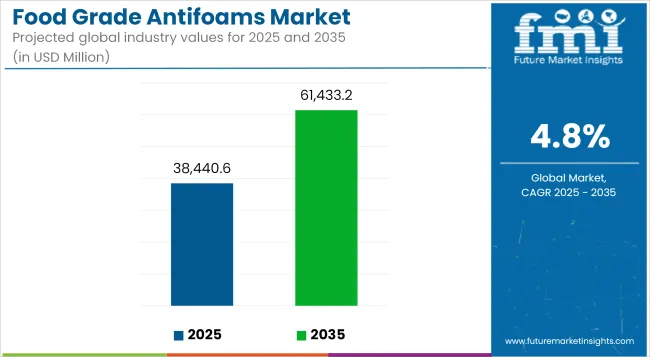

As of 2025, the global food grade antifoams industry is valued at approximately USD 38,440.6 million and is likely to register a CAGR of 4.8% to surpass USD 61,433.2 million by the end of 2035. Rising demand for operational efficiency in large-scale food manufacturing has been instrumental in propelling adoption of foam control agents. With end-use sectors aiming to minimize processing delays and equipment downtime, antifoams have emerged as vital processing aids across dairy, beverages, oils, and fermented food categories.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 38,440.6 million |

| Industry Value (2035F) | USD 61,433.2 million |

| CAGR (2025 to 2035) | 4.8% |

The market is experiencing steady traction as food processors increasingly seek out high-performance, food-safe defoamers that are compliant with global safety standards. Key drivers include the rise in automated processing lines, increasing use of natural and silicone-based agents, and strict sanitation norms requiring defoaming during cleaning-in-place (CIP) operations.

However, growth is slightly restrained by regulatory limitations on ingredient approvals and a growing preference for label-friendly additives. Trends indicate a growing focus on plant-derived and non-silicone antifoams, supported by advancements in emulsion technologies and multifunctional product innovations. Prominent players are expanding portfolios with non-GMO, organic-compatible, and allergen-free variants to meet specific buyer demands across geographies.

By 2035, market demand is expected to pivot towards multifunctional antifoam formulations offering combined benefits of emulsification and microbial stability. Asia-Pacific will increasingly dominate consumption patterns due to rapid industrial food production growth and investment in processing infrastructure.

Antifoams tailored for high-fat and enzymatic systems will gain preference, especially in oils, sauces, and beverage sectors. Product development efforts are being intensified to enhance thermal resistance and reduce residue levels, ensuring optimal performance without compromising on regulatory compliance or sensory attributes.

Bakery and dairy applications are estimated to collectively contribute over 31.5% of the market share in 2025, with bakery representing around 17.4% and dairy products accounting for approximately 14.1%. These segments have emerged as critical end-use domains where foam suppression directly impacts product consistency and processing efficiency.

In high-fat and protein-rich systems, such as cream-based fillings and dairy fermentations, uncontrolled foam can impair texture, yield, and equipment performance. Regulatory frameworks such as the FDA’s 21 CFR 173.340 for secondary direct food additives and EFSA's evaluation protocols have heightened the need for documented safety and purity of antifoam agents used in these applications.

European processors are actively sourcing non-GMO and organic-compatible antifoams from suppliers like Wacker Chemie AG and Ashland, ensuring compliance with EU Regulation No. 1333/2008. In North America, demand has been rising for Kosher and Halal-certified antifoams tailored for cheese vats, spray dryers, and dough processing systems.

Companies like Munzing and BRB International have expanded their bakery and dairy-specific portfolios using emulsion-stabilized food-grade silicones and plant-based esters. The focus remains on developing multifunctional defoamers that offer thermal resilience, minimal flavor interference, and easy dispersion in fat-rich matrices.

The bottled beverage and juice manufacturing segment is projected to hold a 12.6% market share in 2025, driven by stringent processing demands and the increasing shift to automated filling and cleaning systems. Foam generation during carbonation, pasteurization, and high-speed bottling lines poses major operational setbacks, including underfills, sensor malfunctions, and CIP inefficiencies.

To address this, beverage manufacturers are increasingly integrating antifoams that are both heat-stable and compliant with regional food safety codes such as NSF/ANSI 60 and 3-A Sanitary Standards. Companies like Dow and Evonik Industries AG offer low-residue silicone-based defoamers specifically formulated for high-throughput beverage lines, while clean-label trends are catalyzing the adoption of non-silicone emulsifiers from botanical oleoresins.

A growing number of APAC and Latin American facilities are implementing defoamers with rapid dispersion properties to maintain visual clarity and taste neutrality in clear beverages and fortified juices. Beverage giants are mandating supplier compliance with BRC Global Standards and FSSC 22000, influencing ingredient selection. With packaging throughput being a profitability driver, the market is witnessing stronger uptake of antifoam concentrates that ensure fast foam knockdown with minimal carryover or turbidity issues.

Regulatory Compliance and Consumer Concerns

One of the main challenges facing the food-grade antifoams industry is regulatory compliance. Antifoams that are rendered safe for food processing include very stringent testing and have to go through the appropriate conduit set forth by our government and food safety associations before being approved for use in food applications.

Consumer behavior is also shifting toward natural and clean-label solutions, stretching companies to formulate with non-synthetic alternatives. Adapting to these shifting regulatory and consumer demands also requires significant investment in reformulation and research.

Development of Natural and Sustainable Antifoams

Trend of clean-label & natural food additives: The trend toward clean-label and natural food additives is a huge opportunity for the food-grade antifoams industry. Natural food formulations have received attention from customers, who have urged food companies to invest in natural antifoaming agents made from plant oils, beeswax, and proteins in order to produce safer and greener food items.

Additionally, advancements in food processing technology are enabling the production of potent biodegradable antifoams capable of effective foam control while safeguarding food safety and environmental sustainability. Growing consumer awareness and evolving regulations will continue to foster use of natural and sustainable antifoams that will result in significant growth opportunities in the market.

The market for food grade antifoams in the United States is growing due to increasing demand in food processing, beverage manufacturing, and dairy use. Antifoam agents are subject to strict FDA guidelines that ensure their safety and efficacy, spurring a flurry of technological developments in silicone-based and non-silicone alternatives.

The growth of the processed food market which is aided by the advent in quality control and manufacturing efficiency, is also fueling market growth. Moreover, the phenomenal growth of plant-based and alternative protein production is also driving demand for emulsifiers and foam control agents.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

The UK food grade antifoams market is expected to witness significant growth owing to the increasing adoption of natural and clean-label food processing options. Increasing consumer awareness regarding food quality and safety is compelling manufacturers to adopt low-toxicity, food-safe defoamer.

Demand is also being driven by the growth of the brewing, dairy and confectionery industries. Moreover, the food safety regulations of the EU and the UK are stringent, which is further expected to help drive bio-based and organic-type antifoams.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

The demand for food grade antifoams is increasing in Europe largely due to the presence of stringent food safety regulations (such as the European Food Safety Authority), burgeoning food and beverages industry and the growing preference towards sustainable food processing ingredients.

Some examples of the top markets in Europe are Germany, France, and Italy with industrial bakeries, dairy processing facilities, and breweries being the major consumers. In addition, increasing demand for plant-based and alternative protein foods is pushing innovation in natural, biodegradable antifoams.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.0% |

Japan food grade antifoams market is boosted by the country's highly advanced food processing industry and stringent regulatory frameworks with respect with food additives. The rising production of various types of fermented food, dairy products and functional drinks fuels the need for effective antifoaming agents. In addition, the rising need for high-quality, premium packaged food items is propelling the application of silicone-based and non-silicone defoamers in food manufacturing.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

South Korea's food grade antifoams market is growing with the fast expansion of food and beverage production, especially in dairy, sauces, and instant food manufacturing. The growth in the application of automated food processing technologies is stimulating demand for effective defoaming agents. The government emphasis on food safety and quality regulation compliance is also stimulating the use of certified and approved food-grade defoamers in industrial food production.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The Food Grade Antifoams Market is witnessing significant growth due to the increasing demand for efficient foam control solutions in food processing, beverage manufacturing, and dairy production. Antifoams help prevent excessive foam formation, ensuring smooth production processes, improved product quality, and operational efficiency. The market is driven by the rising adoption of food-safe, non-toxic defoaming agents across industries such as dairy, confectionery, bakery, beverages, and food additives.

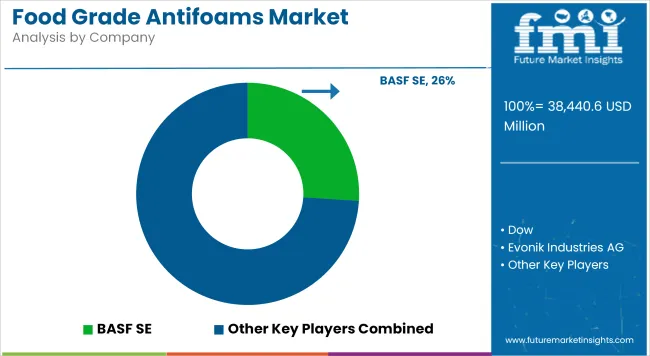

Additionally, technological advancements in silicone-based, non-silicone, and organic antifoam formulations are expanding the market’s potential. Leading companies are focusing on sustainability, regulatory compliance, and innovative product development to strengthen their market position.

The overall market size for food grade antifoams market was USD 38,440.6 Million in 2025.

The food grade antifoams market is expected to reach USD 61,433.2 Million in 2035.

The increasing demand for foam control solutions in food processing industries fuels Food grade antifoams Market during the forecast period.

The top 5 countries which drives the development of Food grade antifoams Market are USA, UK, Europe Union, Japan and South Korea.

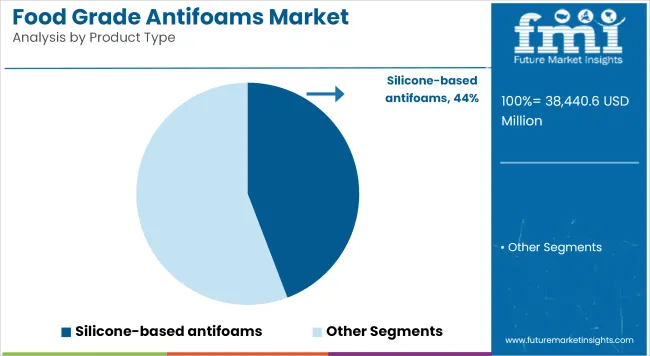

On the basis of product type, Silicone-Based Antifoams to command significant share over the forecast period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Solvent Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Food Grade Industrial Gases Market Size and Share Forecast Outlook 2025 to 2035

Food-Grade Mixing Tank Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Glass Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Food Grade Gas Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Food Grade Phosphate Business

Analysis and Growth Projections for Food Grade Carrageenan Market

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Food Grade Butyric Acid Market Growth - Trends & Forecast 2025 to 2035

Food-Grade Glycerin Market Outlook - Growth & Industry Trends 2025 to 2035

Food Grade Sodium Hypochlorite Market Growth -Industry Trends 2025 to 2035

Food Grade Alcohol Market Trends - Growth & Industry Forecast 2025 to 2035

Food Grade Silica Market Insights – Demand & Applications 2025 to 2035

Food Grade Activated Carbon Market Report - Applications & Growth 2025 to 2035

Food-Grade Calcium Hydroxide Market Trends – Industry Insights 2025 to 2035

Food Grade Alginate Market Report - Applications & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA