39: Europe Agricultural Grade Zinc Chemicals Market Share, By Application, 2022 & 2032

Figure 40: Europe Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Application – 2022-2032

Figure 41: Europe Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Application – 2022-2032

Figure 42: Europe Agricultural Grade Zinc Chemicals Market Share, By Country, 2022 & 2032

Figure 43: Europe Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 44: Europe Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Country – 2022-2032

Figure 45: MEA Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Year-on-Year Growth, 2015-2032

Figure 46: MEA Agricultural Grade Zinc Chemicals Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Mn

Figure 47: MEA Agricultural Grade Zinc Chemicals Market Share, By Type, 2022 & 2032

Figure 48: MEA Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Type – 2022-2032

Figure 49: MEA Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Type – 2022-2032

Figure 50: MEA Agricultural Grade Zinc Chemicals Market Share, By Application, 2022 & 2032

Figure 51: MEA Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Application – 2022-2032

Figure 52: MEA Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Application – 2022-2032

Figure 53: MEA Agricultural Grade Zinc Chemicals Market Share, By Country, 2022 & 2032

Figure 54: MEA Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 55: MEA Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Country – 2022-2032

Figure 56: Asia Pacific Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Year-on-Year Growth, 2015-2032

Figure 57: Asia Pacific Agricultural Grade Zinc Chemicals Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Mn

Figure 58: Asia Pacific Agricultural Grade Zinc Chemicals Market Share, By Type, 2022 & 2032

Figure 59: Asia Pacific Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Type – 2022-2032

Figure 60: Asia Pacific Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Type – 2022-2032

Figure 61: Asia Pacific Agricultural Grade Zinc Chemicals Market Share, By Application, 2022 & 2032

Figure 62: Asia Pacific Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Application – 2022-2032

Figure 63: Asia Pacific Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Application – 2022-2032

Figure 64: Asia Pacific Agricultural Grade Zinc Chemicals Market Share, By Country, 2022 & 2032

Figure 65: Asia Pacific Agricultural Grade Zinc Chemicals Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 66: Asia Pacific Agricultural Grade Zinc Chemicals Market Attractiveness Index, By Country – 2022-2032

Figure 67: US Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 68: US Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 69: US Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 70: Canada Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 71: Canada Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 72: Canada Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 73: Brazil Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 74: Brazil Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 75: Brazil Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 76: Mexico Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 77: Mexico Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 78: Mexico Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 79: Germany Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 80: Germany Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 81: Germany Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 82: U.K. Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 83: U.K. Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 84: U.K. Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 85: France Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 86: France Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 87: France Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 88: Italy Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 89: Italy Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 90: Italy Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 91: BENELUX Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 92: BENELUX Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 93: BENELUX Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 94: Nordic Countries Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 95: Nordic Countries Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 96: Nordic Countries Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 97: China Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 98: China Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 99: China Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 100: Japan Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 101: Japan Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 102: Japan Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 103: South Korea Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 104: South Korea Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 105: South Korea Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 106: GCC Countries Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 107: GCC Countries Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 108: GCC Countries Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 109: South Africa Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 110: South Africa Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 111: South Africa Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Figure 112: Turkey Agricultural Grade Zinc Chemicals Market Value (US$ Mn) and Forecast, 2022 - 2032

Figure 113: Turkey Agricultural Grade Zinc Chemicals Market Share, By Type, 2021

Figure 114: Turkey Agricultural Grade Zinc Chemicals Market Share, By Application, 2021

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Adjuvant Market - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Activator Adjuvant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Agricultural Nets Market Growth - Trends & Forecast 2025 to 2035

Agricultural Equipment Market Growth - Trends & Forecast 2025 to 2035

A Detailed Competition Share Assessment of the Agricultural Sprayers Market

Agricultural Robots Market Trends – Growth & Demand through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA