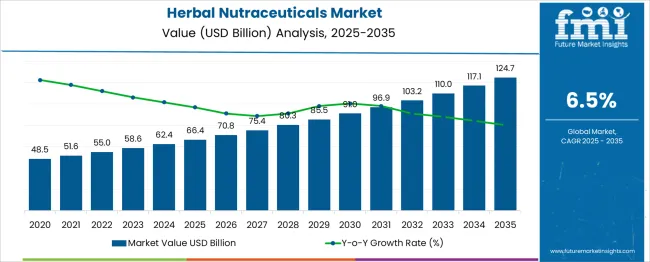

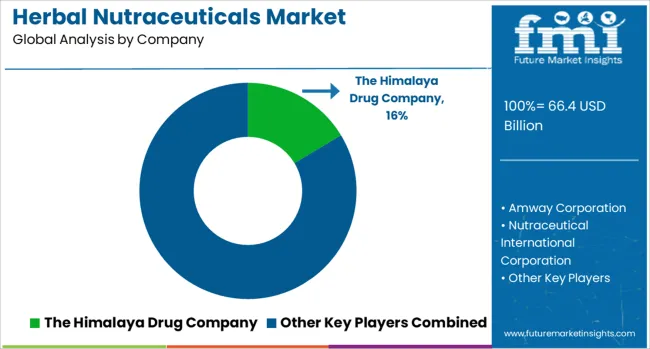

The Herbal Nutraceuticals Market is estimated to be valued at USD 66.4 billion in 2025 and is projected to reach USD 124.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Herbal Nutraceuticals Market Estimated Value in (2025 E) | USD 66.4 billion |

| Herbal Nutraceuticals Market Forecast Value in (2035 F) | USD 124.7 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

Rising awareness of the long-term side effects of synthetic pharmaceuticals, coupled with growing trust in traditional remedies, has led to expanded consumption of herbal supplements.

Changing lifestyles, aging populations, and a surge in chronic health conditions have further intensified demand for natural alternatives that support immunity, digestion, mental health, and metabolic function. The market is also benefiting from increased retail penetration, digital health platforms, and government support for herbal healthcare systems in several countries.

The herbal nutraceuticals market is expected to maintain a strong growth trajectory, supported by innovations in formulation, clean-label positioning, and strategic product launches targeting specific health concerns. The alignment of herbal ingredients with sustainable and holistic wellness trends ensures continued consumer engagement across both developed and emerging markets.

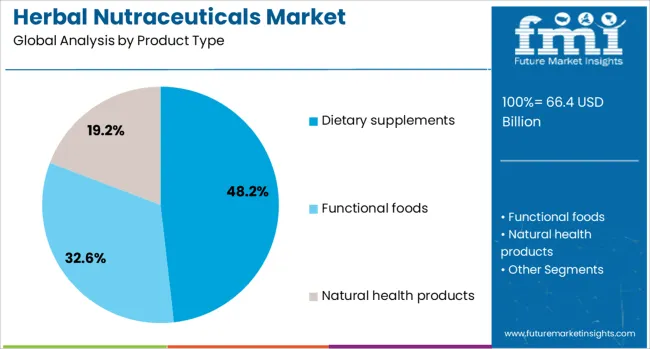

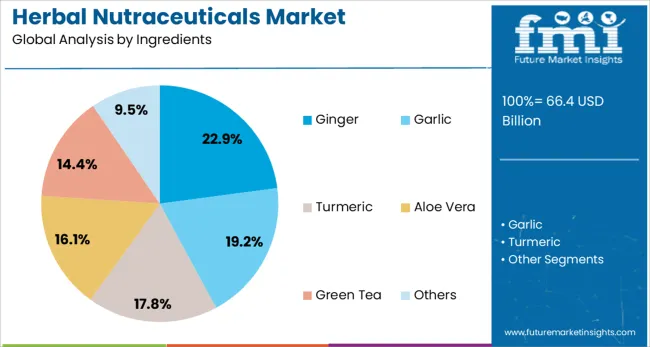

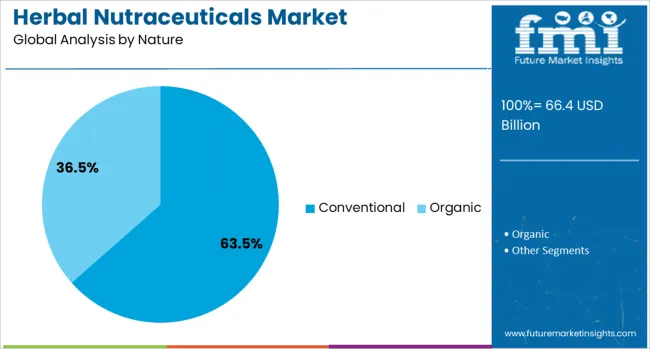

Product type, ingredients, nature, form, sales channel, and geographic regions segment the herbal nutraceuticals market. The herbal nutraceuticals market is divided by product type into Dietary supplements, Functional foods, and Natural health products. The herbal nutraceuticals market is classified into Ginger, Garlic, Turmeric, Aloe Vera, Green Tea, and Others. Based on the nature of the herbal nutraceuticals market, it is segmented into Conventional and Organic. The herbal nutraceuticals market is segmented by form into Powder, Liquid, Capsules & Tablets, and Others. The sales channel of the herbal nutraceuticals market is segmented into Pharmacy, Online store, Supermarket/hypermarket, and Others. Regionally, the herbal nutraceuticals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dietary supplements segment commands the largest share of 48.2% in the product type category, highlighting its dominant role in the herbal nutraceuticals market. These supplements are widely accepted as convenient, non-prescription solutions for enhancing overall health and addressing specific deficiencies.

The segment’s growth has been bolstered by consumer interest in immune-boosting, anti-inflammatory, and energy-enhancing herbal formulations, especially in the wake of heightened health consciousness post-pandemic. Product availability across pharmacies, health stores, and e-commerce platforms has further strengthened its market position.

Companies are actively expanding their herbal supplement lines with targeted offerings for cognitive support, joint health, and digestive well-being. Transparent labeling, third-party testing, and the use of ethically sourced botanical ingredients have enhanced consumer trust and repeat purchases. With increased emphasis on long-term wellness and preventive care, the dietary supplements segment is expected to remain a key revenue driver in the herbal nutraceuticals industry.

The ginger ingredient segment leads with a 22.9% market share, underscoring its established reputation as a multifunctional herb known for its anti-inflammatory, digestive, and antioxidant properties. Ginger's strong presence in both traditional medicine and modern wellness routines has contributed to its widespread use in herbal nutraceutical formulations.

Demand has surged for ginger-based supplements addressing nausea, inflammation, and metabolic health, supported by scientific validation and positive consumer experiences. Additionally, the ingredient’s compatibility with other botanicals makes it a versatile component in combination products targeting multi-dimensional health benefits.

Manufacturers are leveraging its popularity by offering ginger in diverse delivery formats such as capsules, powders, and teas. The segment continues to gain ground as clean-label consumers seek recognizable, functional ingredients with proven efficacy. As the market evolves, ginger’s therapeutic value and natural origin are expected to support its sustained leadership within the herbal ingredient space.

The conventional segment holds a leading 63.5% share in the nature category, reflecting its accessibility, cost-effectiveness, and well-established supply chain. While organic products are gaining visibility, the majority of consumers still opt for conventionally sourced herbal nutraceuticals due to affordability and widespread availability.

Conventional production methods allow for larger batch processing and easier market scalability, making it the preferred choice for manufacturers targeting mass markets. Moreover, advancements in cultivation practices and quality assurance protocols have helped improve the consistency and safety of conventional herbal products.

Retailers and distributors continue to stock conventional formulations extensively across physical and online channels, contributing to strong segment performance. As long as consumer trust in product quality remains intact, the conventional segment is likely to maintain dominance, especially in price-sensitive regions and among first-time buyers entering the herbal nutraceuticals market

Consumer demand for herbal nutraceuticals is rising due to interest in plant-based formulations offering health benefits like immunity and digestion support. Regulatory compliance and clinical validation have reinforced trust, driving market growth through quality assurance and evidence-backed formulations.

Demand for herbal nutraceuticals has been observed to increase as consumers prefer formulations derived from botanicals and traditional herbs. Functional benefits linked with immunity enhancement, digestive health, and stress relief have driven the acceptance of these products across dietary supplements and fortified foods. Brands have concentrated on incorporating standardized extracts, adaptogenic herbs, and polyphenol-rich ingredients in capsules, powders, and liquid formats. The appeal of clean-label formulations with transparent sourcing is seen as a critical factor in purchasing decisions. Distribution networks have expanded across e-commerce, pharmacies, and specialty health stores to capture growing interest in herbal-based dietary regimes.

Regulatory authorities have tightened guidelines on botanical nutraceutical formulations to ensure purity, efficacy, and compliance with safety norms. Companies have responded by investing in clinical trials and standardized extraction processes to substantiate health claims and meet labeling requirements. The introduction of global quality certifications has strengthened consumer trust, supporting market penetration in developed and emerging economies. Partnerships with research institutions for bioavailability studies and formulation stability are seen as strategic measures to secure credibility in competitive landscapes. This emphasis on evidence-backed product development has positioned herbal nutraceuticals as a prominent category in preventive health solutions.

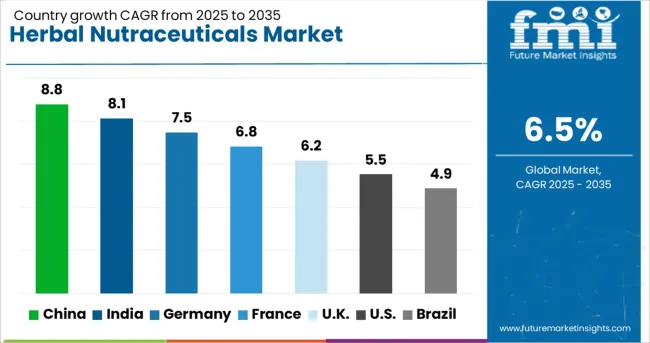

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The herbal nutraceuticals industry, projected to expand at a global CAGR of 6.5% from 2025 to 2035, is demonstrating diverse growth trends across major economies. China is recording the highest momentum with an 8.8% CAGR, supported by large-scale herbal cultivation and strong domestic consumption, making it a dominant supplier of raw botanical ingredients. India is following at 8.1%, driven by traditional Ayurveda-based formulations and rising exports of plant-derived supplements to global markets. Germany shows steady expansion at 7.5%, underpinned by its robust regulatory framework and consumer inclination toward clinically validated herbal solutions. The United Kingdom is experiencing moderate progress with a 6.2% CAGR, fueled by e-commerce adoption and growing interest in herbal wellness. The United States is reporting 5.5%, where growth is anchored by functional nutrition brands targeting preventive health. High-growth potential remains centered in Asia, while developed OECD nations maintain consistent demand for certified and science-backed formulations.

The United Kingdom is projected to grow at a 6.2% CAGR, driven by increasing consumer preference for plant-based supplements and the rapid expansion of e-commerce channels. Demand for herbal blends targeting sleep, stress relief, and gut health is increasing within premium wellness categories. Nutraceutical brands are leveraging influencer-led marketing campaigns and subscription delivery services to build strong consumer engagement. Post-Brexit regulatory adjustments create opportunities for local manufacturers to streamline supply chains and strengthen domestic sourcing. Import reliance for raw herbs remains significant, prompting innovation in vertical farming to secure quality and traceability. Digital-first sales models continue to dominate in urban regions.

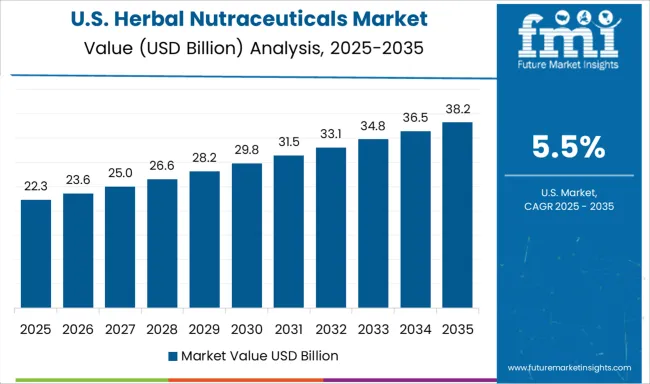

The United States is forecast to grow at a 5.5% CAGR, driven by increased adoption of functional nutrition and plant-based wellness solutions. Herbal nutraceuticals targeting immunity, cognitive health, and anti-inflammatory benefits remain in high demand. Leading brands integrate adaptogenic herbs like ashwagandha and ginseng into capsule, powder, and RTD beverage formats. Rising consumer preference for clean-label, non-GMO, and clinically proven formulations supports premiumization. Investment in scientific research enhances credibility, while collaborations with fitness and telehealth platforms improve distribution. Direct-to-consumer models, supported by subscription offerings, are key growth accelerators, especially among health-conscious millennials and Gen Z consumers.

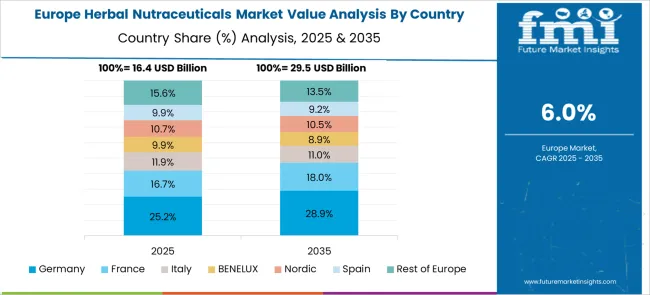

Germany is forecast to grow at a 7.5% CAGR, supported by its advanced regulatory ecosystem and preference for clinically substantiated herbal products. Consumers prioritize safety, traceability, and EU-compliant formulations, driving demand for high-quality botanicals like ginkgo, echinacea, and valerian root. Local brands integrate herbal extracts into functional beverages, gummies, and dietary supplements for convenience-driven consumption. Regulatory approval processes and stringent labeling norms strengthen consumer confidence and enable premium pricing. Pharma-nutra partnerships are accelerating development of botanical-based preventive health solutions. Germany’s export of high-standard herbal nutraceuticals to neighboring EU countries positions it as a benchmark market for safety and innovation.

China recorded a CAGR of nearly 7.1% during 2020-2024, advancing to 8.8% for 2025–2035 as TCM-inspired nutraceuticals gained traction in preventive healthcare. Widespread adoption was driven by government-backed wellness initiatives promoting herbal-based supplements through public health channels. Local manufacturing hubs strengthened capacity in Jiangsu and Zhejiang, ensuring scalable exports. E-commerce platforms and health apps became vital distribution points for younger demographics seeking functional herbal blends for stress relief and immunity.

India is expected to grow at a 8.1% CAGR, supported by strong demand for Ayurveda-inspired nutraceuticals and increasing export activity. Traditional herbs such as ashwagandha, tulsi, and giloy dominate formulations targeting immunity, stress management, and metabolic health. Government initiatives like AYUSH and subsidies for herbal farming promote supply chain expansion. Nutraceutical brands are focusing on clinically validated claims to enhance global acceptance. Growth in online wellness retail and subscription-based delivery models accelerates penetration in Tier II and Tier III markets. Export demand from North America and Europe for herbal extracts and standardized formulations continues to strengthen India’s position in global trade.

In the herbal nutraceutical category, top players are prioritizing clinically validated plant-based formulations and standardized extracts to cater to rising consumer interest in preventive wellness. Companies such as The Himalaya Drug Company, Amway Corporation, and Nutraceutical International Corporation are investing in formulations that combine traditional herbal ingredients with modern dosage forms like capsules, powders, and liquid blends. Their strategies emphasize transparency in sourcing, clean-label claims, and evidence-backed health benefits. Specialized firms like Bio Botanica, Inc., Oregon's Wild Harvest, and Pure Encapsulations, LLC are leveraging concentrated botanical extracts for digestive, immune, and stress management applications. Nature's Bounty and NOW Foods dominate retail and e-commerce channels through extensive herbal supplement portfolios. Emerging players such as Sidled India Pvt Ltd, Herbochem, Gaia Herbs Farm, and Nutramarks, Inc. are expanding production and targeting export markets, positioning themselves as competitive alternatives in global nutraceutical supply chains.

| Item | Value |

|---|---|

| Quantitative Units | USD 66.4 Billion |

| Product Type | Dietary supplements, Functional foods, and Natural health products |

| Ingredients | Ginger, Garlic, Turmeric, Aloe Vera, Green Tea, and Others |

| Nature | Conventional and Organic |

| Form | Powder, Liquid, Capsules & Tablets, and Others |

| Sales Channel | Pharmacy, Online store, Supermarket/hypermarket, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Himalaya Drug Company, Amway Corporation, Nutraceutical International Corporation, Bio Botanica, Inc., Oregon's Wild Harvest, Pure Encapsulations, LLC, Nature's Bounty, Sidled India Pvt Ltd, Herbochem, Gaia Herbs Farm, NOW Foods, and Nutramarks, Inc. |

| Additional Attributes | Dollar sales, share by product type and region, consumer preference for botanical blends, regulatory compliance trends, raw material sourcing, distribution channel growth, clinical validation impact, and competitive strategies shaping global demand. |

The global herbal nutraceuticals market is estimated to be valued at USD 66.4 billion in 2025.

The market size for the herbal nutraceuticals market is projected to reach USD 124.7 billion by 2035.

The herbal nutraceuticals market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in herbal nutraceuticals market are dietary supplements, functional foods and natural health products.

In terms of ingredients, ginger segment to command 22.9% share in the herbal nutraceuticals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Herbal Beauty Product Market Size and Share Forecast Outlook 2025 to 2035

Herbal Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Herbal Personal Care Products Market Size and Share Forecast Outlook 2025 to 2035

Herbal Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Herbal Tea Market Analysis by Raw Material Type, Product Type, Flavor Type, Packaging Type, and Region Through 2035

Herbal Fragrance Ingredients Market Analysis by Application, Ingredients, and Region Through 2035

Pet Herbal Supplements Market Size and Share Forecast Outlook 2025 to 2035

Europe & Asia Pacific Herbal Beauty Products Market Trends – Growth & Forecast 2016-2026

Nutraceuticals Market Size, Growth, and Forecast for 2025 to 2035

Halal Nutraceuticals and Vaccines Market Growth - Trends & Forecast 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA