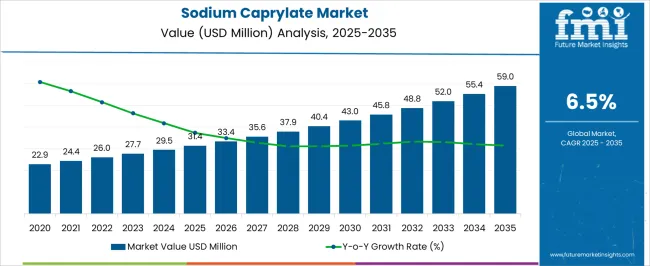

The sodium caprylate market was valued at USD 31.4 billion in 2025 and is projected to reach USD 59 billion by 2035, reflecting a CAGR of 6.5%. This growth path highlights how demand for sodium caprylate is being reinforced by its applications across pharmaceutical formulations, food preservation, and industrial processes. The progression from USD 33.4 billion in 2026 to USD 55.4 billion in 2034 demonstrates a stable rise, pointing toward a market where consistent consumption patterns are shaping the pace of expansion.

The CAGR illustrates not only an upward demand but also the positioning of sodium caprylate as a key compound in sectors that require stability, preservation, and active ingredient formulation. This expansion emphasizes the increasing integration of sodium caprylate into regulated industries where performance consistency and quality standards are prioritized.

The sodium caprylate market stood at USD 31.4 billion in 2025 and is expected to advance to USD 59 billion in 2035, growing at a CAGR of 6.5%. Year-on-year increments portray a measured but firm trajectory, with values rising from USD 35.6 billion in 2027 to USD 52 billion in 2033, before reaching the final forecasted figure. The market is being shaped by steady adoption in therapeutic applications, owing to its role in stabilizing proteins, alongside a growing preference in food processing where preservation methods are critical. Companies that prioritize sodium caprylate in product pipelines are likely to secure higher margins, as its demand curve appears less volatile compared to substitutes. The growth pattern signals that sodium caprylate will remain a central compound across multiple domains, driven by its versatility and consistent utility.

| Metric | Value |

|---|---|

| Sodium Caprylate Market Estimated Value in (2025 E) | USD 31.4 million |

| Sodium Caprylate Market Forecast Value in (2035 F) | USD 59.0 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The sodium caprylate market has been recognized as an integral niche within several large-scale parent industries, each reflecting a distinct level of contribution. Within the pharmaceutical ingredients market, sodium caprylate represents nearly 4.7% due to its widespread role in stabilizing albumin solutions and supporting therapeutic formulations. In the specialty chemicals market, its presence is valued at about 3.8%, largely because of its utility in fine chemical applications and compound development.

The food additives market shows a share of 2.9%, where sodium caprylate has been incorporated as a preservative and antimicrobial agent, particularly in high-protein products. The cosmetic ingredients market reflects a share of 2.3%, with usage driven by its effectiveness as an emulsifier and stabilizer for formulations. In the biotechnology reagents market, sodium caprylate secures a stronger 5.1% share, attributed to its role in protein purification and bioprocessing activities. When aggregated, these segments highlight that the sodium caprylate market collectively accounts for about 18.8% across these parent sectors, indicating its steady integration across diverse applications.

Its impact is often undervalued, yet the compound has been indispensable for product innovation, regulatory compliance, and operational efficiencies in manufacturing pipelines. Market adoption has been observed to expand, with growing demand from biopharma laboratories, personal care formulators, and food producers who rely on consistent antimicrobial performance and stabilizing capacity. This influence makes sodium caprylate a critical enabler for parent industries, positioning it as a compound whose value extends beyond immediate utility into long-term industry competitiveness.

The sodium caprylate market is witnessing progressive expansion, driven by its broad-spectrum utility across pharmaceutical, food, and personal care industries. The compound’s antimicrobial and stabilizing properties have positioned it as a preferred ingredient in formulations requiring extended shelf life and microbial control. Current demand is predominantly led by increased applications in parenteral nutrition, emulsification, and food preservation.

Rising consumer inclination toward clean-label and naturally derived preservatives has further stimulated interest in sodium caprylate. Despite regulatory complexities in certain geographies, the market outlook remains optimistic due to ongoing research supporting its safety and efficacy. Demand from the pharmaceutical sector, particularly for albumin stabilization and lipid emulsions, continues to be a primary growth factor.

In addition, the shift towards alternative preservatives in dairy and processed food segments has broadened its commercial relevance. As global food safety standards evolve and demand for multifunctional excipients rises, the sodium caprylate market is expected to retain a stable upward trajectory throughout the forecast period.

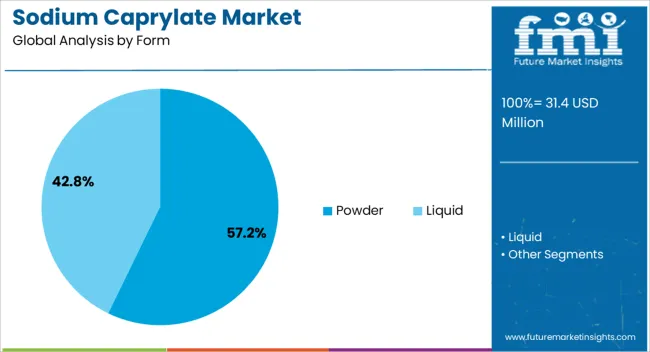

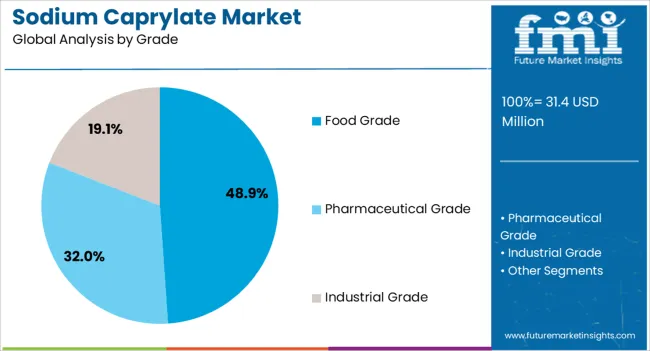

The sodium caprylate market is segmented by form, grade, and geographic regions. By form, sodium caprylate market is divided into Powder and Liquid. In terms of grade, sodium caprylate market is classified into Food Grade, Pharmaceutical Grade, and Industrial Grade. Regionally, the sodium caprylate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder form dominates the sodium caprylate market, contributing approximately 57.2% of the total share. This prevalence is largely attributed to the form’s superior stability, ease of handling, and compatibility across dry and semi-solid formulations. Powdered sodium caprylate offers extended shelf life and facilitates accurate dosing, making it highly suitable for pharmaceutical and nutraceutical applications.

The segment has gained traction in food processing due to its uniform dispersibility and ability to inhibit microbial growth without altering organoleptic properties. Increased demand from personal care formulators for antimicrobial agents that integrate seamlessly into dry powder blends has also supported the segment’s expansion.

Moreover, logistical benefits such as lower transportation costs and enhanced storage flexibility reinforce its preference among manufacturers. As industries continue to prioritize formulation consistency and process efficiency, the powder segment is expected to sustain its leading share in the foreseeable future.

The food grade segment represents the leading grade in the sodium caprylate market, accounting for approximately 48.9% of the overall share. This dominance is driven by heightened demand for food-safe antimicrobial agents, particularly in processed dairy, beverages, and bakery products. Food-grade sodium caprylate is extensively used as a preservative and stabilizer, aligning with industry requirements for non-toxic, GRAS-certified ingredients.

The segment has benefited from growing consumer preference for minimally processed foods with extended shelf life, compelling manufacturers to adopt multifunctional ingredients. Additionally, regulatory alignment with food safety standards in key markets such as North America and Europe has facilitated its broader adoption.

Its role in enhancing food product safety without compromising taste or texture further amplifies its value proposition. With ongoing innovation in clean-label food formulations and the growing need for reliable preservation systems, the food grade segment is anticipated to maintain its lead within the sodium caprylate market.

The sodium caprylate market has been influenced by its expanding role in pharmaceutical formulations, food preservation, and chemical processing applications. Demand has been shaped by the increasing utilization of caprylic acid derivatives in stabilizers and protein purification processes, while lucrative opportunities are emerging from its growing adoption across biologics and specialty chemical production. Noticeable trends are being recorded in its integration with clinical-grade purification methods, while challenges persist in raw material cost fluctuations, regulatory approval hurdles, and supply chain volatility. The sector’s outlook is expected to remain promising with consistent industrial uptake.

The demand for sodium caprylate has been strongly influenced by its essential role as a stabilizer in immunoglobulin formulations and protein purification techniques used by the biopharmaceutical sector. Rising utilization in parenteral drugs, vaccines, and other therapeutic solutions has significantly lifted its demand profile. In the food industry, sodium caprylate has been increasingly employed as a preservative and antimicrobial agent, enhancing its adoption across packaged food categories. In opinion, this rising demand is not merely cyclical but structural, as dependence on biologics and long-shelf-life food categories will continue expanding. Growth has also been propelled by its use in specialty chemicals, where sodium caprylate functions as an intermediate and stabilizing agent. The demand curve has been further shaped by clinical research institutions and contract manufacturing organizations, where reliance on caprylic acid derivatives has been prioritized to maintain product efficacy and quality assurance in critical formulations.

Opportunities in the sodium caprylate market have been defined by its expanding utility across biologics manufacturing, clinical-grade protein purification, and niche chemical synthesis. Its adoption has been enhanced by biopharmaceutical companies seeking reliable stabilizing compounds in large-scale therapeutic production. In opinion, opportunities remain untapped in emerging economies where the healthcare sector is expanding and local drug manufacturing is gaining importance. Sodium caprylate has also been positioned as an effective reagent in chromatographic applications and analytical testing, creating new pathways for suppliers targeting laboratory and research segments. Specialty chemical producers have been exploring its role in tailored formulations, where demand for customized intermediates is expected to rise. The market’s opportunity profile has been strengthened by increasing cross-border pharmaceutical collaborations, where sodium caprylate serves as a critical compound in ensuring consistent production quality. These opportunities are expected to accelerate growth as supply networks mature in regulated as well as semi-regulated markets.

The sodium caprylate market has been shaped by noticeable trends in protein purification, therapeutic stabilizers, and clinical-grade chemical adoption. Biopharmaceutical companies have increasingly relied on sodium caprylate for immunoglobulin stabilization, creating a strong foundation for its long-term demand. A trend toward clinical-grade caprylic acid derivatives has been observed, as regulatory authorities enforce stricter product quality and patient safety benchmarks. In opinion, the prominence of sodium caprylate is expected to deepen, as its role in advanced therapeutics becomes irreplaceable for maintaining drug stability. Trends are also being recorded in its rising adoption by research laboratories conducting protein analysis and chromatography-based studies. Food and beverage industries have followed similar pathways, incorporating sodium caprylate as a preservative in extended shelf-life categories. The influence of these trends has been reinforced by global pharmaceutical alliances, creating interlinked supply chains where sodium caprylate’s reliability and effectiveness make it a preferred chemical agent across varied applications.

The sodium caprylate market has been confronted by persistent challenges related to raw material sourcing, price volatility, and compliance with stringent regulatory frameworks. Rising production costs of caprylic acid, the primary input for sodium caprylate, have been observed to strain manufacturer margins, reducing cost competitiveness in price-sensitive markets. Regulatory delays in approval of pharmaceutical-grade compounds have emerged as another challenge, slowing down time-to-market for new drugs that rely on sodium caprylate in their formulation process. In opinion, the industry has underestimated the complexity of aligning global compliance requirements, particularly in biologics manufacturing. Supply chain risks, such as disruptions in the procurement of raw chemicals and inconsistent delivery cycles, have also hindered growth trajectories. Smaller suppliers have found it difficult to compete with established chemical producers due to these barriers. The persistence of such challenges suggests that sodium caprylate’s market expansion will depend heavily on regulatory streamlining and long-term supplier collaborations.

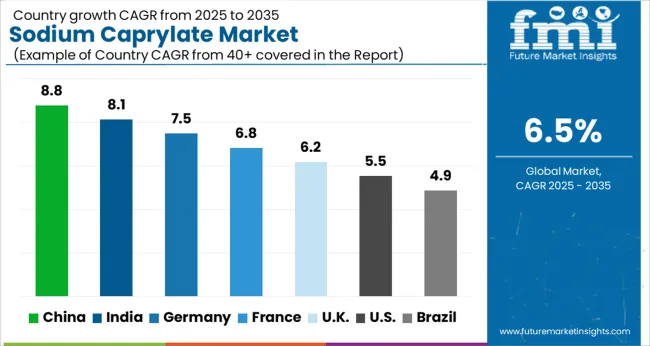

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

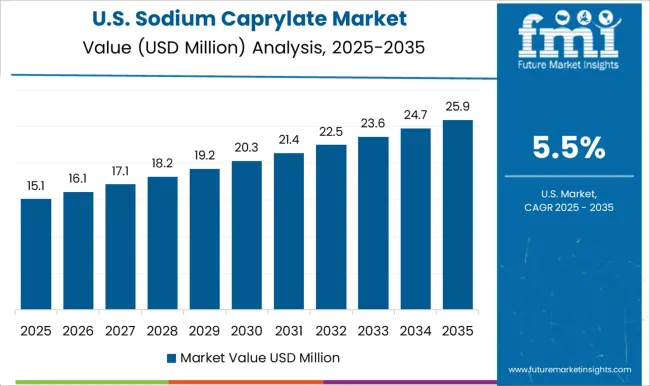

| USA | 5.5% |

| Brazil | 4.9% |

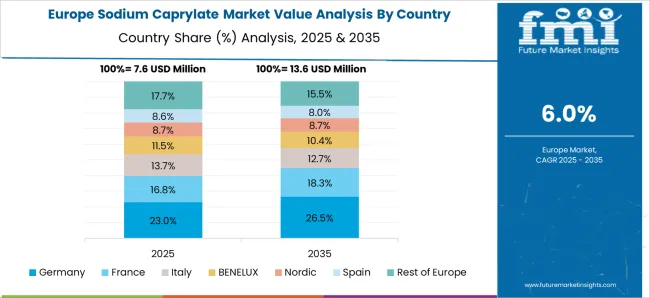

The global sodium caprylate market is projected to grow at a CAGR of 6.5% from 2025 to 2035. China leads with a growth rate of 8.8%, followed by India at 8.1%, and France at 6.8%. The United Kingdom records a growth rate of 6.2%, while the United States shows the slowest growth at 5.5%. Expansion is being driven by increasing demand in pharmaceuticals, food preservatives, and industrial applications. Emerging economies such as China and India are registering stronger growth due to rising healthcare expenditure and food safety concerns, while developed markets like France, the UK, and the USA are advancing through pharmaceutical research, stricter quality standards, and industrial scale applications of sodium caprylate. This report includes insights on 40+ countries; top markets are shown here for reference.

Prominent Trends Observed in Clean-Label and Functional Formulations

The sodium caprylate market in China is growing at a CAGR of 8.8%, supported by rising pharmaceutical production and increasing use in food safety applications. Demand is being influenced by large scale manufacturing of plasma fractionation products where sodium caprylate plays a critical role as a stabilizer. Growth is also reinforced by the expanding food processing sector that values sodium caprylate as a preservative. Chinese producers benefit from cost advantages in chemical manufacturing, extensive raw material access, and rising domestic healthcare investments. Market adoption is being accelerated as pharmaceutical companies expand plasma-derived therapies and food companies strengthen preservation techniques.

The sodium caprylate market in India is advancing at a CAGR of 8.1%, driven by demand from healthcare, pharmaceutical, and food sectors. Expanding plasma fractionation facilities in India are supporting wider usage of sodium caprylate in protein purification. The food industry is also adopting it for safety and shelf life enhancement. Government incentives toward strengthening domestic pharmaceutical production are creating opportunities for sodium caprylate integration into therapeutic manufacturing. Increased investments in healthcare infrastructure and a rising population base are contributing to consistent demand. Adoption is also being driven by cost effective production capabilities and strong domestic consumption.

The sodium caprylate market in France is projected to grow at a CAGR of 6.8%, supported by strong pharmaceutical research and plasma-derived therapies. French pharmaceutical companies emphasize quality and regulatory compliance, making sodium caprylate essential in plasma protein purification processes. Market growth is also influenced by steady demand from the food preservation sector, where strict quality standards drive adoption. Collaborative research initiatives between universities and pharma companies further strengthen its applications. Demand in France remains concentrated in high value medical applications, creating a market with steady but premium oriented expansion.

The sodium caprylate market in the United Kingdom is expanding at a CAGR of 6.2%, supported by adoption in pharmaceuticals, plasma processing, and food preservation. British pharmaceutical companies rely on sodium caprylate for its role in stabilizing plasma proteins during purification. The country’s regulatory standards for food safety and pharmaceutical manufacturing continue to drive consistent demand. Growth is supported by the emphasis on clinical research, advanced plasma therapies, and safe food processing practices. The market is characterized by stable but steady uptake with applications concentrated in healthcare and quality-driven industrial processes.

The sodium caprylate market in the United States is growing at a CAGR of 5.5%, driven by its role in pharmaceuticals, plasma-derived products, and food safety. USA pharmaceutical companies use sodium caprylate extensively in protein stabilization and purification during plasma fractionation. Food companies apply it for antimicrobial purposes and to extend shelf life. Growth is steady, though slower compared to emerging economies, due to market maturity. Emphasis on regulatory compliance and advanced research in biopharmaceuticals continues to sustain demand. While adoption is concentrated in high value applications, USA companies are also exploring its role in novel therapies and food safety technologies.

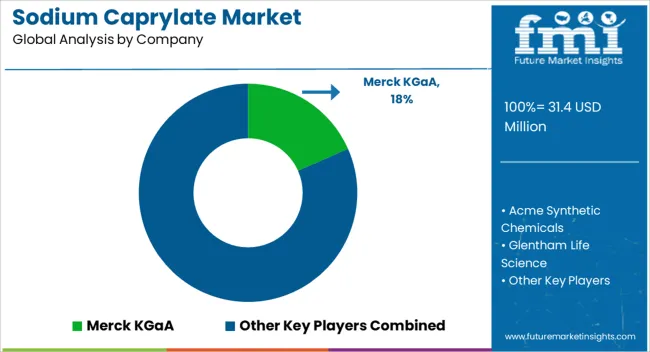

The sodium caprylate market is being driven by a diverse mix of chemical producers, specialty suppliers, and life science giants. Merck KGaA and Thermo Fisher Scientific are being positioned as dominant forces with expansive product portfolios, strong distribution reach, and high trust among pharmaceutical and research institutions. Their strategy is being anchored in providing sodium caprylate with consistent purity levels, backed by regulatory compliance and extensive technical documentation. Tokyo Chemical Industry (TCI) and Spectrum Chemical are being placed as reliable global suppliers, focusing on research-scale and bulk deliveries to laboratories and niche manufacturers.

Acme Synthetic Chemicals, Glentham Life Science, and Beantown Chemical Corporation are being recognized for catering to specialized demand in R&D and formulation development. Penta Manufacturing Company, BOC Sciences, and Ambeed are being observed focusing on value pricing while ensuring competitive delivery timelines. Regional players such as Sisco Research Laboratories and Central Drug House are being regarded as trusted partners within local markets, leveraging cost-effectiveness and faster logistics. The rivalry is being fueled by the ability of each company to blend consistent quality with scalability, making purity, certifications, and batch traceability the decisive differentiators.

Regional firms like Sisco Research Laboratories and Central Drug House are releasing brochures that stress fast delivery cycles and local service presence. Visual clarity, safety instructions, and clear labeling of grades are being prioritized to make brochures appear as trusted reference points. Each document is being shaped as a compact yet authoritative guide, ensuring sodium caprylate offerings are presented with precision, credibility, and immediate decision-making value.

| Item | Value |

|---|---|

| Quantitative Units | USD 31.4 Million |

| Form | Powder and Liquid |

| Grade | Food Grade, Pharmaceutical Grade, and Industrial Grade |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Merck KGaA, Acme Synthetic Chemicals, Glentham Life Science, Beantown Chemical Corporation, Spectrum Chemical, Ambeed, Thermo Fisher Scientific, Tokyo Chemical Industry Co., Ltd. (TCI), Penta Manufacturing Company, BOC Sciences, Sisco Research Laboratories Pvt. Ltd, and Central Drug House |

| Additional Attributes | Dollar sales by product type (pharmaceutical grade, industrial grade) and application (plasma fractionation, food & beverage, personal care, industrial uses) are key metrics. Trends include rising demand in therapeutic protein purification, growth in food preservation applications, and increasing adoption in cosmetics and personal care. Regional adoption, regulatory approvals, and technological advancements are driving market growth. |

The global sodium caprylate market is estimated to be valued at USD 31.4 million in 2025.

The market size for the sodium caprylate market is projected to reach USD 59.0 million by 2035.

The sodium caprylate market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in sodium caprylate market are powder and liquid.

In terms of grade, food grade segment to command 48.9% share in the sodium caprylate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium 3-Nitrobenzenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauroyl Isethionate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA