The Sodium Thiosulphate Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 2.6% over the forecast period. The market is closely connected to several parent markets that significantly contribute to its growth. Within the water treatment chemicals market, sodium thiosulfate accounts for approximately 5–7%, driven by its role as a dechlorinating agent in municipal and industrial water systems. The photographic chemicals market plays a crucial role, contributing around 3–5%, as sodium thiosulfate is used as a fixer in traditional film processing. The pharmaceuticals market influences the sodium thiosulfate market with a share of approximately 10–12%, as it is utilized in treatments for conditions like cyanide poisoning and as an adjunct in chemotherapy to reduce side effects.

The gold mining chemicals market contributes around 8–10%, as sodium thiosulfate is employed in gold extraction processes as a safer alternative to cyanide. Lastly, the textile chemicals market impacts the sodium thiosulfate industry with a share of approximately 4–6%, as it is used in dyeing and bleaching processes. As the demand for sustainable and effective chemical solutions continues to rise across these sectors, the sodium thiosulfate market is expected to expand, driven by technological advancements and increasing applications in various industries.

Manufacturing operations face quality control challenges when validating sodium content, sulfur ratios, and moisture levels across different production batches, particularly when switching between anhydrous and pentahydrate forms that require different processing conditions and storage protocols. Process engineers encounter equipment scaling difficulties when transitioning from batch synthesis to continuous production systems, as heat transfer requirements during crystallization and drying operations become critical factors affecting yield efficiency and product quality consistency. Quality assurance departments must monitor trace impurities and pH levels that can significantly impact performance in chlorine neutralization and photographic applications.

Pulp and paper manufacturing facilities utilizing sodium thiosulfate encounter process integration challenges when coordinating dechlorination procedures with bleaching sequences, requiring precise timing and concentration control to ensure complete chlorine residue removal without affecting fiber properties. Mill operators must balance sodium thiosulfate dosage against water consumption requirements while maintaining consistent white brightness levels and avoiding over-treatment that can affect paper strength characteristics. Environmental compliance teams monitor wastewater discharge parameters that include thiosulfate residues and their potential impact on biological treatment systems.

Water treatment operations using sodium thiosulfate face application complexity when neutralizing chlorine and chloramine residues in different water quality conditions, as pH, temperature, and dissolved solids content affect reaction kinetics and required dosage levels. Treatment plant operators must coordinate chemical feed systems with existing disinfection protocols while ensuring complete dechlorination without creating sulfate buildup that can affect downstream processes. Analytical laboratories require specialized testing protocols for monitoring residual thiosulfate levels and verifying chlorine neutralization effectiveness.

| Metric | Value |

|---|---|

| Sodium Thiosulphate Market Estimated Value in (2025 E) | USD 2.7 billion |

| Sodium Thiosulphate Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 2.6% |

The sodium thiosulphate market is witnessing consistent growth, driven by increasing application in water purification, medical treatments, and chemical manufacturing. The compound’s wide industrial utility stems from its properties as a reducing agent, dechlorinating agent, and photographic fixer, making it integral in both large-scale water treatment and niche applications such as gold extraction and pharmaceutical formulations.

The rising focus on industrial wastewater recycling and stricter regulations regarding effluent treatment have intensified the need for reliable and cost-effective chemical neutralizers, where sodium thiosulphate plays a key role. Additionally, increasing investment in municipal water infrastructure and the growing adoption of environmentally compliant water treatment chemicals have enhanced its market penetration.

Developments in chemical processing and pharmaceutical synthesis have further contributed to the compound’s relevance across multiple value chains. With advancements in high-purity manufacturing and a push toward eco-safe chemical processes, sodium thiosulphate is expected to remain a critical input across both mature and emerging industrial sectors in the foreseeable future.

The sodium thiosulphate market is segmented by grade, purity, application, form, and geographic regions. By grade, the sodium thiosulphate market is divided into Technical Grade, Pharmaceutical Grade, and Food Grade. In terms of purity, the sodium thiosulphate market is classified into 0.99, 0.05, and 0.05. Based on application, the sodium thiosulphate market is segmented into Water Treatment, Textile Processing, Photography, and Food Additives.

By form, the sodium thiosulphate market is segmented into Crystals, Powder, and Solution. Regionally, the sodium thiosulphate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The technical grade segment is projected to contribute 46.2% of the total revenue share in the sodium thiosulphate market in 2025, making it the leading grade by demand. This dominance is supported by its widespread use across industrial water treatment, textile bleaching, and mining applications where ultra-high purity is not required.

The cost-effectiveness of technical-grade sodium thiosulfate, along with its high functional reliability in neutralization and detoxification processes, has enhanced its acceptance across mid-tier industries. This grade is typically used in settings where operational efficiency and chemical performance take precedence over pharmaceutical compliance, allowing for broad-scale deployment in less-regulated environments.

Increasing consumption in mining operations for gold leaching and growing use in dechlorination processes in wastewater plants have further fueled the demand for this grade. Its favorable pricing, availability in bulk quantities, and compatibility with existing treatment protocols continue to position technical grade sodium thiosulphate as a preferred option across resource-intensive sectors.

The 99% purity segment is expected to account for 51.5% of the sodium thiosulphate market revenue share in 2025, establishing it as the most preferred purity level. This segment’s growth is largely driven by the rising need for highly refined chemicals in pharmaceutical synthesis, medical detoxification procedures, and precision laboratory applications. The higher purity ensures minimal contamination and better reaction consistency, which is essential in formulations requiring exact chemical stability.

Increasing deployment in intravenous therapies and as an antidote in cyanide poisoning cases has reinforced the demand for 99% purity sodium thiosulphate in healthcare. Additionally, its growing use in photographic solutions and specialty chemicals has necessitated a consistent supply of high-grade material.

The ability to meet stringent quality and regulatory standards across developed markets has further cemented the segment’s importance Enhanced manufacturing capabilities and advancements in purification techniques are expected to sustain the segment’s leadership as industries prioritize quality assurance and process precision.

The water treatment segment is anticipated to hold 43.7% of the sodium thiosulphate market’s total revenue share in 2025, highlighting its critical role in environmental and industrial sustainability efforts. This segment’s prominence is linked to the compound’s dechlorination capabilities, which are vital in both municipal and industrial water management systems. The ability to neutralize chlorine and other oxidizing agents without introducing harmful byproducts makes sodium thiosulphate a preferred chemical in treated water discharge processes.

Rising investment in infrastructure aimed at improving water quality, especially in regions experiencing rapid urbanization and industrialization, has significantly influenced its adoption. Moreover, regulatory mandates requiring lower residual chlorine levels in effluents have pushed utilities to adopt reliable and cost-effective chemical solutions.

The compound’s compatibility with automated dosing systems and low environmental impact has further supported its integration into advanced treatment facilities. As water reuse and recycling gain global traction, sodium thiosulphate is expected to remain a cornerstone in achieving sustainable water management objectives.

The sodium thiosulphate market is experiencing growth due to its wide range of applications across various industries, including water treatment, textiles, pharmaceuticals, and photography. Sodium thiosulphate is primarily used in water treatment processes to remove chlorine and in the production of photographic films and papers, as well as in the gold extraction process. The increasing demand for efficient water purification systems, coupled with the growth of the pharmaceutical and textile industries, is driving the market. Furthermore, the rising focus on sustainable and eco-friendly solutions in various industrial applications is contributing to the market's expansion.

The class 2 truck market is primarily driven by the increasing demand for efficient and versatile delivery solutions, especially as e-commerce and retail industries continue to grow. The need for reliable last-mile delivery and urban transportation has become crucial as businesses strive to meet customer expectations for fast and accurate deliveries. Class 2 trucks, offering a balance between payload capacity and maneuverability, are ideal for navigating congested urban areas while carrying moderate loads. These vehicles provide flexibility and efficiency in urban settings where larger trucks may not be practical. The growing demand for local transportation services in construction, service, and logistics sectors further supports market growth, as class 2 trucks remain an optimal choice due to their adaptability and fuel efficiency.

Despite its widespread applications, the sodium thiosulphate market faces challenges related to price volatility and regulatory compliance. The production of sodium thiosulphate relies on sulfur, which is subject to price fluctuations due to supply and demand dynamics. These price changes can impact the overall cost structure for manufacturers, affecting market stability. Additionally, the market faces increasing pressure from regulators to ensure that the production and disposal of sodium thiosulphate comply with environmental standards. Stricter regulations on chemical use in various industries, particularly in water treatment and pharmaceutical applications, require continuous innovation and adjustments to production processes, further increasing costs and complexity for manufacturers.

The sodium thiosulphate market presents significant opportunities in the pharmaceutical, gold extraction, and water treatment industries. In the pharmaceutical industry, sodium thiosulphate is gaining recognition for its role in treating cyanide poisoning, which is expanding its use in medical applications. In gold extraction, sodium thiosulphate offers an alternative to cyanide, presenting a safer and more environmentally friendly solution for gold miners. As governments and organizations increasingly focus on eco-friendly practices, sodium thiosulphate is becoming a preferred chemical in the gold mining industry. Moreover, the growing need for efficient water purification systems in both developed and developing regions is driving demand for sodium thiosulphate, offering substantial growth potential across several industrial sectors.

A key trend in the sodium thiosulphate market is the growing focus on sustainable and eco-friendly applications. As industries seek greener alternatives to hazardous chemicals, sodium thiosulphate is increasingly being used in place of more toxic substances, particularly in the gold extraction process, where it offers a non-toxic, less environmentally harmful alternative to cyanide. Additionally, the growing awareness of environmental issues is driving the adoption of sodium thiosulphate in water treatment processes as a safer, more effective neutralizer for chlorine and chloramine. This shift toward safer, more sustainable chemical solutions is expected to continue driving the growth of the sodium thiosulphate market, particularly in industries seeking to reduce their environmental impact.

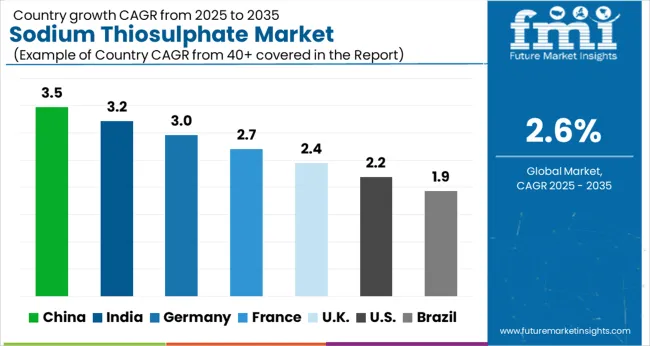

| Countries | CAGR |

|---|---|

| China | 3.5% |

| India | 3.2% |

| Germany | 3.0% |

| France | 2.7% |

| UK | 2.4% |

| USA | 2.2% |

| Brazil | 1.9% |

Global sodium thiosulphate market demand is projected to rise at a 2.6% CAGR from 2025 to 2035. China leads at 3.5%, followed by India at 3.2%, and France at 2.7%, while the United Kingdom records 2.4% and the United States posts 2.2%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for France versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: increasing demand for industrial chemicals, gold mining activities, and water treatment solutions in China and India, while more mature markets like the United States and the United Kingdom experience moderate growth due to established consumption patterns. The analysis includes over 40+ countries, with the leading markets detailed below.

The sodium thiosulphate market in India is expanding at a CAGR of 3.5%, driven by the country’s significant industrial activities, particularly in gold mining, water treatment, and chemical manufacturing. As China continues to be one of the largest producers of gold globally, the demand for sodium thiosulphate in gold extraction processes is growing. The country’s large-scale urbanization and industrialization are driving the need for effective water treatment solutions, where sodium thiosulphate is used to neutralize chlorine. China’s growing chemical industry continues to use sodium thiosulphate in various applications, including in the textile and photography sectors.

Sale of sodium thiosulphate in India is projected to grow at a CAGR of 3.2%, supported by expanding gold mining operations, industrial activities, and growing demand for water treatment solutions. India’s large-scale water treatment projects, particularly in urban areas, are creating significant demand for sodium thiosulphate, which is used to neutralize chlorine. The country’s gold mining activities also contribute to market growth, as sodium thiosulphate is increasingly used in gold extraction. Furthermore, the growing chemical and textile industries in India are using sodium thiosulphate in various applications, providing additional growth potential for the market.

Demand for sodium thiosulphate in France is growing at a CAGR of 2.7%, driven by demand from industries such as water treatment, gold mining, and chemical manufacturing. The need for effective water treatment solutions, particularly in urban areas, is fueling the demand for sodium thiosulphate to neutralize chlorine and other disinfectants. France’s gold mining operations, although smaller compared to China and India, still require sodium thiosulphate for extraction processes. The country’s chemical industry also uses sodium thiosulphate in various applications, including in photography and textile industries, contributing to market growth.

The United Kingdom’s sodium thiosulphate market is growing at a CAGR of 2.4%, supported by demand from industries such as water treatment, chemical manufacturing, and gold mining. The UK’s focus on maintaining water quality in urban and industrial sectors is increasing the need for sodium thiosulphate, used to neutralize chlorine and other chemicals. The growing demand for sodium thiosulphate in gold extraction, although smaller in scale compared to China and India, continues to support the market. The UK’s established chemical industry also contributes to the stable demand for sodium thiosulphate in various industrial applications.

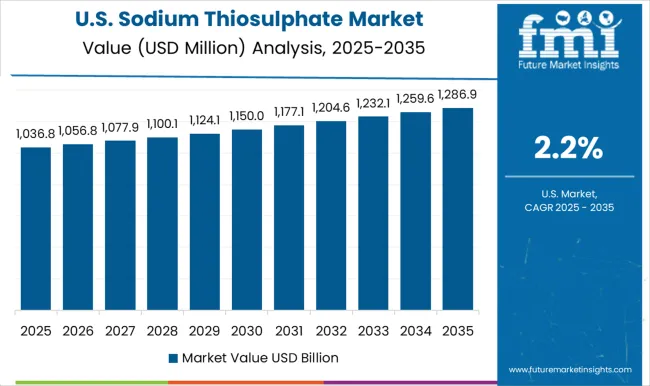

The USA sodium thiosulphate market is growing at a CAGR of 2.2%, driven by steady demand from the water treatment, gold mining, and chemical manufacturing sectors. Sodium thiosulphate is widely used in water treatment applications, particularly in municipalities where chlorine neutralization is required. The USA gold mining industry, although smaller in comparison to other countries, continues to use sodium thiosulphate for gold extraction. Sodium thiosulphate’s applications in the chemical and photographic industries help maintain a stable demand in the USA market.

The Sodium Thiosulphate Market is expanding steadily, driven by rising demand across pharmaceuticals, water treatment, photography, and chemical processing industries. The compound’s versatility—as a dechlorinating agent, reducing agent, and medical antidote, continues to sustain its industrial and healthcare relevance. Growing global awareness of clean water standards and the need for effective wastewater treatment solutions is further boosting sodium thiosulphate consumption worldwide.

Leading Chinese manufacturers such as Jiangsu Yinyang Chemical Co. Ltd., Xingfa Chemicals Group Co. Ltd., and Jiangxi Fengfan Chemical Co. Ltd. dominate global production, leveraging large-scale facilities and integrated supply chains to deliver high-purity industrial and pharmaceutical-grade sodium thiosulphate. Changzhou Chuangshi Chemical Co. Ltd., Shandong Xiya Chemical Group Co. Ltd., and Shandong Hengrui Chemical Co. Ltd. are expanding output to meet growing demand from textile bleaching, gold extraction, and photographic fixing applications.

Jiangsu Wuxi Hongfa Pharmaceutical Co. Ltd. and Shandong Jiaxin Chemical Co. Ltd. focus on medical-grade sodium thiosulphate for use as an antidote in cyanide poisoning and as a mitigating agent for cisplatin-induced toxicity in oncology treatments. Meanwhile, Sichuan Leshan Fengyuan Chemical Co. Ltd., Shanxi Jiaocheng Chemical Co. Ltd., and Guangdong Guanghua Hi-Tech Material Co. Ltd. are advancing product consistency through improved crystallization and purification technologies to serve high-spec chemical sectors.

Manufacturers such as Tianjin Beichen Chemical Industry Co. Ltd., Dezhou Dehua Chemical Plant Co. Ltd., and Shandong Yitai Chemical Co. Ltd. are reinforcing domestic and export capacities to supply water utilities and mining operations seeking cost-efficient dechlorination and refining solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Grade | Technical Grade, Pharmaceutical Grade, and Food Grade |

| Purity | 0.99, 0.05, and 0.05 |

| Application | Water Treatment, Textile Processing, Photography, and Food Additives |

| Form | Crystals, Powder, and Solution |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Jiangsu Yinyang Chemical Co. Ltd., Xingfa Chemicals Group Co. Ltd., Jiangxi Fengfan Chemical Co. Ltd., Changzhou Chuangshi Chemical Co. Ltd., Shandong Xiya Chemical Group Co. Ltd., Jiangsu Wuxi Hongfa Pharmaceutical Co. Ltd., Shandong Jiaxin Chemical Co. Ltd., Shandong Hengrui Chemical Co. Ltd., Shanxi Jiaocheng Chemical Co. Ltd., Tianjin Beichen Chemical Industry Co. Ltd., Sichuan Leshan Fengyuan Chemical Co. Ltd., Guangdong Guanghua Hi-Tech Material Co. Ltd., Dezhou Dehua Chemical Plant Co. Ltd., Shandong Yitai Chemical Co. Ltd |

| Additional Attributes | Dollar sales by product type (sodium thiosulphate crystal, liquid sodium thiosulphate) and end-use segments (photography, gold extraction, water treatment, pharmaceuticals). Demand dynamics are driven by increasing applications in water treatment, gold extraction, and the growing demand for environmentally friendly solutions in industrial processes. Regional trends indicate strong growth in Asia-Pacific, North America, and Europe, with innovations in sustainable manufacturing processes and increasing regulatory pressure on water quality driving market expansion. |

The global sodium thiosulphate market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the sodium thiosulphate market is projected to reach USD 3.5 billion by 2035.

The sodium thiosulphate market is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in sodium thiosulphate market are technical grade, pharmaceutical grade and food grade.

In terms of purity, 0.99 segment to command 51.5% share in the sodium thiosulphate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium 3-Nitrobenzenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauroyl Isethionate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA