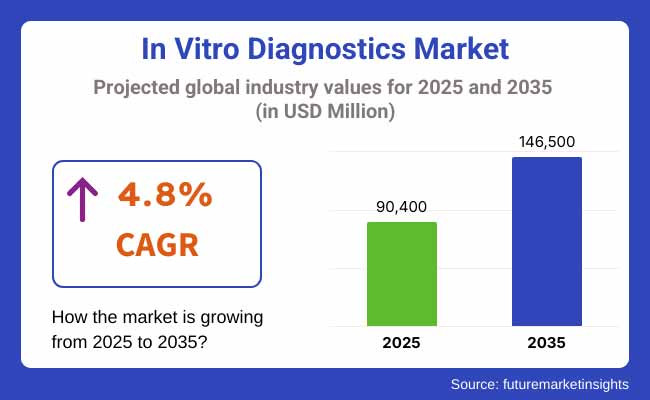

The in vitro diagnostics market is projected to witness substantial growth between 2025 and 2035, driven by increasing demand for early disease detection, precision medicine, and advancements in diagnostic technologies. The market was valued at USD 90,400 million in 2025 and is anticipated to reach USD 146,500 million by 2035, expanding at a compound annual growth rate (CAGR) of 4.8% over the forecast period.

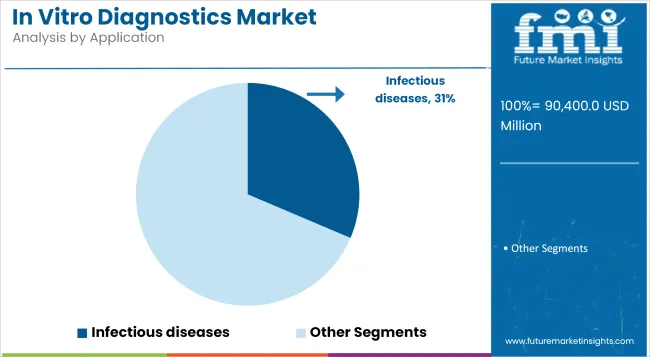

The rising prevalence of chronic diseases, infectious ailments, and genetic disorders has significantly increased the adoption of IVD tests in clinical laboratories, hospitals, and point-of-care settings. Innovations in molecular diagnostics, immunoassays, and next-generation sequencing (NGS) are enhancing diagnostic accuracy, leading to better patient outcomes. Additionally, the growing trend of personalized medicine and companion diagnostics is further driving market expansion.

The integration of artificial intelligence, automation, and digital healthcare solutions is revolutionizing the IVD industry, enabling faster and more precise diagnostics. AI-powered diagnostic platforms, combined with big data analytics and machine learning algorithms, are improving disease prediction models and enabling early detection. Furthermore, the increasing focus on home-based testing kits, regulatory approvals for novel diagnostic tests, and telehealth adoption is creating new growth opportunities for market players.

The market is also benefiting from government initiatives and investments in healthcare infrastructure, particularly in emerging economies. The rise in geriatric populations, increasing healthcare spending, and growing awareness about preventive healthcare are further driving demand for advanced IVD solutions. The shift toward point-of-care and decentralized diagnostics is expected to transform patient care by reducing diagnostic turnaround times and improving accessibility.

Growing needs for precise and rapid disease detection in an increasingly health-conscious world will keep the in vitro diagnostics market booming, as healthcare providers and researchers alike enlist sophisticated diagnostic tools to prevent diseases, intervene early and monitor treatment.

The advent of AI-based diagnostics, home testing, and biomarker-based precision medicine will be instrumental in defining the future of the IVD ecosystem. Furthermore, ongoing advancement in technologies, increasing digitization of healthcare and development of advanced diagnostic capabilities will guarantee the market is able to propel to increased efficiency and improved patient outcomes.

The in vitro diagnostics market in North America dominates due to the presence of advanced healthcare facilities, a high adoption rate of diagnostic technologies, and an increase in the prevalence of chronic diseases. Market expansion in the United States and Canada is a result of strong research investments, key industry players, and supportive regulatory frameworks.

Rising demand for personalized medicine, rapid technological advancements, and increasing expenditure on healthcare further propel the market growth. Furthermore, the increasing adoption rates are underpinned by government programs that advocate for early disease diagnosis and preventive medicine. But, strict regulatory approvals and issues with reimbursement is likely to hinder the market players.

Countries like Germany, France, the UK and Italy hold the lead in adoption, owing to their well-established healthcare systems and strong focus on medical research, making Europe a key market for in vitro diagnostics. There is rising demand for precision medicine, AI-based diagnostics, and early disease detection strategies in the region.

Regulatory guidelines like EU IVDR ensure high-quality standards, but at the same pose challenges for market players in compliance. The focus on point-of-care testing, biomarker-based diagnostics, and the automation of laboratory processes further fuels market growth. But differing healthcare policies among European countries could add complexities to the market.

But the in vitro diagnostics (IVD) market is the fastest expanding area of the Asia-Pacific area, an increase in health care awareness, an aging population, a lack of government investment in health facilities, and a need for improved specialist diagnostic services. It is being driven by demand for early illness detection and advanced diagnostic technologies in countries such as China and India, Japan and South Korea.

These factors include a strong emphasis on digital healthcare, widespread adoption of point-of-care testing, and the growing number of clinical laboratories in the region, thereby driving the market growth. Moreover, the increasing burden of infectious & chronic diseases drives the need for in vitro diagnostic solutions. Nevertheless, obstacles like limited access to healthcare in rural regions and differences in regulations across countries can impact market penetration.

Challenges

Regulatory Complexity and Compliance Requirements

Regulation of the in vitro diagnostics (IVD) industry is strict both in the different regions and by governing bodies like the FDA (USA), EMA (Europe), and CFDA (China). Diverse compliance standards and continuous modification of regulatory frameworks result in manufacturers facing the time-consuming process of product development leading to increased clinical validation, documentation, and market approvals. Small and mid-sized organizations find it difficult to keep up with changing compliance and regulatory requirements which stifles innovation and market expansion.

Opportunities

Advancements in AI and Molecular Diagnostics

AI, machine learning, and next-generation sequencing (NGS) are transforming the accuracy, speed, and automation of IVD testing. These innovations have the potential to improve early disease detection through AI-powered diagnostic algorithms, personalized medicine, and digital pathology notably in oncology, infectious diseases, and genetic disorders. Furthermore, the increasing adoption of point-of-care (POC) testing and home-based diagnostics drives market growth due to the increased accessibility of diagnostics and a reduced burden on healthcare.

The IVD market has been growing rapidly from 2020 to 2024, fuelled by the need for COVID-19 testing, rising rates of chronic diseases, and a surge in at-home diagnostic kits. Yet supply chain disruptions, regulatory challenges and high equipment costs continued to be barriers to expansion. Companies worked on creating fast, portable and AI-based diagnostic tools that could help save time and make testing available to more people.

Personalized medicine, liquid biopsy diagnostics and lab automation will lead the next growth wave as we look to 2025 to 2035. Wearable biosensors, block chain-driven medical data security, and AI-based disease predictions will drive efficiencies to lower disease management costs.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter FDA and EU MDR guidelines on IVD devices |

| Technological Advancements | Rise of AI-assisted diagnostics and molecular testing |

| Industry Adoption | Growth of home-based and point-of-care testing |

| Supply Chain and Sourcing | COVID-19-driven disruptions in reagent supply |

| Market Competition | Dominance of established players like Roche and Abbott |

| Market Growth Drivers | Pandemic-driven diagnostic demand and rising chronic diseases |

| Sustainability and Energy Efficiency | Shift towards eco-friendly reagents and low-waste processes |

| Consumer Preferences | Preference for rapid, non-invasive testing solutions |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Harmonization of global regulations and faster approval pathways |

| Technological Advancements | Widespread use of AI, digital pathology, and block chain security |

| Industry Adoption | Integration of wearable biosensors and remote diagnostics |

| Supply Chain and Sourcing | Localized manufacturing and resilient supply chain strategies |

| Market Competition | Emergence of AI-driven diagnostic start-ups and cloud-based labs |

| Market Growth Drivers | Personalized medicine, AI-powered early disease detection |

| Sustainability and Energy Efficiency | Green laboratory automation and carbon-neutral diagnostics |

| Consumer Preferences | Growing demand for decentralized, at-home diagnostic solutions |

The USA stands out as a crucial market for the IVD domain, backed by a robust healthcare infrastructure and a high embrace of advanced diagnostic technologies (which is also naturally encouraging new entrants into the IVD landscape). The market is driven mainly by the presence of leading IVD manufacturers and increasing government initiatives to improve disease detection and monitoring.

Demand is further driven by the increasing burden of chronic and infectious diseases and the growing geriatric population. Moreover the revolution in diagnostics technologies is further propelled by FDA's regulatory progress which expedites the approval process.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

The UK in vitro diagnostics market is steadily growing, with a driving focus on early disease detection and precision medicine. The National Health Service (NHS) is keen on the implementation of advanced diagnostic tools that could improve patient outcomes.

In addition, the growing investments toward research & development coupled with a strong regulatory framework have adapted to the development of the market. Moreover, the demand for point-of-care and molecular diagnostics is also increasing substantially.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.2% |

Europe is the largest in vitro diagnostics (IVD) market, with Germany, France, and Italy serving as the primary driving economies of this region. The market is governed by an established regulatory framework (including the EU in vitro diagnostic regulation (IVDR)) that assures safety and efficacy.

Growing burden of chronic diseases, and rising healthcare expenditure is one of the major factors driving revenue growth in the market for in vitro diagnostics (IVD) solutions. Moreover, technological breakthroughs associated with molecular diagnostics and automation build the market growth further.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

The global in vitro diagnostics market is expanding, an aging population in Japan and a growing need for disease detection in people as early as possible. Precision medicine and innovative diagnostic techniques are a significant focus.

Moreover, the presence of advanced healthcare infrastructure along with favorable government support for research will further contribute to the market growth. Next generation sequencing and biomarker based diagnostics in particular are a key targets for investment by Japanese companies focused on improving healthcare outcomes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The in vitro diagnostic market in South Korea is rapidly becoming international with the backing of government funding and continuing superiors technology. The country's growing elderly population is driving demand for point-of-care and home-based diagnostics. Also, AI and automation are being used by South Korean companies to create high sensitivity and cost-effective diagnostic solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The in vitro diagnostics (IVD) market is a thriving domain, spurred by developments in the medical field and growing incidents of chronic and infectious diseases, further driving demand for diagnostic solutions within healthcare. In vitro diagnostic tests have been further improved by the combination of artificial intelligence, automation and molecular diagnostics. As healthcare providers attach importance to early detection of diseases and precision medicine, the IVD market will continue to grow.

The increasing incidence of diseases like cancer, diabetes, and cardiovascular disorders has necessitated the development of advanced diagnostic solutions. Furthermore, supportive regulations increasing healthcare ventures to address disease burden, especially in emerging economies, are driving the market growth. With the healthcare paradigm shift towards personalized and treatment combinatorial approaches, IVD plays a significant role in disease detection, prognosis, and therapy monitoring.

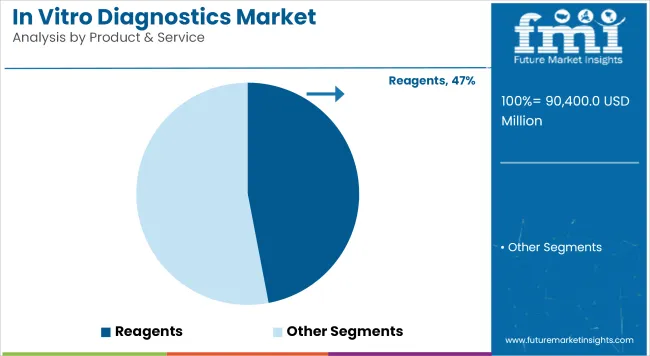

Test type wise Reagents and Instruments contributes for maximum share owing to wide popularity in diagnostic testing across different disciplines.

Specific reagents, namely antibodies, nucleotides, enzymes, are key ingredients in all kinds of diagnostic device such as: immunoassays, molecular diagnostics, haematology tests, etc. With the onset of automated and high-throughput testing operations, we have seen a great need for the quality reagents that can offer quicker and more accurate results. Assay development, biomarker discovery and reagent market segments will continue to innovate and drive demand for the reagents.

Instruments such as analysers and point-of-care are used for performing diagnostic tests in laboratories and other forms of health care facilities. This trend has increased accessibility of testing in remote and resource-acquisition challenged settings. Moreover, the recent strides in connected diagnostics have allowed real-time transmission of instant connected data to make clinical decision-making timelier.

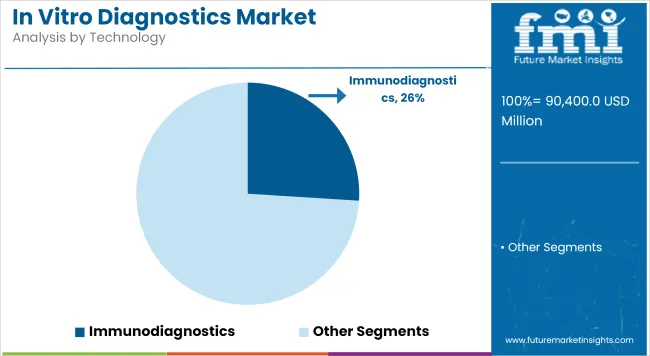

On the basis of technology, immunodiagnostics & molecular diagnostics controls the segment owing to their role in disease detection & monitoring.

High specificity and sensitivity of immunodiagnostic tests, leading to timely and conclusive examination of the disease, is a factor leading to an increase in adoption of immunodiagnostic tests in the market. The immune diagnostics segment is expected to maintain its upward trajectory through ongoing technology advancements in assay performance as well novel biomarkers.

Real time PCR, next-generation sequencing (NGS), and microarray technologies may have completely changed the face of disease detection and molecular diagnostics. Molecular diagnostics has been a game-changer in the fields of infectious disease surveillance, oncology and pharmacogenomics, and a major growth driver for the IVD market.

The in vitro diagnostics market is likely to grow due to increasing focus from healthcare systems globally on early disease detection, personalized treatments, and enhanced patient outcomes. They will continue to shape the future of the IVD market with the introduction of AI driven diagnostics, automation and next-gen sequencers which will continue to take their evolutionary place in the clinic.

The in vitro diagnostics (IVD) market is being driven by a variety of factors such as the increasing demand for early disease detection, advancements in technology which are leading to more robust diagnostic tools, and the growing cases of chronic disease.

Increasing applications in infectious disease testing, oncology, cardiology, and personalized medicine are driving market growth. Since the coronavirus outbreak, manufacturers are concentrating on enhancing precision and availability to consumers through automation, artificial intelligence-based diagnostics, and point-of-care testing products.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Roche Diagnostics | 20-24% |

| Abbott Laboratories | 15-19% |

| Siemens Healthineers | 12-16% |

| Danaher Corporation | 10-14% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Roche Diagnostics | Develops advanced molecular diagnostics, immunoassays, and point-of-care solutions. |

| Abbott Laboratories | Specializes in rapid diagnostics, blood glucose monitoring, and infectious disease testing. |

| Siemens Healthineers | Offers automated laboratory solutions and AI-driven diagnostic imaging. |

| Danaher Corporation | Provides high-throughput diagnostic platforms and precision oncology tests. |

Key Company Insights

Roche Diagnostics (20-24%)

Roche Diagnostics is a worldwide pioneer in IVD, providing a broad portfolio of molecular diagnostics, immunoassays and clinical chemistry products. The company's emphasis on AI integration and customized medicine enhances its competitiveness.

Abbott Laboratories (15-19%)

Abbott Laboratories is focused on rapid point-of-care diagnostics, specifically in the areas of infectious disease, diabetes and cardiac biomarker testing. Its investments in portable and home-based testing solutions further improves access.

Siemens Healthineers (12-16%)

Siemens Healthineers provides automated diagnostic solutions worldwide to clinical laboratories and hospitals. There is a strong competitive advantage for the company due to the focus on AI-based diagnostics and digital pathology.

Danaher Corporation (10-14%)

Danaher Corporation (DHR) - Evolution of the leading edge diagnostic platforms. Strong focus around precision medicine and oncology diagnostics. It helps enhance market presence by its commitment towards high throughput testing and efficient workflow.

Other Major Contributors (30-40% Total)

There are many players competing for the IVD Market as, there are many companies that prefer innovative diagnostic technologies & strategic collaborations. Key players include:

The overall market size for the in vitro diagnostics (IVD) market was USD 90,400 million in 2025.

The in vitro diagnostics (IVD) market is expected to reach USD 146,500 million in 2035.

The demand for in vitro diagnostics (IVD) is expected to rise due to the increasing need for early disease detection, the growth of precision medicine, technological advancements in diagnostic devices, and rising healthcare expenditures.

The top five countries driving the development of the in vitro diagnostics (IVD) market are the USA, Germany, China, Japan, and France.

Molecular diagnostics and immunoassay-based diagnostics are expected to dominate the market due to their increasing application in infectious disease detection, oncology, and genetic testing.

List of Tables

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End-user , 2017 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End-user , 2017 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End-user , 2017 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End-user , 2017 to 2033

Table 17: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Asia Pacific Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 19: Asia Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 20: Asia Pacific Market Value (US$ Million) Forecast by End-user , 2017 to 2033

Table 21: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End-user , 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-user , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-user , 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-user , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-user , 2023 to 2033

Figure 17: Global Market Attractiveness by Technology, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End-user , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End-user , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End-user , 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End-user , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-user , 2023 to 2033

Figure 37: North America Market Attractiveness by Technology, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End-user , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End-user , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End-user , 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-user , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-user , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End-user , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End-user , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End-user , 2017 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End-user , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End-user , 2023 to 2033

Figure 77: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 78: Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Europe Market Attractiveness by End-user , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Asia Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 82: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: Asia Pacific Market Value (US$ Million) by End-user , 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Asia Pacific Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 89: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 90: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 91: Asia Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 92: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: Asia Pacific Market Value (US$ Million) Analysis by End-user , 2017 to 2033

Figure 95: Asia Pacific Market Value Share (%) and BPS Analysis by End-user , 2023 to 2033

Figure 96: Asia Pacific Market Y-o-Y Growth (%) Projections by End-user , 2023 to 2033

Figure 97: Asia Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 98: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 99: Asia Pacific Market Attractiveness by End-user , 2023 to 2033

Figure 100: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 101: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 102: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: Middle East and Africa Market Value (US$ Million) by End-user , 2023 to 2033

Figure 104: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 106: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 109: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 110: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 111: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 112: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: Middle East and Africa Market Value (US$ Million) Analysis by End-user , 2017 to 2033

Figure 115: Middle East and Africa Market Value Share (%) and BPS Analysis by End-user , 2023 to 2033

Figure 116: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-user , 2023 to 2033

Figure 117: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End-user , 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

In-Vitro Diagnostics Packaging Market

In Vitro Diagnostic Substrate Market Size and Share Forecast Outlook 2025 to 2035

In Vitro Fertilization Market Size and Share Forecast Outlook 2025 to 2035

In Vitro Fertilization Banking Services Market - Trends, Demand & Forecast 2025 to 2035

In vitro Fertilization Monitoring System Market

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Point-of-Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Clinical Immunodiagnostics Market Size and Share Forecast Outlook 2025 to 2035

Infectious Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Home Diagnostics Market

Yeast Infection Diagnostics Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Molecular Diagnostics Market Growth - Trends & Forecast 2025 to 2035

Point-of-care Molecular Diagnostics Market Insights – Trends & Growth 2025 to 2035

Infectious Disease Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA