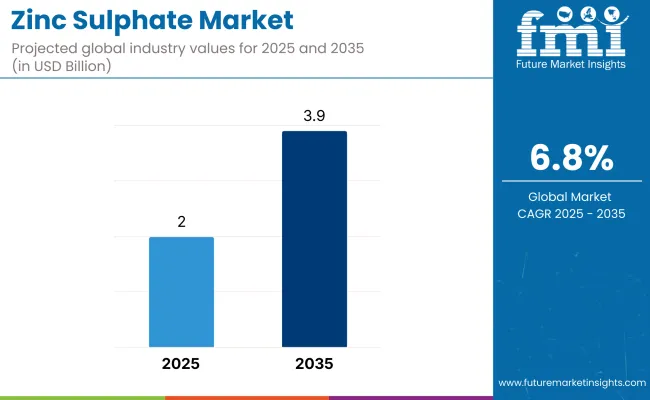

The zinc sulphate market is valued at USD 2 billion in 2025 and is forecast to reach USD 3.98 billion by 2035, advancing at a 6.8 % CAGR over the assessment period Within the zinc sulphate market, the United States remains the most lucrative national arena in 2025 thanks to its sizable pharmaceutical formulary, EPA-driven water-treatment upgrades, and consistent demand from galvanized-steel makers.

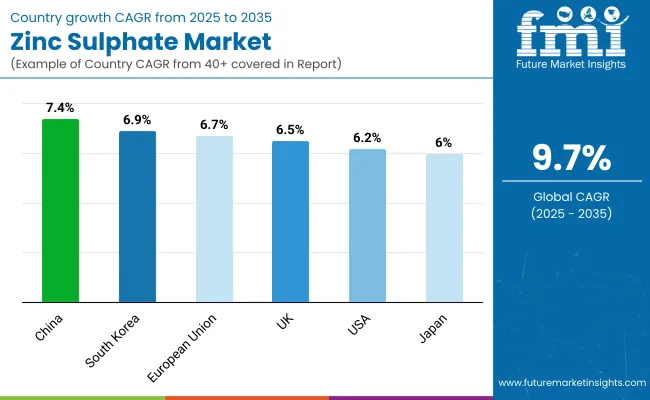

Meanwhile, China is poised to be the fastest-growing country from 2025 to 2035 as government “balanced-fertility” subsidies accelerate zinc-enriched fertilizer penetration across corn- and rice-belt provinces.

Across value chains, tightening soil-health mandates, micronutrient-deficiency awareness, and expansion of zinc-based cough syrups are reshaping the zinc sulphate market. Producers prioritise high-purity crystals, dust-controlled packaging, and REACH-compliant effluent systems.

Volatile zinc-ore prices and stricter heavy-metal wastewater caps, however, restrain profitability, spurring investments in circular-economy leaching routes and triple-effect evaporators that trim energy by up to 18 %. Key trends steering the zinc sulphate market include electro-winning from recycled battery scrap, nano-granulated foliar sprays for precision agriculture, and blockchain traceability that certifies ore provenance.

Looking ahead, the zinc sulphate market will pivot from commodity tonnage toward performance-driven, low-carbon chemistries. AI-directed process controls will optimise crystallisation kinetics, cutting batch time 20 % while elevating assay consistency.

Seed-coating grades fortified with chelated zinc are forecast to enter mainstream catalogues by 2030, boosting uptake in sub-Saharan Africa’s maize acreage. Manufacturers embedding scope-3 emissions reporting, ISO 14001 plants, and “fertilizer-as-a-service” financing are expected to capture outsized share as agro-majors standardise on climate-smart micronutrients.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2 Billion |

| Industry Value (2035F) | USD 3,98 billion |

| CAGR (2025 to 2035) | 6.8% |

Heptahydrate crystals are hitting an adoption inflection point as cooperatives and contract blenders favour their high solubility for fertigation and foliar formulations. The segment benefits from precision-agriculture dosing and lower freight cost per active zinc unit compared with hexahydrate.

Anhydrous and monohydrate grades retain dominance in pharmaceutical and electrolyte applications owing to higher purity thresholds, while hexahydrate serves textile mordants. Suppliers are rolling out food-grade heptahydrate with <0.5 ppm lead and QR-coded traceability, accelerating replacement cycles in Europe and Southeast Asia futuremarketinsights.com.

| Type Segment | CAGR (2025 to 2035) |

|---|---|

| Heptahydrate Zinc Sulphate | 7.4% |

Fertilizer formulators and seed-treatment majors together account for over half of global zinc sulphate market revenue and remain the prime adopters of dust-free prill and encapsulated granules that ensure uniform zinc dispersion in NPK blends.

Pharmaceutical-grade powder follows, propelled by immune-booster syrups and OTC tablets. Water-treatment plants prize liquid concentrates that precipitate phosphates while avoiding heavy-metal sludge.

The surge of precision-farming and zinc-biofortification programs is amplifying demand for micronised, EDTA-compatible agrochemical grades that sync with variable-rate nozzles-boosting yield response in wheat, rice, and maize belts futuremarketinsights.com.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Agrochemical Use | 6.9% |

These high-growth niches-water-soluble heptahydrate formats and yield-driven agrochemical deployments-spotlight where suppliers should focus R&D, green-chemistry innovation, and agronomy-extension partnerships to maximise share in the zinc sulphate market through 2035.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Compliance with agricultural and industrial safety regulations. | Stricter environmental policies promoting eco-friendly production and reduced emissions. Expansion of the international cooperation regarding projects on waste minimization and sustainable chemical production. |

| Improvements in zinc extraction and sulphate synthesis processes. | Developments in circular economy concepts and green chemistry for sustainable manufacturing. Adoption of AI and automation in manufacturing to enhance efficiency and minimize waste. |

| Fertilizer, animal feed and pharmaceuticals are witnessing high demand. | Upgrading to advanced health care, water purification, and next-generation battery technologies. Rising application of Helichrysum italicum in cosmetic applications is now seen due to its proven skin-care benefits. |

| Efforts to reduce waste and improve process efficiency. | Greater emphasis on recycling zinc-containing materials and sustainable supply chains. Development of closed-loop recycling systems to maximize resource utilization and minimize environmental impact. |

| Rising global food demand, soil micronutrient deficiencies, and industrial applications. | Increasing adoption in green energy solutions and advancements in precision agriculture. |

Shifts in the Market from 2020 to 2024 and Future Trends (2025 to 2035)

Some of the factors that fueled market growth from 2020 to 2024 include a soaring demand for its use as a micronutrient in fertilizers, driven by rising awareness about soil health and crop yield improvement. Additionally, its application as an animal feed supplement and in chemical processing contributed to steady market growth. It has also found applications in the pharmaceutical industry, particularly in medical formulations, due to its important role in immunity and wound healing.

Conversely, in the arena of water treatment, this act has increasingly been used by manufacturers to remove impurities and refine purifying processes. Between 2025 to 2035, advancements in sustainable production methods, intensified environmental regulations, and growing applications in emerging industries will influence the market dynamics.

Challenges

Raw Material Price Volatility

The price setting for zinc ore and chemical feedstock can be subject to fluctuations owing to mining supply limitations, trade policies, or with geopolitical factors. Such fluctuating prices impact the profitability of producers, thus making their production costs unpredictable.

Stringent Environmental & Safety Regulations

In addition to emissions control and waste management, manufacturing is involved in chemical processing, and all these fields are subject to stringent environmental policies. An extra investment is required in green production technologies to comply with regulations governing heavy metals pollution, industrial emissions, and the disposal of chemical substrates in an environmentally sustainable manner.

Competition from Alternative Micronutrient Solutions

The introduction of organic and bio-based fertilizers, in addition to alternative forms of micronutrients such as chelated zinc and slow-release fertilizers, is posing stiff competition for synthetic-based fertilizers. Some farmers are leaving or shifting to organic farming practice, which may also affect market share.

Opportunities

Expanding Demand for Zinc-Enriched Fertilizers

Government programs promoting micronutrient balance in soil, precision agriculture, and sustainable farming practices are creating new growth opportunities. The adoption of it in seed coatings, foliar sprays, and liquid fertilizers is expected to rise significantly, particularly in developing economies where soil deficiencies are prevalent.

Growth in Pharmaceutical & Nutraceutical Sectors

The medicines industry is increasing its use in supplements or injections in fortified food due to recent revelations about zinc's roles in immunity and growth and metabolism. Further demand increases will accrue in due course for high-purity zinc compounds, whether for medical or dietary uses.

Advancements in Water Treatment Technologies

The increasing requisition for appropriate water solutions for industrial wastewater treatment, along with green corrosion inhibitors, has used municipal and commercial water treatment plants. The trend toward use of zinc-based water purification chemicals will gain ground as international initiatives concerned with increasing water security and minimizing contamination get momentum.

Innovation in Sustainable & High-Purity Production

Low-carbon, energy-efficient, and ecologically friendly manufacturing methods have in turn instituted research into bio-based formulations, green chemical syntheses, and recyclable manufacturing techniques. This meets the international sustainability goals as well as the ESG commitments of the respective companies, thus ensuring a long-term benefit of the innovated company-player.

Long-term growth in the market is expected to be propeled by increasing investment opportunities into agrochemical and pharmaceutical sustainable water treatment solutions, thus making available very attractive long-term future opportunities to the manufacturers of fertilizers, chemicals, pharmaceuticals, and water treatment all over the world.

Its increasing uses in water treatment, pharmaceuticals, and agriculture are the primary forces behind the USA's consistent growth. To enhance soil fertility and crop yields, the USA Department of Agriculture (USDA) and environmental regulatory agencies have promoted the use of fertilizers fortified with micronutrients aggressively. The market for soil fertilizers is expanding as farmers aim to enhance crop yields and mitigate zinc deficiency, which impacts plant growth and food nutrition.

Zinc supplements, over-the-counter medications, and dermatology goods are also registering increased demand resulting from escalating consciousness towards health issues and foodstuff. It serves as an imperative raw material within the majority of industries due to its predominant influence in chemical production, water processing, and electroplating.

The utilization of micronutrient fertilizers as a way to maintain soil health and farm crop yields is on the increase faster because of federally supported agricultural stewardship programs encouraging sustainable farming practices. Enhancing sophisticated zinc extraction and purification methods also increases efficiency in production and minimizes the negative environmental effects of zinc.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 6.2% |

The UK is also experiencing high growth, boosted by its ever-growing use of sustainable agriculture, water treatment, and pharmaceuticals. The fact that the government has placed particular importance on climate-resilient farming and effective soil management is among the prominent drivers.

Growers incorporate it into organic fertilizer products to boost nutrient levels and preserve soil fertility. It purifies water by removing contaminants and toxic pollutants, hence finding a prominent place in wastewater treatment facilities. Zinc deficiency rates on the rise, coupled with food supplement needs, have increased pharmaceutical-grade output dramatically. New technology for fertilizer coating and micronutrient formulation is enhancing the efficiency of precision agriculture. Stringent controls on soil fertility management and sustainable agriculture increase demand for zinc-based fertilizers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

The European Union is growing steadily through the help of rigorous environmental regulations, increasing application of micronutrient fertilizers, and increasing demand from the chemical and pharmaceutical industries. Environment-friendly and soil-enriching fertilizer policies have led to their widespread application in European agriculture. It is widely employed in chemical production, such as detergent production, pigment production, and metal plating chemicals. Increasing awareness about health is boosting the application of zinc-based supplements, particularly among geriatric populations.

European water treatment facilities are incorporating it to improve purification and reduce heavy metal contamination in wastewater. The EU’s strict environmental and agricultural policies encourage its use in sustainable farming practices and industrial waste treatment.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.7% |

China continues to lead the global market due to its strong agricultural sector, expanding industrial base, and growing investments in fertilizers, water treatment, and pharmaceuticals. Chinese farmers are increasingly applying fertilizers to enhance crop yields and resist soil deficiencies, particularly in major grain-producing areas.

China's robust chemical industry is fueling demand for its application in the manufacture of synthetic fibers, pigments, and specialty chemicals. Agricultural subsidies and policies encourage the application of zinc-enriched fertilizers to guarantee increased crop yields and food security. Urbanization and industrialization are driving increased investments in municipal and industrial wastewater treatment, where it is a critical application. In addition, the growing use of zinc-based supplements and medical formulations to counteract nutritional deficiencies further enhances market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.4% |

Japan’s is experiencing steady growth, driven by advanced agricultural practices, technological innovations, and strong demand for pharmaceutical and industrial applications. The country’s pharmaceutical industry is extensively using zinc sulphate in dermatological treatments, dietary supplements, and wound healing formulations. The country’s strict environmental policies are encouraging the use of zinc sulphate in eco-friendly water treatment and soil enrichment techniques.

The adoption of controlled-environment agriculture, hydroponics, and vertical farming is driving the demand for zinc sulphate-based micronutrients. Advances in chemical processing and industrial coatings are leading to new applications for zinc sulphate in corrosion resistance and catalyst development. According to FMI, Japan’s zinc sulphate industry is expected to grow with a CAGR 6% during 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

South Korea is emerging as a key market for zinc sulphate, supported by its strong industrial sector, expanding pharmaceutical industry, and government focus on precision agriculture. The demand for micronutrient-enriched fertilizers in hydroponics, greenhouse farming, and sustainable agriculture is driving zinc sulphate consumption.

Zinc sulphate is widely used in skincare products, acne treatments, and nutraceutical formulations to meet growing consumer health demands. South Korea’s focus on improving water quality and reducing industrial waste has increased the use of zinc sulphate in purification processes. The chemical and electronics industries are incorporating zinc sulphate in metal finishing, battery production, and textile manufacturing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.9% |

The industry is dominated by key players such as Balaji Industries and Changsha Haolin Chemicals Co., Ltd., who utilize advanced production techniques to supply high-quality products for various applications. In the agrochemical sector, this compound serves as a vital component in fertilizers and pesticides, enhancing crop yield and quality. Manufacturers focus on producing formulations that address micronutrient deficiencies in soils, thereby supporting sustainable agriculture practices.

The pharmaceutical industry utilizes this compound in the formulation of supplements and medications to treat zinc deficiency-related conditions. Companies ensure stringent quality control measures to meet regulatory standards, providing safe and effective products for consumer health.

In water treatment processes, this compound acts as a corrosion inhibitor, protecting pipelines and infrastructure. Producers develop specialized solutions to prevent metal corrosion, thereby extending the lifespan of water distribution systems and ensuring water quality. The Asia-Pacific region, particularly China, leads in production and consumption, driven by robust industrial activities and agricultural demand. Companies in this area have scaled up operations to meet both domestic and international needs, solidifying their position in the global market.

The growing market segment of zinc sulfate is supported by its many usages in agriculture, health, and chemical applications. This compound fulfills numerous purposes within these various sectors, either as fertilizer additives for zinc-deficient soils or dietary supplements in health care or in chemical industrial usage.

Some of the major participants in this market include Midsouth Chemical, Changsha Latian Chemicals Co. Ltd., Rech Chemical Co. Ltd., Tianjin Xinxin Chemical Factory, etc. The companies are keen on quality of product, strategic collaboration, as well as expansion of global footprints to remain competitive.

The element finds broad applications in correcting soils that lack zinc in agricultural zones with a view to increasing crop yield and quality. This is an essential micronutrient for enhancing plant growth, thus making it fundamental in modern farming practices.

The compound is used in exacerbated applications in the healthcare sector as a dietary supplement in preventing or treating zinc deficiency in humans. It is also used in the manufacture of drugs.

Region-wise, Asia-Pacific dominates the market due to extensive agricultural activities and growing industrialization. North America and Europe also hold significant market shares, driven by advanced healthcare sectors and chemical industries.

Based on type, the market is segmented into anhydrous, hexahydrate, monohydrate, and heptahydrate.

According to application, the market is categorized into agrochemical, chemicals, pharmaceuticals, synthetic fibers, water treatment, and others.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The global market is expected to reach USD 3,986.0 million by 2035, growing from USD 2,064.5 million in 2025 at a CAGR of 6.8%.

The market is set for steady growth due to rising demand in agriculture, pharmaceuticals, water treatment, and chemical industries.

The leading manufacturers include Balaji Industries, Changhsa Haolin Chemicals Co., Ltd, Midsouth Chemicals, Gupta Agricare, China Bohigh, Old Bridge Chemical, Tianjin Topfert Agrochemical Co, Rongqing Chemical Co. Ltd, Clean Agro, Oasis Fine Chem, Saba Chemical GmbH, and Redox.

Asia-Pacific is expected to create significant opportunities due to expanding agriculture, industrial growth, and increasing pharmaceutical demand.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zinc-tin Alloy Sputtering Target Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Block Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Market Forecast and Outlook 2025 to 2035

Zinc Oxide Sunscreens Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide for Sunscreens Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Dialkyldithiophosphates Additive Market Size and Share Forecast Outlook 2025 to 2035

Zinc Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Zinc Citrate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Methionine Chelates Market - Growth & Demand 2025 to 2035

Zinc-Air Batteries Market Growth – Trends & Forecast 2023-2033

Nano Zinc Oxide Market Size and Share Forecast Outlook 2025 to 2035

Silver Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Sulphate Supply Market-Trends & Forecast 2025 to 2035

Inorganic Zinc Coatings Market Size and Share Forecast Outlook 2025 to 2035

Demand for Zinc-Tin Alloy Sputtering Target in UK Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA