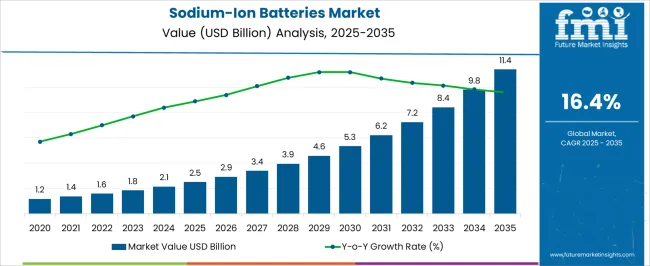

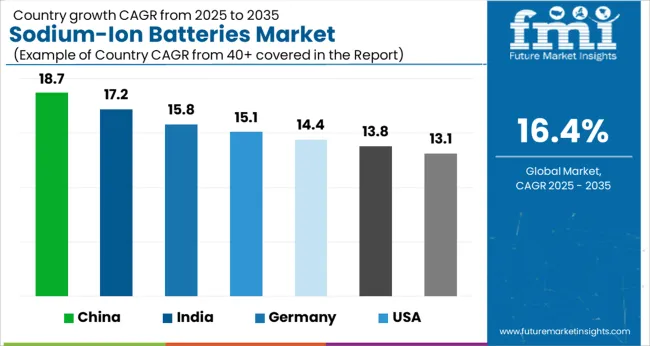

The global sodium-ion batteries market is projected to grow from USD 2.5 billion in 2025 to approximately USD 11.3 billion by 2035, recording an absolute increase of USD 8.8 billion over the forecast period. This translates into a growth of 352% over the decade. The market is forecast to expand at a compound annual growth rate (CAGR) of 16.4%, with the overall market size projected to grow by nearly 4.5x by the end of the forecast period. The market is growing as industries and governments seek cost-effective, sustainable alternatives to lithium-ion technology.

With abundant and widely available sodium resources, these batteries address supply chain risks and price volatility associated with lithium and cobalt. They are gaining traction in stationary energy storage, renewable integration, and low-cost mobility solutions where energy density trade-offs are acceptable. Advancements in cathode and electrolyte materials are improving performance, safety, and cycle life, making sodium-ion batteries more commercially viable. Strong investments from energy companies, automotive OEMs, and material innovators, combined with supportive government policies, are accelerating adoption and pushing commercialization at scale.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.5 billion |

| Industry Value (2035F) | USD 11.3 billion |

| CAGR (2025 to 2035) | 16.4% |

Between 2025 and 2030, the market is projected to expand from USD 2.5 billion to USD 6.0 billion, adding approximately USD 3.5 billion. Growth in this first phase will be supported by large-scale grid storage deployments and increasing adoption in stationary energy storage applications, driving widespread adoption across renewable energy integration and utility-scale storage projects. Electric vehicle manufacturers are emerging as major demand drivers, seeking cost-effective alternatives to lithium-ion batteries while maintaining performance standards and regulatory compliance.

From 2030 to 2035, the market is expected to grow from USD 6.0 billion to USD 11.3 billion, a further increase of USD 5.3 billion. This second phase will be shaped by expanded implementations in electric vehicle platforms, deeper penetration in consumer electronics, and the development of advanced sodium-ion chemistries optimized for specific industry verticals. Technology refresh cycles will emphasize integrated energy storage ecosystems, while regulatory developments will focus on harmonizing sodium-ion battery standards across global markets.

From 2020 to 2024, the market rose from USD 0.4 billion to USD 2.0 billion, propelled by heightened concerns over lithium supply chain constraints and accelerating commercialization activities by leading manufacturers. Early grid-scale storage projects and renewable energy integration assessments established the foundation for enterprise adoption. Research institutions and energy storage developers led early implementation, while commercial enterprises began comprehensive sodium-ion battery evaluations, establishing the groundwork for the 2025-2035 expansion cycle.

The abundant availability of sodium compared to lithium is creating compelling economic advantages for large-scale energy storage applications. Sodium represents approximately 2.6% of the Earth's crust compared to lithium's 0.002%, eliminating supply chain constraints that have driven lithium prices to unsustainable levels. This resource abundance is driving systematic evaluation and adoption of sodium-ion technology across grid-scale storage, renewable energy integration, and cost-sensitive applications, creating sustained demand for sodium-ion battery systems and manufacturing capabilities.

Utility companies worldwide are implementing large-scale sodium-ion battery systems for grid stabilization and renewable energy storage. The technology's inherent safety characteristics, including thermal stability and reduced fire risk, make sodium-ion batteries particularly suitable for grid-scale deployments where safety and reliability are paramount. Long-duration energy storage requirements for wind and solar integration are accelerating adoption of sodium-ion systems, creating compliance-driven demand across multiple energy sectors.

Automotive manufacturers are increasingly adopting sodium-ion batteries for entry-level electric vehicles and energy storage applications where cost advantages outweigh energy density limitations. The technology's ability to operate effectively in extreme temperatures and reduced dependence on critical raw materials align with automotive industry sustainability goals. Mass production scaling and manufacturing optimization are driving demand for specialized sodium-ion automotive applications and hybrid implementation approaches.

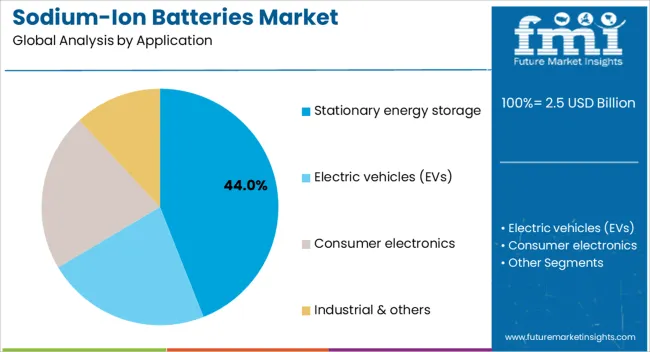

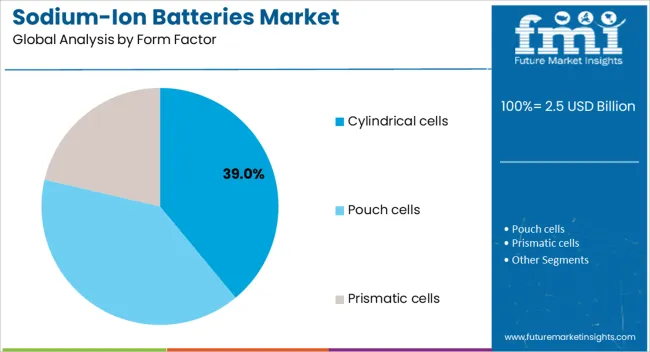

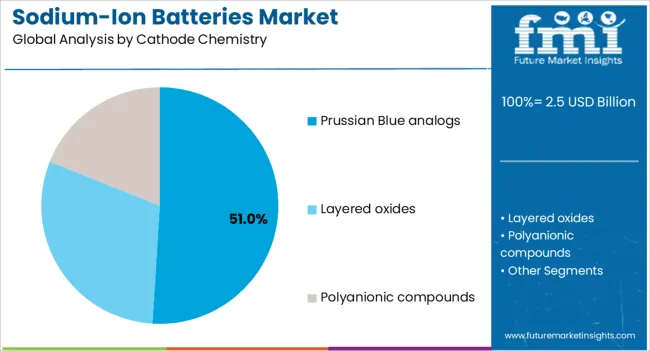

The market is segmented by application into stationary energy storage, electric vehicles, consumer electronics, and industrial & others. By cathode chemistry, the market includes Prussian Blue analogs, layered oxides, and polyanionic compounds. Form factor segmentation comprises cylindrical cells, pouch cells, and prismatic cells. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

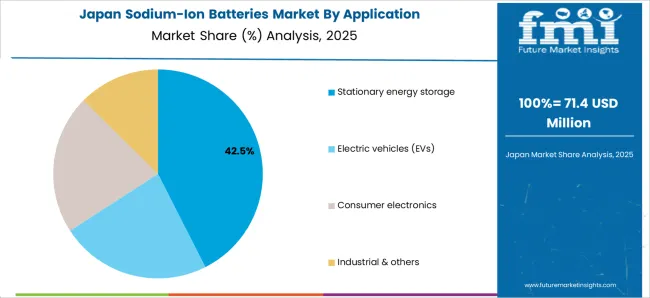

Stationary energy storage applications are projected to command a dominant 44% share of the sodium-ion batteries market by 2025, establishing their position as the primary application for sodium-ion technology. Their deployment in grid-scale storage projects benefits from sodium-ion batteries' inherent safety characteristics and cost advantages over lithium-ion alternatives, providing robust energy storage solutions for renewable energy integration. These applications offer excellent cycle life and thermal stability, making them suitable for comprehensive utility-scale energy storage strategies.

The widespread adoption of stationary storage is driven by their efficiency in long-duration storage applications and ability to provide grid stabilization services without significant performance degradation. Utility companies' commitment to renewable energy integration provides regulatory confidence and ecosystem support, facilitating enterprise adoption across diverse grid applications. While electric vehicles and consumer electronics serve important markets, stationary energy storage offers the scalability, safety, and cost-effectiveness necessary for mainstream deployment, positioning these applications as the cornerstone of sodium-ion battery adoption strategies for utilities seeking both energy security and operational efficiency.

Electric vehicles are set to account for 32% of sodium-ion battery applications in 2025, reflecting the automotive industry's strategic focus on cost reduction and supply chain diversification. Automotive manufacturers face substantial pressure to reduce battery costs while maintaining performance standards, making sodium-ion technology particularly attractive for entry-level EVs and commercial vehicles. Vehicle manufacturers are placing heightened focus on sodium-ion integration for specific vehicle segments, making cost optimization a top priority for organizations targeting mass-market electric mobility.

Consumer electronics represents 14% of applications, with portable devices and energy storage systems requiring cost-effective battery solutions. Industrial & others accounts for 10% of the market, encompassing specialized applications including backup power systems and industrial equipment. In all cases, sodium-ion batteries provide organizations with cost-effective energy storage solutions that address both current requirements and anticipated supply chain vulnerabilities, establishing stationary storage and electric vehicle sectors as the primary drivers of market expansion.

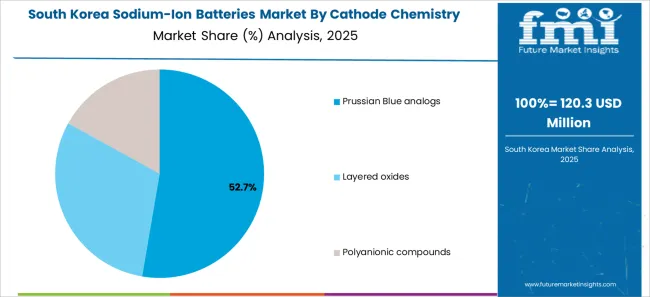

Prussian Blue analogs cathode chemistry is forecasted to capture 51% of the market in 2025, highlighting the technical advantages of this sodium-ion cathode material for commercial applications. These cathodes enable stable sodium-ion insertion and extraction with excellent cycle life characteristics, while providing manufacturing scalability for large-scale battery production. Prussian Blue-based sodium-ion batteries offer superior thermal stability and safety performance compared to traditional lithium-ion alternatives.

Beyond performance advantages, Prussian Blue analogs support cost-effective manufacturing processes using abundant raw materials, enabling organizations to achieve competitive battery costs across multiple applications. Advanced cathode formulations allow optimization of energy density and power characteristics, enabling organizations to tailor performance before full-scale production. Layered oxides, accounting for 33% of the market, remain essential for applications requiring higher energy density, while polyanionic compounds represent 16% of the market for specialized high-power applications, reflecting the diverse cathode chemistry requirements across different sodium-ion battery applications.

Manufacturers are increasingly developing sophisticated Prussian Blue analogs and layered oxide cathode materials that significantly optimize energy density, cycle life, and manufacturing scalability for commercial deployment. These advanced cathode chemistries incorporate precise crystal structure modifications and dopant materials that enhance sodium-ion insertion and extraction kinetics, resulting in improved power delivery and extended operational lifespans. Research institutions and battery manufacturers are collaborating to develop proprietary cathode formulations that address specific performance requirements across different applications, from high-power grid storage systems to energy-dense electric vehicle batteries.

The evolution of cathode chemistry extends beyond performance optimization to encompass manufacturing cost reduction and raw material sustainability. Companies are implementing innovative synthesis methods that utilize abundant industrial precursors and eliminate expensive processing steps, making sodium-ion batteries increasingly cost-competitive with lithium-ion alternatives. Advanced characterization techniques enable precise control over cathode morphology and particle size distribution, resulting in consistent performance across large-scale production runs. These developments provide comprehensive performance frameworks that enable competitive alternatives to lithium-ion batteries across multiple applications, while establishing sodium-ion technology as a viable long-term energy storage solution.

Advanced sodium-ion implementations increasingly incorporate comprehensive renewable energy integration capabilities, combining cost-effective energy storage with sophisticated grid stabilization, peak shaving, and load balancing controls that optimize overall system efficiency. These integrated systems utilize advanced battery management systems that coordinate sodium-ion battery charging and discharging cycles with renewable energy generation patterns, maximizing energy capture during peak production periods and providing reliable power during low generation intervals. Smart grid integration enables sodium-ion battery systems to participate in ancillary services markets, generating additional revenue streams while supporting grid stability and renewable energy adoption.

The integration extends to hybrid energy storage architectures that combine sodium-ion batteries with other storage technologies, creating optimized solutions for specific grid applications and renewable energy profiles. Advanced control algorithms enable seamless switching between storage technologies based on real-time grid conditions, energy prices, and performance characteristics, maximizing economic returns while ensuring grid reliability. Energy management software platforms provide comprehensive monitoring and optimization capabilities that enable utility operators to maximize renewable energy utilization while minimizing grid instability risks. This integration enables organizations to build sustainable energy ecosystems that address both cost optimization and environmental sustainability requirements, while supporting the transition to renewable energy-dominant power grids.

Sodium-ion battery manufacturers are developing comprehensive automated production systems that optimize cathode material synthesis, electrode preparation, and cell assembly processes through advanced robotics, artificial intelligence, and real-time quality monitoring tailored to specific performance requirements and production volumes. These automated systems incorporate precision material handling equipment that ensures consistent cathode and anode preparation, while advanced mixing and coating technologies provide uniform electrode characteristics across large-scale production runs. Machine learning algorithms analyze production data in real-time to identify optimal processing parameters and predict quality outcomes, enabling proactive adjustments that maintain consistent battery performance.

Quality control automation extends throughout the entire manufacturing process, from raw material inspection to final cell testing and validation. Advanced inspection systems utilize computer vision and spectroscopic analysis to identify defects and inconsistencies during production, while automated testing equipment performs comprehensive electrical and thermal characterization of finished cells. Statistical process control systems provide continuous monitoring of key performance indicators, enabling manufacturers to maintain tight quality specifications while maximizing production throughput. These comprehensive automation platforms enable systematic scaling of sodium-ion battery production while minimizing manufacturing costs and maintaining stringent quality standards throughout the production process, supporting the transition from laboratory-scale development to commercial-scale deployment.

China's sodium-ion batteries market is projected to grow at 18.7% CAGR through 2035, the highest globally. CATL's successful commercialization of sodium-ion battery technology and large-scale grid storage deployments have established definitive sodium-ion solutions for utility and automotive adoption. Government mandates supporting renewable energy integration and grid modernization are driving systematic implementation across state-owned utilities and energy storage providers. The country's leadership in battery manufacturing creates competitive advantages, accelerating proactive adoption across electric vehicles, grid storage, and industrial sectors.

India's sodium-ion batteries market is expected to expand at 17.2% CAGR, supported by renewable-heavy grid expansion and government energy storage missions under national sustainability initiatives. The country's ambitious solar and wind energy targets require large-scale energy storage solutions that can operate effectively in challenging climate conditions. Government investment in energy storage manufacturing is driving awareness of sodium-ion technology benefits across grid operators and renewable energy developers. Battery manufacturing incentives are accelerating adoption of cost-effective sodium-ion systems for protecting grid stability and energy security.

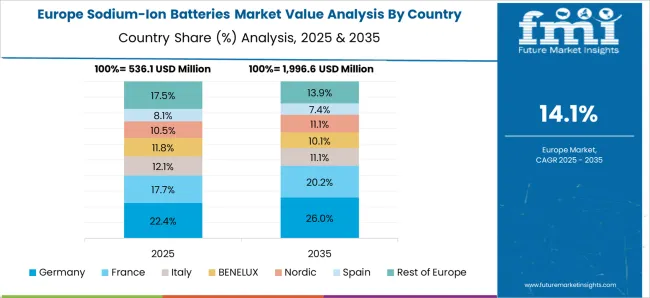

German sodium-ion batteries market is projected to grow at 15.8% CAGR, driven by EU strategic autonomy initiatives and dedicated alternative battery technology funding. The country's industrial manufacturing sector is implementing sodium-ion energy storage to reduce dependence on critical raw materials and enhance supply chain resilience. Government investment in battery research is driving development of European sodium-ion technology capabilities. Energy storage requirements for renewable energy integration are accelerating adoption of sodium-ion systems for protecting industrial operations and grid stability.

The USA sodium-ion batteries market is expected to grow at 15.1% CAGR, supported by Department of Energy funding for long-duration energy storage research and grid modernization initiatives. National laboratories and energy storage developers are implementing sodium-ion technology for grid-scale applications requiring extended duration storage capabilities. Federal investment in critical materials alternatives is creating awareness of sodium-ion benefits for energy security. Major utilities are adopting sodium-ion systems to reduce battery costs while maintaining grid reliability and renewable energy integration capacity.

The UK sodium-ion batteries market is projected to expand at 14.4% CAGR, reflecting early adoption in residential energy storage and innovative second-life battery applications. Home energy storage systems are implementing sodium-ion technology for cost-effective solar energy storage and grid independence solutions. Government initiatives supporting circular economy principles are creating opportunities for sodium-ion batteries in second-life applications after automotive use. Energy storage developers are implementing sodium-ion systems for commercial and industrial applications requiring safe, long-duration storage capabilities.

Japan's sodium-ion batteries market is expected to grow at 13.8% CAGR, focused on advanced Prussian Blue cathode development and consumer electronics applications. Japanese research institutions are leading development of high-performance Prussian Blue analogs for next-generation sodium-ion batteries. The country's consumer electronics industry is adopting sodium-ion technology for cost-sensitive applications and supply chain diversification. Government investment in battery research is driving early adoption of sodium-ion technology across specialized applications and research initiatives.

South Korea's sodium-ion batteries market is projected to grow at 13.1% CAGR, driven by automotive industry investment in EV-grade sodium-ion research and lithium supply chain diversification strategies. Korean automotive manufacturers are developing sodium-ion battery systems for entry-level electric vehicles and commercial applications. Battery manufacturers are implementing sodium-ion technology for reducing dependence on lithium while maintaining competitive performance characteristics. Government support for battery technology development is accelerating adoption of sodium-ion systems across automotive and energy storage applications.

The sodium-ion batteries market is rapidly evolving, characterized by intense competition between established battery manufacturers, emerging sodium-ion specialists, and integrated energy storage solution providers. With growing concerns over lithium supply chain constraints and cost pressures, organizations across all sectors are under pressure to implement cost-effective energy storage solutions that provide reliable performance and supply chain security.

As a result, technology providers are prioritizing development of comprehensive sodium-ion platforms that combine advanced cathode chemistries with scalable manufacturing capabilities, while also ensuring performance optimization and cost competitiveness across diverse energy storage applications. Another area of innovation lies in automated manufacturing and quality control systems, where providers combine advanced materials synthesis with tailored production processes, enabling organizations to execute systematic sodium-ion battery deployment while maintaining operational efficiency.

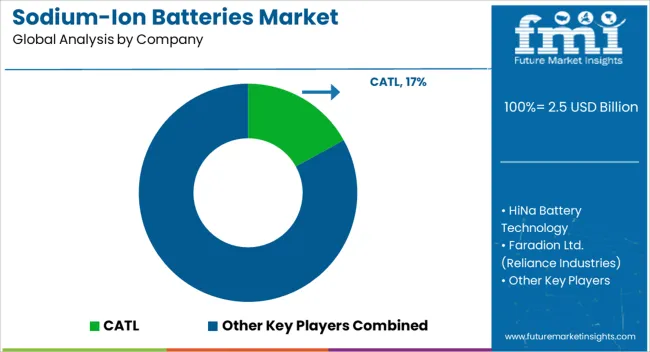

CATL is projected to lead the market with a 17% share in 2025, leveraging its comprehensive battery manufacturing expertise and successful sodium-ion commercialization initiatives. The company's strength lies in its integrated approach, combining advanced cathode chemistry development with large-scale manufacturing capabilities, technical consultation services, and ongoing support throughout deployment lifecycles. This holistic model has established strong partnerships with utility companies and automotive manufacturers, reinforcing CATL's leadership position and enabling the company to set industry standards for both sodium-ion technology and commercial adoption practices.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 billion |

| Application | Stationary energy storage, Electric vehicles, Consumer electronics, Industrial & others |

| Cathode Chemistry | Prussian Blue analogs, Layered oxides, Polyanionic compounds |

| Form Factor | Cylindrical cells, Pouch cells, Prismatic cells |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, United States, United Kingdom, Japan, South Korea |

| Key Companies Profiled | CATL, HiNa Battery Technology, Faradion Ltd., Natron Energy, Altris AB, Tiamat Energy, AMTE Power, Aquion, Contemporary Amperex-backed startups, Northvolt |

| Additional Attributes | Dollar sales by battery type and energy density, regional demand trends, competitive landscape, buyer preferences for cylindrical versus pouch cells, integration with EV, grid storage, and renewable energy systems, innovations in electrode materials, electrolyte optimization, fast-charging capabilities, lifecycle enhancement, and sustainable manufacturing for improved performance and cost efficiency |

The global sodium-ion batteries market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the sodium-ion batteries market is projected to reach USD 11.4 billion by 2035.

The sodium-ion batteries market is expected to grow at a 16.4% CAGR between 2025 and 2035.

The key product types in sodium-ion batteries market are stationary energy storage, electric vehicles (evs), consumer electronics and industrial & others.

In terms of cathode chemistry, prussian blue analogs segment to command 51.0% share in the sodium-ion batteries market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Zinc-Air Batteries Market Growth – Trends & Forecast 2023-2033

Golf Cart Batteries Market Size and Share Forecast Outlook 2025 to 2035

Submarine Batteries Market Analysis - Growth & Forecast 2025 to 2035

Rechargeable Batteries Market

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Locomotive Lighting Batteries Market Analysis - Size, Share & Forecast 2025 to 2035

Two-Wheeler Lead Acid Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thin Film and Printed Batteries Market Trends - Growth & Forecast 2025 to 2035

Lithium-sulfur Solid-state Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA