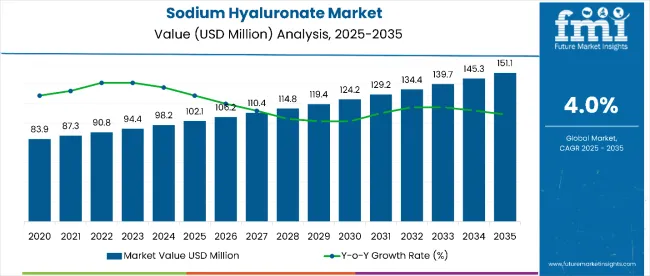

The sodium hyaluronate market is estimated to be valued at USD 102.1 million in 2025 and is projected to reach USD 151.1 million by 2035, registering a CAGR of 4.0% over the forecast period. The sodium hyaluronate market is projected to add an absolute dollar opportunity of USD 79.3 million over the forecast period.

| Metric | Value |

|---|---|

| Sodium Hyaluronate Market Estimated Value in (2025E) | USD 102.1 million |

| Sodium Hyaluronate Market Forecast Value in (2035F) | USD 151.1 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

This reflects a 1.48 times growth at a compound annual growth rate of 4.0%. The market's evolution is expected to be shaped by rising demand for minimally invasive aesthetic procedures, expanding applications in orthopedic viscosupplementation, and growing usage in ophthalmic treatments for dry eye syndrome and cataract surgery.

By 2030, the market is likely to reach approximately USD 127.8 million, accounting for USD 25.7 million in incremental value over the first half of the decade. The remaining USD 53.6 million is expected during the second half, suggesting a moderately back-loaded growth pattern.

Product innovation focusing on enhanced biocompatibility and extended duration formulations is gaining traction due to sodium hyaluronate's superior molecular properties and clinical efficacy compared to traditional hyaluronic acid compounds.

Companies such as Bloomage Bio-Technology Corporation and Fidia Farmaceutici S.p.A. are advancing their competitive positions through investment in advanced fermentation technologies and specialized purification processes. Market performance will remain anchored in regulatory compliance frameworks, clinical validation requirements, and quality assurance standards governing medical-grade sodium hyaluronate production.

Strategic partnerships between pharmaceutical manufacturers and aesthetic clinics are supporting expansion into premium medical and cosmetic applications across global markets.

The market holds approximately 45% of the injectable hyaluronic acid derivatives market, driven by its superior solubility and enhanced tissue penetration properties compared to conventional hyaluronic acid formulations. It accounts for around 32% of the aesthetic dermal filler ingredients market, supported by clinical validation of safety profiles and aesthetic efficacy in facial rejuvenation procedures.

The market contributes nearly 28% to the orthopedic viscosupplementation treatments market, particularly for knee osteoarthritis management where sodium hyaluronate provides sustained joint lubrication and pain relief. The share in the cosmetic anti-aging ingredients market reaches about 18%, reflecting its integration into premium skincare formulations targeting hydration and wrinkle reduction.

The market is undergoing structural transformation driven by aging global populations and rising demand for minimally invasive medical and aesthetic procedures. Advanced biotechnology manufacturing processes using microbial fermentation and sophisticated purification techniques have enhanced product purity, molecular weight consistency, and biocompatibility, making sodium hyaluronate a preferred alternative to animal-derived hyaluronic acid compounds.

Strategic collaborations between biotechnology companies and medical device manufacturers have accelerated commercialization of innovative sodium hyaluronate-based products.

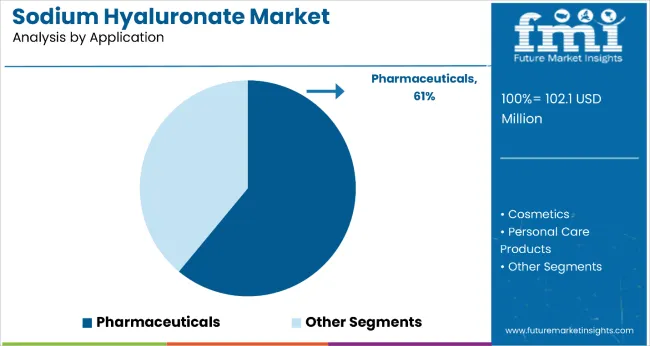

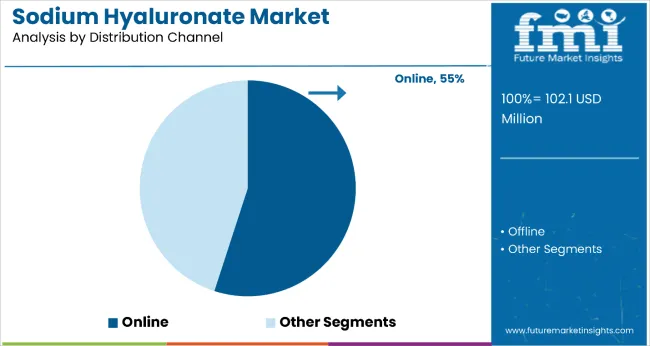

The market is segmented by application, distribution channel, and region. By application, it includes pharmaceuticals, cosmetics, and personal care products. Based on distribution channel, the market is bifurcated into online and offline. Regionally, the market is analyzed across North America, Latin America, Asia Pacific, Western and Eastern Europe, and Japan.

The pharmaceuticals segment leads with a dominant 61.0% market share in the application category, underscoring sodium hyaluronate’s critical role across medical disciplines such as orthopedics, ophthalmology, and dermatology. Its biocompatibility, viscoelasticity, and proven therapeutic efficacy make it indispensable for a range of clinical uses.

The segment is supported by increasing clinical validation, particularly in osteoarthritis management, where intra-articular injections provide long-lasting joint lubrication and pain relief. Ophthalmic usage is also rising, driven by higher cataract surgery rates and growing cases of dry eye syndrome in aging populations.

In dermatology, sodium hyaluronate is gaining traction in wound care and specialized medical skincare. Manufacturers are advancing pharmaceutical-grade formulations with tighter purity standards, controlled molecular weight, and tailored rheological profiles. With expanding regulatory approvals and growing therapeutic applications, the pharmaceuticals segment is expected to retain its market leadership while fostering innovation.

The online distribution channel holds the top position with 55.0% of the total market share, fueled by rapid e-commerce adoption and changing consumer preferences toward convenience, accessibility, and value. Online platforms have become a major sales driver for pharmaceutical, skincare, and personal care products featuring sodium hyaluronate, prized for its hydration, anti-aging, and joint support benefits.

E-commerce players are expanding their presence in rural and tier-2 markets while enhancing digital engagement through influencer campaigns, targeted ads, and customer feedback loops.

The shift to digital was accelerated by the COVID-19 pandemic and continues to grow through value-added services such as subscription plans, discounts, and expedited delivery. This evolving ecosystem makes the online segment the most dynamic and profitable channel for sodium hyaluronate-based product distribution.

Sodium hyaluronate's enhanced solubility, superior tissue penetration capabilities, and proven biocompatibility make it highly attractive for advanced medical applications including orthopedic treatments, ophthalmic procedures, and aesthetic enhancement solutions requiring optimal performance and patient safety.

Growing global aging, demographics are driving increased prevalence of age-related conditions including osteoarthritis, dry eye syndrome, and skin aging, creating sustained demand for effective therapeutic interventions where sodium hyaluronate demonstrates clinical superiority. Technological advancements in biotechnology manufacturing and purification processes are enhancing product quality while reducing production costs.

As healthcare systems increasingly emphasize minimally invasive treatment options and patient quality of life improvements, the market outlook remains favorable. With continued clinical validation of therapeutic benefits, expanding regulatory approvals, and growing physician adoption across multiple medical specialties, sodium hyaluronate is well-positioned to capture increasing market share across pharmaceutical, medical device, and cosmetic applications.

From 2025 to 2035, aging population demographics and minimally invasive procedure preferences were central to market expansion, with biotechnology companies investing in advanced manufacturing capabilities and clinical validation programs. Enhanced fermentation technologies ensuring consistent molecular weight profiles and superior purity became key differentiators. Growing acceptance of sodium hyaluronate's therapeutic benefits across multiple medical specialties supported sustained demand growth.

Aging Demographics Drive Sodium Hyaluronate Therapeutic Demand

The accelerating global aging population has been identified as the primary catalyst for growth in the sodium hyaluronate market. In 2024, increasing prevalence of age-related conditions including osteoarthritis, dry eye syndrome, and skin aging led to widespread adoption of sodium hyaluronate-based therapeutic interventions by healthcare providers seeking effective minimally invasive treatment options.

By 2025, demand was elevated as clinical evidence demonstrated sodium hyaluronate's superior therapeutic efficacy and safety profile compared to traditional treatment alternatives. Scientific validation of the compound's viscoelastic properties and biocompatibility has established its preferred status for orthopedic viscosupplementation, ophthalmic procedures, and aesthetic medicine applications.

These developments confirm that demographic-driven therapeutic needs rather than purely cosmetic considerations are driving sustained market expansion across pharmaceutical and medical device applications requiring proven clinical performance.

Biotechnology Innovation Creates Advanced Product Opportunities

In 2024, pharmaceutical manufacturers began deploying advanced microbial fermentation technologies and sophisticated purification processes to produce pharmaceutical-grade sodium hyaluronate with enhanced purity specifications and optimized molecular weight characteristics, supported by quality assurance systems ensuring consistent therapeutic performance.

Companies offering technically advanced sodium hyaluronate with validated clinical performance specifications and regulatory compliance are positioned to capture growing demand from pharmaceutical manufacturers and medical device companies requiring superior raw materials for critical applications.

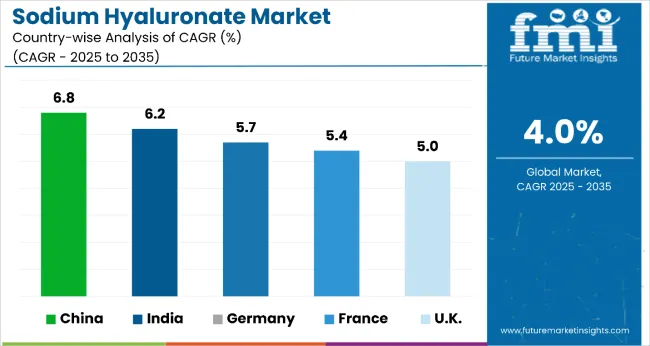

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.2% |

| Germany | 5.7% |

| France | 5.4% |

| UK | 5.0% |

China leads the global sodium hyaluronate market with a robust CAGR of 6.8%, driven by expansive pharmaceutical manufacturing and biotechnology infrastructure, especially in Shandong and Jiangsu. India follows closely at 6.2% CAGR, bolstered by urban healthcare adoption, government-backed therapeutic programs, and increasing demand in orthopedic and aesthetic sectors.

Germany’s CAGR of 5.7% reflects its focus on advanced clinical research and compliance with stringent EU standards, while France shows steady growth at 5.4%, supported by its dominant position in the dermaceutical and anti-aging skincare sectors. The UK, although lacking an explicit CAGR in the text, trails modestly behind these markets, indicated by slightly slower dynamics, potentially around 5.0%, as referenced earlier.

The report covers an in-depth analysis of 40+ countries; five top performing OECD countries are highlighted below.

Sodium hyaluronate market in China is projected to grow at a CAGR of 6.8% from 2025 to 2035. The growth is linked to expanding biotechnology manufacturing in Shandong, Jiangsu, and Shanghai provinces. Pharmaceutical-grade sodium hyaluronate production is widely adopted for domestic medical applications and international export markets.

Output has been expanded by government support for biotechnology industry development and medical device manufacturing capabilities. Advanced manufacturing facilities increasingly serve both domestic healthcare demand and export requirements to North American and European markets.

More than 65% of production targets pharmaceutical and medical applications catering to orthopedic, ophthalmic, and aesthetic medicine demands. Local biotechnology companies have also increased research investment in specialized formulations, especially targeting international regulatory approvals.

Sodium hyaluronate revenue in India is forecast to grow at a CAGR of 6.2% from 2025 to 2035, ahead of the global average by 0.9%. Urban regions, particularly Mumbai, Delhi, and Bangalore, have expanded adoption of sodium hyaluronate treatments in orthopedic and aesthetic medicine applications. Government-backed healthcare initiatives are supporting adoption of advanced therapeutic interventions for aging-related conditions.

Medical facilities have increased integration of sodium hyaluronate procedures to address growing demand for minimally invasive treatments. Export opportunities for locally manufactured products are gaining traction in Southeast Asian and Middle Eastern markets.

Domestic biotechnology manufacturing capabilities are developing to reduce import dependence for specialized medical applications. Healthcare infrastructure expansion in tier-2 cities is creating new market opportunities for therapeutic sodium hyaluronate applications.

Sales of sodium hyaluronate in Germany are expected to grow at a CAGR of 5.7% from 2025 to 2035, exceeding the global rate by 0.4%. Growth is centered on advanced medical applications and clinical research in cities such as Munich, Berlin, and Hamburg. Pharmaceutical-grade sodium hyaluronate with EU regulatory compliance is being adopted for orthopedic viscosupplementation and ophthalmic procedures.

Import volumes from certified biotechnology suppliers have increased, particularly for specialized medical and aesthetic applications. Products meeting stringent European medical device and pharmaceutical standards are favored under rigorous quality frameworks.

Most adoption is driven by specialized medical centers and research institutions requiring consistent quality and full regulatory compliance. Advanced formulations have also gained adoption in clinical research applications, especially for regenerative medicine and tissue engineering studies.

Sales of sodium hyaluronate in France are expected to grow at a CAGR of 5.4% during the forecast period. France leads the European hyaluronic acid market, driven by its sophisticated cosmetic and dermaceutical industries. The country is globally renowned for skincare innovations, particularly in anti-aging and hydration. French consumers prioritize clean beauty and premium formulations, increasing the demand for HA-based serums and injectables.

Additionally, pharmaceutical companies are advancing intra-articular and ophthalmic HA solutions. Regulatory agencies like ANSM ensure high product standards, bolstering consumer trust. Government incentives for biotech R&D are encouraging innovation in HA-based therapies. With a thriving aesthetic medicine market, France is expected to continue driving demand across personal care and medical verticals.

The UK sodium hyaluronate demand is rapidly evolving with rising demand in both healthcare and cosmetic sectors. Consumers are becoming more informed about the benefits of HA in skin hydration, wrinkle reduction, and joint health. The shift towards natural and science-backed skincare solutions has led to a surge in demand for HA-based serums and creams.

Simultaneously, the popularity of cosmetic injectables is growing, especially among millennials and Gen Z. Post-Brexit biotech incentives have fostered the growth of local companies innovating in HA applications. Additionally, e-commerce has significantly expanded access to HA-based personal care products nationwide.

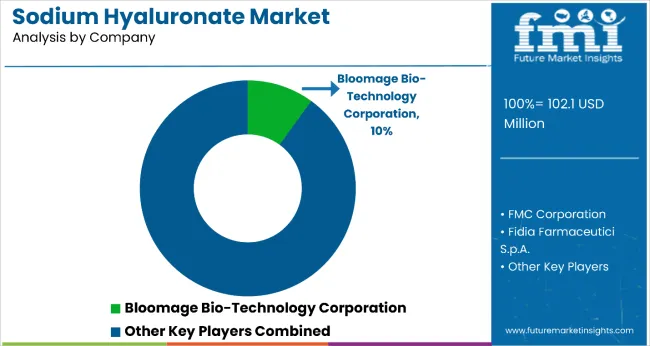

The market is moderately fragmented, with Bloomage Bio-Technology Corporation leading at an estimated 16.3% market share. The company holds a dominant position through its integrated biotechnology manufacturing capabilities, advanced fermentation technologies, and comprehensive product portfolio serving pharmaceutical, medical device, and cosmetic applications.

Key players include Fidia Farmaceutici S.p.A., FMC Corporation, Hyalose LLC, TS-Biotech Co. Ltd., Shiseido Co., S&V Technologies GmbH, VSY Biotechnology BV, Easter Group, and Galderma S.A., each providing specialized sodium hyaluronate solutions including pharmaceutical-grade and cosmetic-grade products for orthopedic, ophthalmic, dermatologic, and aesthetic applications, supported by clinical validation and regulatory compliance expertise.

Key Developments in Sodium Hyaluronate Market

Manufacturers are advancing biotechnology production methods and purification technologies for improved molecular weight control, enhanced biocompatibility, and superior clinical performance, expanding their applicability across pharmaceutical, medical device, and cosmetic applications. Global players are investing in research and development programs and regulatory approval processes for enhanced market access, while regional producers optimize manufacturing capabilities for specialized product requirements.

In Nov 2024, VSY Biotechnology BV: Collaborated with Clarius Mobile Health Corp., designed to enhance access to advanced ultrasound technology for orthopedic and pain management professionals, indirectly supporting the application of VSY’s sodium hyaluronate injections.

| Item | Value |

|---|---|

| Quantitative Units | USD 102.1 million |

| Application | Pharmaceuticals, Cosmetics, and Personal Care Products |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia, and 40+ countries |

| Key Companies Profiled | Hyalose, LLC, FMC Corporation, Fidia Farmaceutici S.p.A., TS-Biotech Co., Ltd, Easter Group, Shiseido Co., S&V Technologies GmbH, Bloomage Bio-Technology Corporation, VSY Biotechnology BV. |

| Additional Attributes | Dollar sales by application and form categories, growing usage in pharmaceutical and medical device applications, stable demand in aesthetic medicine and cosmetic sectors, innovations in biotechnology manufacturing and purification technologies improve quality, biocompatibility, and therapeutic efficacy |

The global sodium hyaluronate market is estimated to be valued at USD 102.1 million in 2025.

The market size for the sodium hyaluronate market is projected to reach USD 151.1 million by 2035.

The sodium hyaluronate market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in sodium hyaluronate market are pharmaceuticals, cosmetics and personal care products.

In terms of distribution channel, online segment to command 62.7% share in the sodium hyaluronate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium 3-Nitrobenzenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA