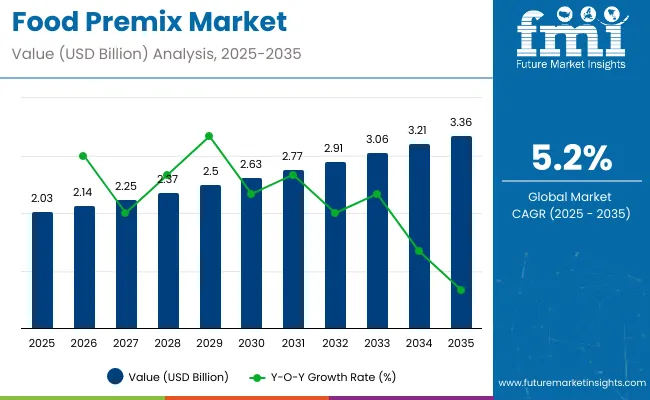

The global food premix market is valued at USD 2.03 billion in 2025 and is projected to reach USD 3.36 billion by 2035, growing at a CAGR of 5.2%. Among all the countries, the USA will dominate the largest market share, while China is forecasted to register the fastest growth rate during the period from 2025 to 2035.

The growth of the food premix market is primarily driven by the increasing demand for nutrient-rich products, such as functional foods and dietary supplements. Health-conscious consumers, particularly in developing regions, are propelling the adoption of food premixes as part of their efforts to improve nutrition and well-being. Government initiatives aimed at fortifying food and addressing nutritional deficiencies are further supporting market expansion.

However, growth is being restrained by challenges such as regulatory complexities, pricing pressures, and the need for standardized nutrient regulations. The market is also experiencing a shift towards clean-label and plant-based formulations, with a focus on sustainability and personalized nutrition. Ongoing research and development activities are playing a significant role in advancing the functionality of food premixes, addressing the demand for tailor-made nutritional solutions.

Looking forward, the food premix market is expected to maintain a steady growth trajectory from 2025 to 2035. As the emphasis on preventive healthcare rises and the prevalence of chronic diseases increases globally, the demand for functional ingredients is anticipated to further accelerate. Regulatory frameworks focused on fortification standards and nutrient validation are expected to enhance consumer trust, thereby fostering market growth and resilience.

The demand for vitamin and mineral blends, particularly in emerging markets, is projected to grow significantly, fueled by an aging population and rising health awareness. Additionally, the integration of digital health solutions and personalized nutrition is expected to drive further adoption of premix products.

As consumers increasingly seek tailored health solutions, the market is anticipated to benefit from innovations that align with individual wellness goals. This trend is expected to support long-term market growth, providing opportunities for continued innovation and expansion across diverse regions.

Per capita spending on food premix is rising globally as consumers seek fortified and functional foods that support overall health and wellness. Food premixes, which are blends of vitamins, minerals, amino acids, and other nutrients, are widely used in products such as cereals, dairy, bakery goods, infant formulas, and nutritional beverages. This trend is being driven by increased awareness of micronutrient deficiencies, an aging global population, and a growing focus on preventive healthcare.

Developed Countries:

In countries such as the United States, Canada, Germany, Japan, and the United Kingdom, per capita spending on food premixes is relatively high. Consumers in these markets are willing to pay premium prices for fortified foods that support immune health, cognitive function, and overall nutrition. The presence of well-established food and beverage industries, combined with strong regulatory frameworks, contributes to stable demand for high-quality and custom-designed premix solutions.

Emerging Markets:

Countries including India, Brazil, Indonesia, South Africa, and Vietnam are experiencing steady growth in per capita spending on food premixes. Rising concerns about malnutrition, government-backed food fortification programs, and increasing disposable income are major factors behind this growth.

The global trade of food premixes is expanding as demand for fortified foods and nutritional products rises across both developed and emerging markets. International trade connects ingredient manufacturers with food, beverage, and nutraceutical companies seeking tailored premix solutions that meet local regulatory standards and consumer preferences. Technological advancements in blending and quality control are also boosting cross-border supply.

Major Exporting Countries:

Leading exporters of food premixes include the United States, Germany, Switzerland, the Netherlands, and China. The United States and Germany export a wide range of high-quality vitamin and mineral blends, often customized for clinical, infant, or sports nutrition applications. Switzerland and the Netherlands are known for advanced R&D capabilities and produce specialized micronutrient premixes for global health programs and food fortification. China offers cost-effective formulations and is expanding its footprint in Asian and African markets.

Major Importing Countries:

Key importers include India, Brazil, Indonesia, Mexico, and South Africa. These countries are scaling up food processing and fortification efforts to address nutritional gaps and improve public health. India and Brazil, in particular, are major markets for imported premixes used in flour, dairy, and infant nutrition. Regulatory changes promoting mandatory fortification and a growing packaged food industry are driving higher imports of premix blends tailored to local needs.

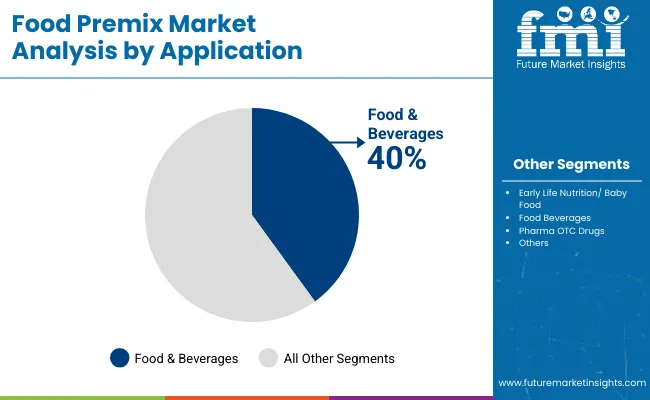

| Segment | Value Share (2025) |

|---|---|

| Food & Beverages (Application) | 40% |

Due to their convenience and adaptability food premixes are becoming more and more used in the food and beverage sector which is driving segment growth. Food premixes are used in a wide variety of food and beverage products including beverage items medical nutrition and sports supplements.

The product is being used more often in bakeries because it has a variety of uses in the industry such as handling dough improving texture and prolonging shelf life. Manufacturers can add more functionality to dairy products by fortifying them with nutrients like calcium vitamin D and probiotics through the use of premixes.

Due to their nutritional value as well as their capacity to enhance mouthfeel through a variety of flavors and tastes premixes are becoming a more common ingredient in beverages like juices energy drinks and flavored drinks.

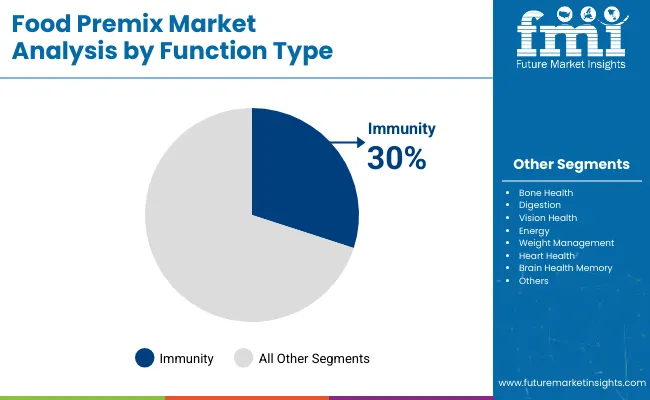

| Segment | Value Share (2025) |

|---|---|

| Immunity (Function Type) | 30% |

Due to the increase in the prevalence of different diseases immunity-boosting food products such as food premixes are becoming more and more popular. Health enthusiasts will find immunity-boosting premixes appealing because they contain vital vitamins like zinc vitamin C and vitamin D.

The target segments growth is anticipated to be aided by rising consumption of food premixes for immunity enhancement. Food premixes prevent common infections and illnesses and help consumers keep their immune systems strong. Consequently, they are experiencing a surge in popularity. Another important factor that is anticipated to support segment growth is the growing interest in preventive healthcare.

Increase in Health Awareness is Driving the Market Growth

As consumers strive to live healthy lives for as long as possible-especially as average as possible-well-being is spreading throughout the world. Lifespan is constantly increasing. Rapid changes in diet and lifestyle have been brought about by economic development urbanization and industrialization. globalization during the last ten years.

Food availability has increased and diversified and access to services has improved along with living standards. has grown and there have been serious adverse effects as well such as less physical activity and improper eating habits. activities as well as a rise in chronic diseases linked to diet.

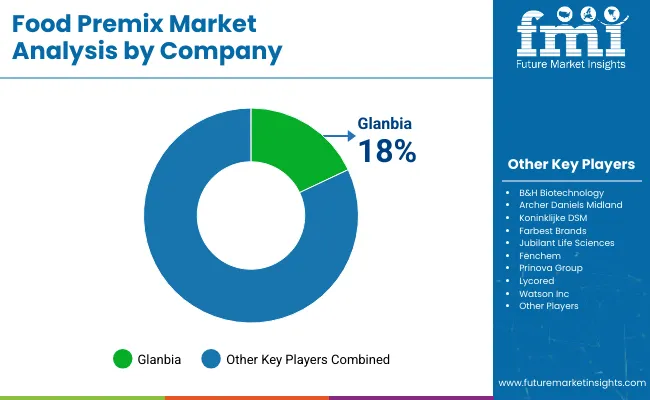

Tier 1 companies comprises industry leaders acquiring a 70% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 20%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 10%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

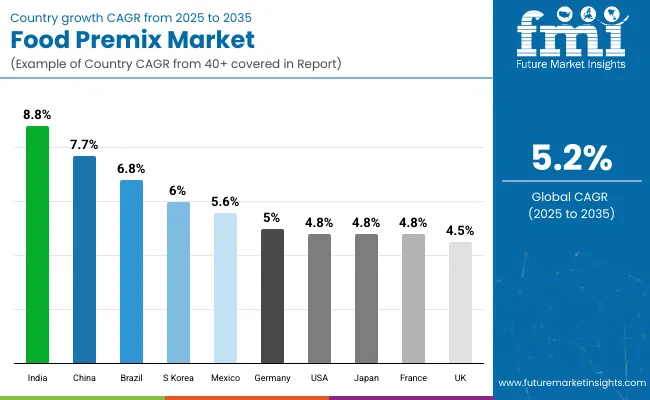

The United States is projected to grow from USD 0.61 billion in 2025 to USD 0.98 billion by 2035, registering a CAGR of 4.8%. Growth is driven by high consumer awareness, a strong dietary supplement culture, and widespread application of premixes in both retail and institutional channels.

Regulatory stability under DSHEA ensures predictable compliance, aiding manufacturers in developing condition-specific formulations for immunity, cognition, and heart health. Public nutrition programs, including school meals and elderly care protocols, create baseline demand for fortified foods. Leading companies like DSM and Glanbia benefit from local R\&D capabilities and strong retail distribution.

While core multivitamin segments are maturing, personalized nutrition and clean-label functional foods continue to gain traction. Challenges include saturation in OTC categories and potential regulatory changes around health claims. Nonetheless, integration of digital diagnostics and AI-driven formulation platforms is helping extend consumer reach. The USA will remain a high-value but moderately growing industry due to its size and innovation maturity.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

China is projected to grow from USD 0.44 billion in 2025 to USD 0.93 billion by 2035, registering a CAGR of 7.7%. Strong momentum is supported by demand for fortified baby foods, clinical nutrition, and immunity-supporting blends. Urban consumers are increasingly adopting personalized supplements, while rural regions benefit from state-led health initiatives.

Regulatory support from the National Health Commission has standardized food fortification practices and strengthened confidence in blend usage. Domestic firms, equipped with low-cost manufacturing and digital reach via WeChat and e-commerce, are gaining share from foreign brands. High growth is also seen in bone health and digestive formulations. Global players continue to engage in joint ventures to localize products and navigate evolving regulations.

Innovation in convenient delivery formats-gummies, sachets, and functional beverages-is driving urban adoption. Despite pricing competition and regulatory shifts, China remains one of the most dynamic and lucrative regions for providers focused on premium, condition-targeted nutrition.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.7% |

India is projected to grow from USD 0.27 billion in 2025 to USD 0.63 billion by 2035, registering a CAGR of 8.8%. Rapid growth is fueled by government-backed nutrition programs such as POSHAN Abhiyaan and the mid-day meal scheme, which mandate iron, folate, and vitamin A inclusion in staple foods. Rising disposable incomes and growing health awareness in Tier 1 and Tier 2 cities have triggered demand for functional beverages, dietary supplements, and fortified snacks.

Regulatory clarity under FSSAI is improving, enabling a streamlined process for certification and labeling. Domestic companies dominate government supply tenders, while global firms focus on urban-centric, premium wellness solutions.

Immunity and energy blends lead consumer adoption, while bone and vision health categories are gaining traction. Although price sensitivity and fragmented distribution networks pose challenges, scale advantages and policy support keep India among the top growth territories globally. Long-term success will depend on affordable innovation and rural supply chain efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.8% |

Germany is projected to grow from USD 0.23 billion in 2025 to USD 0.37 billion by 2035, registering a CAGR of 5%. Growth is supported by robust healthcare spending, EU-aligned regulation, and high consumer trust in functional foods and supplements.

Bone, heart, and immunity-supporting blends remain core growth drivers, especially among aging populations. EFSA regulations and clean-label preferences shape product development, encouraging the use of natural-source vitamins and plant-based minerals. Germany’s role as a B2B blending hub in Western Europe attracts investment in formulation technology and quality assurance systems.

Corporate wellness programs and rising health insurance incentives for preventive care boost uptake of condition-specific solutions. While cost-consciousness in public health procurement and high competition from generics constrain margins, clinical nutrition and fortified dairy maintain consistent expansion. Germany’s regulatory transparency and formulation capacity make it a strategic base for innovation pipelines, although long-term growth will be moderate compared to emerging economies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5% |

Japan is projected to grow from USD 0.22 billion in 2025 to USD 0.35 billion by 2035, registering a CAGR of 4.8%. Growth is underpinned by an aging population and demand for brain health, bone strength, and digestive wellness solutions.

The Foods with Function Claims (FFC) regulation ensures rigorous product validation and safety, fostering strong consumer trust. Functional beverages, fortified dairy, and OTC supplements form the core of demand, with a shift toward sachets and on-the-go formats for the elderly.

Domestic companies dominate distribution, but multinational firms contribute formulation expertise and collaborate in localized R&D. Despite demographic headwinds and conservative claim approvals, innovation in cognitive and immunity-focused blends continues to attract premium consumers.

Growth is further aided by cross-border e-commerce and app-based dietary guidance tools. Though volume expansion remains limited, Japan is a high-value, innovation-driven region ideal for clinically substantiated, premium solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

Brazil is projected to grow from USD 0.19 billion in 2025 to USD 0.37 billion by 2035, registering a CAGR of 6.8%. Growth is underpinned by ANVISA mandates requiring vitamin and mineral fortification in flour and by public nutrition programs targeting school-aged children. Rising urban middle-class demand for fortified snacks, dairy, and beverages supports expansion beyond institutional supply.

Domestic manufacturers maintain an edge in local tenders, while global companies target higher-margin segments such as energy drinks and lifestyle wellness solutions. Immunity and energy blends are particularly popular in major urban centers like São Paulo and Rio de Janeiro. Retail formats are evolving, with flavored powdered solutions gaining traction in sports and family health.

Logistics inefficiencies and exchange rate volatility challenge input pricing, but broad consumer coverage and regulatory mandates maintain structural demand. Brazil is expected to transition toward more personalized nutrition, supported by growing health literacy and digital platform engagement.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 6.8% |

The United Kingdom is projected to grow from USD 0.18 billion in 2025 to USD 0.28 billion by 2035, registering a CAGR of 4.5%. Development is driven by NHS-backed nutrition awareness campaigns and rising consumer focus on gut health and cognitive wellness.

Functional foods, fortified beverages, and dietary gummies are growing rapidly in retail. Post-Brexit trade shifts have increased interest in domestic sourcing and local blending to mitigate import delays and cost exposure. Clean-label expectations and allergen-free formulations dominate product development.

Elderly and prenatal nutrition remain priorities under targeted public initiatives. E-commerce and pharmacy-led channels continue to grow, aided by consumer-facing influencers and personalized wellness platforms.

Though overall growth is modest, the UK remains attractive for clinically backed, premium-positioned blends. Long-term competitiveness will hinge on sustainability credentials and regulatory alignment with EU and domestic food standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

France is projected to grow from USD 0.17 billion in 2025 to USD 0.27 billion by 2035, registering a CAGR of 4.8%. Government support for micronutrient fortification-especially in maternal health and dairy-drives consistent demand. EFSA-aligned regulation and a health-conscious consumer base foster adoption of clinically supported, condition-specific blends.

Bone health, cognitive function, and infant nutrition remain priority areas. Distribution is concentrated in pharmacies and digital wellness platforms, with premium brands outperforming generics. Domestic producers benefit from control over raw material sourcing and formulation traceability. However, conservative preferences around additives and GMOs limit product scope.

Fortified baby foods and elderly nutrition offerings are expanding, supported by public health campaigns and proactive lifestyle shifts. Although growth is modest, France offers margin resilience through its focus on clinically validated, high-integrity formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 4.8% |

South Korea is projected to grow from USD 0.14 billion in 2025 to USD 0.25 billion by 2035, registering a CAGR of 6%. Rapid digital adoption, strong wellness culture, and proactive regulatory support from MFDS are fueling demand for fortified products across categories like skin health, immunity, and energy.

Fortified convenience foods, probiotic beverages, and gummies are growing among urban professionals and Gen Z consumers. Domestic manufacturers lead in flavor customization and are leveraging the K-wellness trend to expand across APAC.

E-commerce channels and mobile health apps are reshaping consumer engagement, while foreign brands gain traction through cross-border platforms. Market saturation in certain ingredient categories, such as collagen and vitamin C, poses short-term limits, but growth headroom remains in clinical-grade and hybrid nutrition formats tailored for high-performance consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6% |

Mexico is projected to grow from USD 0.13 billion in 2025 to USD 0.23 billion by 2035, registering a CAGR of 5.6%. Government-enforced staple fortification policies-covering tortillas, flour, and milk-anchor demand, while COFEPRIS ensures regulatory compliance for all fortified food labeling.

Urban middle-class consumers increasingly adopt OTC fortified beverages, energy blends, and functional snacks. Local producers lead institutional supply, while global firms target the premium retail tier via pharmacy and wellness channels.

Growth in e-commerce and mobile accessibility is bridging delivery gaps in underserved areas. Challenges include rural distribution inefficiencies and low awareness outside urban centers, but Mexico remains attractive for scalable, policy-aligned solutions tied to public health outcomes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Mexico | 5.6% |

Leading producers of food premixes are always coming up with new ideas to supply changing consumer demands. For example, they are creating novel flavors and functionalities for food premixes. To appeal to vegan and environmentally conscious consumers they are also using sustainable ingredients.

A number of players are also expressing interest in implementing tactics to maintain an advantage over their rivals. These consist of joint ventures contracts for distribution the opening of new facilities marketing campaigns and purchases. In an effort to increase sales they are also shifting their products to online platforms.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.03 billion |

| Projected Market Size (2035) | USD 3.36 billion |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Application | Early Life Nutrition/ Baby Food, Food & Beverages, Pharma OTC Drugs, Dietary Supplements, and Nutritional Improvement Programmers |

| By Function Type | Bone Health, Immunity, Digestion, Vision Health, Energy, Weight Management, and Heart Health and Brain Health & Memory |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa |

| Countries Covered | United States, China, India, Germany, Japan, United Kingdom, Brazil, France, South Korea, Mexico |

| Key Players | Glanbia, B&H Biotechnology, Archer Daniels Midland, Koninklijke DSM, Farbest Brands, Jubilant Life Sciences, Fenchem, Prinova Group, Lycored, and Watson Inc |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

By application, methods industry has been categorized into Early Life Nutrition/ Baby Food, Food Beverages, Pharma OTC Drugs, Dietary Supplements and Nutritional Improvement Programmers

By functionality type, industry has been categorized into Bone Health, Immunity, Digestion, Vision Health, Energy, Weight Management, Heart Health and Brain Health Memory

The market spans North America, Latin America, Western Europe, Eastern Europe, South Asia Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East Africa.

The industry is expected to reach USD 3.36 billion by 2035.

The industry is projected to grow at a CAGR of 5.2% during 2025 to 2035.

Vitamin and mineral premixes are the most widely used, particularly in supplements, functional beverages, and infant nutrition.

Leading companies include Glanbia, DSM, ADM, Prinova, Jubilant Life Sciences, and Lycored.

North America and Asia Pacific, driven by strong uptake in the USA, China, and India.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (MT) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ billion) Forecast by Form, 2019 to 2034

Table 4: Global Market Volume (MT) Forecast by Form, 2019 to 2034

Table 5: Global Market Value (US$ billion) Forecast by Ingredient Type, 2019 to 2034

Table 6: Global Market Volume (MT) Forecast by Ingredient Type, 2019 to 2034

Table 7: Global Market Value (US$ billion) Forecast by Application Type, 2019 to 2034

Table 8: Global Market Volume (MT) Forecast by Application Type, 2019 to 2034

Table 9: Global Market Value (US$ billion) Forecast by Function Type, 2019 to 2034

Table 10: Global Market Volume (MT) Forecast by Function Type, 2019 to 2034

Table 11: North America Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ billion) Forecast by Form, 2019 to 2034

Table 14: North America Market Volume (MT) Forecast by Form, 2019 to 2034

Table 15: North America Market Value (US$ billion) Forecast by Ingredient Type, 2019 to 2034

Table 16: North America Market Volume (MT) Forecast by Ingredient Type, 2019 to 2034

Table 17: North America Market Value (US$ billion) Forecast by Application Type, 2019 to 2034

Table 18: North America Market Volume (MT) Forecast by Application Type, 2019 to 2034

Table 19: North America Market Value (US$ billion) Forecast by Function Type, 2019 to 2034

Table 20: North America Market Volume (MT) Forecast by Function Type, 2019 to 2034

Table 21: Latin America Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ billion) Forecast by Form, 2019 to 2034

Table 24: Latin America Market Volume (MT) Forecast by Form, 2019 to 2034

Table 25: Latin America Market Value (US$ billion) Forecast by Ingredient Type, 2019 to 2034

Table 26: Latin America Market Volume (MT) Forecast by Ingredient Type, 2019 to 2034

Table 27: Latin America Market Value (US$ billion) Forecast by Application Type, 2019 to 2034

Table 28: Latin America Market Volume (MT) Forecast by Application Type, 2019 to 2034

Table 29: Latin America Market Value (US$ billion) Forecast by Function Type, 2019 to 2034

Table 30: Latin America Market Volume (MT) Forecast by Function Type, 2019 to 2034

Table 31: Europe Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 32: Europe Market Volume (MT) Forecast by Country, 2019 to 2034

Table 33: Europe Market Value (US$ billion) Forecast by Form, 2019 to 2034

Table 34: Europe Market Volume (MT) Forecast by Form, 2019 to 2034

Table 35: Europe Market Value (US$ billion) Forecast by Ingredient Type, 2019 to 2034

Table 36: Europe Market Volume (MT) Forecast by Ingredient Type, 2019 to 2034

Table 37: Europe Market Value (US$ billion) Forecast by Application Type, 2019 to 2034

Table 38: Europe Market Volume (MT) Forecast by Application Type, 2019 to 2034

Table 39: Europe Market Value (US$ billion) Forecast by Function Type, 2019 to 2034

Table 40: Europe Market Volume (MT) Forecast by Function Type, 2019 to 2034

Table 41: East Asia Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 42: East Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 43: East Asia Market Value (US$ billion) Forecast by Form, 2019 to 2034

Table 44: East Asia Market Volume (MT) Forecast by Form, 2019 to 2034

Table 45: East Asia Market Value (US$ billion) Forecast by Ingredient Type, 2019 to 2034

Table 46: East Asia Market Volume (MT) Forecast by Ingredient Type, 2019 to 2034

Table 47: East Asia Market Value (US$ billion) Forecast by Application Type, 2019 to 2034

Table 48: East Asia Market Volume (MT) Forecast by Application Type, 2019 to 2034

Table 49: East Asia Market Value (US$ billion) Forecast by Function Type, 2019 to 2034

Table 50: East Asia Market Volume (MT) Forecast by Function Type, 2019 to 2034

Table 51: South Asia Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 52: South Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 53: South Asia Market Value (US$ billion) Forecast by Form, 2019 to 2034

Table 54: South Asia Market Volume (MT) Forecast by Form, 2019 to 2034

Table 55: South Asia Market Value (US$ billion) Forecast by Ingredient Type, 2019 to 2034

Table 56: South Asia Market Volume (MT) Forecast by Ingredient Type, 2019 to 2034

Table 57: South Asia Market Value (US$ billion) Forecast by Application Type, 2019 to 2034

Table 58: South Asia Market Volume (MT) Forecast by Application Type, 2019 to 2034

Table 59: South Asia Market Value (US$ billion) Forecast by Function Type, 2019 to 2034

Table 60: South Asia Market Volume (MT) Forecast by Function Type, 2019 to 2034

Table 61: Oceania Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 62: Oceania Market Volume (MT) Forecast by Country, 2019 to 2034

Table 63: Oceania Market Value (US$ billion) Forecast by Form, 2019 to 2034

Table 64: Oceania Market Volume (MT) Forecast by Form, 2019 to 2034

Table 65: Oceania Market Value (US$ billion) Forecast by Ingredient Type, 2019 to 2034

Table 66: Oceania Market Volume (MT) Forecast by Ingredient Type, 2019 to 2034

Table 67: Oceania Market Value (US$ billion) Forecast by Application Type, 2019 to 2034

Table 68: Oceania Market Volume (MT) Forecast by Application Type, 2019 to 2034

Table 69: Oceania Market Value (US$ billion) Forecast by Function Type, 2019 to 2034

Table 70: Oceania Market Volume (MT) Forecast by Function Type, 2019 to 2034

Table 71: Middle East & Africa Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 72: Middle East & Africa Market Volume (MT) Forecast by Country, 2019 to 2034

Table 73: Middle East & Africa Market Value (US$ billion) Forecast by Form, 2019 to 2034

Table 74: Middle East & Africa Market Volume (MT) Forecast by Form, 2019 to 2034

Table 75: Middle East & Africa Market Value (US$ billion) Forecast by Ingredient Type, 2019 to 2034

Table 76: Middle East & Africa Market Volume (MT) Forecast by Ingredient Type, 2019 to 2034

Table 77: Middle East & Africa Market Value (US$ billion) Forecast by Application Type, 2019 to 2034

Table 78: Middle East & Africa Market Volume (MT) Forecast by Application Type, 2019 to 2034

Table 79: Middle East & Africa Market Value (US$ billion) Forecast by Function Type, 2019 to 2034

Table 80: Middle East & Africa Market Volume (MT) Forecast by Function Type, 2019 to 2034

Figure 1: Global Market Value (US$ billion) by Form, 2024 to 2034

Figure 2: Global Market Value (US$ billion) by Ingredient type, 2024 to 2034

Figure 3: Global Market Value (US$ billion) by Application Type, 2024 to 2034

Figure 4: Global Market Value (US$ billion) by Function type, 2024 to 2034

Figure 5: Global Market Value (US$ billion) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ billion) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (MT) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ billion) Analysis by Form, 2019 to 2034

Figure 11: Global Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 14: Global Market Value (US$ billion) Analysis by Ingredient type, 2019 to 2034

Figure 15: Global Market Volume (MT) Analysis by Ingredient type, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Ingredient type, 2024 to 2034

Figure 18: Global Market Y-o-Y Growth (%) Projections by Ingredient type, 2024 to 2034

Figure 18: Global Market Value (US$ billion) Analysis by Application Type, 2019 to 2034

Figure 19: Global Market Volume (MT) Analysis by Application Type, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 22: Global Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 23: Global Market Value (US$ billion) Analysis by Function type, 2019 to 2034

Figure 23: Global Market Volume (MT) Analysis by Function type, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by Function type, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by Function type, 2024 to 2034

Figure 26: Global Market Attractiveness by Form, 2024 to 2034

Figure 27: Global Market Attractiveness by Ingredient type, 2024 to 2034

Figure 28: Global Market Attractiveness by Application Type, 2024 to 2034

Figure 29: Global Market Attractiveness by Function type, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ billion) by Form, 2024 to 2034

Figure 33: North America Market Value (US$ billion) by Ingredient type, 2024 to 2034

Figure 33: North America Market Value (US$ billion) by Application Type, 2024 to 2034

Figure 34: North America Market Value (US$ billion) by Function type, 2024 to 2034

Figure 35: North America Market Value (US$ billion) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ billion) Analysis by Form, 2019 to 2034

Figure 41: North America Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 44: North America Market Value (US$ billion) Analysis by Ingredient type, 2019 to 2034

Figure 45: North America Market Volume (MT) Analysis by Ingredient type, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by Ingredient type, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by Ingredient type, 2024 to 2034

Figure 48: North America Market Value (US$ billion) Analysis by Application Type, 2019 to 2034

Figure 49: North America Market Volume (MT) Analysis by Application Type, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 52: North America Market Value (US$ billion) Analysis by Function type, 2019 to 2034

Figure 53: North America Market Volume (MT) Analysis by Function type, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by Function type, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by Function type, 2024 to 2034

Figure 56: North America Market Attractiveness by Form, 2024 to 2034

Figure 57: North America Market Attractiveness by Ingredient type, 2024 to 2034

Figure 58: North America Market Attractiveness by Application Type, 2024 to 2034

Figure 59: North America Market Attractiveness by Function type, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ billion) by Form, 2024 to 2034

Figure 62: Latin America Market Value (US$ billion) by Ingredient type, 2024 to 2034

Figure 63: Latin America Market Value (US$ billion) by Application Type, 2024 to 2034

Figure 64: Latin America Market Value (US$ billion) by Function type, 2024 to 2034

Figure 65: Latin America Market Value (US$ billion) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ billion) Analysis by Form, 2019 to 2034

Figure 71: Latin America Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 74: Latin America Market Value (US$ billion) Analysis by Ingredient type, 2019 to 2034

Figure 75: Latin America Market Volume (MT) Analysis by Ingredient type, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Ingredient type, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Ingredient type, 2024 to 2034

Figure 78: Latin America Market Value (US$ billion) Analysis by Application Type, 2019 to 2034

Figure 79: Latin America Market Volume (MT) Analysis by Application Type, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 82: Latin America Market Value (US$ billion) Analysis by Function type, 2019 to 2034

Figure 83: Latin America Market Volume (MT) Analysis by Function type, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Function type, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Function type, 2024 to 2034

Figure 86: Latin America Market Attractiveness by Form, 2024 to 2034

Figure 87: Latin America Market Attractiveness by Ingredient type, 2024 to 2034

Figure 88: Latin America Market Attractiveness by Application Type, 2024 to 2034

Figure 89: Latin America Market Attractiveness by Function type, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Europe Market Value (US$ billion) by Form, 2024 to 2034

Figure 92: Europe Market Value (US$ billion) by Ingredient type, 2024 to 2034

Figure 93: Europe Market Value (US$ billion) by Application Type, 2024 to 2034

Figure 94: Europe Market Value (US$ billion) by Function type, 2024 to 2034

Figure 95: Europe Market Value (US$ billion) by Country, 2024 to 2034

Figure 96: Europe Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 97: Europe Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Europe Market Value (US$ billion) Analysis by Form, 2019 to 2034

Figure 101: Europe Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 102: Europe Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 104: Europe Market Value (US$ billion) Analysis by Ingredient type, 2019 to 2034

Figure 105: Europe Market Volume (MT) Analysis by Ingredient type, 2019 to 2034

Figure 106: Europe Market Value Share (%) and BPS Analysis by Ingredient type, 2024 to 2034

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Ingredient type, 2024 to 2034

Figure 108: Europe Market Value (US$ billion) Analysis by Application Type, 2019 to 2034

Figure 109: Europe Market Volume (MT) Analysis by Application Type, 2019 to 2034

Figure 110: Europe Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 112: Europe Market Value (US$ billion) Analysis by Function type, 2019 to 2034

Figure 113: Europe Market Volume (MT) Analysis by Function type, 2019 to 2034

Figure 114: Europe Market Value Share (%) and BPS Analysis by Function type, 2024 to 2034

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Function type, 2024 to 2034

Figure 116: Europe Market Attractiveness by Form, 2024 to 2034

Figure 118: Europe Market Attractiveness by Ingredient type, 2024 to 2034

Figure 118: Europe Market Attractiveness by Application Type, 2024 to 2034

Figure 119: Europe Market Attractiveness by Function type, 2024 to 2034

Figure 120: Europe Market Attractiveness by Country, 2024 to 2034

Figure 122: East Asia Market Value (US$ billion) by Form, 2024 to 2034

Figure 123: East Asia Market Value (US$ billion) by Ingredient type, 2024 to 2034

Figure 123: East Asia Market Value (US$ billion) by Application Type, 2024 to 2034

Figure 124: East Asia Market Value (US$ billion) by Function type, 2024 to 2034

Figure 125: East Asia Market Value (US$ billion) by Country, 2024 to 2034

Figure 126: East Asia Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: East Asia Market Value (US$ billion) Analysis by Form, 2019 to 2034

Figure 131: East Asia Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 133: East Asia Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 134: East Asia Market Value (US$ billion) Analysis by Ingredient type, 2019 to 2034

Figure 135: East Asia Market Volume (MT) Analysis by Ingredient type, 2019 to 2034

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Ingredient type, 2024 to 2034

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Ingredient type, 2024 to 2034

Figure 138: East Asia Market Value (US$ billion) Analysis by Application Type, 2019 to 2034

Figure 139: East Asia Market Volume (MT) Analysis by Application Type, 2019 to 2034

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 142: East Asia Market Value (US$ billion) Analysis by Function type, 2019 to 2034

Figure 143: East Asia Market Volume (MT) Analysis by Function type, 2019 to 2034

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Function type, 2024 to 2034

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Function type, 2024 to 2034

Figure 146: East Asia Market Attractiveness by Form, 2024 to 2034

Figure 147: East Asia Market Attractiveness by Ingredient type, 2024 to 2034

Figure 148: East Asia Market Attractiveness by Application Type, 2024 to 2034

Figure 149: East Asia Market Attractiveness by Function type, 2024 to 2034

Figure 150: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 151: South Asia Market Value (US$ billion) by Form, 2024 to 2034

Figure 152: South Asia Market Value (US$ billion) by Ingredient type, 2024 to 2034

Figure 153: South Asia Market Value (US$ billion) by Application Type, 2024 to 2034

Figure 154: South Asia Market Value (US$ billion) by Function type, 2024 to 2034

Figure 155: South Asia Market Value (US$ billion) by Country, 2024 to 2034

Figure 156: South Asia Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: South Asia Market Value (US$ billion) Analysis by Form, 2019 to 2034

Figure 161: South Asia Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 164: South Asia Market Value (US$ billion) Analysis by Ingredient type, 2019 to 2034

Figure 165: South Asia Market Volume (MT) Analysis by Ingredient type, 2019 to 2034

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Ingredient type, 2024 to 2034

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Ingredient type, 2024 to 2034

Figure 168: South Asia Market Value (US$ billion) Analysis by Application Type, 2019 to 2034

Figure 169: South Asia Market Volume (MT) Analysis by Application Type, 2019 to 2034

Figure 180: South Asia Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 181: South Asia Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 182: South Asia Market Value (US$ billion) Analysis by Function type, 2019 to 2034

Figure 183: South Asia Market Volume (MT) Analysis by Function type, 2019 to 2034

Figure 184: South Asia Market Value Share (%) and BPS Analysis by Function type, 2024 to 2034

Figure 185: South Asia Market Y-o-Y Growth (%) Projections by Function type, 2024 to 2034

Figure 186: South Asia Market Attractiveness by Form, 2024 to 2034

Figure 187: South Asia Market Attractiveness by Ingredient type, 2024 to 2034

Figure 188: South Asia Market Attractiveness by Application Type, 2024 to 2034

Figure 189: South Asia Market Attractiveness by Function type, 2024 to 2034

Figure 180: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 181: Oceania Market Value (US$ billion) by Form, 2024 to 2034

Figure 182: Oceania Market Value (US$ billion) by Ingredient type, 2024 to 2034

Figure 183: Oceania Market Value (US$ billion) by Application Type, 2024 to 2034

Figure 184: Oceania Market Value (US$ billion) by Function type, 2024 to 2034

Figure 185: Oceania Market Value (US$ billion) by Country, 2024 to 2034

Figure 186: Oceania Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 190: Oceania Market Value (US$ billion) Analysis by Form, 2019 to 2034

Figure 191: Oceania Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 194: Oceania Market Value (US$ billion) Analysis by Ingredient type, 2019 to 2034

Figure 195: Oceania Market Volume (MT) Analysis by Ingredient type, 2019 to 2034

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Ingredient type, 2024 to 2034

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Ingredient type, 2024 to 2034

Figure 198: Oceania Market Value (US$ billion) Analysis by Application Type, 2019 to 2034

Figure 199: Oceania Market Volume (MT) Analysis by Application Type, 2019 to 2034

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 202: Oceania Market Value (US$ billion) Analysis by Function type, 2019 to 2034

Figure 203: Oceania Market Volume (MT) Analysis by Function type, 2019 to 2034

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Function type, 2024 to 2034

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Function type, 2024 to 2034

Figure 206: Oceania Market Attractiveness by Form, 2024 to 2034

Figure 207: Oceania Market Attractiveness by Ingredient type, 2024 to 2034

Figure 208: Oceania Market Attractiveness by Application Type, 2024 to 2034

Figure 209: Oceania Market Attractiveness by Function type, 2024 to 2034

Figure 220: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 221: Middle East & Africa Market Value (US$ billion) by Form, 2024 to 2034

Figure 222: Middle East & Africa Market Value (US$ billion) by Ingredient type, 2024 to 2034

Figure 223: Middle East & Africa Market Value (US$ billion) by Application Type, 2024 to 2034

Figure 224: Middle East & Africa Market Value (US$ billion) by Function type, 2024 to 2034

Figure 225: Middle East & Africa Market Value (US$ billion) by Country, 2024 to 2034

Figure 226: Middle East & Africa Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 227: Middle East & Africa Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 228: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 229: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 230: Middle East & Africa Market Value (US$ billion) Analysis by Form, 2019 to 2034

Figure 231: Middle East & Africa Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 233: Middle East & Africa Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 233: Middle East & Africa Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 234: Middle East & Africa Market Value (US$ billion) Analysis by Ingredient type, 2019 to 2034

Figure 235: Middle East & Africa Market Volume (MT) Analysis by Ingredient type, 2019 to 2034

Figure 236: Middle East & Africa Market Value Share (%) and BPS Analysis by Ingredient type, 2024 to 2034

Figure 237: Middle East & Africa Market Y-o-Y Growth (%) Projections by Ingredient type, 2024 to 2034

Figure 238: Middle East & Africa Market Value (US$ billion) Analysis by Application Type, 2019 to 2034

Figure 239: Middle East & Africa Market Volume (MT) Analysis by Application Type, 2019 to 2034

Figure 230: Middle East & Africa Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 231: Middle East & Africa Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 233: Middle East & Africa Market Value (US$ billion) Analysis by Function type, 2019 to 2034

Figure 233: Middle East & Africa Market Volume (MT) Analysis by Function type, 2019 to 2034

Figure 234: Middle East & Africa Market Value Share (%) and BPS Analysis by Function type, 2024 to 2034

Figure 235: Middle East & Africa Market Y-o-Y Growth (%) Projections by Function type, 2024 to 2034

Figure 236: Middle East & Africa Market Attractiveness by Form, 2024 to 2034

Figure 237: Middle East & Africa Market Attractiveness by Ingredient type, 2024 to 2034

Figure 238: Middle East & Africa Market Attractiveness by Application Type, 2024 to 2034

Figure 239: Middle East & Africa Market Attractiveness by Function type, 2024 to 2034

Figure 240: Middle East & Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Premix Industry Analysis in USA Growth & Demand Forecast 2025 to 2035

Food Premix Industry Analysis in Middle East - Size and Share Forecast Outlook 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Comprehensive Analysis of Food Premix Market by Form, Ingredient Type, End-Use Application and Function Type through 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA