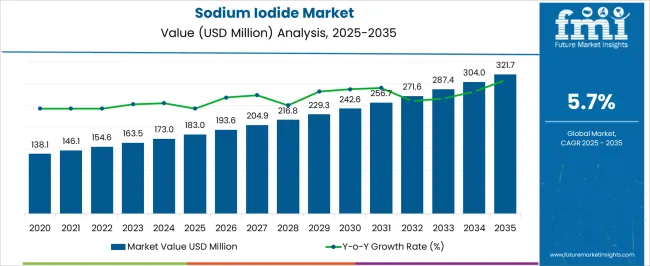

The Sodium Iodide Market is estimated to be valued at USD 183.0 million in 2025 and is projected to reach USD 321.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Sodium Iodide Market Estimated Value in (2025 E) | USD 183.0 million |

| Sodium Iodide Market Forecast Value in (2035 F) | USD 321.7 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The sodium iodide market is experiencing stable expansion, supported by its critical role in multiple industrial and healthcare-related applications. Demand growth is being propelled by its wide use in pharmaceuticals, animal feed, and agrochemicals, alongside specialized applications in chemical synthesis and diagnostic imaging.

The current market landscape reflects increasing reliance on iodine derivatives due to their functional versatility and efficiency in catalytic processes. Supply dynamics are influenced by regional iodine production capabilities and the strategic need for stable raw material availability.

With stricter agricultural and pharmaceutical standards in place, sodium iodide’s importance as a high-purity additive has been reinforced. Looking ahead, further expansion is expected as developing markets increase iodine fortification measures and industrial demand for halogen compounds continues to rise.

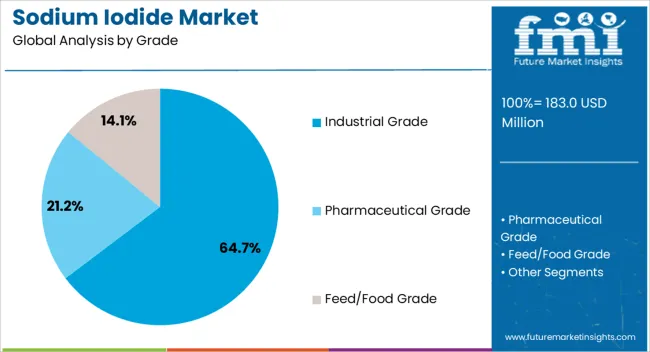

The industrial grade segment dominates the grade category with approximately 64.7% share, supported by its extensive use in chemical manufacturing, pharmaceuticals, and animal nutrition. The segment’s growth is reinforced by strong demand from agrochemical formulations and feed additives where iodine enrichment remains critical.

Industrial grade sodium iodide is also used in dye production, catalysts, and specialized chemical processes requiring stable halogen compounds. Cost-effectiveness and bulk availability make it the preferred grade for large-scale operations.

With sustained demand from both established and emerging economies, the industrial grade segment is expected to remain the cornerstone of overall market performance.

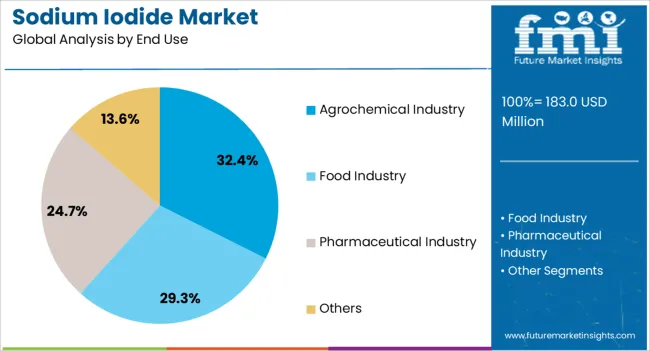

The agrochemical industry segment accounts for approximately 32.4% of the end-use category, reflecting its strong dependence on sodium iodide for crop protection formulations and soil enrichment. Its ability to serve as an iodine source has made it a valued input in pesticide and fertilizer production.

Rising global focus on food security and higher crop yields has reinforced demand within this segment. Regulatory emphasis on effective nutrient management in agriculture further supports market growth.

With expanding adoption of fortified agricultural inputs across developing economies, the agrochemical industry segment is anticipated to sustain its key role in market demand.

Promoting Public Health through the Usage of Iodized Salt

The continual increase in food industry applications has led to an increase in the usage of the iodized salt, which has poised to an immense growth of the market. Enriched with sodium iodide, the iodized salt proves to be an ultimate preventative factor in halting iodine deficiency disorders.

Food fortification programs, leveraged by both governmental and non-governmental organizations, serve as a cornerstone for promoting the consumption of iodized salt. The programs advocate for the inclusion of iodized salt in various food products, ranging from staple commodities to processed foods and condiments.

Surge in the Demand for Pharmaceutical and Healthcare Industry

The growth of the pharmaceutical and healthcare industries is not only a driving factor but it also raises the demand for sodium iodide across many different applications. The trend is favoring the expansion of the market.

The presence of sodium iodide in medical applications and healthcare beyond only pharmaceutical formulations is another wider application. It is found in procedures of nuclear medicine including thyroid cancer treatment as well as radioactive iodine imaging studies.

Incorporation of Iodine-laden Supplements in Veterinary Health driving Sodium Iodide Demand

Increasing awareness regarding the animal health, as well as growing demand in veterinary medicine are the major factors that are accelerating the demand for sodium iodide.

Veterinarians and livestock producers are increasingly incorporating iodine supplements into animal feed formulations, as awareness of the importance of iodine supplementation in animal diets grows.

The rising emphasis on animal health and welfare is fuelling the adoption of iodine supplementation in veterinary practice. In order to ensure optimal animal health, veterinarians are recommending iodine supplements to livestock owners and pet caregivers.

The scope for sodium iodide rose at a 4.4% CAGR between 2020 and 2025. The global market is achieving heights to grow at a moderate CAGR of 5.8% over the forecast period 2025 to 2035. The market witnessed a significant growth during the historical period, attributed to the increased demand from the healthcare sector for diagnostic imaging.

Government regulations on food fortification with iodine to prevent iodine deficiency disorders (IDD), is a major factor accelerating the market growth. Technological advancements are enhancing the appeal of sodium iodide to end users in various industries, including healthcare, food, and industrial sectors.

Rising healthcare expenditure and the adoption of iodine based medical procedures, further driving the market growth. Focus on sustainability will to shape market dynamics as consumers and regulatory bodies increasingly prioritize environmental responsibility.

Health and wellness trends will fuel the demand for iodine supplements, spurring growth in the sodium iodide market. Globalization and market expansion will result in broader geographic reach and market penetration.

Regulatory environment will shape market dynamics and influence product innovation and compliance efforts. Rising preference of the consumers for clean label products, free from artificial additives and preservatives is influencing product formulation and marketing strategies in the market. Manufacturers have been exploring natural sources of iodine and clean label alternatives to meet consumer demand for transparency and authenticity.

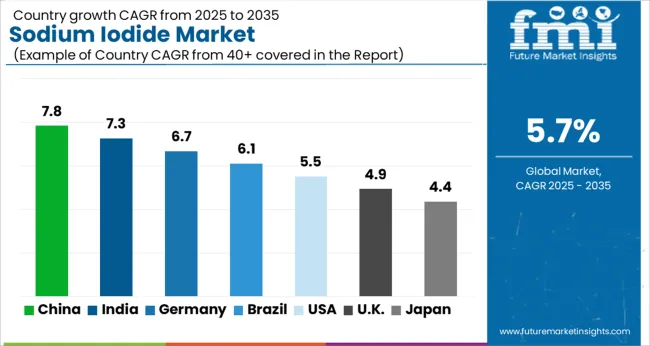

The following table shows the estimated growth rates of the top three markets. Japan and India are set to exhibit high demand in sodium iodide, recording CAGRs of 6.9% and 7.1%, respectively, through 2035.

The sodium iodide market in the United States will expand at a CAGR of 3.9% through 2035. Iodized salt is commonly used in the country to prevent iodine deficiency disorders such as hypothyroidism and goitre. Government initiatives promoting the use of iodized salt in food products and household consumption contribute to the demand for sodium iodide as a key ingredient in iodization processes.

The country has a well-established healthcare industry, where sodium iodide is widely used in diagnostic imaging procedures such as X-rays and nuclear medicine scans. The growing prevalence of chronic diseases, increasing healthcare expenditure, and technological advancements in medical imaging are driving the demand for sodium iodide in the country.

Educational campaigns and initiatives raise awareness about the importance of iodine nutrition and the risks associated with iodine deficiency disorders in the country. Increasing consumer awareness drives demand for iodine containing products, including sodium iodide, influencing consumer purchasing decisions.

The sodium iodide market in the United Kingdom to expand at a CAGR of 4.6% through 2035. Sodium iodide is utilized as a food additive and preservative in the food industry in the United Kingdom. It is added to processed foods, bakery products, and dairy items to ensure adequate iodine intake and food safety.

The growing demand for packaged foods and convenience products contributes to the consumption of sodium iodide in the food sector. Sodium iodide is used in pharmaceutical formulations in the United Kingdom, including tablets, capsules, and topical preparations.

It serves as a source of iodine in thyroid medications and contrast agents for imaging studies, driving demand for sodium iodide in the pharmaceutical sector. Sodium iodide is also used in veterinary medicine, particularly in livestock feed supplements.

The demand for sodium iodide as a nutritional supplement for animals will increase, as the livestock sector in the United Kingdom expands to meet the growing demand for meat and dairy products.

Sodium iodide trends in China are taking a turn for the better. A 7.9% CAGR is forecast for the country from 2025 to 2035. Ongoing research and development efforts focus on exploring new applications and formulations for sodium iodide in China.

Collaboration between industry players, academic institutions, and research organizations contributes to product development and market expansion.

Advances in manufacturing technologies and production processes enhance the efficiency, purity, and performance of sodium iodide products in China. Continuous innovation in formulation techniques and product development meets evolving customer needs and industry requirements, driving market growth.

| Segment | Industrial Grade (Grade) |

|---|---|

| Value Share (2025) | 64.7% |

In terms of grade, the industrial grade segment will dominate the market. Sodium iodide serves as a reagent and indicator in analytical chemistry, particularly in titration and spectrophotometric analysis.

The expanding scope of chemical analysis in research, quality control, and environmental monitoring applications is driving the demand for high purity sodium iodide for analytical purposes. It is used in the photographic industry for silver halide based film and paper processing.

There is sustained demand for sodium iodide in this segment, with the resurgence of film photography in niche markets and the continued use of traditional photographic techniques. Sodium iodide is a versatile reagent in organic synthesis, used in various reactions including Sandmeyer reactions, Finkelstein reactions, and Grignard reactions.

The increasing demand for pharmaceuticals, fine chemicals, and specialty materials is driving growth in organic synthesis applications, thus boosting demand for industrial grade sodium iodide.

| Segment | Agrochemical Industry (End Use) |

|---|---|

| Value Share (2025) | 32.4% |

In terms of end use, the agrochemical industry segment will dominate the sodium iodide market. Iodine supplementation in agricultural soils contributes to soil health by supporting microbial activity, nutrient cycling, and soil structure.

Sodium iodide based agrochemicals help maintain iodine levels in the soil, promoting overall soil fertility and productivity. Iodine plays a crucial role in plant metabolism and growth regulation, influencing processes such as photosynthesis, nutrient uptake, and stress tolerance.

Agrochemical formulations containing sodium iodide can enhance crop performance, leading to increased yields, improved quality, and enhanced resistance to environmental stressors. High value crops, such as fruits, vegetables, and specialty crops, often have specific nutrient requirements for optimal growth and quality.

Sodium iodide based agrochemicals cater to the unique nutritional needs of these crops, supporting their cultivation and meeting market demand for premium quality produce.

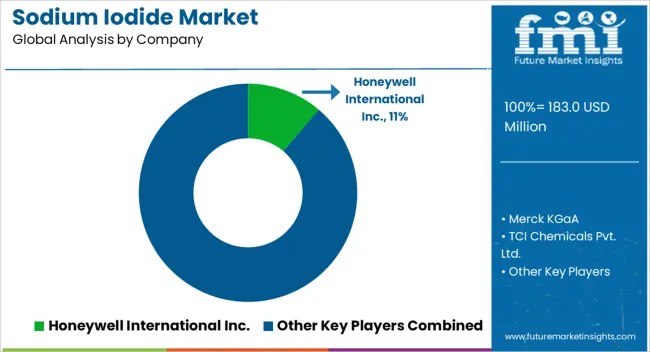

The sodium iodide market is characterized by a mix of global and regional players, each vying for market share through product differentiation, technological innovation, and strategic partnerships.

Global players leverage their extensive resources, research capabilities, and established distribution networks to maintain a competitive edge. The companies often focus on product differentiation and technological innovation to offer high quality products that meet evolving customer demands and regulatory standards.

Strategic partnerships and collaborations with research institutions, universities, and industry associations are commonplace among both global and regional players. Such partnerships enable companies to access cutting edge research, develop novel technologies, and expand their market reach through synergistic alliances.

Carl Roth offers a wide range of high quality chemicals, laboratory equipment, and supplies for research, development, and production. The company provides sodium iodide in various grades for laboratory and industrial applications. The offerings include sodium iodide in pure form, as well as in different concentrations and packaging sizes to meet the diverse needs of customers.

Cole-Parmer specializes in providing laboratory and industrial equipment, instruments, and supplies. The offerings of the company include sodium iodide among their chemical offerings.

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 173 million |

| Projected Market Valuation in 2035 | USD 304 million |

| Value-based CAGR 2025 to 2035 | 5.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Grade, End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Honeywell International, Inc.; Merck KGaA; TCI Chemicals Pvt. Ltd.; Thermo Fisher Scientific Inc.; Santa Cruz Biotechnology, Inc.; Carl Roth; Cole-Parmer; Iofina; American Elements; Haffner GmbH & Co. KG; Ajay-SQM Group; GFS Chemicals, Inc.; Glentham Life Sciences; International Isotopes Inc.; Molekula Group; Oakwood Chemical; CDH Fine Chemical; Sisco Research Laboratories Pvt. Ltd.; Matrix Fine Chemicals; Ise Chemicals Corporation |

The market is classified into industrial grade, pharmaceutical grade, and feed/food grade

The report consists of key end uses of sodium iodide based on food industry, pharmaceutical industry, agrochemical industry, and others.

The analysis of the sodium iodide market has been carried out in key countries North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, The Middle East and Africa

The global sodium iodide market is estimated to be valued at USD 183.0 million in 2025.

The market size for the sodium iodide market is projected to reach USD 321.7 million by 2035.

The sodium iodide market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in sodium iodide market are industrial grade, pharmaceutical grade and feed/food grade.

In terms of end use, agrochemical industry segment to command 32.4% share in the sodium iodide market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium 3-Nitrobenzenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauroyl Isethionate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA