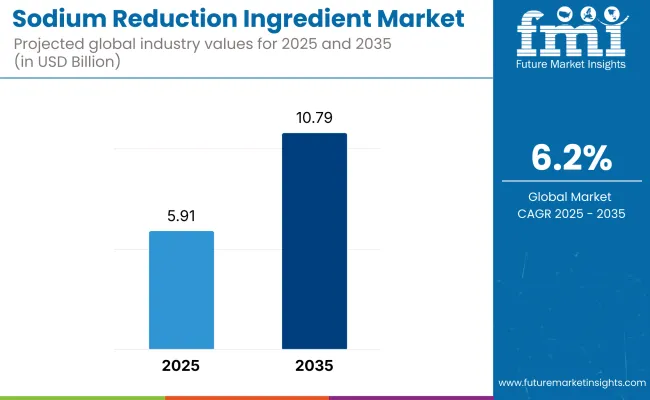

The demand for Sodium Reduction Ingredient market is expected to be valued at USD 5.91 Billion in 2025, forecasted at a CAGR of 6.2% to have an estimated value of USD 10.79 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 5.9% was registered for the market.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 5.91 Billion |

| Projected Global Industry Value (2035F) | USD 10.79 Billion |

| Value-based CAGR (2025 to 2035) | 6.2% |

For investors the food processing industry and regulatory bodies the market expansion presents a significant opportunity to contribute to the development of more nutrient-dense food options. Market expansion is being propelled by consumer awareness of the detrimental effects of increased sodium consumption.

As health and wellness become more important low-sodium food items are becoming more and more popular. Consumer preferences are shifting in favor of healthier options as a result of this trend which is driving market growth. Governments and regulatory agencies strict laws governing the amount of sodium in food items are another important factor propelling the markets expansion.

Strict laws governing the amount of sodium in baked goods have been imposed on the bakery sector. As a result, ingredients that reduce sodium have been adopted. As a result, the market for bakery applications has grown rapidly and is probably going to continue to do so in the years ahead. Finally growing rates of chronic illnesses have also caused the market to expand rapidly.

As a result, trends in the health and wellness industry have raised consumer awareness of the dangers of consuming large amounts of sodium. Customers now prefer low-sodium food items as a result of all of this. Owing to these factors food processing companies are also using SRI to create safer and healthier food products.

Nonetheless a few limitations are impeding the markets expansion. Due to the need for bog processing the final SRI product has a high cost. The products total cost is impacted. Growth in the market is also impacted by the lack of dedication to food flavor. Therefore, taxes and costs are the primary factors that impede market expansion.

| Segment | Value Share (2025) |

|---|---|

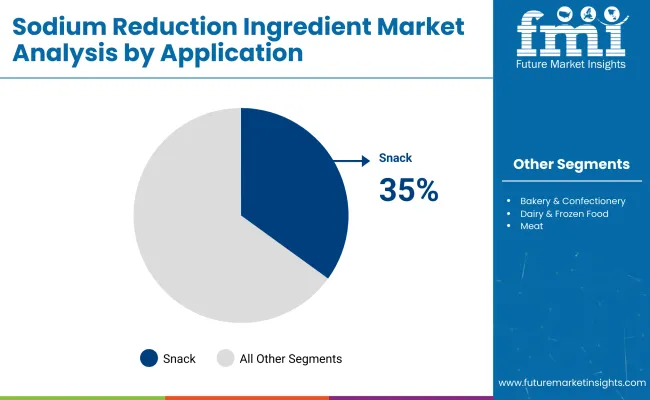

| Snacks (Application) | 35% |

As consumers look for healthier snack options products like chips crackers and nuts are using sodium-reducing ingredients which is driving growth in the snacks market.

| Segment | Value Share (2025) |

|---|---|

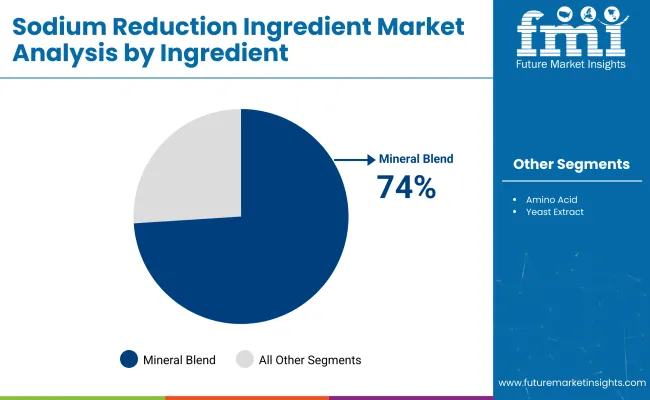

| Mineral Blends (Ingredients) | 74% |

Mineral blends can reduce the amount of sodium added to food products while improving their flavor and taste. Hence as consumers become more conscious of the negative health effects of consuming large amounts of sodium demand is rising.

Due to consumer demand for low-sodium foods manufacturers are turning to mineral blends to reduce sodium levels without sacrificing flavor or quality. This blend has a remarkable projected market share of 74% for 2025 indicating its growing popularity in the market.

Awareness in High Sodium Intake is Driving the Market Growth

The market for sodium reduction ingredients is anticipated to grow at a faster rate overall due to rising consumer preferences for healthier foods brought on by increased awareness of the negative effects of consuming too much salt on the body.

The negative effects of consuming too much sodium on the body have also been brought to light by government initiatives and multi-sector initiatives by various organizations. If salt consumption worldwide is brought down to the recommended level the WHO estimates that 3 million deaths could be avoided annually. As a result, rising public awareness is expected to support the markets overall growth in demand for sodium-reducing ingredients.

During the period 2020 to 2024, the sales grew at a CAGR of 5.9%, and it is predicted to continue to grow at a CAGR of 6.2% during the forecast period of 2025 to 2035.

Ingredients that essentially consist of salt and are made up of potassium and chloride are referred to as sodium reduction ingredients. The process of lowering the salt content of food items is known as sodium reduction. By either replacing the salt in the food or lowering the excess salt in the food products these ingredients are used to lower the salt content of the food items.

One of the key factors propelling the market expansion for sodium reduction ingredients is the global increase in health consciousness. The market is growing faster due to rising consumer awareness of the negative health effects of consuming too much sodium a rise in the demand for processed foods and better efforts by food producers.

The markets expansion is also influenced by the increased use of ingredients in bakery goods dairy products frozen foods and confections as well as better government initiatives. Additionally, the market for sodium reduction ingredients is positively impacted by the rise in heart disease prevalence the broad adoption of the product as a crucial component of many foods and beverages and the increase in disposable income.

Tier 1 companies comprises industry leaders acquiring a80% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 10%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 10%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

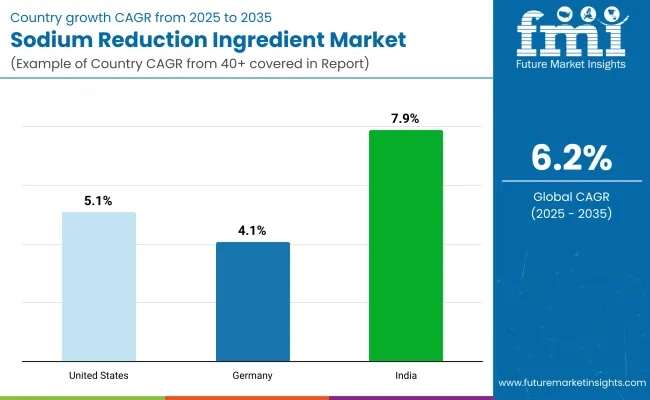

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 5.1% |

| Germany | 4.1% |

| India | 7.9% |

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and India come under the exhibit of high consumption, recording CAGRs of 5.1%, 4.1% and 7.9%, respectively, through 2035.

The sodium reduction ingredient market in the USA is expected to grow at a compound annual growth rate (CAGR) of 5.1% through 2035. This is because there are numerous fast food and other food processing businesses. Additionally, government campaigns are launched to educate consumers about the advantages of sodium-lowering ingredients.

The food and beverage industry in the nation is well-established. This has made it easier to innovate and create ingredients that effectively reduce sodium levels. Furthermore, the need for natural sodium reduction solutions has declined due to growing consumer preference for natural ingredients and clean labels. All of these elements have forced the US market to grow in the market for sodium reduction ingredients.

As a result of their love of spicy foods like pickles Indians are notorious for consuming large amounts of salt. The Indian bakery industrys growth trajectory has been influenced by the countrys expanding population growing foreign influence and shifting eating habits. India is a major participant in the SRI market and is expected to grow at 7.9% CAGR through 2035.

Low-sodium cuisine has recently gained popularity in Germany. Their changing lifestyles have caused consumers to adopt healthier habits and place a greater emphasis on using products that preserve their health. In an effort to lower the risk of hypertension the German Federal Institute for Risk Assessment has announced a reduction in the amount of salt found in processed foods.

The German market for sodium reduction ingredients is expected to grow moderately through 2035 with a compound annual growth rate (CAGR) of 4.1%. International retail giants like Nestle and Unilever frequently use mineral salts especially potassium chloride as a salt-reducing agent. Big businesses are begging authorities to let it be sold as potassium salt in the EU.

The use of sodium-reduction ingredients is also anticipated to have a major positive impact on the frozen foods and bakery products market. In order to meet the increasing demand for healthier food options manufacturers and retailers are now concentrating on research and development to produce new goods. The use of ingredients that lower sodium offers producers a fantastic chance to increase revenue while giving customers healthier options.

By application, methods industry has been categorized into Bakery & Confectionery, Dairy & Frozen Foods, Snacks, Meat, Seafood & Poultry, Soups and Dressings & Salads

By ingredients, industry has been categorized into Amino Acids, Mineral Blends and Yeast Extract

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is expected to grow at a CAGR of 6.2% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 10.79 Billion.

Awareness in sodium intake is increasing demand for Powder Induction and Dispersion Systems.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Angel Yeast Co. Ltd, Royal DSM N.V., Cargill Incorporated and more.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Salt Content Reduction Ingredients Market Size & Trends 2035

Sodium 3-Nitrobenzenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA