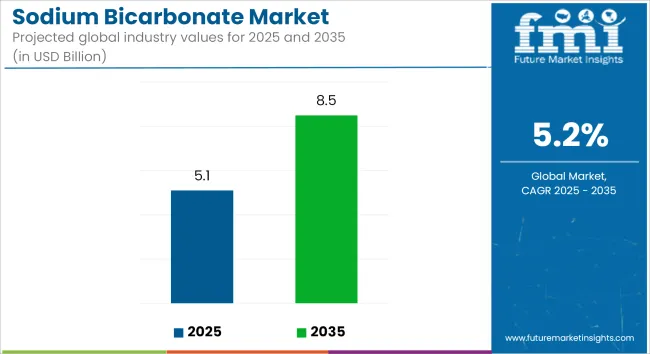

The global sodium bicarbonate market is valued at USD 5.1 billion in 2025 and is expected to reach USD 8.5 billion by 2035, growing at a CAGR of 5.2% over the forecast period. Market expansion is being supported by broad applications across food processing, healthcare, industrial air treatment, and environmentally responsible product formulations.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 5.1 billion |

| Market Value (2035F) | USD 8.5 billion |

| CAGR (2025 to 2035) | 5.2% |

Sodium bicarbonate, classified as GRAS (Generally Recognized as Safe) by the USA Food and Drug Administration, continues to be utilized widely in the food industry as a leavening agent, pH stabilizer, and preservative. Packaged baked goods, ready-to-eat meals, and carbonated beverages remain core application areas contributing to baseline demand.

In pharmaceuticals, sodium bicarbonate is included on the World Health Organization’s List of Essential Medicines. Its use is documented in critical treatments such as metabolic acidosis correction during dialysis and emergency care for drug intoxication. Antacid preparations using sodium bicarbonate are relied upon in both prescription and over-the-counter medications.

Industrial consumption is increasing due to the material’s efficiency in flue gas desulfurization (FGD). The USA Environmental Protection Agency (EPA) has reported sulfur dioxide emission reductions of up to 90% in systems using sodium bicarbonate as a dry sorbent. This application is gaining traction in coal-fired power plants and waste incineration units seeking to comply with clean air standards.

Additional end uses are being supported across fire safety, personal care, and water treatment. The fire extinguisher segment is deploying sodium bicarbonate in dry chemical powder formulations, while personal care products integrate the compound for deodorization and mild abrasion. Its utility as a buffering agent in water treatment systems is also enabling more sustainable pH control in municipal and industrial installations.

Product development efforts are being directed toward high-purity and pharmaceutical-grade variants, with manufacturers upgrading refining processes to support medical and food-grade supply. Demand from animal nutrition is also contributing to volume expansion, with sodium bicarbonate used in livestock feed to regulate rumen pH and improve digestion efficiency. Continued diversification in downstream industries is expected to maintain stable growth momentum across global markets.

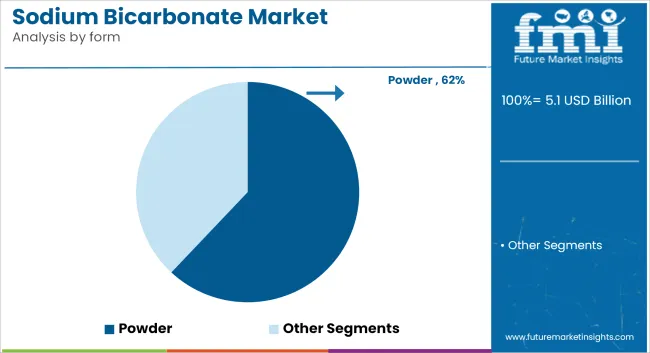

Powder form is estimated to account for approximately 62% of the global sodium bicarbonate market share in 2025 and is projected to grow at a CAGR of 5.3% through 2035. This form is widely used for its fine particle size, high reactivity, and consistent solubility, making it ideal for formulation in baking products, effervescent tablets, and cleaning agents.

Food-grade powder is essential in baked goods for leavening, while pharmaceutical-grade powder is used in antacids and dialysis applications. The segment continues to benefit from increased consumption of processed food and personal care products, particularly across Asia-Pacific and North America. Manufacturers are optimizing production efficiency and purity standards to meet rising demand from regulated and high-volume consumer industries.

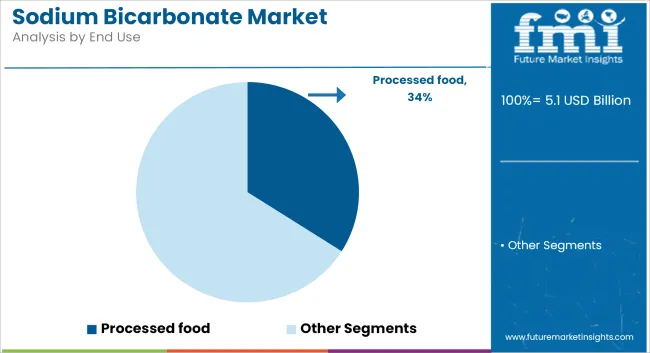

The processed food segment is projected to hold approximately 34% of the global sodium bicarbonate market share in 2025 and is expected to grow at a CAGR of 5.4% through 2035. Sodium bicarbonate acts as a leavening agent, pH buffer, and acidity regulator in products such as bread, cakes, cookies, and crackers.

The clean-label trend and increasing demand for familiar, multi-functional ingredients are reinforcing its presence in bakery and convenience food formulations. With rising urbanization, on-the-go snacking, and demand for shelf-stable products, food processors are scaling usage of sodium bicarbonate in both artisanal and industrial formats. Regulatory approvals and GRAS (Generally Recognized as Safe) status further support its continued preference across global food manufacturing operations.

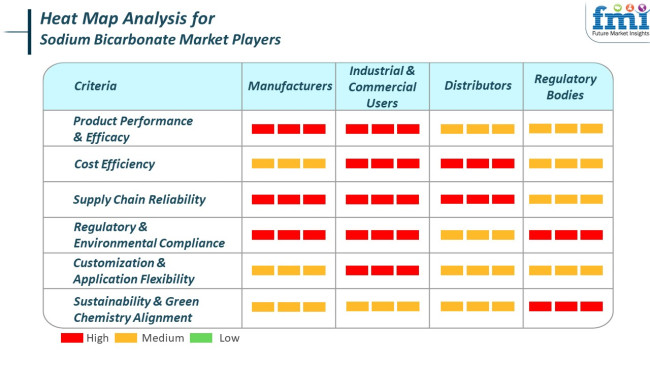

The industry is expanding at a fast pace due to the expansion of demand in many sectors such as food & beverage, pharmaceuticals, and environmental application. The progress is being driven by requirements such as the speeding up need for functional and cost-effective alternatives, stringent government regulations, and the development of usage in emerging industries. The industry is dominated by a vast portfolio of product types specialized by application, end-use industry, and regional distribution.

Producers are keen on producing high-performance products that satisfy the high standards of industrial and commercial customers. They invest in environmentally friendly production processes and strive to provide a secure supply chain to meet the increasing global demand.

Regulatory authorities enact environmental and safety regulation compliance, triggering the use of green and eco-friendly solutions. Regulatory Authorities can play a key role in the industry through regulations that spur the application of green technologies and reduce the environment's footprint in industrial activities.

The industry, which forms an essential segment of food and beverage, pharmaceutical, personal care, and environmental applications industries, is anticipated to undergo steady growth. However, it has certain current and future risks that could influence its trajectory.

One of the significant current risks is the raw material price volatility, namely soda ash and ammonia. Price fluctuations of such materials may influence production cost and profitability levels to manufacturers. The industry is also vulnerable to supply chain interference through geopolitics and transport difficulties, resulting in inconsistency of supply and price instability.

In the future, the industry may be under threat from environmental regulation and sustainability trends. With governments around the world imposing stricter emissions controls and preferring green products, manufacturers are able to be compelled to invest in cleaner technology and sustainable raw material sourcing.

Even though the industry is abounding with prospects for growth, stakeholders will have to surmount risk threats stemming from raw material price volatility, supply chain outages, regulatory pressures from environmental concerns, and competition from replacement products. Forethought measures in response to such risk threats will be the ingredients for long-term success in such a dynamic business.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

| UK | 3.7% |

| France | 3.8% |

| Germany | 3.9% |

| Italy | 3.7% |

| South Korea | 4% |

| Japan | 3.9% |

| China | 4.1% |

| Australia | 3.8% |

| New Zealand | 3.7% |

The USA industry is projected to register a CAGR of 3.9% during the period 2025 to 2035. The growth is due to sustained demand in pharmaceuticals, food processing, treatment of flue gas, and domestic use. The buffering capacity of the compound, its multifaceted uses, and its low cost guarantee its central role in applications between antacids and air pollution control.

Companies such as Church & Dwight Co., Solvay Chemicals Inc., and Tata Chemicals North America control technical-grade and food-grade production. Ongoing environmental regulation to control SO₂ emissions from power plants further drives demand in industrial applications.

UK is anticipated to have a CAGR of 3.7% over the forecast period. Major demand industries are pharmaceuticals, food additives, and wastewater treatment. Use in effluent neutralization and animal feed formulas contributes to uniform consumption levels.

Suppliers like Natrium Limited and local distributors across the globe are maintaining supply flow by strengthening distribution networks and meeting British Pharmacopoeia and food safety requirements. The use of the material in scrubbing emissions and environmental protection supports national decarbonization efforts.

France is expected to grow at a CAGR of 3.8%. The compound has a stronghold in its wide application in bakery, dairy, and health supplements. The pharmaceutical and healthcare sectors also make significant contributions due to the compound's application in effervescent tablets and antacid preparations.

Producers such as Novacarb (Seqens Group) are leading product differentiation with high-purity grades used in medical and specialty food uses. National emphasis on reducing industrial waste and maximizing clean manufacturing practices forms the basis for the long-term future of the industry adoption.

Germany's industry is also set to increase at a CAGR of 3.9%. Strong environmental applications such as flue gas desulfurization and chemical manufacturing are among the driving reasons. Demand from the end-use in food and personal care is also strong because of the customer preference towards mild and non-toxic substances.

Solvay and CIECH Soda Deutschland are industry leaders investing in low-emission manufacturing processes and capacity increases to meet the regional and export industries. Policy conformity with EU sustainability guidelines and industrial management of emissions continues to be the cornerstone of industry stability.

Italy will expand at a CAGR of 3.7%. Food-grade application in bakery food and processed food, as well as in personal care and water treatment, sustains industry demand. The multifunctionality as a deodorizer and pH buffer makes it a staple in household products.

Italian producers and home formulators are simplifying supply chains to satisfy the growing demand for natural and allergy-free cleaning and wellness products. Green regulation of the food processing and chemical industries is predicted to underpin continued growth.

South Korea is projected to grow at a CAGR of 4%, driven by increasing use in industrial gas cleaning, personal care, and pharmaceutical applications. Its capacity to remove acidic gases from emission streams complements environmental regulatory initiatives and clean energy shifts.

LG Chem and OCI Company Ltd. are upgrading technical-grade for high-efficiency emission scrubbing and specialty use. Increased uptake in packaged healthcare and animal care also supports industry growth.

Japan is anticipated to register a growth rate of 3.9% CAGR. The industry has a steady demand for high-precision pharmaceutical formulation, cosmetic materials, and ecological applications. The non-reactive, biocompatible character of the compound fits well with dermal and gastrointestinal product lines.

Firms like Tosoh Corporation and Asahi Kasei Corporation are focusing on ultra-refined grades for sensitive medical and personal care applications. Government subsidies on eco-friendly chemicals and aging population trends are expected to underpin consumption in healthcare segments.

China is anticipated to lead growth with a CAGR of 4.1% based on robust demand in food processing, metallurgy, flue gas treatment, and agriculture. Sodium bicarbonate finds widespread application in livestock feed, aluminum processing, and pharmaceutical production, supporting its cross-sectoral importance.

Producers such as HailianSanyuan and HaohuaHonghe Chemical are increasing production to meet domestic and export demand. National policies favoring clean industry operations and environmental treatment facility expenditure are the drivers of industry growth.

Australia is expected to expand at a CAGR of 3.8%. The compound experiences consistent demand for packaged food, animal health, water treatment, and home cleaning products. It also serves as a chemical-free cleaning option and is being increasingly accepted in environmentally regulated industries.

Formulators and importers are increasingly using sodium bicarbonate in low-impact agrochemicals and household chemical lines. Industrial emission goals at the national level and eco-labeling regulations are maintaining demand in regulated segments.

New Zealand will grow at a CAGR of 3.7%. Applications vary from food-grade usage in bakery and meat preservation to the control of pH in dairy applications and treatment product applications in rural and sanitary veterinary industries. Emphasis on low-processing and organic foods sustains the trend.

Local wholesalers have strong import relationships with Asian and Australian producers to meet growing purity and bio-compatibility standards. Government-initiated clean farming and waste management programs ensure material relevance persists longer in the long term.

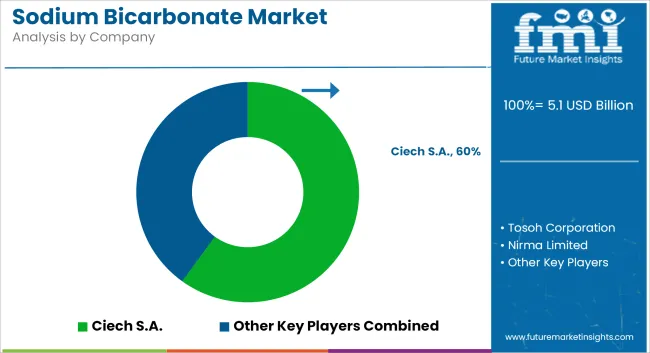

The market is moderately consolidated, with top players focusing on capacity expansions and sustainable production.

By grade type, the industry is segmented into pharmaceutical grade, technical grade, food grade, and feed grade.

By form, the industry is categorized into powder, pellets, slurry, and liquid.

By end use, the industry is segmented into processed food, pharmaceuticals, personal care products, chemicals, agrochemicals & nutrients, detergent, fire extinguisher, leather & dyeing, and others.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa (MEA).

The industry is estimated to reach USD 5.1 billion by 2025.

The industry is projected to grow to USD 8.5 billion by 2035.

China is expected to grow at a rate of 4.1%.

Food-grade sodium bicarbonate is the leading segment, owing to its widespread use in baking, food preparation, and as an antacid in healthcare.

Key players in this industry include Solvay SA, Merck KGaA, Tata Chemicals Ltd., GHCL Ltd., Ciech SA, Nirma Ltd., DCW Ltd., Seqens Group, Tosoh Corporation, Hawkins, Inc., Vitro, and Church & Dwight Co., Inc.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Encapsulated Sodium Bicarbonate Market Trends - Growth & Industry Forecast 2025 to 2035

Pharma Grade Sodium Bicarbonate Market 2024-2034

Pharmaceuticals Grade Sodium Bicarbonate Market Insights - Size, Share & Industry Growth 2025 to 2035

Sodium 3-Nitrobenzenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA