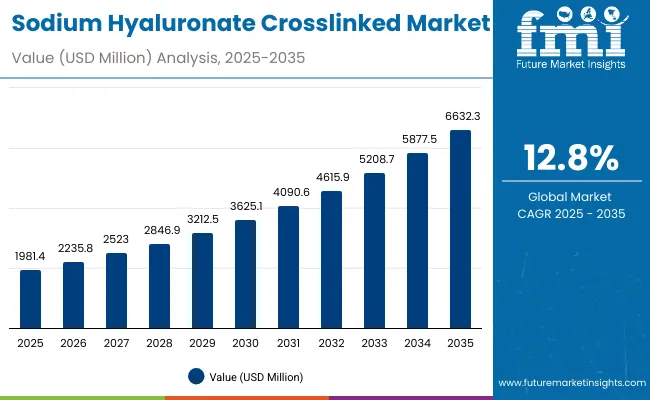

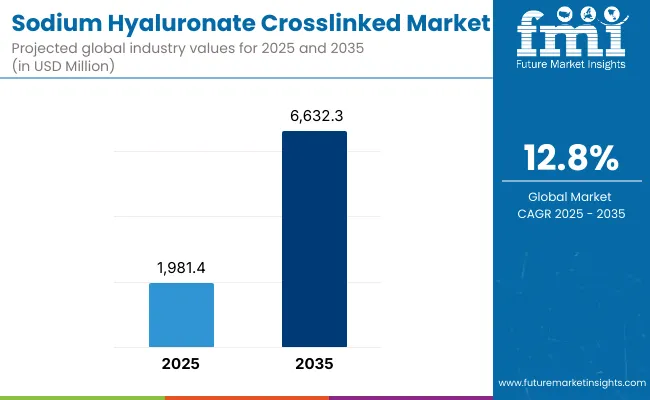

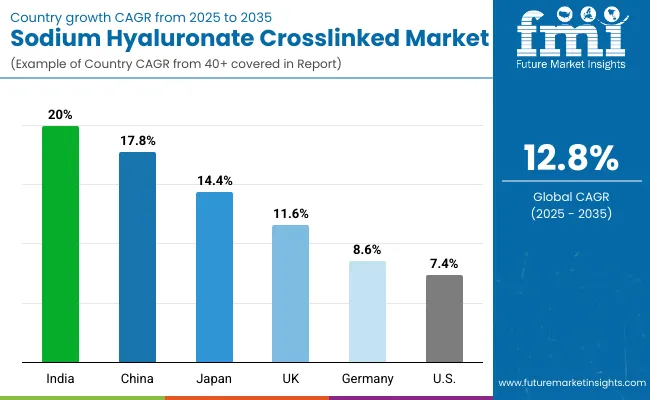

The Sodium Hyaluronate Crosslinked Market is expected to record a valuation of USD 1,981.4 million in 2025 and USD 6,632.3 million in 2035, with an increase of USD 4,650.9 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.8% and a 2X increase in market size.

Sodium Hyaluronate Crosslinked Market Key Takeaways

| Metric | Value |

|---|---|

| Sodium Hyaluronate Crosslinked Market Estimated Value in (2025E) | USD 1,981.4 million |

| Sodium Hyaluronate Crosslinked Market Forecast Value in (2035F) | USD 6,632.3 million |

| Forecast CAGR (2025 to 2035) | 12.8% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,981.4 million to USD 3,625.1 million, adding USD 1,643.7 million, which accounts for 35% of the total decade growth. This phase records steady adoption in deep hydration, wrinkle reduction, and skin plumping treatments, driven by increasing clinical-grade and dermatologist-tested demand. Fillers dominate this period, accounting for over 51.5% of market revenues as they cater to both cosmetic and dermatological applications requiring high efficacy.

The second half from 2030 to 2035 contributes USD 3,007.2 million, equal to 65% of total growth, as the market jumps from USD 3,625.1 million to USD 6,632.3 million. This acceleration is powered by widespread deployment of minimally invasive aesthetic procedures, e-commerce-led distribution, and expanding adoption in East Asia and emerging markets.

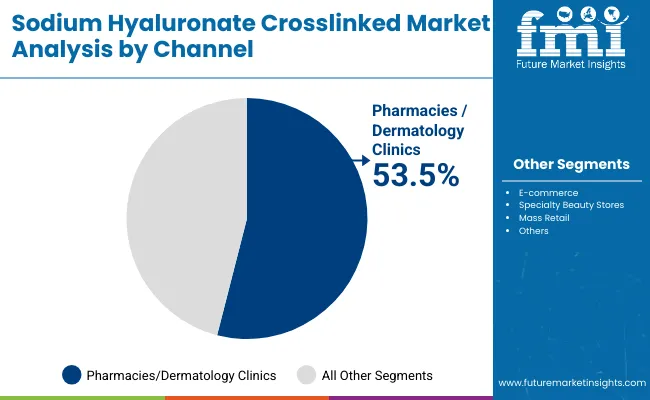

Pharmacies and dermatology clinics continue to dominate channels with 53.5% share in 2025, but e-commerce platforms accelerate penetration by 2035. Leading players increasingly leverage formulation innovation, AI-based skin diagnostics, and personalized cosmetic solutions, expanding the competitive landscape beyond traditional filler-based therapies.

From 2020 to 2024, the Sodium Hyaluronate Crosslinked Market expanded steadily, supported by demand for dermal fillers in anti-aging, wrinkle reduction, and hydration therapies. Market growth during this period was driven by pharma-cosmetic convergence and increased clinical-grade product launches, with injectable filler brands accounting for the majority of revenues. Leading companies such as Allergan Aesthetics (AbbVie), Revance, and Ipsen strengthened their portfolios through innovation and targeted dermatology partnerships.

In 2025, demand is projected at USD 1,981.4 million, with fillers leading the product mix. By 2035, the market is set to reach USD 6,632.3 million, representing a 2X expansion. The revenue mix is shifting as e-commerce channels and personalized skincare solutions gain traction. Pharmacies and dermatology clinics remain dominant (53.5% share in 2025), but digital-first models are reshaping consumer access.

Competitive differentiation is moving beyond formulation quality alone toward ecosystem strategies companies are integrating AI-based skin diagnostics, personalized care, and cross-border distribution networks. Established leaders face rising pressure from Asian players (Hugel, Bloomage, LG Chem), which are expanding aggressively in price-sensitive and high-volume segments. The competitive advantage now lies in brand trust, regulatory compliance, global distribution strength, and innovation in minimally invasive aesthetic solutions.

The growth of crosslinked sodium hyaluronate is strongly tied to the rising adoption of injectables and fillers in non-surgical aesthetics. Compared to traditional surgical procedures, crosslinked formulations offer longer-lasting effects and improved elasticity, directly addressing demand for wrinkle reduction and skin plumping. This clinical efficacy accelerates preference among dermatologists and cosmetic practitioners.

Market growth is reinforced by a clinical shift from linear to crosslinked sodium hyaluronate, driven by superior durability, viscoelastic properties, and resistance to enzymatic degradation. These attributes extend filler longevity and reduce treatment frequency, making them highly attractive to dermatology clinics and consumers alike. This performance edge is expanding adoption across both premium and mid-range aesthetic applications.

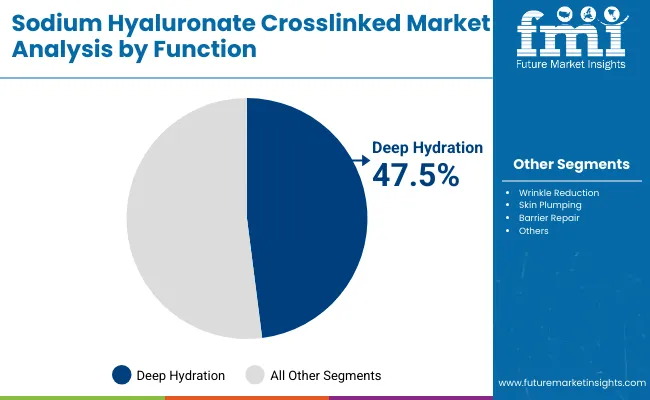

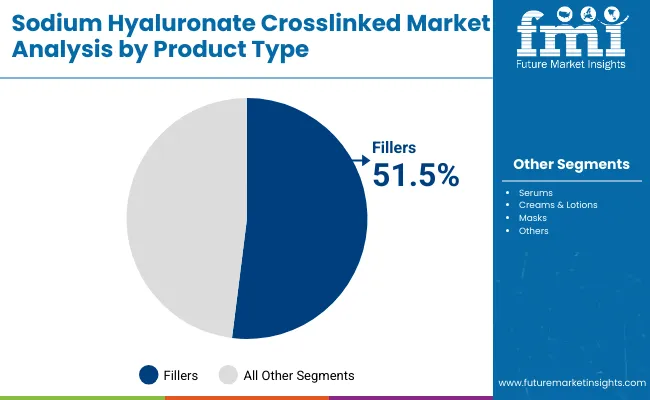

The market is segmented by function, product type, channel, claim, and region. Functions include deep hydration, wrinkle reduction, skin plumping, and barrier repair, highlighting the key therapeutic and cosmetic roles of crosslinked sodium hyaluronate. Product type segmentation covers fillers, serums, creams and lotions, and masks, reflecting the diverse formulations adopted across clinical and consumer settings.

Based on channel, the segmentation includes pharmacies and dermatology clinics, e-commerce, specialty beauty stores, and mass retail, capturing both medical-grade and consumer distribution landscapes. In terms of claims, categories encompass dermatologist-tested, clinical-grade, vegan, and clean-label, addressing rising consumer expectations for product credibility and safety.

Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with country-level analysis highlighting the USA, China, Japan, Germany, UK, and India as key growth markets.

| Function | Value Share % 2025 |

|---|---|

| Deep hydration | 47.5% |

| Others | 52.5% |

The deep hydration segment is projected to account for 47.5% of Sodium Hyaluronate Crosslinked Market revenues in 2025, emerging as one of the most significant functional categories. This leadership is supported by strong consumer preference for long-lasting moisturization, particularly in urban markets where skin dehydration is a recurring concern. Dermatology clinics and premium skincare brands are prioritizing crosslinked sodium hyaluronate formulations because of their superior water retention and elasticity compared to linear hyaluronic acid.

Growth in this segment is further fueled by product diversification into serums, fillers, and creams targeting hydration-focused outcomes. As clinical-grade and dermatologist-tested claims gain traction, deep hydration solutions are being positioned not just as cosmetic enhancers but as therapeutic skincare interventions. With consistent demand across both medical aesthetics and consumer beauty channels, the deep hydration function is expected to remain a cornerstone of the market’s expansion over the forecast period.

| Product Type | Value Share % 2025 |

|---|---|

| Fillers | 51.5% |

| Others | 48.5% |

The fillers segment is forecasted to hold 51.5% of the Sodium Hyaluronate Crosslinked Market share in 2025, driven by its widespread use in wrinkle reduction, skin plumping, and deep hydration therapies. Crosslinked sodium hyaluronate fillers are preferred by dermatologists and aesthetic practitioners for their longer-lasting effects and improved viscoelasticity compared to traditional formulations.

Their adaptability across both clinical-grade and premium cosmetic applications has strengthened adoption in North America, Europe, and East Asia. The segment’s momentum is further reinforced by product innovations that enhance injection safety, patient comfort, and natural-looking outcomes. With increasing demand for minimally invasive procedures, fillers are expected to remain the cornerstone of product adoption and retain their leadership throughout the forecast period.

| Channel | Value Share % 2025 |

|---|---|

| Pharmacies/dermatology clinics | 53.5% |

| Others | 46.5% |

The pharmacies and dermatology clinics segment is projected to account for 53.5% of Sodium Hyaluronate Crosslinked Market revenues in 2025, maintaining its dominance as the leading distribution channel. This preference stems from the high consumer trust in dermatologist-prescribed treatments and the critical role of professional guidance in injectable and clinical-grade formulations.

The channel benefits from direct patient interaction, regulatory compliance, and the ability to integrate advanced procedures such as crosslinked fillers within medical environments. With rising demand for minimally invasive cosmetic interventions, clinics are increasingly becoming the first point of access for patients seeking reliable results. Although e-commerce is expanding rapidly, pharmacies and clinics are expected to remain the primary revenue-generating platform, supported by both medical credibility and consumer preference for professional oversight.

Preference for Longer-Lasting Aesthetic Outcomes

Crosslinked sodium hyaluronate is rapidly gaining traction due to its enhanced viscoelastic properties and resistance to enzymatic degradation. Unlike linear formulations, crosslinked variants offer superior longevity, reducing the frequency of repeat treatments. This durability appeals to both dermatologists and patients seeking cost-efficient, minimally invasive procedures with natural results. The combination of efficacy and convenience is pushing fillers into mainstream cosmetic and therapeutic applications, solidifying their dominance in the overall product mix.

Rising Integration of Clinical-Grade Claims

The market is expanding as companies emphasize dermatologist-tested and clinical-grade claims to differentiate products. With rising consumer concerns around product authenticity and safety, these validated claims are shifting demand toward regulated, science-backed formulations. Crosslinked sodium hyaluronate, already preferred in professional dermatology, is finding broader adoption in retail beauty through serums and creams carrying clinical endorsements. This alignment of professional credibility with consumer-facing marketing is creating a dual growth channel for premium and mid-tier brands.

Stringent Regulatory Approvals for Injectable Fillers

One key restraint arises from the complex regulatory approval process for injectable fillers containing crosslinked sodium hyaluronate. Requirements vary significantly across regions, with stricter guidelines in the USA and Europe delaying product launches and limiting smaller firms from entering. The need for extensive safety trials and post-market surveillance increases compliance costs. This regulatory friction hampers faster commercialization, restricting innovation pipelines and giving established multinational brands a stronger advantage over emerging players.

Expansion of E-Commerce Dermatology Platforms

A distinct trend is the surge of e-commerce-driven dermatology platforms offering crosslinked sodium hyaluronate-based skincare and filler consultations. Unlike traditional retail, these digital channels integrate AI-driven skin assessments and tele-dermatology services to guide product choices. The model not only broadens access in price-sensitive regions but also creates personalized treatment pathways. This shift toward digital-first distribution is reshaping competitive strategies, pushing brands to invest in online exclusives, subscription kits, and virtual dermatologist partnerships.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 17.8% |

| USA | 7.4% |

| India | 20.0% |

| UK | 11.6% |

| Germany | 8.6% |

| Japan | 14.4% |

The global Sodium Hyaluronate Crosslinked Market shows clear regional divergence in growth pace, influenced by regulatory frameworks, aesthetic treatment culture, and disposable income.

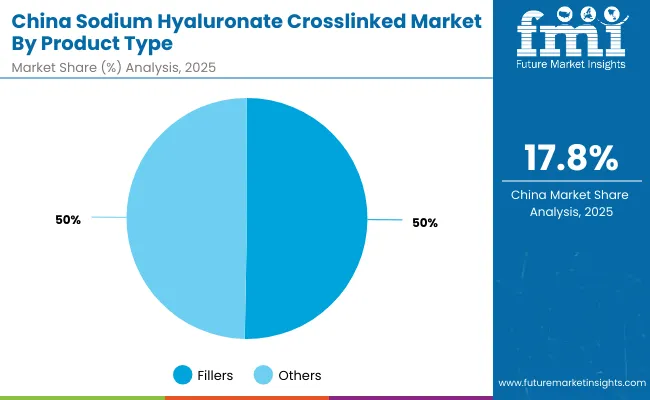

Asia-Pacific emerges as the fastest-growing region, with China (17.8%) and India (20.0%) leading. Growth in China is supported by strong demand for medical aesthetics, government approvals for crosslinked fillers, and local players such as BloomageBioTech scaling production. India’s trajectory reflects rising acceptance of aesthetic procedures among younger demographics, medical tourism demand, and affordability compared to Western markets.Japan (14.4%) adds further momentum, where an aging population drives high demand for wrinkle reduction and skin-plumping applications.

Europe maintains steady growth, led by the UK (11.6%) and Germany (8.6%), supported by stringent regulatory oversight that emphasizes product safety and clinical validation. The UK shows resilience through strong private dermatology clinics, while Germany reflects consistent adoption in both medical and retail-grade hydration therapies.

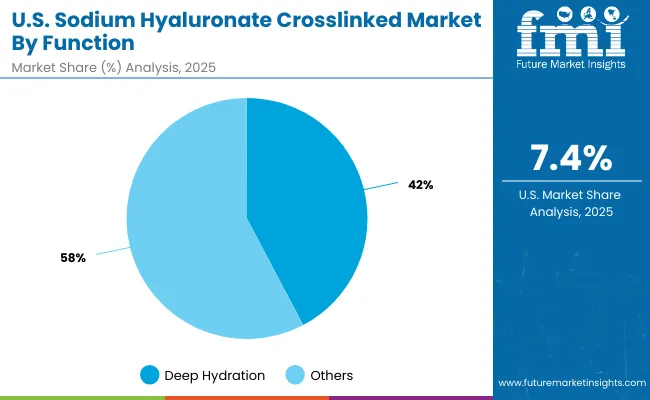

North America shows a more moderate expansion, with the USA at 7.4% CAGR, reflecting maturity of the injectable aesthetics segment. Here, Allergan Aesthetics (AbbVie) dominates with strong brand loyalty, but newer players such as Revance are challenging with differentiated filler portfolios. Growth is driven less by volume expansion and more by premium product launches and combination therapies that integrate crosslinked fillers with botulinum toxin treatments.

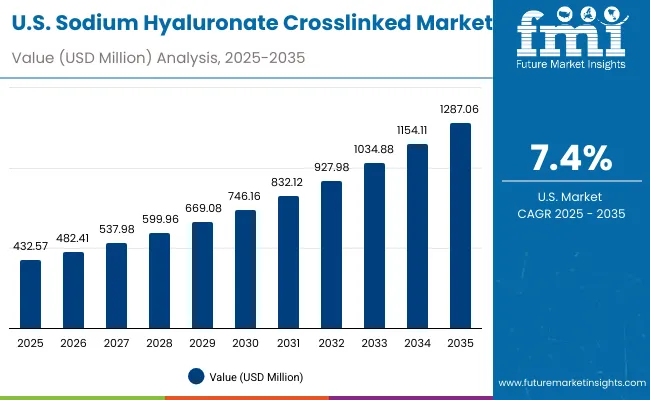

| Year | USA Sodium Hyaluronate Crosslinked Market (USD Million) |

|---|---|

| 2025 | 432.57 |

| 2026 | 482.41 |

| 2027 | 537.98 |

| 2028 | 599.96 |

| 2029 | 669.08 |

| 2030 | 746.16 |

| 2031 | 832.12 |

| 2032 | 927.98 |

| 2033 | 1034.88 |

| 2034 | 1154.11 |

| 2035 | 1287.06 |

The Sodium Hyaluronate Crosslinked Market in the United States is projected to expand steadily, rising from USD 432.6 million in 2025 to USD 1,287.1 million by 2035. Growth is driven by the high popularity of minimally invasive cosmetic procedures, established dominance of Allergan Aesthetics (AbbVie), and expanding clinic networks offering advanced filler treatments. Demand is further supported by consumer preference for longer-lasting wrinkle reduction and skin hydration solutions, along with innovations in customized filler formulations and combination therapies with botulinum toxins.

The Sodium Hyaluronate Crosslinked Market in the United Kingdom is expected to expand steadily, driven by strong demand for dermal fillers and hydration therapies. The market benefits from a well-developed network of private dermatology clinics, high consumer awareness of minimally invasive treatments, and the growing popularity of wrinkle reduction procedures. Regulatory oversight ensures clinical safety, supporting the adoption of crosslinked formulations over linear alternatives.Strategic collaborations between global brands and local distributors further enhance market enetration.

India is witnessing rapid growth in the Sodium Hyaluronate Crosslinked Market, forecast to expand at a CAGR of 20.0% through 2035. Rising disposable incomes, medical tourism, and growing awareness of minimally invasive procedures are fueling adoption across both metropolitan and tier-2 cities. Clinics and dermatologists are increasingly introducing crosslinked fillers to meet demand for wrinkle reduction and hydration therapies. Local manufacturers and global players are expanding access through cost-effective formulations, making aesthetic treatments more affordable.

The Sodium Hyaluronate Crosslinked Market in China is expected to grow at a CAGR of 17.8% through 2035, the highest among leading economies. This strong momentum is driven by the rapid acceptance of minimally invasive cosmetic procedures, supportive regulatory approvals, and the competitive presence of domestic players such as BloomageBioTech. Local firms are producing cost-effective crosslinked fillers, boosting accessibility across both metropolitan and tier-2 cities. Rising disposable incomes, increasing medical tourism, and the cultural emphasis on youthful appearance further accelerate market expansion.

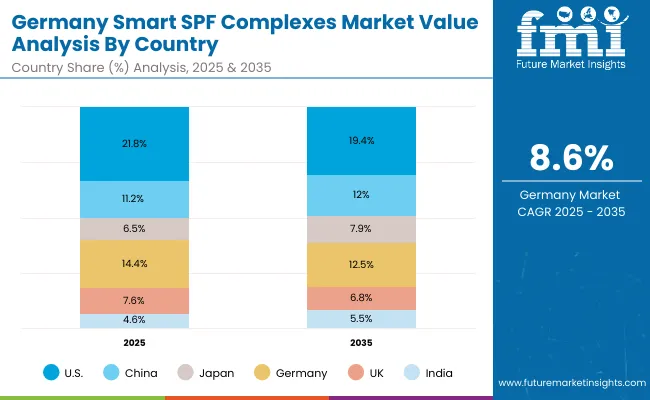

| Country | 2025 Share (%) |

|---|---|

| USA | 21.8% |

| China | 11.2% |

| Japan | 6.5% |

| Germany | 14.4% |

| UK | 7.6% |

| India | 4.6% |

| Country | 2035 Share (%) |

|---|---|

| USA | 19.4% |

| China | 12.0% |

| Japan | 7.9% |

| Germany | 12.5% |

| UK | 6.8% |

| India | 5.5% |

The Sodium Hyaluronate Crosslinked Market in Germany is projected to remain a key European hub, holding 14.4% of global share in 2025, before moderating slightly to 12.5% by 2035 as Asia-Pacific expands more rapidly. Germany’s strong growth is supported by its well-established dermatology infrastructure, widespread insurance-backed aesthetic procedures, and high consumer preference for clinically validated, minimally invasive treatments. The market also benefits from EU regulatory rigor, which reinforces trust in crosslinked formulations over unregulated alternatives.

| USA Function | Value Share % 2025 |

|---|---|

| Deep hydration | 42.3% |

| Others | 57.7% |

The Sodium Hyaluronate Crosslinked Market in the United States is projected to expand steadily, supported by strong demand for anti-aging and hydration treatments. In 2025, deep hydration accounts for 42.3% of revenues, while wrinkle reduction and other applications collectively hold 57.7%. Growth is anchored by the dominance of Allergan Aesthetics (AbbVie) and the expanding portfolios of competitors such as Revance Therapeutics. The market benefits from high consumer spending on minimally invasive procedures, alongside advanced distribution through pharmacies and dermatology clinics.

| China Product Type | Value Share % 2025 |

|---|---|

| Fillers | 50.3% |

| Others | 49.7% |

The Sodium Hyaluronate Crosslinked Market in China presents strong opportunities, with fillers accounting for 50.3% of revenues in 2025. Growth is supported by a surge in non-surgical cosmetic procedures, particularly among younger demographics and urban consumers. Domestic companies such as BloomageBioTech are capitalizing on demand by offering competitively priced crosslinked fillers, making treatments accessible in both premium and mid-market segments. Government approvals and growing trust in locally produced formulations further expand opportunities, especially in wrinkle reduction and skin plumping therapies.

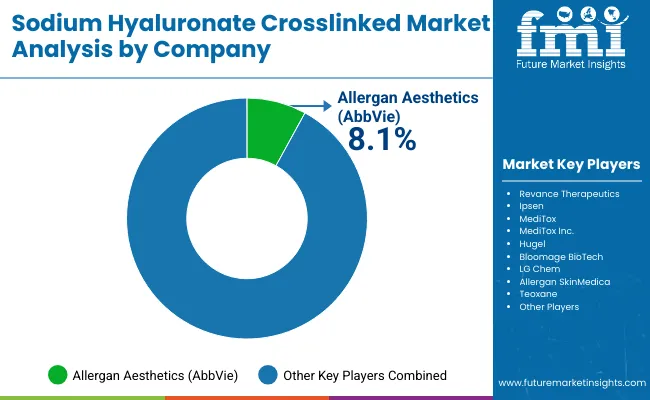

| Companies | Global Value Share 2025 |

|---|---|

| Allergan Aesthetics (AbbVie) | 8.1% |

| Others | 91.9% |

The Sodium Hyaluronate Crosslinked Market is moderately fragmented, with a mix of global leaders, regional specialists, and emerging innovators. Allergan Aesthetics (AbbVie) holds the largest single share at 8.1%, anchored by its strong brand equity, established filler portfolio, and expansive clinic partnerships in North America and Europe.

Mid-sized players such as Revance Therapeutics, Ipsen, Hugel, and LG Chem are gaining traction by focusing on differentiated formulations, localized pricing, and expanding distribution in Asia-Pacific. Their strategies emphasize longer-lasting filler durability, enhanced safety profiles, and broader accessibility in mid-tier markets.

Asian firms like BloomageBioTech and Meditox are leveraging cost-effective innovation and government support to capture growing demand in China, South Korea, and India. These companies thrive on regional adaptability, affordability, and quick regulatory alignment, making them competitive against Western incumbents.

Competitive differentiation is shifting from pure filler formulations to holistic ecosystems integrating personalized aesthetic solutions, AI-driven skin diagnostics, and omni-channel distribution models. As digital-first consultation and e-commerce platforms expand, market leadership will depend not only on clinical efficacy but also on consumer engagement and brand trust across hybrid medical-retail channels.

Key Developments in Sodium Hyaluronate Crosslinked Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,981.4 Million |

| Function | Deep hydration, Wrinkle reduction, Skin plumping, Barrier repair |

| Product Type | Fillers, Serums, Creams & lotions, Masks |

| Channel | Pharmacies/dermatology clinics, E-commerce, Specialty beauty stores, Mass retail |

| Claim | Dermatologist-tested, Clinical-grade, Vegan, Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Allergan Aesthetics (AbbVie), Revance Therapeutics, Ipsen , MediTox , MediTox Inc., Hugel , Bloomage BioTech , LG Chem , Allergan SkinMedica , Teoxane |

| Additional Attributes | Dollar sales by product type and function, adoption trends in minimally invasive aesthetic procedures, rising demand for crosslinked formulations with longer durability, sector-specific growth in dermatology clinics, medical aesthetics, and retail skincare, revenue segmentation by product claims such as dermatologist-tested and clinical-grade, integration with AI-driven skin diagnostics and personalized treatment platforms, regional trends influenced by affordability, medical tourism, and regulatory frameworks, and innovations in crosslinking technologies and hybrid filler-skincare formulations. |

The global Sodium Hyaluronate Crosslinked Market is estimated to be valued at USD 1,981.4 million in 2025.

The market size for the Sodium Hyaluronate Crosslinked Market is projected to reach USD 6,632.3 million by 2035.

The Sodium Hyaluronate Crosslinked Market is expected to grow from USD 1,981.4 million in 2025 to USD 6,632.3 million in 2035, expanding by USD 4,650.9 million, at a 12.8% CAGR over the forecast period.

The key product types in the Sodium Hyaluronate Crosslinked Market are Fillers, Serums, Creams & Lotions, and Masks.

In terms of product type, the Fillers segment is projected to command a 51.5% share of the Sodium Hyaluronate Crosslinked Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauroyl Isethionate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Metasilicate Pentahydrate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA