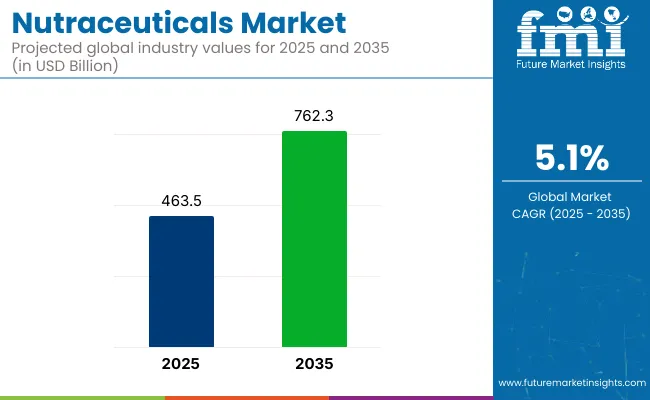

In 2025, the global nutraceuticals market size is assessed at USD 463.5 billion and is forecasted to witness robust growth, reaching USD 762.3 billion by 2035, reflecting a CAGR of 5.1%. The rising prevalence of lifestyle-related chronic conditions, including obesity and cardiovascular ailments, has pushed consumers to seek proactive health solutions.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 463.5 billion |

| Projected Market Value (2035F) | USD 762.3 billion |

| Value-based CAGR (2025 to 2035) | 5.1% |

Nutraceuticals, with their blend of nutritional and therapeutic benefits, have been increasingly integrated into daily consumption patterns, blurring the line between conventional foods and health-enhancing interventions.

The market’s expansion is underpinned by heightened health consciousness, a rapidly aging global population, and consumer preference for clean-label and personalized wellness products. Strong growth has been observed across functional foods and beverages enriched with bioactive ingredients such as probiotics, omega-3, plant-based proteins, and herbal extracts.

However, despite growing consumer demand, regulatory complexities and inconsistent global standards have presented restraints. At the same time, technological innovations in encapsulation, bioavailability enhancement, and AI-driven formulation have invigorated new product development. Key market participants have been responding with rapid portfolio diversification and positioning nutraceuticals as daily essentials rather than occasional supplements.

By 2035, demand for condition-specific supplements targeting immunity, cognition, metabolic health, and healthy aging is expected to intensify. Innovations in delivery formats such as gummies, powders, and fortified snacks are projected to enhance consumer compliance.

The convergence of food tech and pharma is anticipated to strengthen cross-industry collaborations and drive scientific validation, building stronger consumer trust. Functional foods are expected to remain the leading product category, while dietary supplements are forecasted to gain traction across preventive and therapeutic use cases. Growth will remain particularly strong in Asia-Pacific and North America, where urbanization, healthcare costs, and digital wellness ecosystems continue to shape purchasing behaviors.

In 2025, beauty-from-within nutraceuticals account for approximately 6.4% of the global market share. By 2035, this segment is expected to expand significantly, driven by innovations in collagen peptides, biotin blends, astaxanthin, and ceramide-based formulations. These ingestible beauty solutions are strategically positioned at the intersection of skincare and wellness, supported by growing scientific substantiation and cross-sector collaborations.

The segment’s momentum is reinforced by consumer demand for holistic skincare and healthy aging alternatives that go beyond topical applications. Regulatory clarity from agencies such as the European Food Safety Authority (EFSA) on health claims related to skin hydration and elasticity has improved market credibility, especially in European countries.

Brands like HUM Nutrition, Reserveage, and Shiseido’s INRYU have successfully positioned beauty supplements as daily-use, efficacy-backed routines. Consumer receptivity is highest among urban female demographics aged 25-45, especially in digitally enabled markets with strong e-commerce penetration.

High compliance rates, appealing formats like gummies and sachets, and influencer-driven awareness are further accelerating adoption. As transparency, traceability, and clinically supported claims become more central to purchasing decisions, this segment is expected to evolve into a core category within the broader nutraceuticals landscape.

Holding a 9.1% share in 2025, the clinical nutrition segment is expanding steadily in response to a growing burden of malnutrition, post-operative recovery needs, and chronic disease management. Positioned between food and pharmaceuticals, this segment leverages evidence-backed formulations designed for use in clinical and institutional settings.

Companies such as Abbott (Ensure, Glucerna) and Nestlé Health Science (Peptamen, Resource) continue to lead product development for specific therapeutic indications, including oncology nutrition, enteral feeding, and diabetes-specific formulas. This segment benefits from government-backed reimbursement programs and hospital procurement frameworks, particularly in North America and Europe.

Regulatory oversight by entities such as the USA FDA (under Medical Foods guidance) and EFSA ensures scientific rigor, aiding clinical adoption. Rising elderly populations and longer hospital stays have further expanded the use of tube feeds and disease-specific oral nutritional supplements (ONS).

Clinical nutrition’s strategic relevance is growing as healthcare systems globally emphasize outcome-driven care. Continued R&D in personalized amino acid profiles, high-protein modular components, and microbiome-supportive blends is expected to deepen integration into mainstream therapeutics by 2035.

Regulatory Compliance and Standardization

The international approval and labeling criteria for nutraceuticals are subjected to stringent regulations, which posits as a major challenge to the market. However, manufacturers face challenges expanding internationally due to varying regulatory requirements imposed by different governments.

Compliance with FYDA, EFSA, and other regulatory bodies regarding the safety, efficacy, and health claim of the product, adds complexity to product development. To adapt to these shifting regulatory landscapes, companies must spend countless hours and resources on research, testing and compliance strategies.

High Production Costs and Supply Chain Issues

The growing popularity of natural and organic nutraceutical ingredients create higher production costs and may disrupt the supply chain. It is financially and logistically difficult to source high-quality raw materials, practice sustainable agriculture, and ensure product consistency. Moreover, changing raw material prices, transportation costs, supply chain bottlenecks, etc. set the stage for affecting the profitability in the market. To deal with them companies need to create optimal sourcing logic, accept technology innovation, and build low cost supply chains.

Rising Health Awareness and Preventive Healthcare Trends

The demand for nutraceuticals is being driven by increased consumer awareness about health and wellness. The growing emphasis on preventive healthcare, combined with many incidences of lifestyle-related diseases, is driving consumers to initiate functional foods and dietary supplements.

The growing elderly population will increase the demand surrounding nutraceutical supplements addressing joint support and health, immune function and health, cognitive health, and cardiovascular health. The growing demand for customized dietary solutions will drive growth for companies investing in research and innovation to deliver personalized nutrition products and services.

Expansion of E-Commerce and Direct-to-Consumer Sales

The emergence of e-commerce platforms and the digital revolution spur lucrative prospects for the nutraceuticals market. The online retailing sector is thriving because of the convenience, greater product availability, and comprehensive information a consumer gets through online purchasing.

Membership-based nutraceutical/microbiome approaches and direct-to-consumer (DTC) business models are becoming more common. Organizations that adopt digital marketing channels, AI-powered consumer insights, and frictionless online purchasing experience will boost their market presence and consumer interaction.

Driven by rising health awareness as well as demand for functional foods, the United States accounts for a large portion of the global nutraceuticals market. Appropriate diet means consumers are looking for dietary supplements of probiotics and fortified foods that care for general wellness.

The market is also expanding due to an increasing aging population and rising prevalence of chronic diseases. Industry drivers include FDA regulatory approvals, as well as product innovation in plant-based and organic nutraceuticals. This market growth is hampered by limited accessibility, which is being improved by e-commerce platforms and direct-to-consumer sales channels.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

The UK nutraceuticals market has been growing progressively, ultimately propelled by the rising intake of functional foods and dietary supplements. Consumers are increasingly focused on health; consequently, products high in vitamins, minerals, and antioxidants are in greater demand.

Personalized nutrition is also on the rise, with companies providing individualized supplement regimens. The trend of online retail and pharmacy sales shows no sign of slowing down, as does the rise of sustainable and eco-friendly packaging solutions. In addition, regulatory frameworks like EFSA guidelines ensure product quality and safety, bolstering market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.0% |

The EU nutraceuticals market area is growing as consumers shift towards preventive health. Dietary supplements, functional foods and beverages enriched with omega-3, probiotics, and fiber are also driving demand for the market in countries such as Germany, France and Italy.

Concerns about sustainability have fueled a growing interest in plant-based and clean-label nutraceuticals. Distribution channels are dominated by online sales and also retail pharmacies. Government programs encouraging healthy eating and strict labeling regulations are shaping market trends, ensuring continuous innovation in the sector.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.2% |

With high consumer awareness and governmental support for functional food regulation, Japan's nutraceuticals market is highly developed. There is an increasing demand in energy-boosting supplements, anti-aging formulations, and gut health products.

Conventional components, including green tea extracts, fermented foods, and ocean-derived supplements, account for the greatest share of the industry. Beauty-from-within nutraceuticals, like collagen-based drinks, are also enjoying a boom. The increasing elderly demographic also fuels the demand for cognitive and joint health supplements. Market growth is driven by the presence of major domestic brands and robust research investments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

The nutraceuticals market in South Korea is booming as consumers increasingly choose functional and fortified foods. The popularity of K-beauty and wellness trends has led to strong demand for skin-enhancing and anti-aging supplements.

Probiotics and fermented foods continue to hold ground in the market, a spotlight on the country’s deep-rooted heritage in gut health solutions. Buying patterns are being molded by e-commerce platforms and health-conscious younger consumers. Also, advancements in technology such as application of nano-encapsulation in nutraceutical formulations to improve absorption, leading to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

The nutraceuticals market is expanding at a fast pace following the rising consumer demand for health-beneficial dietary supplements, functional foods, as well as beverage products. Formulations that are innovative, from plant-derived ingredients to personalized nutrition solutions, are witnessing investments from companies looking to address consumer demand.

Some of the factors limiting the market are advancements in biotechnology and increasing regulation compliance to safety standards, and rising awareness about preventive health care. The growth is driven by the rising prevalence of lifestyle disorders such as diabetes, hypertension, obesity, alongside increasing population of old people and growing disposable incomes. Research-backed formulations, sustainable sourcing, and digital platforms for direct-to-consumer sales have become almost central to manufacturers’ strategies, shoring up their positions in the global marketplace.

The overall market size for nutraceuticals market was USD 463.5 billion in 2025.

The nutraceuticals market expected to reach USD 762.3 billion in 2035.

Rising health awareness, increasing chronic diseases, growing demand for functional foods, expanding aging population, and advancements in personalized nutrition will drive market demand.

The top 5 countries which drives the development of nutraceuticals market are USA, UK, Europe Union, Japan and South Korea.

Expanding sales channels driving market growth to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Halal Nutraceuticals and Vaccines Market Growth - Trends & Forecast 2025 to 2035

Herbal Nutraceuticals Market Size and Share Forecast Outlook 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA