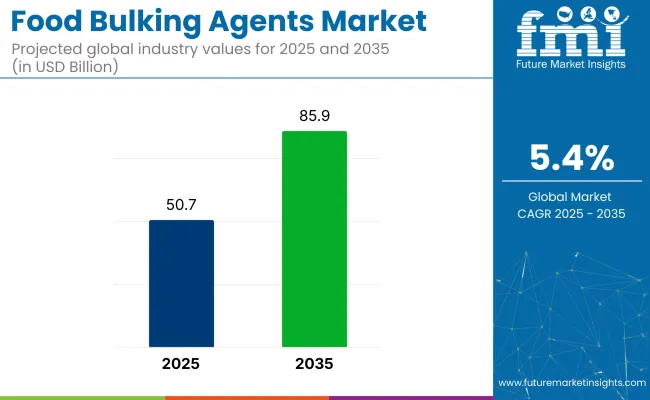

The global food bulking agents market is valued at USD 50.7 billion in 2025 and is poised to reach USD 85.9 billion by 2035, reflecting a CAGR of 5.4%.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 50.7 billion |

| Market Value (2035) | USD 85.9 billion |

| CAGR (2025 to 2035) | 5.4% |

This growth is being driven by increasing demand for low-calorie and reduced-sugar formulations, rising health consciousness, and the need for clean-label ingredients. Additionally, innovation in bulking agents for dairy alternatives and plant-based foods is expected to support market expansion, as consumers continue to prioritize healthier eating habits worldwide.

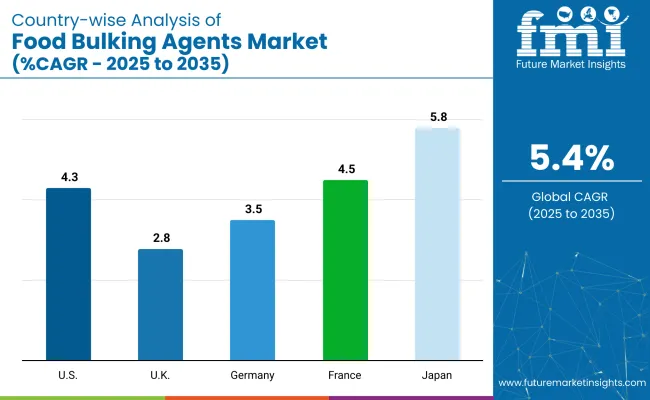

The USA is projected to remain the largest market for food bulking agents with an expected CAGR of 4.3%, driven by the high prevalence of dietary restrictions and clean label trends. Japan is expected to record strong growth with a CAGR of 5.8%, supported by its focus on dietary innovation and health-enhancing foods. Germany is projected to grow at a CAGR of 3.5%, driven by increasing demand for organic and functional food ingredients. Powders are anticipated to maintain a dominant form segment share of 48%, while antioxidants will hold the product type segment with a 28% share in 2025.

Government regulations are being increasingly enforced to ensure the safety, transparency, and quality of food bulking agents used across applications. Strict guidelines by regulatory bodies such as the FDA, EFSA, and FSSAI require bulking agents to be tested and validated for human consumption without adverse health impacts. Labeling standards are mandated to display clear ingredient information, promoting consumer awareness and clean label compliance.

The market holds varying shares within its parent markets. It accounts for approximately 8-10% of the overall food ingredients market, driven by its essential role in texture and volume enhancement. Within the functional food ingredients market, it represents nearly 12-14%, owing to its integration in health-focused and reduced-calorie formulations.

The market also contributes around 10-12% to the food additives segment, as bulking agents are classified under texturizing additives. In the dietary fibers market, food bulking agents hold a 6-8% share, particularly due to the rising use of fiber-based bulking solutions aligned with clean label trends.

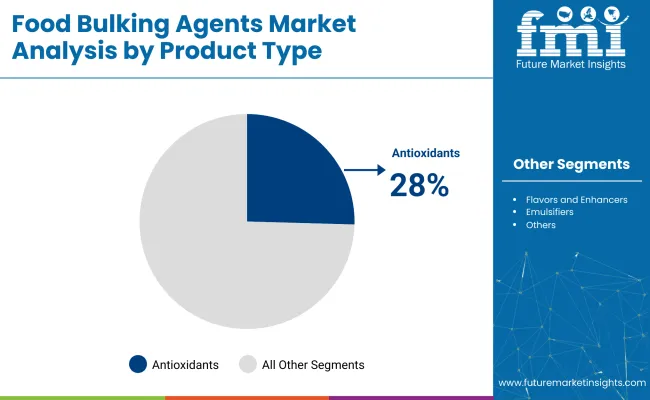

The market is segmented by product type into antioxidants, flavors and enhancers, anticaking agents, acids, emulsifiers, humectants, stabilizers, and others (including preservatives and color stabilizers); by application into bakery and confectionery, dairy and frozen products, beverages, meat and seafood products, snacks, nutraceuticals, animal feed, and others (including sauces, dressings, and ready-to-eat meals).

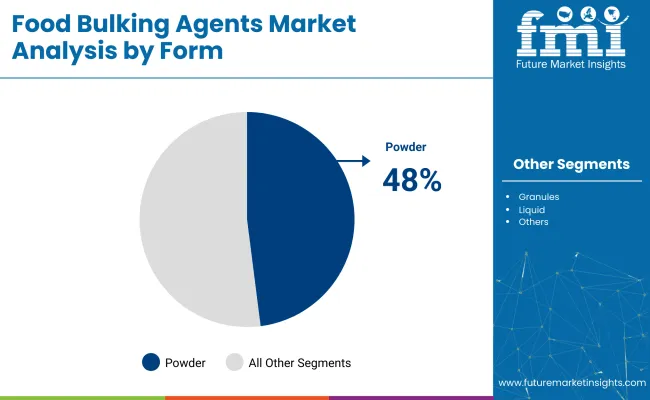

By form into powder, granules, liquid, and others (including pastes and gels); and by region into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

Antioxidants hold the most lucrative position in the product type segment with an expected 28% market share in 2025.

Bakery and confectionery hold the most lucrative position in the application segment, accounting for 28.4% market share in 2025.

Powder holds the most lucrative position in the form segment, accounting for 48% market share in 2025.

The global food bulking agents market is growing steadily, driven by rising demand for processed and convenience foods, increasing preference for natural and clean-label bulking agents, and advancements in food formulation and texturizing technologies.

Recent Trends in the Food Bulking Agents Market

Key Challenges in the Food Bulking Agents Market

Japan is projected to record the highest growth in the food bulking agents market with a CAGR of 5.8% from 2025 to 2035, driven by strong innovation and processed food consumption. France follows with a CAGR of 4.5%, supported by premium bakery and confectionery demand. The USA shows steady growth at 4.3%, fueled by natural and clean-label trends. Germany’s market is expected to grow moderately at 3.5%, driven by its robust food manufacturing sector. The UK records the slowest growth among these countries at 2.8%, constrained by its mature market and strict regulatory environment for food additives.

This report covers an in-depth analysis of 40+ countries; the five top-performing OECD Countries are highlighted below.

The USA food bulking agents revenues are projected to grow at a CAGR of 4.3% from 2025 to 2035.

Sales of food bulking agents in the UK are projected to grow at a CAGR of 2.8% from 2025 to 2035.

Germany’s food bulking agents revenue is projected to grow at a CAGR of 3.5% from 2025 to 2035.

France’s food bulking agents revenue is projected to grow at a CAGR of 4.5% from 2025 to 2035.

Sales of food bulking agents in Japan are projected to grow at a CAGR of 5.8% from 2025 to 2035.

The market remains moderately consolidated, with major players such as Ingredion Incorporated, Cargill, ADM, and DuPont Nutrition & Biosciences holding significant market shares due to their global distribution networks and diversified product portfolios. Smaller regional players like VW-Ingredients and BEHN MEYER focus on specialized offerings in local markets, contributing to partial fragmentation in niche segments.

Top companies compete through innovation in clean-label formulations, strategic acquisitions, regional expansions, and partnerships with food processors to meet growing demand for natural and functional bulking agents. Ingredion emphasizes plant-based and specialty starch bulking agents to address health-conscious trends, while Cargill invests in R&D to develop multifunctional solutions enhancing texture and stability.

Recent Food Bulking Agents Industry News

In February 2025, Flowers Foods, Inc. acquired Simple Mills, Inc. for USD 795 million. Simple Mills, known for its nutrient-rich, gluten-free snacks and baking mixes, will operate as an independent subsidiary, helping Flowers Foods expand in the better-for-you and snacking categories.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 50.7 billion |

| Projected Market Size (2035) | USD 85.9 billion |

| CAGR (2025 to 2035) | 5.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in metric tons |

| By Product Type | Antioxidants, Flavors and Enhancers, Anticaking Agents, Acids, Emulsifiers, Humectants, Stabilizers, Others (Preservatives, Color Stabilizers) |

| By Application | Bakery and Confectionery, Dairy and Frozen Products, Beverages, Meat and Seafood Products, Snacks, Nutraceuticals, Animal Feed, Others (Sauces, Dressings, Ready-to-Eat Meals) |

| By Form | Powder, Granules, Liquid, and Others (Pastes, Gels) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | BEHN MEYER, Ingredion Incorporated, Cargill, DuPont Nutrition & Biosciences, Symrise, CP Kelco, VW-Ingredients, Archer Daniels Midland Company (ADM), Roquette, Kerry Group, BASF |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The market is valued at USD 50.7 billion in 2025.

The market is expected to reach USD 85.9 billion by 2035.

The market is projected to grow at a CAGR of 5.4% during this period.

Antioxidants lead the product type segment with a 28% market share in 2025.

Japan holds the largest CAGR of 5.8% in the food bulking agents market.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA