The Sodium Lauroyl Isethionate Market is estimated to be valued at USD 112.0 million in 2025 and is projected to reach USD 172.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period. The sodium lauroyl isethionate (SLI) market is closely connected to several parent markets that significantly contribute to its growth. Within the personal care and cosmetics market, SLI accounts for approximately 54.5%, driven by its mild, sulfate-free properties that make it ideal for sensitive skin formulations . The household cleaning products market plays a crucial role, contributing around 5–10%, as SLI is used in products like dishwashing liquids and hand soaps due to its gentle yet effective cleaning properties. The industrial cleaning market influences the SLI market with a share of approximately 5–7%, as SLI is utilized in industrial hand cleansers and other cleaning agents that require mild surfactants. The pharmaceuticals market contributes about 5%, as SLI is used in medicated soaps and dermatological cleansers for sensitive skin . Lastly, the e-commerce market impacts the SLI industry with a share of approximately 10–15%, as online platforms facilitate the distribution of personal care products containing SLI, expanding their reach to a broader consumer base . As the demand for mild, biodegradable, and sulfate-free surfactants continues to rise across these sectors, the SLI market is expected to expand, driven by technological advancements and increasing applications in various industries.

| Metric | Value |

|---|---|

| Sodium Lauroyl Isethionate Market Estimated Value in (2025 E) | USD 112.0 million |

| Sodium Lauroyl Isethionate Market Forecast Value in (2035 F) | USD 172.3 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The sodium lauroyl isethionate market is experiencing sustained expansion due to its wide application in formulating mild surfactants for skincare, haircare, and hygiene products. Its prominence has been reinforced by the growing consumer demand for sulfate-free and paraben-free formulations that offer gentle cleansing without compromising foaming properties. Sodium lauroyl isethionate’s high biodegradability and skin-friendly profile have gained traction among eco-conscious manufacturers and clean beauty brands, particularly in Europe, North America, and fast-growing Asian markets.

Regulatory shifts emphasizing safer ingredients and transparency in personal care formulations have further bolstered its usage. The compound's compatibility with other anionic and non-ionic surfactants, along with its stability in various pH ranges, has enabled its integration into advanced emulsification systems and aqueous formulations.

Continued innovations in mild surfactant systems, paired with rising disposable income and grooming awareness in developing economies, are expected to propel market demand The long-term outlook remains positive as formulators and end-use industries prioritize skin compatibility, environmental safety, and performance in surfactant design.

The sodium lauroyl isethionate market is segmented by application type, formulation type, end-user industry, product type, distribution channel, and geographic regions. By application type, the sodium lauroyl isethionate market is divided into Personal Care Products, Household Cleaning Products, Industrial Cleaning Agents, Cosmetics, and Pet Care Products. In terms of formulation type, the sodium lauroyl isethionate market is classified into Aqueous Formulations, Non-aqueous Formulations, Powdered Formulations, and Concentrates.

Based on end-user industry, the sodium lauroyl isethionate market is segmented into Cosmetics and Personal Care, Household Care, Pharmaceuticals, Food and Beverage, and Textiles. By product type, the sodium lauroyl isethionate market is segmented into Surfactants, Emulsifiers, Thickeners, and Cleansing Agents. By distribution channel, the sodium lauroyl isethionate market is segmented into Distributors and Wholesalers, Online Retailers, Direct Sales, and Supermarkets and Hypermarkets. Regionally, the sodium lauroyl isethionate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The personal care products segment is expected to account for 32.8% of the total revenue share in the sodium lauroyl isethionate market in 2025. This leadership position is driven by the rising consumer inclination toward mild surfactants in daily grooming and hygiene routines.

Sodium lauroyl isethionate has been widely utilized in facial cleansers, shampoos, body washes, and syndet bars due to its gentle cleansing action and ability to generate a rich, creamy lather even in hard water. Its low irritation profile and ability to maintain the skin’s natural lipid barrier have made it a preferred ingredient among dermatologically tested product lines.

The shift away from sulfates and harsh detergents in both mass-market and premium formulations has positioned sodium lauroyl isethionate as a core component in next-generation cleansing systems. Additionally, its stable performance in cold-processed formulations and compatibility with sensitive skin products have led to widespread adoption across global personal care portfolios.

Aqueous formulations are projected to hold 40.3% of the total sodium lauroyl isethionate market revenue share in 2025, emerging as the dominant formulation type. This growth is supported by the compound’s high solubility, excellent foaming properties, and ease of incorporation into water-based systems. Aqueous formulations have gained industry-wide acceptance for enabling homogeneous dispersion and faster processing times during production, which enhances efficiency and scalability for manufacturers.

Sodium lauroyl isethionate’s ability to retain its mildness and functional efficacy in aqueous systems has facilitated its integration into a wide range of cleansing products designed for sensitive skin. Regulatory compliance and safety considerations associated with water-based formulations have further contributed to their adoption.

The increasing demand for sustainable and rinse-off formulations, particularly in baby care, premium haircare, and dermatologically approved cleansers, has accelerated the use of aqueous formats. Enhanced shelf stability and simplified product development workflows continue to support the growth of this segment across industrial applications.

The cosmetics and personal care segment is anticipated to represent 36.8% of the total revenue share in the sodium lauroyl isethionate market in 2025, making it the largest end-use industry. This dominance has been driven by the escalating demand for skin-friendly and biodegradable surfactants in facial and body care products.

Sodium lauroyl isethionate’s ability to deliver luxurious texture and mild cleansing without stripping the skin has made it a staple in modern cosmetic formulations. With the growth of clean beauty trends and consumer awareness regarding ingredient transparency, formulators have increasingly replaced traditional sulfates with gentler alternatives such as sodium lauroyl isethionate.

Its performance advantages, including soft after-feel, reduced eye sting, and compatibility with botanical actives, have supported its widespread use across premium and mass personal care brands. Furthermore, the rise in urbanization, evolving grooming habits, and increasing penetration of personal care products in emerging markets have sustained demand for cosmetic-grade surfactants, reinforcing this segment’s leadership position.

The sodium lauroyl isethionate market is experiencing steady growth due to its increasing use in personal care products, particularly in skin care and hair care formulations. Sodium lauroyl isethionate is a mild, surfactant ingredient known for its gentle cleansing properties, making it a preferred choice for formulations targeting sensitive skin. With the growing consumer preference for products that are both effective and gentle on the skin, this ingredient is gaining traction in shampoos, facial cleansers, body washes, and other personal care products. The rising demand for clean and safe formulations is further contributing to the market expansion.

The sodium lauroyl isethionate market is primarily driven by the rising demand for gentle yet effective personal care products. Consumers are becoming increasingly aware of the ingredients in their skin and hair care products, seeking formulations that offer a balance between efficacy and gentleness. Sodium lauroyl isethionate, with its mild cleansing and foaming properties, is ideal for sensitive skin types, making it a popular choice in premium and hypoallergenic product lines. As awareness about skin health and the need for safer ingredients in personal care grows, sodium lauroyl isethionate is increasingly favored in both mainstream and specialized cosmetic formulations.

The sodium lauroyl isethionate market presents significant opportunities, especially with the increasing growth of the natural and clean beauty trends. As consumers seek more natural, safer, and eco-friendly ingredients in their personal care products, sodium lauroyl isethionate, which is derived from coconut oil, fits well with the demand for plant-based and gentle surfactants. Its ability to provide a mild yet effective cleansing experience makes it suitable for formulations targeting sensitive skin, baby care, and dermatologically tested products. The increasing focus on sustainability and clean label products further strengthens the potential for sodium lauroyl isethionate adoption in the personal care industry, especially within premium product categories.

Despite its growing popularity, the sodium lauroyl isethionate market faces challenges such as price sensitivity and competition from alternative surfactants. Sodium lauroyl isethionate, while highly effective, tends to be more expensive than traditional surfactants like sodium lauryl sulfate (SLS), which can limit its adoption in cost-sensitive markets. This price disparity may encourage manufacturers to opt for cheaper alternatives, especially in mass-market personal care products. Although sodium lauroyl isethionate is mild and effective, there are several other surfactants in the market that offer similar properties, contributing to the competitive pressure. Overcoming these challenges requires demonstrating the superior benefits of sodium lauroyl isethionate in terms of skin and hair care performance.

A key trend in the sodium lauroyl isethionate market is the shift toward mild surfactants and advanced formulations in personal care products. With growing concerns about the harsh effects of sulfates and other aggressive cleansing agents, consumers are increasingly opting for milder alternatives that provide effective cleansing without stripping natural oils from the skin and hair. Sodium lauroyl isethionate, with its gentle yet effective properties, is becoming a key ingredient in sulfate-free, non-irritating formulations. Additionally, innovations in product development are driving the creation of multifunctional personal care products, where sodium lauroyl isethionate is incorporated not only for its cleansing properties but also for its moisturizing and conditioning effects. This trend is pushing the demand for sodium lauroyl isethionate in a wide range of personal care and cosmetic products.

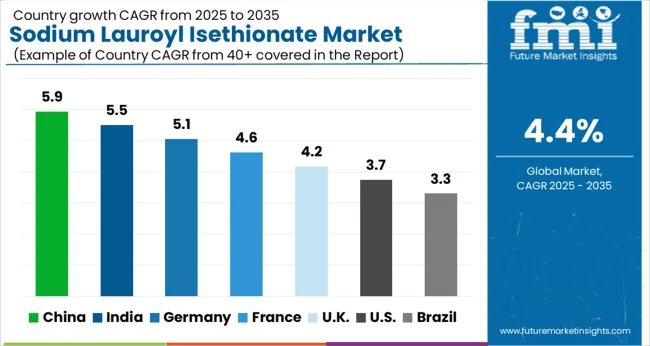

| Countries | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The global sodium lauroyl isethionate market is projected to grow at a CAGR of 4.4% from 2025 to 2035, driven by the increasing demand for mild and effective ingredients in personal care products. China leads with 6.3% growth, supported by strong consumer demand in personal care and cosmetics. India follows at 5.5%, fueled by rising disposable incomes and a preference for natural products. Germany, the UK, and the USA experience steady growth, driven by the demand for clean-label, eco-friendly, and skin-friendly formulations in the personal care industry. The analysis spans over 40+ countries, with the leading markets shown below.

The sodium lauroyl isethionate market in China is projected to grow at a CAGR of 5.9% through 2035. The market’s growth is fueled by the country’s booming personal care and cosmetics sectors, where sodium lauroyl isethionate is used as a mild surfactant in skincare and haircare products. As consumer demand for high-quality, gentle skincare formulations rises, especially among the middle class, the adoption of sodium lauroyl isethionate continues to increase. China’s growing focus on natural and organic ingredients in beauty products, alongside the rise in e-commerce, further strengthens market growth.

The sodium lauroyl isethionate market in India is expected to grow at a CAGR of 5.5% through 2035. With the increasing focus on personal care and hygiene, there is growing demand for mild and effective surfactants in haircare and skincare products. The rise in disposable incomes, urbanization, and a growing middle-class population are driving consumer preferences for high-quality cosmetic formulations. Additionally, India’s growing demand for organic and eco-friendly beauty products is propelling the market for sodium lauroyl isethionate. The expanding retail and e-commerce sectors further support the market’s growth in India.

The sodium lauroyl isethionate market in France is projected to grow at a CAGR of 5.1% through 2035. The demand for sodium lauroyl isethionate is driven by its use as a mild surfactant in personal care products like shampoos, body washes, and facial cleansers. Germany’s focus on sustainability and clean-label products in the cosmetics industry is a major driver for the adoption of sodium lauroyl isethionate, which is considered a safer alternative to harsher surfactants. As consumers increasingly demand natural and skin-friendly ingredients, the market for sodium lauroyl isethionate is expected to grow steadily.

The sodium lauroyl isethionate market in the United Kingdom is projected to grow at a CAGR of 4.2% through 2035. The UK market is benefiting from increasing consumer awareness of the benefits of gentle and mild surfactants in skincare and haircare products. The growing demand for organic, eco-friendly, and natural personal care products is driving the adoption of sodium lauroyl isethionate, which is seen as a safer alternative to traditional surfactants. Additionally, the UK’s strong retail and e-commerce industries provide platforms for the continued growth of this market.

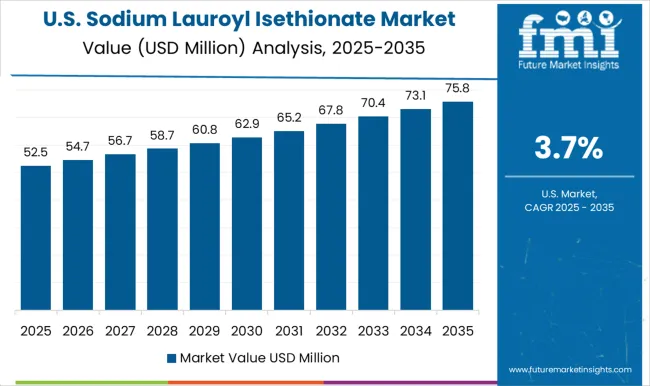

The USA sodium lauroyl isethionate market is projected to grow at a CAGR of 3.7% through 2035. The demand for sodium lauroyl isethionate is driven by the growing focus on mild, effective ingredients in personal care and hygiene products. As the USA market increasingly shifts toward natural and clean-label products, sodium lauroyl isethionate is becoming a preferred ingredient in cosmetics due to its gentle nature and skin-friendly properties. Additionally, the USA market is benefitting from the rise of eco-conscious consumers and the growth of the e-commerce sector, which further boosts market expansion.

Jilin Aegis Chemical is a significant player, providing high-quality SLI for various personal care applications, focusing on mildness and skin compatibility. Innospec Performance Chemicals specializes in the production of SLI, offering effective surfactants for personal care products, particularly for hair and skin care, emphasizing safety and performance. Parchem Fine & Specialty Chemicals offers a broad portfolio of surfactants, including sodium lauroyl isethionate, focusing on providing high-quality ingredients for the cosmetics and personal care industry. KIYU New Material manufactures surfactants with superior cleansing properties, positioning SLI as a core ingredient in formulations for body care and facial cleansers.

Galaxy Surfactants provides SLI solutions known for their mildness, which are particularly used in high-end shampoos, body washes, and facial cleansers. JEEN International Corporation offers a range of SLI-based products used in cosmetics and personal care applications, focusing on providing effective and safe cleansing solutions. McKinley Resources provides premium SLI products used in a wide variety of personal care formulations, emphasizing product quality and customer satisfaction. BASF SE is a global leader, offering a range of high-performance surfactants, including SLI, for use in hair care, skin care, and personal hygiene products. Taiwan NJC Corporation manufactures SLI products used in various cosmetics and toiletries, providing effective surfactants for gentle cleansing. Henan Surface Chemical Industry provides reliable SLI for personal care and household products, focusing on ensuring excellent performance in cleansing and foaming applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 112.0 Million |

| Application Type | Personal Care Products, Household Cleaning Products, Industrial Cleaning Agents, Cosmetics, and Pet Care Products |

| Formulation Type | Aqueous Formulations, Non-aqueous Formulations, Powdered Formulations, and Concentrates |

| End-User Industry | Cosmetics and Personal Care, Household Care, Pharmaceuticals, Food and Beverage, and Textiles |

| Product Type | Surfactants, Emulsifiers, Thickeners, and Cleansing Agents |

| Distribution Channel | Distributors and Wholesalers, Online Retailers, Direct Sales, and Supermarkets and Hypermarkets |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | JilinAegisChemical, InnospecPerformanceChemicals, ParchemFine&SpecialtyChemicals, KIYUNewMaterial, GalaxySurfactants, JEENInternationalCorporation, McKinelyResources, BASFSE, TaiwanNJCCorporation, and HenanSurfaceChemicalIndustry |

| Additional Attributes | Dollar sales by product type (Sodium Lauroyl Isethionate powder, liquid) and end-use segments (shampoos, body wash, facial cleansers, bath products). Demand dynamics are driven by the growing consumer preference for mild, effective, and eco-friendly cleansing agents, with increasing demand for personal care products that offer gentle yet effective skin and hair care solutions. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in surfactant formulations, sustainability concerns, and consumer interest in safe and mild ingredients propelling market expansion. |

The global sodium lauroyl isethionate market is estimated to be valued at USD 112.0 million in 2025.

The market size for the sodium lauroyl isethionate market is projected to reach USD 172.3 million by 2035.

The sodium lauroyl isethionate market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in sodium lauroyl isethionate market are personal care products, household cleaning products, industrial cleaning agents, cosmetics and pet care products.

In terms of formulation type, aqueous formulations segment to command 40.3% share in the sodium lauroyl isethionate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Metasilicate Pentahydrate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Ferrocyanide Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA