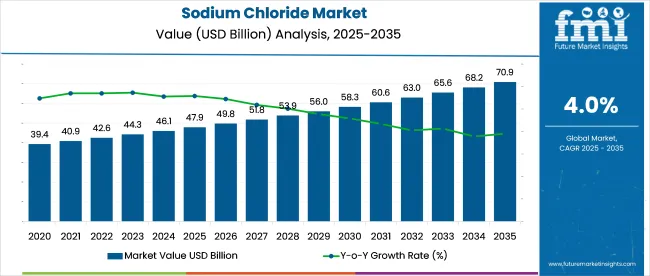

The global sodium chloride market is forecasted to reach USD 70.9 billion by 2035, recording an absolute increase of USD 23.0 billion over the forecast period. The market is valued at USD 47.9 billion in 2025 and is set to rise at a CAGR of 4.0% during the assessment period. The overall market size is expected to grow by nearly 1.5 times during the same period, supported by increasing demand for chlor-alkali chemicals and water treatment solutions worldwide, driving demand for efficient industrial salt supplies and increasing investments in chemical manufacturing, municipal infrastructure, and food processing globally. Environmental concerns regarding salt production and competition from synthetic alternatives in specific applications may pose challenges to market expansion.

Between 2025 and 2030, the market is projected to expand from USD 47.9 billion to USD 58.7 billion, resulting in a value increase of USD 10.8 billion, which represents 47.0% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for chlorine and caustic soda production, product innovation in high-purity pharmaceutical grades and specialty formulations, as well as expanding integration with water treatment infrastructure and food safety programs. Companies are establishing competitive positions through investment in solar evaporation facilities, solution mining technologies, and strategic market expansion across chemical manufacturing, deicing, and food-grade applications.

From 2030 to 2035, the market is forecast to grow from USD 58.7 billion to USD 70.9 billion, adding another USD 12.2 billion, which constitutes 53.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized sodium chloride systems, including advanced vacuum-refined grades and integrated brine solutions tailored for specific industry requirements, strategic collaborations between salt producers and end-user industries, and an enhanced focus on ecofriendly production methods and environmental compliance. The growing focus on water infrastructure development and pharmaceutical manufacturing quality will drive demand for high-purity sodium chloride solutions across diverse industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 47.9 billion |

| Market Forecast Value (2035) | USD 70.9 billion |

| Forecast CAGR (2025-2035) | 4.0% |

The sodium chloride market grows by enabling chemical manufacturers to produce essential industrial chemicals including chlorine, caustic soda, and soda ash that serve as building blocks for countless downstream products ranging from PVC plastics to pharmaceuticals. Chemical industries face continuous demand growth for chlor-alkali products, with sodium chloride serving as the primary feedstock for electrolytic chlorine production used in water treatment, polymers, and industrial chemicals manufacturing. The water treatment sector's expansion driven by urbanization and infrastructure development creates steady demand for sodium chloride in water softening systems, municipal water treatment facilities, and industrial process water conditioning.

Municipal infrastructure development accelerates sodium chloride adoption for road deicing and snow removal in northern climates, where highway safety programs require reliable winter maintenance material supplies ensuring transportation system functionality during winter weather events. Food processing industry growth drives demand for food-grade sodium chloride serving preservation, flavor enhancement, and processing functions across packaged foods, dairy products, and meat processing applications. Environmental concerns regarding salt runoff impacts on freshwater ecosystems and soil quality may drive regulatory restrictions on deicing applications, while technological alternatives including potassium chloride in water softening and alternative deicing agents create competitive pressure in specific market segments.

The market is segmented by end use, product form, source, and region. By end use, the market is divided into chemicals, food & beverages, water treatment, deicing, industrial, oil & gas, pharmaceuticals, and agriculture. Based on product form, the market is categorized into solid, liquid brine, and high-purity refined/vacuum salt. By source, the market is segmented into sea water & brine and solid mining. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

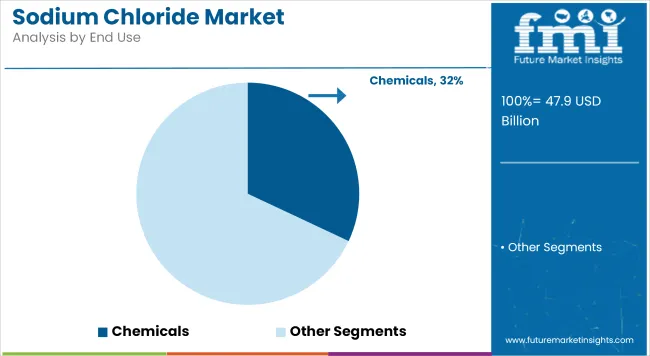

The chemicals segment represents the dominant force in the market, capturing approximately 32.0% of total market share in 2025. This critical end-use category encompasses sodium chloride consumption as feedstock for chlor-alkali production, soda ash manufacturing, and other chemical derivative processes that form the foundation of modern chemical industry value chains. The chemicals segment's market leadership stems from chlorine and caustic soda's indispensable roles across polymer manufacturing, water treatment chemicals, pharmaceutical intermediates, and industrial chemical production requiring large-scale, reliable salt supply.

Within the chemicals end-use segment, chlor-alkali production including chlorine and caustic soda manufacturing accounts for 21.0% of total market share, serving as the largest single sodium chloride application through electrolytic processes producing chlorine gas and sodium hydroxide for PVC, pulp and paper, and chemical synthesis. Soda ash production represents 7.0% share through Solvay process and other synthetic routes producing sodium carbonate for glass manufacturing, detergents, and chemical processing. Other chemical derivatives capture 4.0% share in specialty chemical production and industrial processes.

Food & beverages represent 19.0% market share through food preservation, flavor enhancement, and dairy processing. Water treatment accounts for 14.0% share in municipal and industrial water softening and purification. Deicing captures 13.0% share through road salt applications. Industrial non-chemical uses represent 9.0%, oil & gas holds 5.0%, pharmaceuticals account for 4.0%, and agriculture represents 4.0% of the market.

Key technological advantages driving the chemicals segment include:

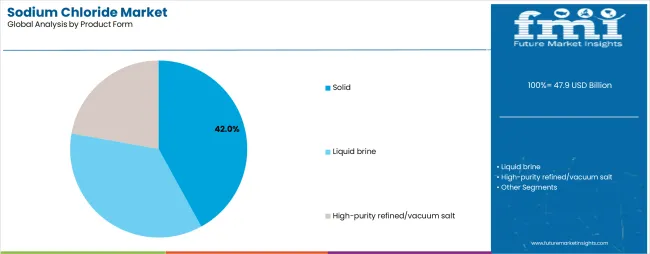

Solid sodium chloride dominates the product form segment with approximately 42.0% market share in 2025, reflecting diverse applications ranging from deicing and food processing to chemical feedstock requiring crystalline or granular salt forms. The solid segment's market leadership is supported by versatile application compatibility, established production infrastructure, and cost-effectiveness for bulk industrial and municipal uses requiring dry salt handling and storage systems.

Within the solid product form segment, rock salt mined directly from underground deposits accounts for 18.0% of total market share, serving deicing, industrial, and chemical applications where lower purity grades meet functional requirements at competitive costs. Solar-evaporated salt produced through seawater or brine evaporation in coastal facilities represents 16.0% share through natural evaporation processes yielding high-purity crystals suitable for food and chemical uses. Pellets and tablets including water softener salt capture 8.0% share in consumer and commercial water treatment applications requiring dissolution-optimized forms.

Liquid brine accounts for 39.0% market share through direct use in chemical manufacturing, pipeline delivery to chlor-alkali plants, and deicing applications utilizing pre-wetted or liquid application methods. High-purity refined and vacuum salt represents 19.0% of the market through specialty pharmaceutical, food-grade, and analytical applications requiring ultra-pure sodium chloride meeting stringent quality specifications.

Key factors driving solid form dominance include:

The market is driven by three concrete demand factors tied to industrial chemical production and infrastructure development. First, chlor-alkali industry expansion supporting PVC production, water treatment chemicals, and industrial chlorine applications creates fundamental demand for sodium chloride feedstock, with global chlorine production capacity projected to grow 3-4% annually driven by construction materials, water infrastructure, and pharmaceutical intermediates requiring reliable salt supply at multi-million-ton scale for integrated chemical complexes. Second, urban infrastructure development and water quality improvement programs drive municipal water treatment sodium chloride consumption, with water softening systems requiring continuous salt supply for ion exchange regeneration in municipal facilities, commercial buildings, and industrial process water systems addressing hardness issues and improving water quality for equipment protection and consumer applications. Third, winter road safety programs and expanding highway networks in northern climates sustain deicing market growth, with state departments of transportation and municipal public works departments stockpiling millions of tons annually for snow and ice control operations ensuring transportation system reliability and public safety during winter weather events.

Market restraints include environmental concerns regarding sodium chloride impacts on freshwater ecosystems, soil chemistry, and vegetation health creating regulatory pressure to reduce deicing salt application rates, implement best management practices, and evaluate alternative materials including calcium chloride, magnesium chloride, and organic deicers that may substitute for traditional rock salt in environmentally sensitive areas. Production energy intensity and greenhouse gas emissions associated with vacuum refining and transportation create sustainability challenges, particularly for high-purity pharmaceutical and food-grade products requiring energy-intensive processing and long-distance logistics from production facilities to end-use markets. Competition from substitute materials including potassium chloride in water softening applications and alternative chemical feedstocks for specific industrial processes creates pressure in selected market segments where technical performance and economic considerations favor alternative materials.

Key trends indicate growing adoption of liquid brine and pre-wetted salt applications for deicing operations improving efficiency and environmental performance through reduced material usage, enhanced ice-melting effectiveness, and minimized scatter losses compared to traditional dry salt spreading, with many highway agencies transitioning winter maintenance strategies. Innovation in high-purity pharmaceutical-grade production supports growing demand for intravenous solutions, dialysis, and biotechnology applications requiring ultra-pure sodium chloride meeting USP, EP, and other stringent pharmacopeia specifications validated through advanced refining and quality control processes. Increasing integration of desalination by-product salt recovery provides alternative supply sources in water-scarce regions where seawater desalination facilities generate concentrated brine streams that can be processed into commercial salt products supporting circular economy principles.

| Country | CAGR (2025-2035) |

|---|---|

| India | 5.2% |

| China | 4.8% |

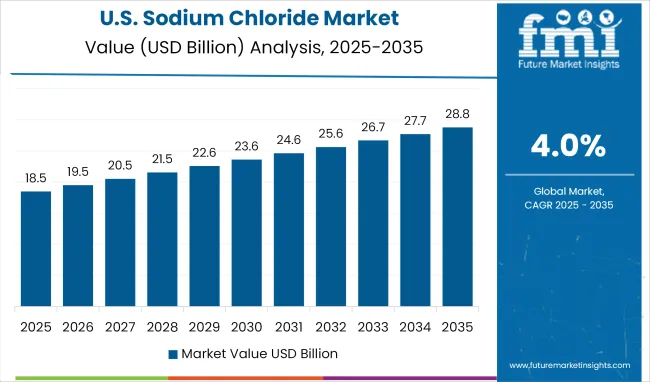

| USA | 4.0% |

| Brazil | 4.3% |

| Canada | 4.2% |

| Mexico | 4.1% |

| Germany | 3.6% |

The global market is anticipated to expand moderately between 2025 and 2035, supported by rising demand from chemical manufacturing, food processing, and de-icing applications. India leads with a CAGR of 5.2%, driven by expanding chlor-alkali production and industrial salt utilization. China follows at 4.8%, supported by consistent demand from chemical processing and water treatment industries. Brazil records a 4.3% CAGR, reflecting increasing industrial use and food-grade salt consumption. The United States grows at 4.0%, driven by steady demand for de-icing and chemical applications. Canada and Mexico show similar growth at 4.2% and 4.1%, respectively, supported by industrial and food processing sectors. Germany registers a 3.6% CAGR, reflecting a mature European market with stable demand for industrial and de-icing salt, coupled with efficiency improvements in production and distribution across regional supply chains.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

India demonstrates the strongest growth potential in the market with a CAGR of 5.2% through 2035. The country's leadership position stems from packaged food industry expansion requiring food-grade salt, pharmaceutical-grade vacuum salt capacity development supporting IV solutions and dialysis applications, and extensive coastal solar evaporation infrastructure in Gujarat, Tamil Nadu, and Rajasthan. Growth is concentrated in major producing and consuming regions, including Gujarat's coastal districts for solar salt production, Maharashtra for chemical and pharmaceutical applications, and Tamil Nadu for food processing and industrial uses. Distribution channels through established chemical trading networks and direct supply relationships with food processors and pharmaceutical manufacturers expand deployment across diverse applications. The country's Make in India initiatives and pharmaceutical export growth provide policy support for high-purity salt production and quality standards enhancement.

Key market factors:

In major industrial provinces including Shandong, Jiangsu, Zhejiang, and coastal regions, sodium chloride consumption is accelerating across chlor-alkali production facilities, industrial water treatment systems, and refined salt processing operations, driven by chemical industry expansion and urbanization. The market demonstrates strong growth momentum with a CAGR of 4.8% through 2035, linked to PVC production capacity additions and comprehensive chemical complex development serving construction materials and industrial chemicals. Chinese manufacturers are implementing modern solar evaporation facilities and vacuum refining capacity producing pharmaceutical and food-grade products meeting international quality standards. The country's integrated chemical industry structure and coastal salt production advantages create steady demand for both brine feedstock and solid salt products.

Key market characteristics:

The United States market demonstrates mature sodium chloride consumption patterns across water softening, deicing, and chemical manufacturing applications, with documented usage in residential and commercial water treatment systems, comprehensive highway winter maintenance programs, and Gulf Coast chlor-alkali facilities. The country shows steady growth potential with a CAGR of 4.0% through 2035, driven by ongoing infrastructure development, population growth in water-scarce regions requiring softening, and consistent winter maintenance requirements across northern states. American consumers and industries utilize sodium chloride across diverse applications including consumer water softening tablets, bulk road salt stockpiles, and pipeline brine delivery to integrated chemical complexes. Established supply chains including Great Lakes mining operations and Gulf Coast solar facilities support reliable material availability.

Key development areas:

Brazil's market expansion is driven by PVC value chain development supporting construction and packaging industries, processed food sector growth consuming food-grade salt, and municipal water infrastructure expansion requiring water treatment chemicals. The country demonstrates solid growth potential with a CAGR of 4.3% through 2035, supported by domestic chemical industry investment and urbanization trends. Brazilian manufacturers are developing integrated chlor-alkali capacity and solar evaporation facilities in coastal regions producing material for chemical and food applications. Growing focus on domestic chemical production and processed food manufacturing creates compelling business cases for sodium chloride production capacity expansion and quality improvement initiatives.

Market characteristics:

Canada's market demonstrates strong sodium chloride consumption driven by entrenched deicing programs across provinces, petrochemical industry requirements in Alberta and Ontario, and water treatment applications supporting municipal infrastructure. The country shows steady growth potential with a CAGR of 4.2% through 2035, driven by reliable winter maintenance programs, potash industry by-product salt availability, and chemical manufacturing requirements. Canadian municipalities and provincial transportation departments maintain comprehensive rock salt stockpiles supporting winter road maintenance operations ensuring highway safety and transportation system functionality during extended winter seasons. Established mining operations and import infrastructure from United States suppliers support reliable material availability for seasonal demand patterns.

Key market characteristics:

Mexico's market demonstrates growth through integrated chlor-alkali facilities serving PVC and chemical industries, water treatment infrastructure expansion supporting urban development, and food processing sector requirements. The country shows solid growth potential with a CAGR of 4.1% through 2035, driven by nearshoring manufacturing trends, chemical industry investment, and urban infrastructure development. Mexican manufacturers are operating integrated salt-chlorine-PVC complexes and expanding water treatment capacity supporting municipal and industrial applications. Coastal solar evaporation facilities and solution mining operations provide material for chemical and food applications serving domestic and export markets.

Market development factors:

Germany's advanced chemical industry demonstrates mature sodium chloride consumption patterns focused on chlor-alkali production, industrial water softening, and pre-wetted winter service applications, with documented integration across established chemical complexes and municipal infrastructure systems. The country maintains moderate growth momentum with a CAGR of 3.6% through 2035, driven by ongoing chemical production supporting automotive, construction, and pharmaceutical industries. German operations prioritize efficiency, environmental compliance, and quality standards, creating steady demand for reliable sodium chloride supply from domestic mining operations and European producers. The market benefits from established infrastructure including solution mining facilities and brine pipeline networks supporting integrated chemical production.

Market development factors:

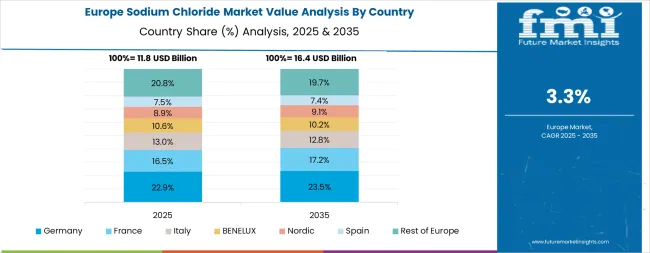

The sodium chloride market in Europe accounts for an estimated 28.0% of global spending in 2025, with regional concentration in chemical manufacturing, water treatment, and deicing applications. Within Europe, Germany leads with approximately 19% of regional market share, supported by chlor-alkali integration, industrial water softening applications, and pre-wetted winter service programs in major industrial centers focusing efficiency and environmental compliance.

The United Kingdom follows with approximately 15% share driven by municipal deicing operations, food processing applications, and water utility requirements across England, Scotland, and Wales. France holds approximately 14% share supported by refined food and pharmaceutical-grade production alongside PVC value chain integration. Italy commands approximately 11% market share driven by packaged food applications, tanning and leather industry clusters, and coastal solar salt production in southern regions.

Spain accounts for approximately 9% share supported by food processing applications and chemical manufacturing hubs in coastal industrial areas. Netherlands captures approximately 8% share through Rotterdam chlor-alkali and PVC complexes alongside water treatment applications. Poland represents approximately 7% share driven by packaging, chemicals, and winter maintenance requirements. The Nordic region collectively holds approximately 7% share focusing high-specification road salt and strict environmental controls on deicing operations. Rest of Eastern Europe accounts for approximately 10% of regional market share through integrated chemical parks, district heating brine applications, and public-sector procurement programs.

The European market benefits from established regulatory frameworks governing food-grade salt specifications, pharmaceutical quality standards, and environmental best practices for deicing operations, supporting quality-focused production and application methods. Integration of chlor-alkali production facilities with salt supply infrastructure creates stable long-term demand patterns, while seasonal deicing requirements and water treatment applications provide diversified end-use consumption across the region.

The Japanese market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of pharmaceutical-grade vacuum salt and food-grade refined products with existing chemical manufacturing and consumer applications. Japan's focus on quality excellence and strict specifications drives demand for ultra-pure sodium chloride supporting pharmaceutical manufacturing, food processing, and specialty chemical applications meeting stringent purity and consistency requirements. The market benefits from established supply chains connecting domestic producers and international suppliers with pharmaceutical manufacturers and food processors, creating comprehensive quality assurance systems prioritizing material purity and documentation. Manufacturing facilities showcase advanced quality control implementations where sodium chloride products achieve exceptional consistency through integrated testing and validation supporting pharmaceutical and food industry requirements.

The South Korean market is characterized by focus on chlor-alkali production supporting PVC manufacturing, food processing applications, and water treatment requirements in urban centers. The market demonstrates stable demand patterns as Korean chemical manufacturers and food processors source reliable sodium chloride supply from domestic coastal solar facilities and import sources. Local salt producers and international suppliers maintain market presence through quality assurance programs and technical service supporting chemical and food industry applications deployed across integrated industrial complexes and food processing facilities. The competitive landscape shows established supply relationships between salt producers and major end-users, creating stable commercial frameworks balancing domestic production with strategic imports meeting volume and quality requirements across chemical, food, and water treatment applications.

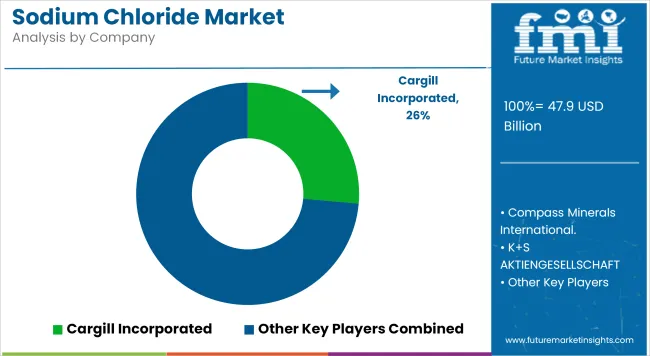

The market features approximately 20-25 meaningful players with moderate concentration, where the top three companies control roughly 25-30% of global market share through established production assets and extensive logistics networks. Competition centers on production scale, logistics efficiency, and quality consistency rather than product differentiation alone. The leading company, Cargill Incorporated, commands approximately 9.0% of global market share through diversified salt operations including solar evaporation facilities, mining assets, and vacuum refining capacity serving food, chemical, and deicing applications across multiple continents.

Market leaders include Cargill Incorporated, Compass Minerals International, and K+S Aktiengesellschaft, which maintain competitive advantages through vertically integrated production operations, established logistics infrastructure including rail terminals and bulk handling facilities, and comprehensive product portfolios spanning industrial, food-grade, and pharmaceutical-quality specifications, creating switching barriers through supply reliability and consistent quality. These companies leverage production scale and strategic asset locations to defend market positions while expanding into specialty applications and geographic markets.

Challengers encompass Tata Chemicals Ltd. with strong positions in Indian and global markets, INEOS (INOVYN) ChlorVinyls with integrated chlor-alkali operations, and Dampier Salt Ltd. (Rio Tinto) with large-scale Australian solar salt production. Regional specialists including Salins Group focusing on European solar salt, Südwestdeutsche Salzwerke AG with German rock salt operations, Nouryon serving chemical industry applications, and Dominion Salt Ltd. with New Zealand production focus on specific geographic markets or quality grades, offering differentiated capabilities in local supply, specialty refining, and application-specific formulations.

Regional players and emerging producers create competitive pressure through capacity expansion and cost-advantaged production, particularly in high-growth markets including India, China, and Middle East where coastal solar evaporation facilities and solution mining operations provide logistics advantages and cost competitiveness. Market dynamics favor companies that combine reliable production operations with comprehensive logistics infrastructure addressing complete supply chain requirements from mining or evaporation through bulk handling, packaging, and delivered supply meeting customer volume, quality, and timing requirements across diverse applications.

Sodium chloride represents an essential industrial commodity and consumer product that enables chemical manufacturers to produce chlorine and caustic soda through electrolysis, supports municipal infrastructure through water treatment and winter road maintenance, and serves fundamental roles in food preservation and processing, delivering reliable, cost-effective supply of a naturally abundant mineral resource with applications spanning chemical feedstock (32% end-use share), food processing (19% share), and water treatment (14% share) across diverse industrial and consumer markets. With the market projected to grow from USD 47.9 billion in 2025 to USD 70.9 billion by 2035 at a 4.0% CAGR, these mineral systems offer compelling advantages - abundant availability, established infrastructure, and versatile functionality - making them indispensable across chemical manufacturing, infrastructure maintenance, and food processing sectors requiring reliable salt supply for essential applications.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How Producers and Mining Companies Could Strengthen the Ecosystem?

How End-User Industries Could Navigate the Shift?

How Infrastructure Managers Could Capture Value?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 47.9 billion |

| End Use | Chemicals (Chlor-alkali, Soda ash, Other chemical derivatives), Food & Beverages, Water Treatment, Deicing, Industrial (non-chemical), Oil & Gas, Pharmaceuticals, Agriculture |

| Product Form | Solid (Rock salt, Solar-evaporated, Pellets/tablets), Liquid brine, High-purity refined/vacuum salt |

| Source | Sea water & brine (Solar evaporation, Solution-mined brine), Solid (rock/halite mining), Other (desalination by-product) |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | India, China, the USA, Brazil, Canada, Mexico, Germany, and 40+ countries |

| Key Companies Profiled | Cargill, Compass Minerals International, K+S Aktiengesellschaft, Tata Chemicals, INEOS, Dampier Salt, Salins Group, Südwestdeutsche Salzwerke, Nouryon, Dominion Salt |

| Additional Attributes | Dollar sales by end use, product form, and source categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with salt producers and logistics integrators, production facility requirements and specifications, integration with chemical manufacturing and infrastructure applications, innovations in refining technology and green production systems, and development of specialized grades with enhanced purity and environmental compliance capabilities. |

The global sodium chloride market is estimated to be valued at USD 47.9 billion in 2025.

The market size for the sodium chloride market is projected to reach USD 70.9 billion by 2035.

The sodium chloride market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in sodium chloride market are chemicals, food & beverages, water treatment, deicing, industrial (non-chemical), oil & gas, pharmaceuticals and agriculture.

In terms of product form, solid segment to command 42.0% share in the sodium chloride market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Sodium Chloride in EU Size and Share Forecast Outlook 2025 to 2035

Industrial Sodium Chloride Market Size & Trends 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA