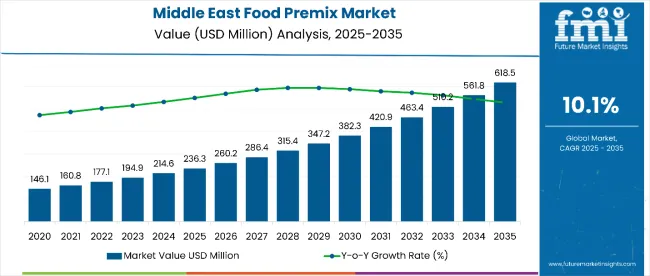

The Middle East food premix market is estimated to be valued at USD 236.3 million in 2025. It is projected to reach USD 618.5 million by 2035, registering a compound annual growth rate (CAGR) of 10.1% over the forecast period. The Middle East food premix market is projected to add an absolute dollar opportunity of USD 394.8 million over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 236.3 million |

| Forecast Value in (2035F) | USD 618.5 million |

| Forecast CAGR (2025 to 2035) | 10.1% |

This reflects a 2.74 times growth at a compound annual growth rate of 10.1%. The market's evolution is expected to be shaped by rising demand for fortified foods and functional nutrition products, particularly where micronutrient deficiency prevention and health-conscious consumption patterns are required.

By 2030, the market is likely to reach approximately USD 375.8 million, accounting for USD 148.7 million in incremental value over the first half of the decade. The remaining USD 246.1 million is expected during the second half, suggesting a moderately back-loaded growth pattern. Product substitution for conventional food ingredients and synthetic supplements is gaining traction due to food premixes' superior nutritional consistency and regulatory compliance benefits.

Companies such as DSM Nutritional Products and Glanbia Nutritionals are advancing their competitive positions through investment in customized blending technologies and halal-certified production systems. Health-focused procurement models and government fortification mandates are supporting expansion into bakery products, dairy fortification, and infant nutrition applications. Market performance will remain anchored in ingredient sourcing reliability, regulatory compliance standards, and nutritional efficacy benchmarks.

The Middle East food premix market holds approximately 0.4% of the global food premix market, driven by its strategic focus on addressing regional nutritional deficiencies and growing health consciousness among consumers. It accounts for around 15% of the Middle East functional foods market, supported by government initiatives promoting food fortification and increasing demand for preventive healthcare solutions.

The market contributes nearly 8% to the regional nutritional supplements industry, particularly for vitamin and mineral fortification in staple foods and infant nutrition products. It holds close to 12% of the food ingredients market in the Middle East, where premixes are used for dairy fortification, bakery enrichment, and beverage supplementation. The share in the nutraceuticals market reaches about 18%, reflecting its preference among manufacturers seeking standardized nutritional enhancement solutions.

The market is experiencing rapid transformation driven by rising awareness of micronutrient deficiencies and increasing prevalence of lifestyle-related health conditions. Advanced blending technologies using precise dosing systems and quality control measures have enhanced product consistency, nutritional stability, and regulatory compliance, making food premixes a preferred alternative to individual ingredient additions and post-manufacturing supplementation.

Manufacturers are introducing customized formulations and halal-certified products tailored for regional dietary preferences and religious requirements, expanding their role beyond basic fortification. Strategic partnerships between international premix suppliers and local food manufacturers have accelerated adoption in commercial food processing. Government mandates for food fortification have widened market acceptance and forced traditional food producers to adopt nutritional enhancement strategies.

The market is segmented by ingredient, form, application, function, and country. By ingredient, the market is segmented into vitamins, minerals, amino acids, nucleotides, and botanicals. Based on form, the market is divided into powder and liquid formats. Based on application, the market is classified into dietary supplements, food and beverages, pharmaceutical over-the-counter drugs, and early life nutrition products. By function, the market is divided into immunity, bone health, digestion, energy, weight management, heart health, vision health, and brain health and memory. Geographically, the market spans Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Israel, and the rest of the Middle East region.

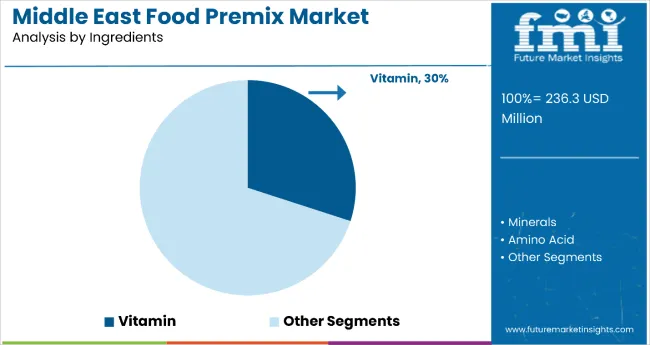

The vitamins segment holds a leading 30% share in the ingredient type category, reflecting their fundamental importance in addressing widespread vitamin deficiencies and supporting basic physiological functions across the Middle East population. Vitamins serve as essential components in food fortification programs and dietary supplementation, particularly for addressing deficiencies in vitamin D, vitamin B complex, and vitamin A that are prevalent in the region.

The segment benefits from increasing recognition of vitamin deficiency-related health issues and growing consumer demand for fortified foods and functional beverages. Government-mandated fortification programs for staple foods like flour, rice, and dairy products have established vitamins as primary ingredients in regional food premix formulations.

Manufacturers are focusing on developing stable vitamin formulations and specialized delivery systems to maintain potency during food processing and storage in the region's challenging climate conditions. As health awareness continues rising and fortification programs expand across Middle Eastern countries, the vitamins segment is expected to maintain its dominant position, supporting continued growth in preventive nutrition applications.

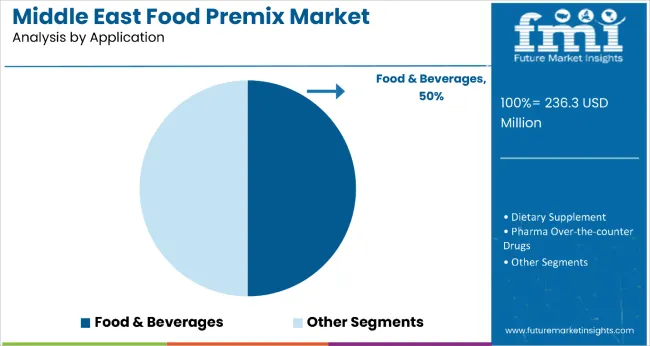

The food and beverages segment leads the Middle East food premix market by application, accounting for a dominant 50% market share in 2025. This reflects the widespread incorporation of fortified ingredients across mainstream food categories, including dairy, bakery, beverages, cereals, and snacks.

Rising demand for functional and clean-label products among health-conscious consumers is driving the uptake of nutrient-enriched food offerings. Food premixes offer processors a reliable method to meet regulatory and nutritional labeling requirements, while ensuring consistency in micronutrient delivery across production batches.

Government-mandated fortification initiatives, particularly in Saudi Arabia, the UAE, and Kuwait, have further cemented food and beverages as the primary channel for premix application. Staples such as wheat flour, milk, and edible oils are routinely enriched with vitamins and minerals to address regional micronutrient deficiencies, especially vitamin D, iron, and folic acid. Beverage manufacturers are also incorporating energy, immunity, and digestion-targeted premixes in flavored drinks, juices, and dairy-based formulations.

As Middle Eastern consumers increasingly seek out functional foods with specific health benefits, the food and beverages segment is expected to sustain its leading role. Product innovation, coupled with expanding retail and foodservice channels, continues to widen the scope of premix integration in diverse culinary formats across the region.

The Middle East's high prevalence of micronutrient deficiencies, combined with government initiatives promoting food fortification and increasing health awareness, makes food premixes an essential solution for improving population-level nutrition and addressing malnutrition challenges.

Growing consumer consciousness about preventive healthcare and functional foods is further propelling adoption, especially in infant nutrition and dietary supplements, where nutritional precision and consistency are prioritized. Government regulations mandating food fortification, along with innovations in customized blending and halal certification processes, are also enhancing market accessibility and consumer trust.

As urbanization accelerates alongside lifestyle changes and increasing disposable incomes, and health-conscious consumption patterns become more prevalent, the market outlook remains favorable. With manufacturers and consumers prioritizing nutritional adequacy, product consistency, and regulatory compliance, food premixes are well-positioned to expand across bakery, dairy, beverage, and pharmaceutical applications.

From 2025 to 2035, government fortification mandates were implemented across multiple Middle Eastern countries, improving nutritional standards and expanding premix adoption in staple food production. Automated blending systems and quality control technologies were introduced in food manufacturing facilities, enhancing production efficiency and reducing contamination risks.

These developments position fortification-ready solutions as critical components for manufacturers aiming to serve health-conscious consumers and comply with regulatory requirements efficiently.

Government Fortification Initiatives Drive Market Expansion

The rising prevalence of micronutrient deficiencies and malnutrition-related health conditions has been recognized as the primary catalyst for growth in the Middle East food premix market. In 2024, regional health authorities documented elevated rates of vitamin D, iron, and folate deficiencies across multiple countries, prompting the implementation of mandatory food fortification programs. By 2025, staple food manufacturers were required to incorporate specific vitamin and mineral combinations to address identified nutritional gaps in the population.

These developments demonstrate that public health priorities rather than consumer trends are driving systematic adoption of food premix solutions. Manufacturers providing compliant formulations with precise nutritional profiles and stability characteristics are well-positioned to capture sustained demand from food processors and government procurement programs.

Supply Chain Complexity and Ingredient Cost Volatility Restrict Market Growth

Growth faces constraints due to complex supply chain requirements and fluctuating costs for key raw materials, including vitamins and minerals. Ingredient sourcing from international suppliers can experience delays of 6 to 12 weeks due to import procedures and quality verification requirements, which can impact production scheduling and inventory management. Price volatility for essential vitamins and minerals can vary by 15% to 35% quarterly, affecting product pricing stability and margin predictability for premix manufacturers.

Regional distribution challenges in reaching smaller food processors add 8 to 15 days to delivery timelines across Gulf countries. Limited local manufacturing capacity for specialized ingredients restricts supply chain resilience and increases dependency on imports. These constraints make market expansion challenging despite strong regulatory support and growing demand for fortified food products.

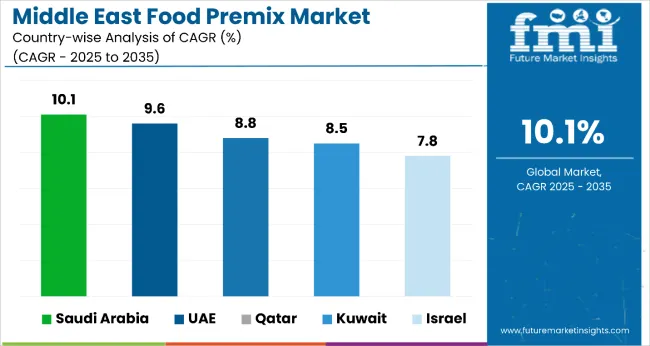

| Country | CAGR |

|---|---|

| Saudi Arabia | 10.1% |

| United Arab Emirates | 9.6% |

| Qatar | 8.8% |

| Kuwait | 8.5% |

| Israel | 7.8% |

In the Middle East food premix market, growth rates vary across countries, reflecting diverse national priorities and infrastructure capabilities. Saudi Arabia leads with the highest projected CAGR of 10.1% from 2025 to 2035, followed closely by the UAE at 9.6%, driven by government-backed fortification mandates. The UAE posts a strong 9.6% CAGR, benefiting from expatriate-targeted formulations and robust food service adoption.

Qatar follows at 8.5%, with a focus on institutional and sports nutrition. Israel records the slowest growth at 7.8%, attributed to its maturity in food processing and reliance on high-grade imports. Overall, Gulf nations outperform due to aggressive fortification and healthcare-linked programs.

The food premix market in Saudi Arabia is estimated to grow at a CAGR of 10.1% from 2025 to 2035, outperforming the regional average by 1.5%. The growth is linked to comprehensive vitamin D and iron fortification programs in flour, dairy products, and infant foods. Customized premix formulations are widely adopted in commercial bakeries and dairy processing facilities. Output has been expanded by government support for local food manufacturing and import substitution initiatives.

Fortified products are increasingly replacing conventional foods in retail distribution networks, with more than 70% of wheat flour production incorporating mandatory vitamin and mineral premixes catering to national nutritional guidelines. Local food processors have also increased adoption of halal-certified premixes, especially in traditional food categories and export-oriented products.

The demand for food premix in the UAE is projected to rise at a CAGR of 9.6% from 2025 to 2035, ahead of the regional average by 0.8%. Dubai and Abu Dhabi emirates have expanded premix adoption in hotel and restaurant supply chains and processed food manufacturing. Government-backed nutrition awareness campaigns are supporting premix integration in school feeding programs and healthcare institutions.

Food manufacturers have shifted toward imported premium premixes to serve diverse expatriate populations with varying nutritional requirements. Infant nutrition products are expanding rapidly, with specialized premix formulations gaining traction in pediatric healthcare applications. Export-oriented food processing remains strong, as most premium formulations target international quality standards. Import volumes for specialized premixes continue growing, especially for applications requiring specific nutrient profiles and cultural dietary compliance.

The sales of food premix in Qatar are anticipated to flourish at a CAGR of 8.8% from 2025 to 2035, exceeding the regional rate by 0.2%. Growth is centered on sports nutrition applications and institutional food service sectors, supporting major infrastructure projects and sporting events. Specialty premix formulations with performance enhancement properties are being specified for athlete nutrition and wellness programs.

Import volumes from European suppliers have increased, particularly for organic and natural ingredient formulations. Premium premix products with sustainability certifications are favored under environmental initiatives and green building requirements. Most adoption is driven by institutional buyers, with limited retail consumer awareness. Multi-nutrient formulations have gained share in healthcare facility food service and corporate catering applications.

The revenue from food premix in Kuwait is forecast to expand at a CAGR of 8.5% from 2025 to 2035, slightly above the regional average. Growth has been concentrated in diabetes management and elderly nutrition applications, reflecting demographic health priorities. Demand is shifting from general-purpose premixes toward specialized formulations compatible with traditional Middle Eastern cuisine preparation methods.

Therapeutic nutrition premixes and medical food applications lead in commercial adoption. Domestic distribution networks have strengthened through partnerships with regional healthcare providers and medical nutrition specialists. While international suppliers continue dominating, several Kuwaiti companies are developing localized premix formulations for traditional food applications. Government healthcare programs have improved adoption rates of specialized nutrition products in clinical and home care settings.

The food premix market in Israel is projected to expand at a CAGR of 7.8% from 2025 to 2035, trailing the Middle East regional average of 10.1% by 2.3%. Despite slower growth, the sector benefits from Israel’s highly advanced food processing ecosystem, strong regulatory alignment with international standards, and widespread adoption of fortified ingredients across clinical and wellness applications.

Food-grade premixes are increasingly incorporated in health-oriented dairy, cereals, and plant-based products targeting urban consumers with high nutritional awareness.

The pharmaceutical and dietary supplement segments remain pivotal, supported by robust R&D capabilities and widespread consumer acceptance of preventive nutrition. Domestic innovation is strengthened through collaborations between biotech startups and major food manufacturers, enabling high-precision premix formulations that comply with EU and USA pharmacopeial standards. However, limited raw material production and dependency on imports for high-grade ingredients slightly constrain growth relative to Gulf economies.

The market is moderately fragmented, featuring a mix of international nutrition companies, regional distributors, and specialized blending facilities with varying degrees of technical capabilities and market coverage. Lycored and DSM Nutritional Products lead the premium segment, supplying customized premix formulations for pharmaceutical applications and high-value food fortification programs. Their strength lies in technical expertise, regulatory compliance capabilities, and established relationships with major food manufacturers.

Barentz and Watson Inc. differentiates through regional distribution networks and localized technical support, addressing the growing demand for accessible premix solutions in smaller food processing operations and emerging market segments.

Established players such as Archer Daniels Midland and Glanbia focus on large-scale commercial applications and bulk supply arrangements, leveraging global supply chain capabilities and standardized formulation expertise for major food manufacturers and government procurement programs.

Regional companies including UFUK KIMYA and Vitamiks Gida provide specialized solutions for local market requirements, ensuring cultural dietary compliance and halal certification for traditional food applications.

Entry barriers remain moderate, driven by regulatory compliance requirements, technical formulation expertise, and the need for reliable supply chain management in challenging regional conditions. Competitiveness increasingly depends on formulation capabilities, quality assurance systems, and the ability to meet diverse cultural and regulatory requirements across multiple countries.

Key Developments in the Middle East Food Premix Market

| Item | Value |

|---|---|

| Quantitative Units | USD 236.3 Million |

| Ingredient Type | Vitamins, Minerals, Amino Acids, Nucleotides, and Botanicals |

| Form | Powder and Liquid |

| Application | Dietary Supplements, Food & Beverages, Pharma Over-the-counter Drugs, and Early Life Nutrition |

| Function | Immunity, Bone Health, Digestion, Energy, Weight Management, Heart Health, Vision Health, and Brain Health & Memory |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain, Oman, Israel, and the Rest of the Middle East |

| Key Companies Profiled | Lycored, B&H Biotechnology Co., Ltd, Barentz, Watson Inc., UFUK KIMYA ILAC SAN. TIC. LTD, Vitamiks Gida San. Ve. Ticaret Ltd., Fenchem, Archer Daniels Midland Company, Jubilant Life Science, Koninklijke DSM N.V., SternVitamin GMBH & Co., Prinova Group LLC, Hexagon Nutrition Pvt. Ltd, Farbest Brand, and Glanbia PLC |

| Additional Attributes | Dollar sales by ingredient type and application sector, growing usage in government fortification programs and dietary supplement manufacturing, stable demand in food processing and infant nutrition applications, innovations in customized blending and stability enhancement improve product consistency, regulatory compliance, and cultural dietary requirements |

The Middle East food premix market is estimated to be valued at USD 236.3 million in 2025.

The market size for the Middle East food premix market is projected to reach USD 618.5 million by 2035.

The Middle East food premix market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The vitamins account for a significant market share of 30% in 2025.

In terms of application, the food & beverages segment is expected to command a 50% market share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Food Emulsifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Grade Solvent Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Food Dietary Fibers Market Size and Share Forecast Outlook 2025 to 2035

Food Traceability Market Size and Share Forecast Outlook 2025 to 2035

Food Processor Market Size and Share Forecast Outlook 2025 to 2035

Food Flavor Enhancer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA