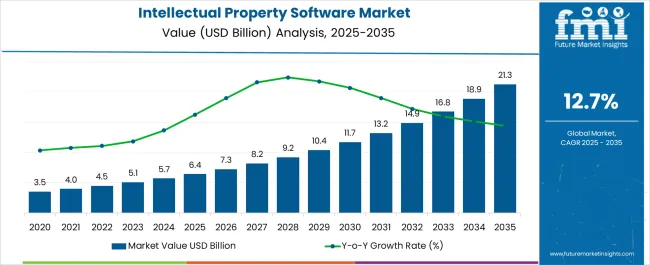

The Intellectual Property Software Market is estimated to be valued at USD 6.4 billion in 2025 and is projected to reach USD 21.3 billion by 2035, registering a compound annual growth rate (CAGR) of 12.7% over the forecast period.

| Metric | Value |

|---|---|

| Intellectual Property Software Market Estimated Value in (2025 E) | USD 6.4 billion |

| Intellectual Property Software Market Forecast Value in (2035 F) | USD 21.3 billion |

| Forecast CAGR (2025 to 2035) | 12.7% |

The intellectual property software market is witnessing steady growth driven by the increasing need for efficient management of intangible assets amid complex regulatory landscapes. Growing emphasis on patent protection, trademark enforcement, and intellectual property portfolio management has accelerated the adoption of specialized software solutions.

Organizations are prioritizing automation and digital tools to enhance patent lifecycle management, reduce risks of infringement, and improve collaboration across legal and R&D teams. The rise in patent filings globally and heightened focus on competitive intelligence have further propelled demand.

Integration capabilities with existing enterprise software and cloud-based solutions have improved accessibility and scalability. Going forward, advancements in AI-driven analytics and blockchain for IP security are expected to provide new growth avenues, while regulatory compliance pressures ensure sustained market expansion..

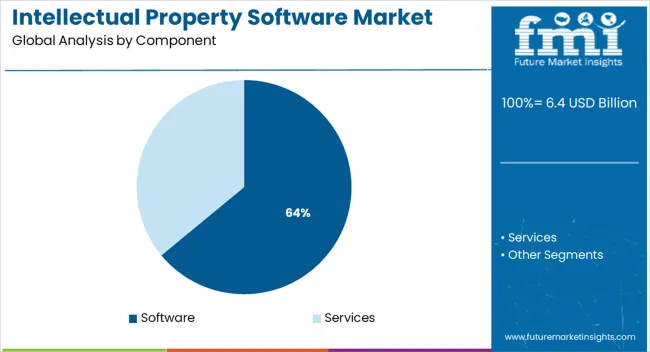

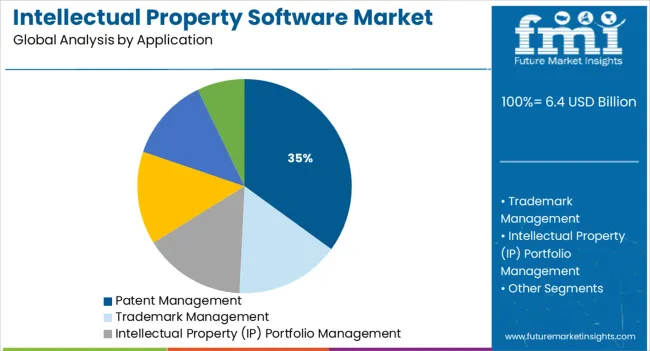

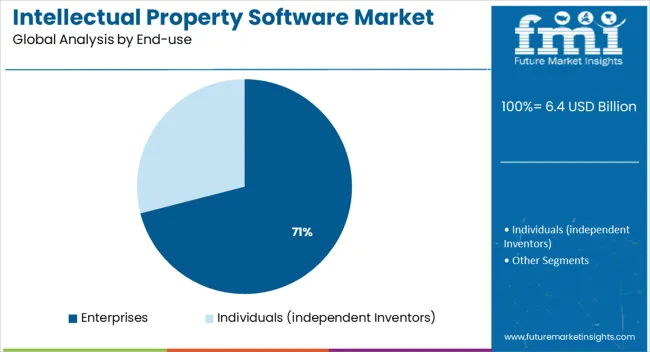

The market is segmented by Component, Application, and End-use and region. By Component, the market is divided into Software and Services. In terms of Application, the market is classified into Patent Management, Trademark Management, Intellectual Property (IP) Portfolio Management, Intellectual Property (IP) Licensing, Intellectual Property (IP) Reporting & Analytics, and Others. Based on End-use, the market is segmented into Enterprises and Individuals (independent Inventors). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software component is projected to hold 64.00% of the intellectual property software market revenue by 2025, establishing it as the dominant segment. This leadership is attributed to the growing demand for comprehensive, scalable, and customizable IP management platforms that support patent filing, monitoring, and enforcement.

Software solutions enable automation of routine processes, facilitating faster patent prosecution and improved accuracy. The cloud deployment model has made software offerings more accessible to small and medium enterprises, enhancing market penetration.

Additionally, the ability to integrate AI-powered search and analytics tools within software platforms has strengthened their position by enabling strategic decision-making and competitive insights. Software's adaptability to evolving IP regulations and increasing cross-border IP activities has further reinforced its market dominance..

Patent management is expected to account for 35.00% of the total application revenue share in 2025, positioning it as the leading application segment. This prominence is driven by the critical role patents play in protecting innovations and maintaining competitive advantage in technology-intensive industries.

Increasing patent filings across sectors such as pharmaceuticals, technology, and manufacturing have necessitated robust management solutions to streamline patent lifecycle processes. Automated patent docketing, portfolio analytics, and deadline tracking capabilities have improved operational efficiency and reduced compliance risks.

Furthermore, regulatory mandates requiring transparency and documentation in patent portfolios have bolstered adoption. Enhanced integration with R&D and legal workflows has made patent management software an indispensable tool for enterprises focusing on intellectual property optimization..

Enterprises are projected to contribute 71.00% of the market revenue in 2025, marking them as the primary end-use segment. This dominance is supported by the extensive intellectual property portfolios maintained by large organizations seeking to safeguard innovations and monetize IP assets.

Enterprises have been investing in sophisticated software solutions that provide end-to-end management capabilities, including IP asset valuation, risk assessment, and competitive benchmarking. The need to ensure compliance with international IP laws and reduce litigation exposure has accelerated software adoption.

Additionally, enterprises benefit from enhanced data security, customizable reporting, and integration with enterprise resource planning (ERP) and customer relationship management (CRM) systems. As IP continues to be a key driver of enterprise value, the demand for specialized software solutions within this segment is expected to grow steadily..

In recent years, the administration of patent IP has noticed a substantial movement in favor of digitalization. The number of patent applications dramatically rose in 2024. NTT, with 790 domestic filings that had the patent publication granted as of May 2024, was the leading firm based on the total number of AI-related patent applications in Japan, as per a Japan Patent Office analysis published in August 2024. Other significant Japanese businesses like Hitachi, Fujitsu, and Canon came after NTT.

One of the commonly used measures for gauging inventive activity, the number of foreign patent applications submitted under the Patent Cooperation Treaty (PCT) of the WIPO increased by 0.92% in 2024 to reach 275,500 applications, according to a study released in February 2025. As the major source of foreign patent applications, Asia demonstrated its dominance, accounting for 54.1% of all applications in 2024, increasing from 38.5% in 2011.

Huawei Technologies, a Chinese telecom behemoth, was the top filer in 2024 with 6,962 filed PCT applications, winning the title for a fourth straight year. Following it was Samsung Electronics of the Republic of Korea, Qualcomm Inc. of the US (3,931), LG Electronics Inc. of the Republic of Korea, and Mitsubishi Electric Corp. of Japan (2,673). In 2024, the number of published applications increased at the quickest rate (+80.9%), which helped Qualcomm Inc. rise from fifth place in 2024 to second place in 2024. The number of digital communication-related filings by Qualcomm nearly quadrupled, reaching 1,486. Thus, with such increasing numbers, the demand for intellectual property software is on the rise too.

China is the main driver of global growth in demand for intellectual property (IP) rights, and Asia has established itself as the major source of foreign patentability, accounting for 54% of all application domains in 2024, up from 38.5% in 2024. Asia-Pacific was home to four of the leading five PCT filers at WIPO in 2024. The largest filer in 2024 was indeed the Chinese telecom giant Huawei Technologies, which had 6,962 published PCT applications.

On the other hand, in 2024 the Chinese Patent Office recorded close to 815,000 anomalies in patent applications. For instance, the China National Intellectual Property Administration discovered four batches totaling 815,000 erroneous patent applications in December 2024. The first three batches' rate of return as of right now is 93.1%. As there were over 5.7 million patent applications filed in 2024, this would suggest that approximately 15% of all Chinese patent applications were irregular (or aberrant). Additionally, there were 376,000 fraudulent trademark registration applications during the press conference.

As IT sectors become virtual, the pandemic accelerated the rate of technology adoption, according to the CEO and Managing Director of Tech Mahindra. As a result, for the information technology-enabled services (ITeS) sector in India, which has been at the forefront of technological transformation and organizations, cloud-based technology services would empower hybrid workspaces, improve agility, and encourage intellectual property (IP)-led innovation.

The shift of industries to paperless or cloud-based business models, the adoption of AI technology, decreased data storage costs, the expansion of Blockchain technology, and a high growth rate of data are likely to propel the global intellectual property software market forward. The incorporation of advanced AI and aided algorithms in intellectual property are major drivers boosting the demand for intellectual property software.

The demand for intellectual property software is growing as end users are increasingly using intellectual property software to secure and establish a brand, keep their work exclusive and private, and protect the exclusive tenure of their works in order to obtain a competitive advantage in the intellectual property software market.

The Ministry of Micro, Small, and Medium Enterprises (SMEs) has exclusive rights to the use of their creative designs, inventive original or new goods, and brands owing to intellectual property rights. The demand for intellectual property software is also rising as many private enterprises have made intellectual property protection and administration a primary concern, particularly in areas such as the arts, culture, and technology.

The sales of intellectual property software are rising as it is both efficient and equitable and can assist businesses in realizing the potential of intellectual property as a catalyst for cultural and social well-being as well as economic development.

Intellectual property assets contribute to economic development in a variety of ways, as many businesses earn royalties by licensing their IP assets to third parties. As a result, increased emphasis on intellectual property protection and management is projected to drive intellectual property software market growth during the forecast period.

In the evolution of information and communication technologies, intellectual property plays a critical role. Companies may reach out to markets at a lower cost and in a much shorter time frame, thanks to ICT. Furthermore, IP systems are crucial for SMEs to employ in order to take benefit of ICT.

The intellectual property software market competitiveness of SMEs is predicted to improve with the integration of intellectual property protection and information and communication technology. As a result of this, the demand for intellectual property software is predicted to rise rapidly.

A number of businesses intend to develop new products with a variety of services in order to suit the diverse demands of intellectual property software market clients. As a result of the availability of such technology, SMEs are implementing IP systems to safeguard their tangible and intangible assets in order to remain competitive and boost the sales of intellectual property software.

In 2024, the on-premise segment dominated the intellectual property software market, accounting for nearly 50.9 percent of total revenue. An organization's internal infrastructure is used to install and run this software. Individuals who file a patent can also track and manage their applications using the intellectual property software on their PC. Internal teams can use the on-premise deployment to patch problems and detect faults in the systems.

In 2024, the software segment led the intellectual property software market with a CAGR of 13.5%. The increased adoption of intellectual property management software in many industries, such as BFSI, IT and telecom, technology, automotive, healthcare, and jewelry, can be related to the segment's rise. These industries rely on software to apply for and manage their intellectual property rights

From 2025 to 2035, the patent management segment is expected to lead the intellectual property software market with a CAGR of 11.5%. The growth is due to a rise in the number of patent applications filed over time. According to Nasscom data, India saw a six-fold increase in the number of Internet of Things (IoT) applications in June 2024, with approximately 80 percent of patents relating to Industry 4.0.

| Regions | CAGR (2025 to 2035) |

|---|---|

| USA Market | 11.1% |

| UK Market | 13.2% |

| China Market | 13.4% |

| Japan Market | 12.7% |

| India Market | 15.5% |

During the forecast period, North America is predicted to dominate the intellectual property software market. The USA intellectual property software market is growing at a CAGR of 11.1%.

The region's rise can be ascribed to end-user knowledge of intellectual property and its management, a large number of internet users in the USA and Canada, and the presence of businesses like Anaqua Inc., CPA Global, and Questel in the USA.

In addition, the growing number of intellectual property offices in the region is aiding the intellectual property software market expansion. According to data supplied by the World Intellectual Property Organization (WIPO), intellectual property offices in North America accounted for more than one-fifth of all IP offices worldwide in 2020.

Meanwhile, from 2025 to 2035, the Asia Pacific market is expected to grow at the fastest rate. The region's market growth is expected to be boosted by an increase in the number of IT and telecom enterprises, as well as numerous automobile manufacturing units in nations like India and China.

India’s intellectual property software market is projected to grow at the fastest rate in APAC with a CAGR of 15.5%.

Major players in the intellectual property software market are concentrating on business expansion in order to strengthen their market position. In order to acquire a competitive advantage in the industry, key market players are forming partnerships and collaborations.

Recent Developments in the Intellectual Property Software Market

The global intellectual property software market is estimated to be valued at USD 6.4 billion in 2025.

The market size for the intellectual property software market is projected to reach USD 21.3 billion by 2035.

The intellectual property software market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in intellectual property software market are software, _cloud-based, _on-premise, services, _development & implementation services, _consulting services and _maintenance & support services.

In terms of application, patent management segment to command 35.0% share in the intellectual property software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise IP Management Software Market Growth – Trends & Forecast 2023-2033

Intellectual Property Rights And Royalty Management Market Size and Share Forecast Outlook 2025 to 2035

South Korea Intellectual Property Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Intellectual Property Market Size and Share Forecast Outlook 2025 to 2035

Property Management Software Market Growth - Trends & Forecast 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA