The global Vaccines Market is estimated to be valued at USD 54.50 billion in 2025 and is projected to reach USD 111.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 54.50 billion |

| Projected Market Size in 2035 | USD 111.3 billion |

| CAGR (2025 to 2035) | 7.4% |

The vaccines market is experiencing accelerated evolution, influenced by heightened awareness of immunization benefits, increased government funding, and the expansion of advanced manufacturing capabilities. With successful vaccination campaigns globally has driven stronger public trust and reinforced the role of vaccines as essential preventive healthcare tools. Regulatory agencies have prioritized faster review pathways and emergency use authorizations for high-impact vaccines, creating an environment of expedited development and commercialization.

Emerging scientific publications have highlighted the growing importance of novel vaccine platforms, including mRNA, vector-based, and recombinant protein technologies, which are expected to complement traditional approaches in the coming years.

Pharmaceutical companies have strengthened their pipelines with next-generation candidates targeting endemic, pandemic, and rare infectious diseases. Sustained public-private partnerships and increased investments in cold chain infrastructure have further supported market expansion.

In 2025, inactivated vaccines are anticipated to hold a 24.7% revenue share in the vaccines market. This segment’s strength has been attributed to their established safety profiles and proven immunogenicity across multiple disease areas. Regulatory approvals for these vaccines have consistently reflected strong efficacy data, supporting physician confidence and public acceptance.

Manufacturing scalability and the availability of standardized production protocols have facilitated consistent supply in both developed and emerging regions. Health authorities have endorsed these vaccines as foundational components of national immunization schedules, driving stable demand. Additionally, favorable storage requirements relative to some newer platforms have reinforced their widespread use in varied healthcare settings.

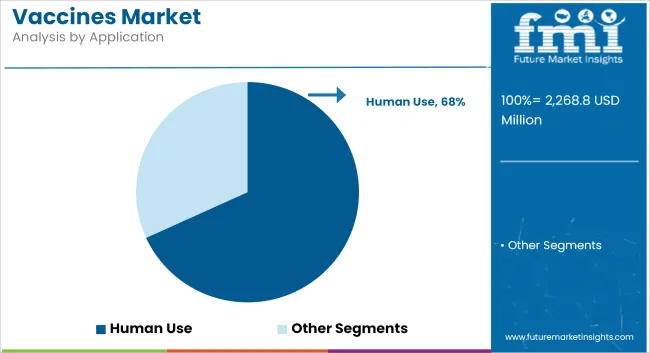

Human use applications are projected to account for 68.2% of the vaccines market share in 2025. The segment has been reinforced by the prioritization of immunization programs aimed at reducing morbidity and mortality from infectious diseases across all age groups. Public health initiatives and funding commitments have been directed toward achieving high coverage rates in pediatric, adolescent, and adult populations.

Regulatory frameworks have provided strong support for accelerated approvals and procurement agreements to expand vaccine access. Consumer confidence has been bolstered by transparent safety monitoring and education campaigns. Pharmaceutical manufacturers have invested heavily in expanding production capacity and developing combination vaccines to streamline administration.

Supply chain gaps, vaccine hesitancy, and high development costs limit access and coverage.

Despite the rising demand, the constraints of the cold-chain hold back vaccine availability, especially in rural and remote areas. In many countries, vaccine hesitancy deriving from misinformation, religious ideology, or concerns about safety, is another significant barrier to universal coverage.

High R&D costs, complex and costly regulatory approvals, and the risk of clinical trial failure create a heavy burden on manufacturers. The cash-based model of services and limited healthcare infrastructure in low-income countries further limits the realization of potential immunization programs.

Personalized vaccines, mRNA platforms, and adult immunization drive future potential.

The future of vaccines will move toward precision immunization with the advancement of personalized or therapeutic vaccines being investigated for cancers, autoimmune diseases and allergies. Proven during the COVID-19 pandemic, mRNA technology is blooming to prevent influenza, RSV, and malaria.Similarly, adult and travel vaccination programs can be an opportunity, especially among aging populations and mobile workforces.

Thermostable and needle-free vaccines investments can vastly improve compliance as well as minimize bottlenecks in the distribution pipeline. And because AI has also helped in vaccine development, we will see a better digital immunization records.

The USA vaccines market continues to grow steadily due to strong immunization programs, advanced biotechnology capabilities, and high public health funding ,the cdc and hhs spend vast sums of time on routine vaccinations and preparedness for pandemic.

Increasing adoption of mRNA-based and combination vaccines for influenza, HPV and COVID-19 is moving technologies forward; Cold-chain warehouse storage, R&D, and manufacturing infrastructure are expanding in Massachusetts and Pennsylvania to satisfy rising domestic and international demand from major pharma companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.7% |

In the UK, the development and deployment of vaccines are underpinned by robust public-private collaboration and centralized procurement through the National Health Service (NHS). The government funds rapid vaccine development platforms via the UK Vaccine Network and the Vaccines Manufacturing and Innovation Centre (VMIC).

The country is also focusing on multivalent and nasal vaccines for respiratory infections. It continues to drive the expansion of domestic production, driven by a strong demand for childhood immunisation coverage, seasonal flu vaccination as well as global demand for travel and export-oriented vaccines.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.2% |

New funding will be provided to expand the EU vaccines market, helping to implement new vaccine health- and economic policies and strengthen vaccine research and manufacturing resilience under the EU4Health programme within the scope of Horizon Europe. Vaccine production, especially for recombinant protein, mRNA, and viral vector platforms, is particularly concentrated in Germany, France, and Belgium.

European public health agencies are already able to co-operate with each other to make them better equipped for a pandemic make sure of vaccine coverage across borders. The European Centre for Disease Prevention and Control (ECDC) supports data-driven vaccination rollout, while policy initiatives around the European Immunization Agenda 2030 will underpin access and innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.4% |

Japan’s vaccines market is expanding at a time of an aging population, growing adult immunization awareness, and expanding domestic R&D. Japan's MHLW encourages investment in new vaccine technologies: MHLW in 2022 published draft Q&A in which it identified types of next-generation vaccines, including mRNA and cell-culture platforms.

Japan Is Boosting Its Vaccine Self-Sufficiency With New National Programs Incentivizing Local Production Of Pandemic And Seasonal Vaccines for pediatric and adult diseases such as pneumococcal infections, influenza, and shingles continue to top the high demand list. Export-oriented firms enter partnerships across Southeast Asia for regional immunization initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The country is seeking to position itself as a global vaccine hub, investing in domestic mRNA platforms and cell-culture manufacturing . Cutting-edge companies are forging global pharmaceutical partnerships for clinical testing and manufacturing scalability.

Childhood immunization programmes are almost universal, and booster dose programmes for the older population are being scaled up. Local pandemic preparedness has been the focus of government efforts, prompting capacity-building for next-generation vaccine platforms and biologic supply chains.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

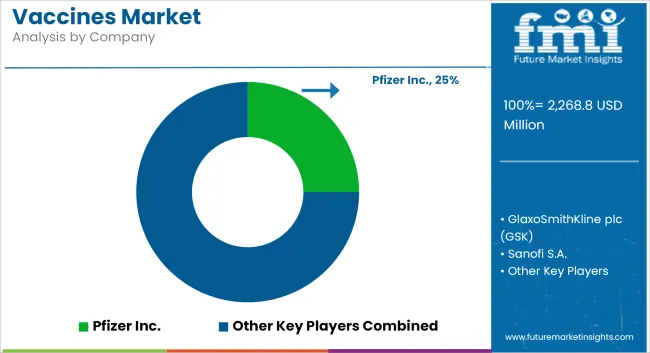

The vaccines market is highly competitive and dynamic, driven by expanding immunization programs, pandemic preparedness initiatives, and ongoing R&D investment in novel vaccine platforms. Leading companies are prioritizing mRNA, viral vector, and recombinant protein technologies to accelerate development pipelines and respond to emerging infectious threats.

Strategic collaborations, government partnerships, and global supply agreements are central to scaling manufacturing and distribution capabilities. Additionally, focus areas such as thermostable formulations, combination vaccines, and equitable access in low- and middle-income countries are reshaping competitive strategies. Regulatory approvals and landmark product launches are intensifying rivalry, as companies aim to solidify leadership positions across pediatric, adult, and travel vaccine segments.

The overall market size for the vaccines market was approximately USD 54.50 billion in 2025.

The vaccines market is expected to reach approximately USD 111.3 billion by 2035.

The demand for vaccines is rising due to increasing global focus on immunization programs, advancements in vaccine development technologies, and the need to address emerging infectious diseases.

The top 5 countries driving the development of the vaccines market are the United States, China, India, Germany, and Japan.

Inactivated vaccines and human-use applications are expected to command significant shares over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cat Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Fish Vaccines Market

Live Vaccines Market

Nasal vaccines Market

Travel Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Dengue Vaccines Analysis by Product Type by Product, By Age Group and by Distribution Channel through 2035

Varicella Vaccines Market Insights - Growth, Trends & Forecast 2024 to 2034

Veterinary Vaccines Market Analysis - Size, Share, and Forecast 2025 to 2035

Attenuated Vaccines Market Analysis - Size, Share & Forecast 2024 to 2034

Aquaculture Vaccines Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Recombinant Vaccines Market Analysis – Trends & Future Outlook 2018-2028

Pneumococcal Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Anti-Infective Vaccines Market Growth – Trends & Forecast 2025 to 2035

The Companion Animal Vaccines Market is segmented by product, indication and end user from 2025 to 2035

Chile Aquaculture Vaccines Market Insights – Size, Demand & Forecast 2025-2035

China Aquaculture Vaccines Market Outlook – Growth & Forecast 2025-2035

Seasonal Influenza Vaccines Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Norway Aquaculture Vaccines Market Insights – Size, Demand & Growth 2025-2035

Vietnam Aquaculture Vaccines Market Trends – Growth & Demand 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA