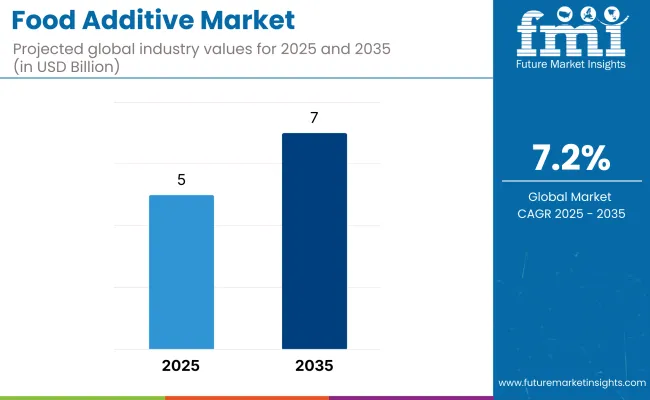

The global food additive market is estimated to be worth USD 5 billion by 2025 and is projected to reach a value of USD 7 billion by 2035, reflecting a CAGR of 7.2% over the assessment period 2025 to 2035.

This anticipated growth is underpinned by a dynamic shift in global food systems where manufacturers are increasingly leveraging multifunctional additives to address consumer expectations for texture enhancement, extended shelf life, and clean-label compliance.

Growing population, evolving dietary preferences, and increasing demand for processed foods continue to serve as central catalysts for the integration of additives across categories such as dairy, bakery, beverages, and confectionery.

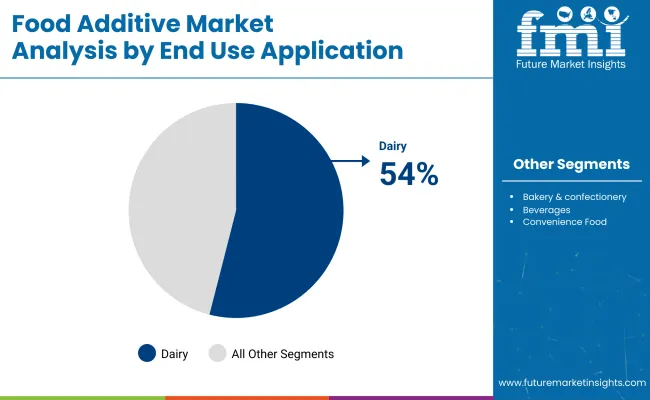

Within this context, the dairy industry is expected to remain the dominant end-use sector, accounting for the largest application share in 2025. This segmental leadership is primarily attributed to the intensifying need for emulsifiers, stabilizers, and hydrocolloids that enable desirable textures and stability in products like flavored milk, yogurt, and dairy-based desserts. Notably, hydrocolloids such as carrageenan, guar gum, and pectin are playing an increasingly critical role in clean-label product development without compromising on sensory appeal.

Food safety authorities and regulatory bodies have strengthened oversight and encouraged the use of naturally derived or bio-based additives, which has positively influenced R&D initiatives and innovation pipelines among leading companies.

Stakeholders are actively investing in advanced formulation techniques to reduce dependency on synthetic ingredients while improving functional efficacy, creating opportunities for innovation in enzymes, natural preservatives, and flavor enhancers.

Furthermore, emerging technologies such as microencapsulation and precision fermentation are being explored to enhance the stability, bioavailability, and controlled release of key additive components. These advancements are expected to redefine value propositions and unlock new commercialization channels in both developed and developing economies.

With sustained demand growth across ready-to-eat meals and functional foods, manufacturers are also realigning their strategies to integrate regional ingredient sourcing, vertical partnerships, and cleaner production methodologies.

As of 2025, the market remains moderately fragmented, with multinational corporations consolidating their footprint while niche players leverage formulation agility and region-specific regulatory approvals to capture white space.

The dairy industry application segment is projected to maintain a commanding 54% share of the global food additives market in 2025, advancing at a CAGR of around 6.9% through 2035. This sustained dominance is rooted in the rising functional and formulation demands across both traditional and modern dairy portfolios.

Dairy manufacturers have been increasingly dependent on food additives to meet consumer expectations for textural appeal, stability, and shelf life in value-added formats. In particular, emulsifiers, stabilizers, and hydrocolloids have been positioned as essential formulation tools amid the growing demand for protein-rich, indulgent, and clean-label dairy products.

The expansion of flavored and fortified dairy beverages has further elevated the need for additives that can maintain emulsion integrity, optimize mouthfeel, and withstand cold-chain inconsistencies across global distribution.

As plant-based and hybrid dairy alternatives gain relevance, the technical challenge of mimicking the structural behavior of traditional dairy matrices has reinforced the strategic significance of additives. Leading brands have been recalibrating R&D efforts toward natural or bio-derived alternatives, driven by evolving regulatory scrutiny and consumer aversion to artificial components.

Over the forecast period, dairy processors that embrace additive-enabled innovation-while navigating transparency and sustainability benchmarks-will be positioned to lead in both volume growth and premium product differentiation.

Bakery and confectionery applications are anticipated to grow at a CAGR of approximately 7.4% through 2035, accounting for a notable share of total additive demand by volume. The segment’s expansion reflects evolving formulation complexities aligned with clean-label expectations and the reengineering of legacy recipes to meet functional health trends.

Food additives have become increasingly indispensable in bakery manufacturing as producers respond to rising demand for shelf-stable, soft-textured, and allergen-friendly baked goods. The adoption of dough conditioners, stabilizers, and leavening agents has enabled consistent output despite variability in raw ingredient quality. Concurrently, emulsifiers are being used strategically to maintain moisture retention, reduce staling, and support reduced-fat formulations without sacrificing sensory quality.

In confectionery, where texture and appearance strongly influence consumer purchase, additives continue to serve as critical enablers of visual appeal, shape retention, and gloss control. Moreover, sugar reduction initiatives have accelerated interest in additive systems that can maintain viscosity, mouthfeel, and stability amid formulation shifts.

As bakers and confectioners prioritize health-forward innovation, the need for multifunctional, minimally processed additives is likely to intensify. Market participants capable of providing customizable additive solutions tailored to specific product matrices will gain competitive advantage as functional formulation becomes a key brand differentiator.

Demand for functional food additives is Driving the Market Growth

The growing consumption of foods with high nutritional value is expected to increase demand for functional food additives which in turn is expected to support the growth of the food additives market. Seaweed derivatives for example are used by food and beverage producers to lower sugar levels by replacing fat and stevia-based sweeteners.

Rich in vital nutrients and antioxidants functional food additives reduce the risk of chronic illnesses and stop cell damage among other health benefits. Consequently, the growing demand for processed foods is expected to drive up demand for food additives over the projection period. Consequently, the food additives industrys revenue is driven.

During the period 2020 to 2024, the sales grew at a CAGR of 6.8%, and it is predicted to continue to grow at a CAGR of 7.2% during the forecast period of 2025 to 2035.

One of the primary factors anticipated to propel the market for food additives is the growth of the processed food and convenience industries particularly in developing nations. In a similar vein rising consumer expenditure on packaged foods will probably boost demand for food additives through 2035.

In areas like the Middle East and East Asia there is a noticeable increase in demand for processed foods with longer shelf lives. This is because of rising per capita consumer income and fast urbanization. As a result, food additive sales are expected to rise quickly during the evaluation period because they are now necessary components of these food items.

Tier 1 companies comprises industry leaders acquiring a 30% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base.

They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 50%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 20%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope.

As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

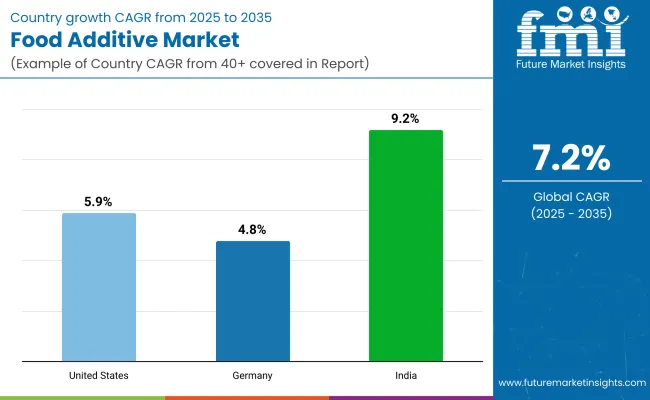

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and India come under the exhibit of high consumption, recording CAGRs of 5.9%, 4.8% and 9.2%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 5.9% |

| Germany | 4.8% |

| India | 9.2% |

The fast-paced lifestyle in the United States has led to a sharp increase in the demand for processed and convenient foods. Since food additives are frequently used in these products to improve their taste appearance and shelf life this is anticipated to boost sales of food additives.

The food processing sector is well-established in the USA. The introduction of modified products that satisfy the changing needs of consumers is the main focus of many prominent companies in this industry. Their demand is fueled by the various food additives they use for this purpose.

New ingredients and their possible uses are being actively researched by major manufacturers. For example, research is being done on the use of fibers and carbohydrates as food additives to improve texture bulking and sweetening. In the USA food additive market food fortification is becoming a major trend.

Foods with extra health benefits are becoming more and more popular in the country. Food manufacturers are using food additives as a result of this. Consumers growing health concerns are predicted to increase demand for healthy food additives such as low-calorie sweeteners. Similarly, the United States market share for food additives is expected to grow through 2035 as more attention is paid to extending the shelf life of packaged food items.

As lifestyles change and urbanization increases more Indian consumers are gravitating toward quick and simple food solutions. Foods with longer shelf lives better flavors and higher nutritional content appeal to consumers. As a result, the use of food additives will keep growing.

Manufacturers are being prompted by shifting consumer preferences to use a range of conventional or natural additive sources. Furthermore, more natural and functional additives are being used in food products as a result of rising consumer awareness of the value of health and wellness.

Indias food additive market is expected to grow even more as a result of the expanding food and beverage sector and rising disposable income. The use of additives is then encouraged by regulatory actions to guarantee food safety and quality standards.

In terms of food additives Germany is the biggest market in Europe holding about 20% of the regional market by 2025. The robust food processing industry and strong technological capabilities of the nation are responsible for its market leadership manufacturing of food ingredients. German manufacturers focus heavily on research and development particularly in natural and substances with clean labels.

The country’s market is characterized by high-quality standards innovative product development and a strong focus on environmentally friendly production techniques. The existence of significant research institutes and food processing companies enhances Germanys standing in the European market even more.

The market for food additives will continue to grow as a result of major players in the industry making significant investments in R&D to broaden their product lines. In order to increase their market share market players are also engaging in a number of strategic initiatives.

Key market developments include the introduction of new products contracts mergers and acquisitions increased investments and partnerships with other businesses. To grow and thrive in a more competitive and growing market environment the food additives industry needs to provide affordable products.

The market is expected to grow at a CAGR of 7.2% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 7 Billion.

Demand for functional Food Additive is increasing demand for Food Additive.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Chr. Hansen Holding A/S, Royal DSM N.V., BASF SE and more.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analysis and Growth Projections for Food and Beverage Additive Market

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

Algae-based food additive market analysis by product type, source, functionality, application and by region growth, trends and forecast from 2025 to 2035

Clean Labelled Food Additives Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA