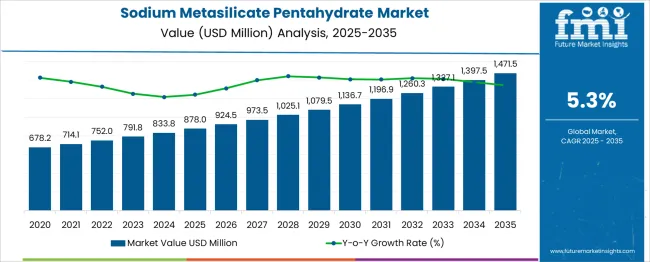

The Sodium Metasilicate Pentahydrate Market is estimated to be valued at USD 878.0 million in 2025 and is projected to reach USD 1471.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. The market follows a typical technology adoption lifecycle within the chemical industry, driven by demand in applications such as detergents, water treatment, construction, and industrial cleaning. From 2020–2024, the market is in the early adoption phase, growing from USD 678.2 million - USD 833.8 million. During this period, conventional sodium metasilicate products dominate, analogous to “hydraulic” technologies well-established, cost-effective, and widely used. Specialty formulations and higher-purity grades, comparable to electric hydraulic and EPS segments, see limited adoption due to higher costs and niche applications.

From 2025–2030, the market enters the scaling phase, expanding from USD 878.0 million - USD 1,136.7 million. Adoption accelerates as industrial users seek optimized, higher-purity products for advanced cleaning, detergent, and water treatment formulations.

Electric, hydraulic-like innovations, such as eco-friendly or low-alkali grades, gain traction in environmentally conscious applications, while EPS-like solutions, including customized formulations for specialty industries, begin to undergo broader deployment. Between 2030 and 2035, the market enters a period of consolidation, reaching USD 1,471.5 million. Growth moderates as production and consumption stabilize, with mature segments dominating mainstream applications and specialty products catering to high-value niche industries. The overall market maturity curve is sigmoid-shaped, with segments mapped by adoption readiness, cost, and application complexity.

| Metric | Value |

|---|---|

| Sodium Metasilicate Pentahydrate Market Estimated Value in (2025 E) | USD 878.0 million |

| Sodium Metasilicate Pentahydrate Market Forecast Value in (2035 F) | USD 1471.5 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The growing emphasis on high-performance, eco-friendly cleaning agents has led to an expanded use of sodium metasilicate pentahydrate in formulation-intensive applications. The material’s ability to function as a builder, emulsifier, and corrosion inhibitor has been instrumental in its widespread adoption in industrial and institutional cleaning sectors.

Additionally, regulatory movements encouraging the replacement of phosphate-based detergents have created opportunities for sodium metasilicate-based alternatives, thereby further supporting market growth. Technological advancements in manufacturing processes have enabled the production of high-purity grades with consistent quality, aligning with global standards and meeting rising demand from chemical and textile processing industries.

Increasing investments in wastewater management and industrial maintenance, particularly across the Asia Pacific and North America, are expected to bolster consumption volumes. The future outlook remains strong as industries continue to seek reliable, high-solubility compounds with enhanced safety profiles and multi-functionality.

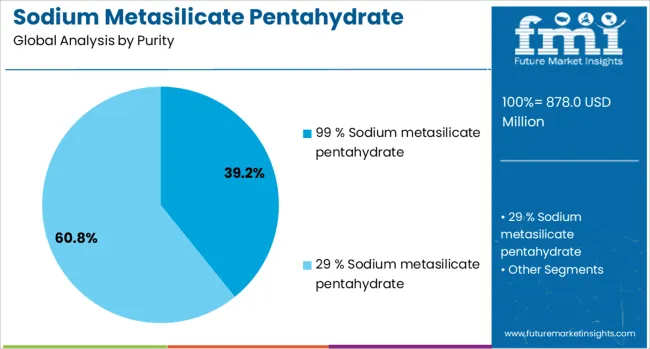

The sodium metasilicate pentahydrate market is segmented by purity and geographic regions. By purity, the sodium metasilicate pentahydrate market is divided into 99% Sodium metasilicate pentahydrate, 29% Sodium metasilicate pentahydrate, and 50% Sodium metasilicate pentahydrate. Regionally, the sodium metasilicate pentahydrate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 99 % sodium metasilicate pentahydrate segment is expected to contribute 39.2% of the total revenue share in the market by 2025, reflecting its position as the preferred purity level across critical industrial applications. The increasing requirement for high-grade, consistent-performance materials in sectors such as water treatment, metal cleaning, and detergent manufacturing has supported this dominance.

The superior solubility and enhanced alkalinity of 99% purity enable efficient dispersion and high reactivity, making it ideal for applications where chemical stability and performance precision are crucial. Stringent quality standards in end-use industries have driven the shift toward purer formulations to ensure process uniformity and compliance.

Additionally, the ability to tailor concentrations in automated chemical dosing systems has reinforced the segment’s relevance in industrial cleaning and boiler treatment applications. As demand for scalable, high-purity raw materials continues to grow across both developed and emerging economies, this segment is expected to sustain its leading role, driven by performance reliability and regulatory alignment.

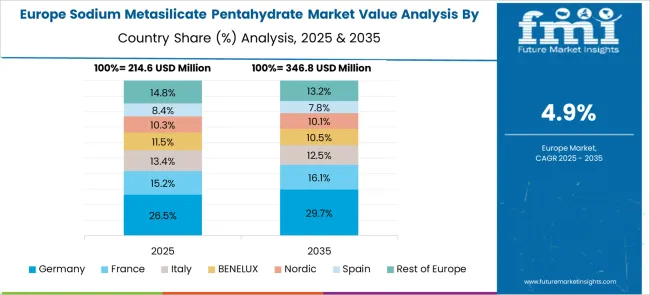

The sodium metasilicate pentahydrate market is growing steadily due to its widespread use in detergents, water treatment, pulp and paper, and industrial cleaning applications. Its strong alkaline properties, corrosion inhibition, and dispersing abilities make it essential in multiple industries. Asia-Pacific leads the market because of expanding industrial production and detergent manufacturing, while Europe and North America focus on specialty applications and regulatory-compliant formulations. Growing demand for high-efficiency cleaning agents and industrial processing chemicals continues to drive market expansion globally.

Sodium metasilicate pentahydrate is extensively used in powdered and liquid detergents due to its excellent alkaline and sequestering properties. It improves cleaning efficiency, removes stains, and enhances detergent stability. Industrial cleaning applications, including metal degreasing and surface treatment, rely on its ability to remove oils, dirt, and corrosion products effectively. Its use in household and commercial cleaning solutions continues to rise as consumer awareness of hygiene grows. Manufacturers are developing formulations with controlled solubility and reduced environmental impact to cater to modern cleaning needs, driving consistent market adoption.

In the pulp and paper industry, sodium metasilicate pentahydrate acts as a dispersant, scale inhibitor, and buffer, enhancing process efficiency. Water treatment applications utilize it to control water hardness, remove scale, and optimize pH levels. Its chemical stability and multifunctional properties make it a reliable choice across industrial applications. Continuous industrialization, increased paper production, and growing municipal and industrial water treatment demand are expanding the application base. Suppliers focusing on quality consistency, bulk availability, and customizable particle sizes can cater effectively to these sectors, further boosting global market growth.

Asia-Pacific dominates the market due to rapid industrialization, rising detergent manufacturing, and expanding pulp and paper production. North America and Europe focus on specialty chemicals, compliance with environmental regulations, and high-purity applications. Regional demand is influenced by industrial output, urbanization, and increasing commercial cleaning needs. Local production capacities, import-export dynamics, and raw material availability shape market growth patterns. Expansion in emerging markets, alongside increased industrial and municipal usage, drives steady adoption and provides opportunities for manufacturers to strengthen their presence across all regions.

Manufacturers are forming alliances with chemical distributors, industrial users, and detergent producers to improve supply reliability and product customization. Collaborations facilitate bulk distribution, tailored particle sizes, and optimized purity levels for specific applications. Partnerships also support regulatory compliance, research on improved formulations, and faster market penetration. By leveraging strategic networks, companies can provide better customer support, meet diverse industrial requirements, and strengthen market positioning. Such initiatives enhance brand recognition and create long-term growth opportunities across detergent, industrial, pulp, paper, and water treatment sectors globally.

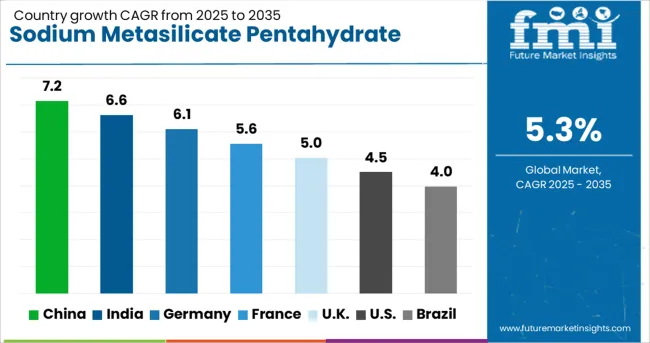

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

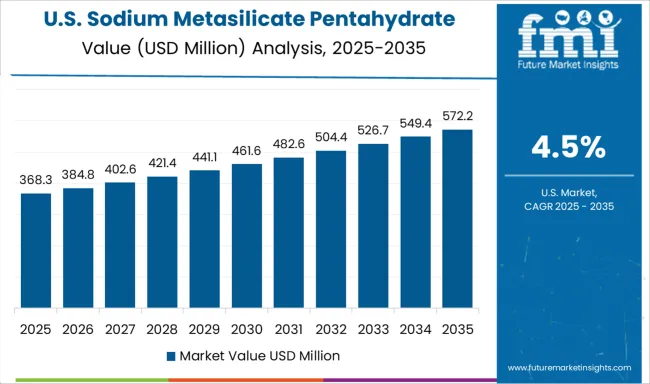

| USA | 4.5% |

| Brazil | 4.0% |

The sodium metasilicate pentahydrate market is projected to grow at a CAGR of 5.3%, driven by its widespread application in detergents, water treatment, and chemical manufacturing. China leads with a growth rate of 7.2%, benefiting from abundant raw material supply and large-scale production facilities. India follows at 6.6%, supported by increasing industrial usage and growing domestic chemical manufacturing. Germany, at 6.1% growth, focuses on high-purity production and serves both domestic and European markets. The UK, growing at 5.0%, leverages established distribution networks and consistent industrial demand, while the USA, at 4.5%, maintains steady growth through chemical and cleaning product applications. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the sodium metasilicate pentahydrate market with a 7.2% growth rate, driven by high demand in detergents, cleaning agents, and industrial applications. Compared to India, China benefits from a large manufacturing base and well-established chemical supply chains. Urbanization, rising disposable income, and industrial expansion fuel demand for cleaning and maintenance products. Domestic and export-oriented manufacturers focus on producing high-quality, water-soluble pentahydrate compounds. Technological advancements in chemical processing enhance product efficiency and reduce production costs. Environmental regulations encourage the adoption of sustainable manufacturing processes, improving product quality and compliance. Growing end-use sectors such as textiles, pulp and paper, and construction further support market growth. Overall, China maintains a strong position due to its industrial capacity, technological expertise, and rising consumption across multiple sectors.

The market in India grows at 6.6%, supported by increasing demand from detergents, cleaning agents, and industrial chemical applications. Compared to Germany, India focuses on cost-effective production and domestic supply chain optimization. Rising urbanization, industrial development, and hygiene awareness drive steady consumption of sodium metasilicate pentahydrate. Manufacturers invest in modern processing technologies to improve yield, reduce waste, and maintain competitive pricing. The expanding textile, pulp and paper, and construction industries fuel additional growth opportunities. Government initiatives promoting cleanliness, sanitation, and industrial modernization also enhance market adoption. Export opportunities in neighboring countries provide further revenue streams. Product innovations, such as higher purity grades and improved solubility, increase market appeal. Overall, India experiences steady market growth driven by industrial expansion, cost efficiency, and growing end-use sector demand.

The market in Germany grows at 6.1%, driven by demand for high-purity chemicals in industrial cleaning, detergents, and manufacturing applications. Compared to the UK, Germany emphasizes sustainability, environmental compliance, and premium product quality. Industrial sectors such as automotive, textiles, and pulp and paper create steady demand. Manufacturers focus on precision chemical processing, advanced production techniques, and waste reduction to maintain competitive advantages. Export opportunities across Europe further strengthen market resilience. Regulatory compliance, environmental standards, and product innovation play key roles in maintaining growth. Investments in research and development improve performance, reduce environmental impact, and ensure long-term competitiveness. Germany’s market stability benefits from industrial expertise, quality standards, and increasing adoption of sustainable chemical solutions.

The UK market grows at 5.0%, supported by demand from detergents, cleaning agents, and industrial applications. Compared to the US, the UK focuses on regulatory compliance, high-quality standards, and eco-friendly manufacturing practices. Manufacturers invest in advanced production technologies to improve product efficiency and reduce waste. Urbanization, hygiene awareness, and industrial growth fuel market adoption. Industrial sectors, including textiles, construction, and chemical manufacturing, contribute to steady demand. Retail and commercial channels facilitate product distribution across consumer and industrial markets. Sustainability trends and environmental regulations drive innovation and cleaner production processes. Overall, the UK market maintains stable growth, shaped by quality standards, regulatory compliance, and technological advancements in production.

The United State market grows at 4.5%, driven by demand from detergents, cleaning products, and industrial applications. Compared to China, the US emphasizes premium product quality, sustainability, and regulatory compliance. Manufacturers focus on producing high-purity pentahydrate compounds to meet consumer and industrial requirements. Industrial sectors, including textiles, pulp and paper, and construction, maintain steady chemical consumption. Research and development investments improve production efficiency, environmental compliance, and product performance. Distribution through retail, commercial, and industrial channels ensures wide market reach. Sustainability initiatives and technological innovations support market competitiveness. Overall, the US market experiences stable growth, driven by industrial demand, regulatory standards, and focus on environmentally friendly chemical solutions.

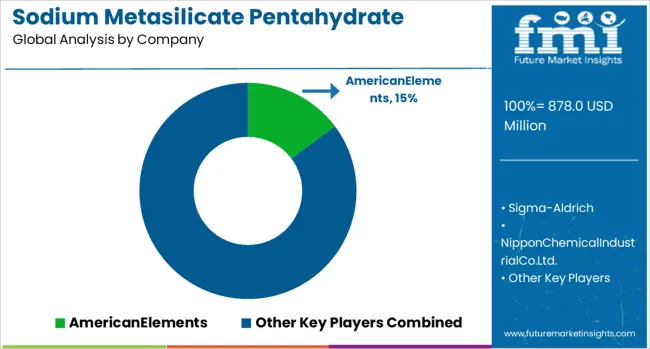

American Elements and Sigma-Aldrich (Merck Group) lead the market through high-purity and laboratory-grade offerings, targeting chemical manufacturers, research institutions, and industrial users. Nippon Chemical Industrial Co., Ltd. dominates in Asia with a focus on chemical intermediates for industrial processes, leveraging strong regional distribution and robust manufacturing capabilities.

Key regional players such as Jay Dinesh Chemicals and Qingdao HaiWan Chemical (Group) Co., Ltd. provide both industrial-scale and specialty-grade products, offering extensive supply networks across domestic and international markets. Silmaco, Shanghai Yueda Industrial & Chemical Co., Ltd., and Qingdao Darun Chemical Industrial Co. focus on scalable production capacities and efficient logistics to meet growing demand in Asia Pacific and export markets. Niche and regional players like Henny Enterprises and Mistral Industrial Chemicals differentiate through customized formulations, packaging solutions, and targeted industrial segments, catering to small-scale and specialized applications.

Historically, companies have prioritized expanding production facilities, optimizing purity levels, and building resilient distribution channels. Forecast strategies indicate a shift toward enhanced product standardization, regional expansion through partnerships or localized plants, and development of application-specific formulations for detergents, water treatment, ceramics, adhesives, and industrial cleaning. Differentiation levers include product purity, particle size consistency, solubility, and tailored chemical grades. Growth opportunities are prominent in emerging economies with expanding industrial sectors, where demand for efficient, cost-effective, and versatile chemical intermediates is rising. Companies are leveraging both technological refinement and supply chain optimization to capture incremental market share and strengthen global positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 878.0 Million |

| Purity | 99 % Sodium metasilicate pentahydrate, 29 % Sodium metasilicate pentahydrate, and 50 % Sodium metasilicate pentahydrate |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AmericanElements, Sigma-Aldrich, NipponChemicalIndustrialCo.Ltd., JayDineshChemicals, QingdaoHaiWanChemical(Group)Co.,Ltd., Silmaco, ShanghaiYuedaIndustrial&ChemicalCo.,Ltd., QingdaoDarunChemicalIndustrialCo.Ltd., HennyEnterprises, and MistralIndustrialChemicals |

| Additional Attributes | Dollar sales in the Sodium Metasilicate Pentahydrate Market vary by grade including industrial and technical, application across detergents, water treatment, and construction chemicals, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand in cleaning products, construction activities, and water treatment applications. |

The global sodium metasilicate pentahydrate market is estimated to be valued at USD 878.0 million in 2025.

The market size for the sodium metasilicate pentahydrate market is projected to reach USD 1,471.5 million by 2035.

The sodium metasilicate pentahydrate market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in sodium metasilicate pentahydrate market are 99 % sodium metasilicate pentahydrate, _washing powder, _textile, _cement, _paper, _ceramic, _metal surface treatment, _chemical production, _flameproofing, _mineral flotation, 29 % sodium metasilicate pentahydrate, _cosmetics, _ceramic, _paper, _detergents, _textiles, 50 % sodium metasilicate pentahydrate, _oil drilling, _cement, _textile, _detergent, _paper, _ceramics and _electroplating.

In terms of , segment to command 0.0% share in the sodium metasilicate pentahydrate market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA