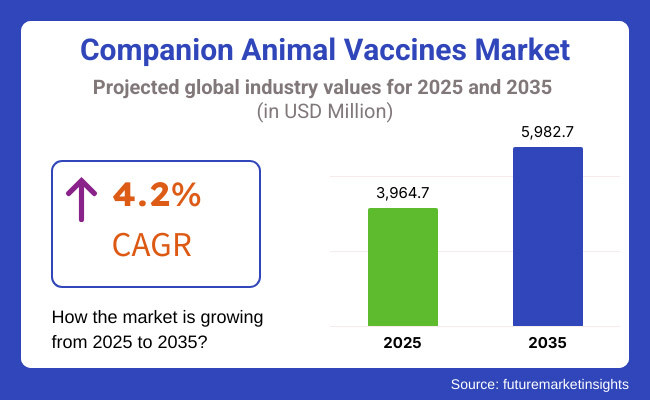

The companion animal vaccines products market is expected to reach USD 3,964.7 million by 2025 and is expected to steadily grow at a CAGR of 4.2% to reach USD 5,982.7 million by 2035. In 2024, companion animal vaccines generated roughly USD 3,818.1 million in revenues.

The sales of companion animal vaccines is witnessing remarkable growth because of the increasing occurrence of zoonotic diseases and growing practice of preventive veterinary medicine. As pet owners begin to understand the importance of vaccinations with a guarantee of their pet's health from a long-term perspective, the demand will only increase for combination vaccines in cats and dogs. These combination vaccines offer multivalent protection against various diseases, making them a cost-effective and time-efficient choice for both veterinarians and pet owners.

Moreover, the increasing coverage of pet insurance has motivated owners to adopt frequent veterinary consultations, including vaccination. Increased veterinary healthcare infrastructure and subsequent investments in recombinant and DNA-based vaccines are also fuelling market penetration. Technological advances, for example, in oral and needle-free vaccines are also enhancing the attractiveness of immunization by simplifying administration and lowering pet stress.

But some of facts such as strict approval procedures, development costs for vaccines, and restrictive access to animal care in emerging markets create difficulties for market growth. Despite those obstacles, greater emphasis on custom pet immunization creates considerable prospects for industry competitors. Companies in the market allocating resources toward creative vaccine technologies and sophisticated diagnostic systems are best set up for accomplishment in this transformative market.

The companion animal vaccine market has historically grown in parallel with increasing pet ownership and advances in veterinary medicine. Infectious diseases including rabies, distemper and parvovirus were primary vigor issues and few pet vaccines were available previously. Vaccination programs were primarily focused on livestock, and immunization of companion animals, such as pet dogs and cats, was introduced only during the mid-to-late 20th century.

In recent times, as more people kept pets particularly in developed countries the veterinary medicine adoption has also increased, with safer and more effective vaccines. Over time, advances in immunology and biotechnology lead to recombinant and DNA-based vaccines, which helped reduce side effects, while maximizing effectiveness.

The North American animal companion vaccines industry growth is mainly driven by high levels of pet ownership, growing focus on preventive animal care, and high presence of prominent veterinary drug companies. The United States leads the region as a result of rising veterinary expenditures, extensive presence of sophisticated vaccines, and high pet insurance coverage of immunization. Despite challenges like pet owner vaccine hesitancy, fears of side effects, and exorbitant costs of veterinary care, market growth is affected. Further market growth in North America is anticipated to be driven by the rising adoption of AI in veterinary diagnostics, increased mobile pet vaccination services, and increased investment in gene-edited vaccine solutions.

Europe is a second most dominating market for companion animal vaccines, owing to the strict animal health laws, rising adoption of annual pet vaccination schemes, and rising investment in veterinary research. Germany, France, and the UK are among the major markets, with established veterinary networks, growing demand for pet travel vaccines, and increasing government programs encouraging pet disease prevention. Nevertheless, issues like rigorous EU regulatory adherence, excessive R&D expenses in the development of new vaccines, and scarce distribution of advanced vaccines in some regions can affect market growth. Growing emphasis on veterinary immunotherapy, increase in oral vaccine formulations, and increased collaboration between pet care firms and veterinary research centers are defining the European market scenario. In addition, the increasing trend of customized pet immunization schedules is enhancing vaccine efficacy and pet health results.

The rise in pet adoption, increasing disposable income, and improved veterinary preventive care knowledge, are anticipated the companion animal vaccine market in the Asia-Pacific region. Growing pet healthcare infrastructure, along with shifting government initiatives in support of animal health, and an increased demand for combination vaccines for pets are major factors expected to bolster this market in the near future. But obstacles like affordability limitations, insufficient standardized veterinary healthcare practices, and inadequate access to contemporary veterinary clinics in rural regions can prevent market penetration. With increasing the numbers of veterinary vaccine producers globally, advancements of mobile pet health care services and integration of AI based diagnostics for real-time disease detection are creating opportunities. Moreover, advances in biotechnology-based veterinary vaccines, along with increased investment in nasal spray and needle-free vaccination technologies, are also improving regional vaccine access and adherence.

Significant Challenges Development of Vaccine and Regulatory Hurdles Are Creating Barrier in the Companion Animal Vaccines Market

There are several barriers that are hindering growth and adoption of the companion animal vaccines. Yes, the one of the important reasons is the very strict regulatory approval process before they allow for the development of vaccine. The usual process of developing a vaccine includes high-level clinical tests and following the regulation guidance by the organizations like the FDA and EMA that cause product delays and costs increase for the manufacturers.

Such high expense of developing and distributing vaccines is another major hindrance for some emerging key players. R&D for new vaccines entail sophisticated biotechnology, extensive testing periods, and quality control practices, which render them costly to manufacture. These expenses are frequently passed on to veterinarians and pet owners, making them less affordable and with fewer market reach.

Moreover, in developing countries, limited access to veterinary services perpetuates a mismatch in vaccine access. Most countries do not have adequate veterinary facilities, and the vaccination rate is lower among pets. This makes it possible for preventable diseases to continue circulating, limiting the growth of markets.

Overall, vaccine resistance from pet owners regarding fears about safety, adverse effects, and disinformation detrimentally affects demand. Such resistance lessens market penetration, causing companies to undertake investment in educational campaigns and raising awareness. These constraints ultimately impede market expansion, constrain availability, and incur costs for the manufacturer, vet, and owner of a pet.

Opportunities

Growth in Need for Preventive Veterinary Treatment Creating Opportunities for the Companion Animal Vaccines Industry

The companion animal vaccine has significant opportunities for growth and innovation. Major opportunities abound, including the growing need for preventive veterinary treatment. As the number of pet owners continues to grow globally, there is increasing awareness among pet owners about the role of vaccination in preventing disease. Growing focus on pet health has boosted the number of vaccines being adopted, which is expanding the market.

A major opportunity is in vaccine development technologies. The arrive of recombinant and DNA-based vaccines upgrades the safety and efficacy of vaccines with little risk of adverse effects. Additionally, the emergence of oral and needle-free vaccine delivery systems is enhancing convenience to veterinarians and pet owners, thereby increasing compliance with vaccination regimens.

The increasing coverage of pet insurance is also propelling market growth. Greater numbers of pet owners are insuring under plans that include vaccination, hence making them more affordable and accessible and this set to be to increase demand for core and specialist vaccines. With veterinary healthcare infrastructure being improved and investment in research, these technologies will provide new business opportunities for manufacturers, fueling revenue growth and increased global outreach.

In the late 2020 to 2024, the companion animal vaccine market grew strongly, benefitted because of increasing pet-aging and awareness towards preventive healthcare. The COVID-19 pandemic affected the market when a swarm of people adopted pets, increasing calls to the veterinarian and the want for vaccines. And governments and veterinary organizations also stressed preventing rabies and zoonotic disease, leading to increasingly strict vaccination mandates around the globe. Having provided conventional vaccines that took decades to develop, pharmaceutical companies focused on expanding their portfolios with recombinant and DNA-based vaccines, delivering a more efficient product with fewer side effects.

Advances in technology in this time frame also facilitated improved cold chain logistics, which is necessary for the stability of vaccines, making them widely available, even in remote areas. Moreover, the growth in pet insurance coverage in countries like the USA, UK, and Japan made vaccinations more economy-friendly as well, further increasing rates of compliance. Leaders in the field including Zoetis, Merck Animal Health and Boehringer Ingelheim maintained them spend in R&D, fuelling innovations in vaccine formulation. But strict regulatory approvals and vaccine hesitancy among pet owners continue to be major hurdles, impacting total market

Looking ahead future outlook companion animal’s vaccine market is built on the high preparation on plant-based vaccine production, which offers a sustainable and cost-effective alternative. Pet owners will soon be able to expect longer-duration vaccines, which will decrease the frequency for booster shots, making it more convenient. Additionally, we will see mainstream adoption of needle-free vaccine delivery systems, which will make pets more comfortable and contribute to high adoption rates. Growing disposable income and enhanced veterinary infrastructure in emerging economies will support the expansion of the market.

The growing emphasis on combination vaccines that immunize against multiple diseases with a single shot will simplify vaccination schedules. Also, supply chain improvements and localized manufacturing will increase the availability of the vaccine, making it more accessible to people globally. Such factors are anticipated to drive continuous growth of the market in the upcoming decade.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emphasis on vaccine safety and efficacy, with product approval procedures for new veterinary vaccines. |

| Technological Advancements | Use of recombinant and DNA-based vaccines for better protection and fewer side effects. |

| Consumer Demand | Increased pet ownership and higher expenditures on preventive pet care. |

| Market Growth Drivers | Increased pet adoption, government rabies control initiatives, and enhanced veterinary access. |

| Sustainability | Early progress toward green vaccine production and reducing waste in animal clinics. |

| Supply Chain Dynamics | Dependence on conventional veterinary supply chains and clinic-based vaccine distribution. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Increased regulatory support for AI-based vaccine development and customized immunization regimens. |

| Technological Advancements | Combination of AI, nanotechnology, and mucosal vaccine delivery systems for better efficacy. |

| Consumer Demand | Increased demand for long-acting, combination, and needle-free vaccines. |

| Market Growth Drivers | In expansion into developing markets, growth in pet immunotherapy, and tailored vaccination plans. |

| Sustainability | Wider use of biodegradable packaging and carbon-free vaccine manufacturing. |

| Supply Chain Dynamics | Expansion of direct-to-consumer and e-commerce-based vaccine distribution networks. |

Market Outlook

The companion animal vaccine industry in the United States witnessed significant grown with recent advances of biotechnology and a strong veterinary infrastructure. Pharmaceutical companies in the USAare investing in new-generation vaccines, including recombinant and mRNA vaccines, which led to better efficacy and safety. The Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA) produces a strong framework of regulation ensuring the quality and consistency of vaccines, helping to restore consumer confidence and drive sales. One of the key growth factors for the industry is the strong rate of pet adoption, after increasing knowledge mental health care and pet companionship benefits. The American Veterinary Medical Association (AVMA) as well as other similar organizations advocate for vaccination protocols that pet owners typically comply with. The ubiquity of veterinary hospitals, clinics, and pet pharmacies also facilitates the access of these vaccines, therefore driving the growth of the industry.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.5% |

Market Outlook

The required regulatory compliance of companion animal vaccines has also expedited the growth of the companion animal vaccines market in Germany, as have government-initiated disease eradication campaigns. The Paul-Ehrlich-Institut (PEI), responsible for monitoring veterinary vaccines, imposes very strict requirements with respect to the safety and efficacy, so that only the good products will ever make it to the market. This has led to sound consumer confidence, with high vaccination coverage. In Germany, rabies and other zoonotic diseases are also under scrutiny to be eliminated, which increases the demand for vaccines annually. Germany has the highest penetration of insurance in Europe, and a significant majority of the costs vets charge are covered, even vaccinations. This incentivizes pet owners to stay on track for vaccinations, increasing vaccine sales. Additionally, registration of pets is a requirement in some states, thereby requiring regular vet visits, during which vaccinations are a standardized procedure.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.3% |

Market Outlook

The companion animal vaccine industry in India has been growing consistently over the past few years owing to the rising number of companion animal veterinary services and government-run awareness campaigns. Traditional veterinary care in India has focused on livestock, but the humanization of pets in India has led to greater investing in companion animal healthcare facilities. In collaboration with various veterinary associations, the Department of Animal Husbandry and Dairying has launched nationwide vaccination drives to further strengthen immunization coverage in rural and urban areas. Pet ownership in India, particularly among middle-class families living in cities, has surged sharply. This has increased the need for regular vaccinations, leading to increased sales of the core vaccines and those that are non-core. The growth of corporate veterinary chains and pet wellness clinics also continues to improve vaccine access and criminalize vaccination protocols.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.1% |

Market Outlook

China has also witnessed major investment in domestic vaccine production, minimizing imports and guaranteeing vaccine supply. The growth of indigenous pet pharma companies is propelling the creation of affordable vaccines specific to Chinese pet owners' needs. The government has also implemented urban pet management regulations, promoting good pet ownership and vaccination adherence. Pet superstore expansion and the rise of e-commerce sites are making veterinary products, such as vaccines, easily accessible. The online channels such as online veterinary pharmacies are gaining popularity mainly due to pet owners can buy vaccines and plan veterinary visits online. In addition, China's pet wellness phenomenon, driven by rising disposable income, has propelled increased expenditure on preventive care, including vaccinations.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.9% |

Market Outlook

Brazilian tropical climate and the considerable prevalence of vector-borne diseases, such as tick-borne diseases in dog, made this matrix a growing demand for regional vaccination intervention. The surge in veterinary pharmaceutical exports has also helped make Brazil an unexpected leader in vaccine manufacturing for domestic and international markets. The cultural approach of pet humanization in Brazil was driven by several socio-economic factors, leading to the perspective of pets as family members over the last years. This has led to higher veterinary care costs, and vaccination among other preventive care methods. In addition to pet friendly policies implemented in some residential estates and public places, vaccination compliance has also increased since many pet friendly facilities require the pets being vaccinated to be granted access. The increasing presence of government-sponsored veterinary services, and the collaborative effort between domestic and international drug manufacturers will likely contribute to further growth of this sector. And, considering the still increasing rate of pet adoption, any demand for new vaccines, tailored to Brazil's unique disease profile, will persist and leave the country in a competitive position in an international companion animal vaccine market.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 2.2% |

Owing to Long-Lasting Immunity by Stimulating a Strong Immune Response the Attenuated Live Vaccines holds Significant Share

Attenuated live vaccines are the most popular companion animal vaccine and produce prolonged immunity by provoking an exaggerated immune response. These are composed of weakened yet living pathogens, which are reproduced within the host but without initiating disease. These are effective for immunizing animals against rabies, distemper, parvovirus (parvoviral), FeLV, and other disease conditions. The growing pet adoption rates, rising emphasis on preventive veterinary care, and rising demand for efficient vaccines with low booster requirements are fueling market demand. North America and Europe are the leaders in attenuated live vaccine adoption because of stringent pet vaccination regulations and sophisticated veterinary healthcare infrastructure, whereas Asia-Pacific is experiencing high growth due to rising pet ownership and growing awareness of pet immunization.

Recombinant Vaccines are Gaining Popularity due to their High Safety Profile

Recombinant vaccines are becoming increasingly popular because of their high safety level, specific immune response, and low risk of reversion to virulence. They employ genetically modified antigens to induce immunity without the necessity of live pathogens. They are commonly applied in canine distemper, rabies, and feline leukemia, providing potent, long-lasting immunity with less side effect. The growing demand for genetically modified vaccines, increasing approvals for recombinant animal vaccines, and increasing research for DNA vaccine are some of the factors driving the market. North America and Europe dominate recombinant vaccine innovation given their strong veterinary biotech capabilities, while the Asia-Pacific region is expected to fuel demand owing to increased veterinary biologics R&D activities.

Veterinary Clinics Represent One of the Largest Distribution Channels

One of the largest avenues for companion animal vaccine distribution remains within veterinary clinics, which give easy, convenient access to pet health services and where routine vaccinations are part of a standard care plan. These types of clinics offer routine immunization, disease prevention research, and emergency veterinary care and are the best option for pet owners searching for preventive healthcare. Annual vaccination programs, increasing availability of advanced immunization products, and growing awareness about pet health and disease prevention are among the factors boosting demand. Veterinary clinic-based vaccines are mostly dominated by North America and Europe due to strict regulations for these kinds of pet healthcare in these regions; the Asia-Pacific region is experiencing an increasing demand owing to the growing veterinary services industry and the increased pet ownership.

Veterinary Hospitals are the Major Hubs for Vaccine Administration

Veterinary hospitals play an important role as delivery sites of the vaccine with an emphasis on high-risk and complicated cases requiring monitoring post vaccination. “They provide complete veterinary services, including responding to vaccine reactions, advanced diagnostics for vaccine titers (to determine whether a patient needs to be vaccinated) and specialty vaccine protocols for geriatric or immunocompromised patients.”

Increasing prevalence of zoonotic diseases, rising investments in veterinary hospital facilities and growing adoption of multi-disease vaccination protocols are driving the growth of the market. North America and Europe are among the leading large animal veterinary hospitals administering vaccine with established veterinary networks, while Asia-Pacific is on a growth trajectory owing to increasing investment in pet care healthcare services.

The industry for companion animal vaccines is highly fragmented owing to increasing pet adoption, increasing awareness regarding preventive veterinary medicine, and advancements in vaccine technology. To remain competitive, businesses are investing in novel recombinant vaccines, combination vaccines, and improved cold-chain logistics. Shaping the changing landscape for companion animal immunization are established veterinary pharmaceutical companies, biotechnology pioneers, and new animal health upstarts.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Zoetis Inc. | (24-25)% |

| Merck Animal Health | (19-20)% |

| Boehringer Ingelheim GmbH | (17-18)% |

| Elanco Animal Health Incorporated | (13-14)% |

| Other Companies (combined) | (14-15)% |

Key Company Offerings and Activities

| Company Name | Key Company Offerings and Activities |

|---|---|

| Zoetis Inc. | Market leader in vaccines such as Vanguard (dog) and Felocell (cat) for core and non-core diseases. |

| Merck Animal Health | Manufactures Nobivac canine and feline vaccines and other companion animal vaccines with a focus on broad immunization protection. |

| Boehringer Ingelheim GmbH | Specialism in advanced vaccines like Duramune and Purevax, using recombinant and adjuvant technology. |

| Elanco Animal Health Incorporated | Provides a range of veterinary vaccines against rabies, Lyme disease, and respiratory diseases prevention. |

Zoetis Inc. (24-25%)

Zoetis Inc. is working to build out its pipeline of companion animal vaccines by investing in recombinant and recombinant and monoclonal antibody-based vaccines that seek to maximize immune response and minimize negative effects.

Merck Animal Health (19-20%)

Vaccines are being looked at more for long-acting potential to help reduce frequency of boosters and pet owner compliance, according to Merck Animal Health, which is expanding its research into this area.

Boehringer Ingelheim GmbH (17-18%)

To reduce pain associated with immunization and increase adoption rates, Boehringer Ingelheim GmbH is working on its development of needle-free and oral vaccine delivery technologies.

Elanco Animal Health Incorporated (14-15%)

Elanco Animal Health Incorporated combining precision immunology and genetic sequencing with vaccine development to optimize and personalize immunization regimens for companion animals.

Other Key Players (14-15% Combined)

A number of other companies are major contributors to the companion animal vaccines market through innovative technologies and increased distribution networks. They include:

With the demand for companion animal vaccines procedures growing unabated, firms are focusing on expansion, accelerating research and development activities, regulatory clearances, and strategic partnerships to reinforce their market positions and enhance surgical outcomes.

The overall market size for companion animal vaccines market was USD 3,964.7 million in 2025.

The companion animal vaccines market is expected to reach USD 5,982.7 million in 2035.

rising prevalence of zoonotic diseases, increasing adoption of preventive veterinary care, and growing demand for combination vaccines for cats and dogs has significantly increased the demand for companion animal vaccines.

The top key players that drives the development of companion animal vaccines market are Zoetis Inc., Merck Animal Health, Boehringer Ingelheim GmbH, Elanco Animal Health Incorporated and Virbac.

Attenuated live vaccines by product is companion animal vaccines market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Species Type, 2017 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Species Type, 2017 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Species Type, 2017 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Species Type, 2017 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Species Type, 2017 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Species Type, 2017 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Species Type, 2017 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Species Type, 2017 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Species Type, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Species Type, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Species Type, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 37: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Species Type, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Species Type, 2017 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Species Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Species Type, 2017 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 77: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Species Type, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 83: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 89: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 90: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) Analysis by Species Type, 2017 to 2033

Figure 92: East Asia Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 93: East Asia Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 97: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 98: East Asia Market Attractiveness by Species Type, 2023 to 2033

Figure 99: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 106: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 109: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 110: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 111: South Asia Market Value (US$ Million) Analysis by Species Type, 2017 to 2033

Figure 112: South Asia Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 113: South Asia Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 114: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 115: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 118: South Asia Market Attractiveness by Species Type, 2023 to 2033

Figure 119: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Species Type, 2017 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Species Type, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Species Type, 2017 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Species Type, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Companion Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Cardiac Drugs Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Specialty Drugs Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Pain Management Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Drugs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA