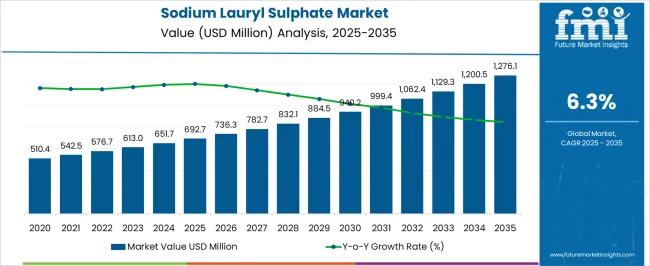

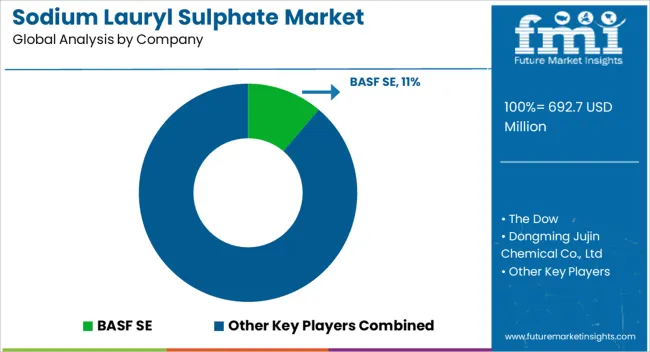

The Sodium Lauryl Sulphate Market is estimated to be valued at USD 692.7 million in 2025 and is projected to reach USD 1276.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Sodium Lauryl Sulphate Market Estimated Value in (2025 E) | USD 692.7 million |

| Sodium Lauryl Sulphate Market Forecast Value in (2035 F) | USD 1276.1 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The Sodium Lauryl Sulphate (SLS) market is experiencing robust growth, driven by its widespread use in personal care, household cleaning, and industrial applications due to its excellent surfactant properties. Demand is being fueled by increasing consumption of detergents, shampoos, soaps, and other cleaning products, where SLS enhances foaming, emulsifying, and cleaning efficiency. Advancements in production technologies and process optimization are improving yield, reducing costs, and enabling large-scale industrial adoption.

Growing awareness regarding product performance, formulation versatility, and cost-effectiveness has reinforced market expansion. The focus on eco-friendly and sustainable formulations is influencing manufacturers to innovate production processes while maintaining performance standards.

Rising industrialization, urbanization, and population growth in emerging economies are increasing the demand for personal care and household cleaning products, further boosting the market The ability of SLS to serve multiple applications, combined with its adaptability in formulations, positions it for continued adoption, with sustained growth expected across detergents, cosmetics, and other industrial segments over the coming decade.

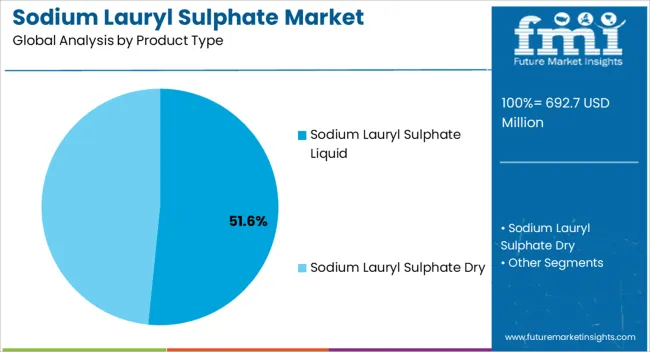

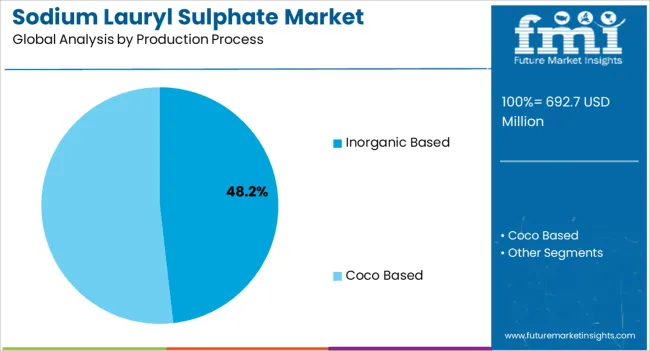

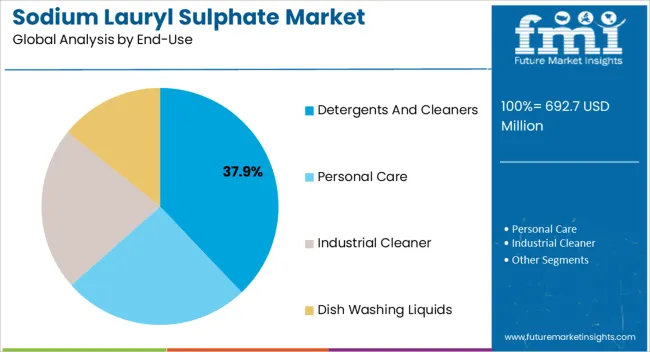

The sodium lauryl sulphate market is segmented by product type, production process, end-use, and geographic regions. By product type, sodium lauryl sulphate market is divided into Sodium Lauryl Sulphate Liquid and Sodium Lauryl Sulphate Dry. In terms of production process, sodium lauryl sulphate market is classified into Inorganic Based and Coco Based. Based on end-use, sodium lauryl sulphate market is segmented into Detergents And Cleaners, Personal Care, Industrial Cleaner, and Dish Washing Liquids. Regionally, the sodium lauryl sulphate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sodium lauryl sulphate liquid segment is projected to hold 51.6% of the market revenue in 2025, establishing it as the leading product type. Its market dominance is being driven by ease of handling, uniform solubility, and compatibility with various formulations in personal care and industrial applications. Liquid SLS allows for consistent dispersion in shampoos, soaps, and detergents, enhancing product efficiency and performance.

The reduced need for additional processing compared with powder forms lowers production costs and streamlines manufacturing. Widespread adoption across both small and large-scale producers, combined with its versatility in multiple end-use applications, reinforces its leading position.

Continuous improvements in stabilization techniques and quality assurance practices have further strengthened reliability and adoption rates As demand for high-performance, cost-effective, and versatile surfactants increases globally, the sodium lauryl sulphate liquid segment is expected to maintain its market leadership, supported by broad applicability across cleaning and personal care industries.

The inorganic based production process segment is anticipated to account for 48.2% of the market revenue in 2025, making it the leading production method. Growth in this segment is being driven by the scalability, cost-effectiveness, and consistent quality offered by inorganic synthesis techniques. This process allows for high-purity SLS production with predictable chemical properties, which is essential for industrial and personal care applications.

Efficiency in raw material utilization, reduced energy consumption, and compatibility with automated production systems further reinforce adoption. Manufacturers benefit from the ability to produce large volumes reliably while maintaining quality standards, supporting supply chain stability.

Rising demand from detergents, personal care, and industrial cleaning product manufacturers is accelerating deployment of the inorganic production process As global consumption of SLS continues to rise, this method is expected to retain its leading share, driven by its operational efficiency, scalability, and ability to meet stringent quality and regulatory requirements across multiple applications.

The detergents and cleaners segment is expected to hold 37.9% of the market revenue in 2025, establishing it as the leading end-use industry. Growth is being driven by increasing consumption of household and industrial cleaning products that rely on SLS for foaming, emulsifying, and cleaning performance. Rising urbanization, population growth, and increasing awareness of hygiene standards are contributing to the growing demand for high-quality detergents and cleaners.

SLS provides cost-effective formulation benefits, enabling manufacturers to produce products that deliver superior cleaning efficiency at competitive pricing. Integration of SLS in liquid, powder, and multi-functional cleaning products has expanded its applicability.

Regulatory compliance, product performance, and environmental considerations are influencing manufacturers to adopt high-purity SLS, ensuring safety and effectiveness in end-use applications As demand for cleaning solutions continues to grow globally, the detergents and cleaners segment is expected to remain the primary driver of market revenue, supported by widespread adoption and formulation versatility.

Sodium lauryl sulphate is created when lauryl alcohol is mixed with sulphur trioxide gas, oleum/chlorosulphuric acid, and neutralized with sodium carbonate or sodium hydroxide. It can also be made by hydrolyzing coconut first and then hydrogenating the leftovers.

Sodium lauryl sulfate is a highly sought-after detergent component due to its amphiphilic properties. The renowned surfactant Sodium Lauryl Sulphate (SLS) is also widely used in applications.

Sodium lauryl sulphate comes in three different forms: powder, needles, and grains. In industrial and textile applications, it is utilized in cleaning processes, cleaning solutions, and foaming & rowing agents. It can remove oil stains and residues from a variety of surfaces, making it useful for use in a number of speciality cleaning products. A synthetic soap or survivor called sodium lauryl sulfate can be made from coconut oil, palm kernel oil, or milk. Several cleaning and hygiene products use it as a protein repair agent and it is appropriate for a number of general electrophoresis applications. furthermore, sodium lauryl sulfate is very effective at removing grime, mud, and oil stains thanks to its better foam- and lather-forming properties. Furthermore, the increasing need for sodium lauryl sulfate in the cleaning industry has had a significant impact on the development of effective procedures during the past few decades. Due to the increased use of personal care products and flexible access to sophisticated economic livestock, demand for the product has been continually rising.

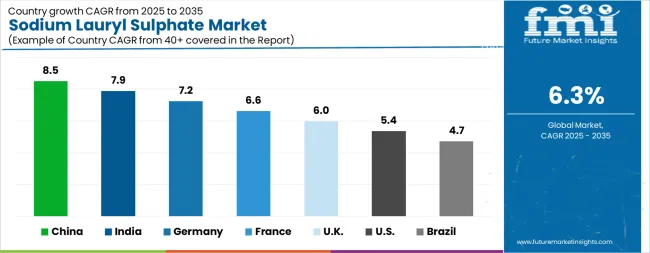

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The Sodium Lauryl Sulphate Market is expected to register a CAGR of 6.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.5%, followed by India at 7.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.7%, yet still underscores a broadly positive trajectory for the global Sodium Lauryl Sulphate Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.2%. The USA Sodium Lauryl Sulphate Market is estimated to be valued at USD 249.9 million in 2025 and is anticipated to reach a valuation of USD 421.0 million by 2035. Sales are projected to rise at a CAGR of 5.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 35.2 million and USD 22.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 692.7 Million |

| Product Type | Sodium Lauryl Sulphate Liquid and Sodium Lauryl Sulphate Dry |

| Production Process | Inorganic Based and Coco Based |

| End-Use | Detergents And Cleaners, Personal Care, Industrial Cleaner, and Dish Washing Liquids |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, The Dow, Dongming Jujin Chemical Co., Ltd, Henan GP Chemicals Co.,Ltd, Shanghai Youyang Industrial Co, Stepan Company, Clariant Corporation, Acme-Hardesty Company, Alpha Chemicals Pvt. Ltd., Croda International Plc, The Chemours Company, Huntsman Corporation, Lion Specialty Chemicals Co. Ltd., Galaxy Surfactants Ltd., Henkel AG & Co. KGaA, Solvay S.A, and Evonik |

The global sodium lauryl sulphate market is estimated to be valued at USD 692.7 million in 2025.

The market size for the sodium lauryl sulphate market is projected to reach USD 1,276.1 million by 2035.

The sodium lauryl sulphate market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in sodium lauryl sulphate market are sodium lauryl sulphate liquid and sodium lauryl sulphate dry.

In terms of production process, inorganic based segment to command 48.2% share in the sodium lauryl sulphate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium 3-Nitrobenzenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauroyl Isethionate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA