Europe Premix Food Market was valued at USD 599 million in 2023, and is anticipated to be valued at USD 712.6 million in 2025 and USD 1,766.0 million by 2035, growing at a CAGR of 9.5% during the forecast period of 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Value (2025E) | USD 712.6 Million |

| Projected Europe Value (2035F) | USD 1,766.0 Million |

| Value-based CAGR (2023 to 2035) | 9.5% |

The Europe food premix market is expected to grow at a strong pace by 2035 at a vigorous pace due to the growing demand for fortified and functional foods. USD 599 million in 2023 to USD 712.6 million by 2025, at a CAGR of 9.5%. Major growth factors are awareness towards health, personalized nutrition and the convenience of food premix.

The growth of functional foods and fortified diets, specifically, are driving forces in this (market). In addition, changing lifestyles and growing demand for plant-based and clean-label products have led to the adoption of food premixes across Europe.

The increasing demand for food products that offer improved nutritional value, such as essential vitamins, minerals, and other micronutrients, propels the food premix market in the food sector. On another note, food processors are also turning their attention to practical, ready-to-mix solutions to meet consumer demand for convenience and personalized nutrition.

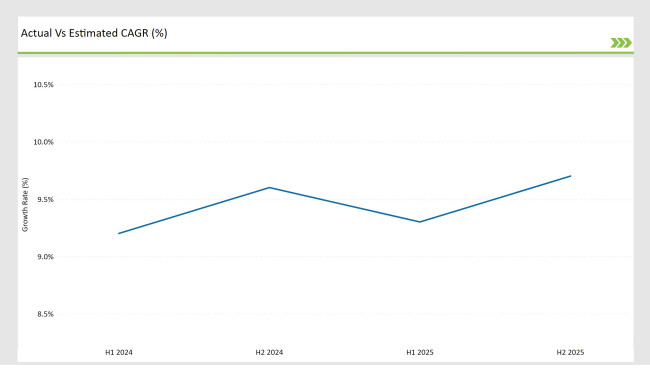

A detailed comparative analysis of changes in the compound annual growth rate (CAGR) across a 6 month distance, for the base year (2024) and the current year (2025) for the European food premix market, can be found in the table below. This bi-annual assessment captures key changes in underlying market dynamics, and sketches revenue recognition trends that equip stakeholders with a better understanding of the course for growth over the year. H1 is from January to June and H2 is from July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the European food premix sector, the market is expected to grow for first half of 2024 at a CAGR of 9.2% followed by 9.6% in the second half of 2024. In 2025, the H1 growth rate is expected to reduce slightly to 9.3%, before increasing to 9.7% in H2. Such upward trend signifies high momentum in the second half of the forecast period, experiment on food premix solutions and higher acceptance from consumers are the factors influencing the growth.

| Date | Development/Event & Details |

|---|---|

| March 2024 | Anuga FoodTec 2024 : Held in Cologne, Germany, this major trade fair attracted nearly 40,000 visitors from 133 countries. The event emphasized sustainability, alternative proteins, and digitalization in food processing. Anuga FoodTec and the German Association for Alternative Protein Sources (BALPro e.V.) extended their cooperation during this event. |

| December 2024 | Prinova Europe launches plant-based dairy replacement premixes : To meet growing demand for plant-based foods, Prinova Europe introduced a new range of premixes for dairy replacement products. |

| 2024 | Smart Packaging Innovation : Researchers developed a battery-free, stretchable, and autonomous smart packaging system. This innovation integrates a gas sensor for real-time food monitoring and controlled release of active compounds, extending the shelf-life of food products. |

| 2024 | Surge in E-commerce Sales : Sales of food premix ingredients are surging over e-commerce platforms, with the global food premix market projected to reach a value of USD 102.7 billion by 2034. |

| 2024 | Clean Label Trend : There is an increasing demand for clean label and organic premixes. Manufacturers are focusing on developing all-natural premixes containing whole-food based, organic, and minimally processed ingredients to meet evolving customer preferences. |

High Demand for Fortified and Functional Foods in Growing European Markets

Market Dynamics - European Food Premix Market The HDT segment is experiencing low growth due to rising consumer interest in health and wellness. This led you to be aware of better preventive healthcare and thus the launching of the increasing demand "source: vitamins, minerals, amino acids, and nucleotides" based nutrient products.

As a result, the increasing demand for functional foods and beverages with personalized premixes to address various health concerns like immune system health, bone health, digestion, and cognitive function has grown. And manufacturers are answering the call with nutrient blends designed for certain demographies and life stages.

After the pandemic era, where maintaining health proactively became part of the everyday life of the population, functional foods have emerged and been adopted with the UK, the Vis County of Germany and the Netherlands being at the forefront of this growth and adoption.

Focus on Premixes with Plant-Based and Clean Label Shifts

With the plant-based lifestyle gaining widespread popularity across Europe, we have seen tremendous growth in the demand for vegan and clean label food premixes. There is a growing consumer interest in foodstuffs reflecting a responsible ethical and environmental investment that is driving innovation for premix manufacturers using the right combination of botanical and plant-based micronutrients.

Another growing trend for clean labels is nudging brands to remove artificial additives, allergens and genetically modified ingredients from their premix formulations. Companies like DSM, SternVitamin and Prinova are working on developing premixes that overcome these progressive expectations by providing transparency and functionality without sacrificing nutritional value.

One of the prominent trends fueling the growth is the shift towards gluten-free food products across Europe, including plant-based dairy alternatives, meat substitutes, and fortified snacks, making plant-based premixes one of the hot growth segments in the European food premix market.

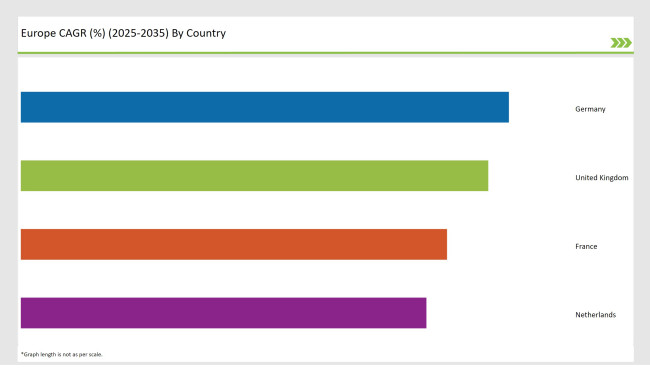

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Because of the growing demand for plant based and organic products, Germany remains one of the pioneering countries within the European algae omega market. From the demand for eco-friendly products to the concept of veganism, consumer behaviour has gone till this extent.

Leading manufacturers such as BASF and DSM have established a strong foothold in the country, focused on the proliferation of algae omega supplements across both retail and B2B channels. Moreover, German food safety, and supplement regulations have set up a necessary environment for algae omega to thrive.

The UK is yet another impressive market for algae omega in Europe, with one of the drivers pushing it forward being strong demand for vegan and plant-based health supplements. The U.K., for instance, is a pretty health-conscious consumer, and so has many switching over from fish oil - unsustainable, to say the least - to algae omega-3 oils, ethical.y.

Others such as Corbion target the U.K. algae omega, further up the plant-based supplement food chain. A further contribution to the market can be attributed to the increasing focus towards veganism and the rising public awareness about the benefits taking omega-3 fatty acids.

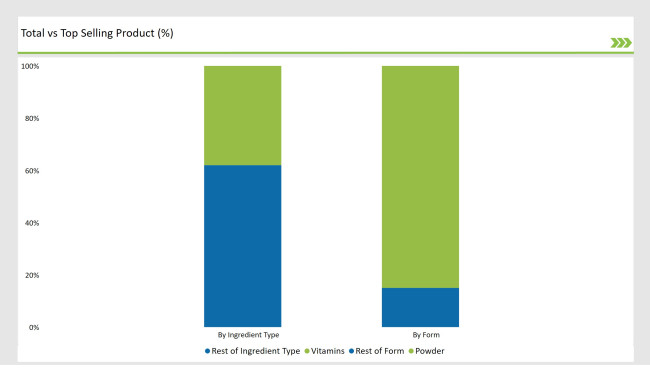

% share of Individual Categories by Form and Ingredient Type in 2025

The European food premix market is predominantly dominated by powdered premixes as they are compatible with most dry formulations along with being cost-effective but liquid formats are being increasingly used in functional beverages, dairy alternatives, and infant nutrition products. Liquid premixes are more easily incorporated into manufacturing processes and deliver micronutrients faster in select health applications, particularly those that involve clinical nutrition and infant formulas.

Collectively skin vitamins and minerals share over 60% of ingredient type of Europe in food premix formulations. This dominance highlights the constant demand for fortified foods as consumers increasingly look for products that promote immunity, energy, and overall wellness.

Demand for clean-label vitamin-mineral blends also are on the rise among manufacturers, given the recent trends toward plant-based, organic and allergen-free products. Companies such as DSM, Glanbia Nutritionals, and SternVitamin are investing in R&D to develop tailored micronutrient premix solutions to serve specific age groups and health goals, especially given the European market's highly regulated and health-focused consumer.

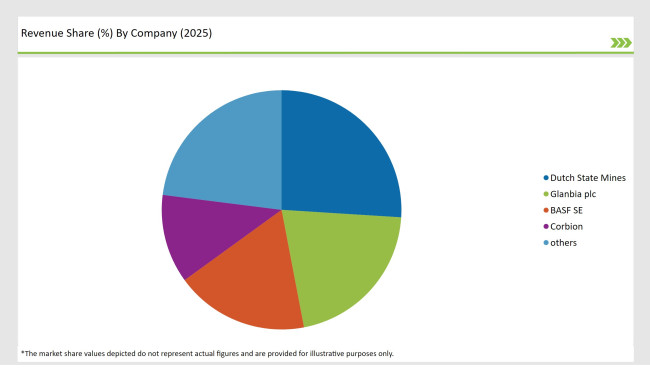

2025 Market share of Europe Food Premix Suppliers

Note: Above chart is indicative in nature

Market Consolidation in the European Food Premix Market Moderate Key companies operating in the global vitamin sector are primarily active in Europe and include Dutch State Mines (DSM), Glanbia plc, and BASF SE, which benefit from their advanced formulation capabilities, their high levels of R&D investment and their extensive European distribution networks.

Nearby are Corbion and SternVitamin which cater to health and wellness segments with specialized blends. In contractual manufacturing, Vitablend, Watson, and Hellay Australia Pvt fill niche as well as regional needs, providing customized solutions around clean label and local compliance needs.

As per Form, the industry has been categorized into Powder and Liquid.

As per Ingredient Type, the industry has been categorized into Vitamins, Minerals, Amino Acids, and Nucleotides.

As per End-Use Application, the industry has been categorized into Early Life Nutrition/Baby Food, Pharma OTC Drugs, Food & Beverages, and Dietary Supplements.

As per Function Type, the industry has been categorized into Bone Health, Immunity, Digestion, Vision Health, Energy, Weight Management, Heart Health, and Brain Health & Memory.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czechia, and Rest of Europe.

The Europe food premix industry is estimated at USD 712.6 Million in 2025.

The market is forecasted to reach USD 1,766.0 Million by 2035, growing at a CAGR of 9.5% from 2025 to 2035.

Key players include DSM-Firmenich, Glanbia plc, BASF SE, Corbion, Watson, SternVitamin, Vitablend, and Jubilant Life Sciences.

The powder form dominates due to its superior shelf life, ease of storage, and broad application range.

Main applications include early life nutrition, dietary supplements, OTC pharmaceuticals, and functional foods & beverages.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA