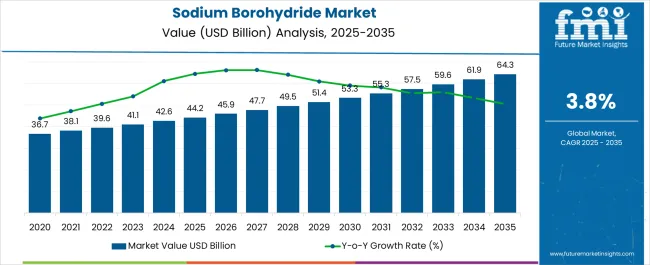

The Sodium Borohydride Market is estimated to be valued at USD 44.2 billion in 2025 and is projected to reach USD 64.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Sodium Borohydride Market Estimated Value in (2025 E) | USD 44.2 billion |

| Sodium Borohydride Market Forecast Value in (2035 F) | USD 64.3 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The Sodium Borohydride market is witnessing significant growth, driven by its wide-ranging applications across chemical synthesis, pulp and paper processing, water treatment, and pharmaceutical manufacturing. The increasing demand for eco-friendly bleaching agents and reducing chemicals in industrial applications is supporting adoption. Technological advancements in manufacturing processes have enhanced product purity, stability, and reactivity, enabling broader utilization in critical chemical reactions and industrial operations.

The market is also being influenced by the rising focus on sustainable production practices and the need to minimize environmental impact associated with chemical usage. Growth in end-use industries, such as pulp and paper, along with increasing investments in chemical processing infrastructure, is further propelling demand.

Regulatory emphasis on efficient and safe chemical handling practices is promoting the adoption of standardized products As companies increasingly prioritize process efficiency, energy conservation, and high-quality outputs, sodium borohydride is expected to remain a critical chemical reagent, supporting consistent market expansion over the forecast period.

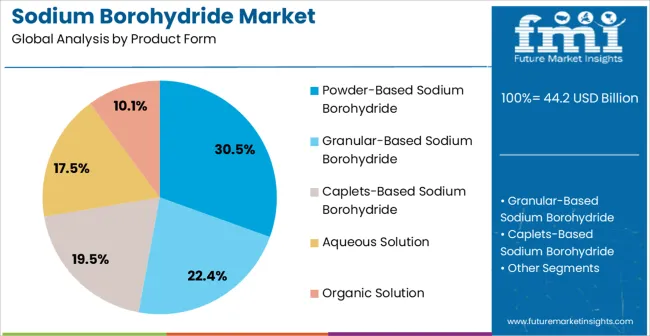

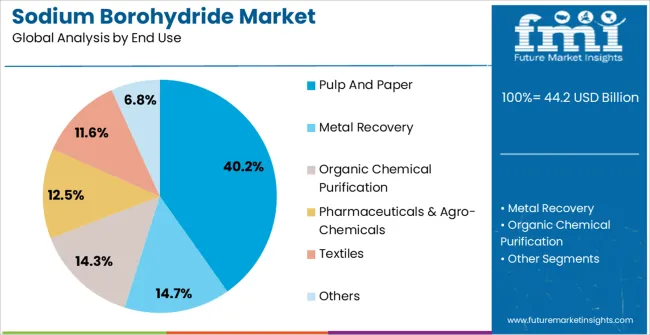

The sodium borohydride market is segmented by product form, end use, and geographic regions. By product form, sodium borohydride market is divided into Powder-Based Sodium Borohydride, Granular-Based Sodium Borohydride, Caplets-Based Sodium Borohydride, Aqueous Solution, and Organic Solution. In terms of end use, sodium borohydride market is classified into Pulp And Paper, Metal Recovery, Organic Chemical Purification, Pharmaceuticals & Agro-Chemicals, Textiles, and Others. Regionally, the sodium borohydride industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder-based sodium borohydride segment is projected to hold 30.5% of the market revenue in 2025, making it the leading product form. Its dominance is driven by ease of handling, storage, and dosing in various chemical and industrial applications. Powder form allows precise measurement for controlled chemical reactions, ensuring consistent product quality and performance.

It is particularly preferred in chemical synthesis, pharmaceutical manufacturing, and laboratory-scale operations where high reactivity and uniform dispersion are critical. The powder format also supports efficient integration into automated processing systems and scalable industrial workflows.

Improvements in granulation techniques and purity control have enhanced reliability and minimized safety risks during transportation and usage As demand for high-quality, standardized reagents grows, the powder-based product form is expected to maintain its market leadership, supported by its operational flexibility, compatibility with diverse industrial processes, and widespread acceptance across chemical and pharmaceutical sectors.

The pulp and paper segment is anticipated to account for 40.2% of the market revenue in 2025, establishing it as the leading end-use industry. Growth is being driven by the increasing demand for bleaching agents that improve paper whiteness and strength while minimizing environmental impact. Sodium borohydride is utilized to reduce residual lignin content and enhance fiber quality, which is critical for high-performance paper products.

Its chemical stability, reactivity, and ability to act as a selective reducing agent make it an efficient choice for pulp processing. Rising global paper consumption, along with expansion in packaging, tissue, and specialty paper production, is further fueling adoption.

Environmental regulations encouraging the use of eco-friendly and energy-efficient chemicals are reinforcing the segment’s growth As pulp and paper manufacturers continue to prioritize product quality, operational efficiency, and compliance with environmental standards, the segment is expected to maintain its leading position, supported by the continued demand for high-performance, sustainable bleaching and reducing solutions.

Sodium borohydride is an effective and a selective specialty reducing agent used in the manufacture of pharmaceuticals. Sodium borohydride is used for reduction of metal ions, carbonyls and peroxides as well as purification and removal of oxidation, odor and color of precursors in organic chemical products.

Sodium borohydride is also used to control pollution and recycle noble metals. Sodium borohydride is a less expensive metal hydride and is an efficient and cost-effective reducing agent. Sodium borohydride finds wide area of applications in the synthesis of many intermediates used in manufacture of medicines and fine chemical products, pharmaceuticals, the recovery & preparation of catalysts, precious heavy metals & rare earth metals among others. Sodium borohydride is used as a reducing agent when reacting with ketone chlorine, aldehyde and ketone

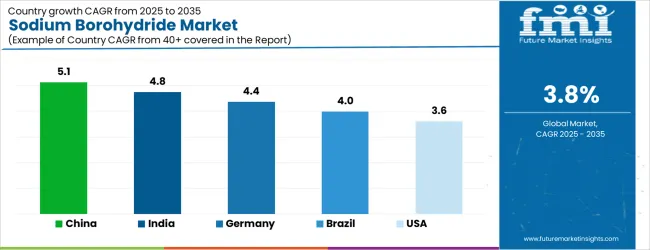

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| Brazil | 4.0% |

| USA | 3.6% |

| UK | 3.2% |

| Japan | 2.9% |

The Sodium Borohydride Market is expected to register a CAGR of 3.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.1%, followed by India at 4.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 2.9%, yet still underscores a broadly positive trajectory for the global Sodium Borohydride Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.4%. The USA Sodium Borohydride Market is estimated to be valued at USD 15.8 billion in 2025 and is anticipated to reach a valuation of USD 15.8 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.4 billion and USD 1.4 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 44.2 Billion |

| Product Form | Powder-Based Sodium Borohydride, Granular-Based Sodium Borohydride, Caplets-Based Sodium Borohydride, Aqueous Solution, and Organic Solution |

| End Use | Pulp And Paper, Metal Recovery, Organic Chemical Purification, Pharmaceuticals & Agro-Chemicals, Textiles, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

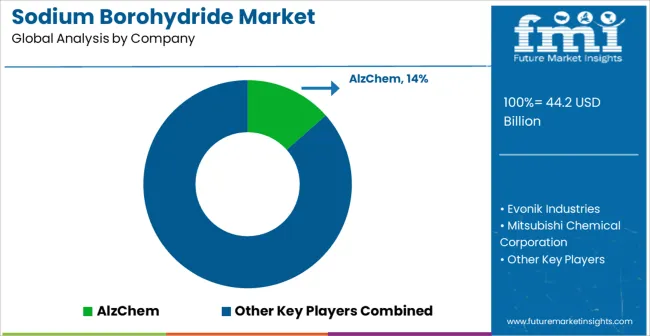

| Key Companies Profiled | AlzChem, Evonik Industries, Mitsubishi Chemical Corporation, Solvay, Ingevity, Nuodex Industries, Perstorp, Merck KGaA, UBE Corporation, R.T. Vanderbilt Company, Clariant International, Brenntag, Atofina Chemicals, and KH Neochem |

The global sodium borohydride market is estimated to be valued at USD 44.2 billion in 2025.

The market size for the sodium borohydride market is projected to reach USD 64.3 billion by 2035.

The sodium borohydride market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in sodium borohydride market are powder-based sodium borohydride, granular-based sodium borohydride, caplets-based sodium borohydride, aqueous solution and organic solution.

In terms of end use, pulp and paper segment to command 40.2% share in the sodium borohydride market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium 3-Nitrobenzenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauroyl Isethionate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA