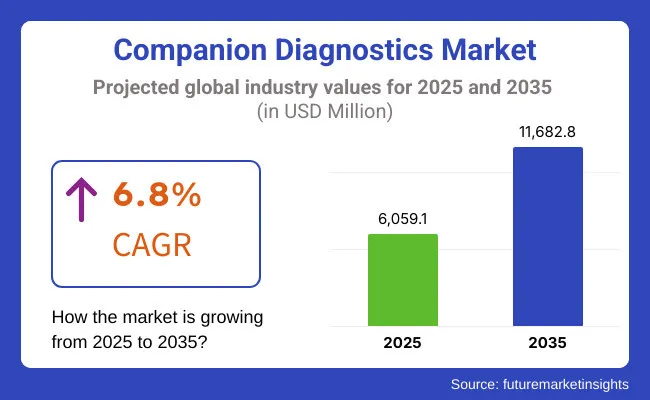

The companion diagnostics market is estimated to be valued at USD 6,059.1 million in 2025. It is projected to reach USD 11,682.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The companion diagnostics market is undergoing rapid transformation, fuelled by the acceleration of personalized medicine and the co-development of targeted therapies. The current landscape is defined by increased regulatory clarity from the FDA and EMA on drug-diagnostic co-approvals, driving greater investment in biomarker-based stratification tools. The expansion of indications in oncology, particularly for non-small cell lung cancer (NSCLC), breast cancer, and melanoma, remains a key revenue contributor. At the same time, emerging use cases in immunology, infectious diseases, and neurology are diversifying the market's therapeutic reach.

The growing emphasis of payers on the effectiveness of precision therapy is strengthening the need for companion diagnostics to mitigate treatment inefficiency and adverse outcomes. Furthermore, the rising adoption of next-generation sequencing (NGS) in clinical settings is enabling multiplexed diagnostic platforms, making companion diagnostics more cost-effective and scalable. As pharmaceutical pipelines increasingly rely on biomarker-driven drug development, the companion diagnostics market is poised for robust expansion over the next 5-7 years.

Leading manufacturers, including Roche Diagnostics, Qiagen, Thermo Fisher Scientific, Illumina, and Agilent Technologies, are at the forefront of companion diagnostics innovation. These players are forming co-development partnerships with pharmaceutical companies to create new drug-diagnostic combinations, particularly in oncology. In January 2025, Roche announced that the USA Food and Drug Administration (FDA) has approved a label expansion for the PATHWAY® anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody* to identify patients with HR-positive, HER2-ultralow metastatic breast cancer who may be eligible for treatment with ENHERTU®.

Matt Sause, CEO of Roche Diagnostics, stated during the press release, “One in eight women in the United States will face invasive breast cancer in their lifetime. The rising incidence of metastatic breast cancer, particularly among younger populations, underscores the urgent need for new diagnostic options. The approval of our test for determining HER2-ultralow status offers new hope to patients by providing a possible path to HER2-targeted treatment where none existed before, helping clinicians transform outcomes for many facing this challenging disease.”

North America dominates the global companion diagnostics market, driven by a strong alignment between regulatory frameworks, pharmaceutical innovation, and clinical infrastructure. The USA FDA’s proactive approach toward co-approval of therapies and diagnostics has significantly shortened development cycles. Uptake is especially high in NGS-based CDx platforms, supported by reimbursement pathways for biomarker-driven oncology treatments. Academic medical centers and cancer consortia are partnering with diagnostic firms to integrate mIF, digital pathology, and liquid biopsy-based assays into clinical workflows.

Europe presents strong growth potential, particularly in Germany, the UK, France, and the Nordics, driven by increasing investment in precision oncology infrastructure and the adoption of HTA-linked diagnostics. Regulatory harmonization under the IVDR (In Vitro Diagnostic Regulation) is creating a structured pathway for the approval of companion diagnostics, promoting clarity for drug-CDx developers.

Hospital-based molecular pathology networks are expanding, especially in state-funded cancer programs, enhancing access to CDx in public health systems. Pan-European cancer missions and digital integration in molecular labs further catalyse growth in this region.

By product type, the kits and reagents segment is expected to hold a significant market share of 59.6% in 2025. The dominance of kits & reagents in the companion diagnostics market was attributed to their central role in facilitating personalized medicine. These products have been widely adopted due to their ability to offer rapid, reliable, and specific detection of biomarkers required for targeted therapies. The growth of targeted drug development pipelines by pharmaceutical companies has further driven the demand for test kits tailored to particular therapies.

Additionally, regulatory approvals for new companion diagnostic kits, particularly those used in oncology, have reinforced their market penetration. Ease of integration into existing laboratory workflows and recurring usage in testing protocols have enabled steady revenue generation. As more therapies receive label indications requiring a companion diagnostic, the reliance on kits & reagents is expected to expand, solidifying their leadership in the product landscape.

Molecular diagnostics led the companion diagnostics market with a market share of 49.1% in 2025, owing to their unparalleled accuracy in detecting genetic mutations and variations that guide therapeutic decisions. The high sensitivity and specificity of techniques such as PCR, NGS, and in situ hybridization have enabled their widespread deployment in oncology-focused companion diagnostics. Molecular tools have been favoured in regulatory pathways due to their validation in clinical trials and alignment with precision medicine standards.

The increasing prevalence of cancer and genetic disorders, coupled with advancements in biomarker discovery, has further supported this segment's growth. Molecular diagnostics have also been bolstered by partnerships between pharmaceutical companies and diagnostic developers to co-develop tests alongside drugs, streamlining market access and treatment personalization.

The breast cancer segment dominated the market, holding a 30.4% market share in 2025 as the leading application in the companion diagnostics market, driven by the high global incidence of the disease and the clinical success of targeted therapies, such as HER2 inhibitors. The need for accurate determination of HER2, BRCA1/2, and ER/PR status has necessitated the use of companion diagnostics to guide treatment regimens.

Numerous FDA-approved companion diagnostics specifically address breast cancer therapies, creating a strong foundation for market growth. The shift toward early-stage detection and precision treatment in oncology has increased the reliance on validated diagnostics in breast cancer care. Furthermore, growing awareness and screening initiatives, particularly in developed markets, have contributed to increased test volumes, thereby reinforcing this segment’s market position.

Pharmaceutical and biotechnology companies were the dominant end-users, holding a market share of 42.6% in 2025. This is due to their strategic integration of companion diagnostics into drug development pipelines. The emphasis on co-development models, wherein diagnostics are developed in tandem with targeted therapeutics, has been a key driver. These entities have prioritized companion diagnostics to meet regulatory demands for personalized therapies and to enhance drug efficacy and safety profiles.

Additionally, investments in precision medicine programs and the expansion of biomarker-based clinical trials have significantly contributed to diagnostic utilization. Collaborations with diagnostic manufacturers and contract research organizations (CROs) have also facilitated the rapid development of tests and their regulatory submission, thereby accelerating market adoption among pharmaceutical and biotechnology firms.

Lack of reimbursement is limiting the growth of the market

Reimbursement is among the biggest impediments to the adoption of companion diagnostics. Most healthcare systems lack defined policies for reimbursement of these tests, and hence, uncertainty of cost exists for patients and providers alike.

Companion diagnostics are based on state-of-the-art technologies, such as next-generation sequencing (NGS) and liquid biopsy, which require expensive equipment, testing, and trained personnel, making them costly. In the absence of proper reimbursement, the tests become extremely expensive for most patients, making precision medicine unaffordable.

Pharmaceutical firms and diagnostic companies face challenges in obtaining reimbursement approvals, as payers require robust evidence of clinical value and cost savings. The prolonged approval process only further delays market acceptance. In decentralized healthcare systems, reimbursement policies become highly diverse, creating challenges for companies to develop stable pricing strategies.

In response to this, stakeholders are advocating for standardized reimbursement models and highlighting the long-term value of companion diagnostics in enhancing treatment outcomes and reducing total healthcare expenses.

Expanding the application beyond oncology presents a lucrative growth opportunity.

The strongest opportunities within the companion diagnostics market will lie in growing uses beyond oncology. Companion diagnostics have been widely applied in cancer therapy to date; however, their applications in other therapeutic classes are growing rapidly. Some emerging areas of application include neurology, cardiology, infectious diseases, and autoimmune diseases, where biomarker-based diagnostics could potentially enhance the accuracy of treatments.

For instance, in neurology, companion diagnostics can help identify which patients are likely to respond to targeted therapies for Alzheimer's and Parkinson's disease. For infectious diseases, such tests could optimize the use of antiviral and antibiotic treatment for better patient outcomes and lower rates of drug resistance. Furthermore, NGS and artificial intelligence-based diagnostics are increasingly broadening the application of companion diagnostics into multiple disease states.

The requirement for companion diagnostics is expected to increase as pharmaceutical companies invest in biomarker research beyond oncology. This diversification presents a huge market growth and innovation opportunity in precision medicine.

The companion diagnostics market in the United States is experiencing robust growth, driven by the increasing adoption of personalized medicine and advancements in targeted therapies.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.0% |

Market Outlook

Germany's companion diagnostics market is set for steady growth, supported by a well-established healthcare system and ongoing research in personalized medicine.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.5% |

Market Outlook

China's companion diagnostics market is poised for significant expansion, driven by increasing healthcare investments and a rising focus on precision medicine.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.7% |

India's companion diagnostics market is experiencing robust growth, attributed to increasing disease awareness and improvements in healthcare infrastructure.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.1% |

Brazil's companion diagnostics market is expanding, driven by increasing healthcare investments and a growing focus on personalized medicine.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 7.0% |

The market for companion diagnostics is driven by a growing demand for personalized medicine, advancements in biomarker discovery, and the regulatory support of precision therapies. Companies invest in NGS, liquid biopsy technologies, and AI-based diagnostic platforms to remain competitive. The market is influenced by established diagnostic companies, pharmaceutical collaborations, and emerging biotech innovators, all of which contribute to making companion diagnostics a dynamic arena.

Recent Development:

assay, kits & reagents and software and services

immunohistochemistry, molecular diagnostics, in-situ hybridization, real time PCR, and gene sequencing

colorectal cancer, breast cancer, lung cancer, melanoma, urology, and gastric cancer

pharma and biotech companies, clinical research organizations, reference laboratories and others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global companion diagnostics industry is projected to witness CAGR of 6.8% between 2025 and 2035.

The global companion diagnostics market stood at USD 5,700.5 million in 2024.

The global companion diagnostics market is anticipated to reach USD 11,682.8 million by 2035 end.

China is expected to show a CAGR of 7.7% in the assessment period.

The key players operating in the global companion diagnostics industry are F. Hoffmann-La Roche AG, Qiagen Ltd., bioMérieux Inc., Abbott, Thermo Fisher Scientific Inc., Myriad Genetics Inc., Dako Inc., Biogenex Laboratories, Inc., ARUP Laboratories, Ventana Medical Systems Inc., Leica Biosystems Nussloch GmbH and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Companion Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Cardiac Drugs Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Specialty Drugs Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Pain Management Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Drugs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Companion Animal Vaccines Market is segmented by product, indication and end user from 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

DNA Diagnostics Market Growth - Trends & Forecast 2024 to 2034

Food Diagnostics Services Market Size, Growth, and Forecast for 2025–2035

Rabies Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Tissue Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Sepsis Diagnostics Market Growth - Trends & Forecast 2025 to 2035

Poultry Diagnostics Market - Demand, Growth & Forecast 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

In Vitro Diagnostics Market Insights - Trends & Forecast 2025 to 2035

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA