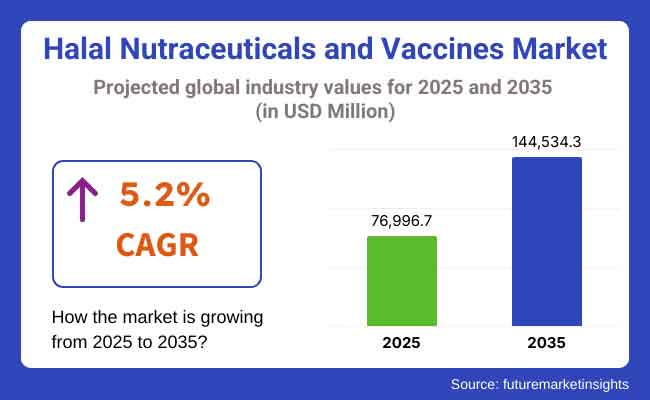

The halal nutraceuticals and vaccines market is expected to reach approximately USD 76,996.7 million in 2025 and expand to around USD 144,534.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The halal nutraceuticals and vaccines market is booming tremendously with the increasing global population of Muslims and hence its demand for Shariah-compliant health products. Nutraceuticals (functional foods, dietary supplements, and herbal products) are widely accepted products because of their health benefits and compliance to halalness. The halal vaccine market is also growing, with pharmaceutical companies and governments developing vaccines that comply with Islamic regulations.

Market expansion is being driven by factors such as enhanced consumer awareness, biotechnological advancements, and government policies that support growth. To ensure products conform to halal standards, industry leaders are investing in research and certification procedures while maintaining product safety and efficacy.

These are regions with a significant Muslim population, driving the market's expansion in these areas, particularly in the Asia-Pacific and the Middle East. The halal nutraceuticals and vaccines market is expected to experience growth in demand for ethical and religiously acceptable healthcare products over the upcoming years.

The yearly scope of the Halal Nutraceuticals and Vaccines Market between 2020 and 2024 was forecasted to be between the years when halals products were more and more observed by consumers from all over the world, ignited the emergence of the halals products along with the awareness of healthiness. The COVID-19 outbreak in 2020 ignited the interest in immune-boosting supplements, which consequently converted into halal vitamins, probiotics and herbal supplements selling at an unprecedented rate.

Governments and drug manufacturers responded by investing in halal-certified vaccines, particularly in Muslim countries. Malaysia, Indonesia, UAE, and others established halal certification frameworks that made compliance compulsory for market players.

Multinationals entered the halal sector in 2021 to 2023 with growth in product innovation. Up increased access, as well, with digital health platforms and online stores." By 2024, the market would be mature with harmonized halal regulations and increasing consumer trust. The introduction of ethical, organic and plant-based nutraceuticals also contributed to this trend, further validating the capability of halal healthcare solutions to expand and gain acceptance across the world.

The halal nutraceuticals and vaccines market in North America grew due to increased consumer awareness of halal-compatible products, an increase in diaspora demand, and the ethical branding of halal products. The multicultural nature of the region, with an emerging Muslim consumer base, fueled demand for certified halal health products. Unlike Asia and the Middle East, where laws are stringent, the United States and Canada rely on private halal certification agencies to sanction nutraceuticals and supplements.

The increasing demand for clean-label, non-GMO, and organic products among vegan and plant-based consumers also fueled demand for halal nutraceuticals. The demand for halal vaccines in the pharmaceutical industry was initially small but was increasing, particularly for export to Middle Eastern and Southeast Asian markets.

Independent start-ups, offering new halal herbal supplements, further contributed to the market's growth. As of 2024, the North American halal health market was well established, demonstrating momentum through direct-to-consumer marketing, online sales, and targeted branding directed at ethical consumers.

Regulatory compliance, halal tourism and government support were major contributors to the European halal nutraceuticals and vaccines market. Halal standards were included in the national food and pharmaceutical policy of European nations such as France, Germany, and the UK, unlike North America, where certification was driven by private firms. This led to greater market formalization, attracting investment from multinational corporations.

One important growth catalyst was the emergence of halal tourism, with destinations such as Spain and the UK seeing a demand for halal-certified wellness products by Muslim holidaymakers. Moreover, government-supported research programmes in halal pharmaceuticals promoted Shariah-compliant vaccines.

An increasing demand for probiotic-based nutraceuticals and sports nutrition supplements was also observed, which has been driven by the European population, particularly those involved in fitness promotion. From 2024 onward, the market shifted from merely serving Muslims to attracting a wider audience in pursuit of ethical, natural, and transparent health solutions. Hence, Europe became the lead exporter of halal nutraceuticals.

Asia was the largest contributor to the halal nutraceuticals and vaccines market, driven by government regulations, advancements in technology and a growing domestic consumer market. In contrast to Europe and North America, where halal compliance is optional, Malaysia and Indonesia require nutraceuticals to obtain halal certification, contributing to the rapid formalization of the market. As a result, Asia is the global leader in halal health products, boasting robust regulatory frameworks and standards.

Biotechnology and Islamic finance were one force that promoted the halal vaccine industry. China and South Korea also developed halal-certified pharmaceutical programs with an eye toward export opportunities in the Middle East and Africa.

Similarly, the growing popularity of Ayurvedic traditional herbal supplements in countries such as India and Indonesia served as the driving force for innovations in producing Ayurveda-based halal nutraceuticals. By 2024, not only would Asia have bolstered its domestic market, but it would also have become the leading exporter of halal-certified pharmaceuticals, powerfully transforming the landscape of biotech-led halal health solutions.

Challenges

Regulatory Inconsistencies and Certification Barriers in Halal Nutraceuticals and Vaccines

Regulatory differences by region pose a major challenge to the global expansion of halal nutraceuticals and vaccines. Halal health products are similar to regular pharmaceuticals, but they must comply with Shariah-based certification in addition to the standard requirements for medicines, which are usually country-based. Although countries such as Malaysia and Indonesia boast comprehensive halal regulatory regimes, other regions such as North America and Europe are plagued by fragmented halal certification schemes, resulting in ambiguity and burdensome compliance for enterprises.

Moreover, the lack of mutual recognition of halal accreditations between various markets confines global trade, which leads to higher costs and time involved in getting multiple certifications. International regulations make it extremely difficult for small and mid-sized manufacturers to enter the global market.

Banning or preventing the trading of nutraceuticals and vaccines that are halal definitely affects the halal industry in its entirety as there is currently no harmonized global standard for halal nutraceuticals and vaccines causing companies to incur higher operating costs, longer time to gather approvals from all regulations wherever they go and the need to invest large amount of capital into market expansion ultimately causing the industry not to reach the full potential global growth.

Opportunities

Expansion of Halal-Certified Biotech and Personalized Nutrition

The increased demand from consumers for personalized health solutions, combined with the rapid growth of biotechnology, is a key factor driving the expansion of halal nutraceuticals and vaccines. There is growing demand for halal-certified supplements to support individual health conditions, dietary needs, and religious beliefs as the world increasingly adopts personalized nutrition plans based on genetic profiling and other lifestyle factors. Those embracing science-based innovations that focus on human and planetary needs, including personalized halal probiotics and other functional foods, are outpacing their rivals.

Furthermore, growing investments in halal-certified biopharmaceuticals pave the way for the evolution of vaccines that comply with Islamic values. Research on gelatin-free and ethically sourced vaccines is being more readily accepted, especially in Muslim-majority countries.

Building partnerships with halal certification agencies for businesses operating in the biotech sector will enhance credibility and expedite market penetration. Companies providing scientifically substantiated, and halal-compliant health solutions will be adequately positioned to leverage an emerging global market driven by health conscious and ethically driven consumers.

The halal nutraceuticals and vaccines market experienced significant growth from 2020 to 2024, driven by increasing health consciousness, improved regulations and standards, and rising demand for Shariah-compliant health products. The pandemic accelerated interest in immune-boosting supplements, and governments in Muslim-majority countries strengthened halal certification frameworks. The expansion of e-commerce and improved global trade partnerships also contributed to the increase in market penetration.

The Future of the Industry: Moving forward, the industry will be propelled by innovations in biotechnology, AI-driven personalized health solutions, and new approaches to ethical vaccine development. Nutrigenomics will lead to more personalized halal supplements, while blockchain tracking systems can greatly increase supply chain visibility for halal certifications.

Halal nutraceuticals and vaccines will appeal to both Muslim and non-Muslim consumers as clean-label and ethical products become a market imperative. The next stage of market growth will be fueled by heightened investments into R&D, along with advancements and innovations in plant-based and fermentation-based halal supplements.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Guidelines were implemented to ensure the safety and efficacy of herbal medicinal products which regulated the protocols and usage |

| Technological Advancements | New extraction and formulation techniques enhance product efficacy and shelf life. |

| Consumer Demand | Consumers and health care providers demand natural and plant-based remedies: as herbal medicinal products are increasingly preferred by consumers, their patient acceptance among health care providers can lead to higher demand for herbal medicinal products. |

| Market Growth Drivers | Increasing prevalence of chronic diseases, advancements in herbal product development, and a trend toward natural and preventive healthcare approaches. |

| Sustainability | Changing manufacturing processes to make them greener and products more sustainable. |

| Supply Chain Dynamics | Relies on specialized suppliers for high-quality raw materials, taking local actions to prevent supply chain issues seen in global contexts |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Continuous monitoring and potential adjustments of regulations to balance consumer safety with technological innovation, alongside efforts to harmonize global standards for herbal products to facilitate international trade. |

| Technological Advancements | Next-gen products: Focus on developing next-gen products that leverage digital technologies, like AI-driven personalized recommendations and blockchain for supply chain clarity, to drive consumer trust and engagement |

| Consumer Demand | Increasing adoption of herbal products among active and reclusive use consumer groups in domestic and foreign countries, and the thrust of improved technologies for providing personalized and preventive healthcare solutions focused on overall well-being |

| Market Growth Drivers | Emerging markets continued to expand their product offerings, with rising investments in research and development, as well as continuous technological innovations that enhance product efficacy and ultimately lead to increased consumer satisfaction. A worldwide focus on sustainable and ethical consumption also emerged. |

| Sustainability | The use of recyclable materials, energy-efficient stages in manufacturing and distribution, as well as the shaping of global manufacturing and distribution standards, will all help to protect the environment while also lowering the carbon footprint of the herbal medicinal products. |

| Supply Chain Dynamics | Increased local cultivation and manufacturing capabilities, enabled by technology and regulation, aside from efforts through public-private partnerships, not only ensure faster growth but also provide protection against imports, while maintaining a secure and agile supply chain to meet emerging consumer demands for herbal products. |

Market Outlook

The United States herbal medicinal products market has experienced significant growth in recent years, driven by increasing consumer awareness of natural and plant-based remedies, particularly for stress relief, immune support, and digestive health. Although herbal products are regulated as dietary supplements instead of drugs, the interest in scientifically validated, clean-label items is growing.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.8% |

Market Outlook

The market for herbal medicinal products in India is substantial and expanding, driven by the country’s deep-seated Ayurvedic heritage, its formidable export potential and government-supported efforts to promote natural medicine. The government is a major supplier of herbal ingredients and finished products globally, and domestic use remains a growing trend among the urban and rural populations.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 7.0% |

Market Outlook

With its deep-rooted tradition in traditional Chinese medicine (TCM) and the Chinese government's strong integration of TCM into its mainstream healthcare, China boasts a thriving herbal medicinal products market. The market includes over-the-counter products, prescription herbal drugs, and functional foods. China is also working on modernizing herbal formulas and expanding overseas.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 7.5% |

Market Outlook

Germany is one of the most developed and regulated markets for herbal medicinal products in the world. This country has deep historical roots in phytotherapy, and herbal medicines are recognized as official pharmaceuticals, reimbursed by public health insurance. Plant-based medicines for treating everyday ailments, such as colds, digestive issues, or conditions caused by stress, enjoy high trust among German consumers.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 6.5% |

Market Outlook

With high biodiversity, cultural use of traditional herbal medicine, and an increase in phytotherapy acceptance by mainstream health care, the market of Brazil’s herbal medicinal products is rapidly developing. Government regulation leans toward support of formalization for herbal medicines, and domestic companies are working to develop products that utilize native botanicals and Amazonian varieties.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.3% |

Dietary Supplements Leading the Halal Nutraceuticals Market Due to Health Awareness and Lifestyle Changes

Balanced lifestyle changes and increased health awareness are boosting the demand for halal dietary supplements. Dietary supplements capture the major application segment, as they are an ideal method for disease prevention. With growing health concerns and preventive healthcare trends among consumers, the halal nutraceuticals market is expected to grow significantly in the coming years. The explosion of vegan, organic and plant-based supplements has also helped cement demand, as they meet halal and clean-label trends.

The post-pandemic period accelerated the adoption of vitamins, probiotics, and herbal supplements, as the population sought natural immunity boosters. Furthermore, the aging population and increasing disposable incomes in Malaysia, Indonesia, and the UAE have contributed to demand for halal-certified dietary supplements to address particular health conditions.

These products are also readily available, thanks to e-commerce platforms and direct-to-consumer sales, which fuel market growth. Dietary supplements are projected to remain the leading segment of the halal health market, powered by increased regulatory support and standardization of halal certifications.

Vaccines Emerging as a Key Product Segment in the Market

Vaccines are emerging fast in halal healthcare market due to demand for Shariah-compliant immunization solutions. Halal VaccineThe modern worldakan for vaccination is not without controversy formed for its practice, and several of their vaccination works may derive porcine ingredients that contribute to stabilize, whereas previous studies proven

The COVID-19 pandemic has fuelled the need for the development of halal vaccines, one of which may be formed from porcine-derived ingredients and non-compliant stabilizers. Malaysia, Indonesia, and the UAE have spearheaded the effort to develop and produce halal vaccines in accordance with both medical and religious principles.

Fueling the momentum towards gelatin-free and plant-based vaccines is also the growing presence of biotechnology and the adoption of ethical sourcing practices in the pharmaceutical industry. Besides, governments and regulatory bodies are also funding halal biopharmaceutical R&D, which helps to innovate the production of vaccines.

With increasing public awareness and demand for ethical healthcare solutions, halal vaccines are poised to become a ubiquitous segment, catering not only to the needs of Islamic populations but also to those seeking ethical, high-quality immunization options globally.

General Well-Being Leading the Halal Nutraceuticals Market by Application

General well-being has emerged as the leading application segment in the halal nutraceuticals market, driven by the increasing consumer inclination towards preventive healthcare and holistic wellness. Vitamins, minerals & herbal supplements are already allowed for halal certification by consumers since they want to maintain overall wellness, plus food energy & mental health as well. The increasing popularity of self-care and natural healing has also pushed the sales of nutraceutical components that support daily nutritional needs, immune functioning, digestive health, and stress management.

In the wake of the pandemic, consumers have placed a higher premium on foods high in nutrients and, ideally, responsibly sourced nutrients, which means broadly health-promoting supplements have become staples in daily health-related routines.

The convergence of e-commerce and direct-to-consumer sales has also facilitated broader market penetration by putting such products within reach of consumers. In terms of application, the overall well-being segment is anticipated to continue leading the sales in the worldwide halal nutraceuticals sector in part due to rising disposable incomes and government backing of halal-certified wellness products.

Immune & Digestive Health Emerging as a Key Application in the Halal Nutraceuticals Market

Growing awareness about gut health, immunity, and disease prevention is expected to propel the immune and digestive health applications in the halal nutraceuticals market. The growing understanding of gut-immune interactions has led to an increased demand for halal-certified probiotics, prebiotics, and functional foods, which may promote digestive balance and provide additional immune support.

Interest in immune supplements has been supercharged in the post-pandemic era, as consumers are focused on natural ways to boost their body’s defense systems. Moreover, new dietary trends, including a preference for plant-based options and herbal formulations, have spurred innovation in fermented, high-fiber, and gut-friendly halal supplements.

Both governments and healthcare providers are promoting preventive healthcare, thereby increasing the adoption of digestive and immunity-relief nutraceuticals. As research continues to establish the importance of microbiome health on overall wellness, this sector is poised for substantial growth, driving the future of halal nutraceutical innovation.

The global herbal medicinal products market is highly competitive. It is expanding rapidly due to growing consumer preference for natural remedies, increasing awareness of herbal alternatives, and favorable regulatory frameworks in many regions.

The market covers everything from immunity, digestion and mental health to chronic disease management through botanical-based formulations. To create a food-grade entry, companies have invested in standardized herbal extracts, scientific validation, and sustainable sourcing. The sector encompassed traditional medicine companies, pharmaceutical firms, and nutraceutical players.

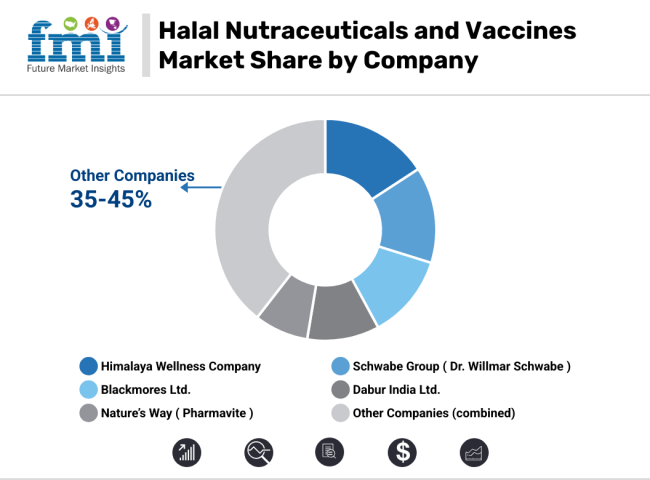

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| Himalaya Wellness Company | Offers a broad range of clinically studied herbal medicinal products for immunity, digestion, and wellness. |

| Schwabe Group | A pioneer in phytopharmaceuticals, known for homeopathy and plant-based medications standardized to European standards. |

| Blackmores Ltd. | Offers premium herbal and nutritional supplements, with a focus on mental health, immunity, and joint care. |

| Dabur India Ltd. | A leader in Ayurvedic formulations, Dabur offers a wide range of herbal medicines, including chyawanprash and syrups. |

| Nature’s Way | Manufactures herbal supplements with certified organic ingredients and a focus on immune and digestive health. |

Key Company Insights

Himalaya Wellness Company (14-18%)

A global leader in Ayurvedic herbal medicines, Himalaya emphasizes scientific validation and exports to over 90 countries.

Schwabe Group (12-16%)

A major player in Europe, Schwabe leads in evidence-based herbal remedies with GMP-certified manufacturing and clinical research.

Blackmores Ltd. (10-14%)

Known for high-quality natural health products, Blackmores maintains strong brand equity in the Asia-Pacific herbal markets.

Dabur India Ltd. (8-12%)

One of the oldest and most recognized herbal product companies globally, Dabur combines Ayurvedic heritage with modern production.

Nature’s Way (5-9%)

A significant USA-based herbal brand, Nature’s Way leverages sustainable sourcing and transparent labeling for consumer trust.

Beyond the leading companies, several other manufacturers make significant contributions to the market, thereby enhancing product diversity and driving technological advancements. These include:

Vaccines and Dietary Supplements

Sports Nutrition, General Well-Being, Immune & Digestive Health, Bone & Joint Health, Heart Health, Disease Prevention, Weight loss

Hospital Pharmacies, Retail Pharmacies, Online Sales and Super Markets

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for halal nutraceuticals and vaccines market was USD 76,996.7 million in 2025.

The halal nutraceuticals and vaccines market is expected to reach USD 144,534.3 million in 2035.

The rise of online retail and direct-to-consumer sales is making halal health products more accessible worldwide aiding in the market growth

The top key players that drives the development of halal nutraceuticals and vaccines market are Himalaya Wellness Company, Schwabe Group, Blackmores Ltd., Dabur India Ltd. And Nature’s Way.

Dietary supplements is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Halal Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Halal Ingredient Market Analysis - Size, Growth, and Forecast 2025 to 2035

Nutraceuticals Market Size, Growth, and Forecast for 2025 to 2035

Vaccines Market Insights - Trends, Growth & Forecast 2025 to 2035

Halal Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Halal Cheese Market

Market Share Breakdown of Halal Tourism Services

Halal Tourism Market Analysis by Tour Type, Tourist Type, Tourist Demography, Age Group, and by Booking Channel - Forecast for 2025 to 2035

UK Halal Tourism Market Analysis – Growth, Applications & Outlook 2025-2035

Cat Vaccines Market Size and Share Forecast Outlook 2025 to 2035

United States Halal Tourism Market Outlook – Trends, Demand & Forecast 2025–2035

Fish Vaccines Market

Live Vaccines Market

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Nasal vaccines Market

Herbal Nutraceuticals Market Size and Share Forecast Outlook 2025 to 2035

Travel Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Dengue Vaccines Analysis by Product Type by Product, By Age Group and by Distribution Channel through 2035

Germany Halal Tourism Market Report – Trends & Innovations 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA