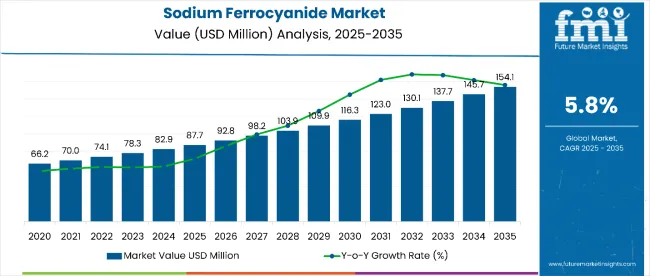

The sodium ferrocyanide market is estimated to be valued at USD 87.7 million in 2025 and is projected to reach USD 154.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. The sodium ferrocyanide market is projected to add an absolute dollar opportunity of USD 66.4 million over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 87.7 million |

| Forecast Value in (2035F) | USD 154.1 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

This reflects a 1.65 times growth at a compound annual growth rate of 5.8%. The market's evolution is expected to be shaped by rising demand for anticaking agents in food processing, expanding applications in pigment production, and growing usage in water treatment and chemical manufacturing processes.

By 2030, the market is likely to reach approximately USD 126.8 million, accounting for USD 30.0 million in incremental value over the first half of the decade. The remaining USD 36.4 million is expected during the second half, suggesting a moderately back-loaded growth pattern. Product diversification across industrial applications is gaining traction due to sodium ferrocyanide's versatile chemical properties and multifunctional capabilities as both a stabilizer and a complexing agent.

Companies such as Jinxi Meihua and GACL are advancing their competitive positions through investment in production capacity expansion and quality enhancement technologies. Market performance will remain anchored in regulatory compliance frameworks, food safety standards, and environmental regulations governing chemical manufacturing processes. Strategic partnerships between chemical suppliers and end-user industries are supporting expansion into specialized applications and emerging markets.

The sodium ferrocyanide market holds approximately 35% of the ferrocyanide compounds market, driven by its widespread use as an anticaking agent in food-grade salt and its essential role in Prussian blue pigment production. It accounts for around 18% of the food-grade anticaking agents market, supported by regulatory approval in major markets and a proven safety profile for human consumption.

The market contributes nearly 28% to the specialty chemical additives market, particularly for applications requiring precise chemical stabilization and complexing properties. It holds close to 22% of the water treatment chemicals market for heavy metal removal applications, where its chelating properties provide effective contamination control. The share in the industrial pigments market reaches about 15%, reflecting its critical role in producing high-quality blue pigments for paints and coatings.

The market is undergoing structural change driven by rising demand for food safety and quality enhancement solutions across global food processing industries. Advanced manufacturing processes using controlled crystallization and purification techniques have enhanced product purity, consistency, and application performance, making sodium ferrocyanide a preferred choice over alternative anticaking agents and complexing chemicals.

Manufacturers are introducing specialized grades with enhanced stability, improved solubility characteristics, and customized particle sizes tailored for specific industrial and food applications. Strategic collaborations between chemical manufacturers and food processing companies have accelerated adoption in premium salt products and specialized food formulations.

Digital supply chain platforms and direct-to-manufacturer distribution models have improved market access and enabled efficient inventory management.

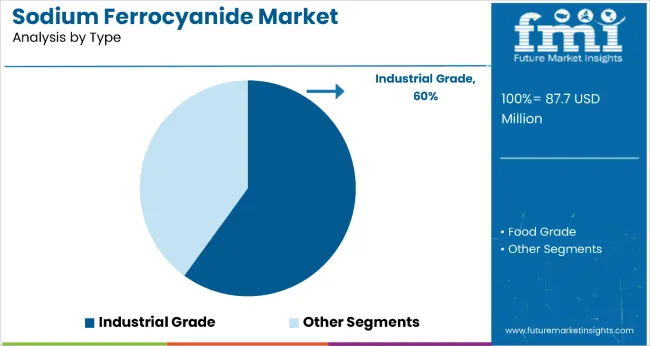

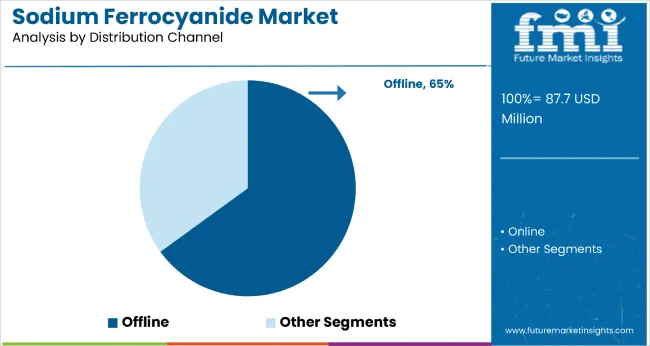

The market is segmented by application, type, distribution channel, and region. By application, it includes blue pigments, photography, metal and leather, dyeing industry, blueprint paper, biochemical, and water treatment. Based on type, the market is bifurcated into food grade and industrial grade. Based on the distribution channel, the market is classified into online and offline. Regionally, the market is analyzed across North America, Latin America, Asia Pacific, Eastern Europe, Western Europe, and Japan.

The industrial grade segment commands a 60% share in the type category, underscoring sodium ferrocyanide’s dominant role in non-food applications such as pigment manufacturing, blueprinting, metal surface treatment, and water purification. Its effectiveness as a stabilizing and anticaking agent in harsh chemical environments makes it ideal for industrial settings. Demand is driven by its compatibility with various formulations and its function as a key intermediate in complexation reactions and coordination compounds.

Industrial-grade sodium ferrocyanide is favored in blue pigment synthesis (Prussian blue), which is widely used in printing inks, coatings, and artistic pigments. It also plays a significant role in wastewater treatment due to its capacity to precipitate heavy metals.

The segment benefits from stable demand in mature markets and expanding applications in emerging economies with growing industrial infrastructure. As environmental regulations evolve, manufacturers are focusing on improving the purity and safety profile of industrial-grade formulations to ensure compliance and broaden usage.

The offline segment leads the distribution channel category with a 65% market share, primarily due to the bulk and regulated nature of sodium ferrocyanide transactions, which require direct business-to-business engagements, long-term supply contracts, and logistics capabilities. Industrial users and large-scale food processors prefer purchasing through offline distributors, authorized agents, and direct manufacturer relationships to ensure supply consistency and traceability.

Offline distribution channels also support stringent compliance requirements, with established players providing documentation, technical support, and post-sale services that are essential in sectors like food additives and water treatment. As sodium ferrocyanide is subject to regulatory oversight, especially in food-grade applications, offline networks help maintain product authenticity and batch traceability.

The segment's dominance is further reinforced by limited online presence due to the chemical’s handling regulations and the need for customized delivery solutions. However, digital B2B platforms are emerging, and some suppliers are gradually shifting toward hybrid distribution models. Still, offline channels remain the cornerstone of the market's global supply chain.

Sodium ferrocyanide's proven safety profile as a food additive (E535), excellent anticaking properties, and versatile industrial applications as a stabilizer and complexing agent make it an essential ingredient across food processing, chemical manufacturing, and specialty industrial sectors.

Growing awareness of food quality and safety standards is further propelling adoption, especially in processed salt products where consistent flow properties and extended shelf life are critical for consumer acceptance and commercial viability. Technological advancements in production processes and expanding applications in water treatment and pigment manufacturing are also driving market expansion.

As global food processing industries continue expanding and environmental regulations favor effective water treatment solutions, the market outlook remains favorable. With continued innovation in application technologies, growing adoption in emerging markets, and increasing integration into specialty chemical formulations, sodium ferrocyanide is well-positioned to capture expanding opportunities across diverse industrial applications.

From 2025 to 2035, food safety regulations and industrial application diversification were central to market expansion, with companies investing in quality assurance systems and specialized product development. Advanced manufacturing technologies ensuring consistent purity and particle size distribution became key differentiators. Growing demand for water treatment solutions and specialty chemical applications supported market growth beyond traditional food industry usage.

Food Processing Industry Growth Drives Sodium Ferrocyanide Demand

The expanding global food processing industry has been identified as the primary catalyst for growth in the sodium ferrocyanide market. In 2024, increasing consumer demand for processed and convenience foods led to widespread adoption of high-quality anticaking agents by commercial salt producers and food manufacturers seeking consistent product performance.

By 2025, demand was elevated as food safety regulations emphasized the importance of approved additives with proven safety profiles for human consumption. Scientific validation of sodium ferrocyanide's anticaking effectiveness and regulatory acceptance in major markets has demonstrated superior performance compared to alternative compounds.

These developments confirm that food industry expansion and quality requirements, rather than price considerations alone, are driving sustained market growth across processed food applications and specialty salt products.

Industrial Application Diversification Creates Market Opportunities

In 2024, chemical manufacturers began integrating sodium ferrocyanide into specialized applications, including water treatment for heavy metal removal and pigment production for high-performance coatings, supported by advanced processing technologies that optimize product characteristics for specific industrial requirements.

By 2025, advanced sodium ferrocyanide grades were being deployed in pharmaceutical applications and specialty chemical synthesis, requiring precise complexing and stabilization properties.

These implementations demonstrate that sodium ferrocyanide can evolve from basic anticaking applications to sophisticated industrial chemical applications, enabling innovative process solutions. Suppliers offering technically advanced sodium ferrocyanide with consistent quality specifications and specialized functionality are positioned to capture growing demand from industrial manufacturers requiring reliable chemical performance in critical applications.

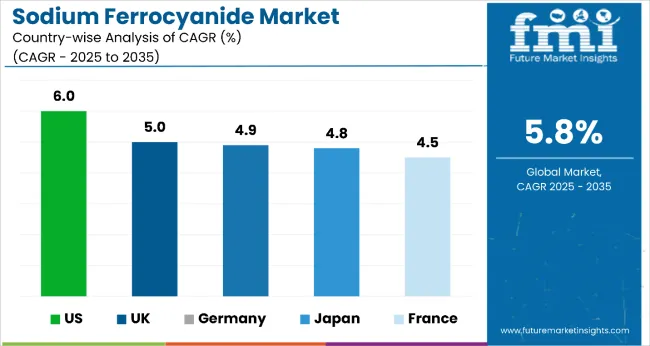

| Country | CAGR |

|---|---|

| USA | 6% |

| UK | 5% |

| Germany | 4.9% |

| Japan | 4.8% |

| France | 4.5% |

Among key developed economies, the USA leads the sodium ferrocyanide market with a robust CAGR of 6.0% from 2025 to 2035, driven by diversified applications across food processing, deicing, and water treatment. The UK follows with a steady 5.0% CAGR, reflecting consistent demand despite clean-label pressures.

Germany and Japan demonstrate mature market dynamics, growing at 4.9% and 4.8% respectively, supported by industrial and food-grade applications under strict regulatory environments. France records a slightly lower CAGR of 4.5%, limited by growing substitution trends in industrial sectors. Overall, growth differentials highlight the USA as the dominant force in this evolving market.

The report covers an in-depth analysis of 40+ countries; five top performing OECD countries are highlighted below.

The sodium ferrocyanide market in the USA is projected to expand at a CAGR of 6.0% from 2025 to 2035, the highest among developed economies, fueled by robust demand in food processing, industrial salt applications, and water treatment. Stringent FDA regulations and food safety requirements continue to support the adoption of high-purity food-grade sodium ferrocyanide as an anticaking agent.

Large-scale salt producers in states like Texas and California integrate E535 into iodized salt blends and industrial-grade formulations for deicing and agriculture. The USA also leads in R&D investments targeting enhanced compound purity and traceability. Industrial-grade applications in pigments and metal treatment add further momentum to growth.

The revenue from sodium ferrocyanide in the UK is anticipated to grow at a CAGR of 5.0% from 2025 to 2035, supported by increasing demand for food-grade anticaking agents in salt packaging and niche usage in industrial water treatment. Although the UK maintains regulatory alignment with former EU food additive standards (E535), domestic adoption is tempered by rising clean-label trends and ingredient scrutiny.

Still, major salt processors in Manchester and Liverpool continue using sodium ferrocyanide to meet flowability standards for consumer table salt and commercial foodservice applications. Demand from industrial pigment production and dyeing also persists, albeit in small volumes.

The sales of sodium ferrocyanide in Germany are expected to rise at a CAGR of 4.9% between 2025 and 2035, driven by consistent demand from premium salt refiners, pharmaceutical suppliers, and pigment manufacturers. Adoption is most pronounced in Bavaria and North Rhine-Westphalia, where industrial clusters rely on certified chemical inputs.

German food safety standards support limited yet consistent use of food-grade sodium ferrocyanide in refined salt blends. Meanwhile, high-purity grades are gaining traction in electronic-grade pigment applications and pharmaceutical excipients. Import volumes continue to rise, reflecting reliance on Asia-Pacific production facilities.

The demand for sodium ferrocyanide in Japan is set to grow at a CAGR of 4.8% through 2035, underpinned by mature demand in food processing, pigment manufacturing, and water purification. Japanese food producers prioritize precise anticaking performance in high-end table salt brands, contributing to over 60% of market revenue.

Pigment demand is also notable due to the importance of Prussian blue in automotive coatings and specialty printing inks. Environmental compliance remains strict, especially in wastewater treatment, where sodium ferrocyanide aids in removing heavy metals. Import reliance is balanced by local formulation expertise and high product safety benchmarks.

The sodium ferrocyanide market in France is poised to rise at a CAGR of 4.5% from 2025 to 2035, supported by usage in salt processing, premium salt formulations, and select industrial applications. French regulations permit the use of sodium ferrocyanide (E535) within tightly regulated thresholds, which supports its continued application in premium iodized salt blends and gourmet salt formats.

Industrial usage in leather processing and printing pigments is gradually being replaced by bio-based alternatives, although legacy applications persist. Major production and distribution nodes are concentrated in the Normandy and Rhône-Alpes regions.

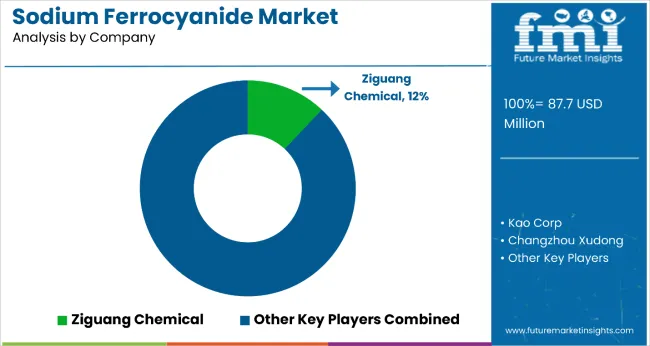

The market is moderately consolidated, with Ziguang Chemical leading at an estimated 12% market share. The company holds a dominant position through its integrated production capabilities, established customer relationships in the food and chemical industries, and comprehensive quality assurance systems ensuring regulatory compliance across major markets.

Key players include GACL, Ziguang Chemical, Chengxin Yongan, Sichuan Chemical, Sincere-Chem, Kun Lun, Evonik Industries AG, Changzhou Xudong, and Hebei Chengxin, each providing specialized sodium ferrocyanide solutions, including food-grade and industrial-grade products for anticaking, pigment production, and specialty chemical applications, supported by technical expertise and regulatory compliance capabilities.

Market demand is driven by food processing industry growth, expanding industrial chemical applications, and increasing regulatory requirements for approved food additives. Competition focuses on product quality consistency, regulatory compliance maintenance, and technical support for specialized applications across diverse end-user industries.

Key Developments in the Sodium Ferrocyanide Market

Manufacturers are advancing production technologies and quality control systems for improved purity, consistency, and regulatory compliance, expanding their applicability across food processing, specialty chemical, and industrial applications. Global players are investing in capacity expansion and quality certification systems for enhanced market access, while regional producers optimize operations for cost-effective supply to local markets.

Integration of environmental management systems, sustainability reporting, and customer technical support is becoming standard, driven by regulatory requirements and industry best practices. Partnerships with food processors and chemical manufacturers are accelerating the adoption of specialized sodium ferrocyanide grades in innovative applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 87.7 Million |

| Application | Blue pigments, Photography, Metal and Leather, Dyeing Industry, Blue Print Paper, Bio-Chemical, and Water Treatment |

| Type | Food Grade and Industrial Grade |

| Distribution Channel | Online Retail and Offline Retail |

| Regions Covered | North America, Latin America, Asia Pacific, Eastern Europe, Western Europe, and Japan |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Jinxi Meihua, GACL, Ziguang Chemical, Chengxin Yongan, Sichuan Chemical, Sincere-Chem, Kun Lun, Evonik Industries AG, Changzhou Xudong, and Hebei Chengxin |

| Additional Attributes | Dollar sales by application and grade categories, growing usage in food processing and specialty chemical applications, stable demand in industrial and water treatment sectors, innovations in production technologies, and quality enhancement improve purity, consistency, and regulatory compliance |

The global sodium ferrocyanide market is estimated to be valued at USD 87.7 million in 2025.

The market size for the sodium ferrocyanide market is projected to reach USD 154.1 million by 2035.

The sodium ferrocyanide market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in sodium ferrocyanide market are food grade and industrial.

In terms of application, blue pigments segment to command 44.8% share in the sodium ferrocyanide market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium 3-Nitrobenzenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA