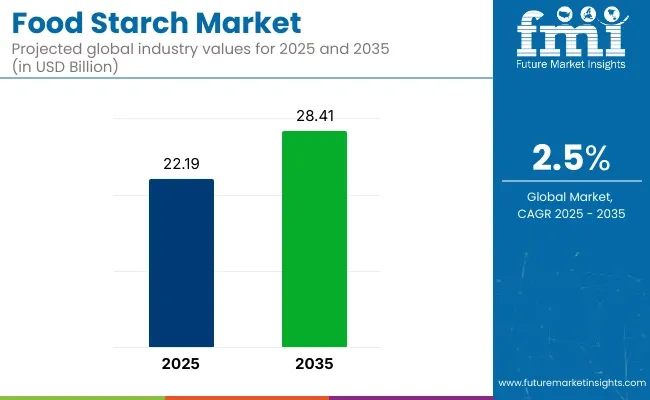

The global food starch market is expected to rise from USD 22.19 billion in 2025 to USD 28.41 billion by 2035, with a compound annual growth rate (CAGR) of 2.5%. This growth is driven by the increasing demand for processed and convenience foods, the versatility of starch in various applications, and the rising preference for clean-label ingredients among consumers.

Recent developments in the food starch market highlight significant advancements in product offerings and applications. Manufacturers are focusing on producing high-quality, functional starches that cater to the evolving needs of the food industry. Innovations in starch modification techniques have led to the development of products with improved properties, such as enhanced stability, texture, and shelf life, making them suitable for a wide range of food applications.

A notable trend in the market is the growing emphasis on sustainability and natural ingredients. Consumers are increasingly seeking products made with minimal processing and free from artificial additives. In response, companies are investing in the development of natural and organic starches derived from sources like maize, wheat, potato, and cassava. These clean-label starches align with consumer preferences for transparency and health-conscious choices.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 22.19 billion |

| Projected Market Size in 2035 | USD 28.41 billion |

| CAGR (2025 to 2035) | 2.5% |

On April 19, 2025, Archer Daniels Midland (ADM) announced the successful commissioning of its expanded corn-starch processing capacity at its Marshall, Minnesota facility-as per Associated Press via local reporting. The expansion, completed in early 2024, responds to surging demand from both food and bio-based chemical sectors.

Plant manager Eric McVey stated, “The increased starch production is helping meet demand from ADM customers,” and highlighted an upcoming nearby Solugen facility that will leverage the site’s dextrose output. This development underlines ADM’s strategic shift toward starch-based products and reinforces its role in sustainable, plant-derived chemical supply chains.

The market's growth is also supported by the expanding applications of food starch in various sectors. In the food and beverage industry, starches are widely used as thickening agents, stabilizers, and emulsifiers in products such as sauces, soups, dairy items, and baked goods. The versatility of starch allows it to perform multiple functions, making it an essential ingredient in many food formulations.

As the food starch market continues to evolve, ongoing research and development efforts are expected to lead to the introduction of more specialized and efficient products. These advancements will cater to the diverse needs of food manufacturers and consumers, further driving the market's growth and enhancing the quality of food products worldwide

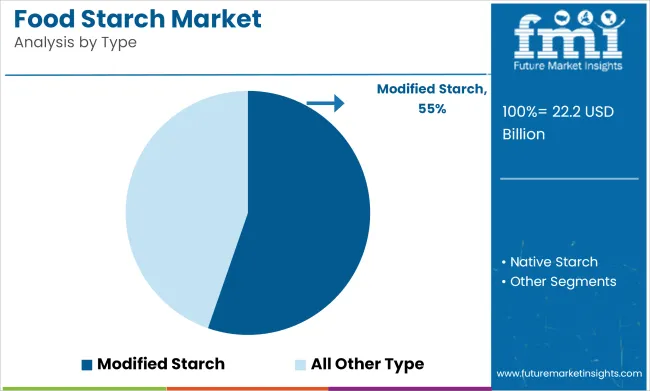

The global food starch market is projected to experience significant growth from 2025 to 2035. Key segments driving this growth include modified starch and maize-based starch. These segments are driven by the increasing demand for starch as a versatile ingredient in the food and beverage industry, particularly in processed foods, beverages, and gluten-free products.

Modified starch is projected to account for 55.3% of the market share in 2025. This segment is expected to dominate due to the versatility and functional properties that modified starch provides in food applications.

Modified starch is altered through physical, enzymatic, or chemical processes to enhance its performance, such as improving stability, texture, and shelf life of food products. It is widely used in the food industry for products like sauces, dressings, soups, baked goods, and dairy products, where it serves as a thickener, stabilizer, and texture enhancer.

The demand for modified starch is increasing as food manufacturers seek to create cleaner labels, enhance the sensory properties of their products, and meet consumer preferences for gluten-free and natural ingredients.

Companies such as Ingredion and Cargill are leading innovation in modified starch solutions, developing products with improved functionality, such as better freeze-thaw stability, improved gelling, and enhanced emulsification. As consumers demand healthier and more sustainable food options, the modified starch segment is expected to continue growing, offering functional solutions for a wide range of food applications.

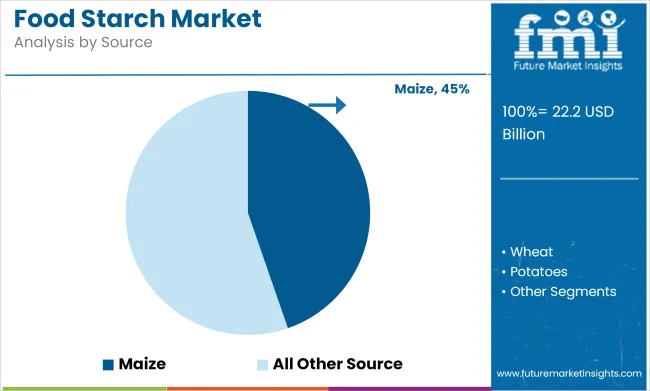

Maize is expected to hold 44.7% of the food starch market share by source in 2025. This growth is driven by maize's abundance, cost-effectiveness, and wide availability, making it a primary source of starch in the food industry.

Maize starch is used in a variety of food products, including snacks, confectionery, and beverages, due to its excellent gelling, thickening, and stabilizing properties. It is a key ingredient in gluten-free and specialty food formulations, where its neutral flavor and versatile functional properties are highly valued.

The maize starch segment is also supported by its use in other industries, including pharmaceuticals and paper manufacturing. Leading suppliers such as ADM and Tate & Lyle are expanding their maize-based starch product offerings to include cleaner-label options, as well as modified maize starches that meet specific industry requirements.

As global demand for cost-effective and functional food ingredients rises, maize-based starch is expected to maintain a strong market presence, particularly in developing markets where its affordability and versatility are key selling points.

Challenge

Fluctuating Raw Material Prices

Fluctuating raw material costs pose significant challenges for food starch production. For the starch industry, especially those which are dependent on corn, wheat and potatoes as primary inputs, variations in crop yield, climate changes, and even political tensions affecting the grain trade are all major instabilities to their future. Such unpredictable factors naturally affect profits. Volatile industries such as this one cannot take lightly.

Stringent Food Safety Regulations

The industry's food safety level and labelling met many challenges of this nature. Regulatory agencies in different parts of the world have diverse regulations in terms of meeting quality standards for products, allergen labelling, and traceability. As for these rules, even stricter requirements in testing, certification and reformation of the product are placed upon manufacturers, making it a hot potato from both operating and financial standpoints.

Opportunity

Rising Demand for Clean-Label and Plant-Based Ingredients

The market for Food Starch is driven by increased consumer sensitivity to clean-label and vegetarian products. For example, instead of using artificial thickeners and stabilizers, a growing number of people are choosing natural food starch. This has increased demand for food-grade organic microbial sources of non-GMO origin, raw and sustainably produced by chemical-free starches in the food and drink industries.

Expansion in the Functional Food and Convenience Food Sectors

At the same time, the mushrooming demand for functional foods and convenience foods provides further growth prospects. In ready-to-eat meals, snacks and processed foods, starch is widely used as a texture improver, stabiliser and form modifier. The trend toward quick meal solutions and health foods is giving the industry a chance not only to eat starches used very differently from before, in new product applications.

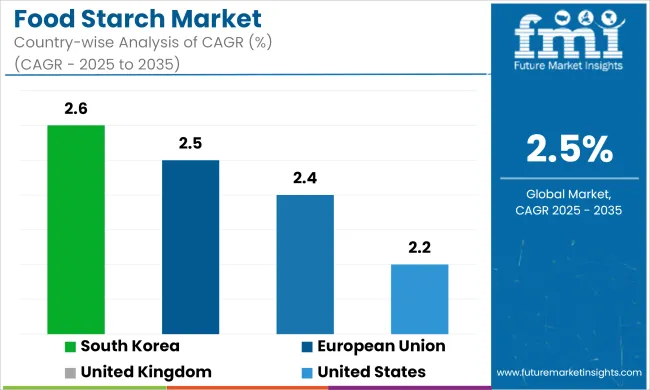

In the United States, growth in the food starch market is moderate. The sector is propelled by a thriving food and beverage industry that accounts for one of the world's largest markets. Despite ongoing controversy over starch in processed foods, bakery goods, and precooked meals, consumer need is unabated.

The lean move is expected to be driven by a greater consumer demand for clean-label and non-GMO products up-to-date with changing attitudes toward health, combined with modified and native starch solutions to bring consumption closer to non-fattening new heights.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.2% |

The United Kingdom food starch market is currently maintaining its solid footing. The sector's strong growth is thanks to a food processing industry that is becoming progressively more mechanised, together with an increasingly greater need for packed foods in packets or cans. The rising societal importance of natural ingredients and healthy, clean-label carbohydrates is creating an expanded base of raw materials for manufacturers to draw on.

Longer-term growth will come from adapting native starches derived from corn, potato and wheat to please this widening customer base. For instance, one major share of the UK's tremendous appetite (especially in the baking andconfectionery sector) for food starch derives simply from improving the texture or lengthening the shelf life of products made thusly.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.4% |

The European Union food starch market, industry participants benefit from well-developed food and drink markets. There is strong consumer demand for convenience foods and processed items. Large user industries (such as dairy, bakery, sauces, ready meals) require starch principally as part of their functionality, to give products appropriate flow consistency or to gel and texture their texture. Consumer demand for gluten-free and Cinderella foodstuffs; drivers of innovation in food manufacturers are thus experimenting with tapioca, maize rice etc.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 2.5% |

South Korea's food starch market exhibits the same robust development as its food engineering sector, and fast-changing diet points toward more convenient and modern forms of food. As ordinary ingredients in home cooking, Korea's traditional cuisine is still largely made out of starches. And it's been well-served by its bakery, confectionery and dairy sectors, which provide a large market for quality starch

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.6% |

Due to the preference for convenience foods and the rising popularity of processed foods, the food starch market is expanding. In addition, growth in this market is being driven by texturizer’s thickeners as well as a more widespread use than ever before due to foodstuffs 'required to be no- genetically modified organism (GMO's).

There has also been an increase in people's appetite for jams with no preservatives or colourings added which tend not to spoil on storage shelves before they get used after all; taboos have arisen about nasty additives like artificial sweeteners because everybody knows what kind of consequences that implies researchers told us support expressly r the demand for natural food starches these days.

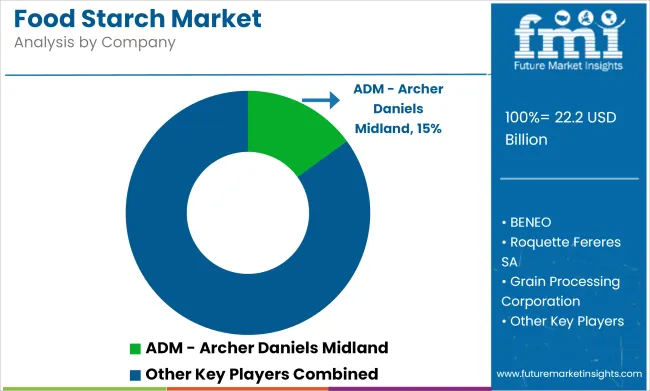

Cargill, Incorporated (20-24%)

Cargill takes up much space amid the market with carb or fiber products and its clear consciousness of present trends

Archer Daniels Midland Co. (15-19%)

ADM focuses on enhancing the texture, taste and shelf life of processed foods with starch products

Ingredion Incorporated (12-16%)

Ingredion is the world's premier provider of innovative starches and polyols, including both gluten-free varieties as well as organic formulations.

Tate & Lyle PLC (10-14%)

Tate & Lyle serves the food industry by developing versatile starches that cater to this increasingly strong trend for healthier and natural foods.

Roquette Frères (8-12%)

Roquette has vast experience in developing starches that are suitable for plant-based and nutritionally fortified products.

Other Key Players (30-40% Combined)

Numerous regional and niche players are contributing to product diversification and technological advancements, including:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 22.19 billion |

| Projected Market Size (2035) | USD 28.41 billion |

| CAGR (2025 to 2035) | 2.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Types Analyzed (Segment 1) | Modified Starch, Native Starch |

| Sources Analyzed (Segment 2) | Maize, Wheat, Potatoes, Other |

| Applications Analyzed (Segment 3) | Animal Feed, Bakery and Confectionery, Beverage, Cosmetics |

| Sales Channels Analyzed (Segment 4) | Offline Sales Channel (Supermarkets/Hypermarkets, Departmental Stores, Convenience Store, Other Sales Channels), Online Sales Channel (Company Website, E-commerce Platform) |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Food Starch Market | ADM - Archer Daniels Midland, The Agrana Group, BENEO, Roquette Fereres SA, Grain Processing Corporation, Royal Avebe U.A, National Starch Food Innovation, Cargill Incorporated, Ingredion Inc., Emsland Group |

| Additional Attributes | dollar sales, CAGR trends, type segmentation, source-based demand, application trends, sales channel performance, competitor dollar sales & market share, regional growth patterns |

The overall market size for food starch market was USD 22.19 billion in 2025.

The food starch market is expected to reach USD 28.41 billion in 2035.

Rising demand for convenience foods, clean-label ingredients, and functional properties will drive food starch market growth, with maize and modified starch dominating due to affordability, versatility, and broad food applications.

The top 5 countries which drives the development of food starch market are USA, European Union, Japan, South Korea and UK.

Modified Starch demand supplier to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Food Starch in EU Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA